Blog

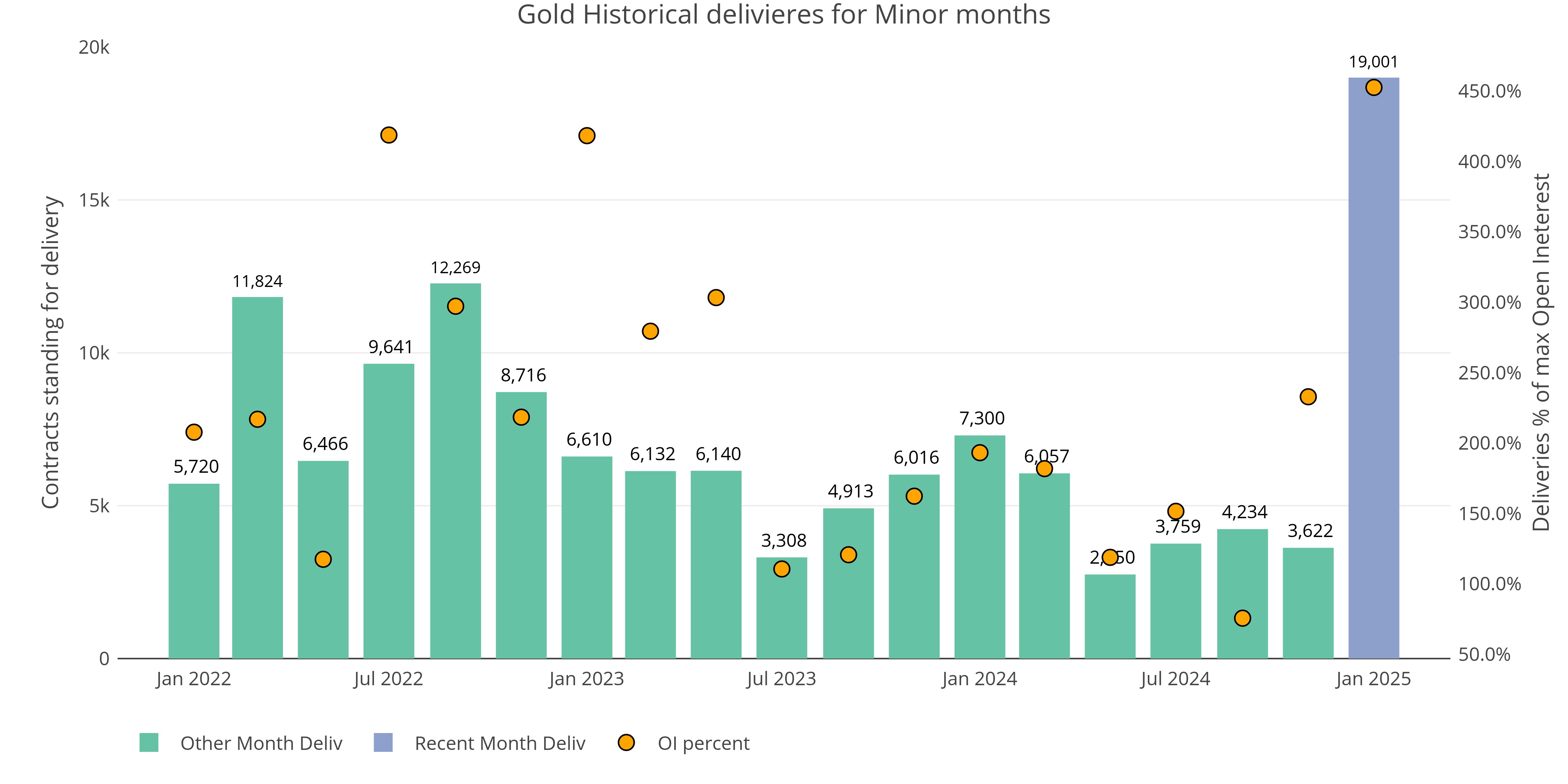

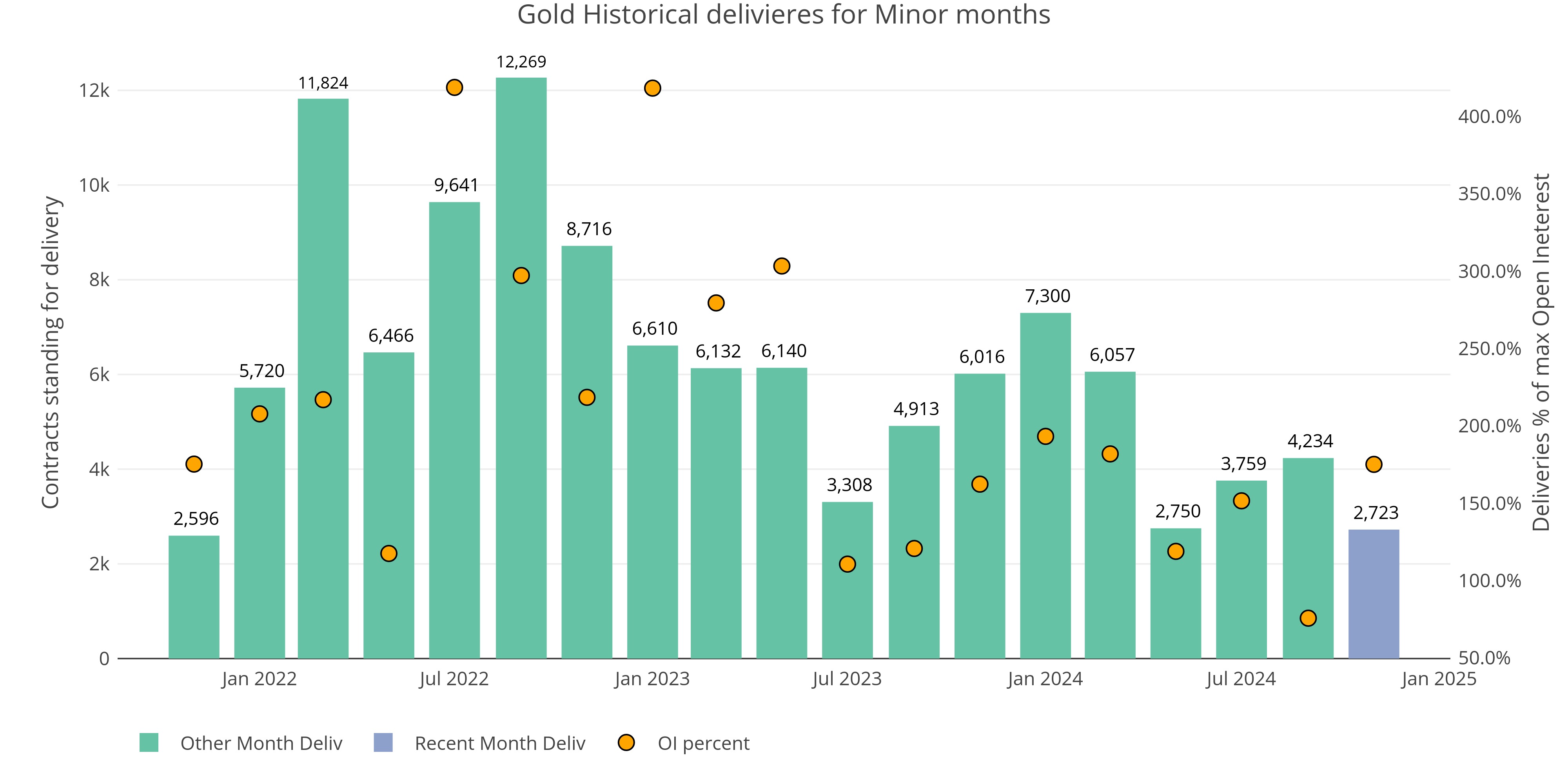

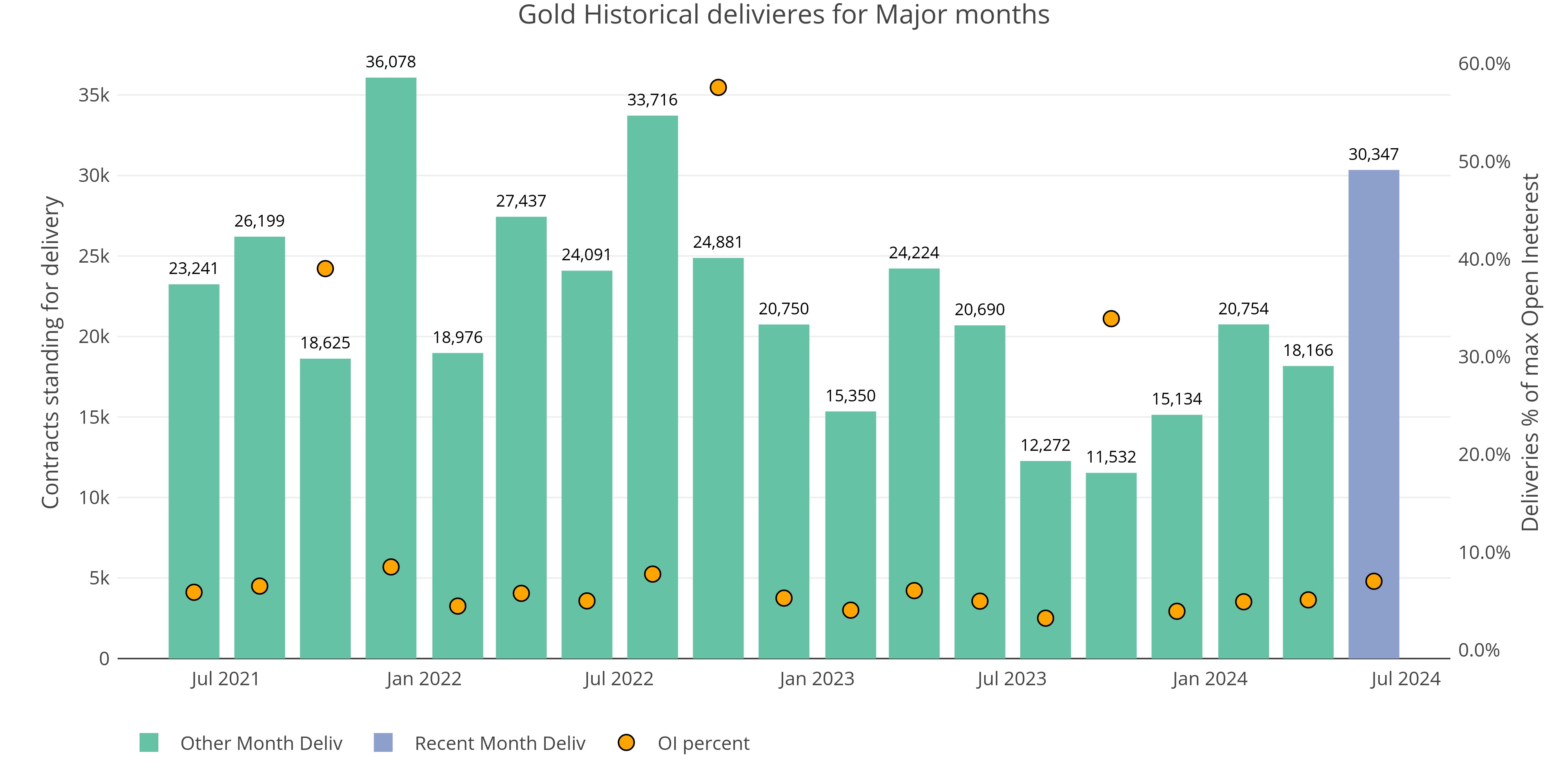

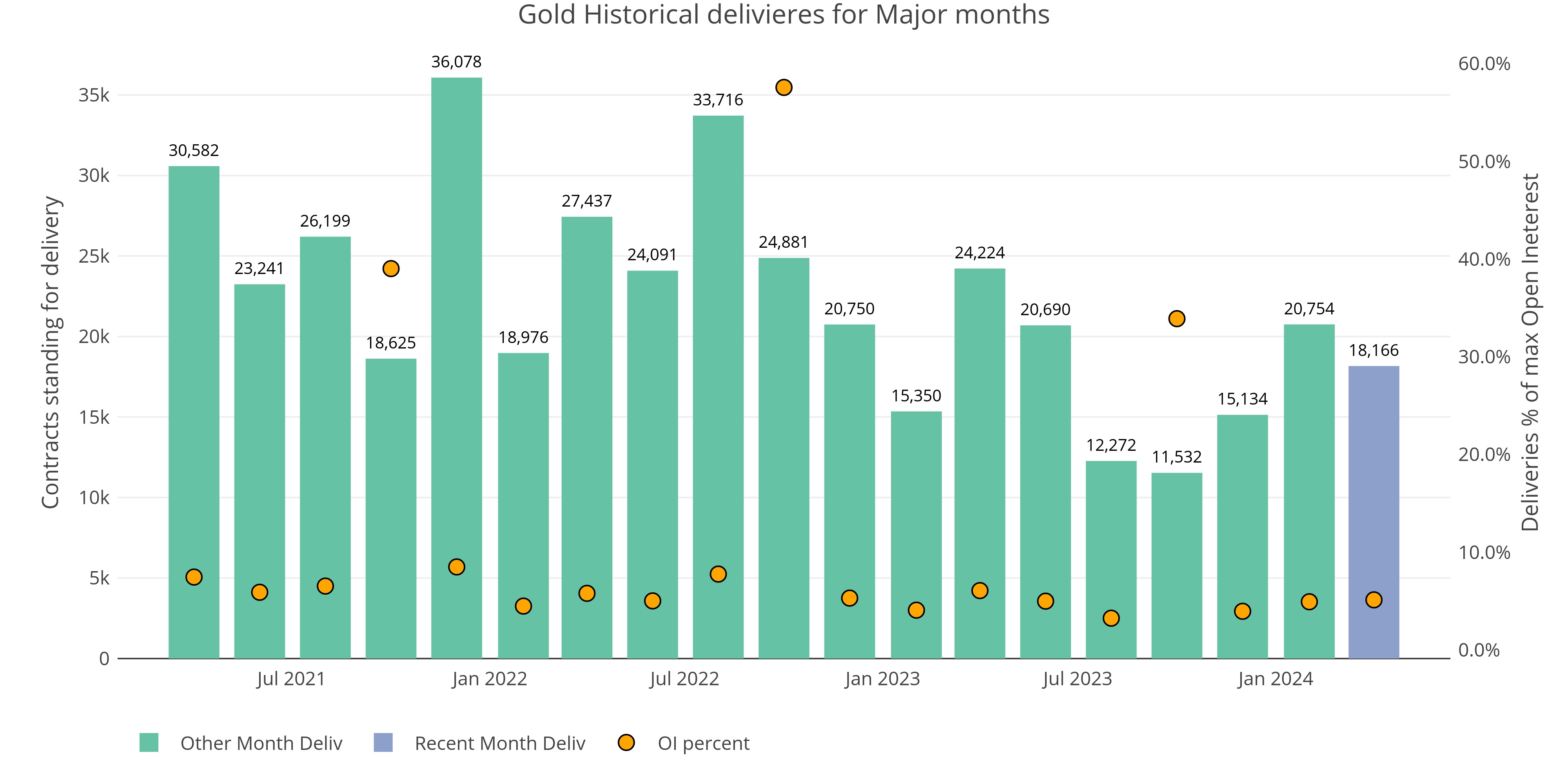

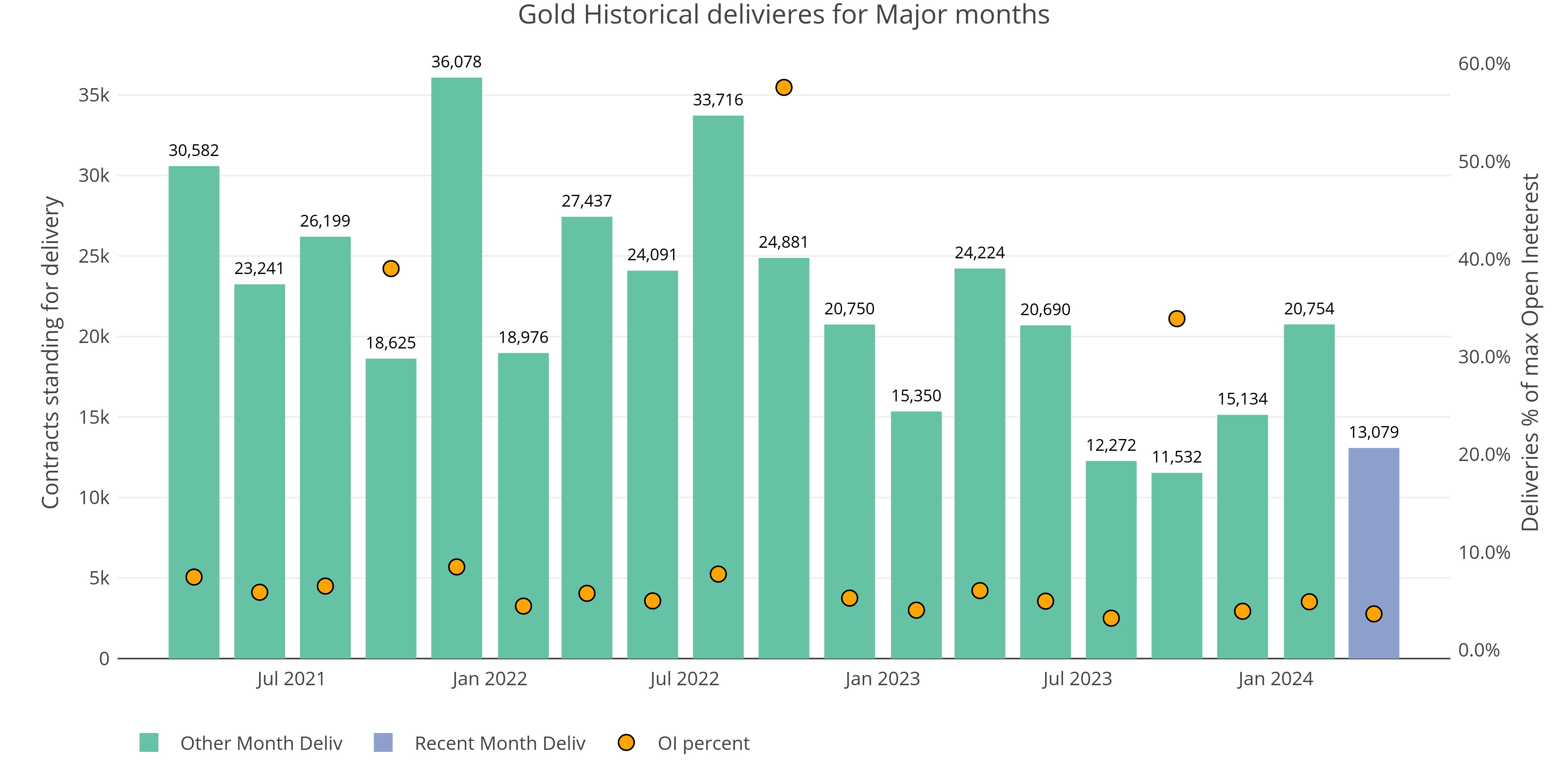

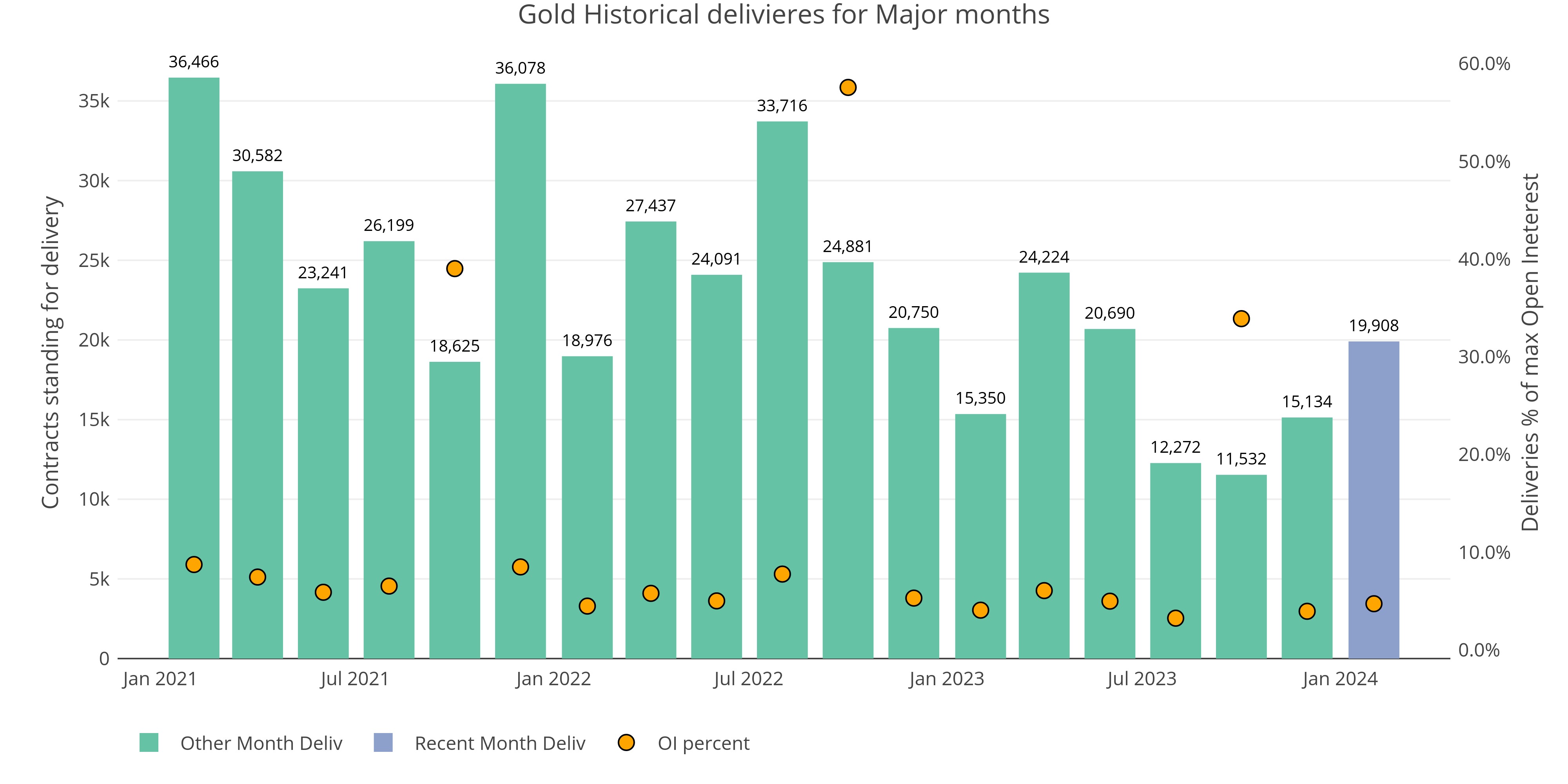

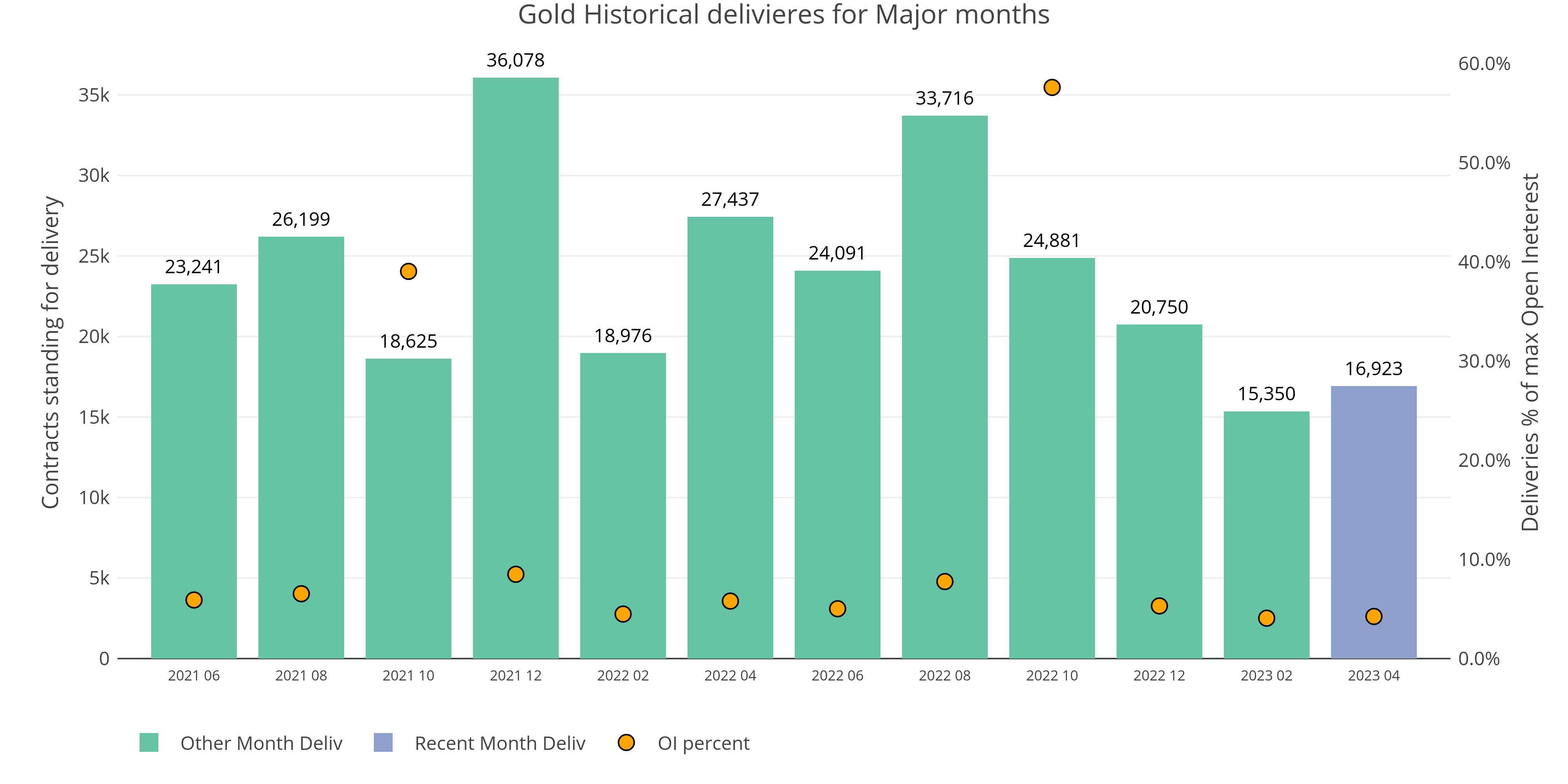

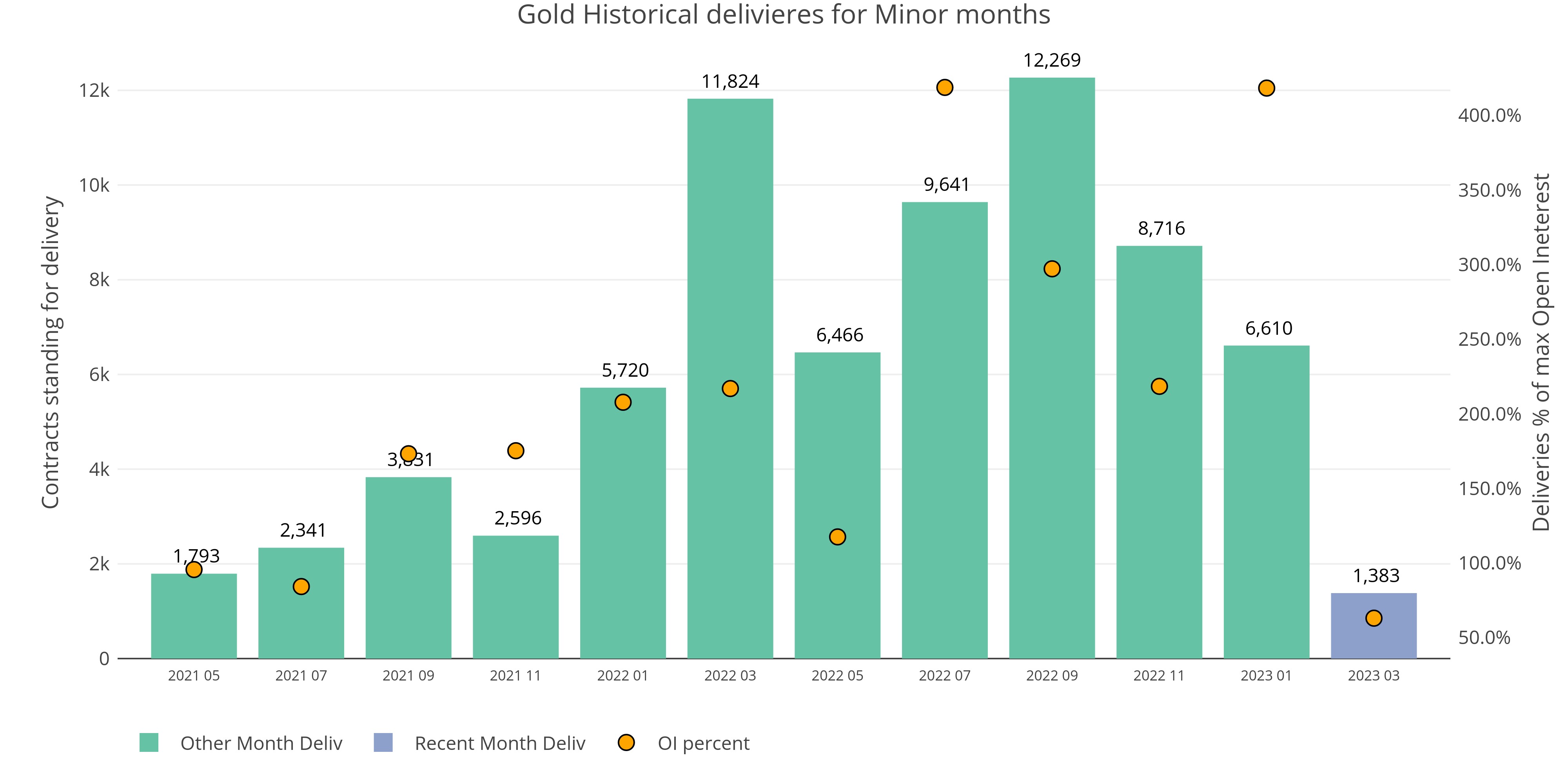

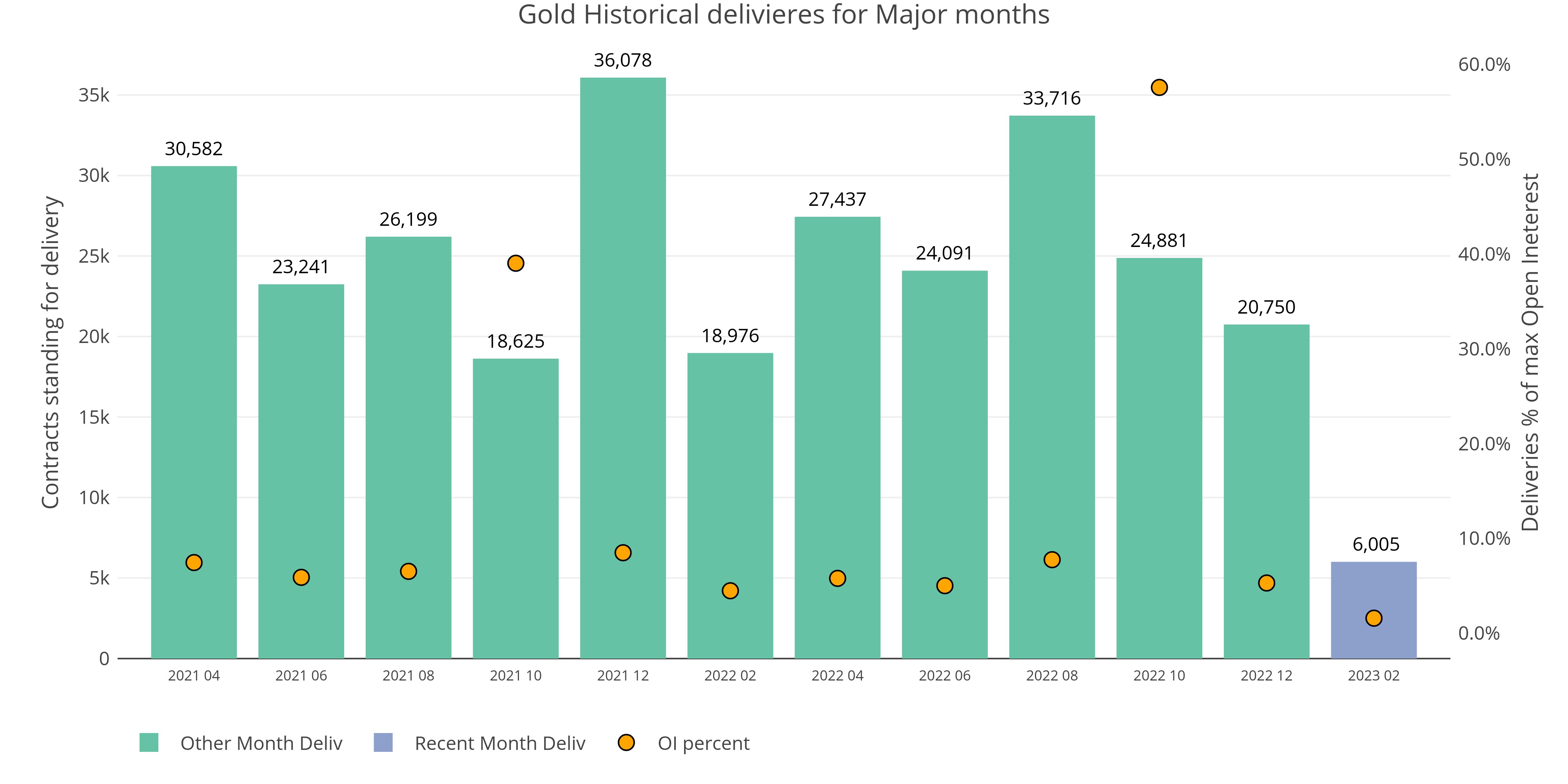

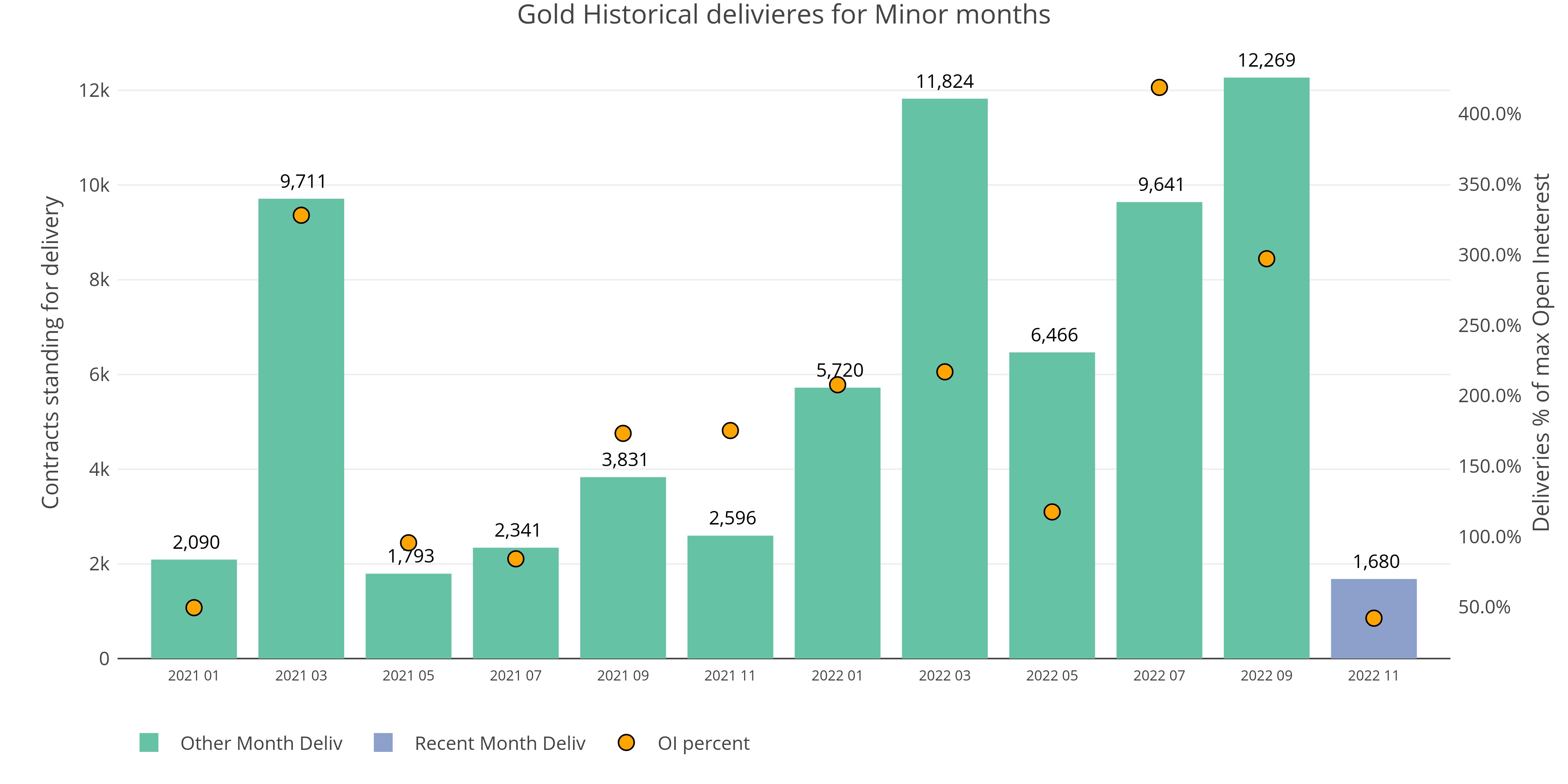

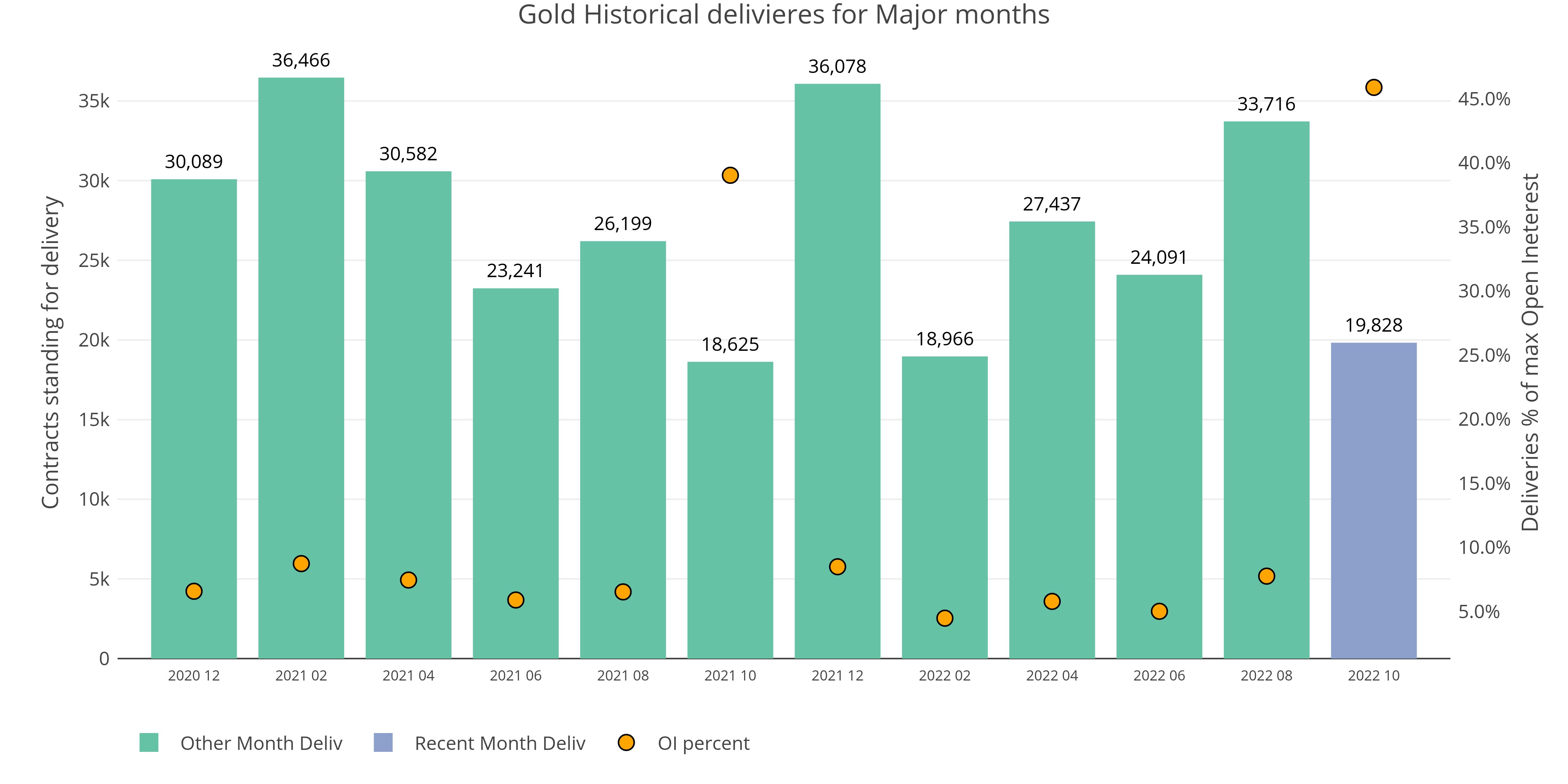

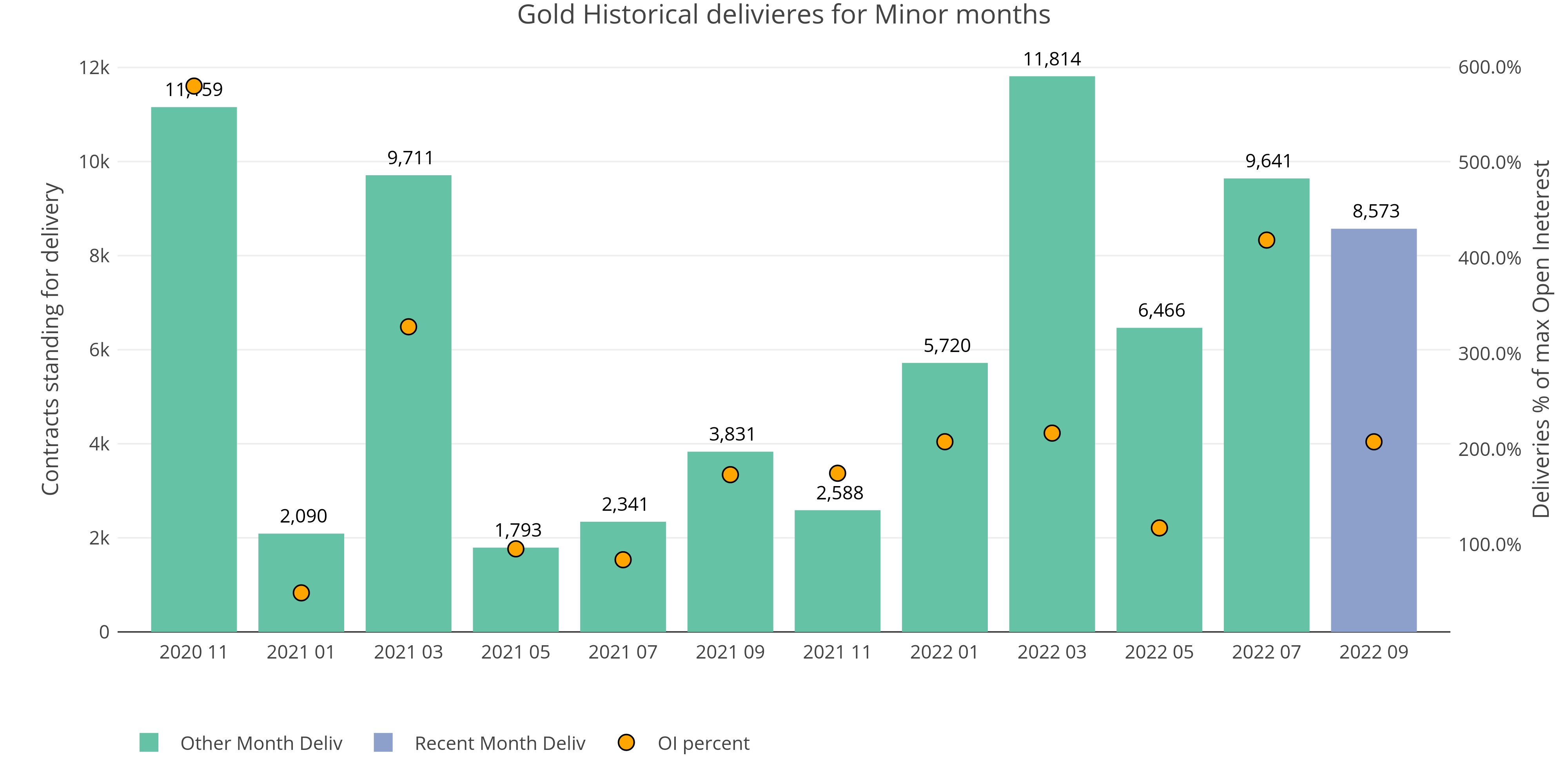

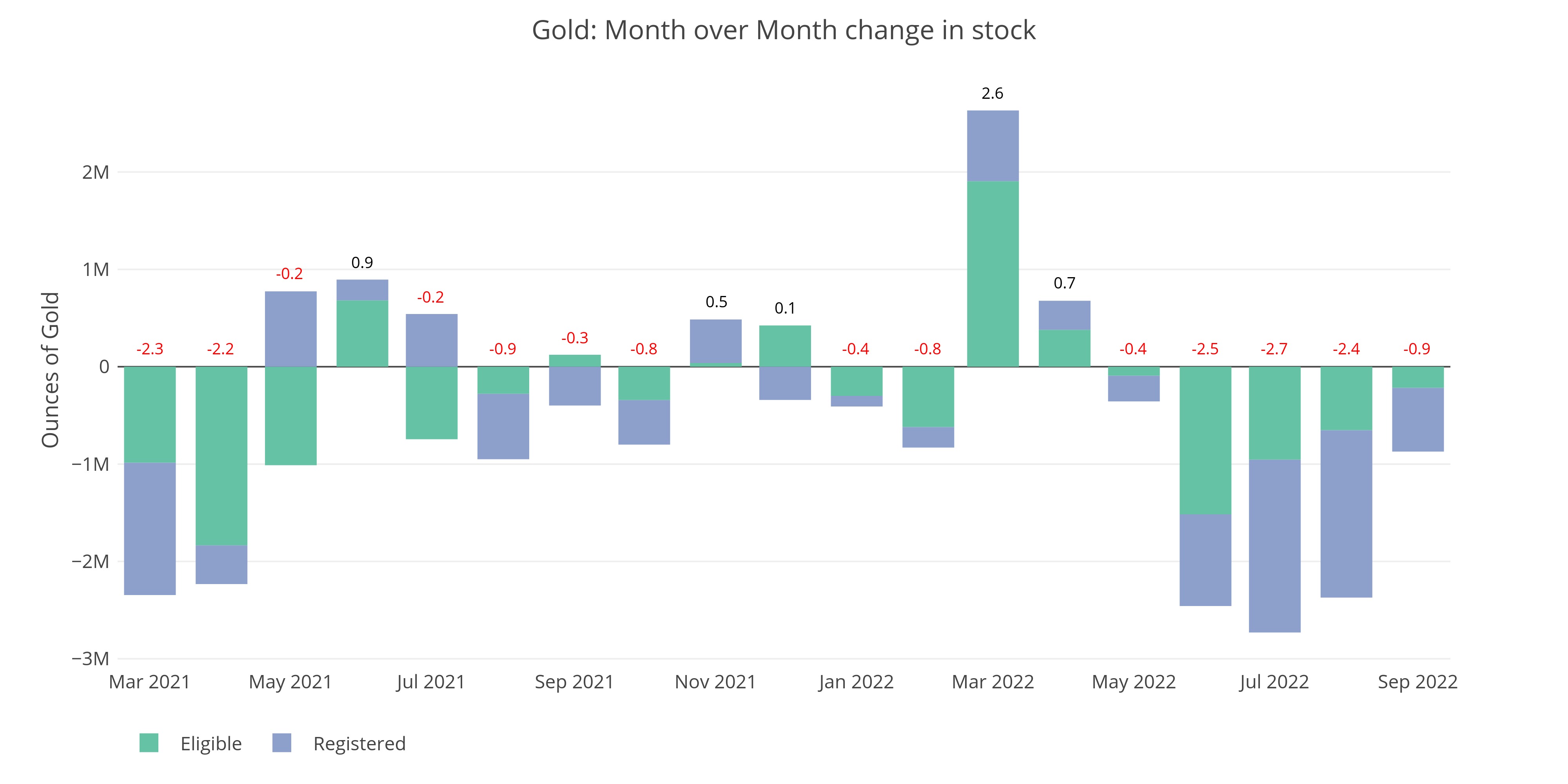

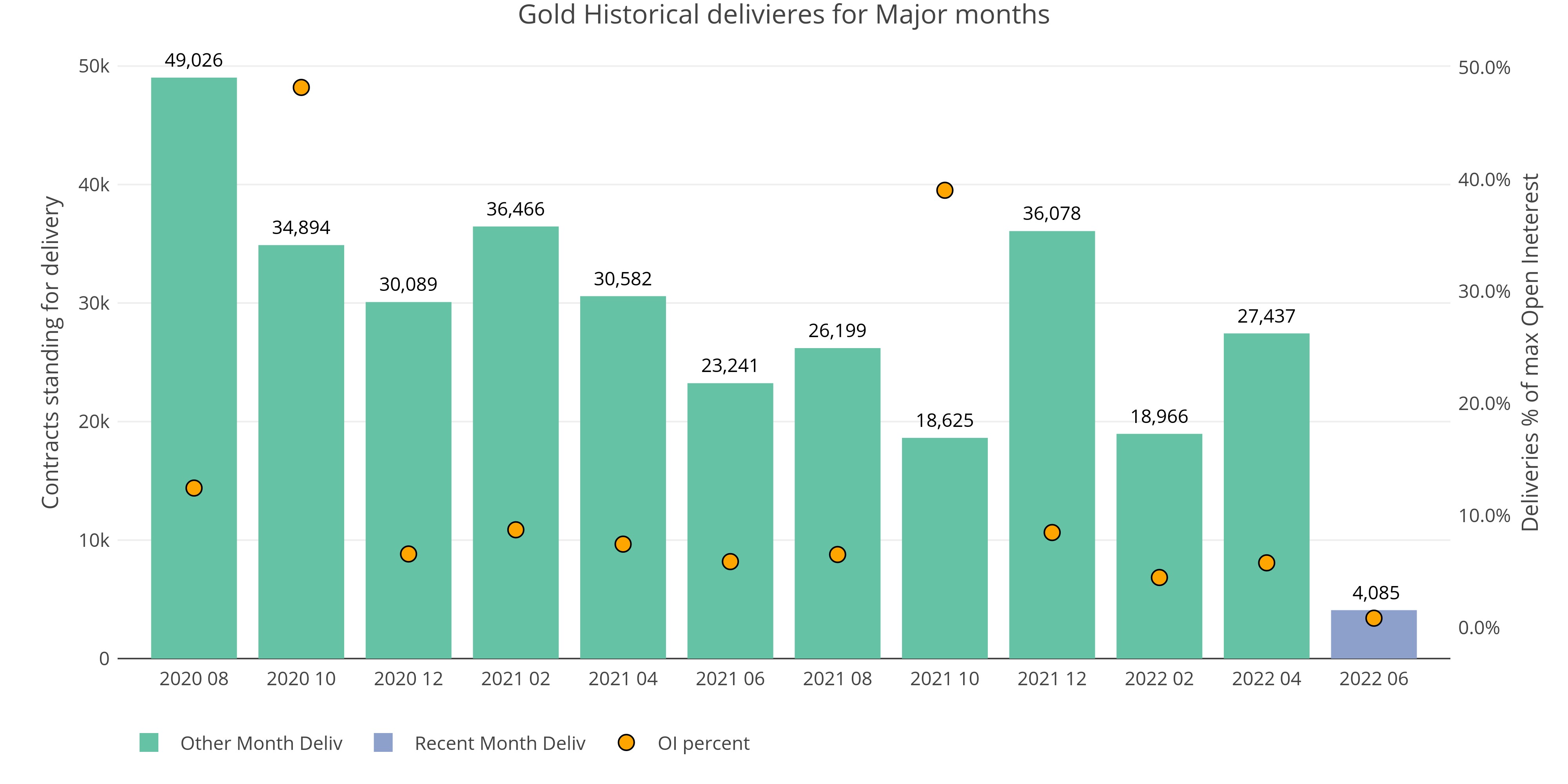

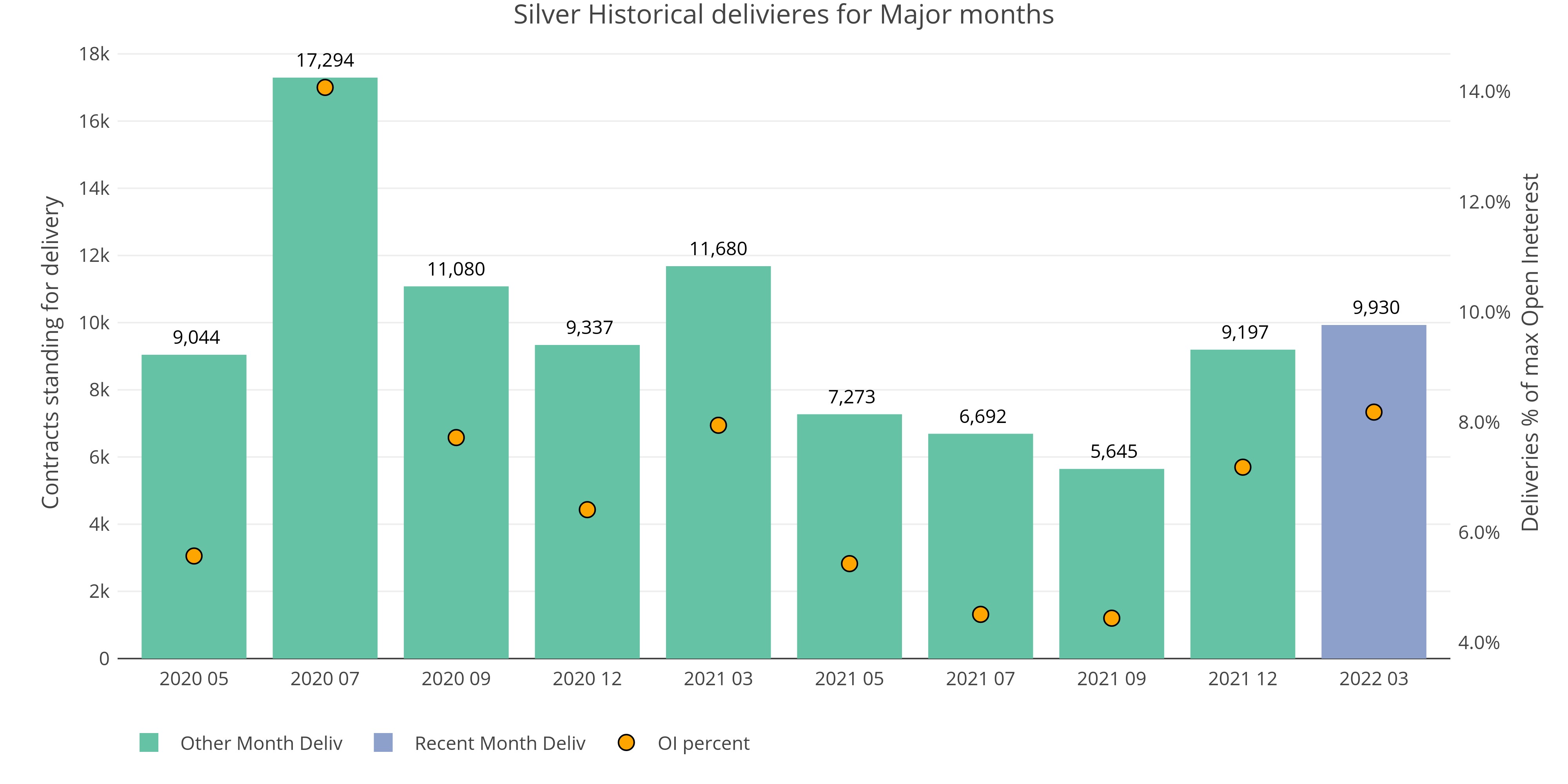

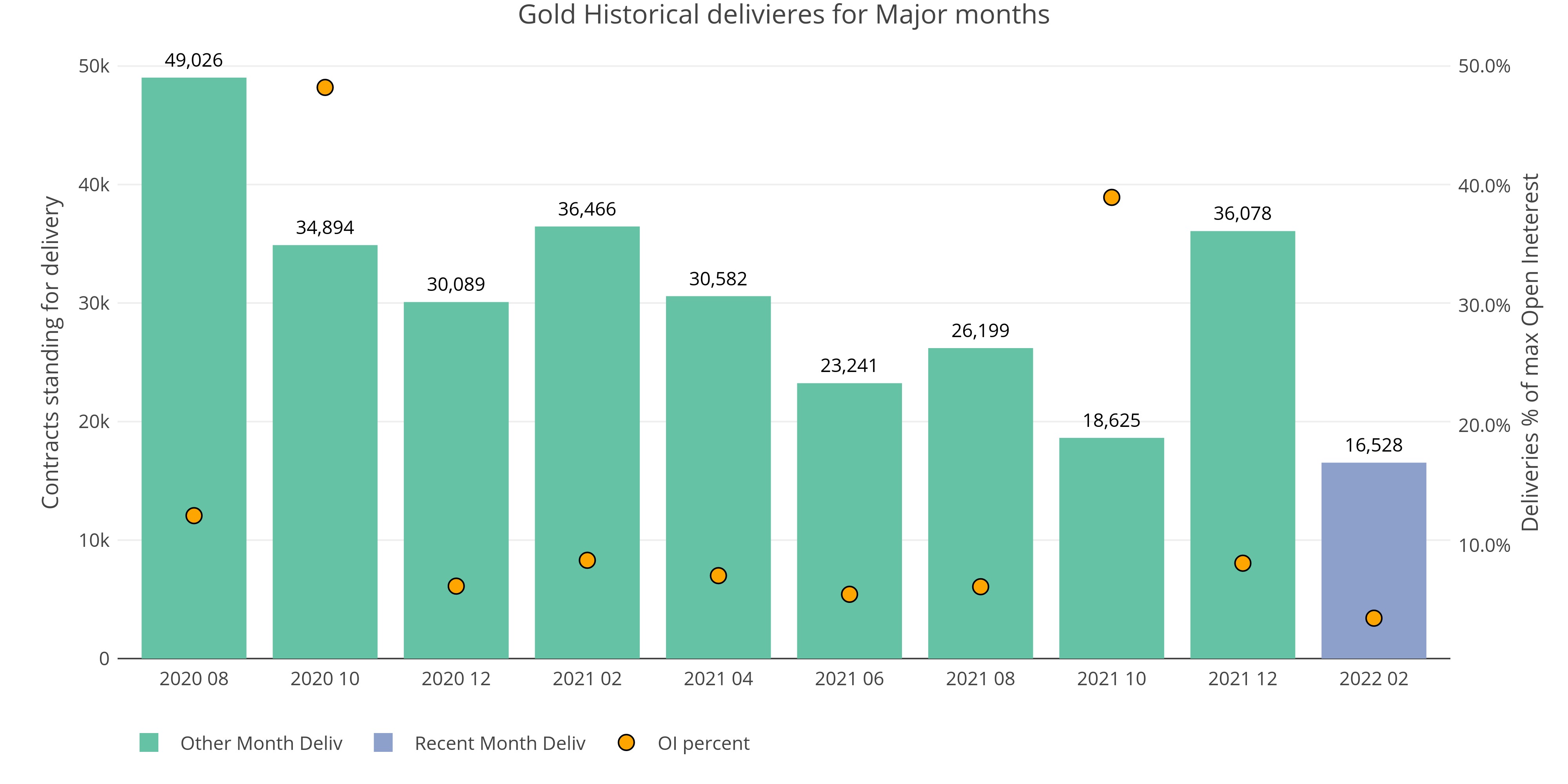

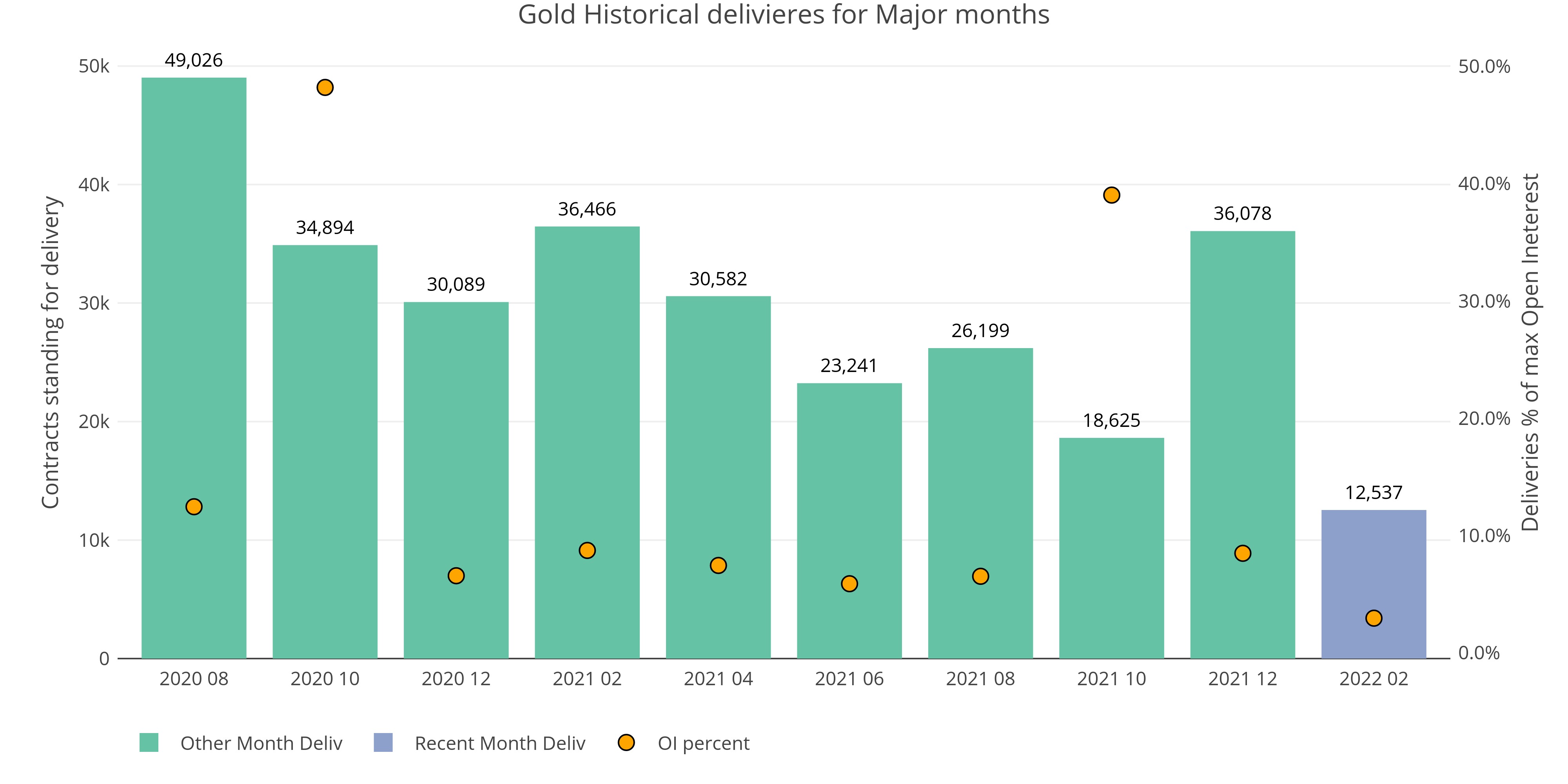

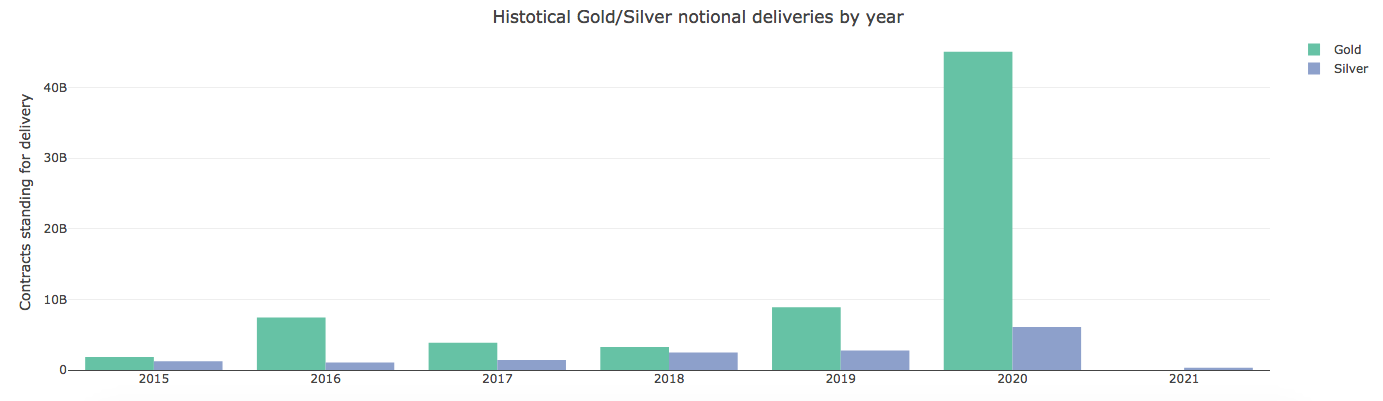

Comex Deliveries: November Shatters Records, December Looks Strong

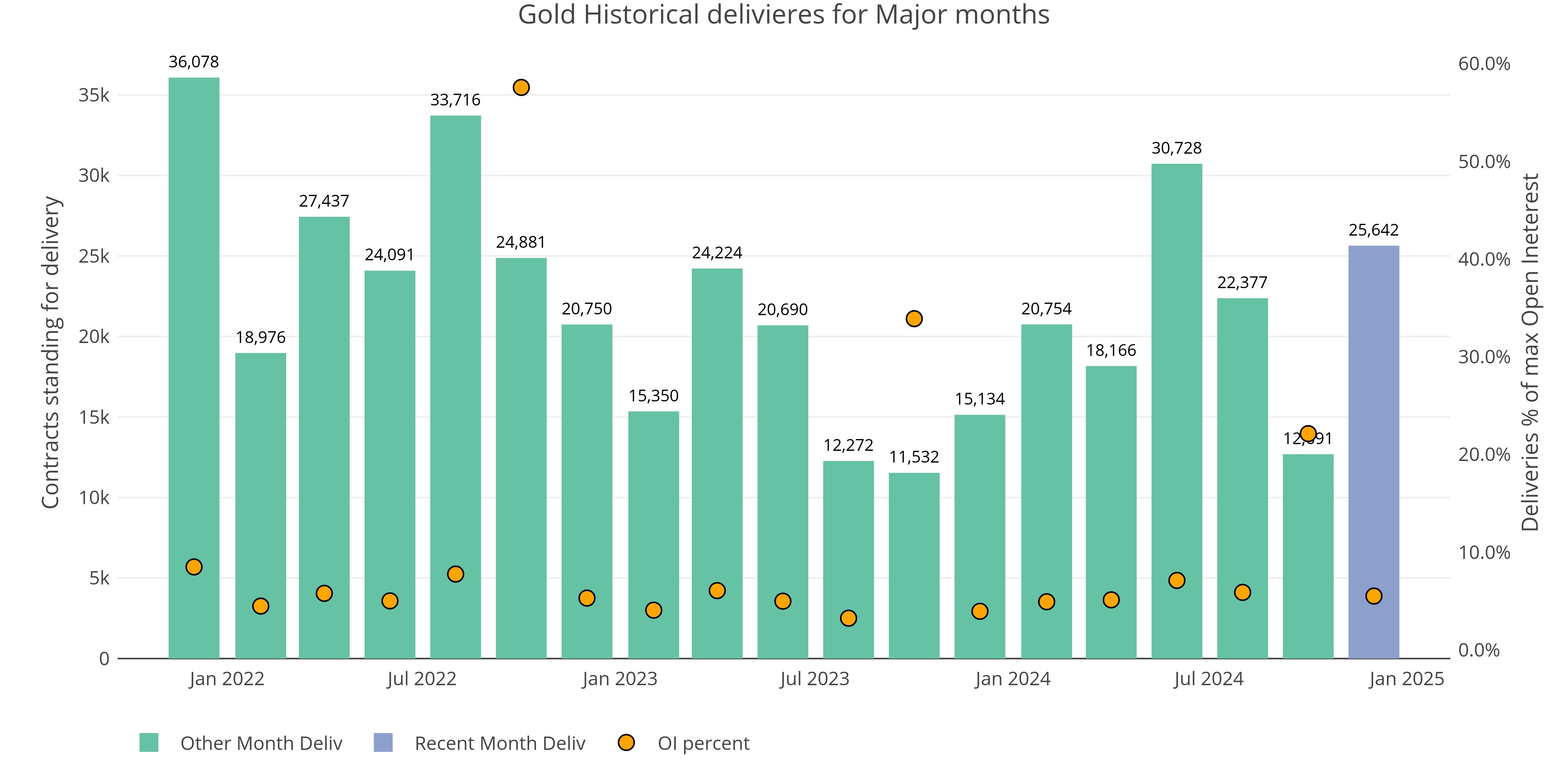

Deliveries continue unabated and this could be the strongest December on record

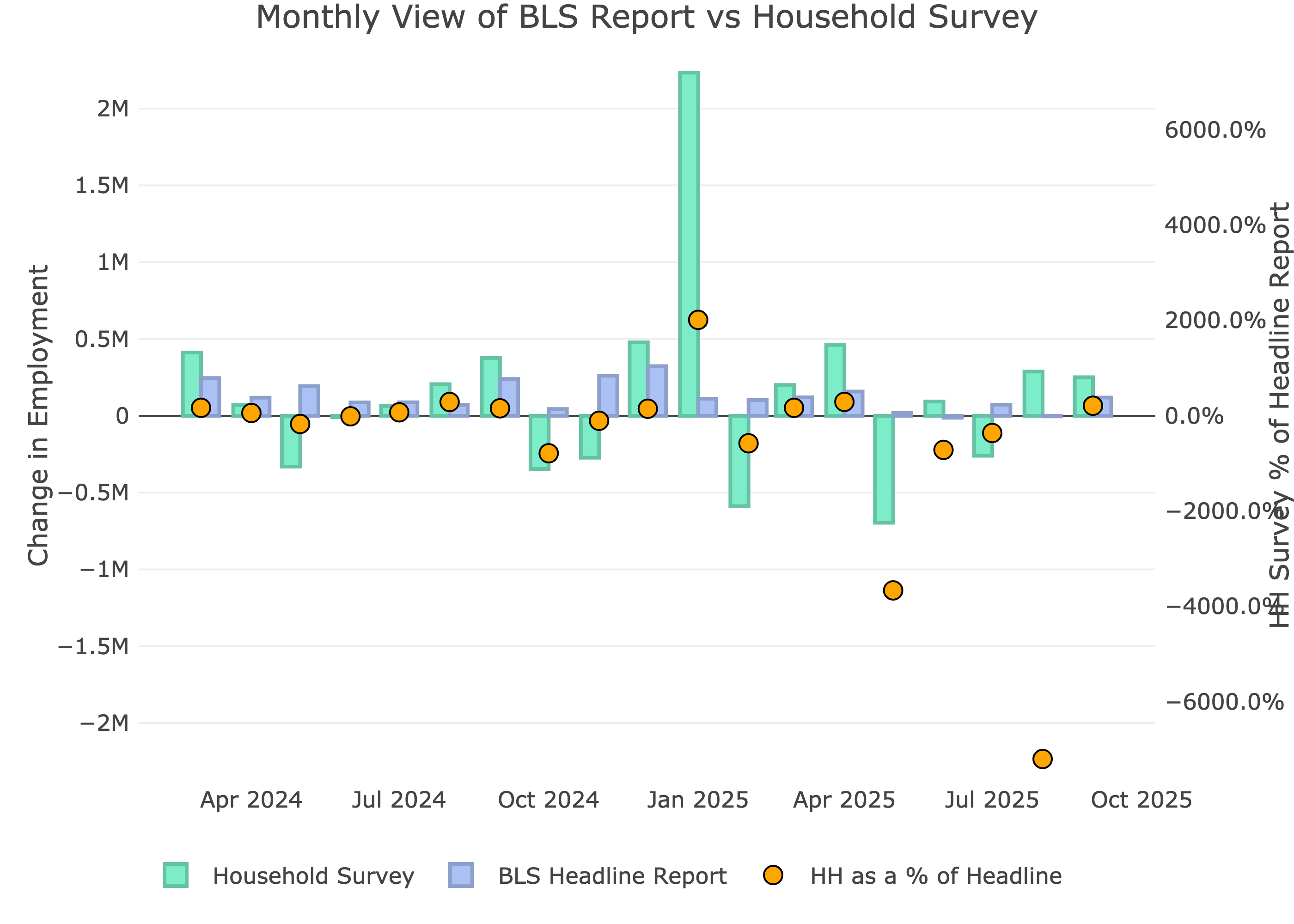

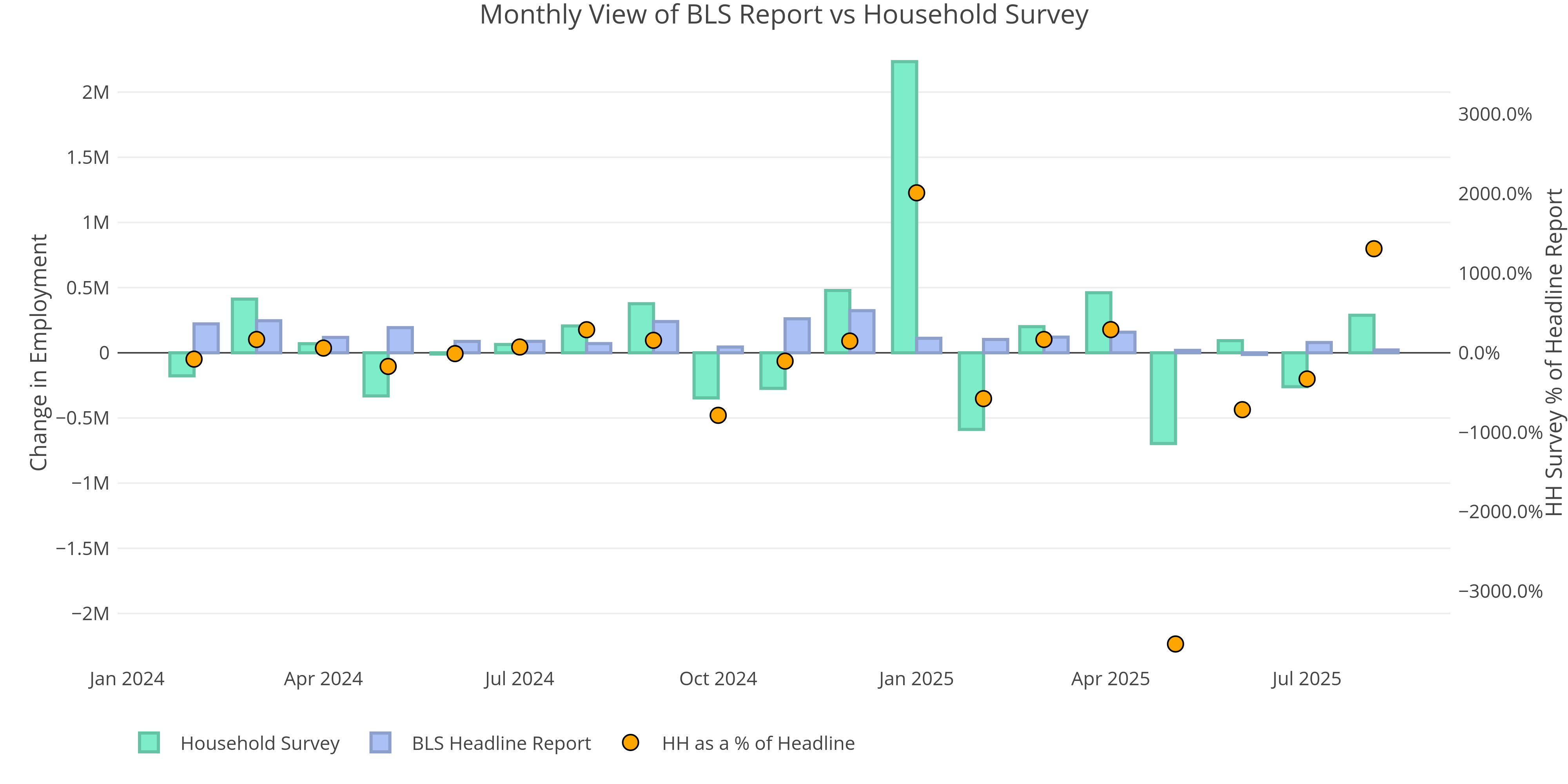

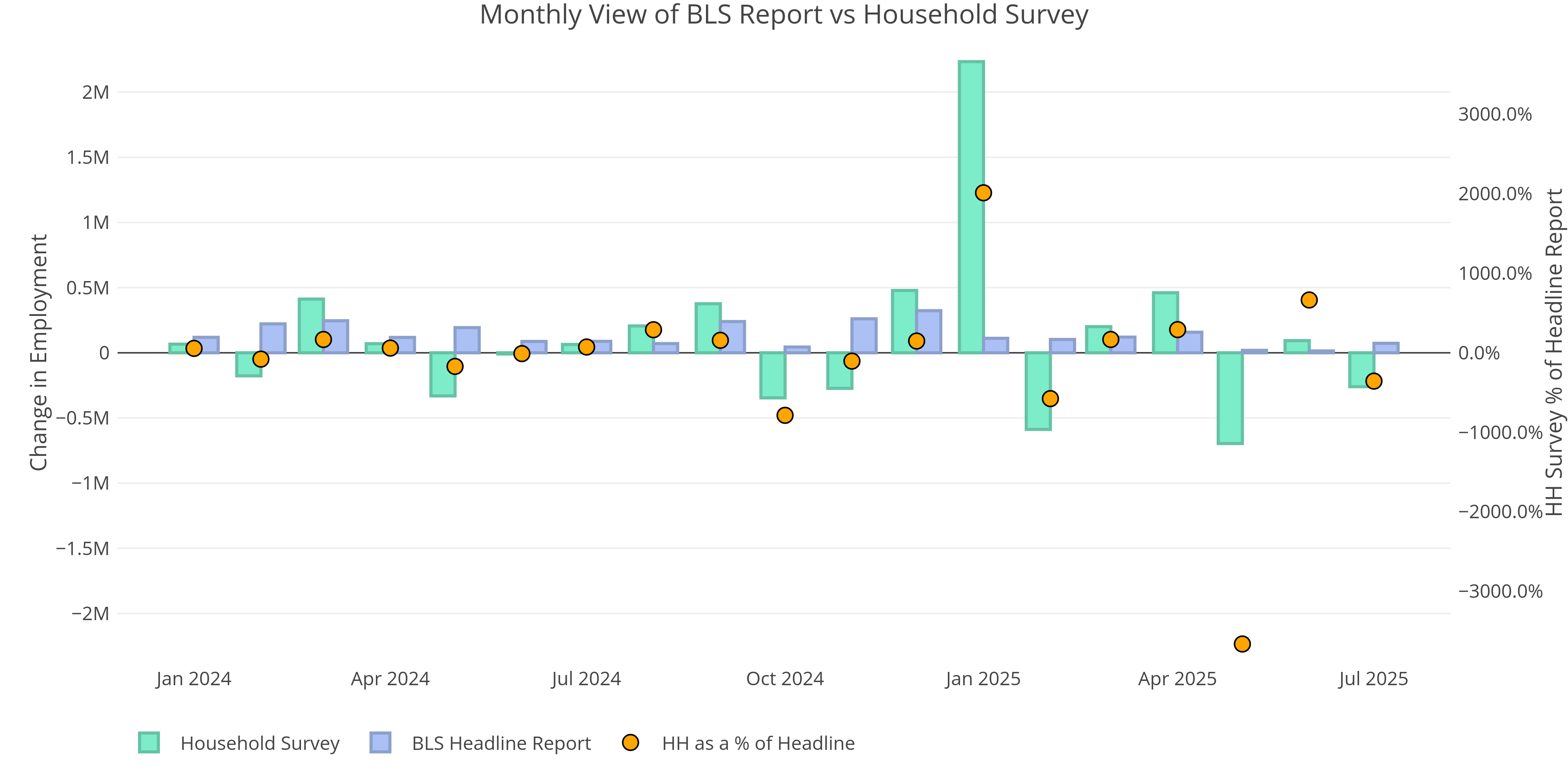

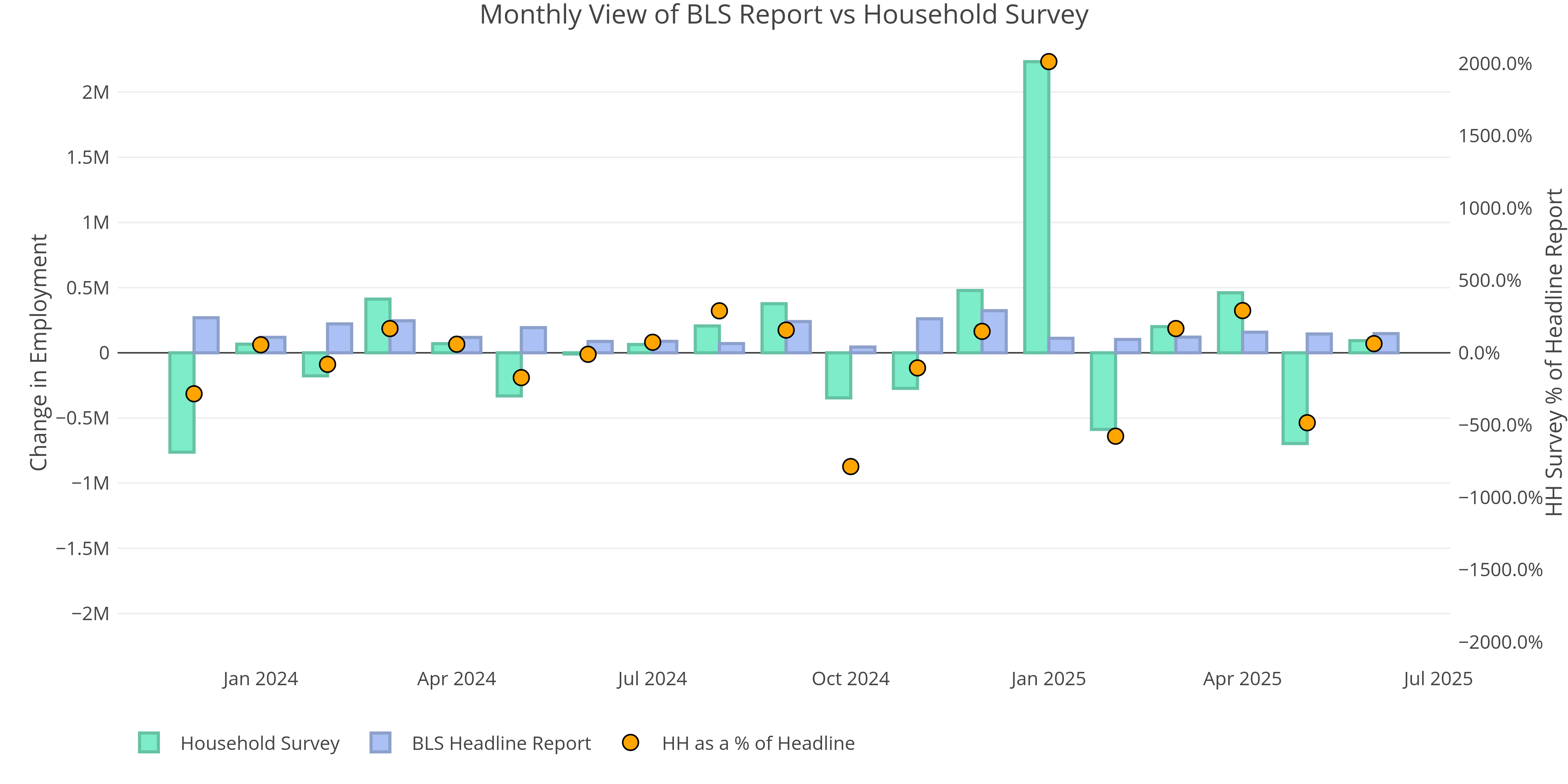

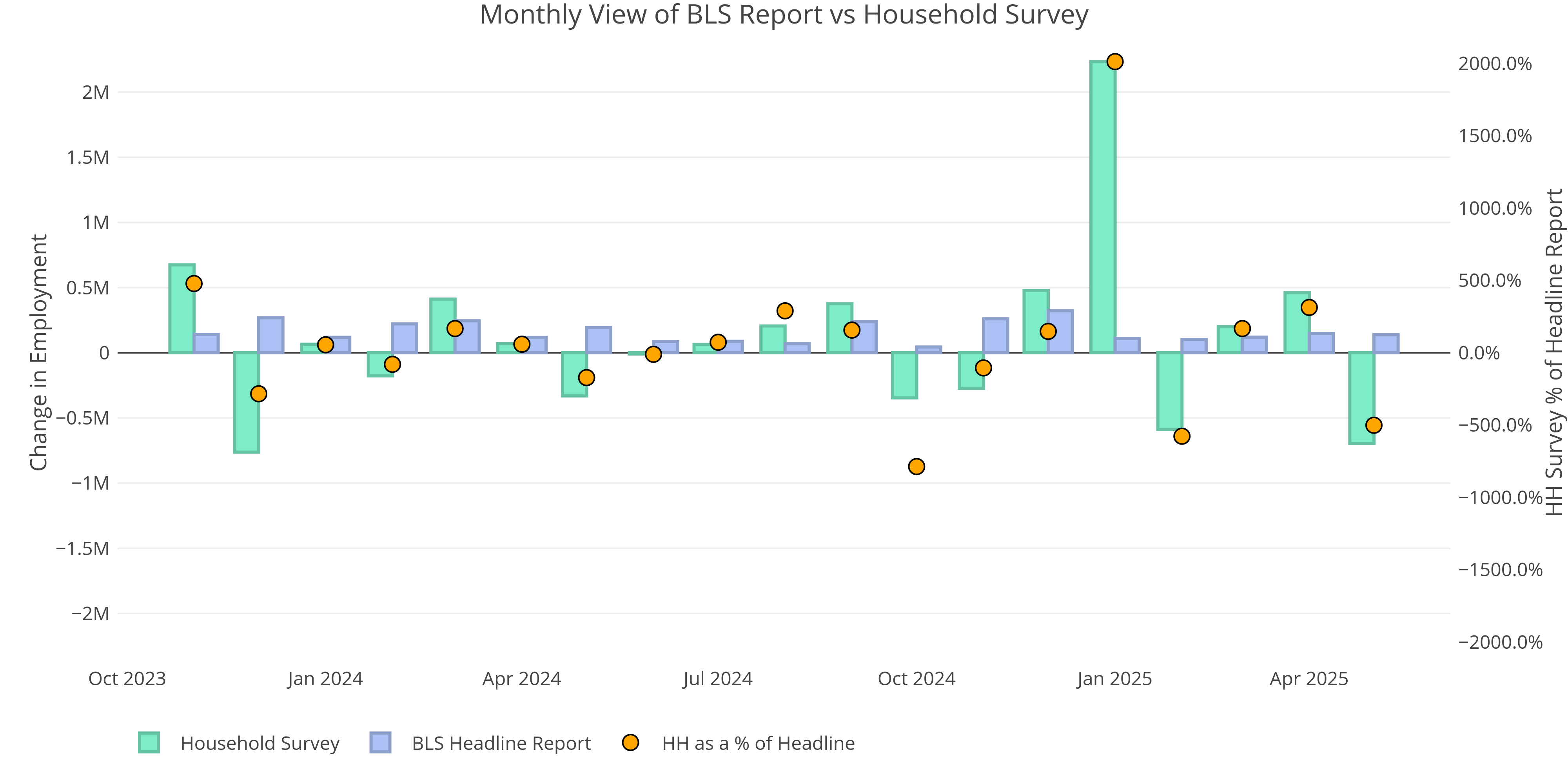

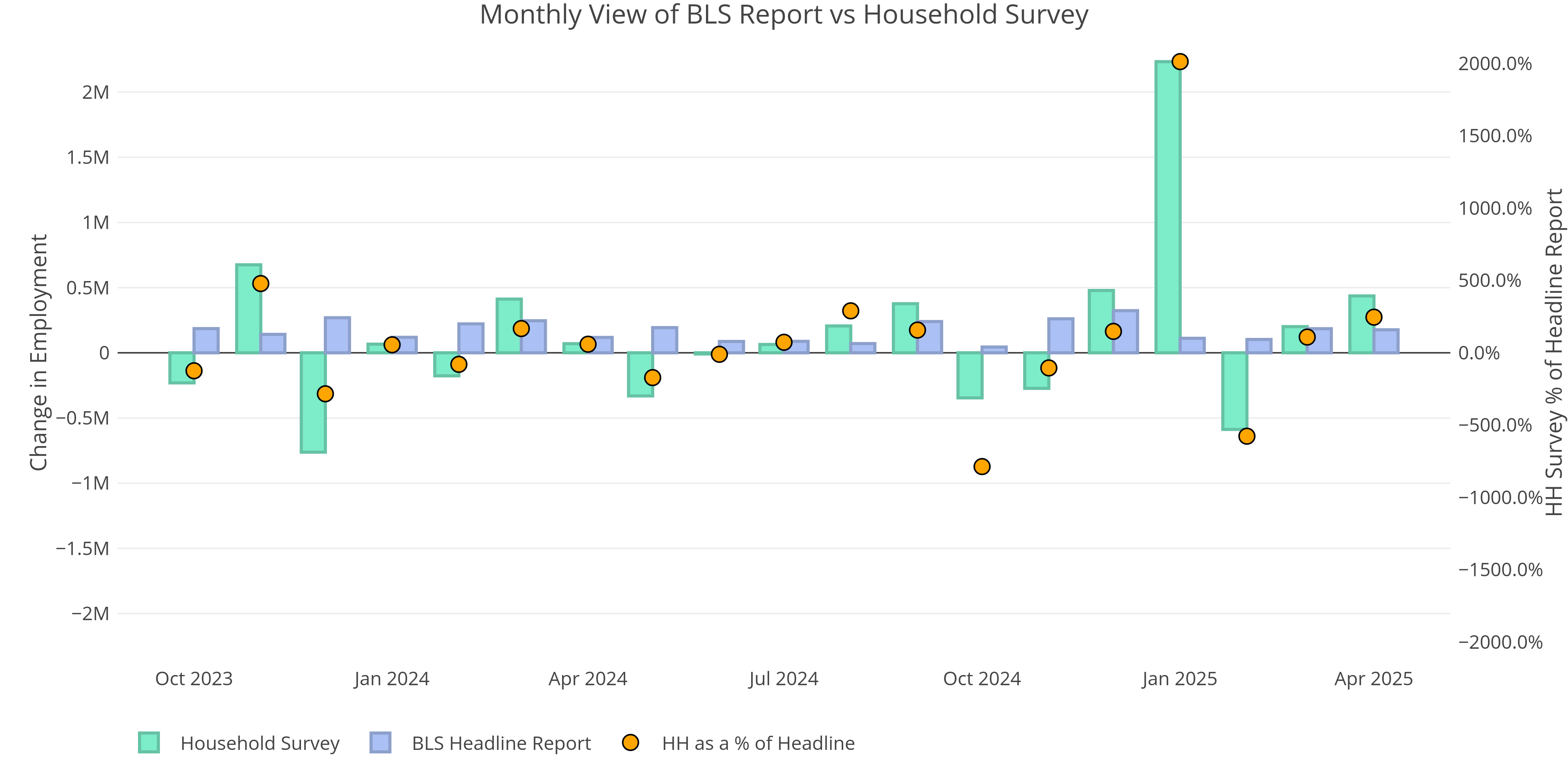

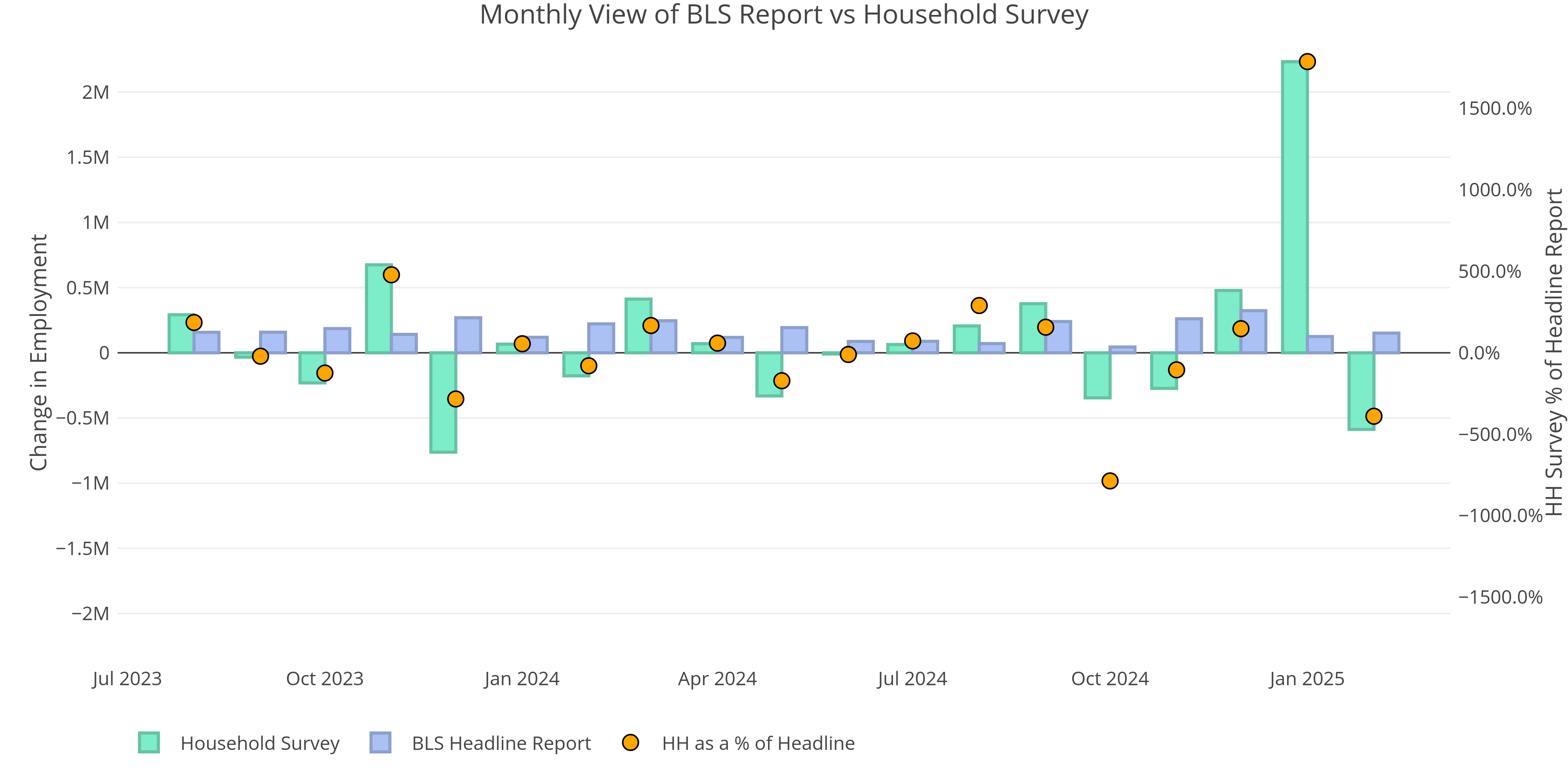

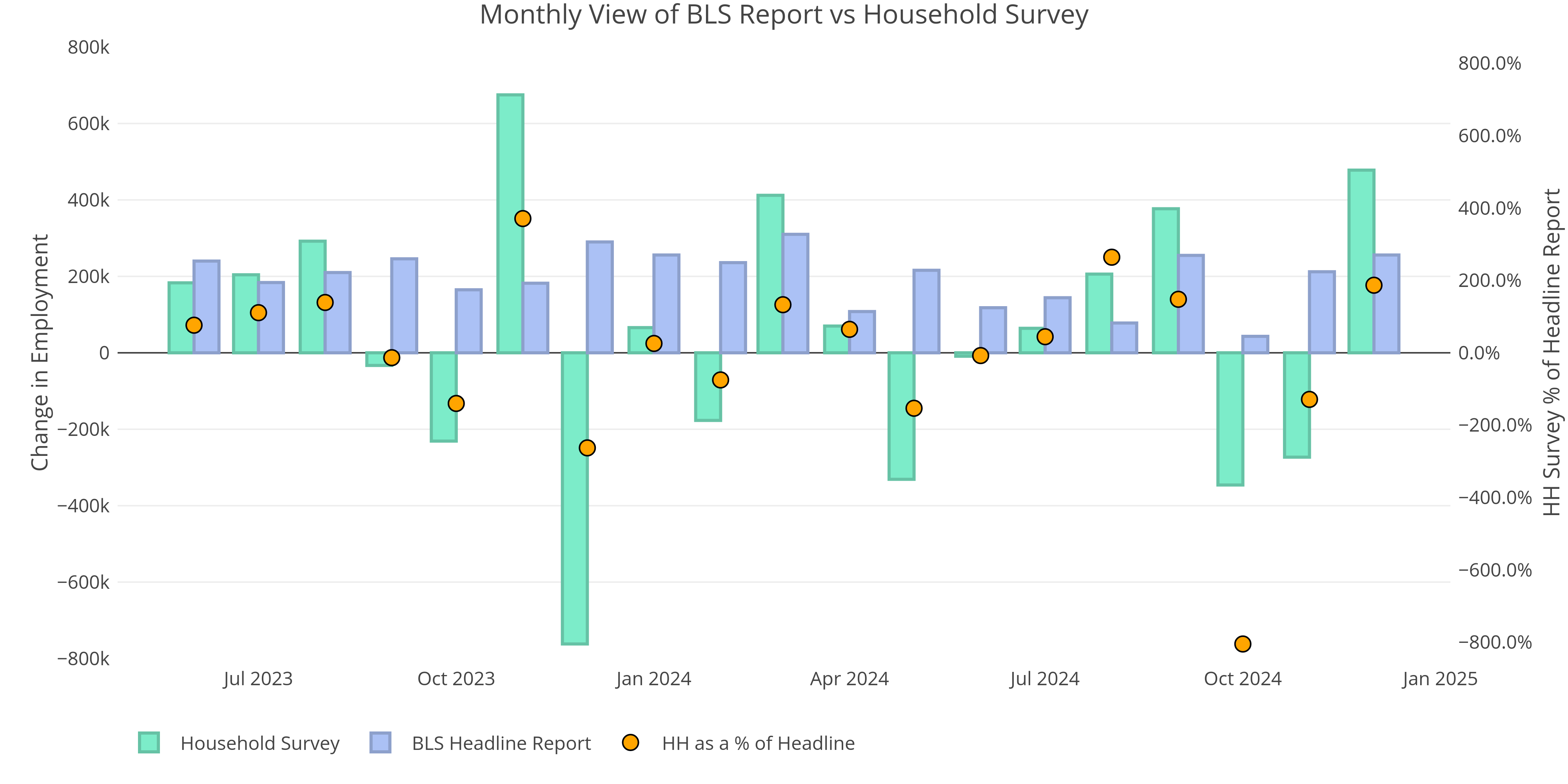

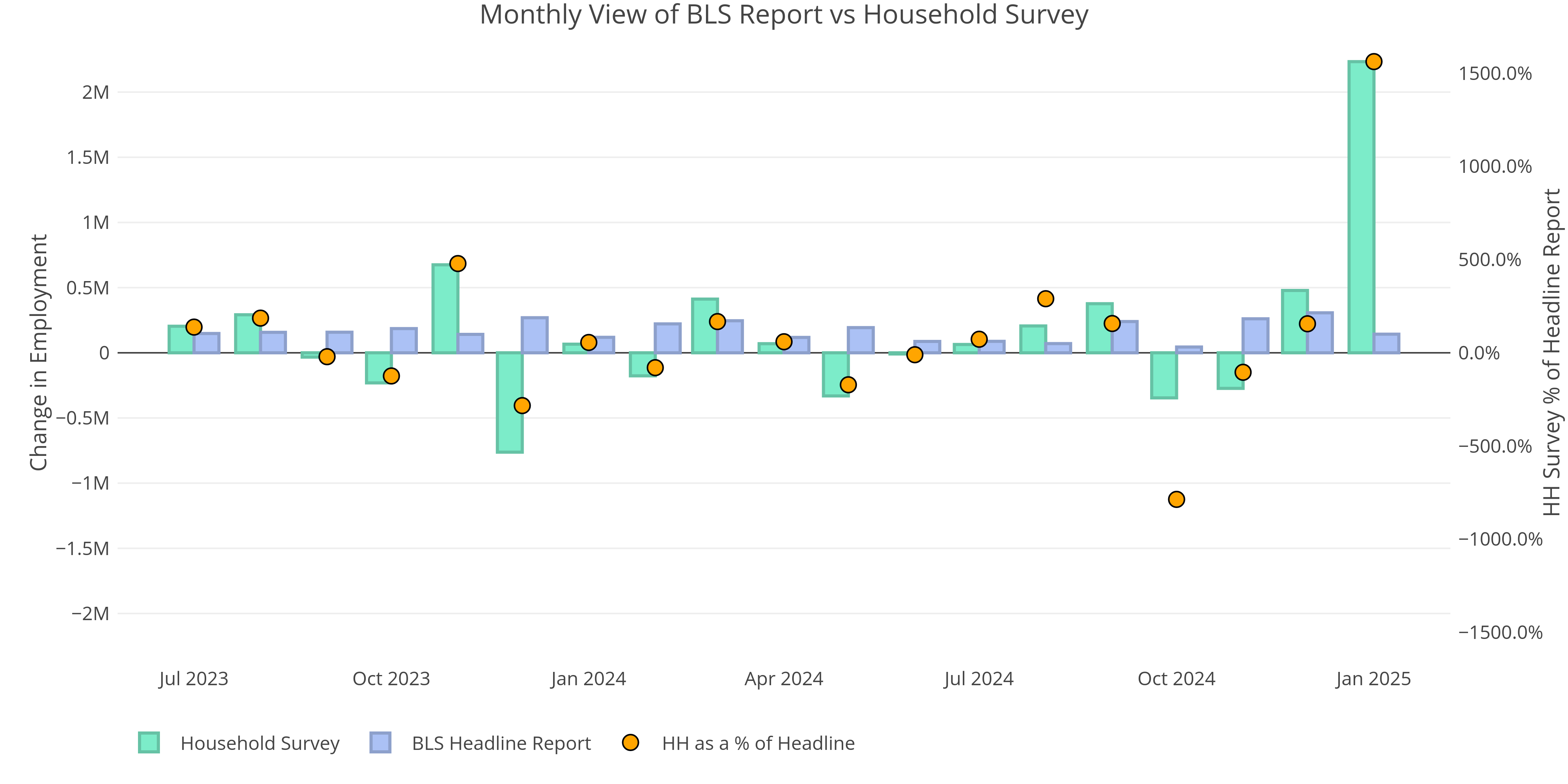

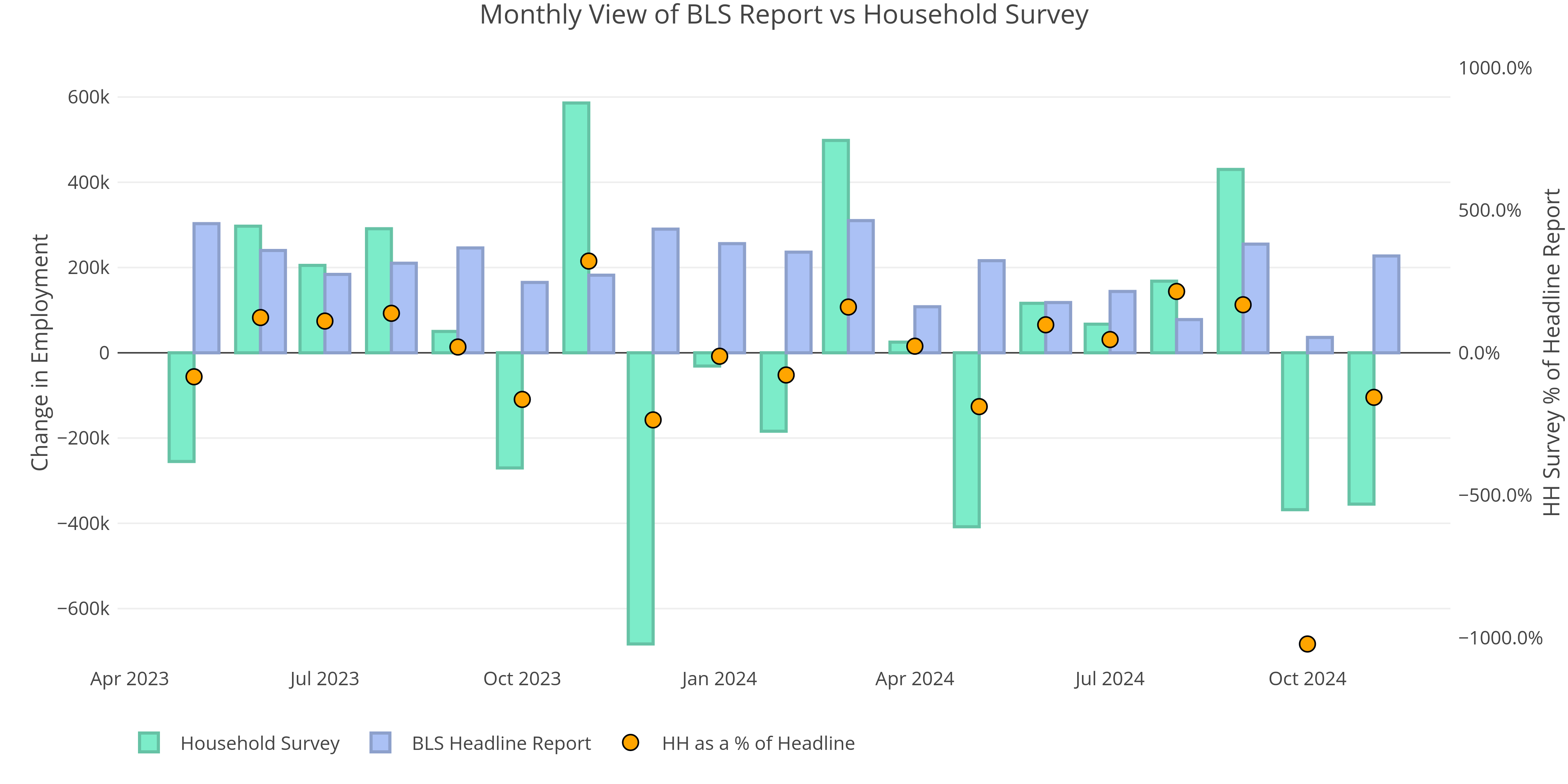

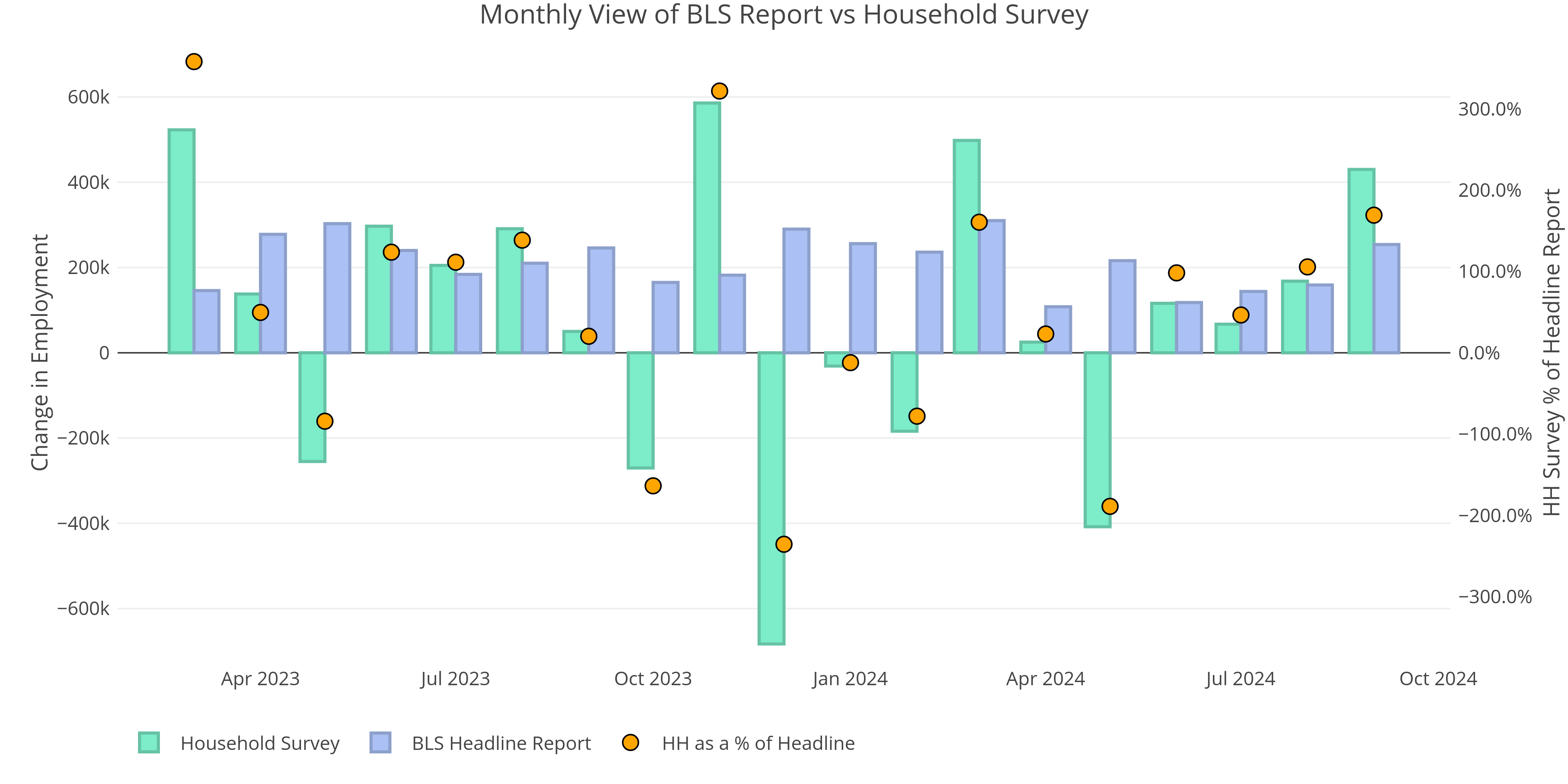

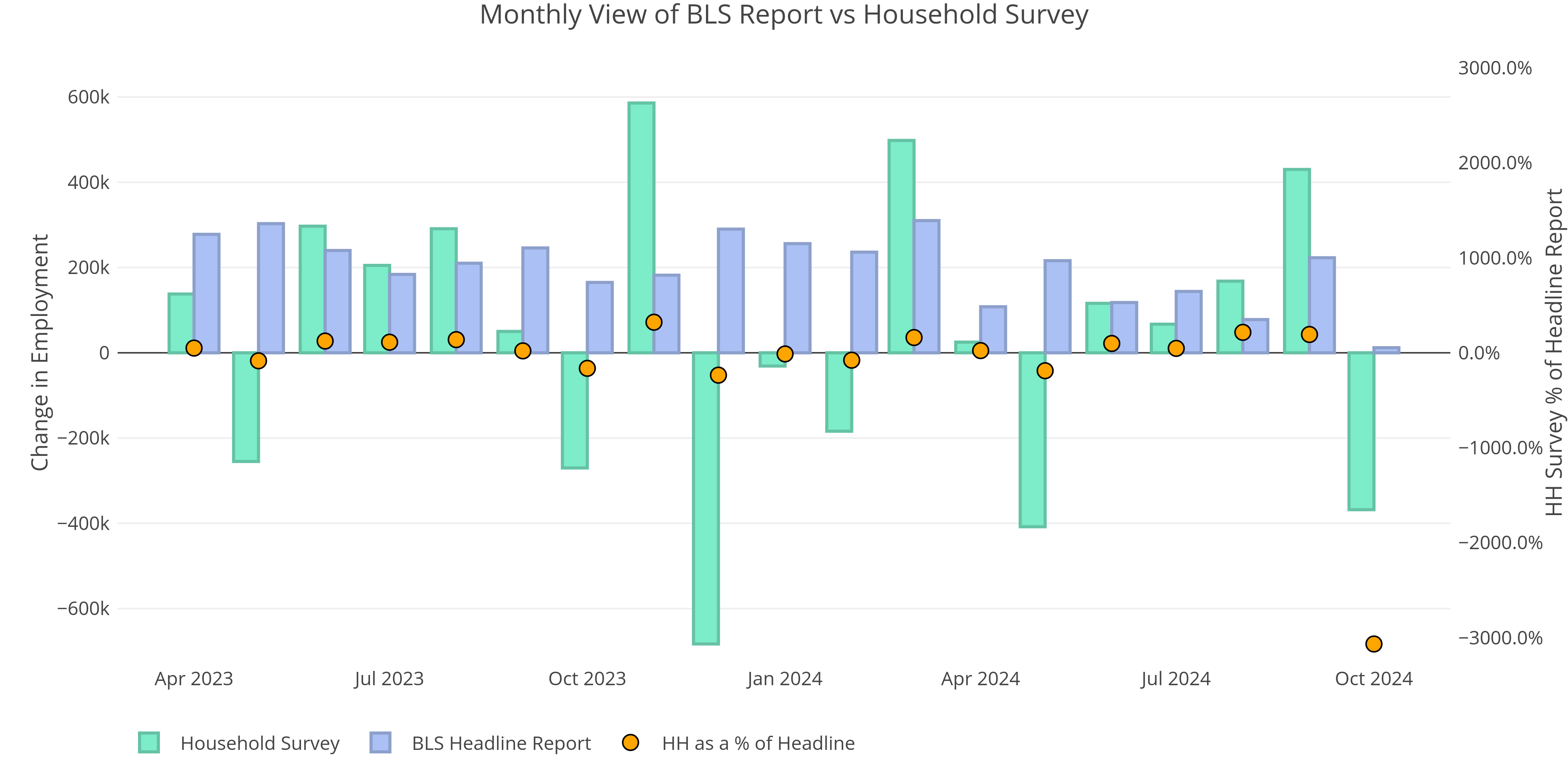

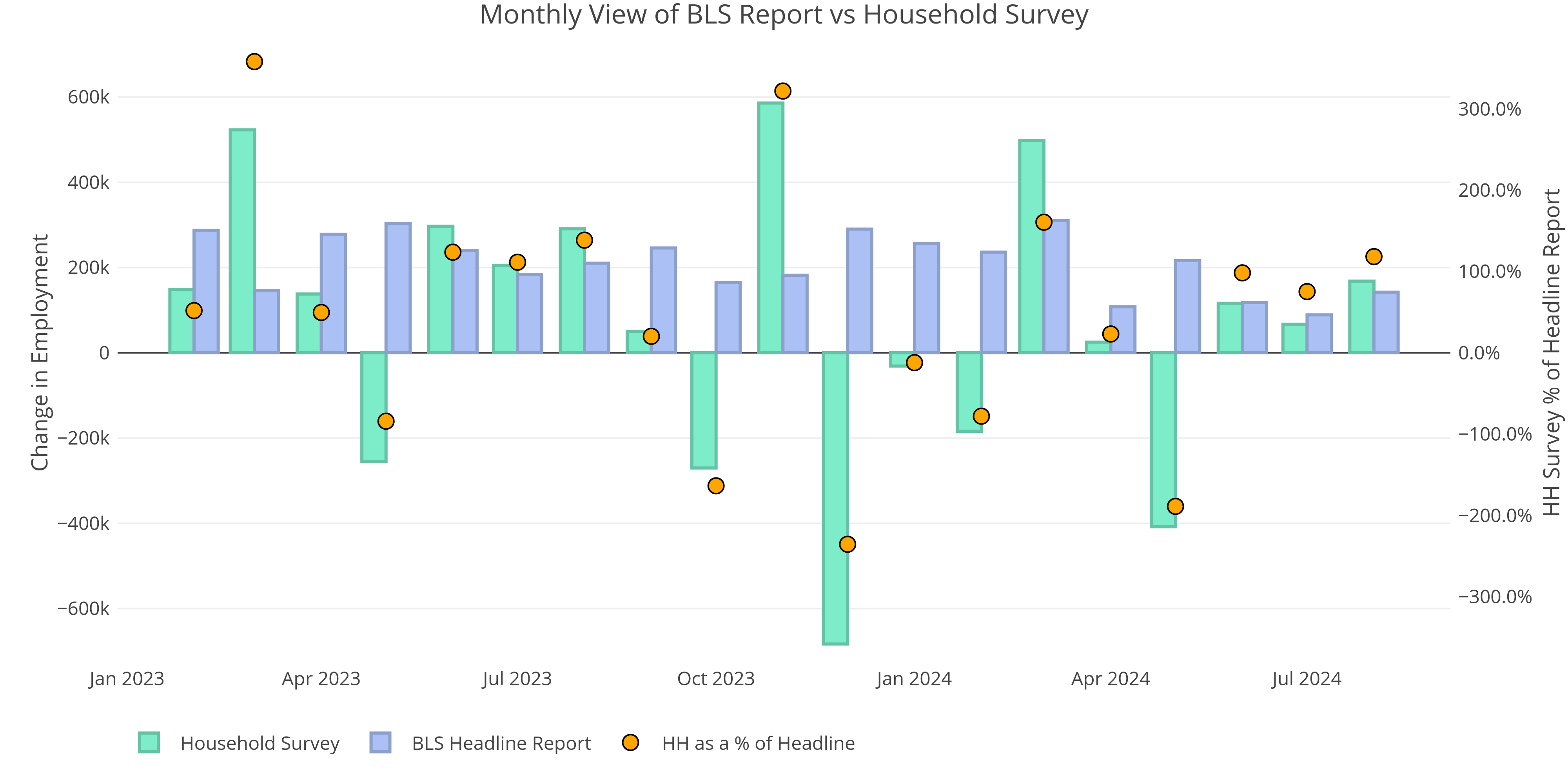

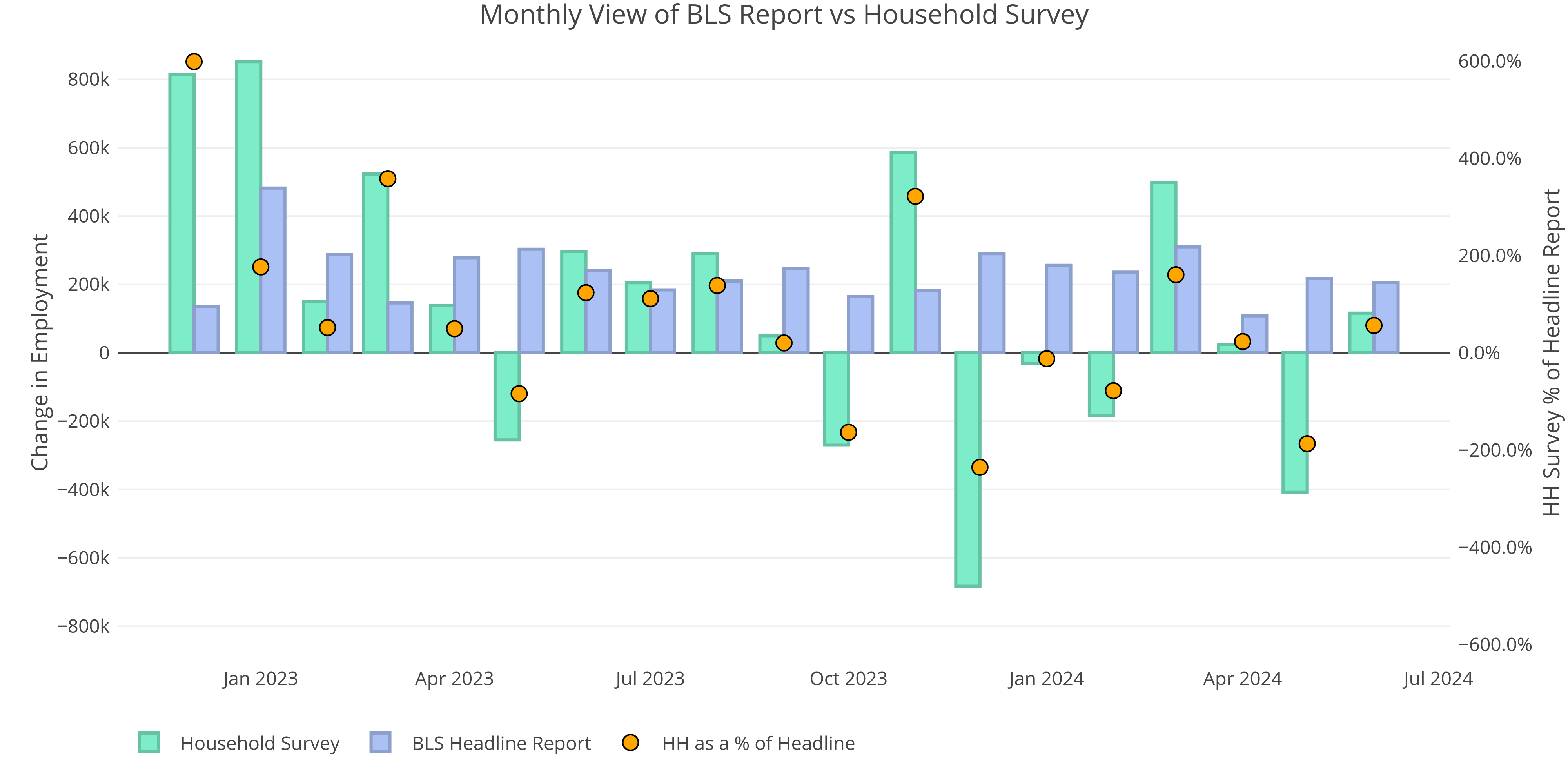

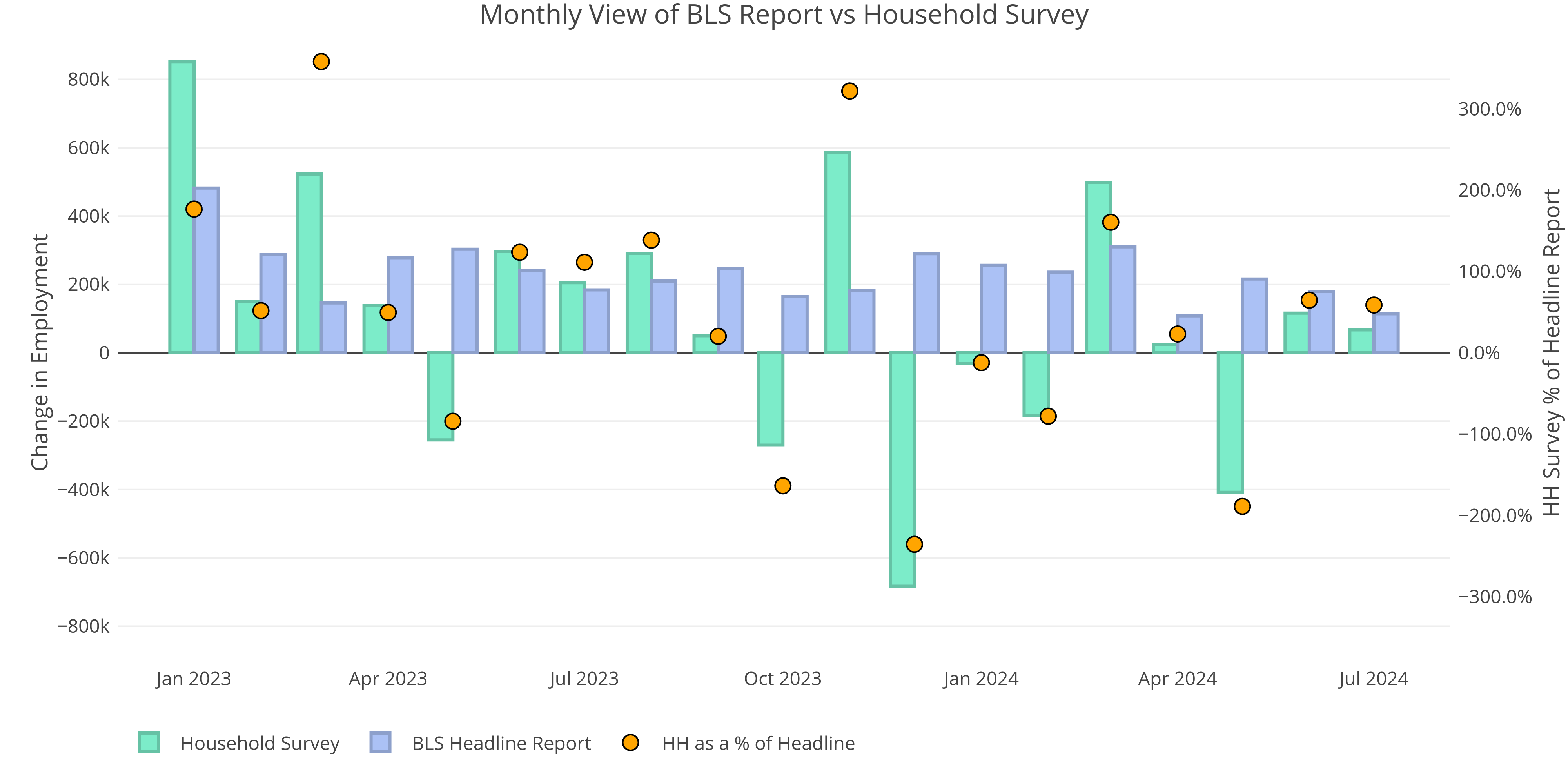

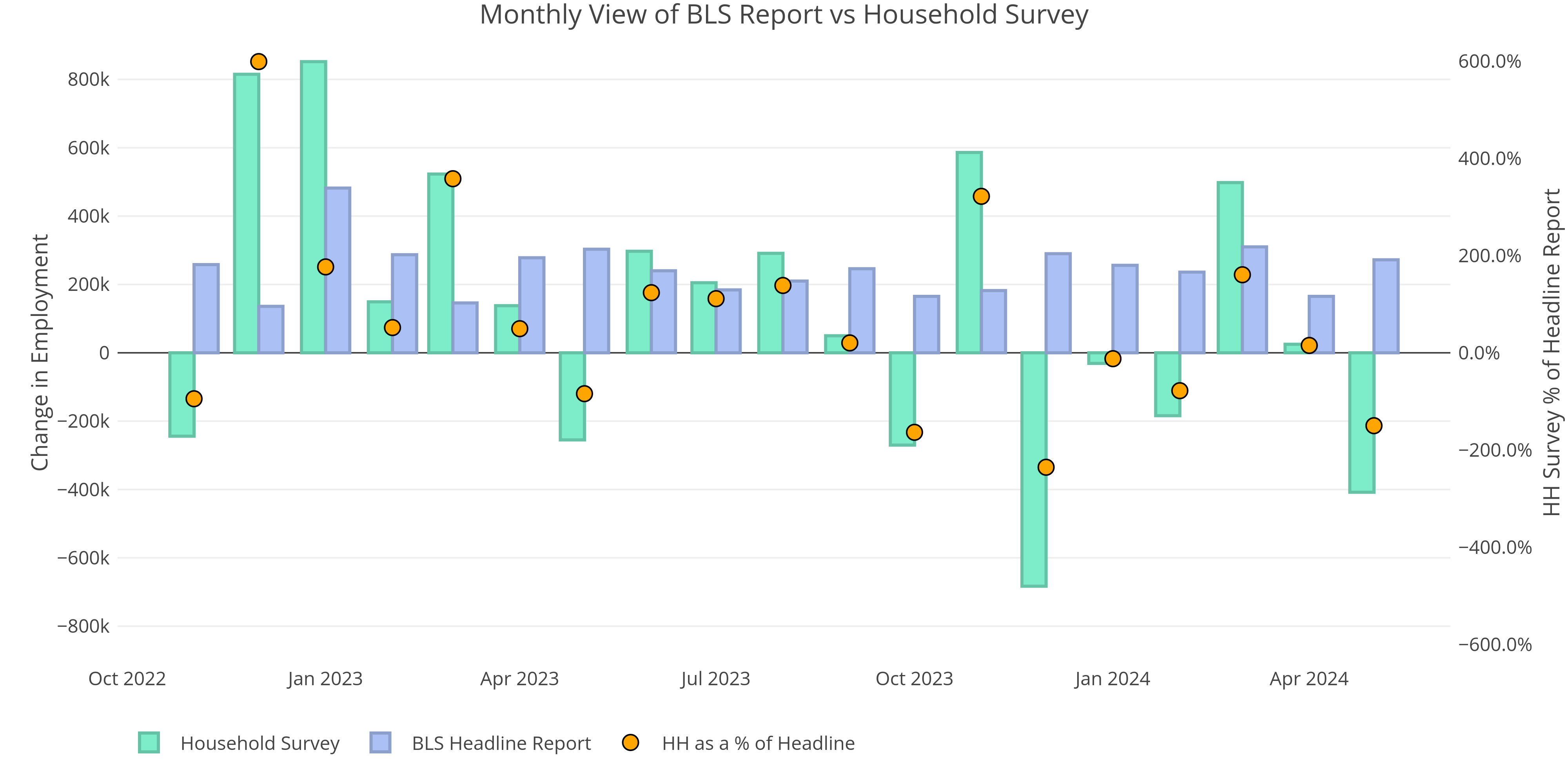

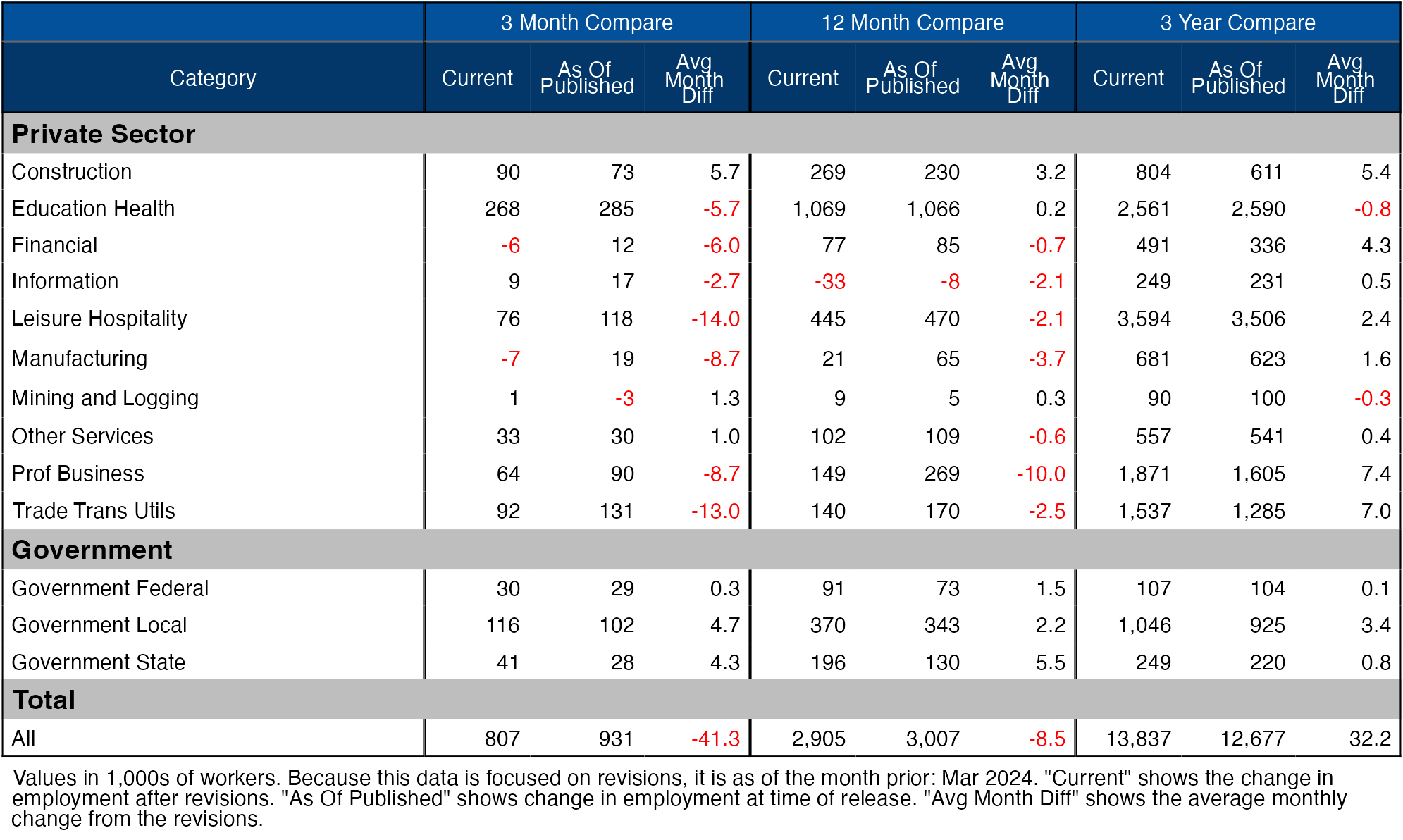

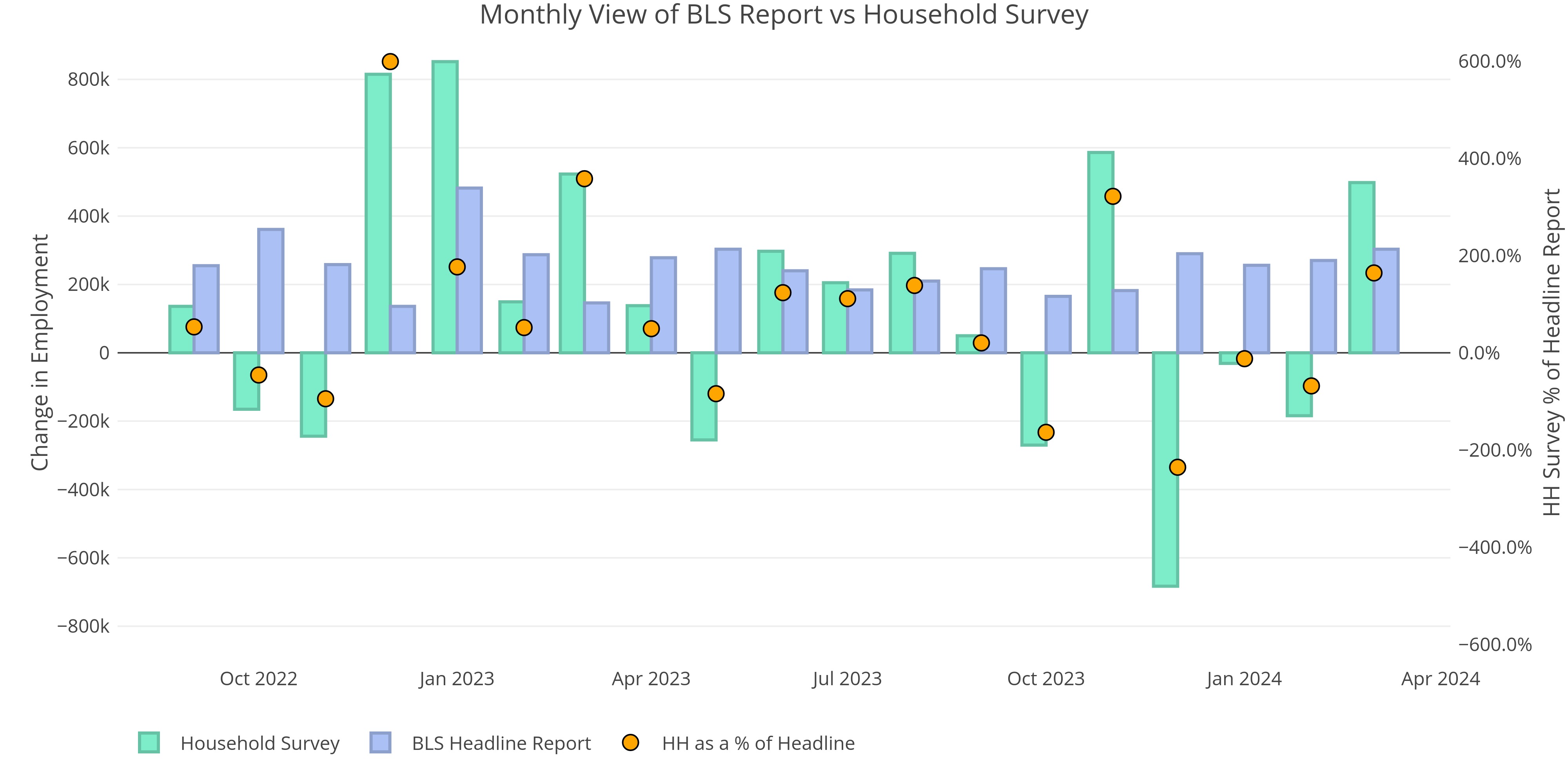

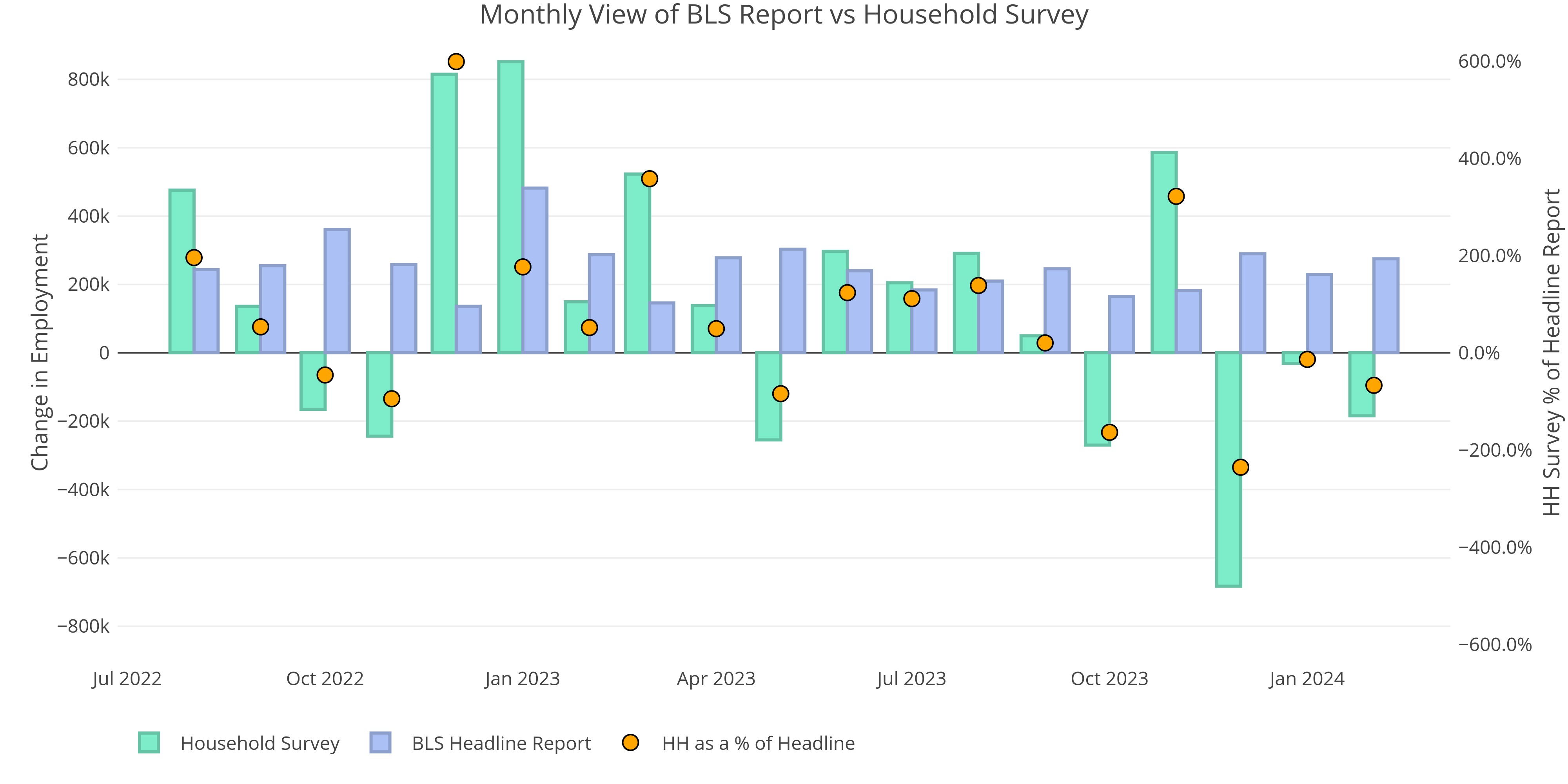

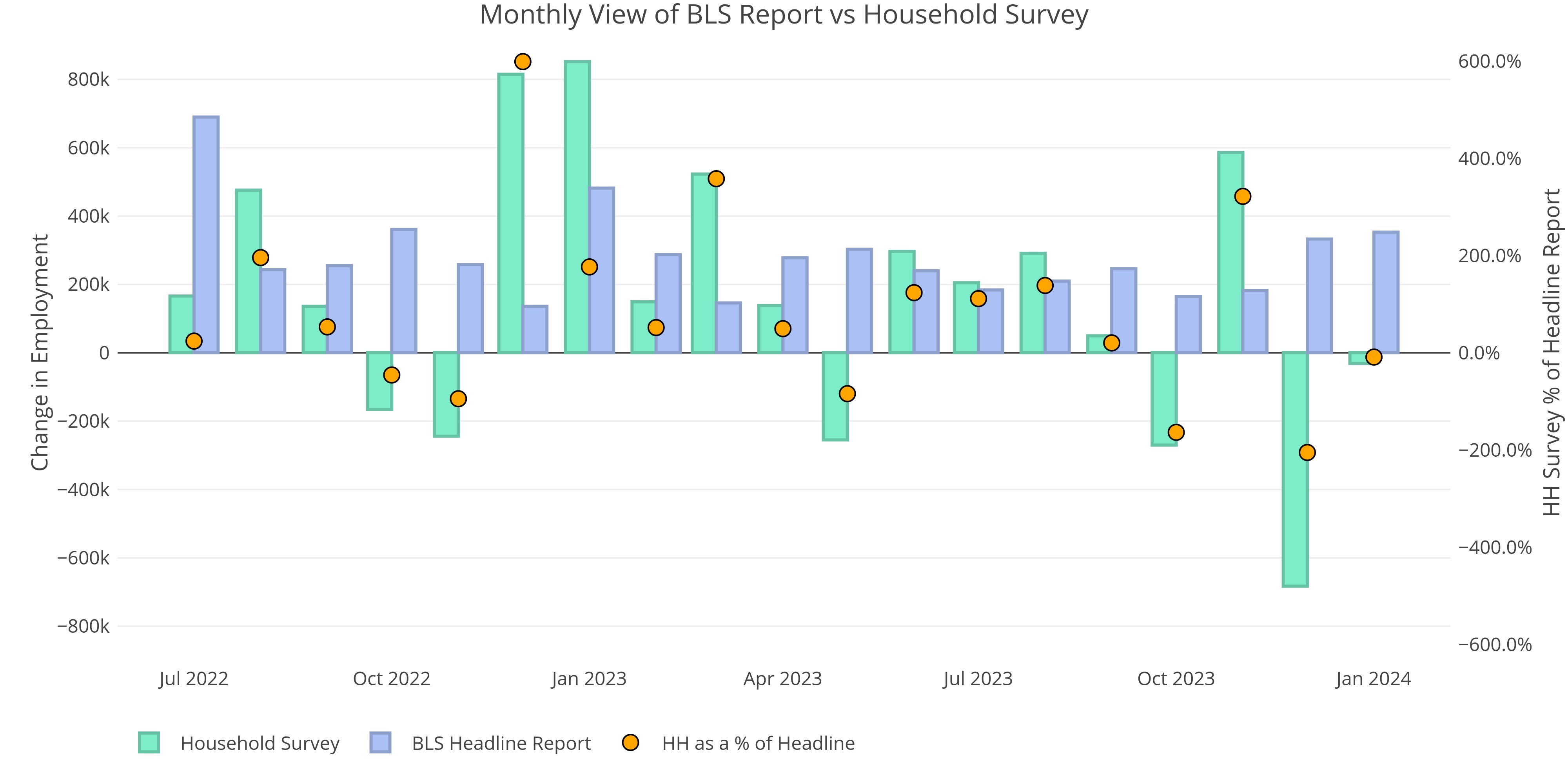

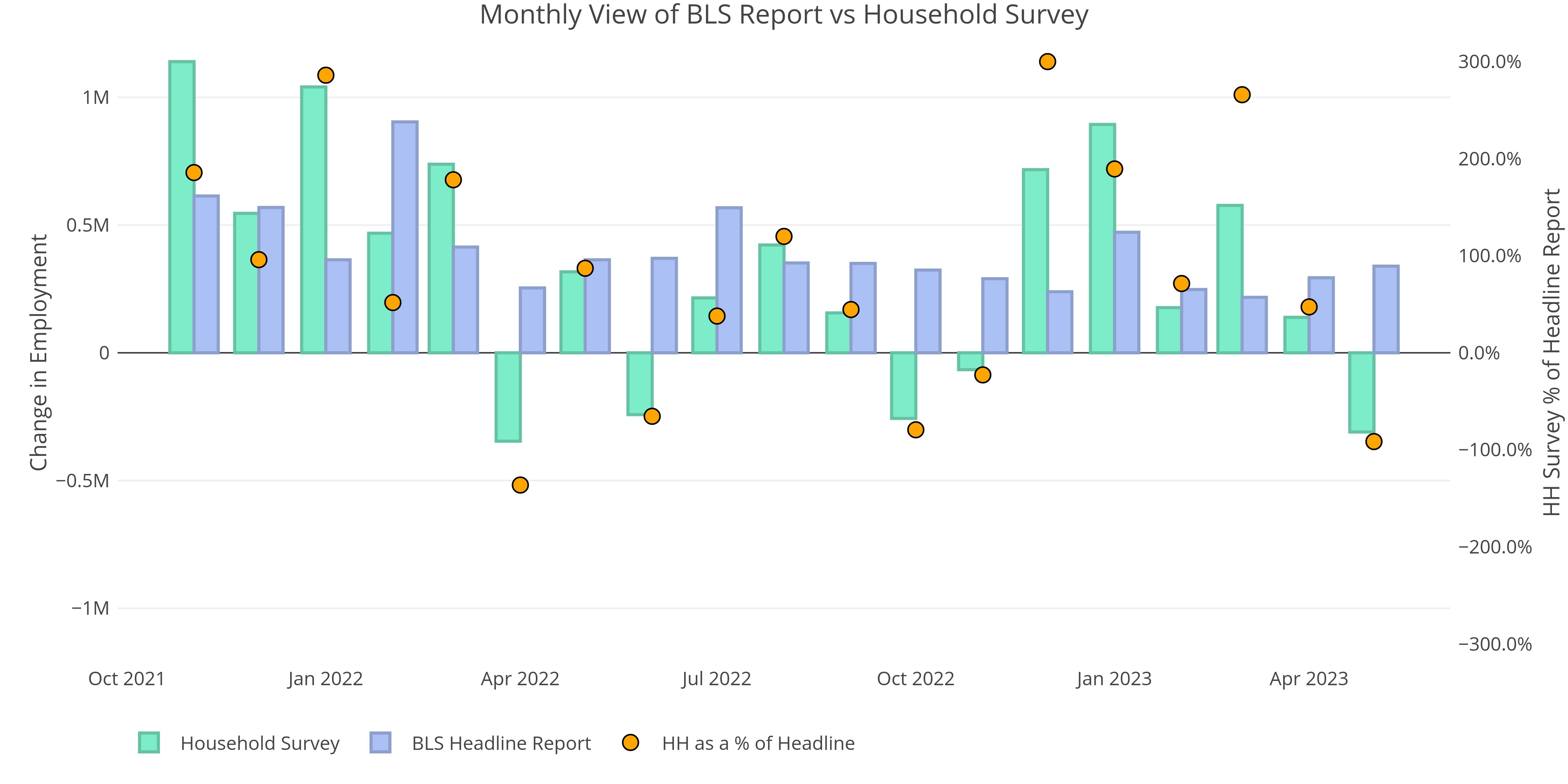

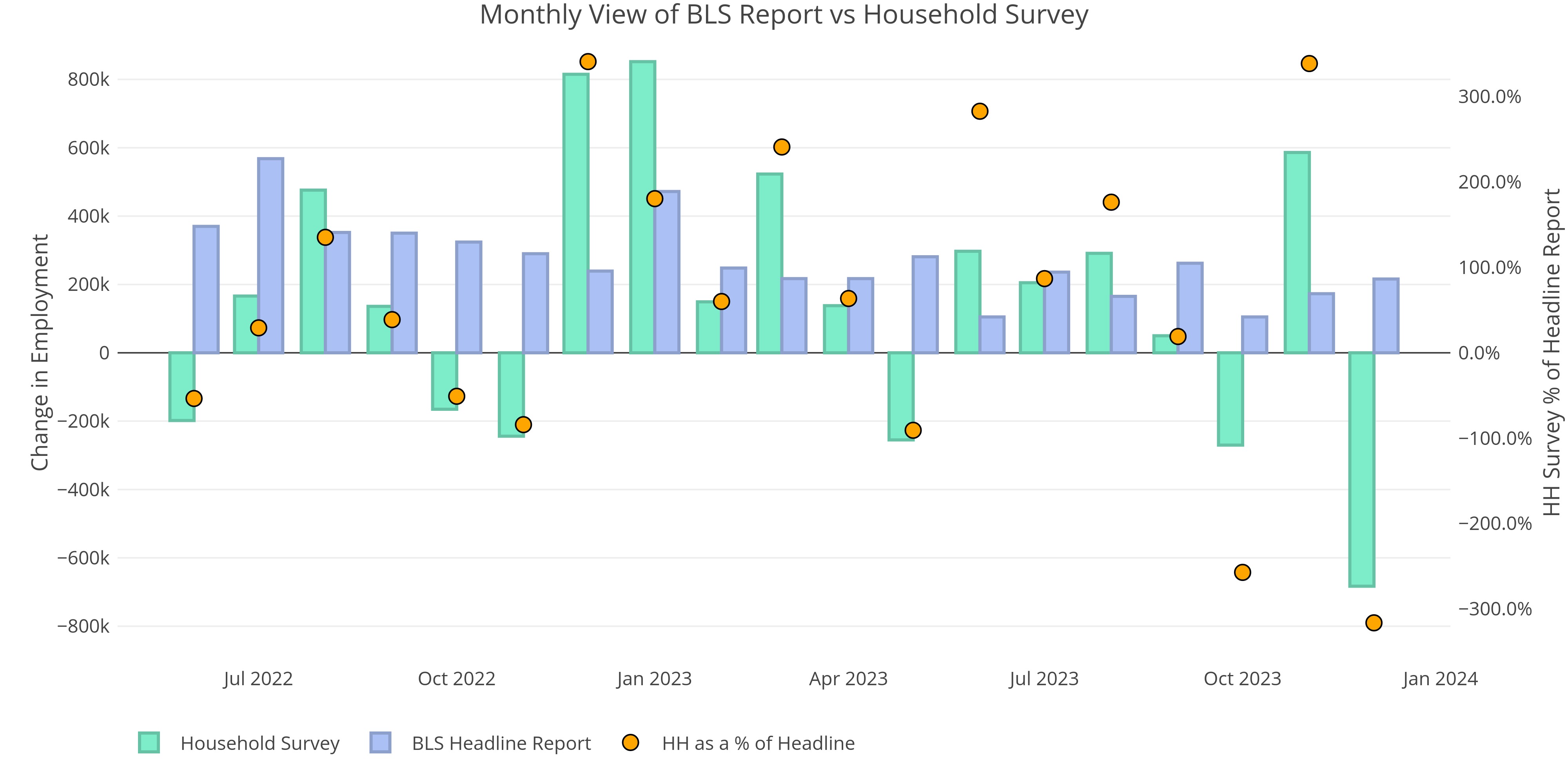

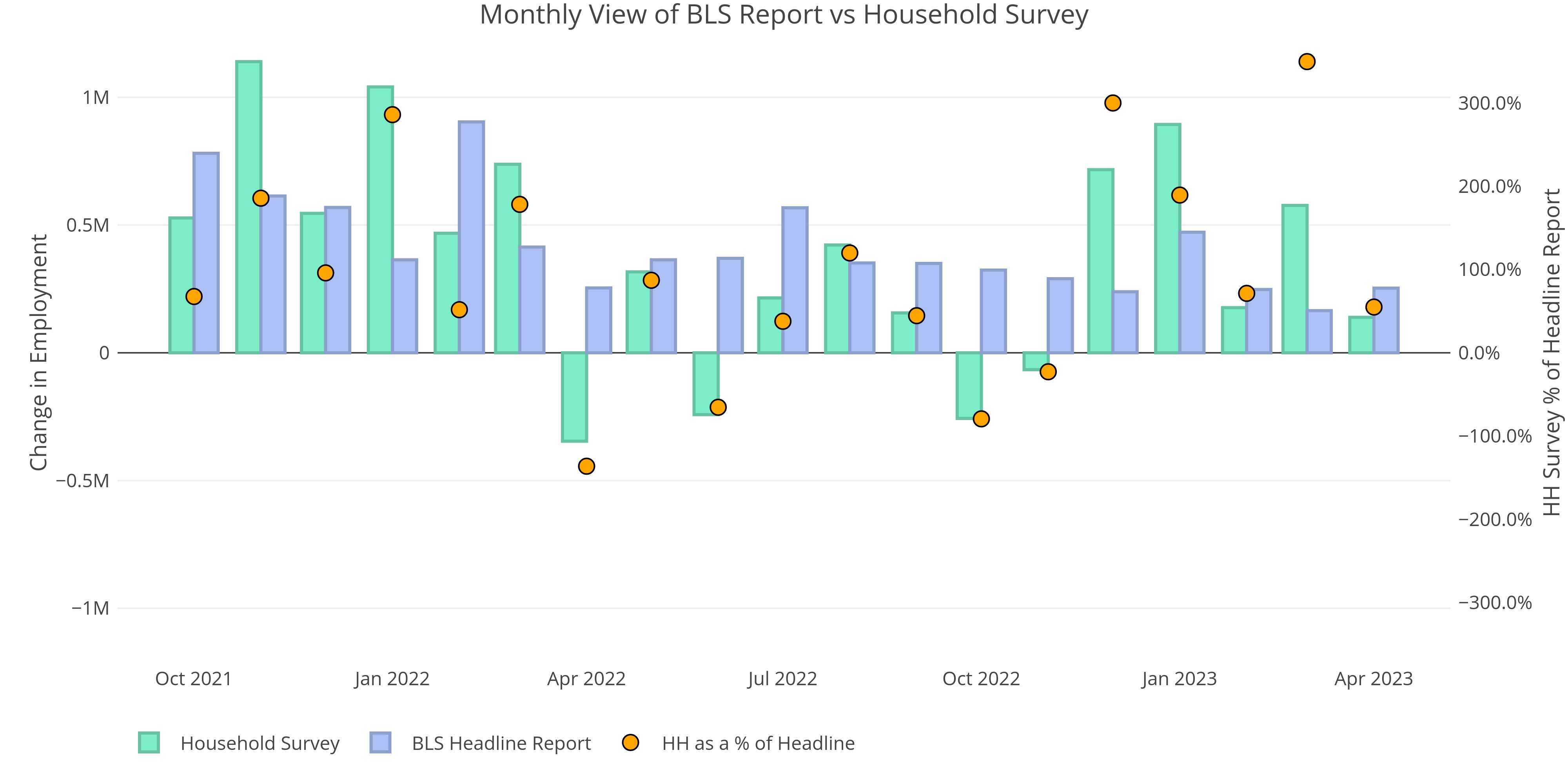

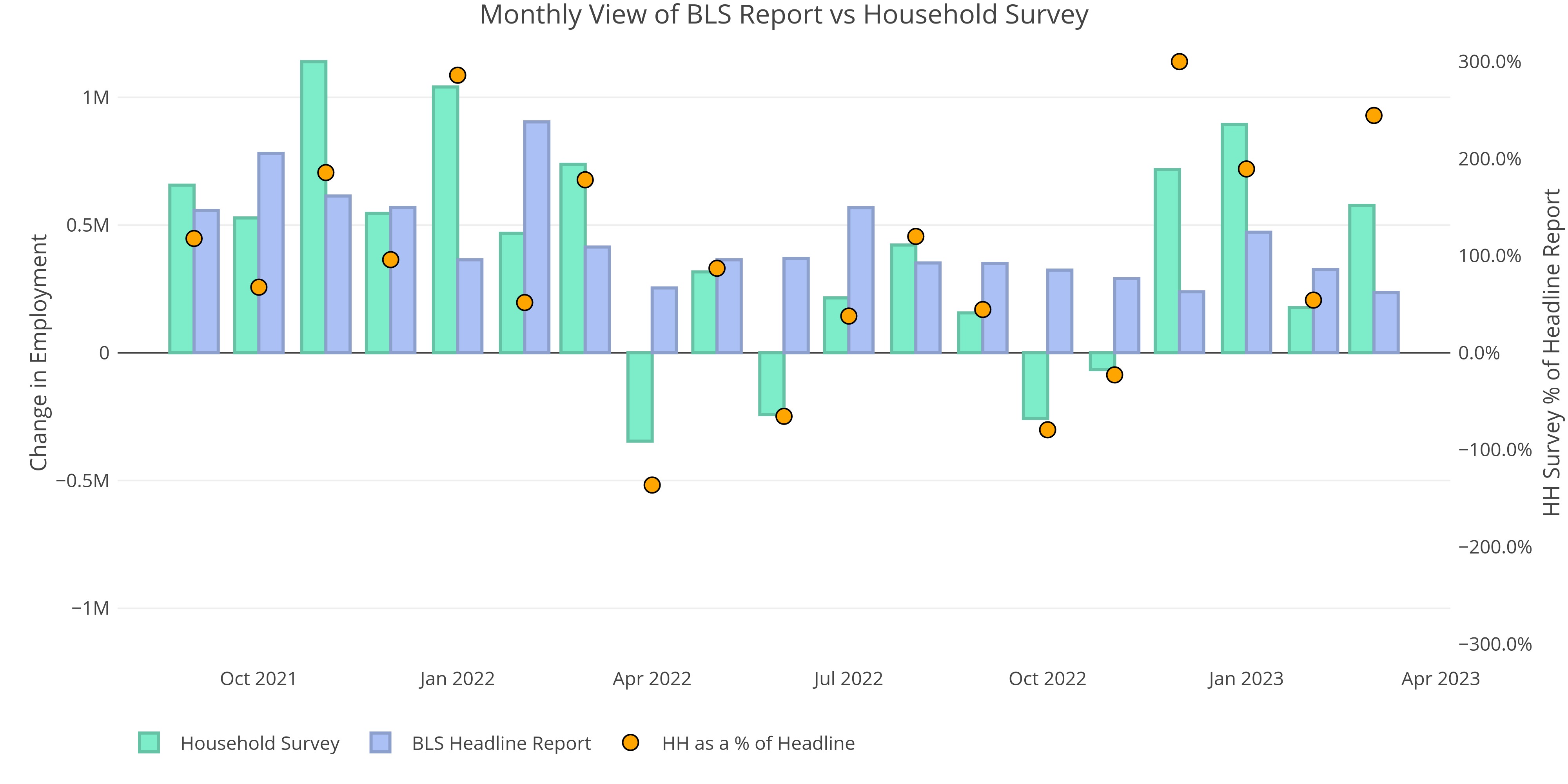

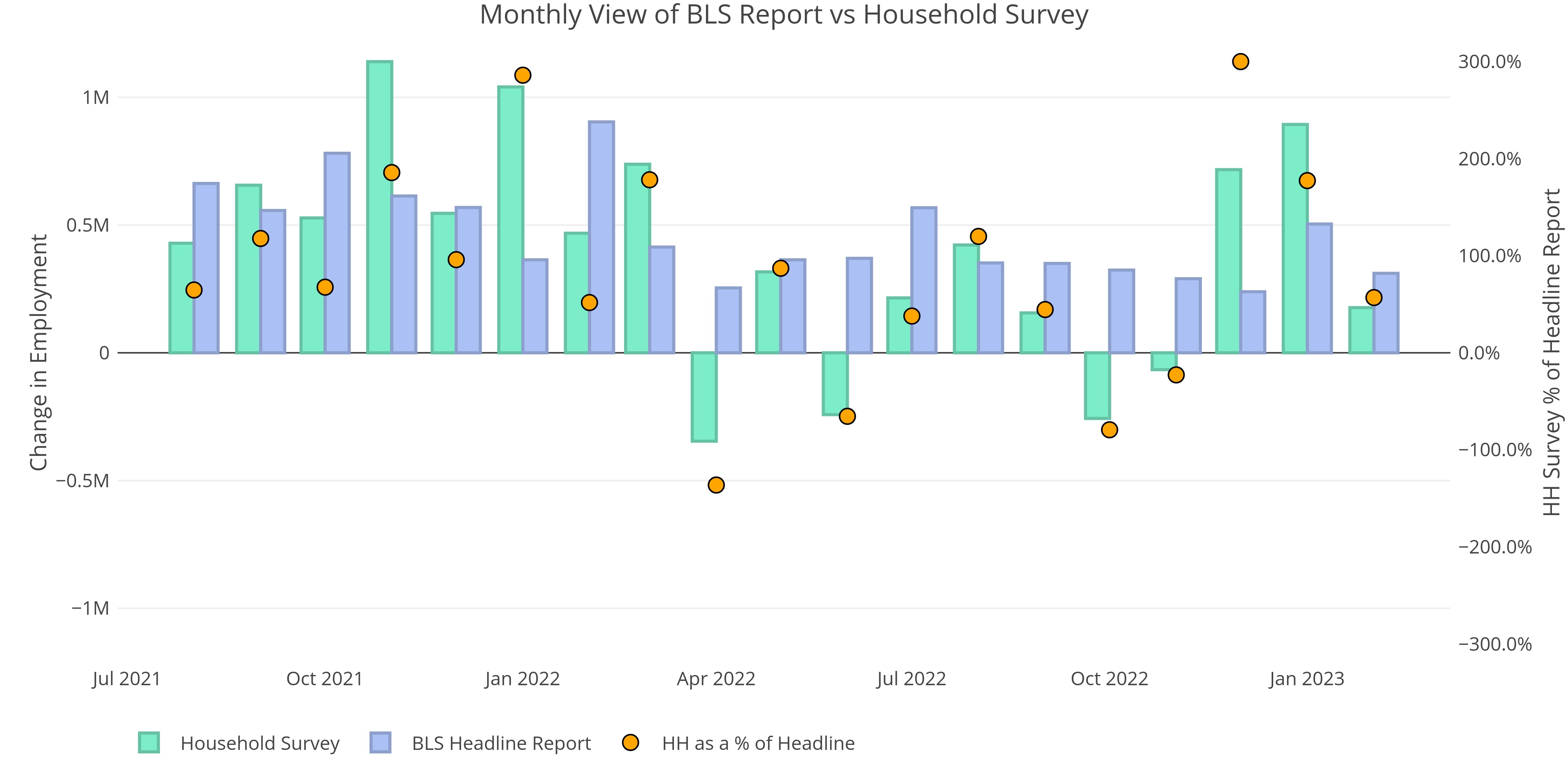

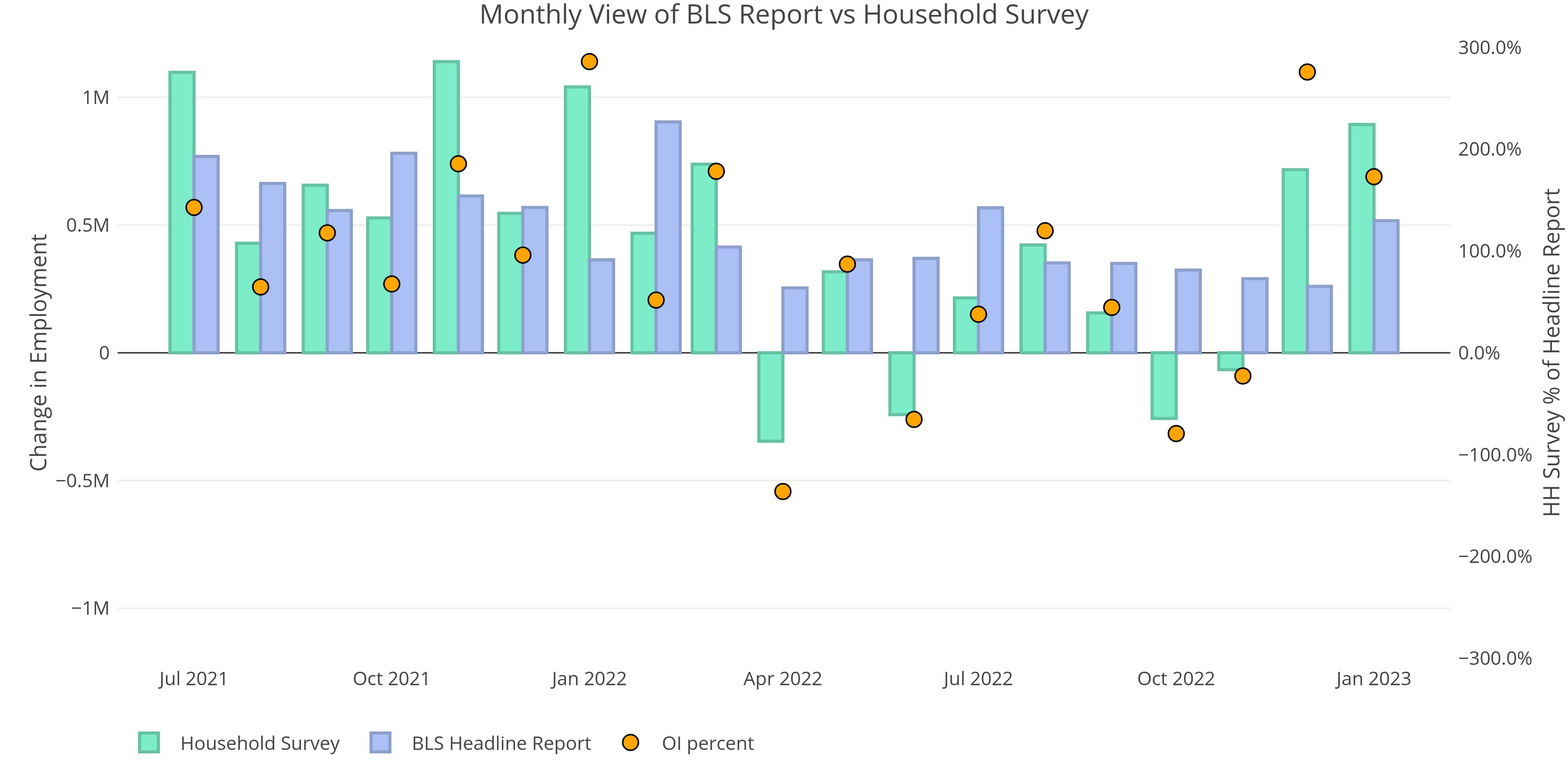

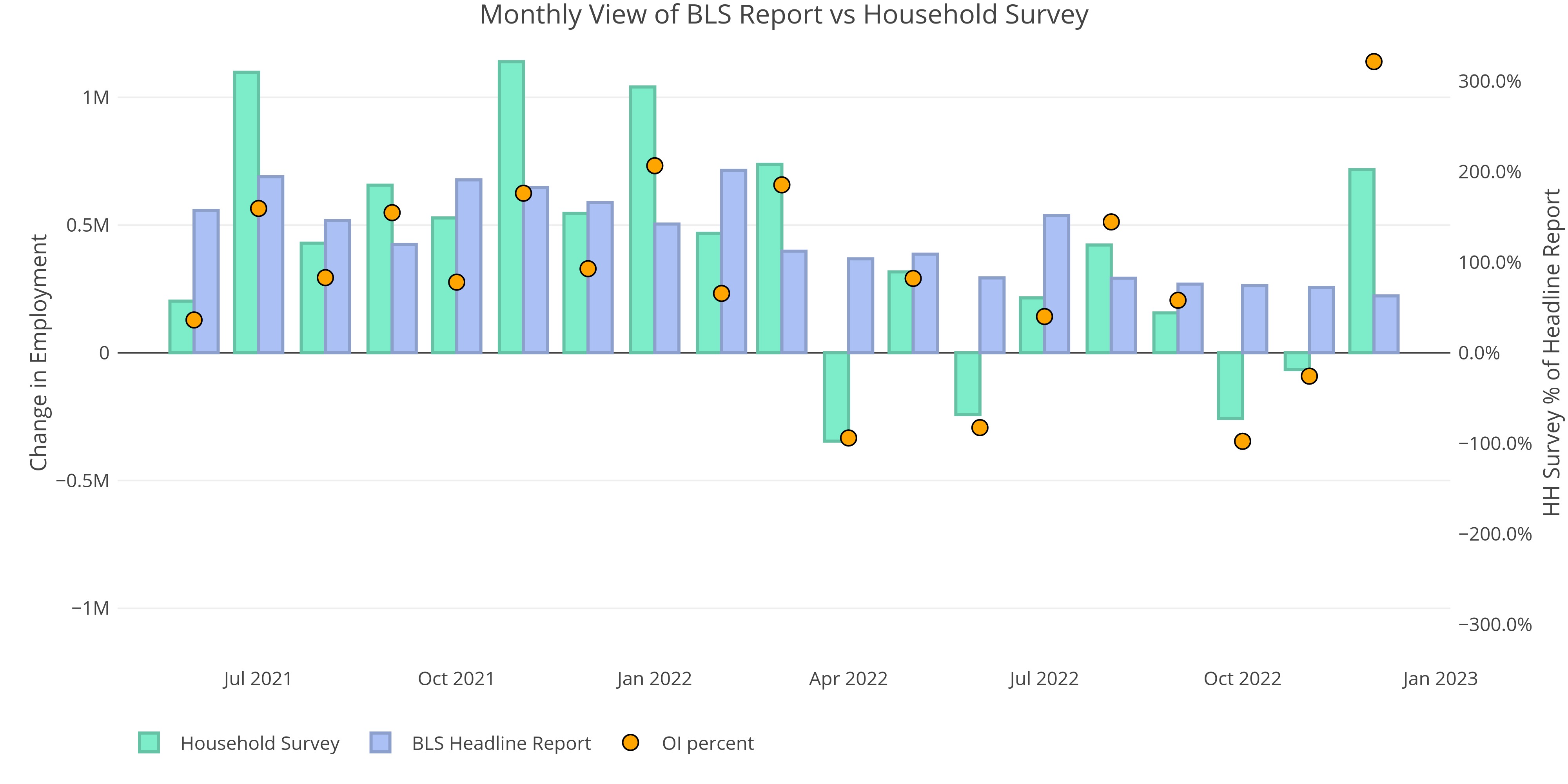

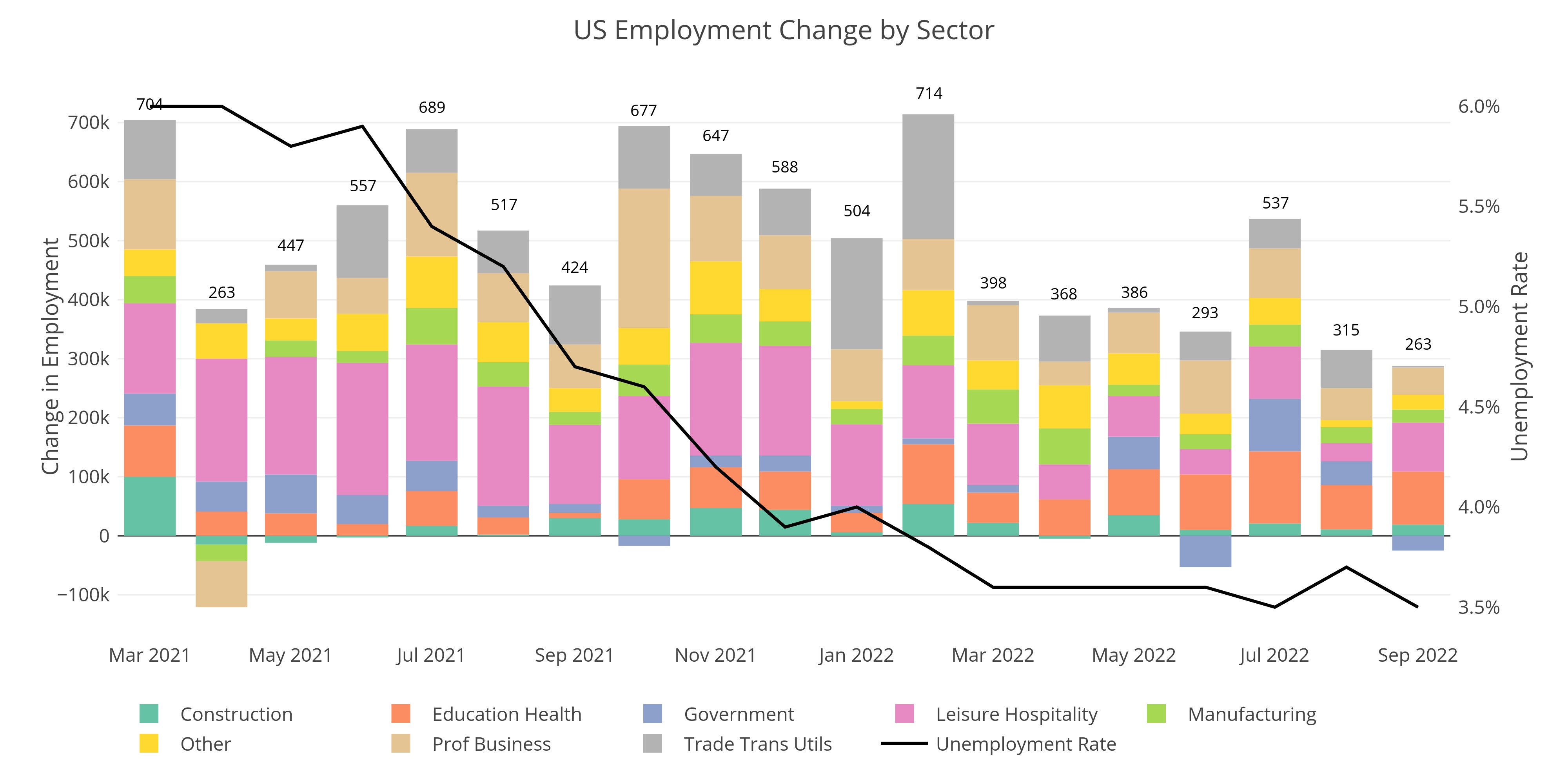

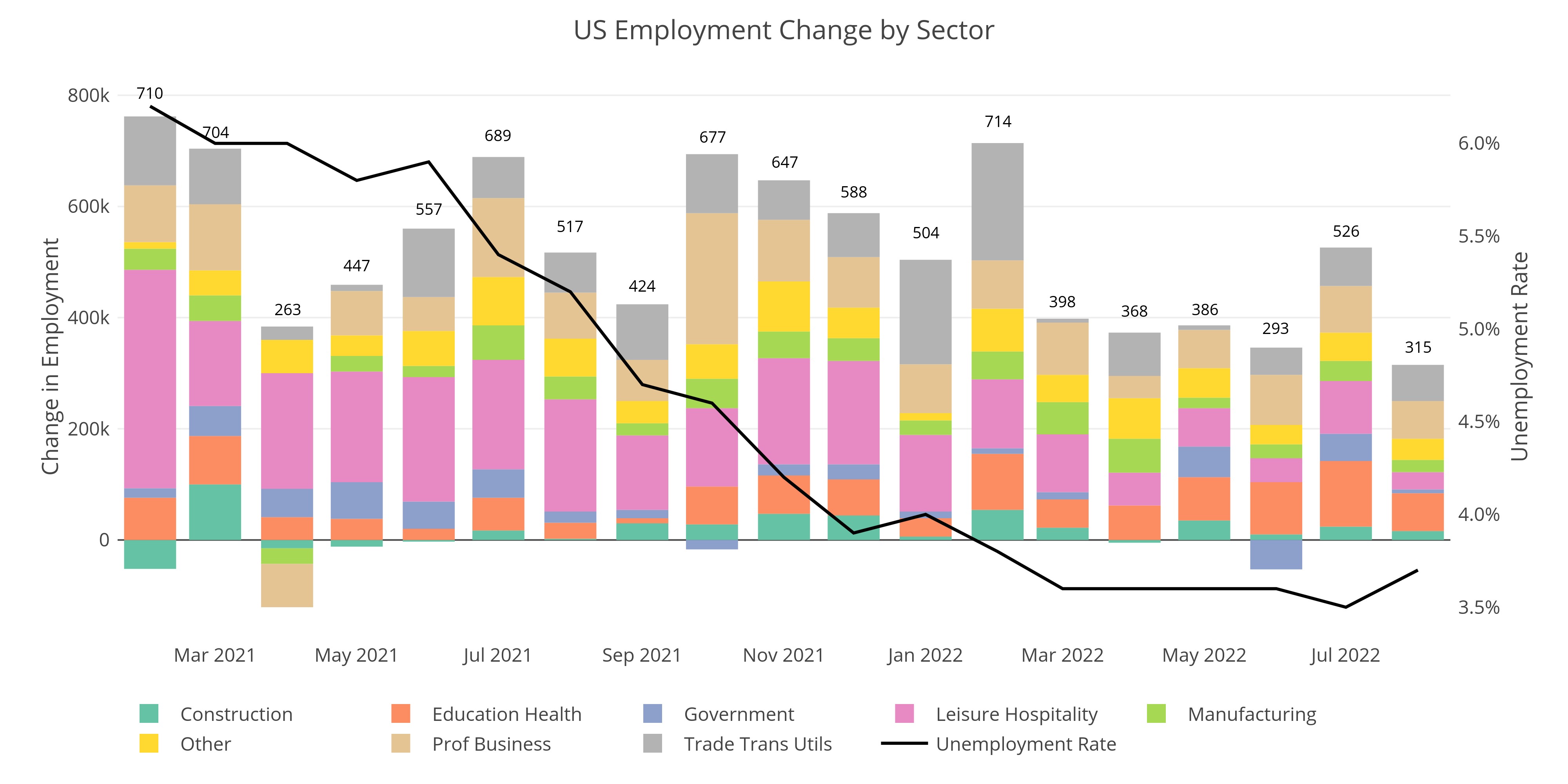

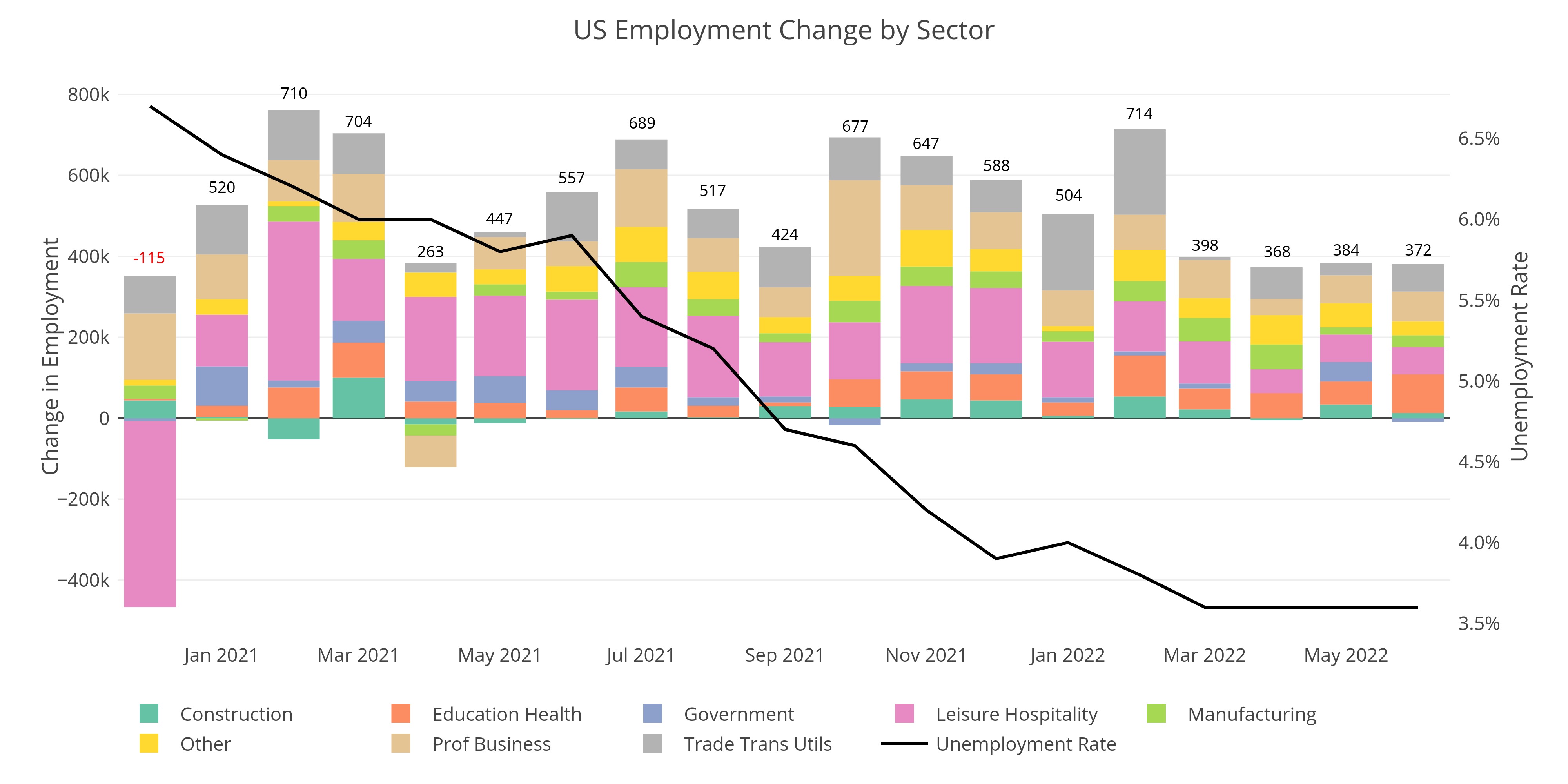

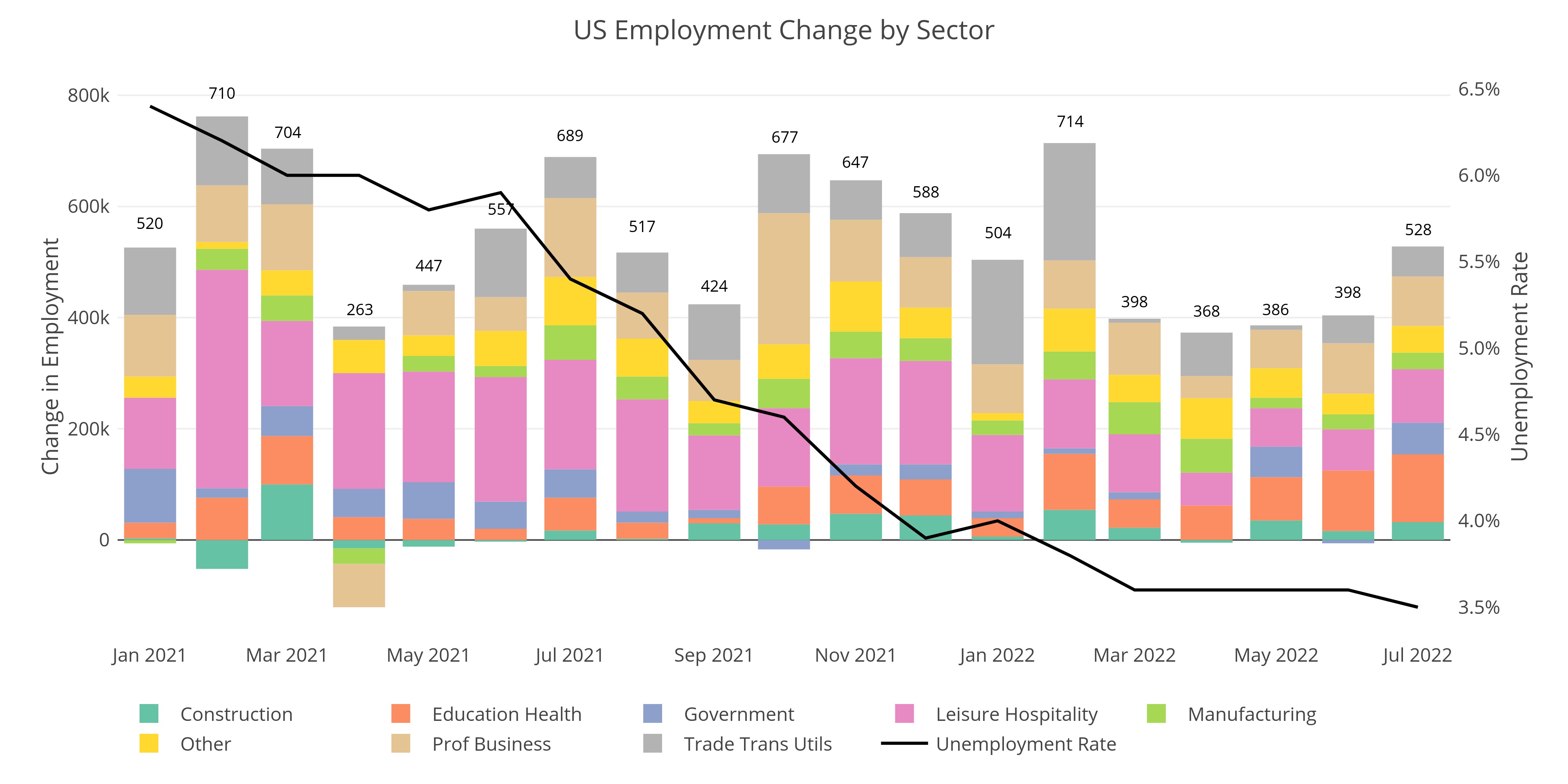

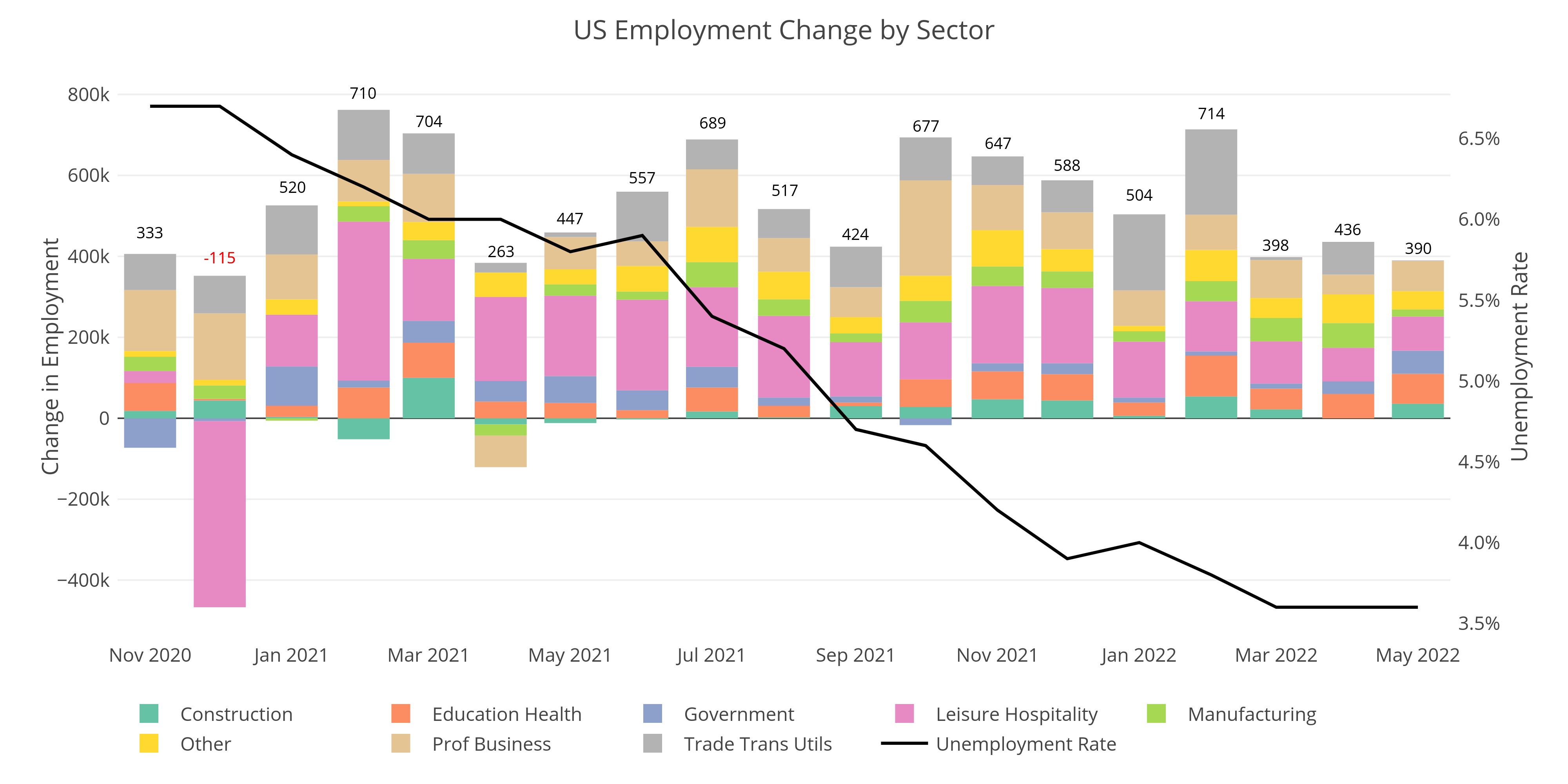

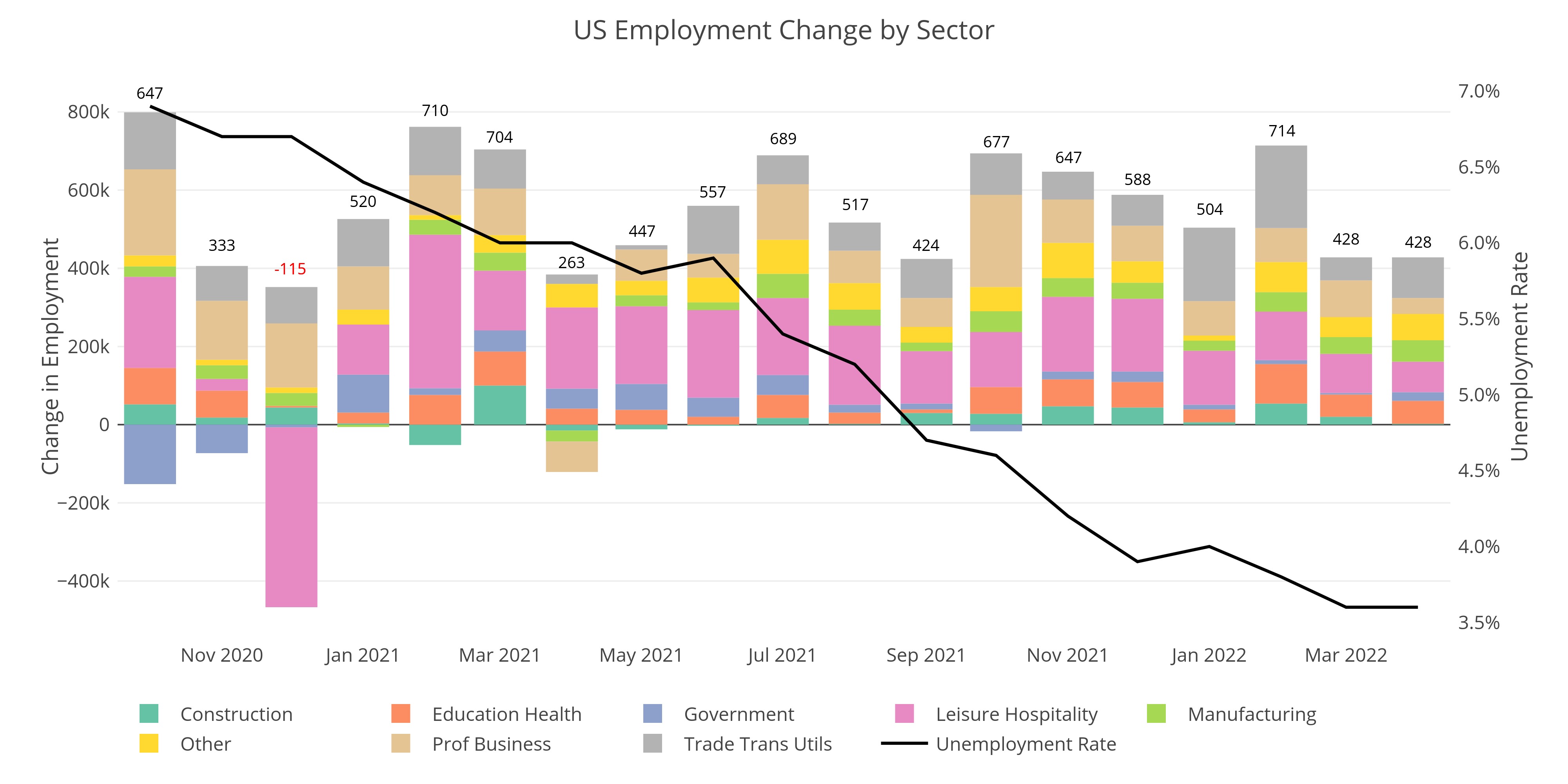

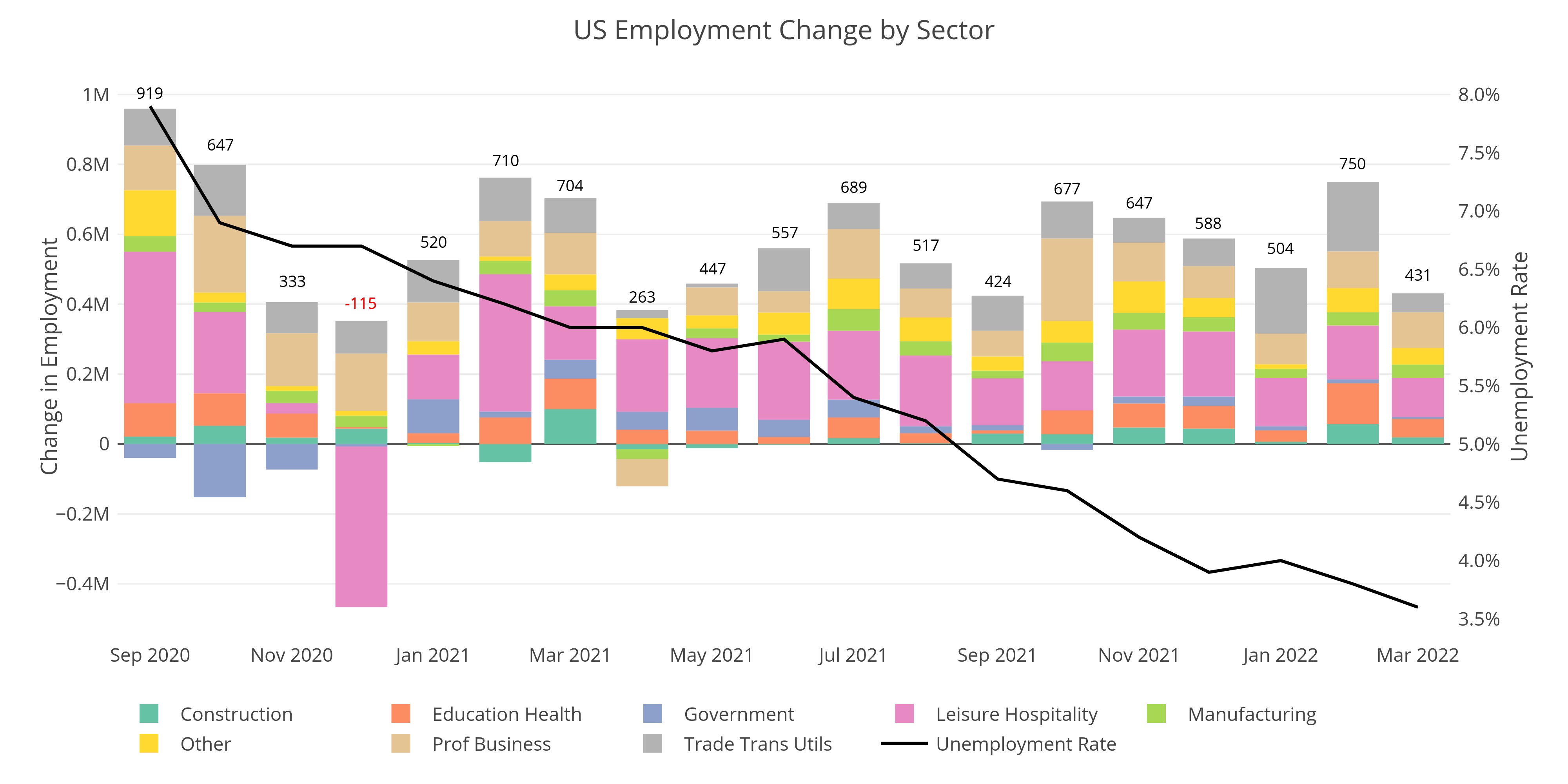

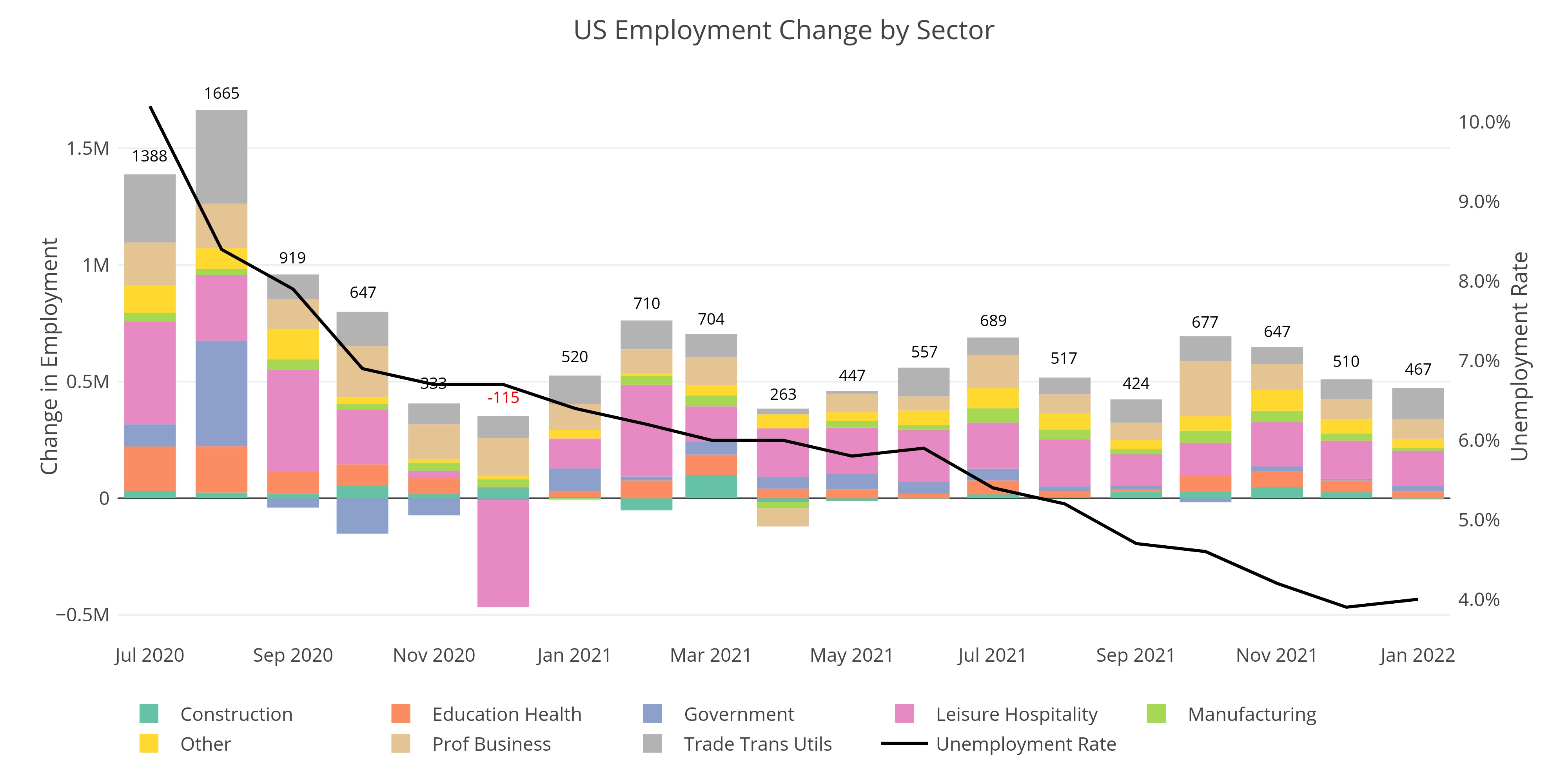

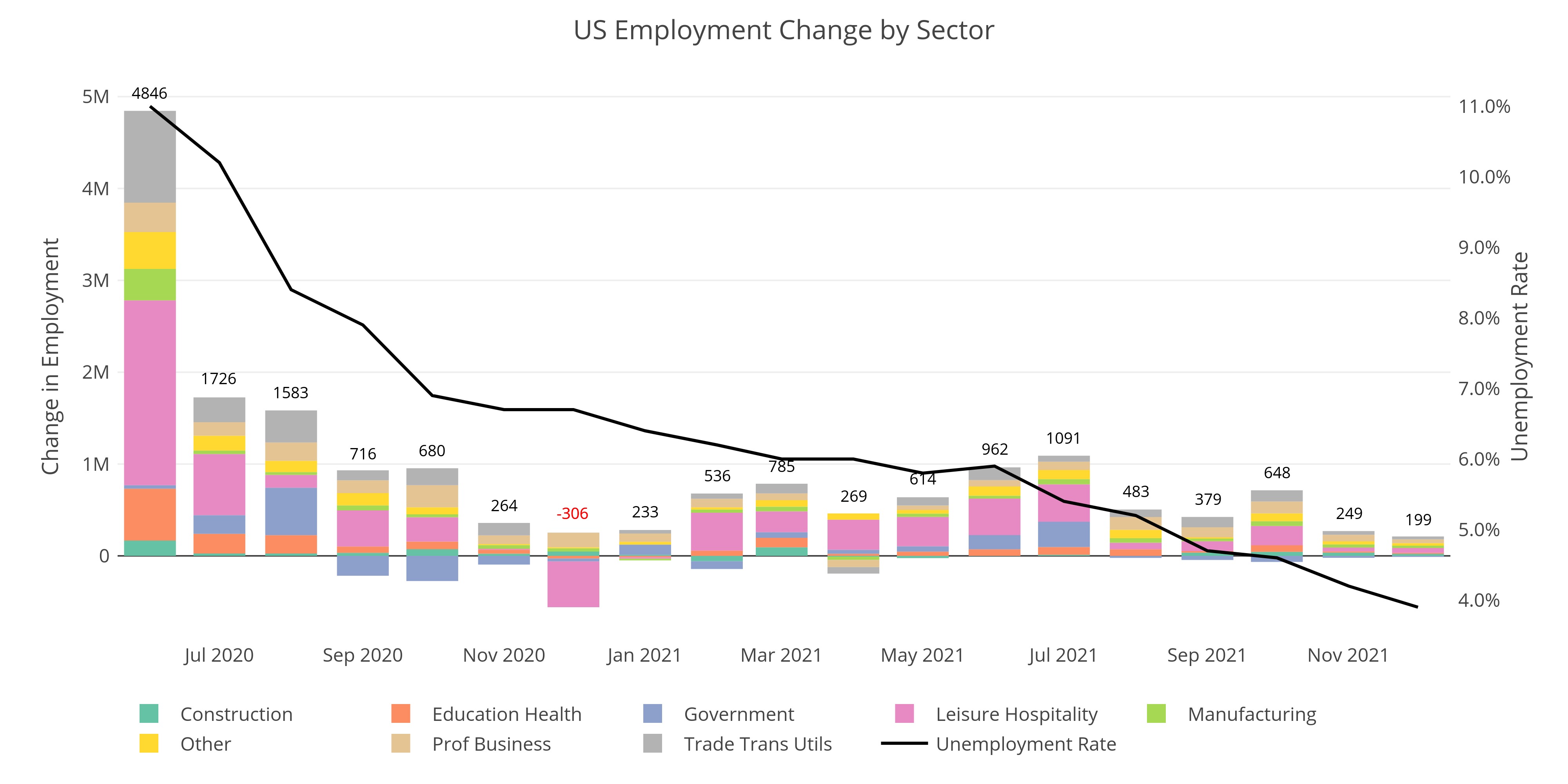

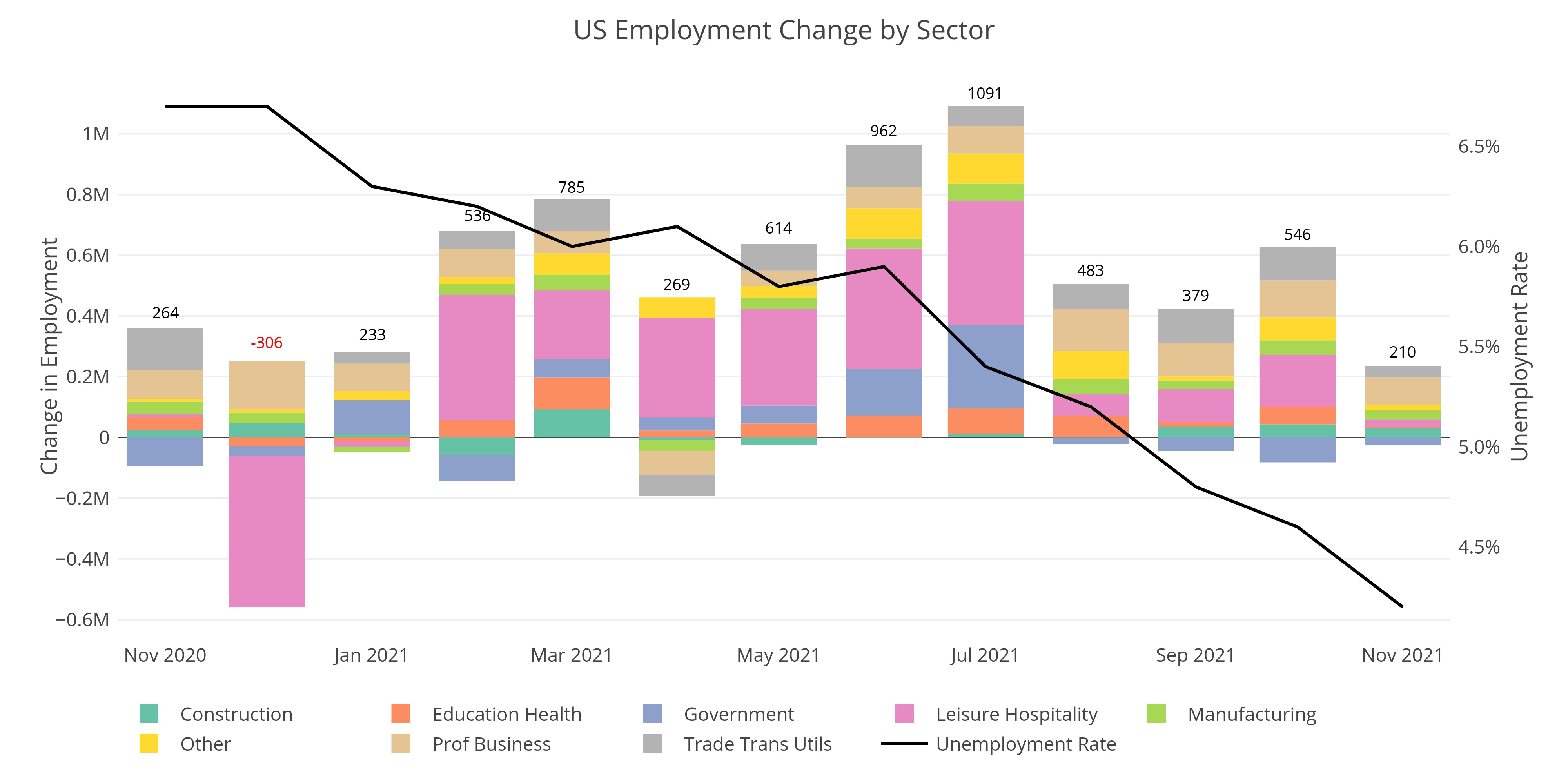

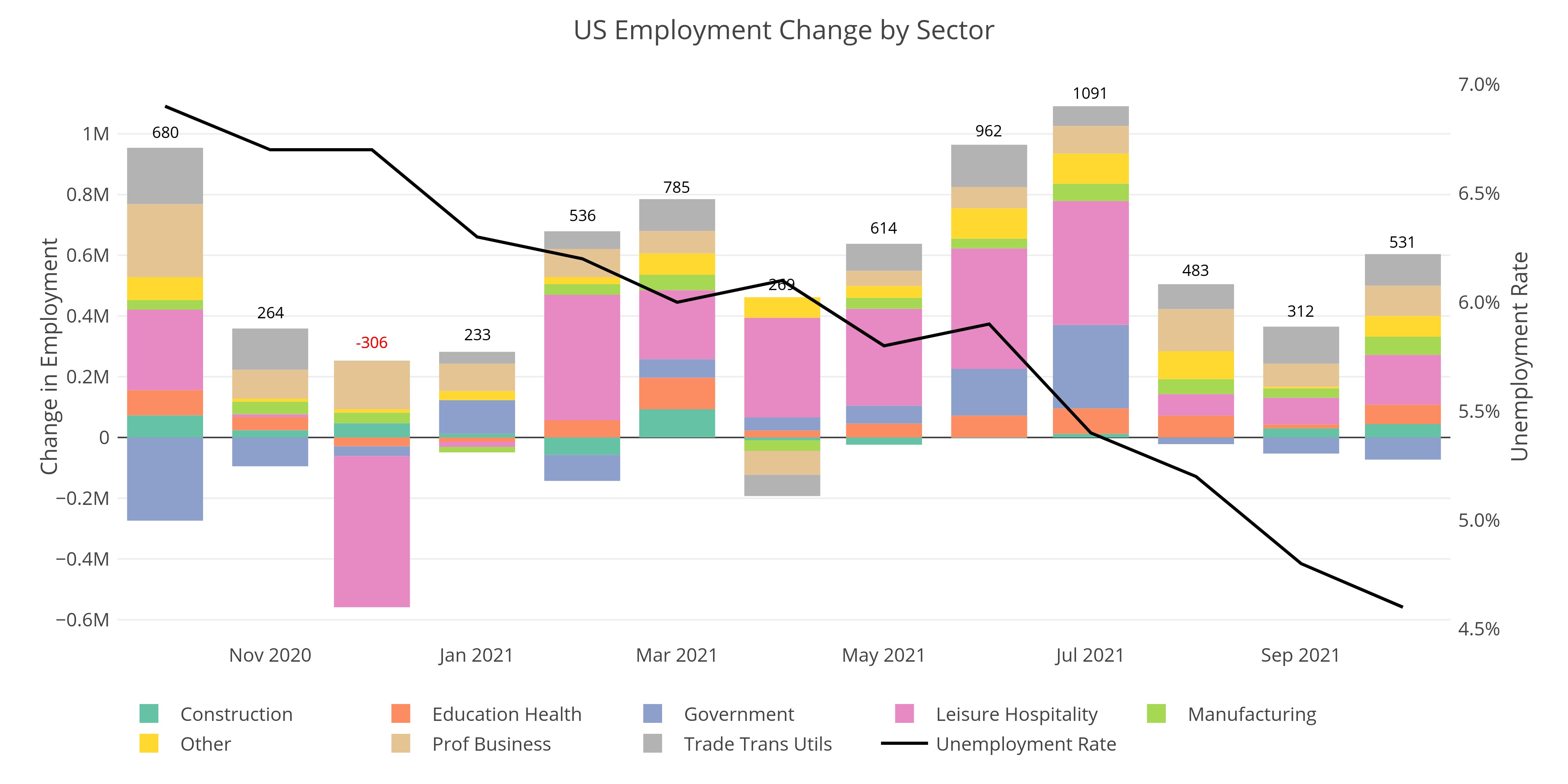

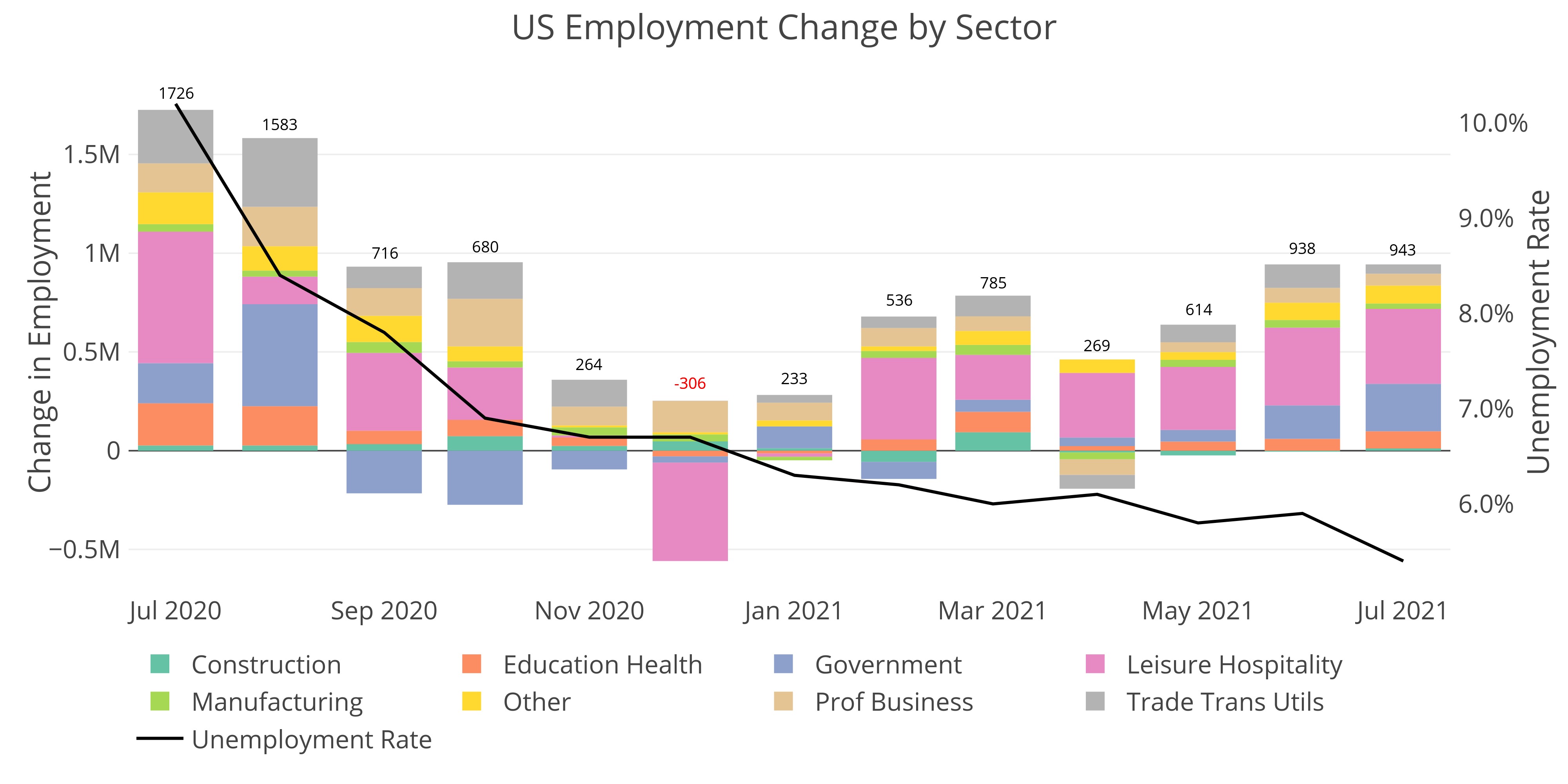

Jobs: Every Month in 2025 has Been Revised Down with Two Turning Negative

In a rare move, the Household survey outperformed the Headline Report for the second month in a row

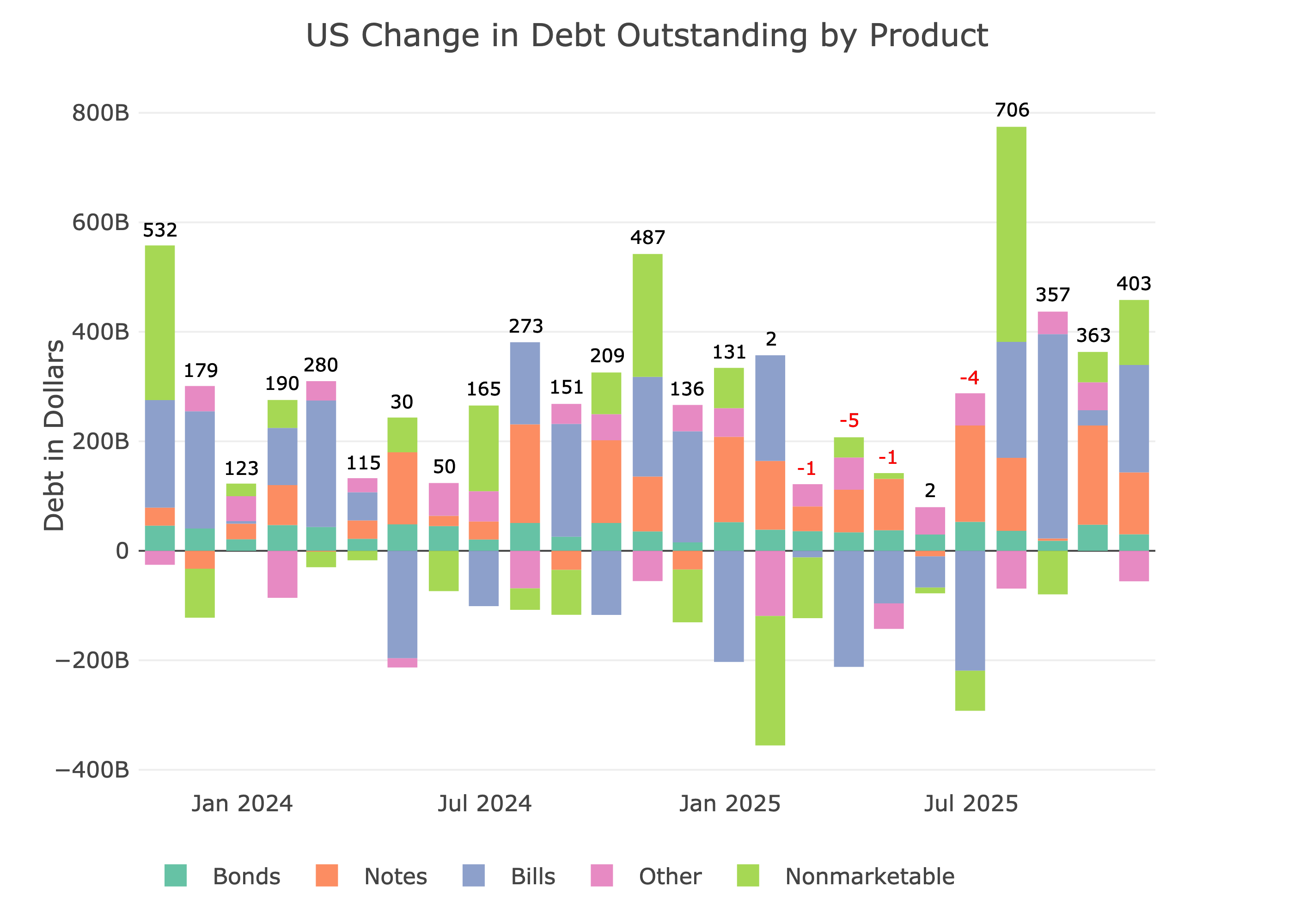

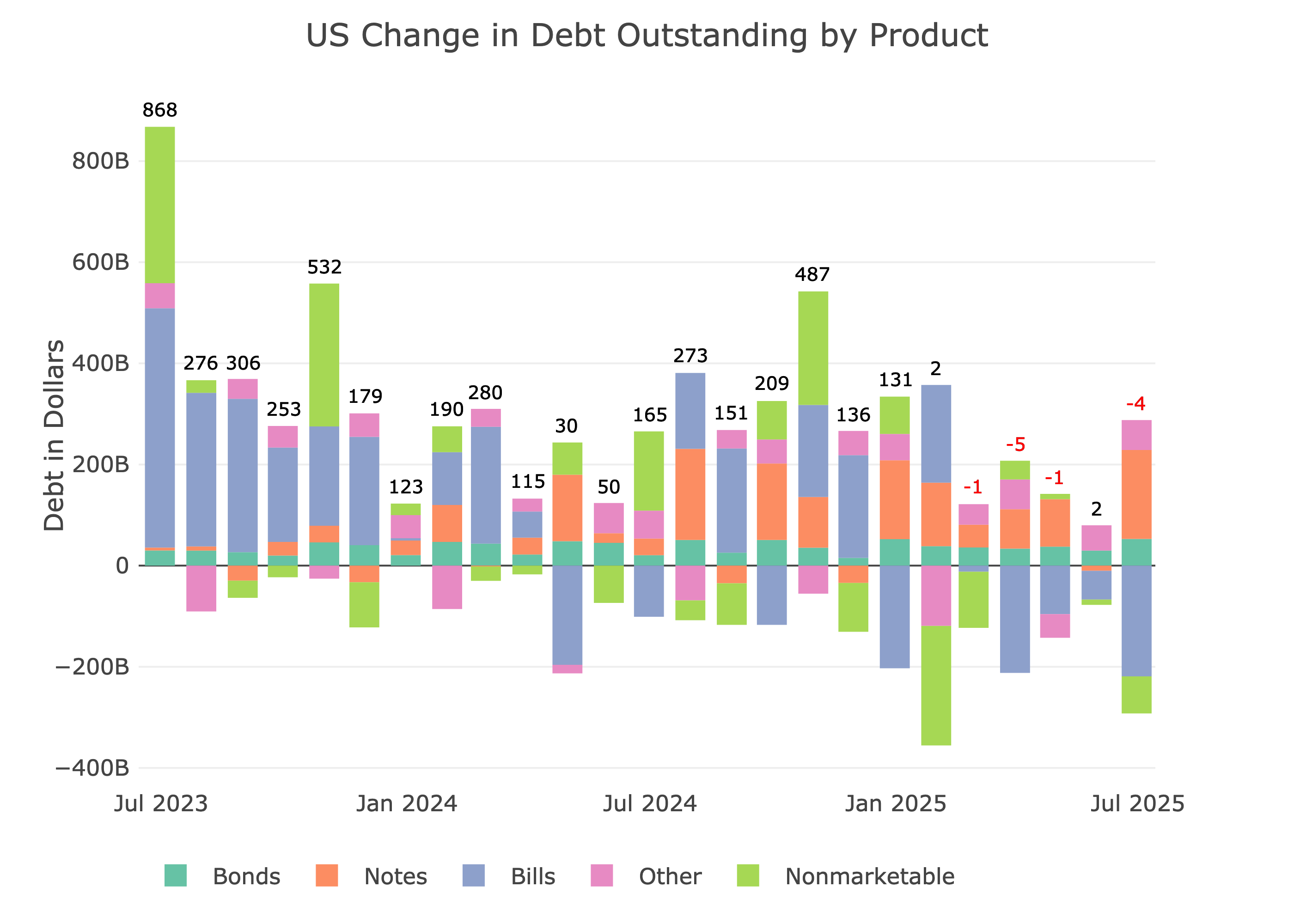

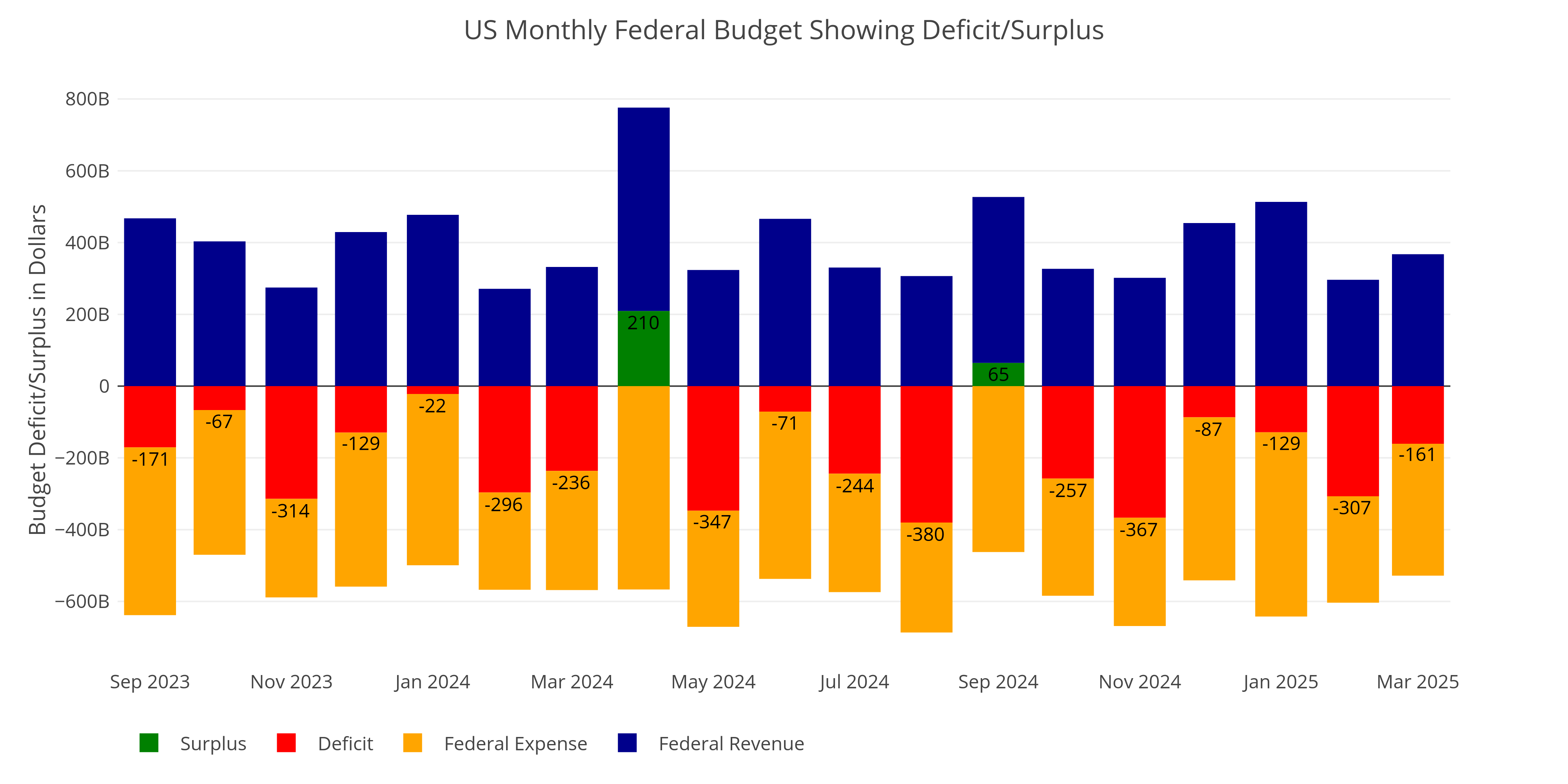

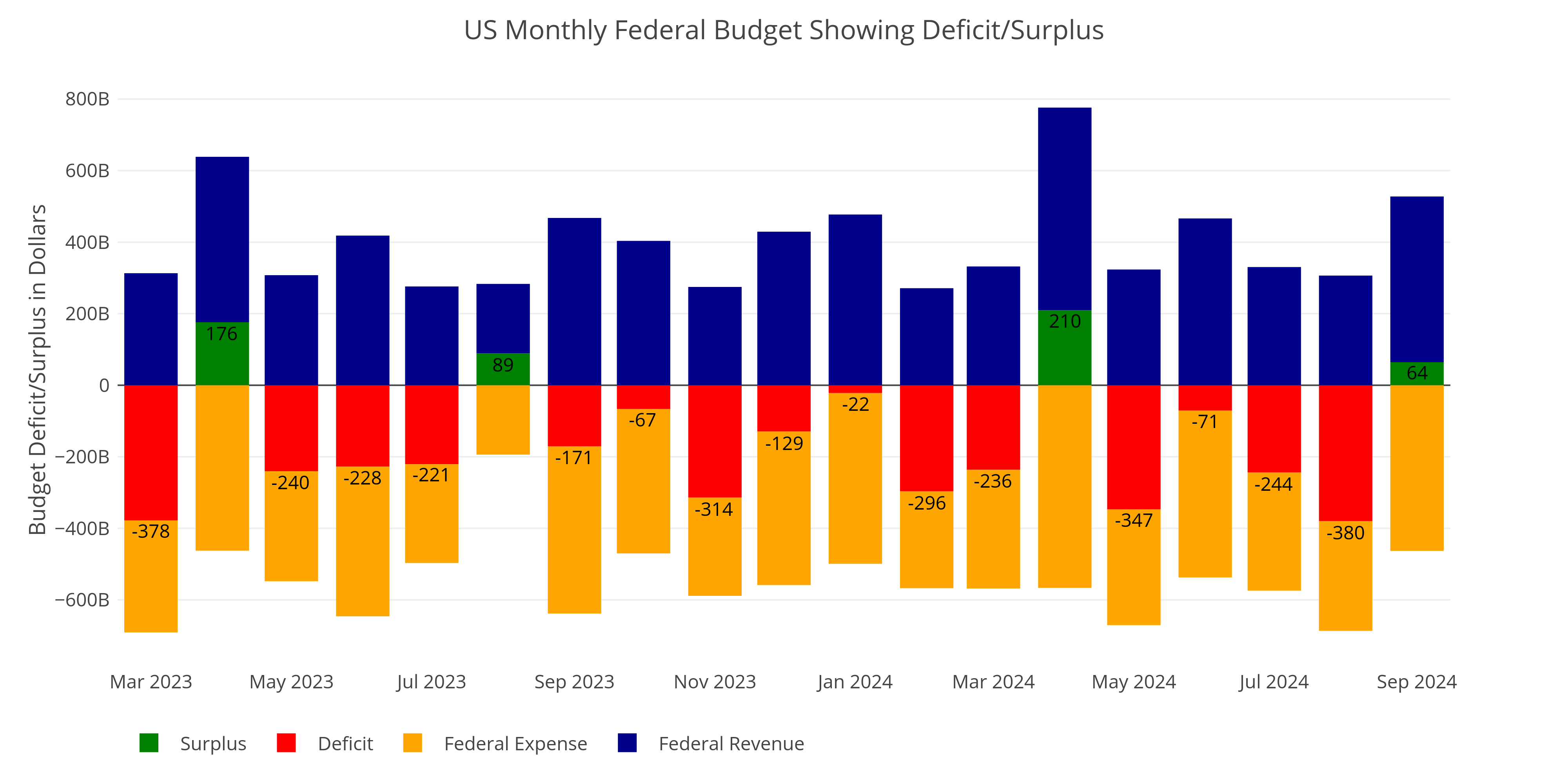

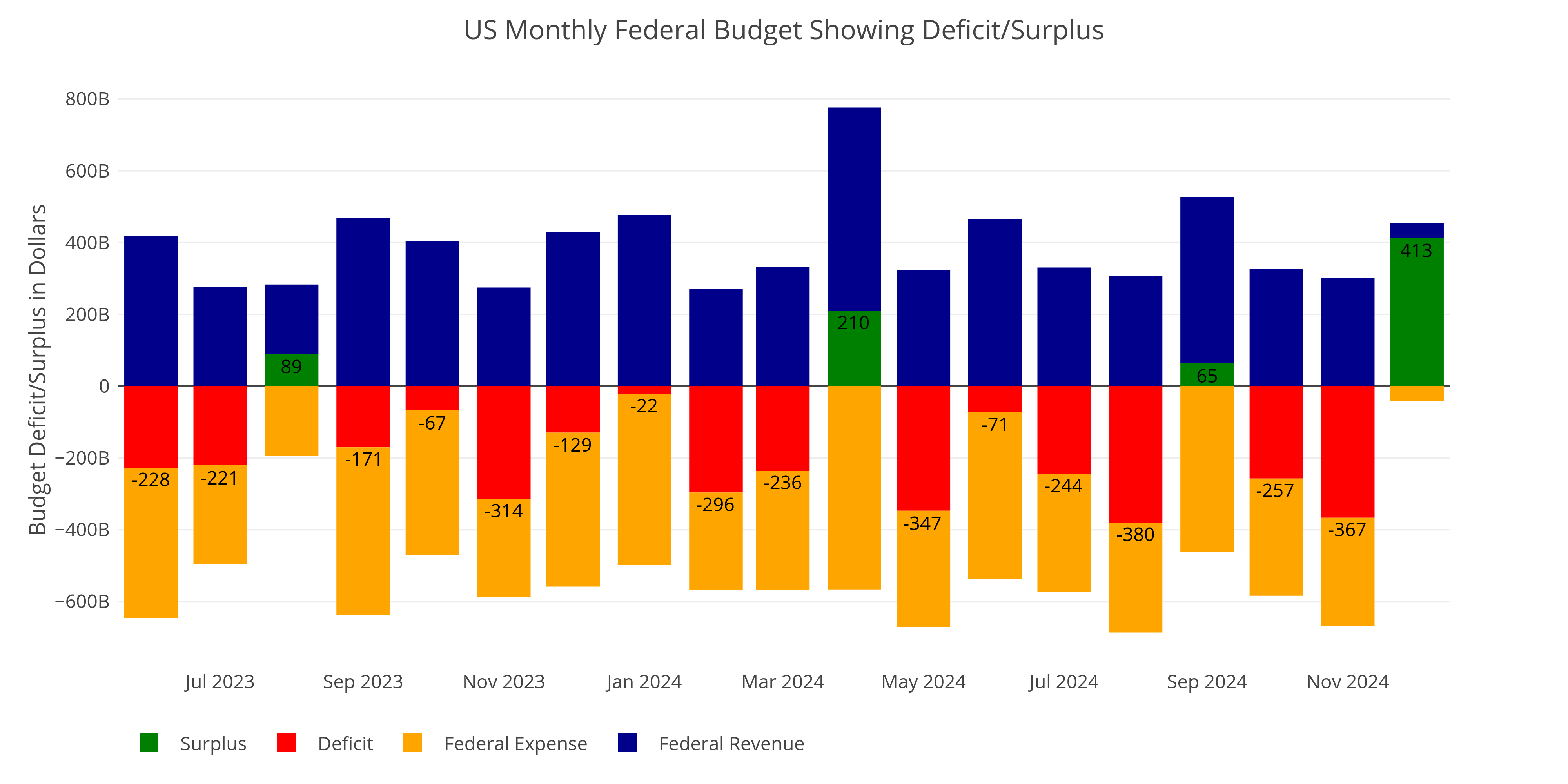

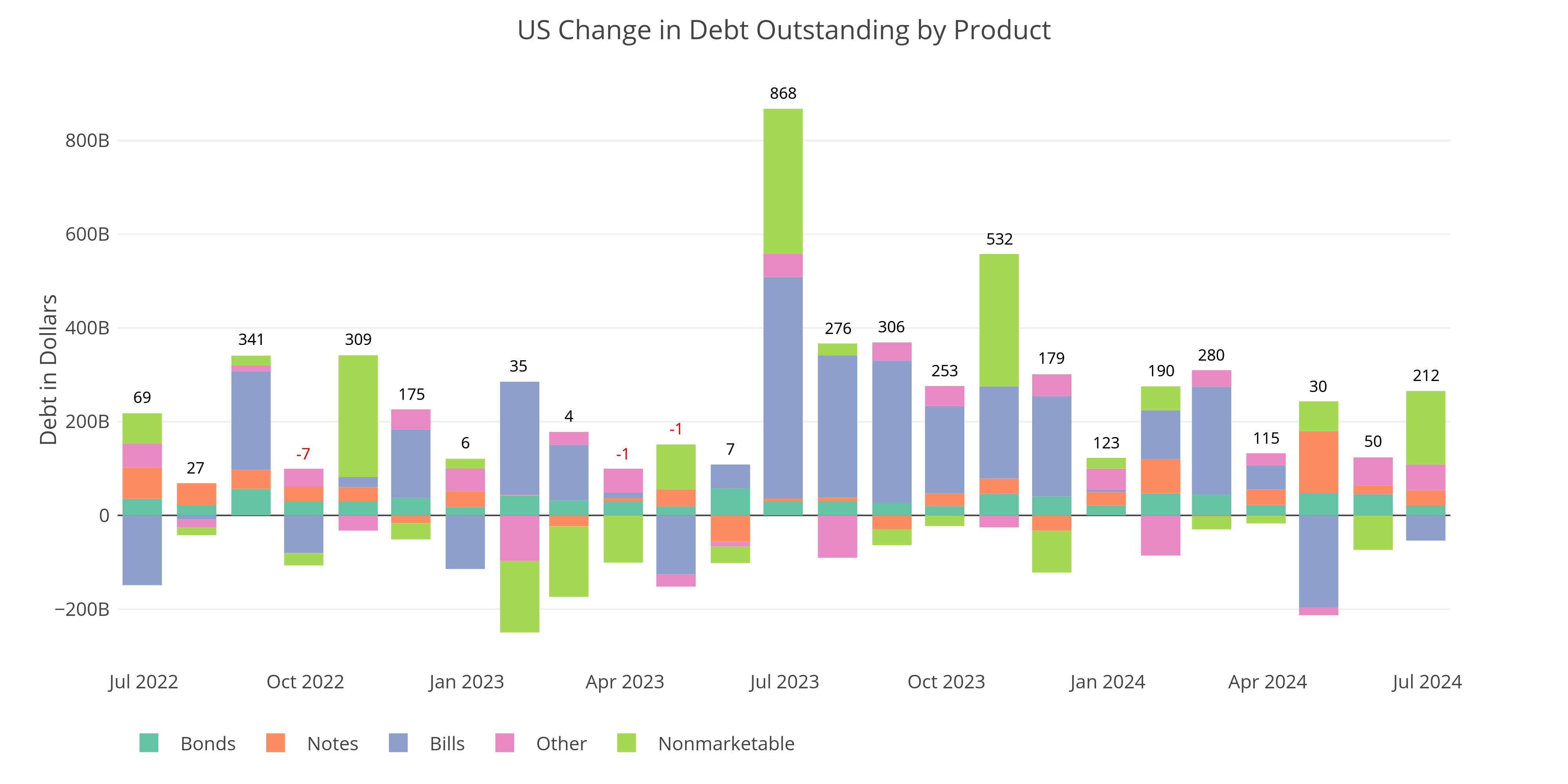

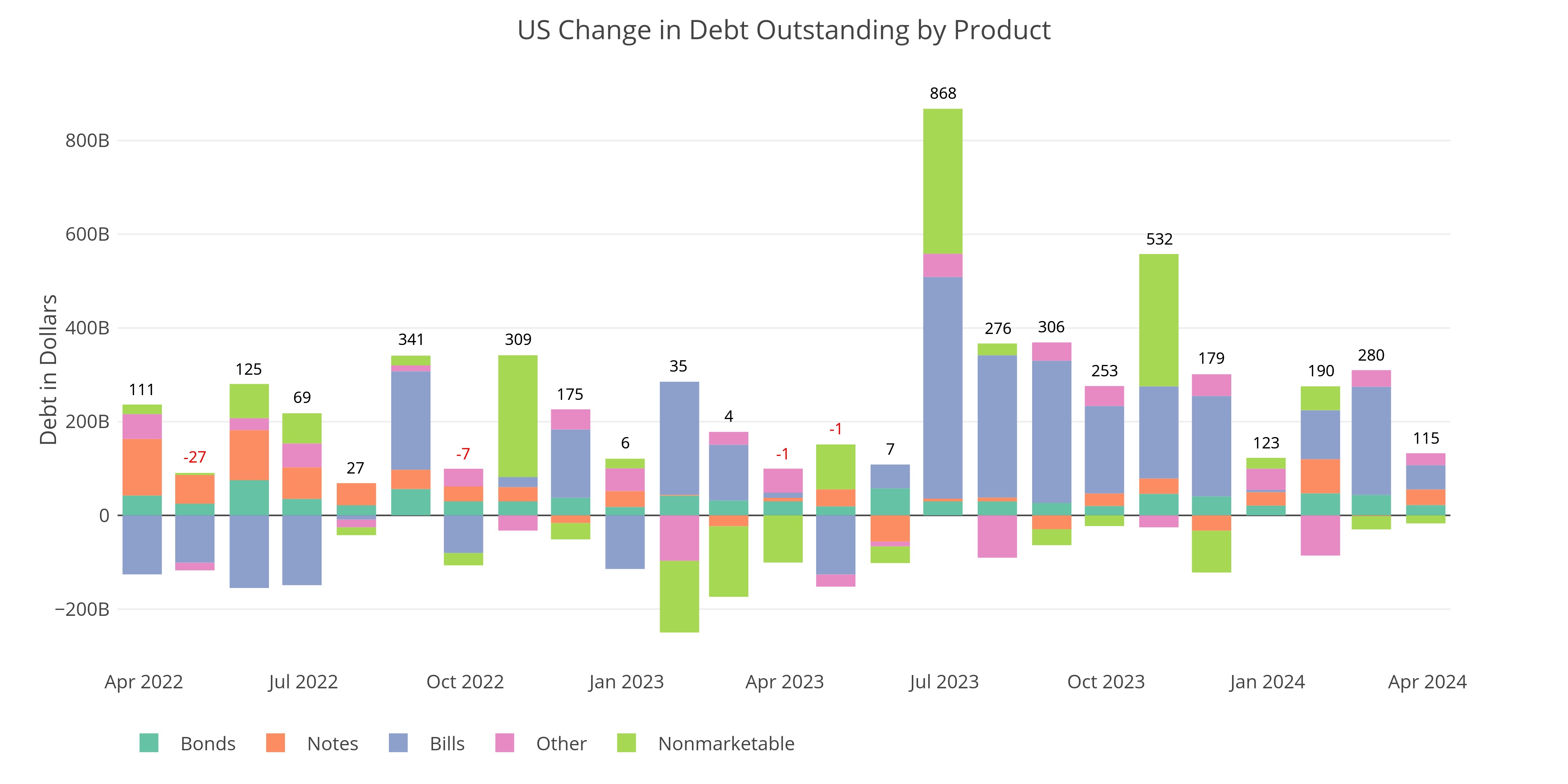

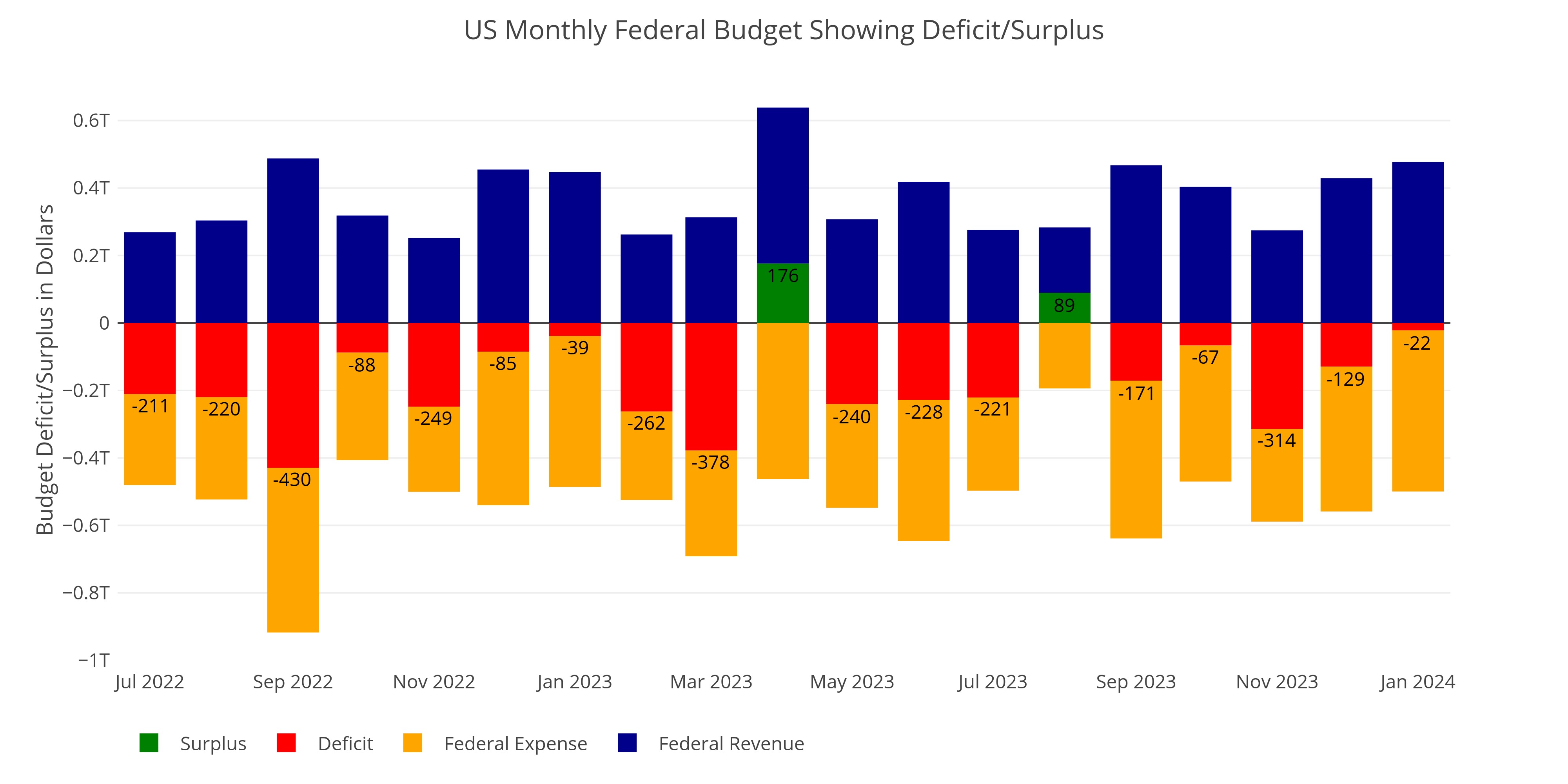

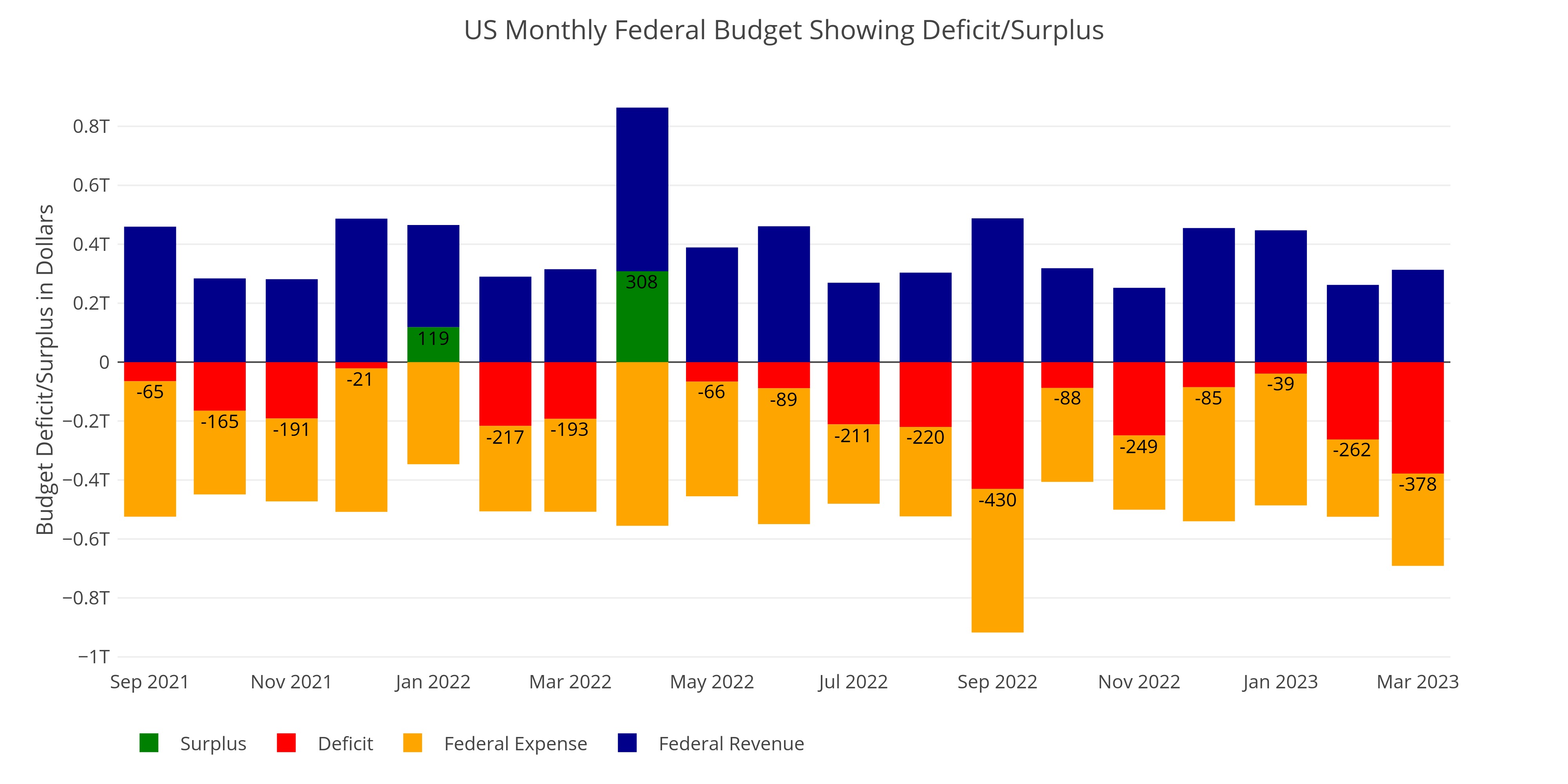

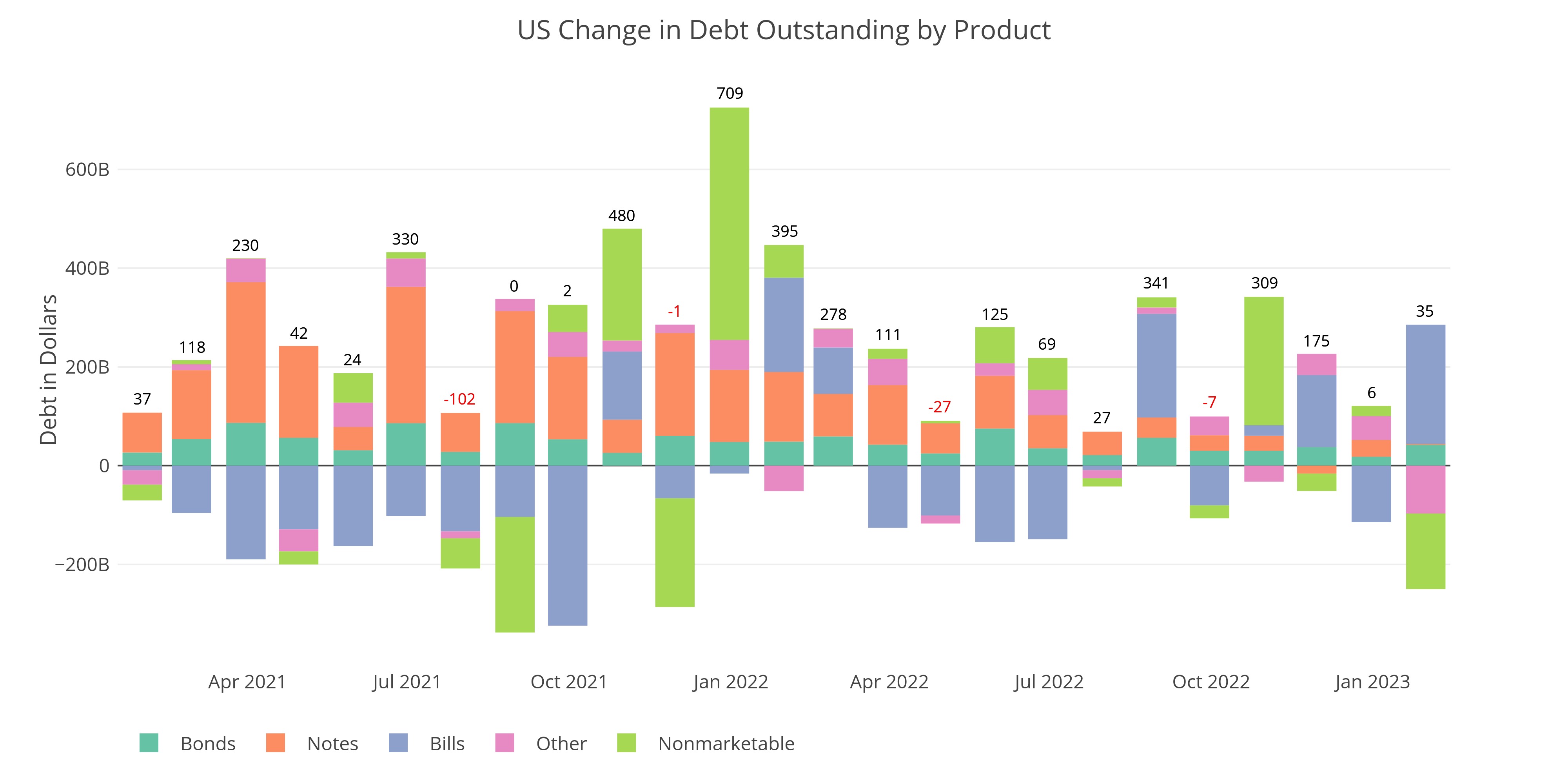

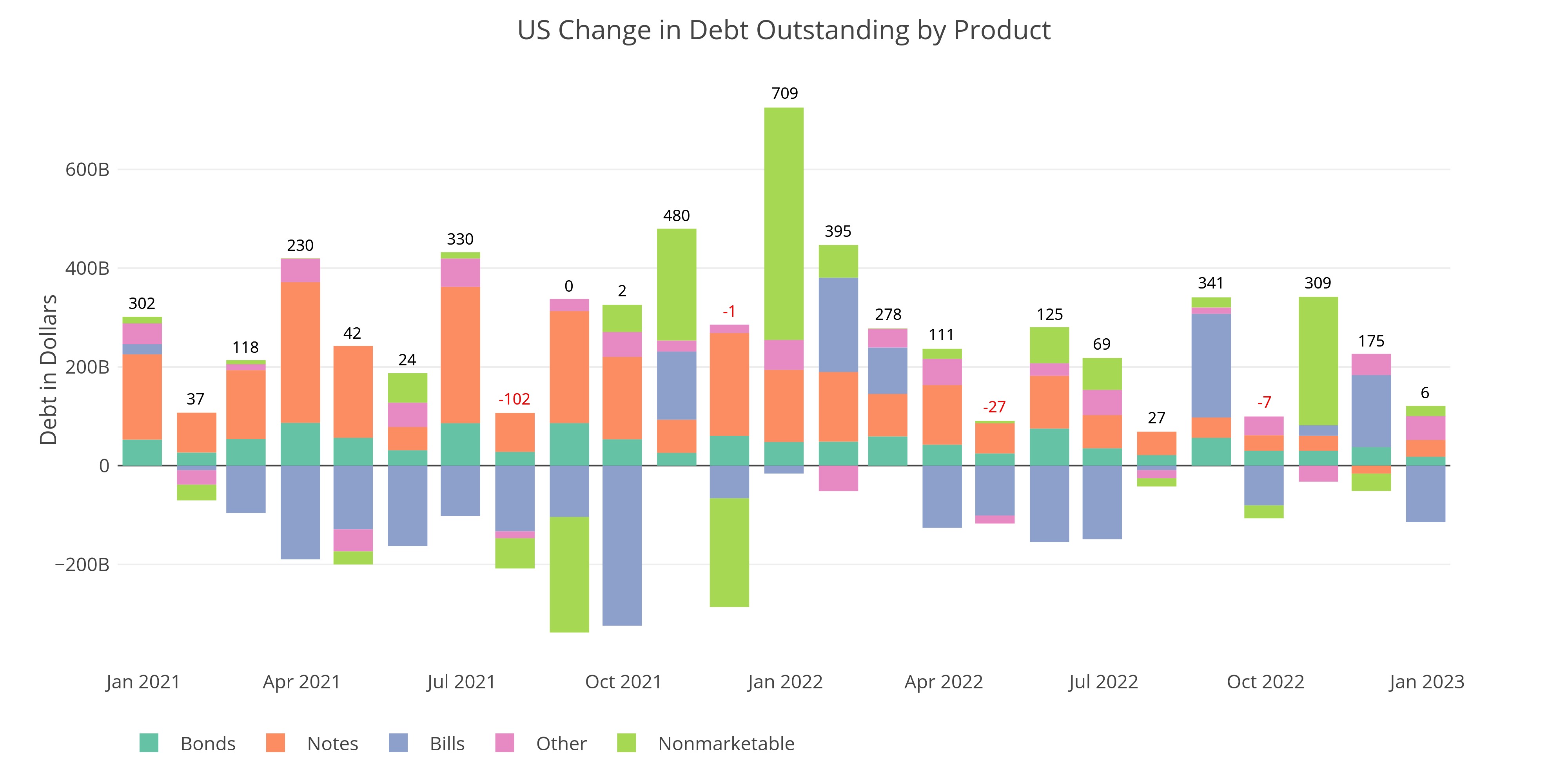

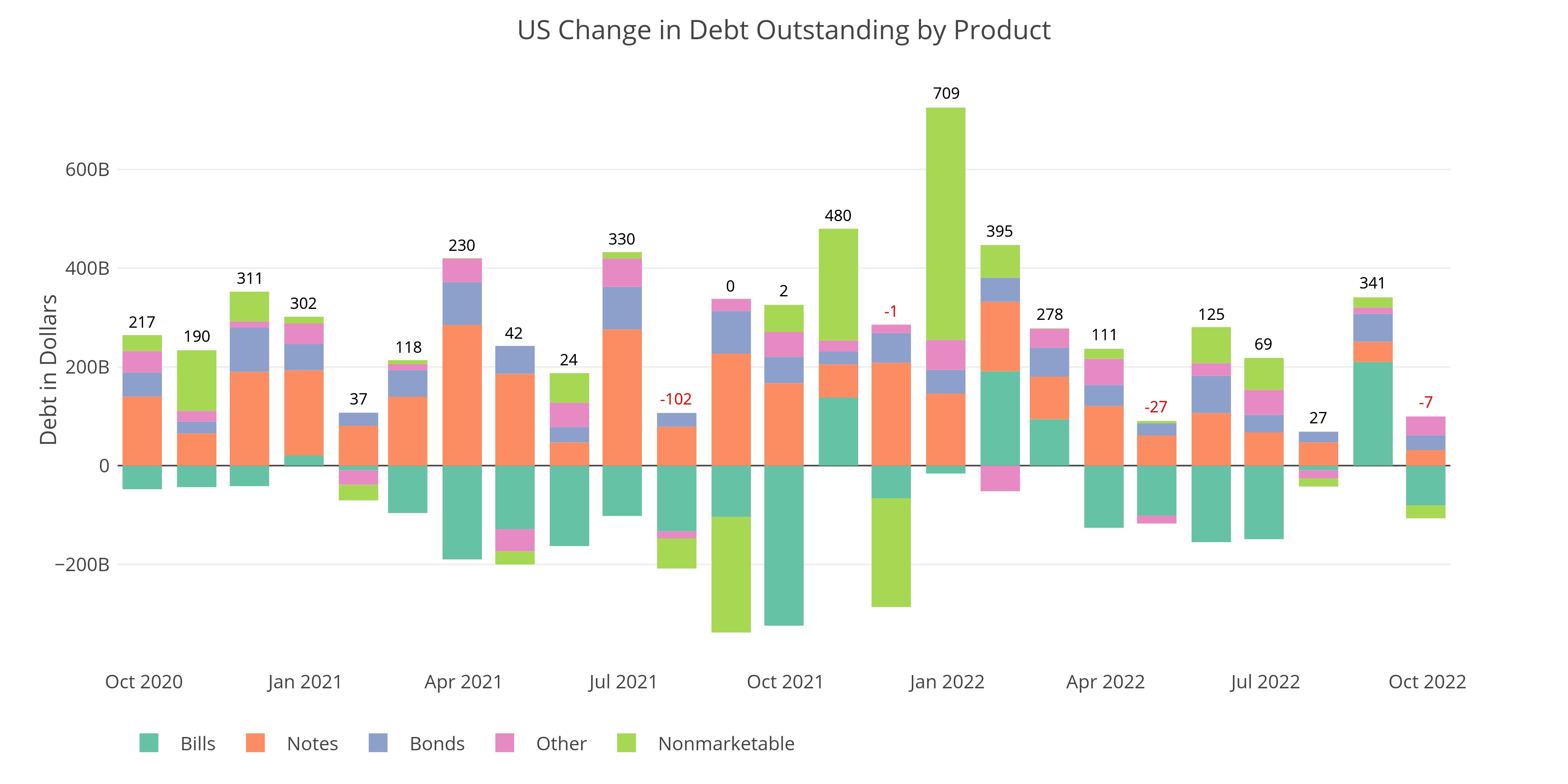

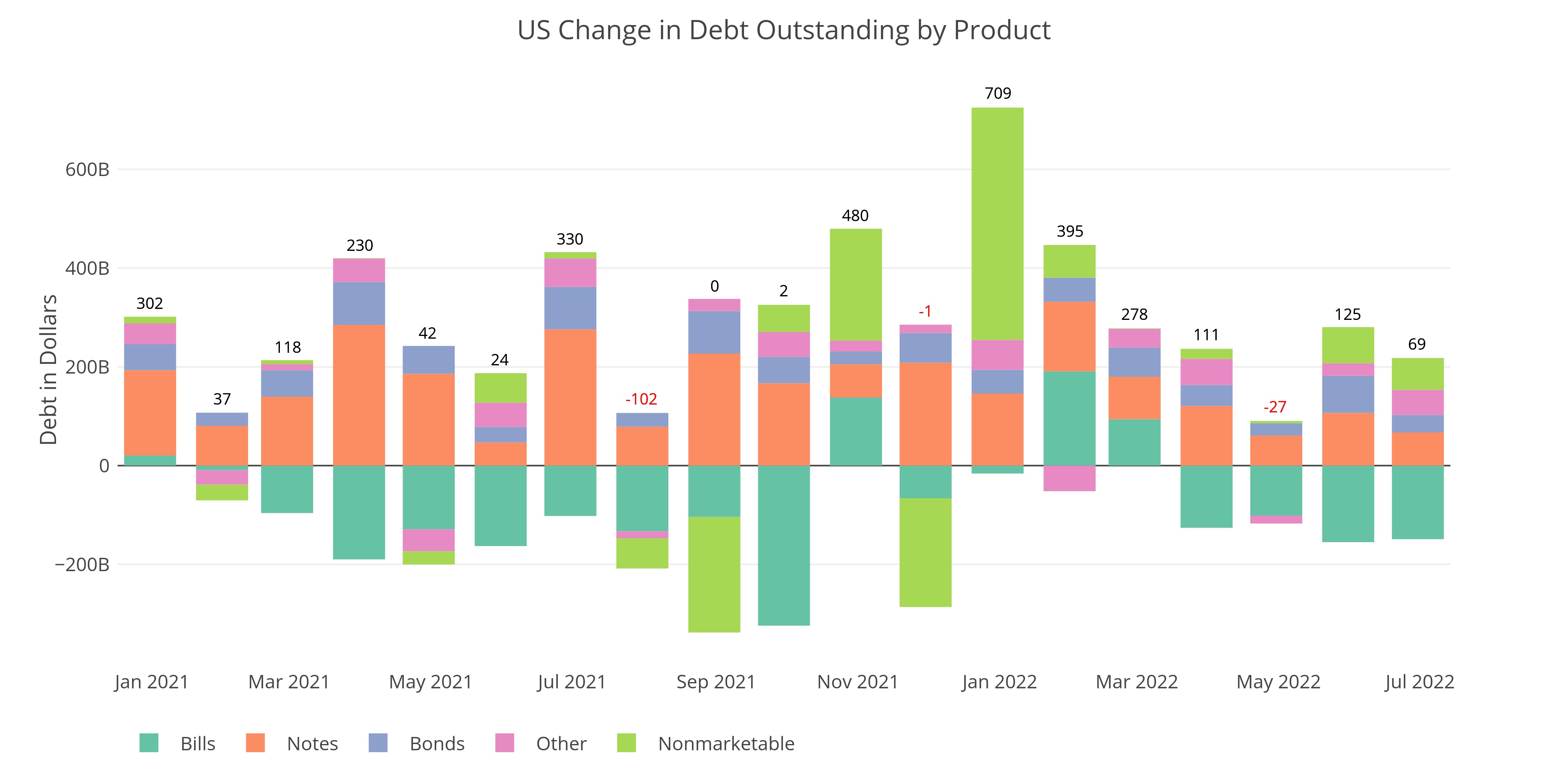

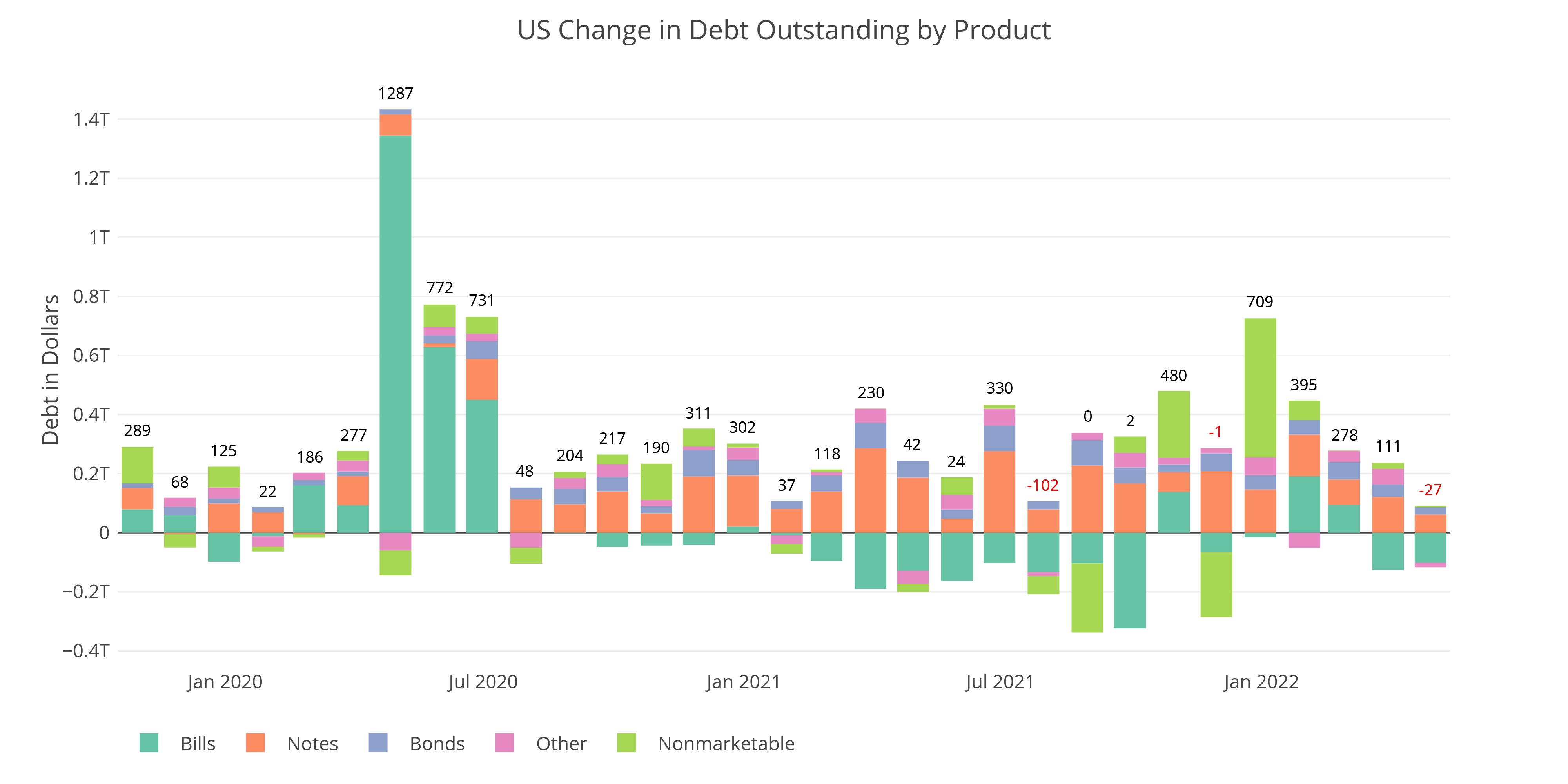

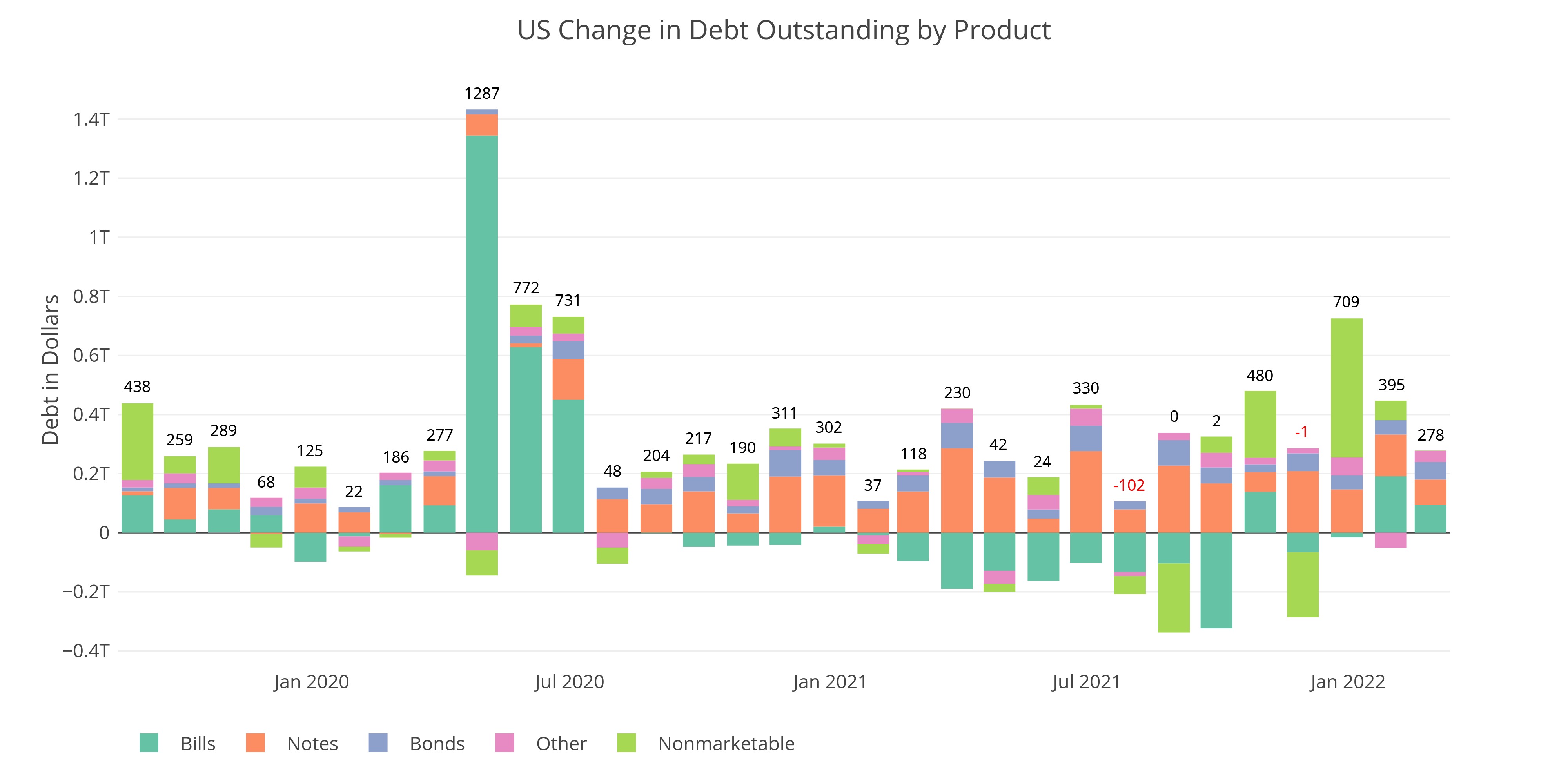

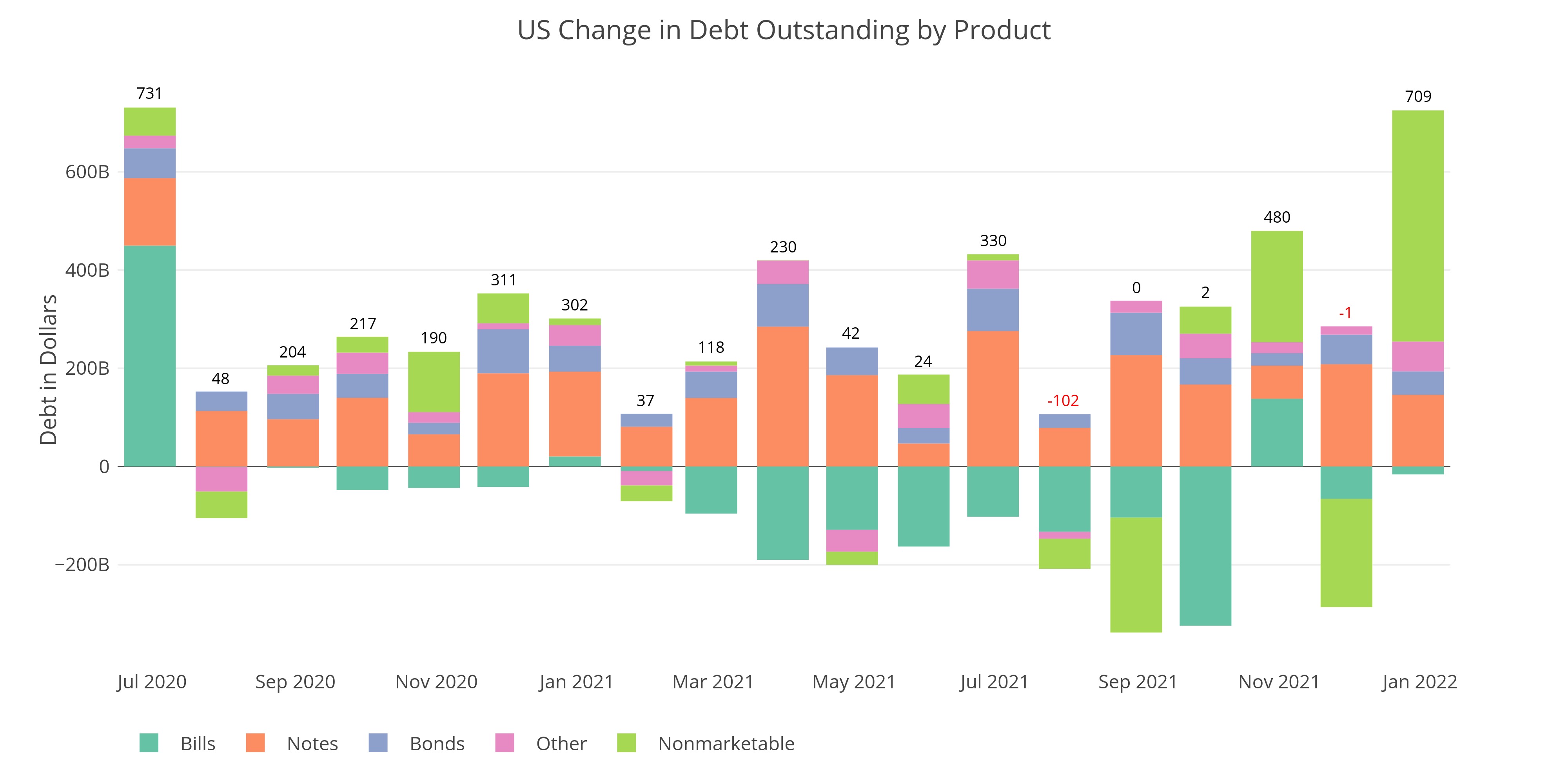

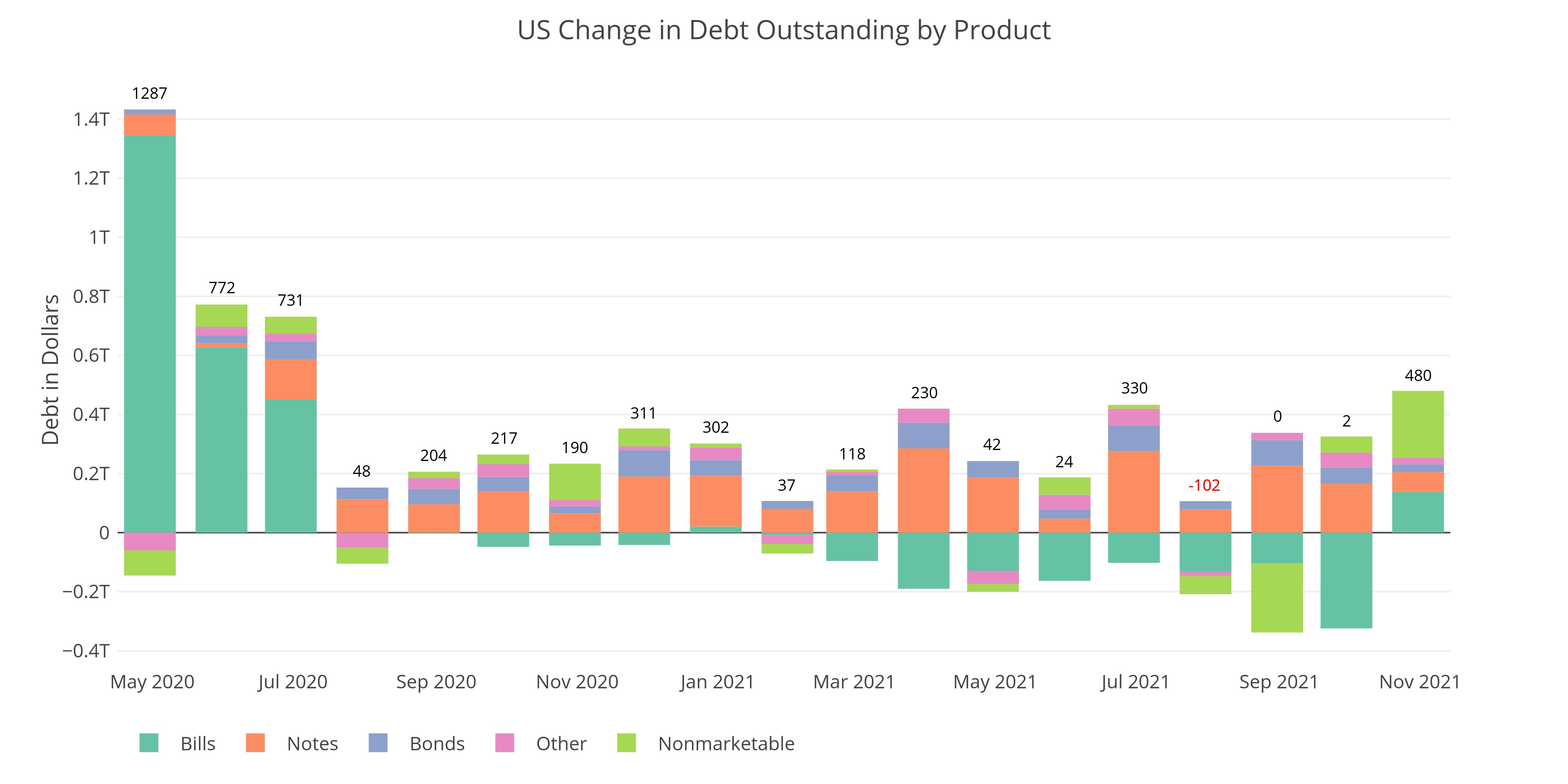

US Government Borrows $1.8T in Four Months

The debt ceiling doesn't actually exist

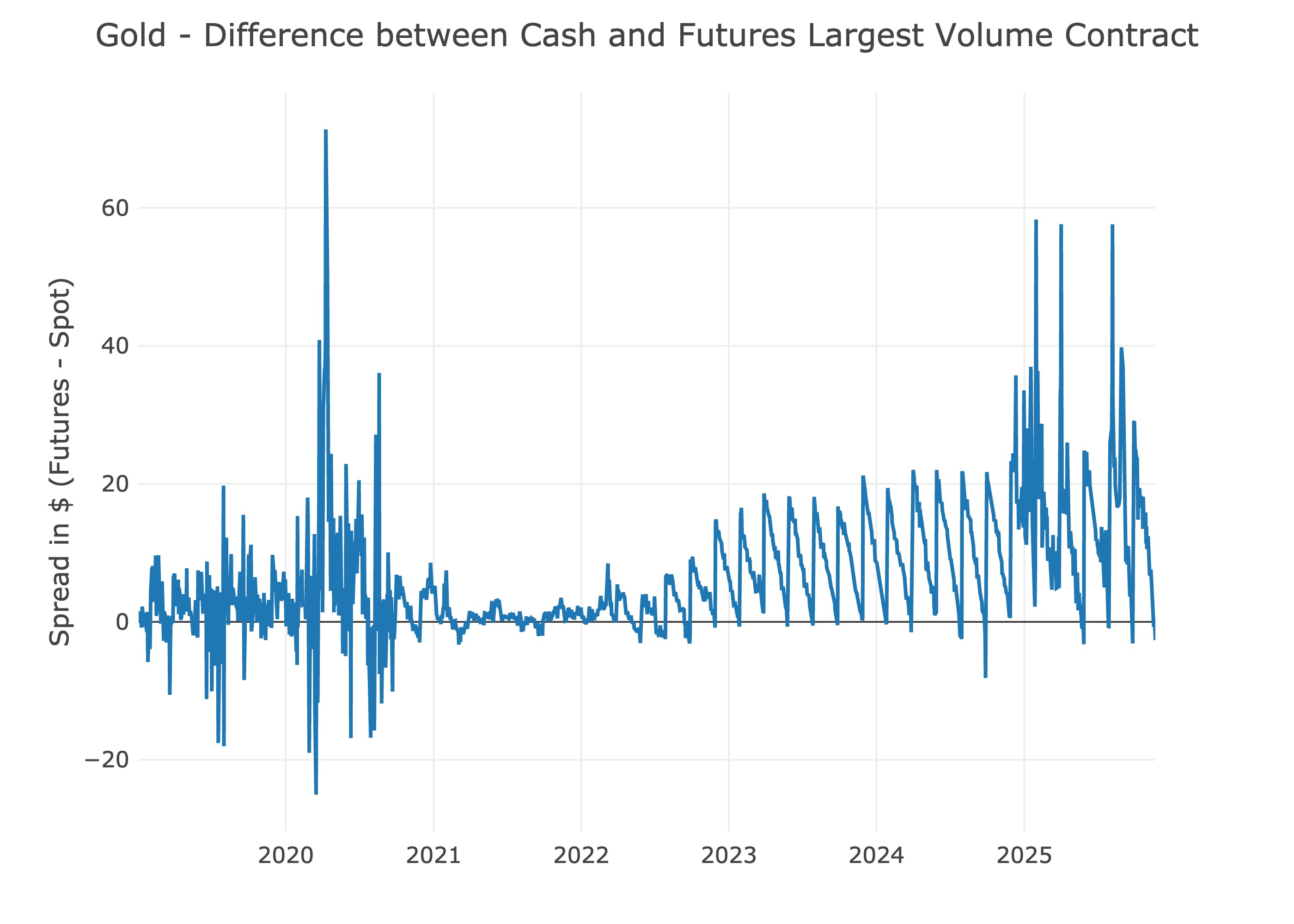

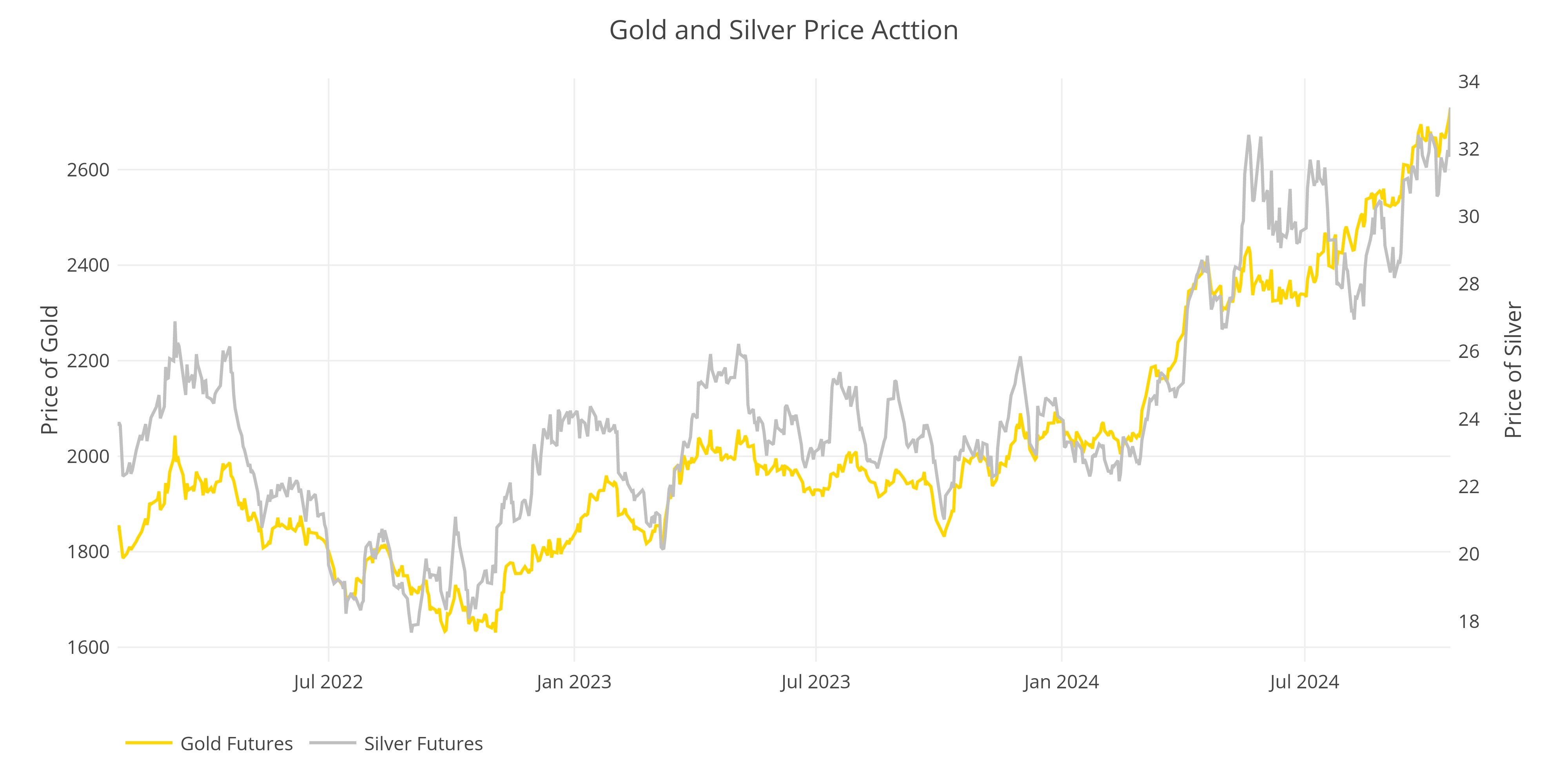

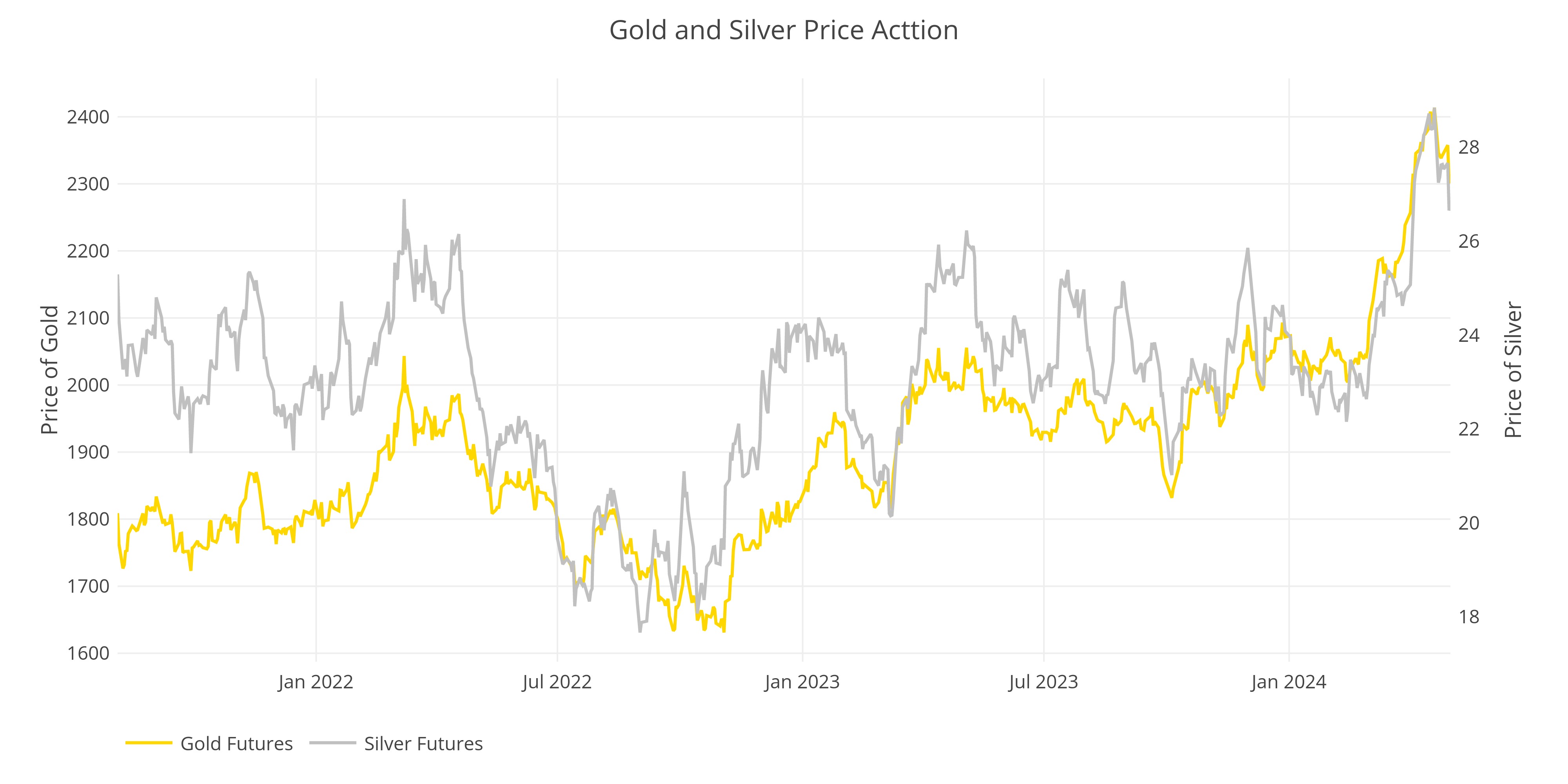

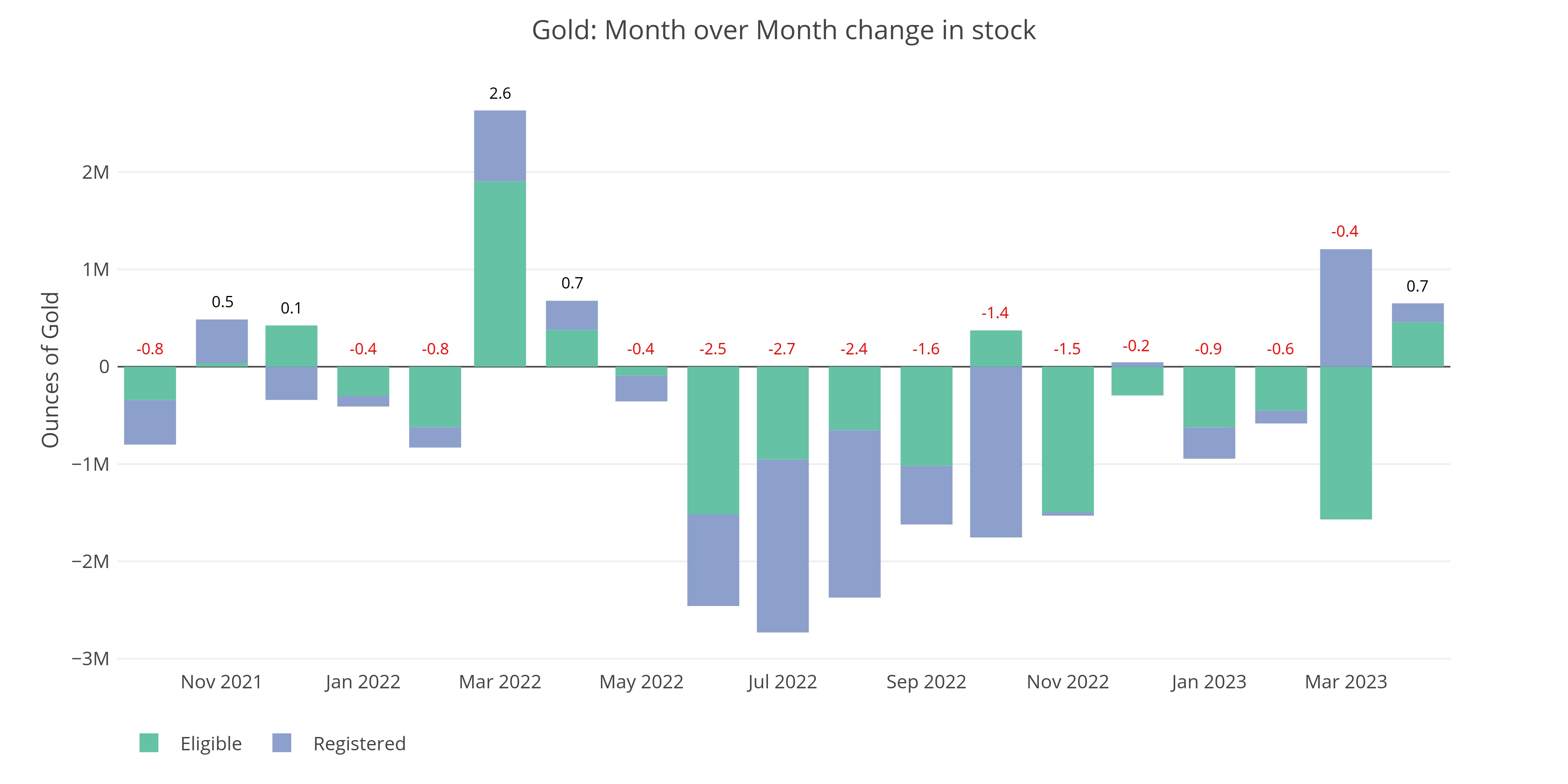

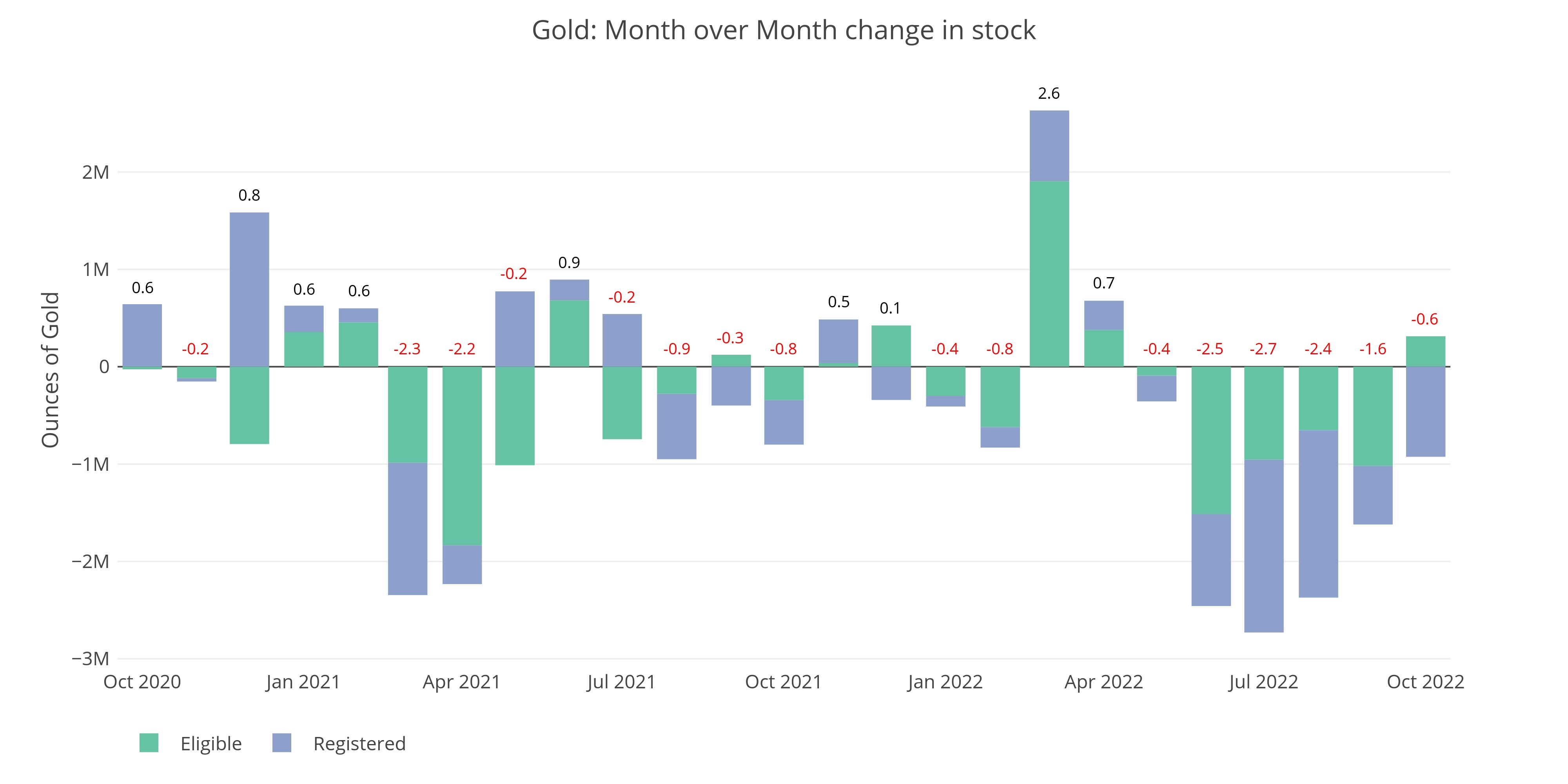

Comex Update: Physical Markets Remain Under Pressure

The London silver squeeze has eased for now, but expect another one soon

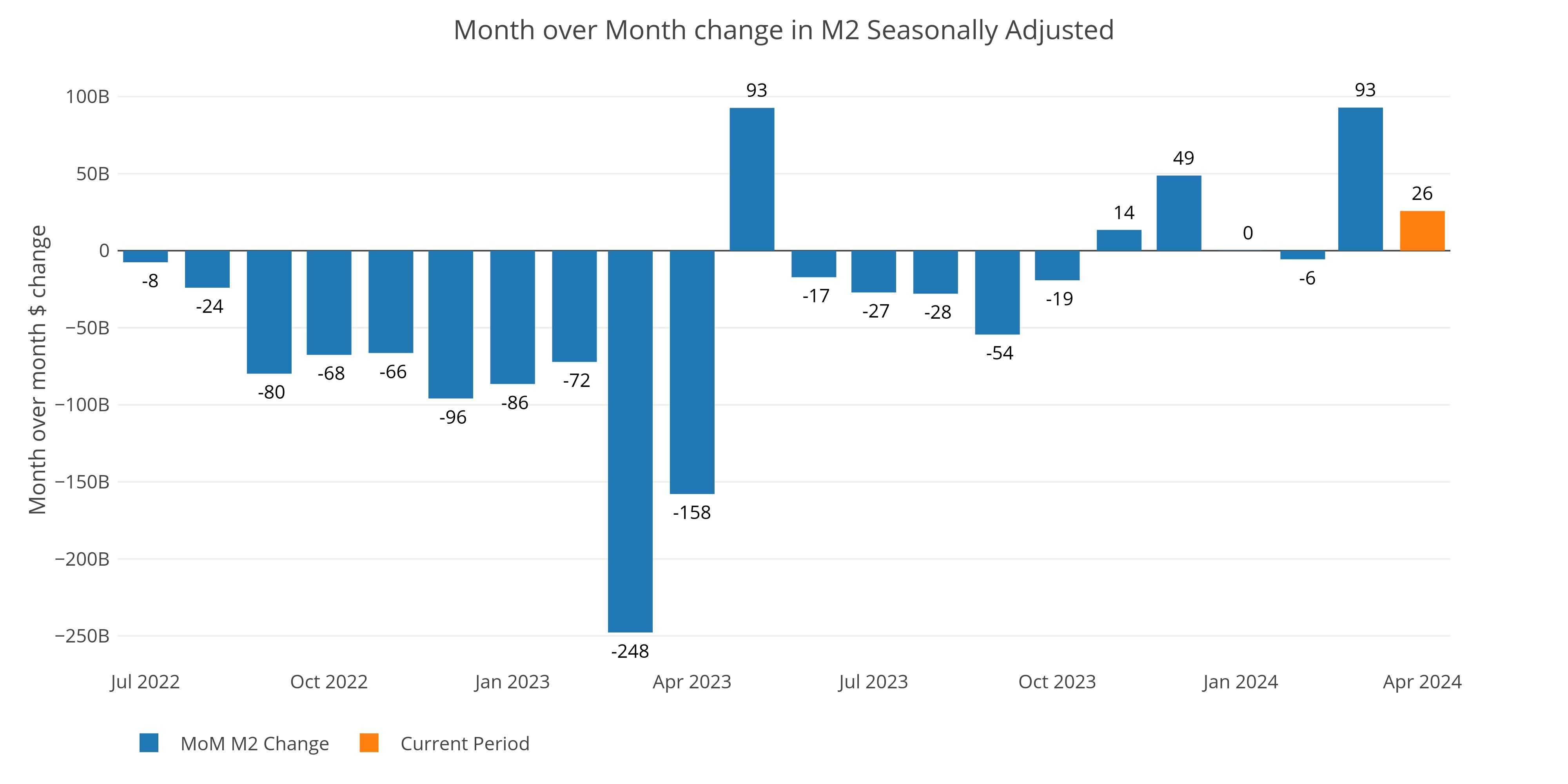

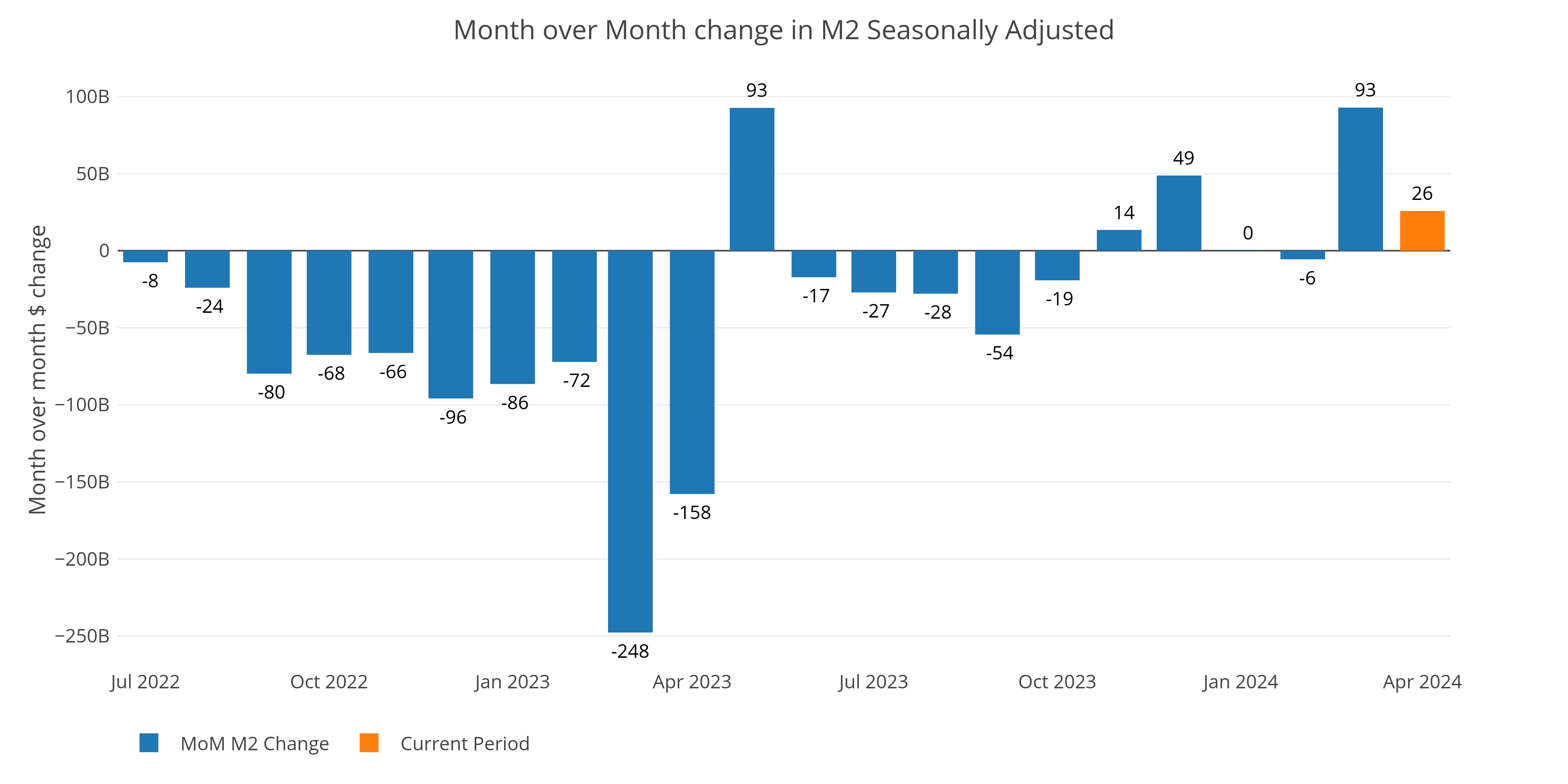

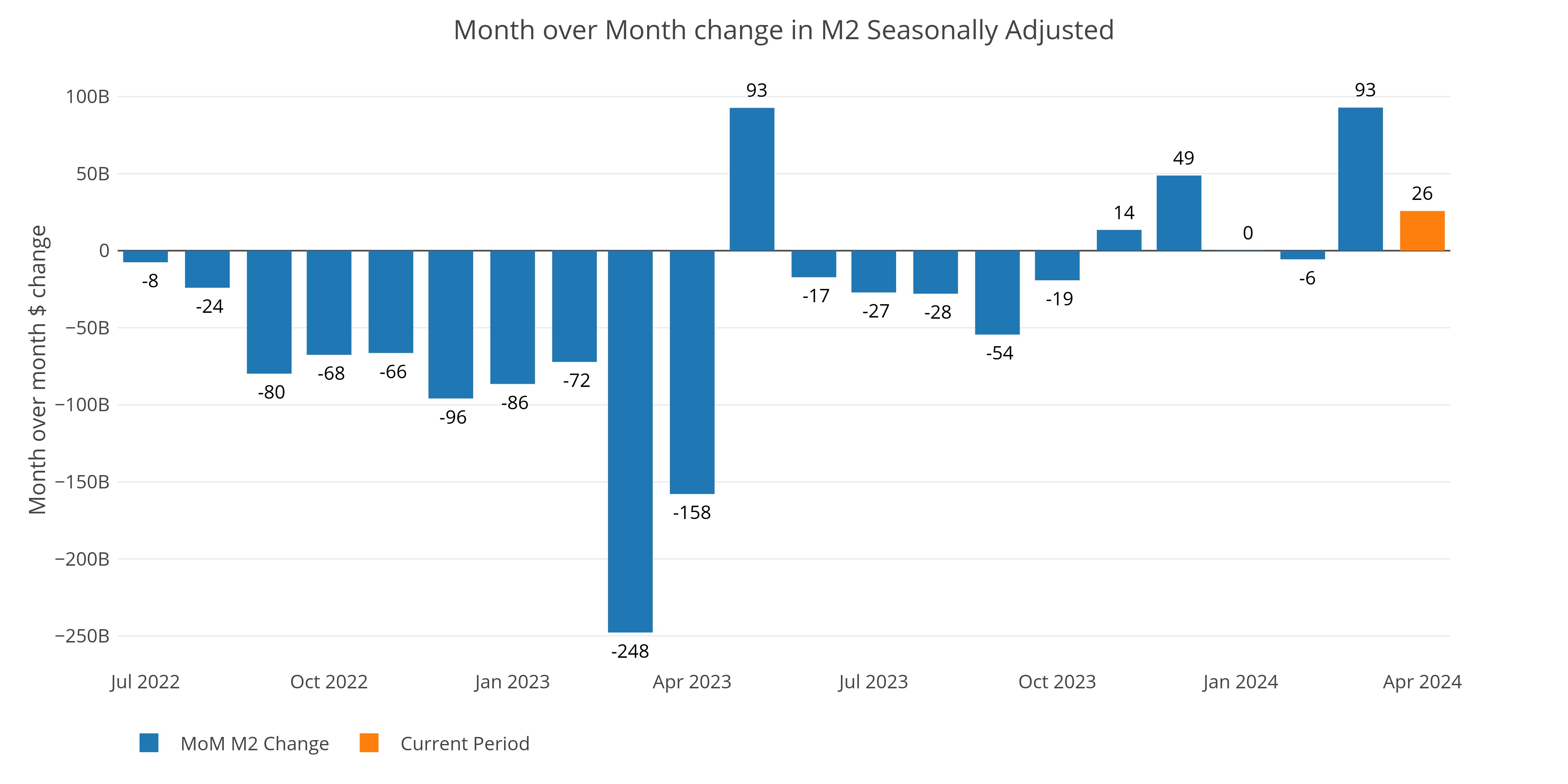

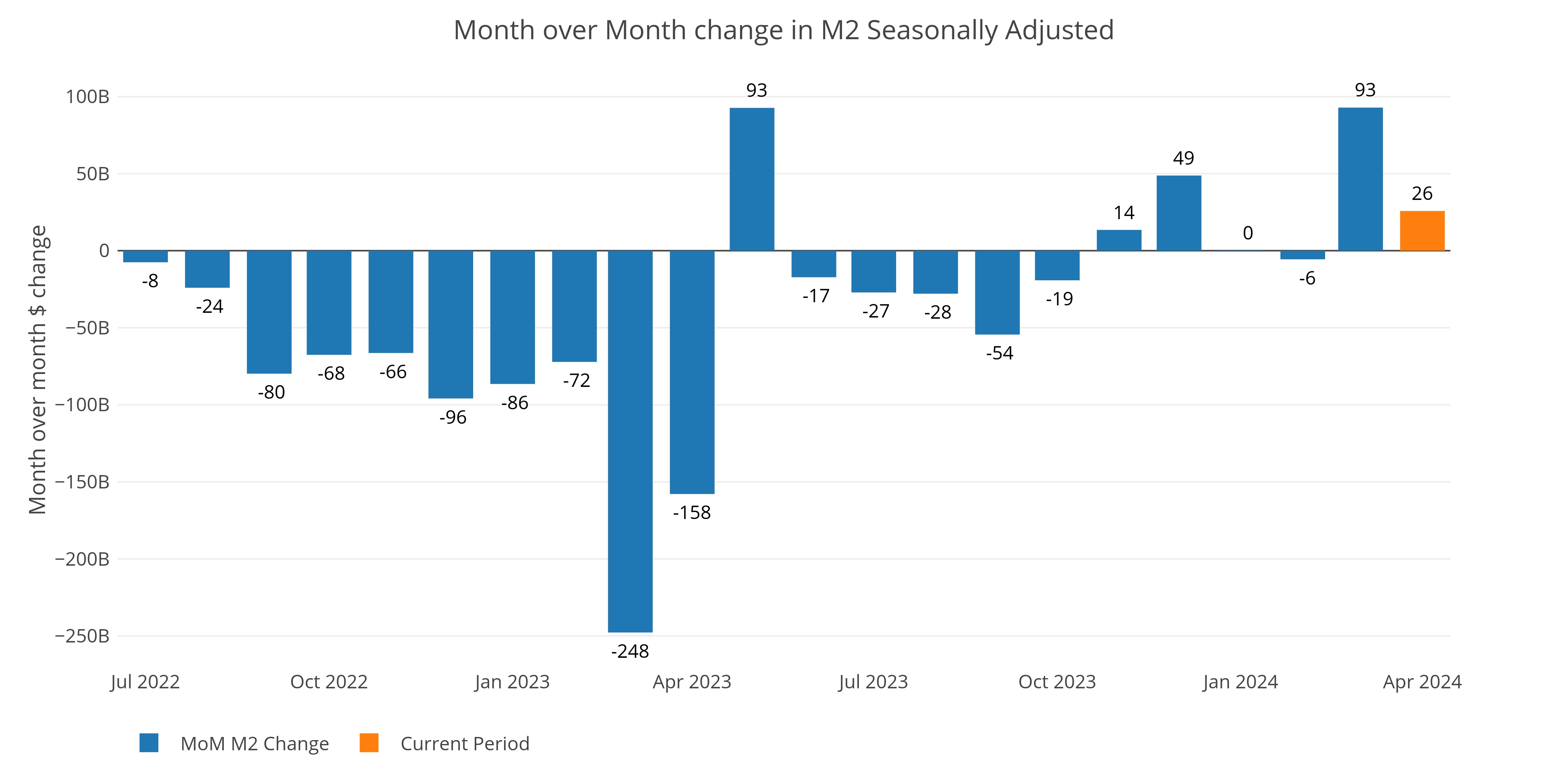

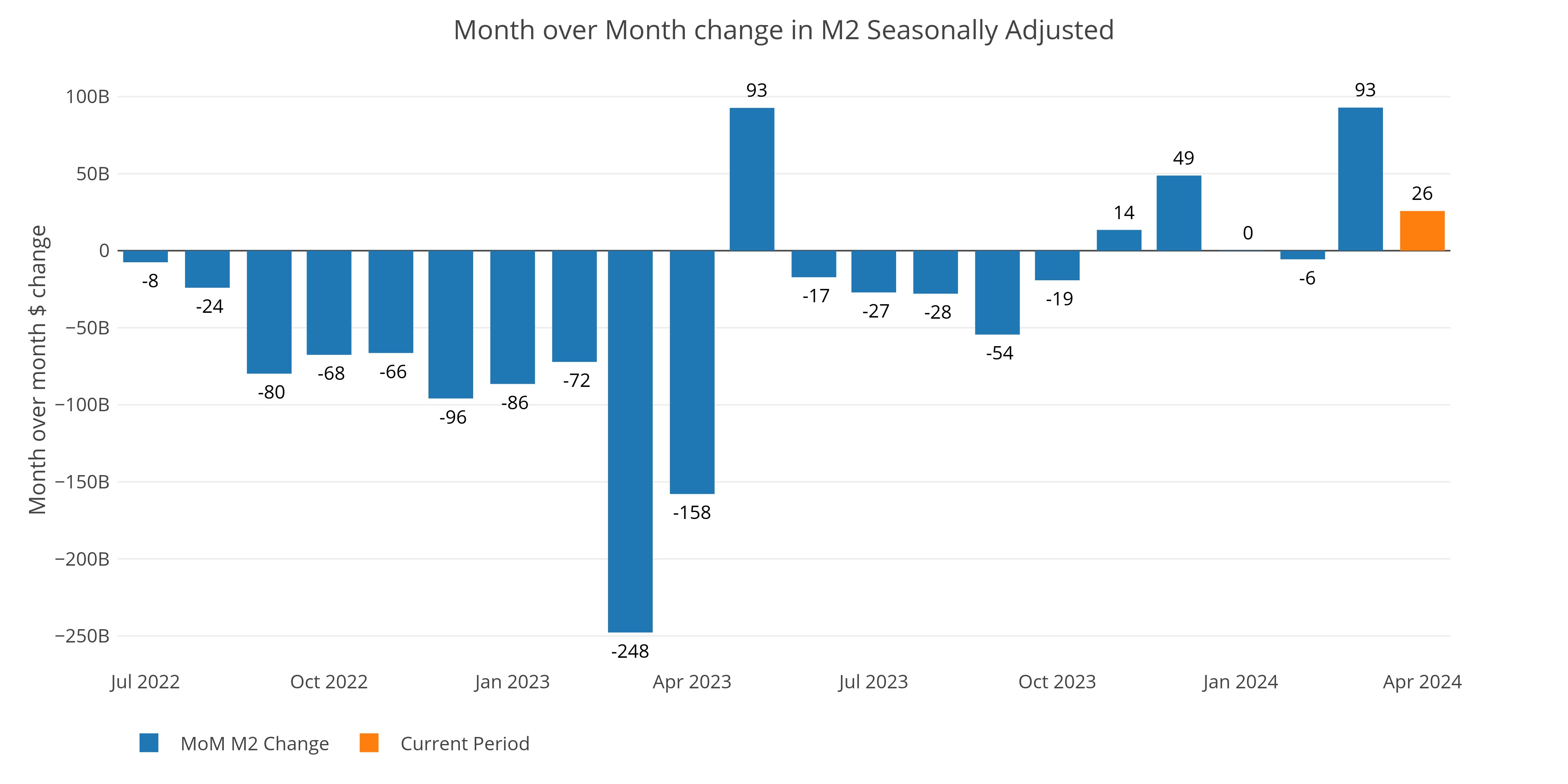

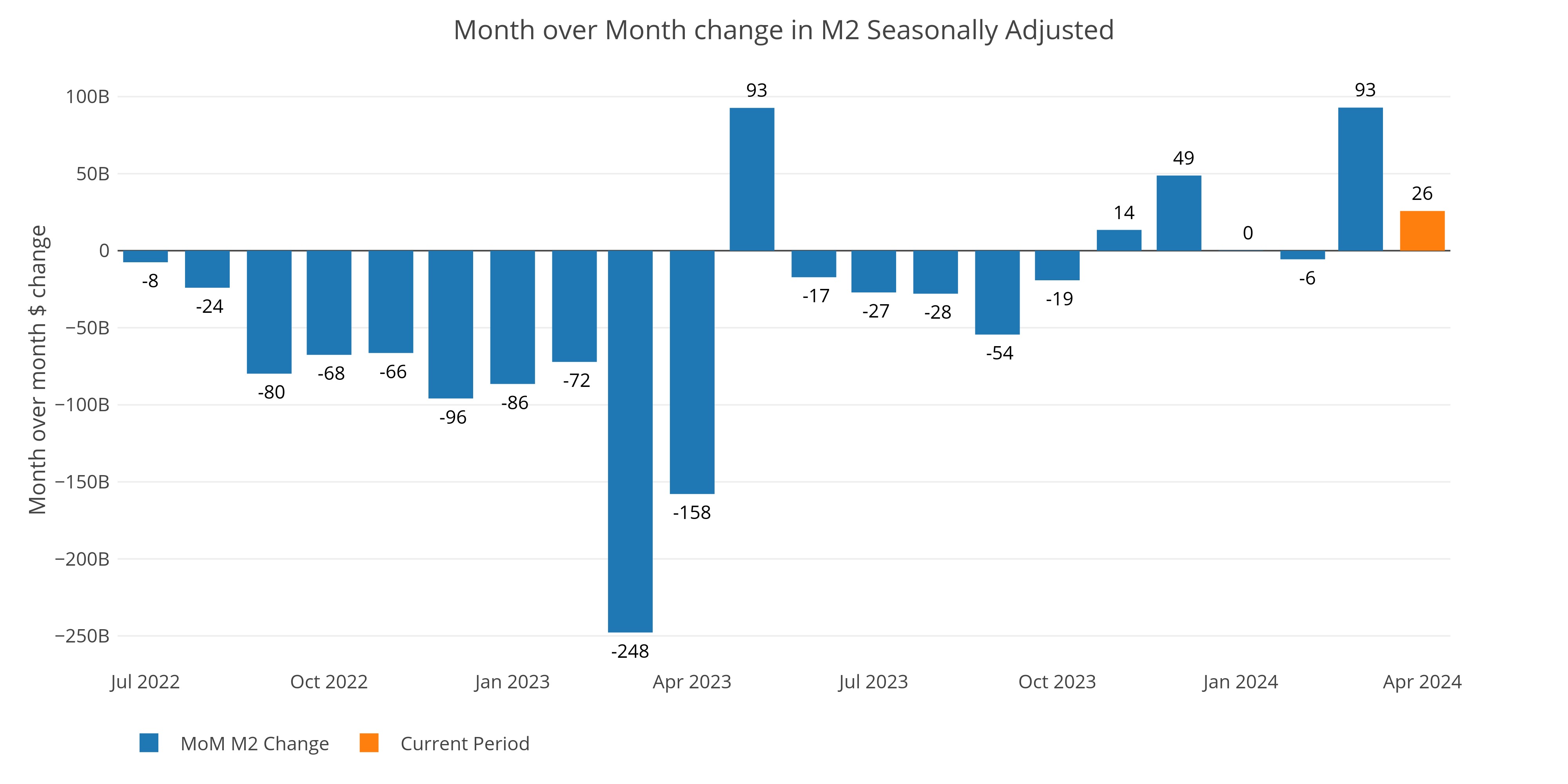

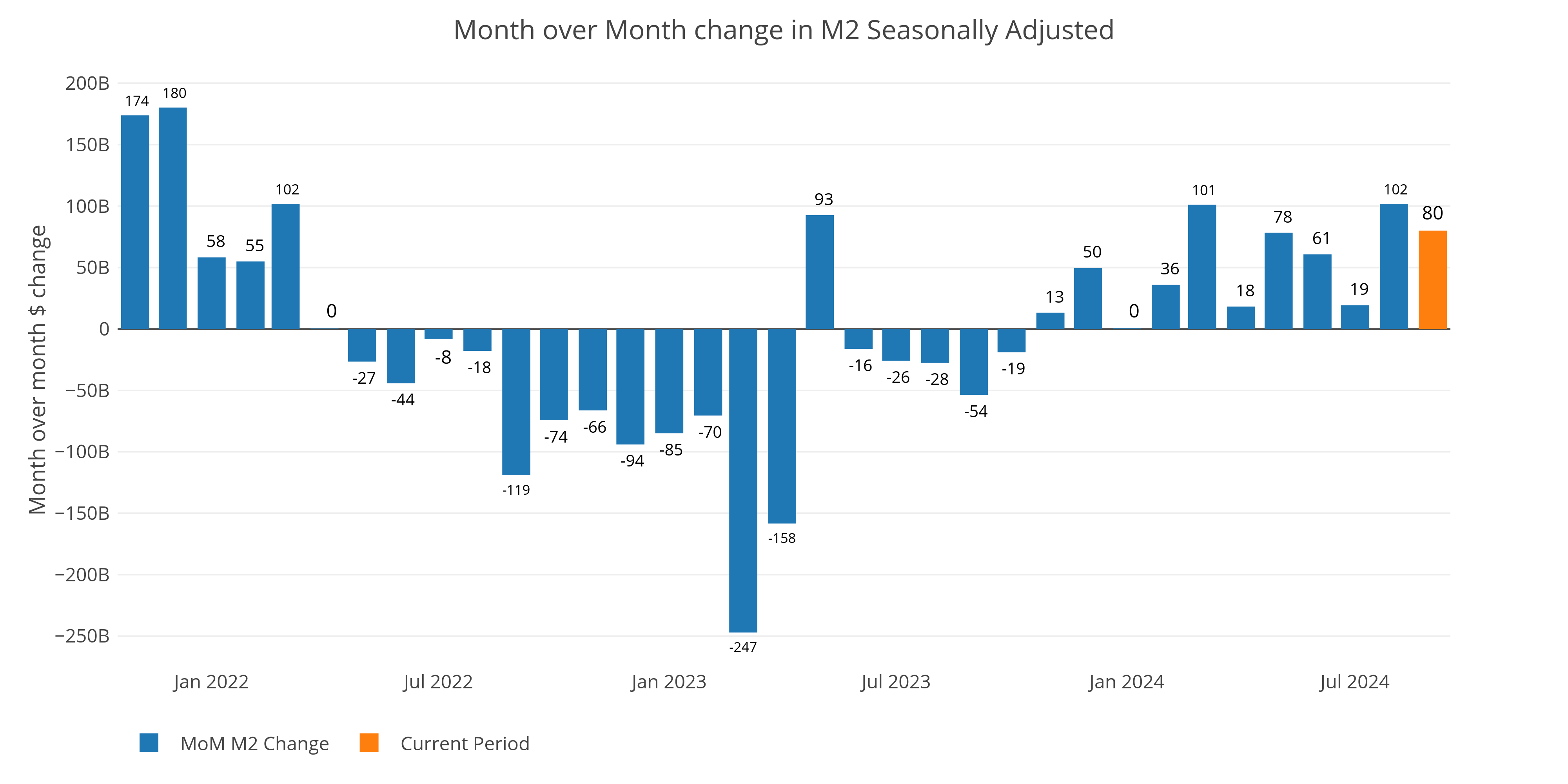

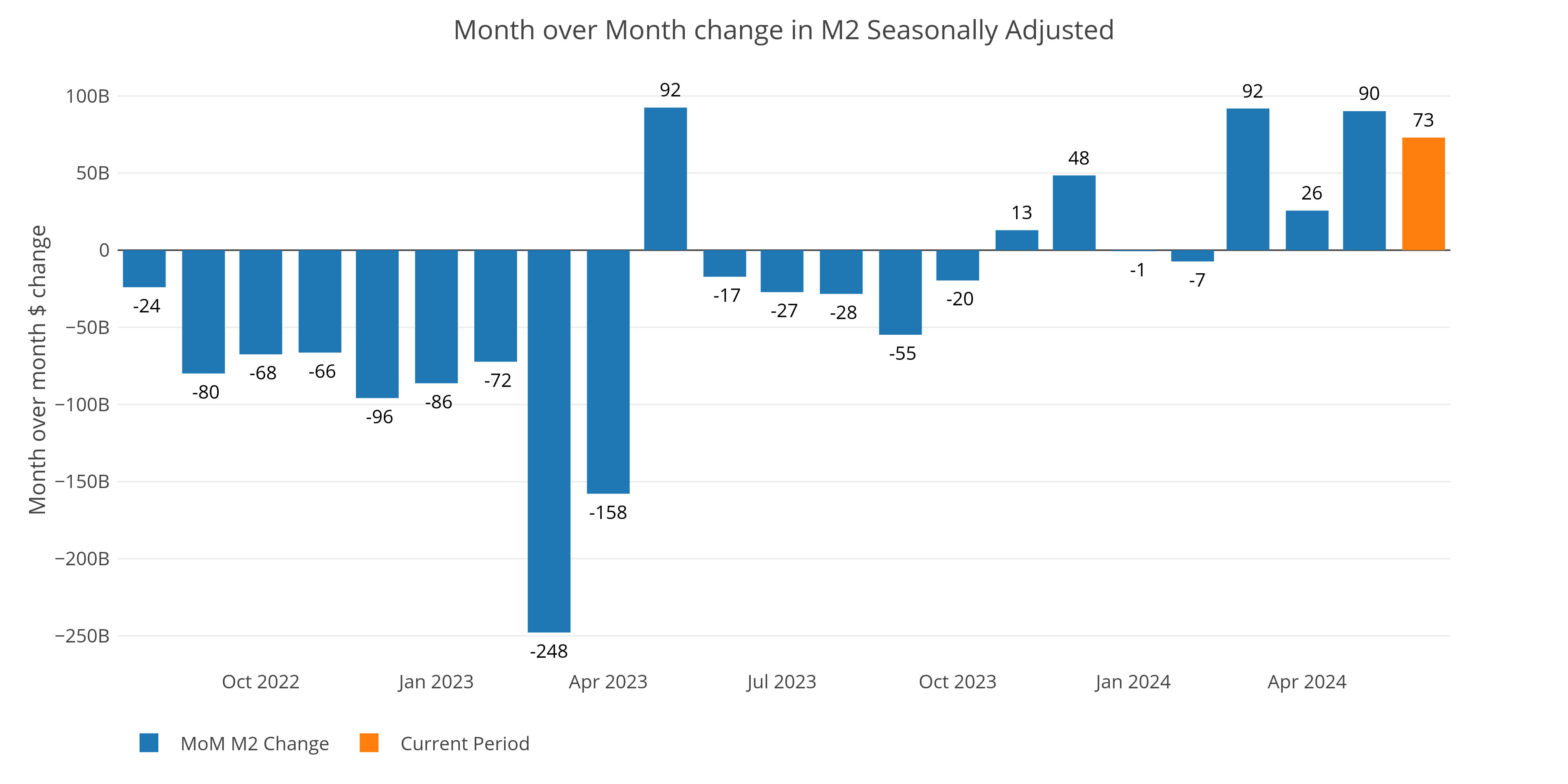

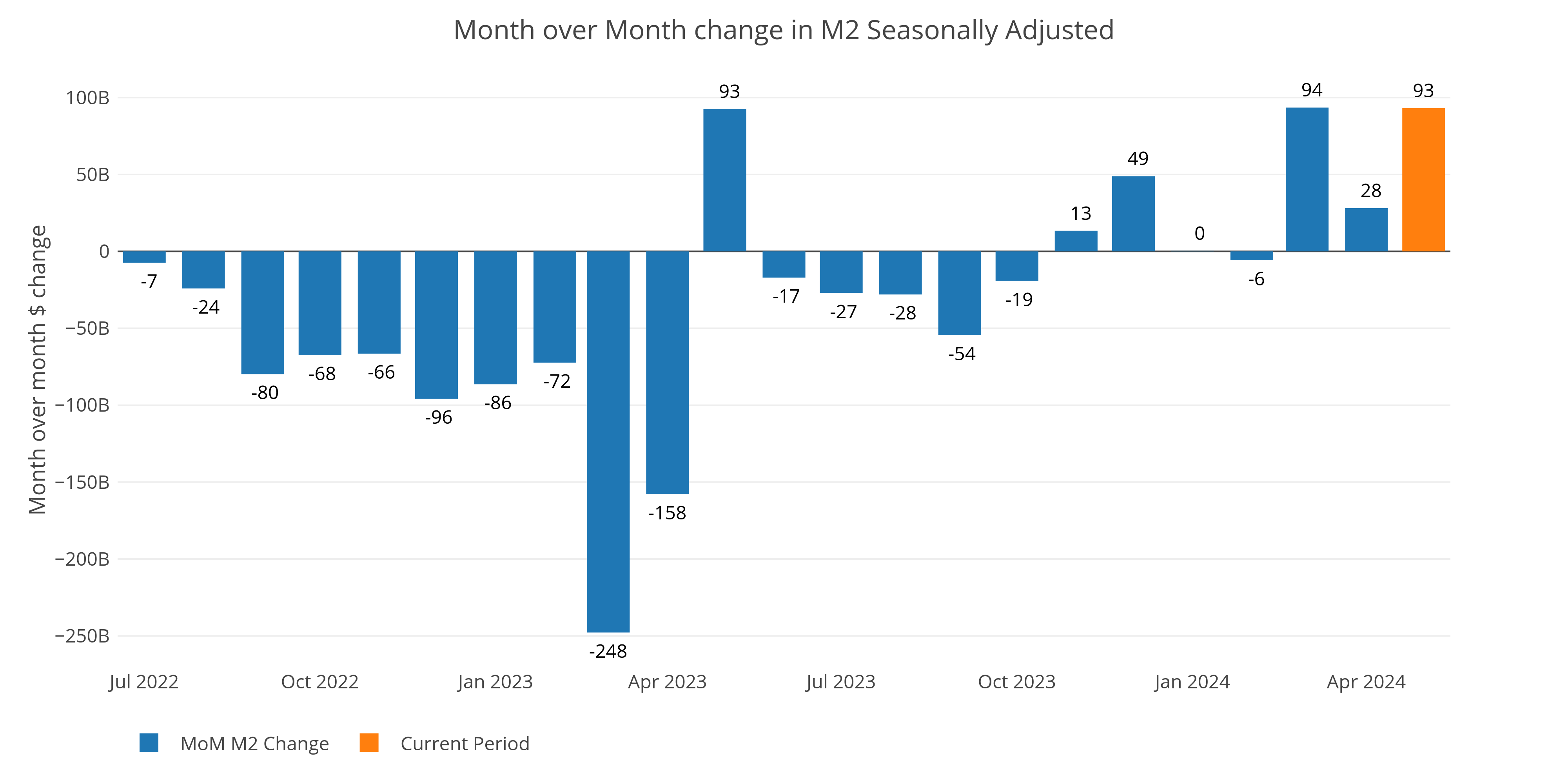

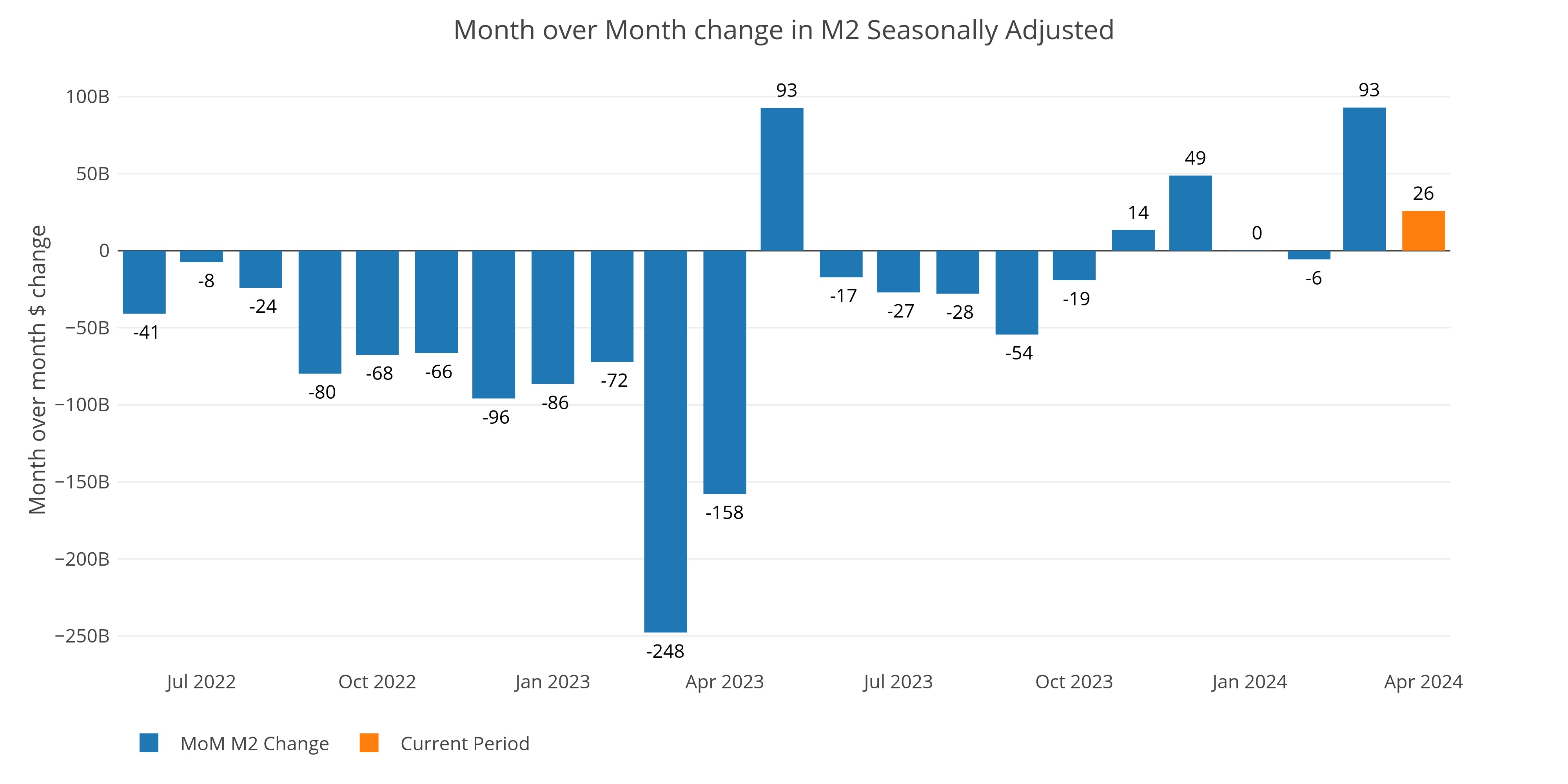

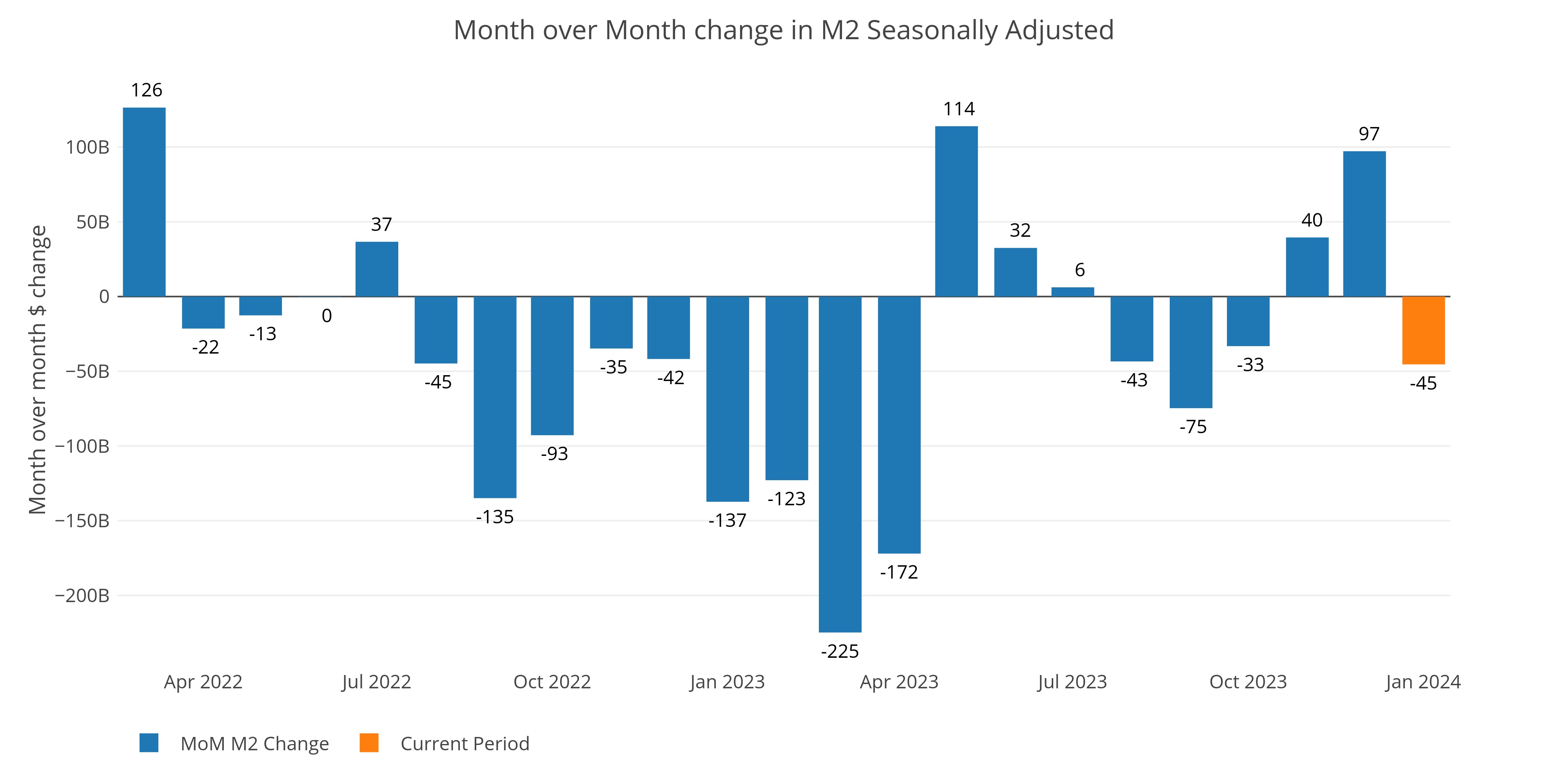

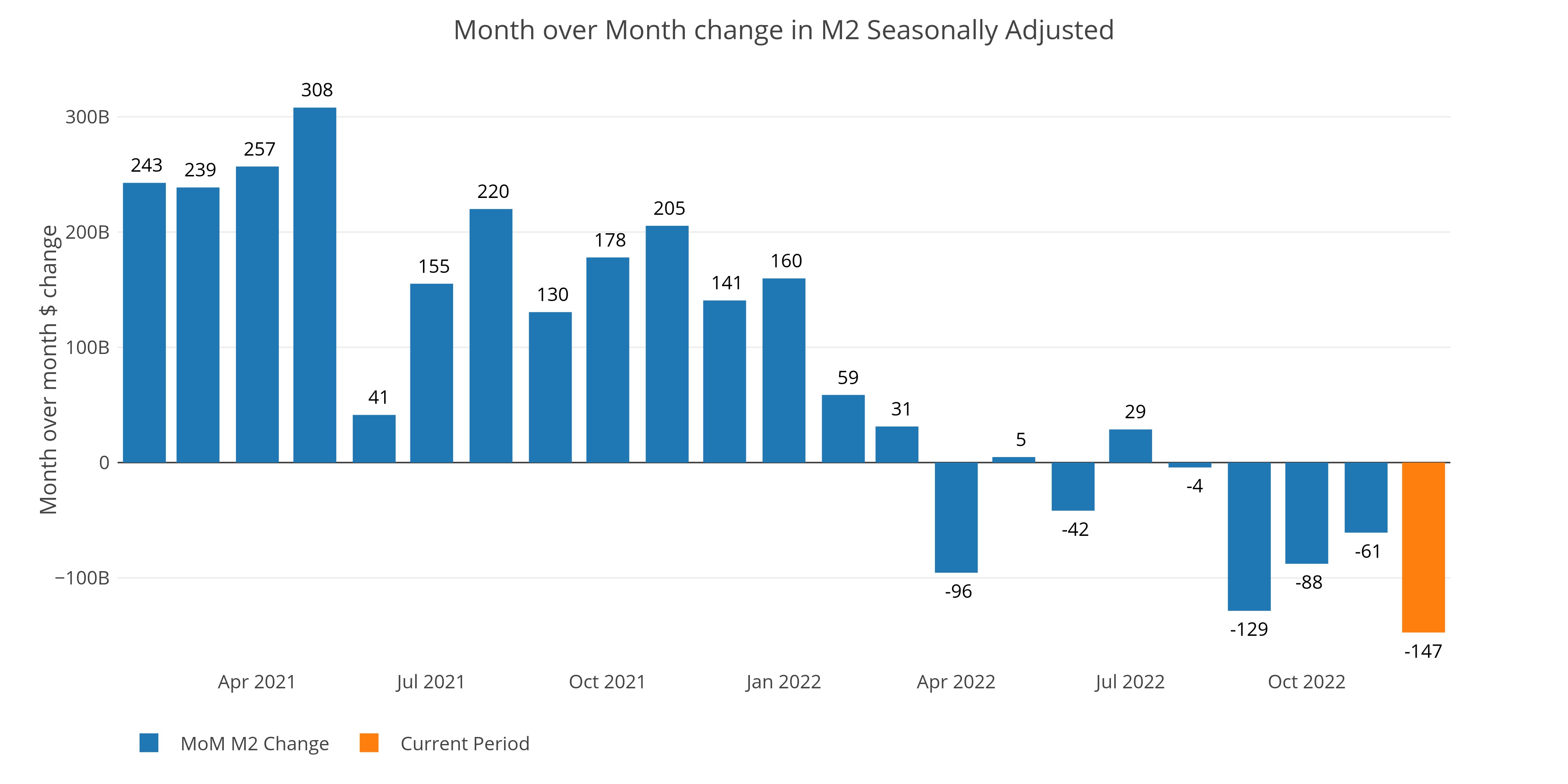

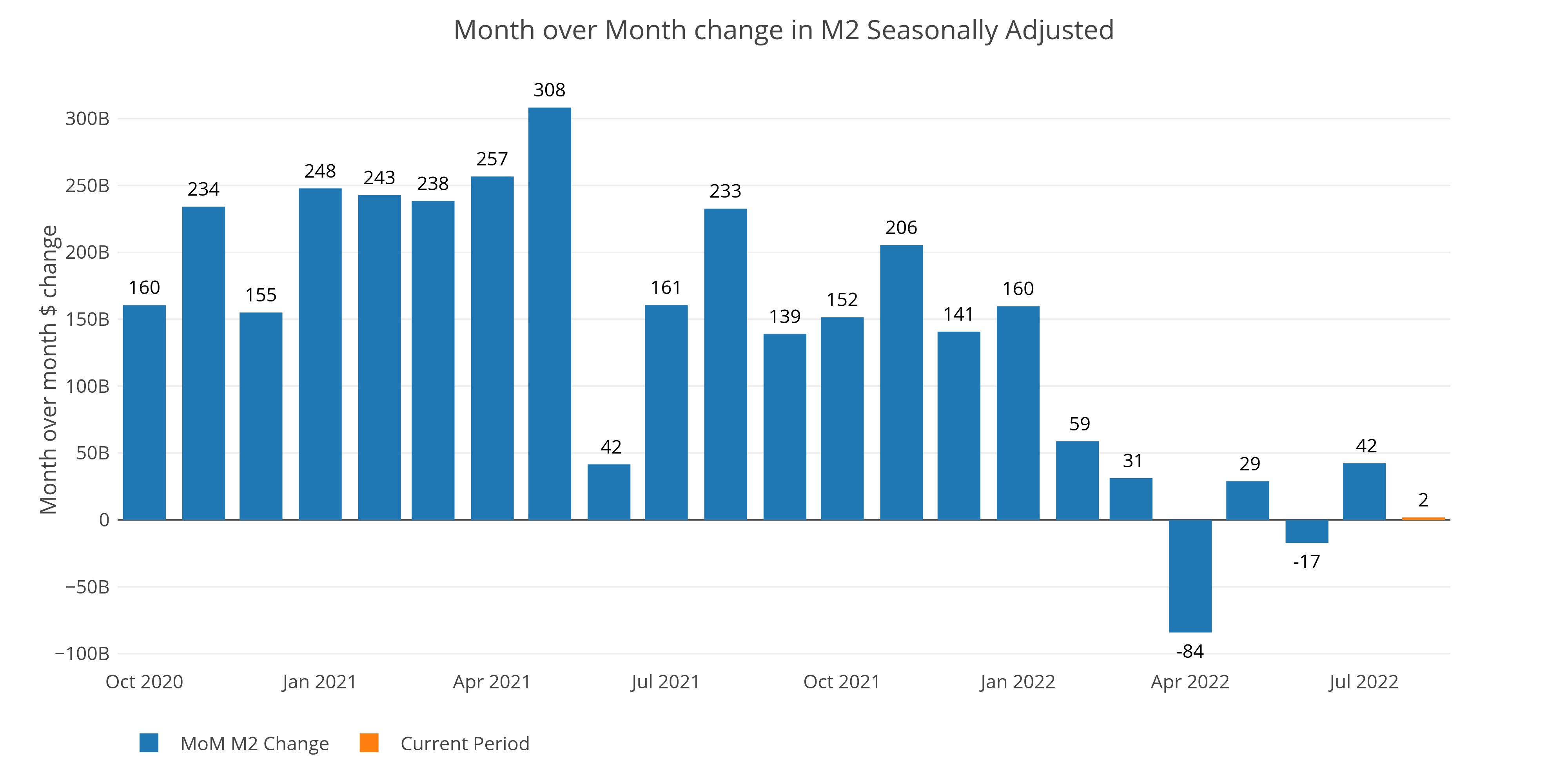

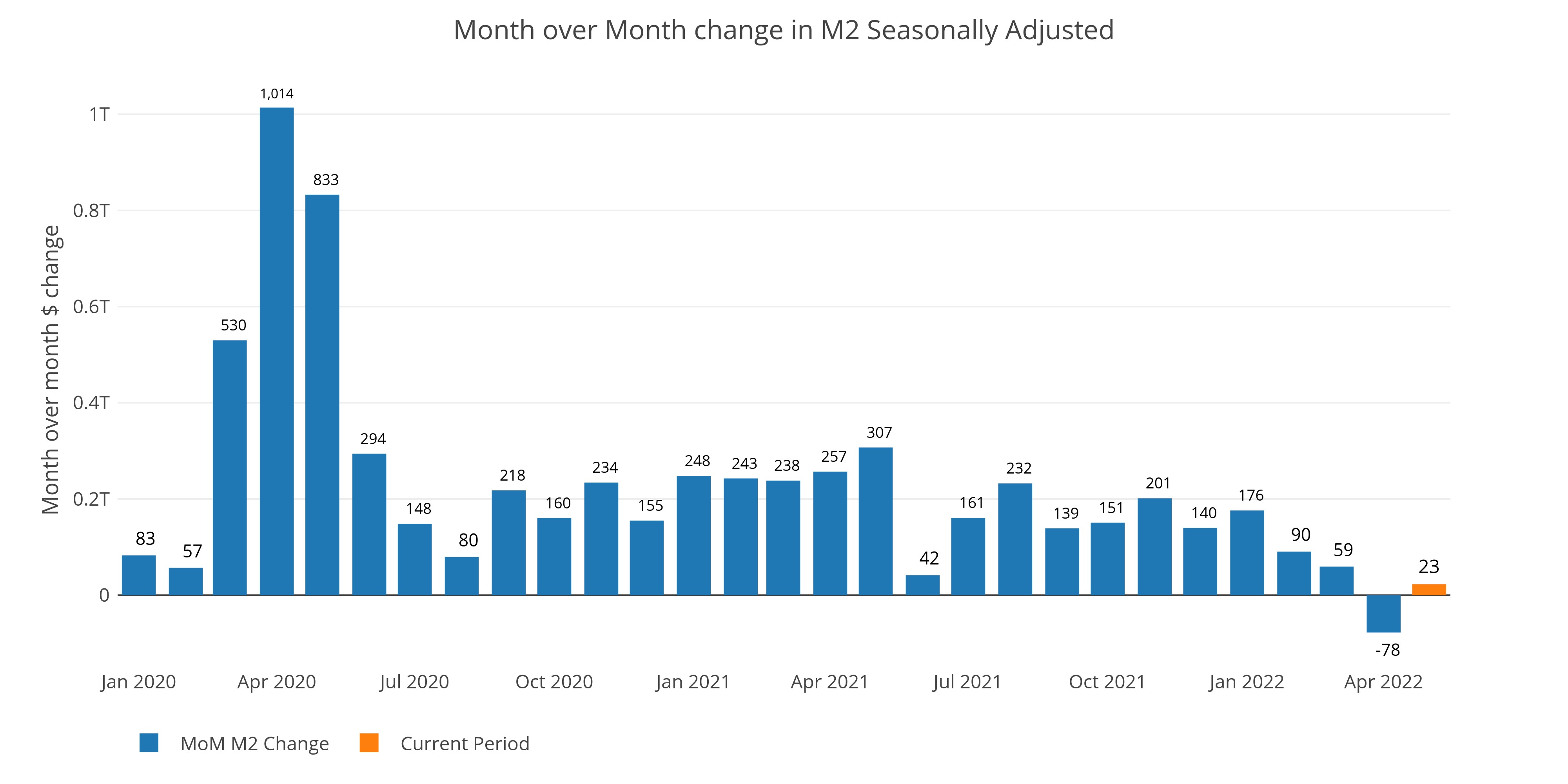

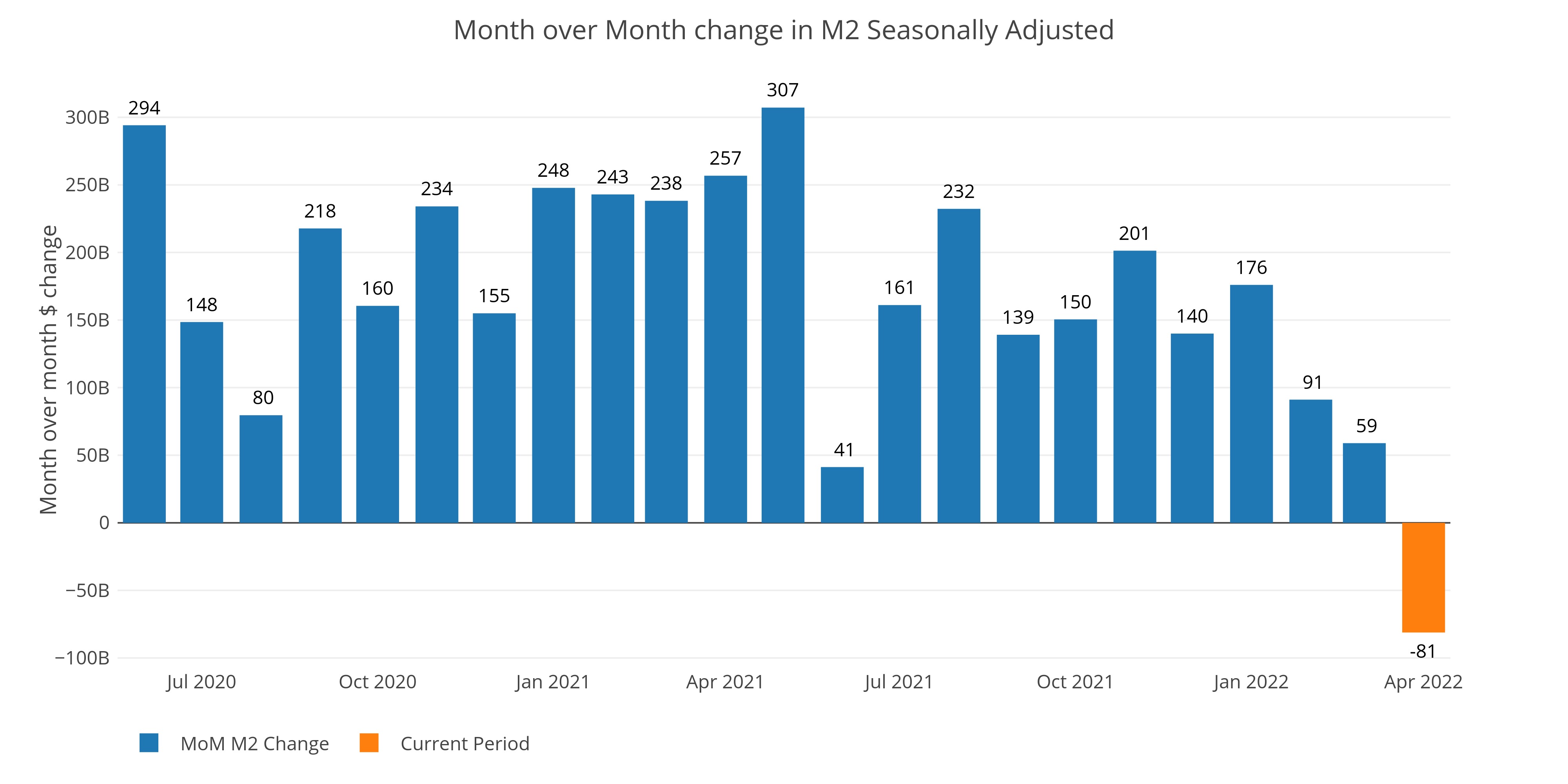

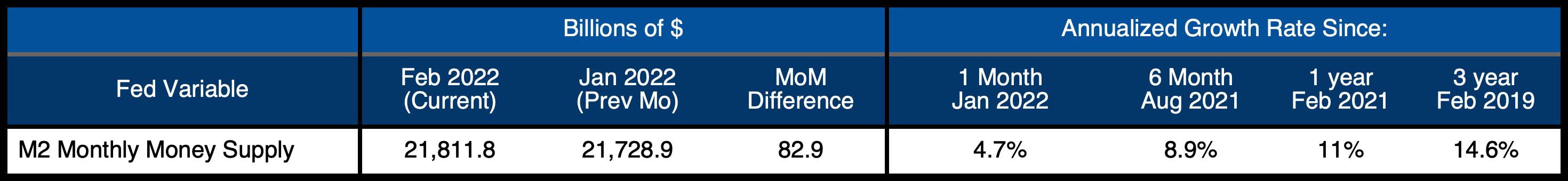

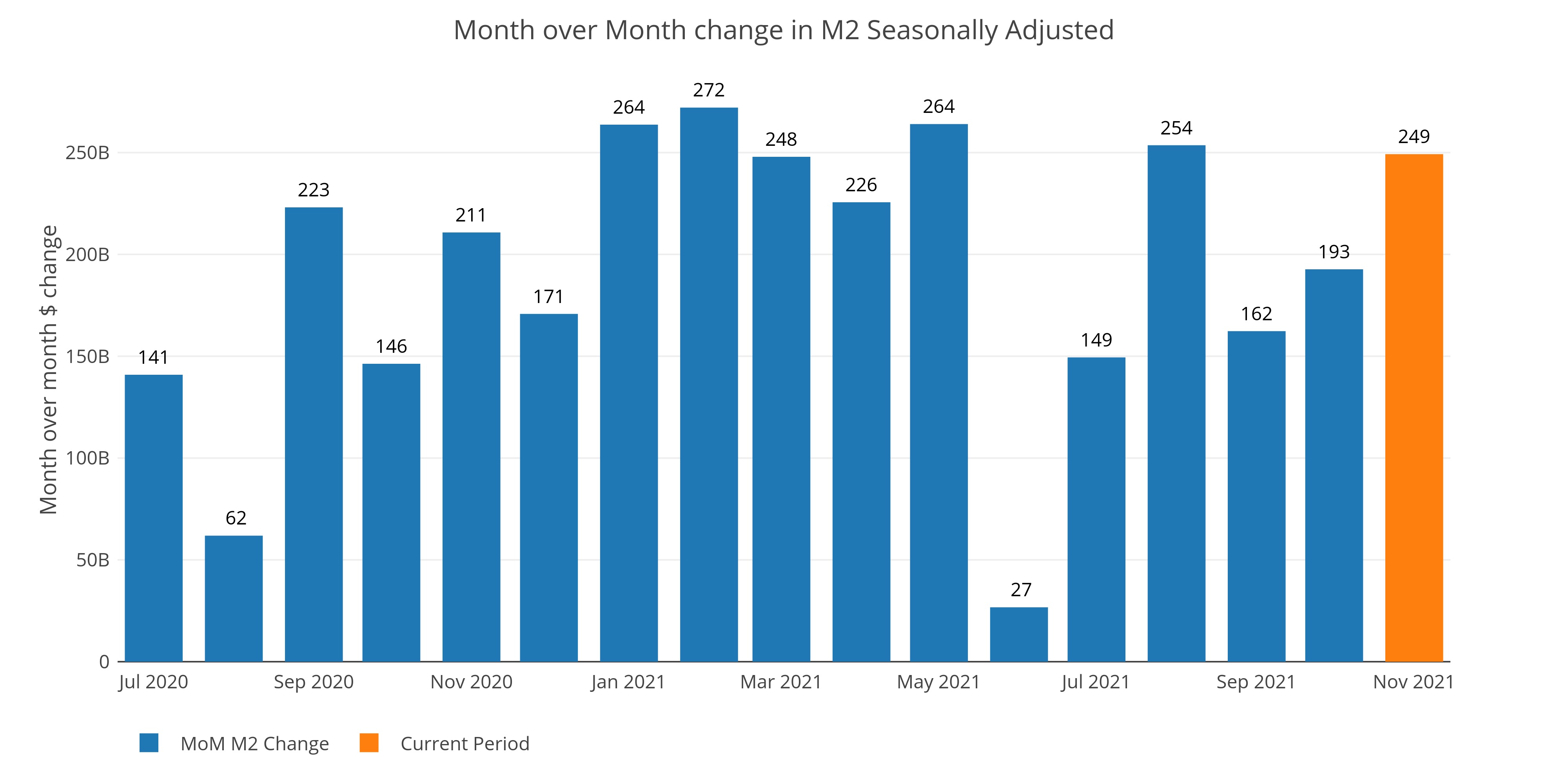

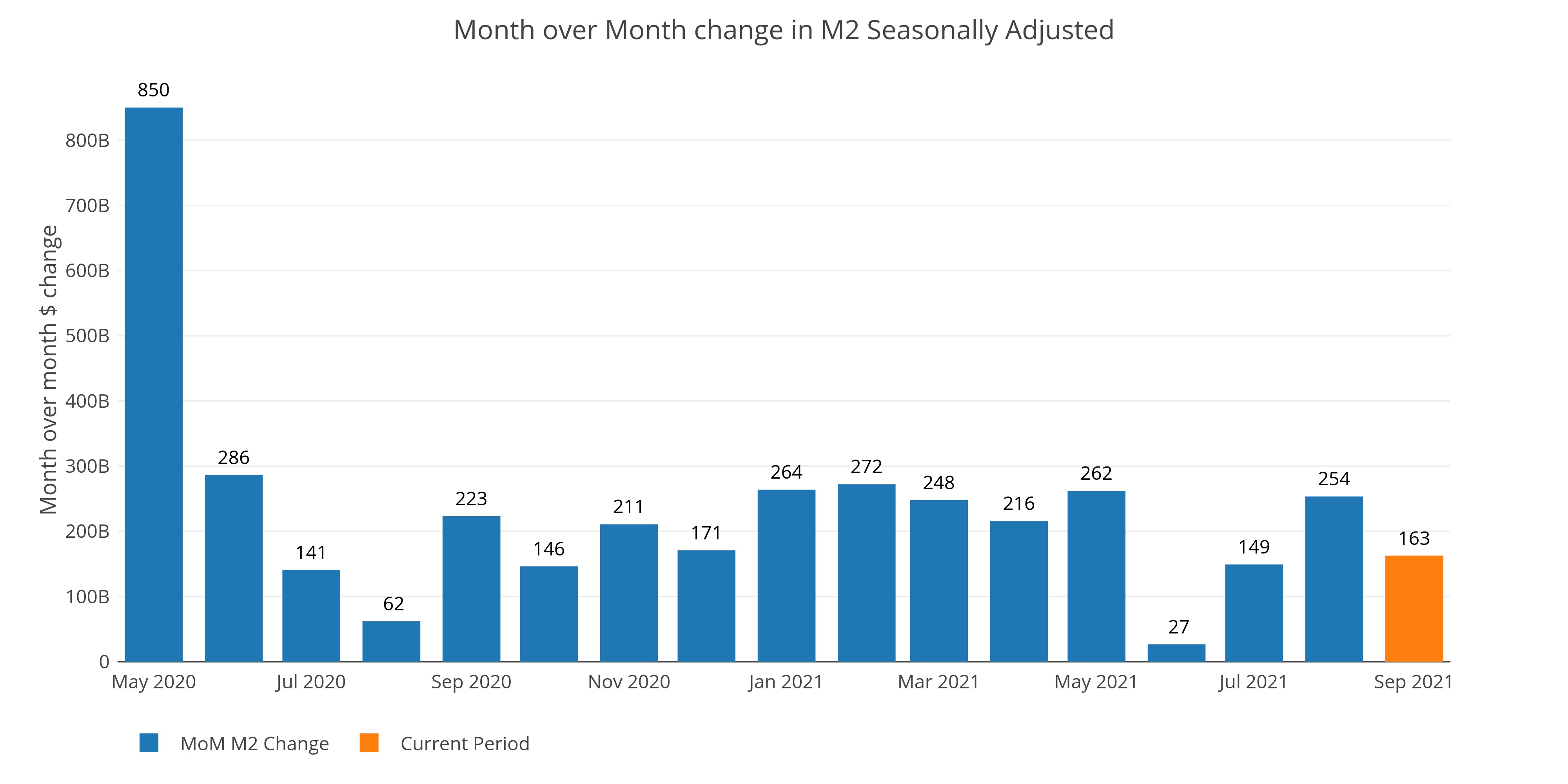

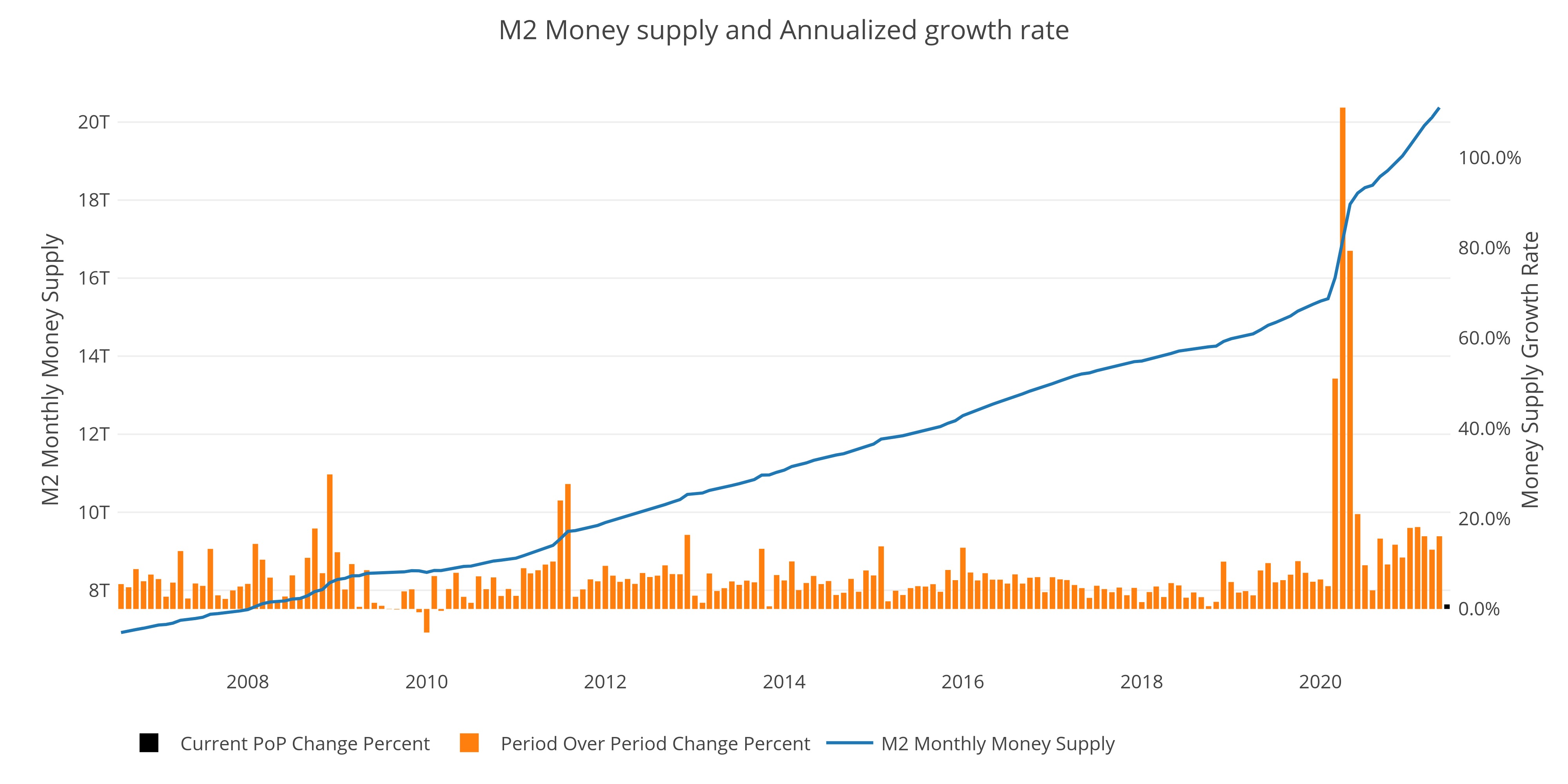

What Debt? Just inflate! 13 Week Money Supply Continues Accelerating

The Fed is cutting rates into a rising inflation environment. That is not a good recipe for success

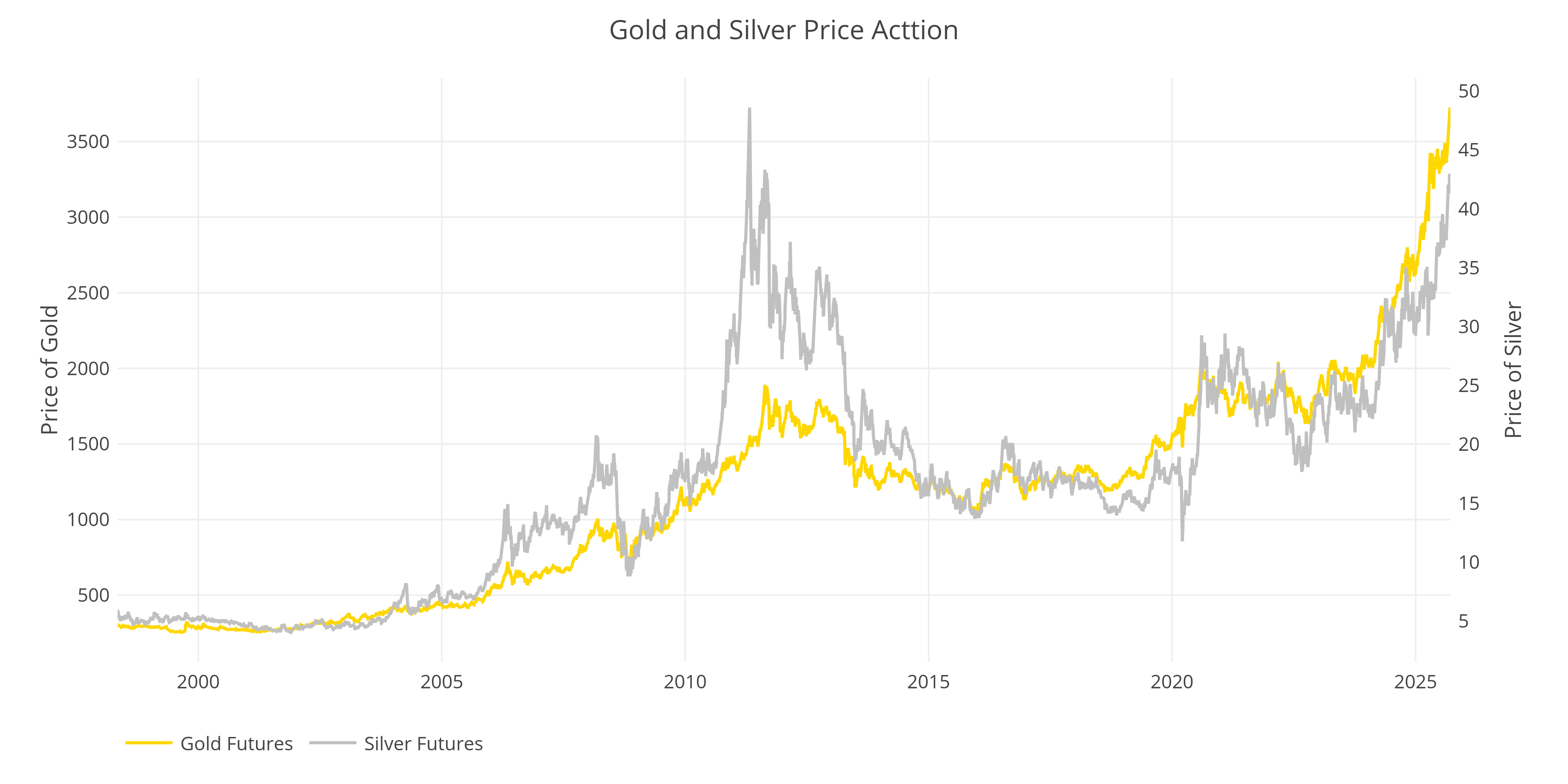

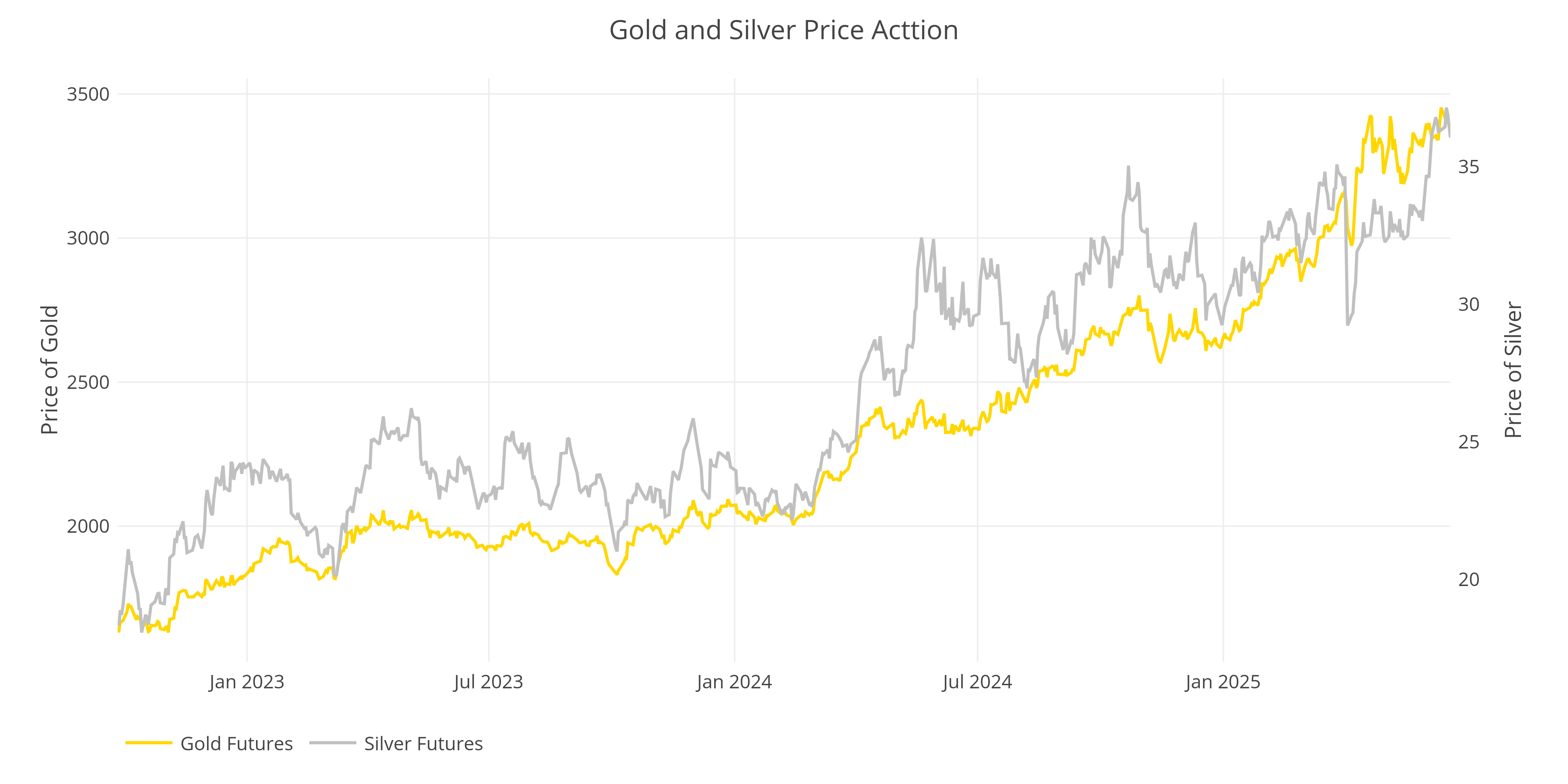

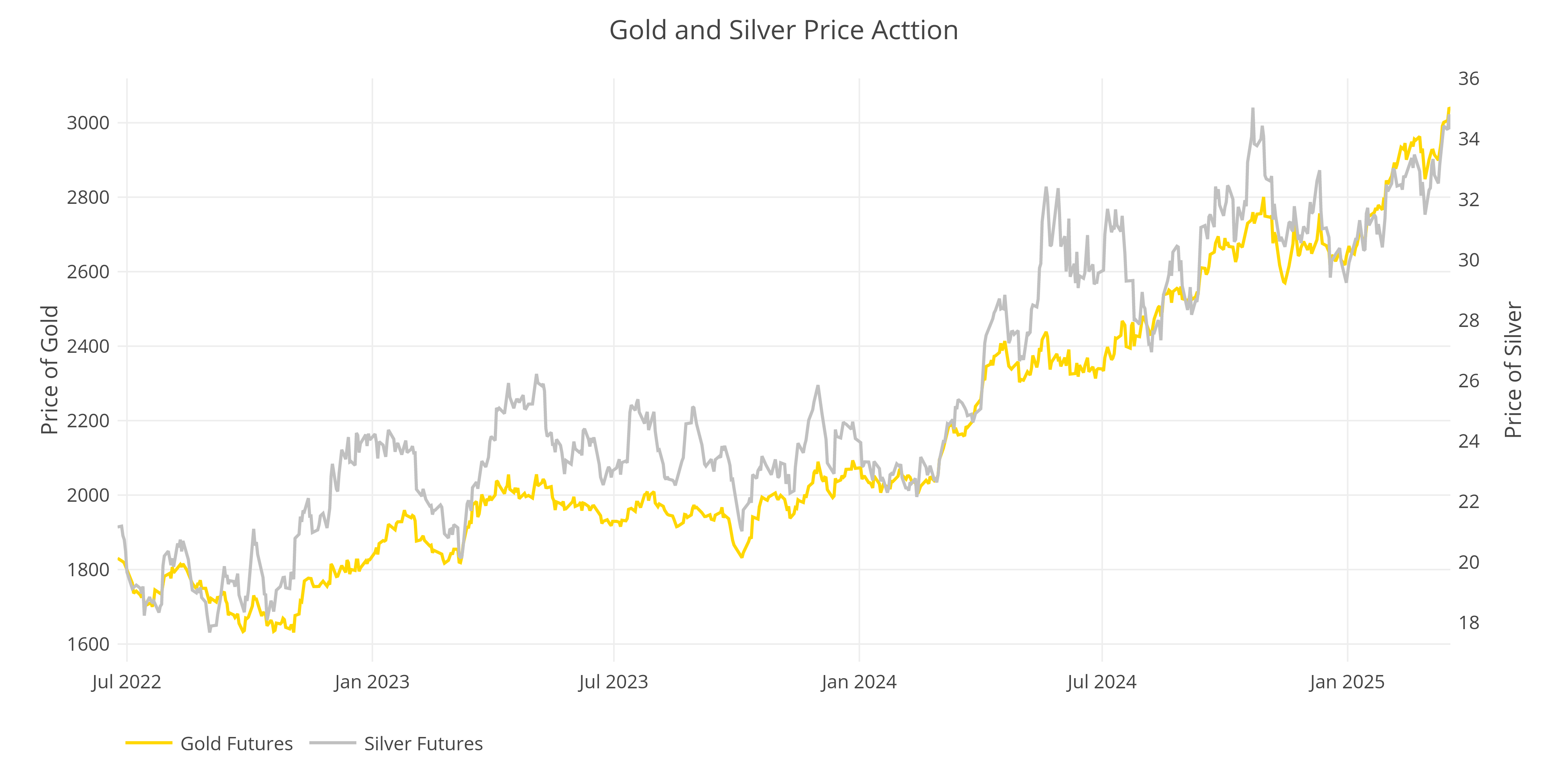

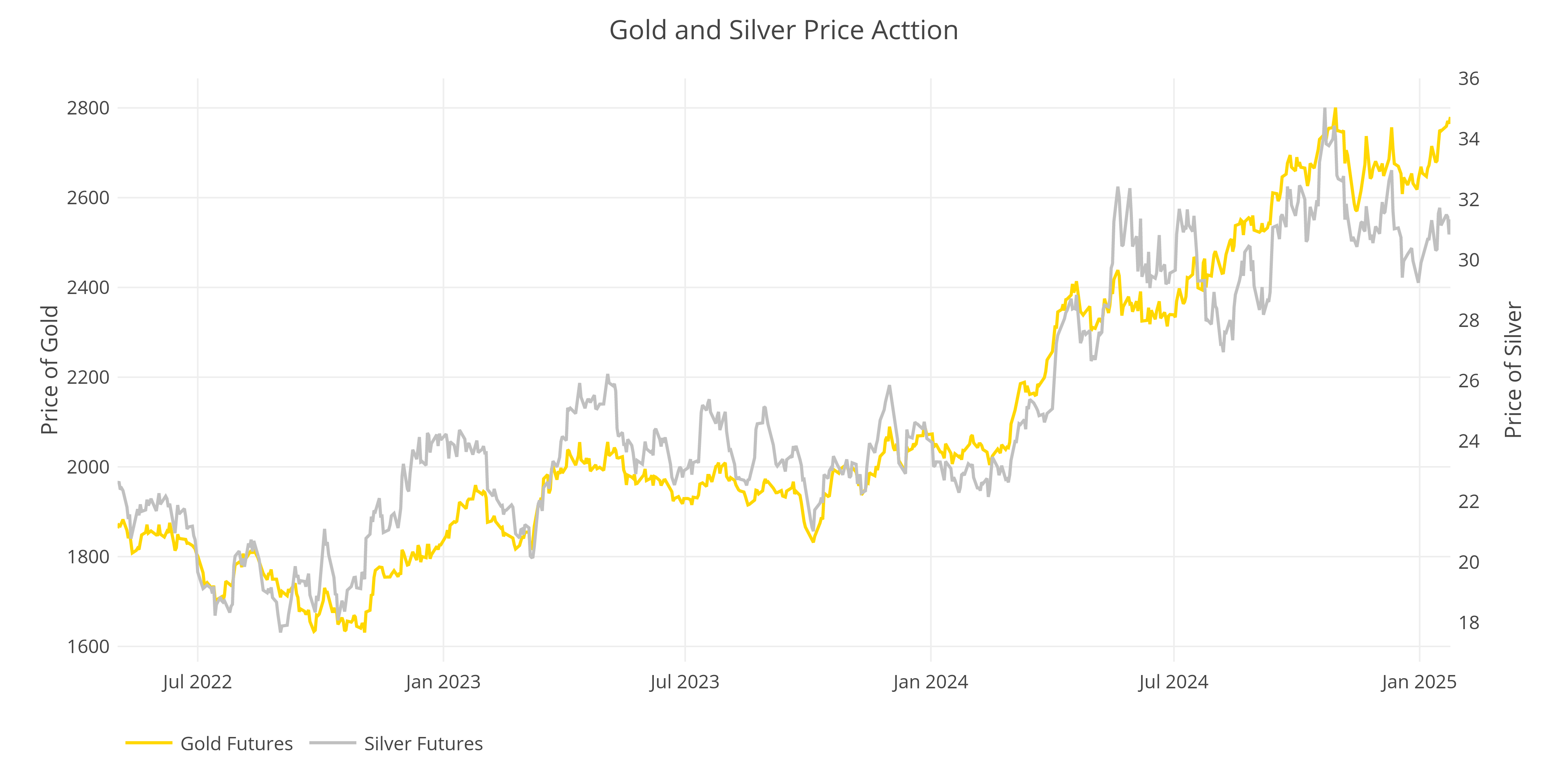

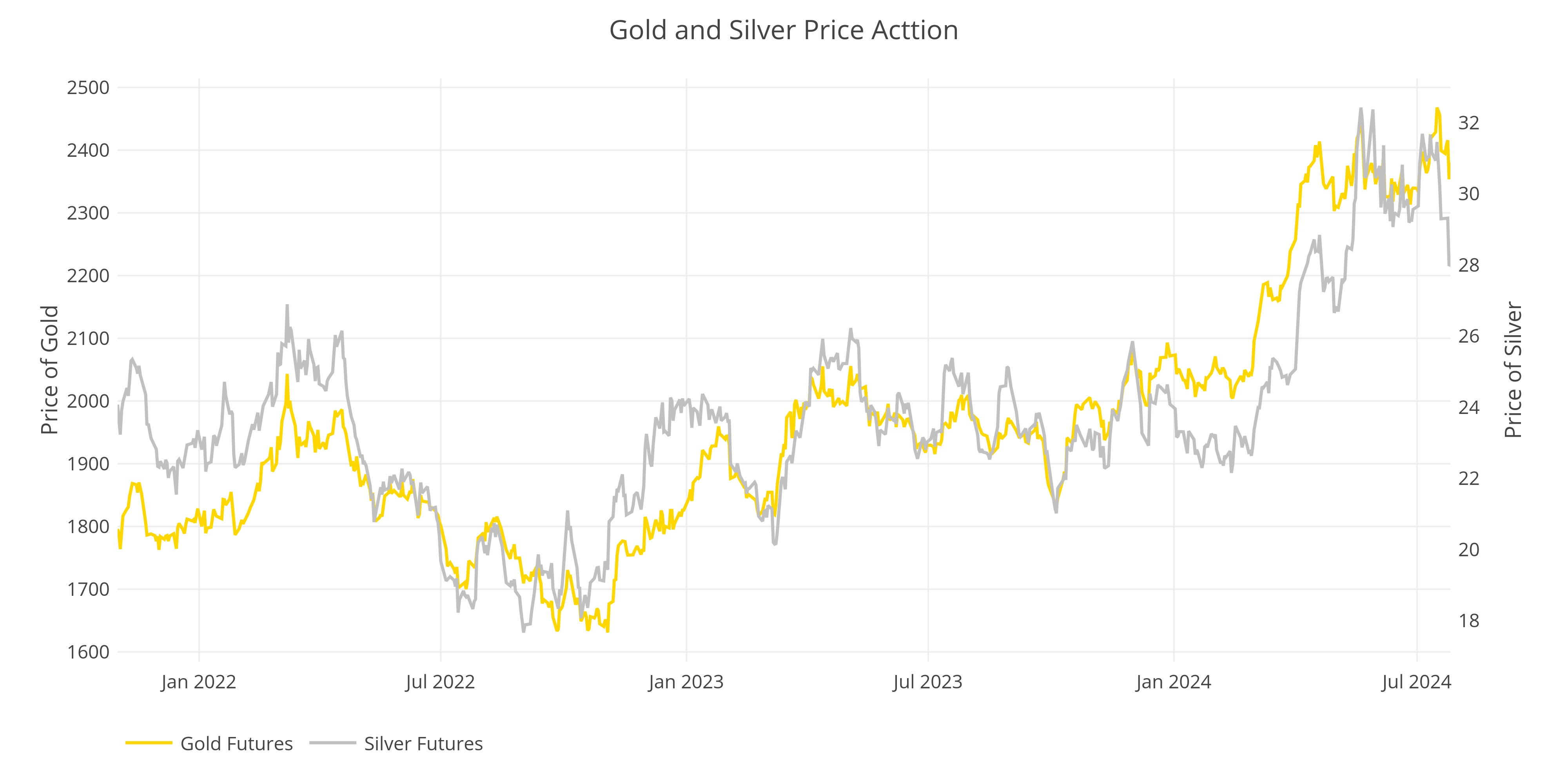

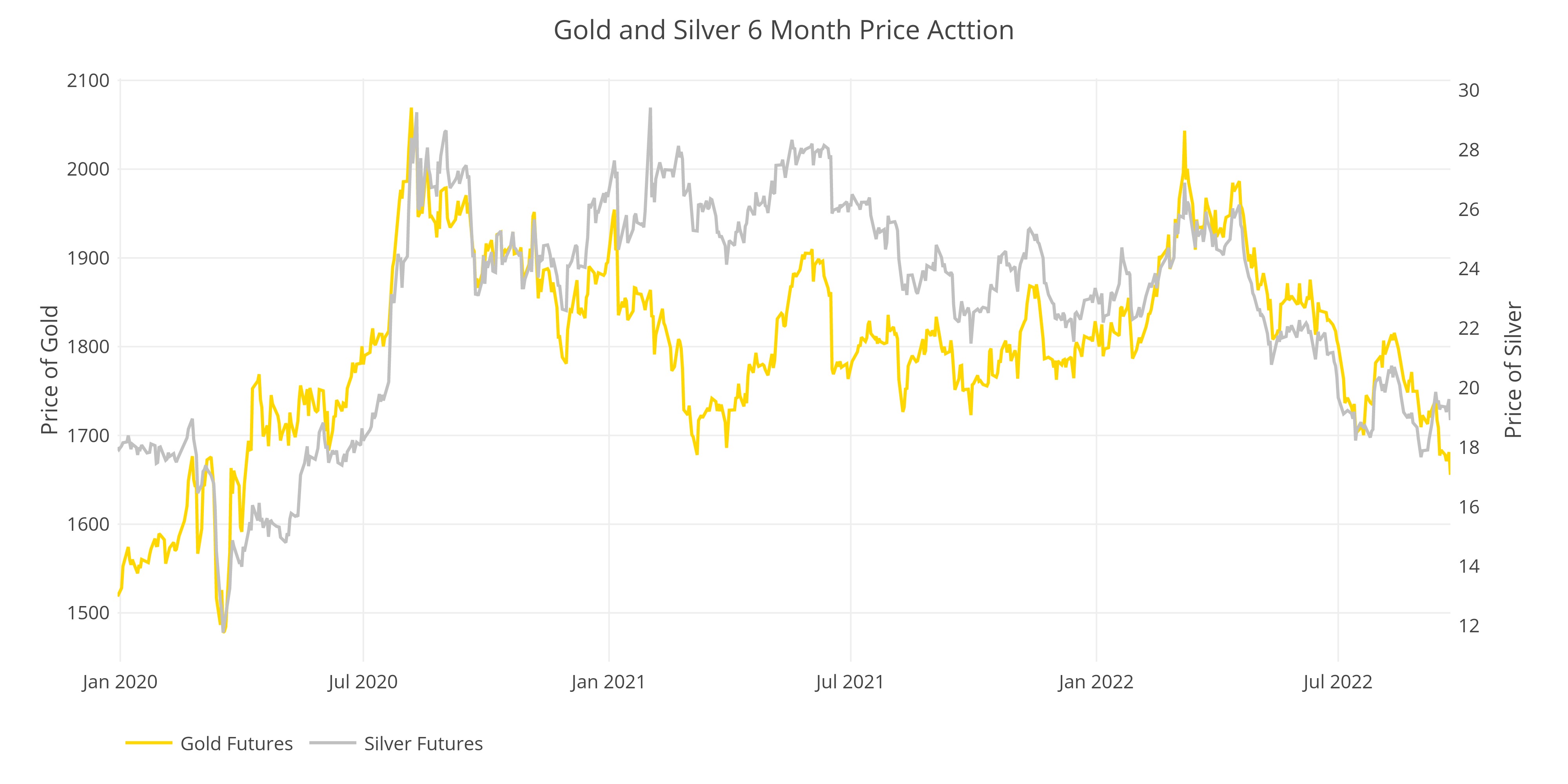

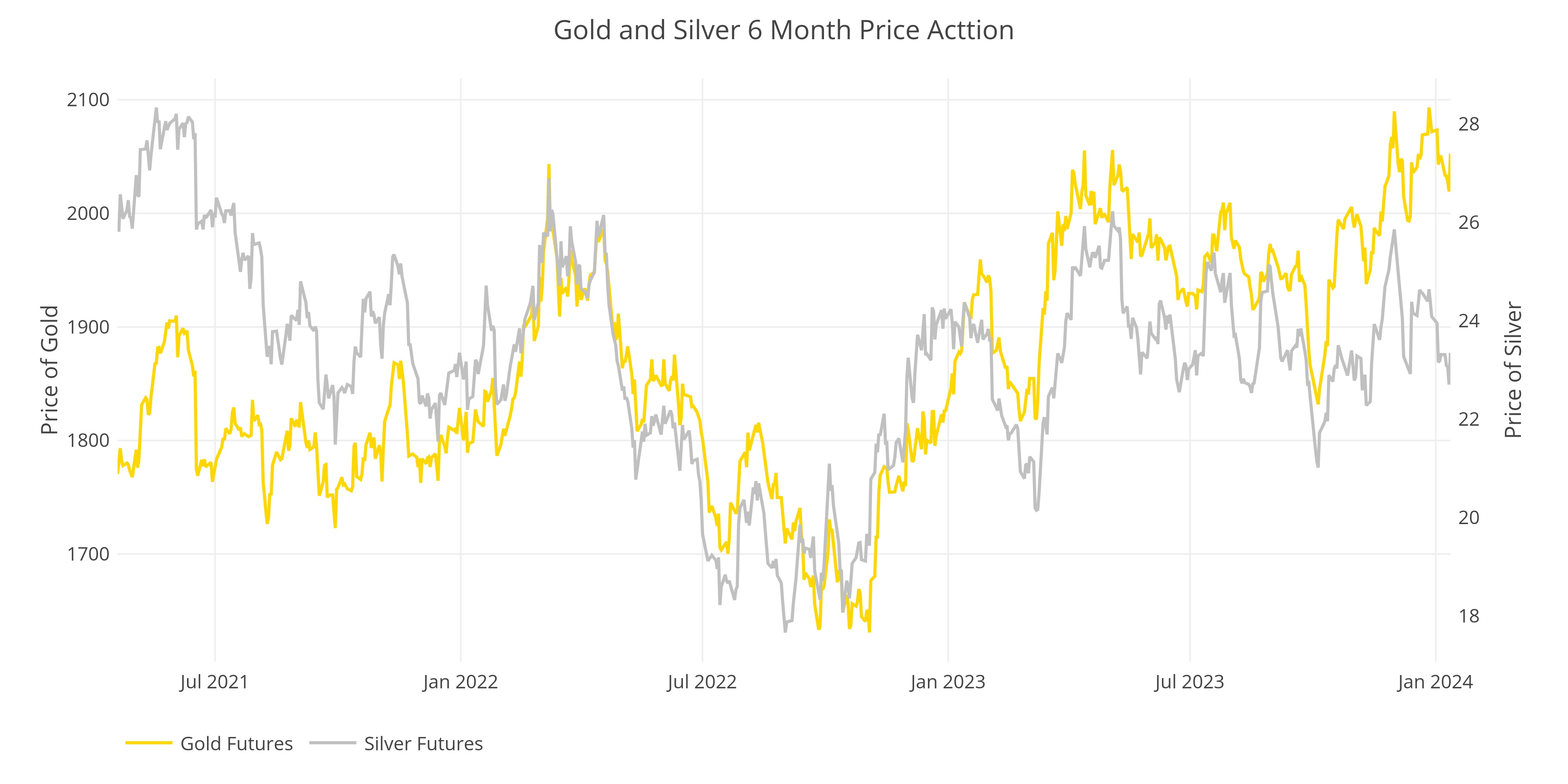

The Technicals: Recovering from 2011 PTSD

This does not look like a repeat of the 2011 blow-off top

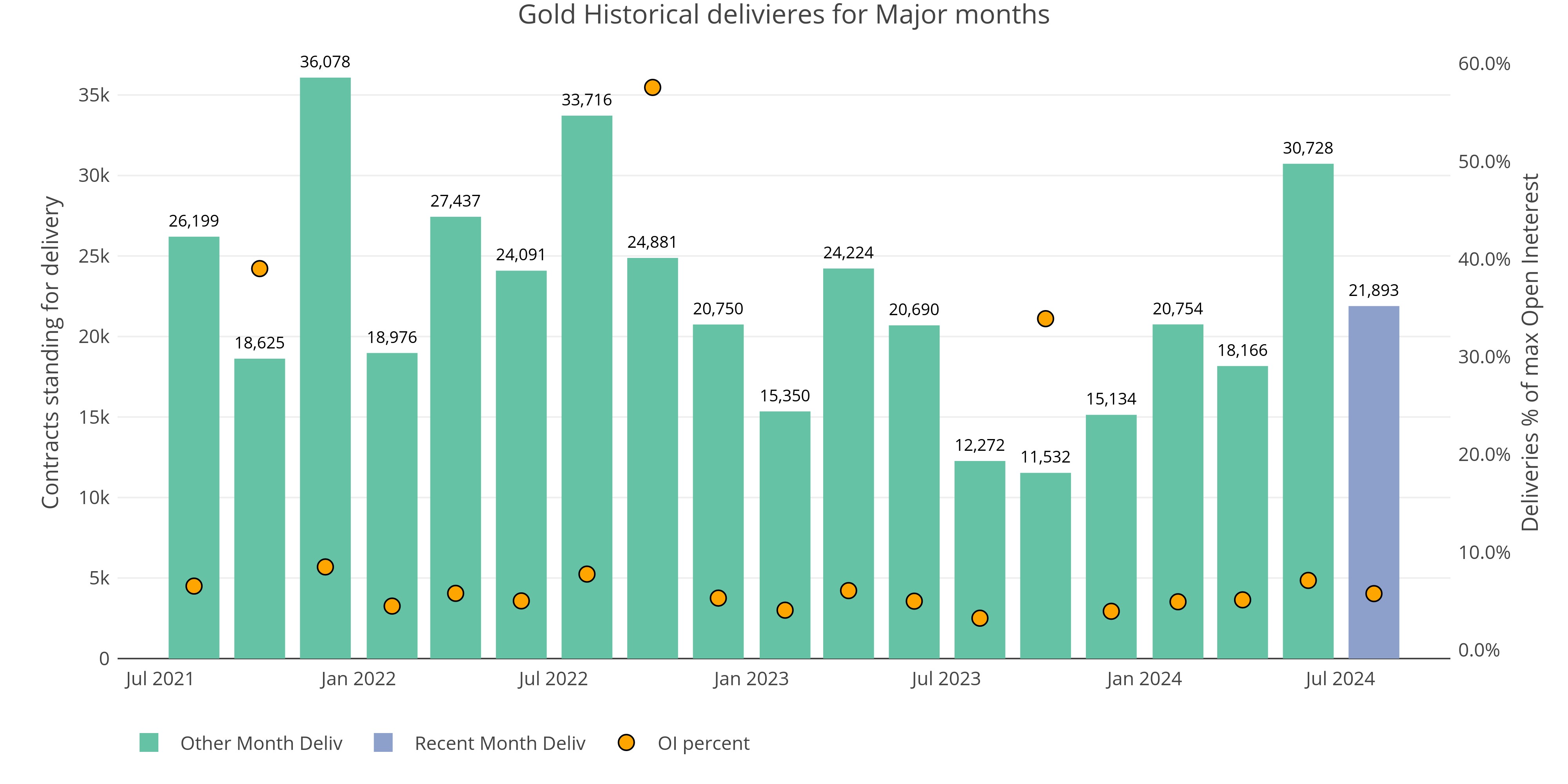

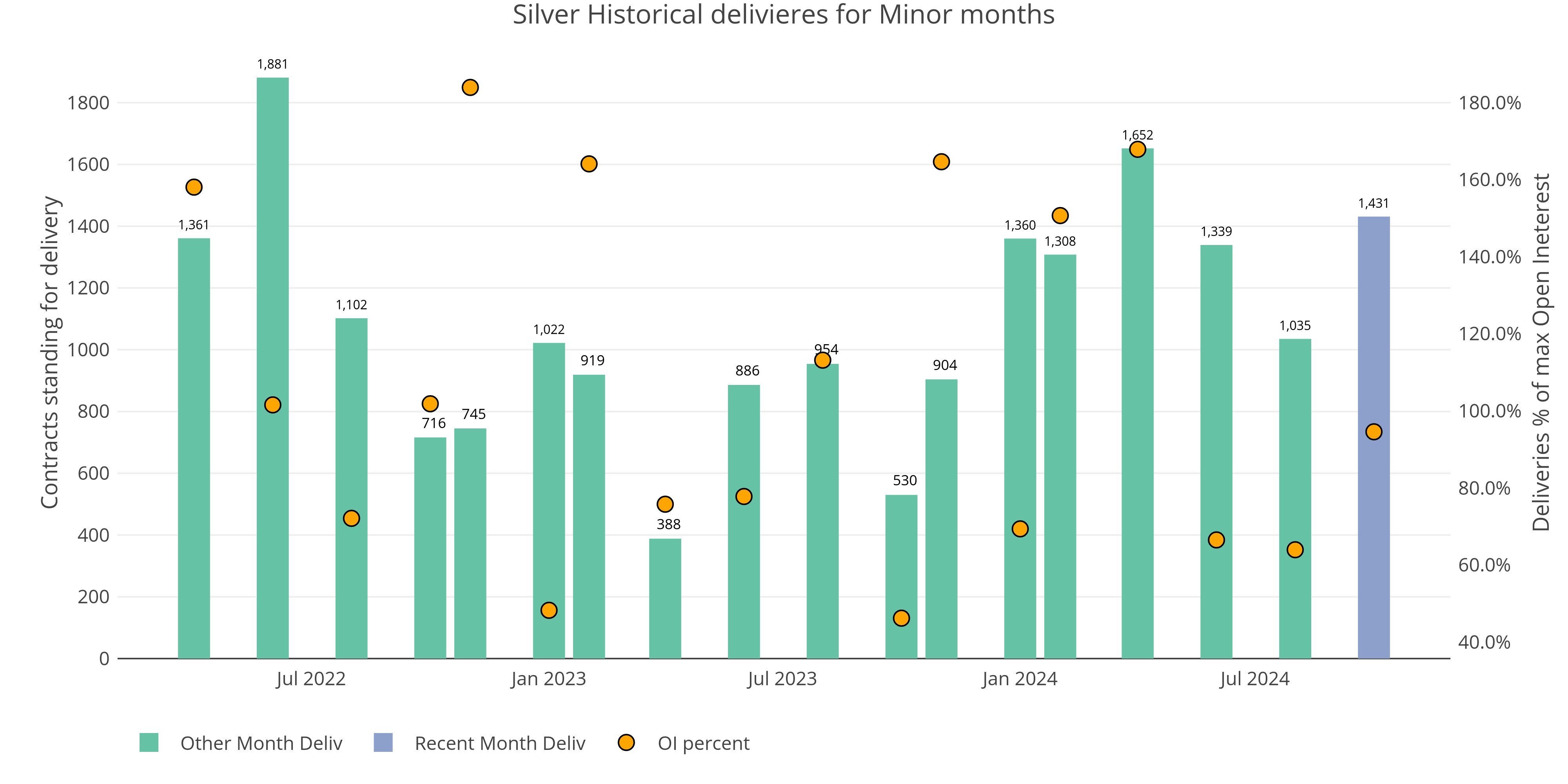

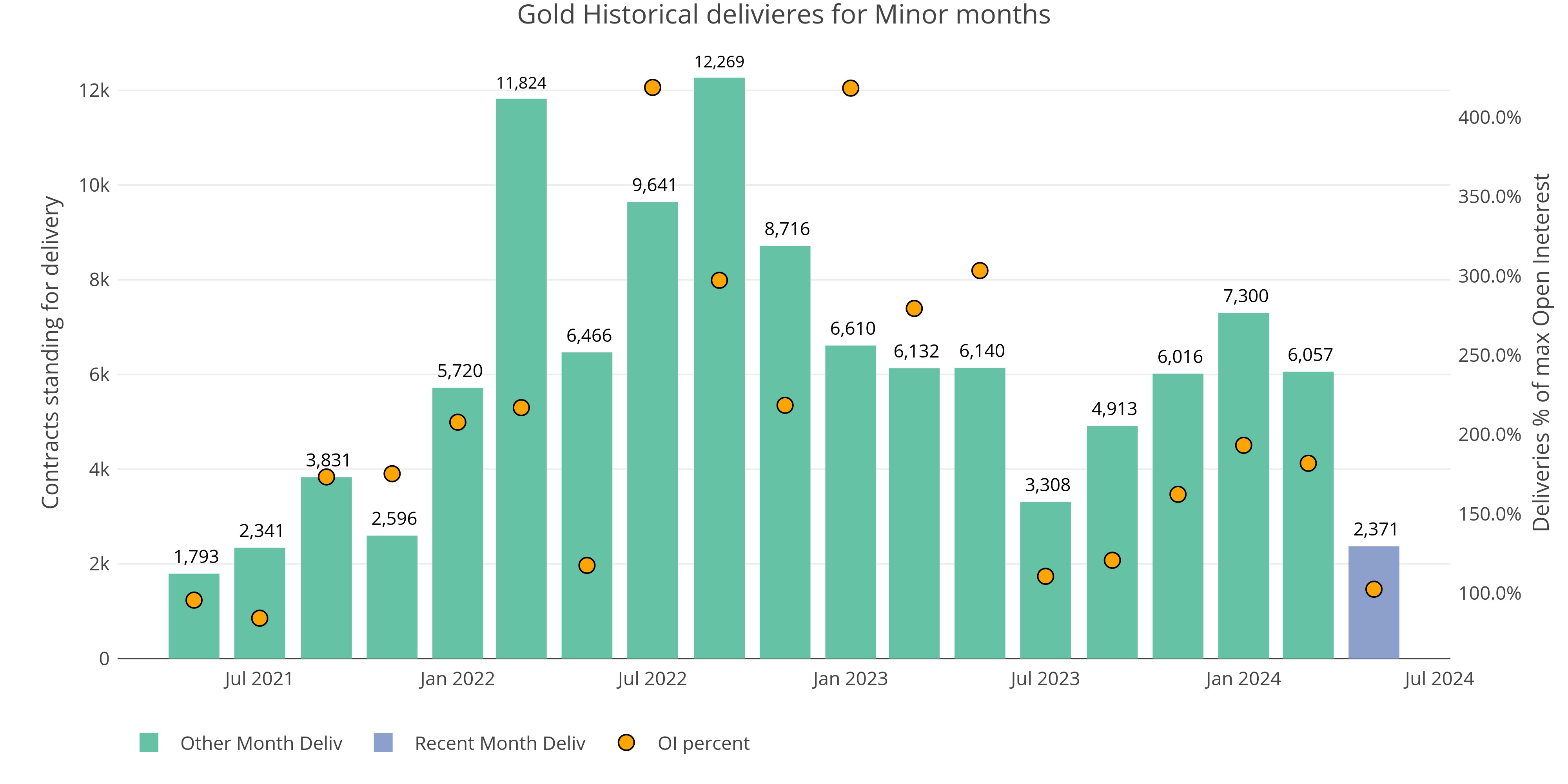

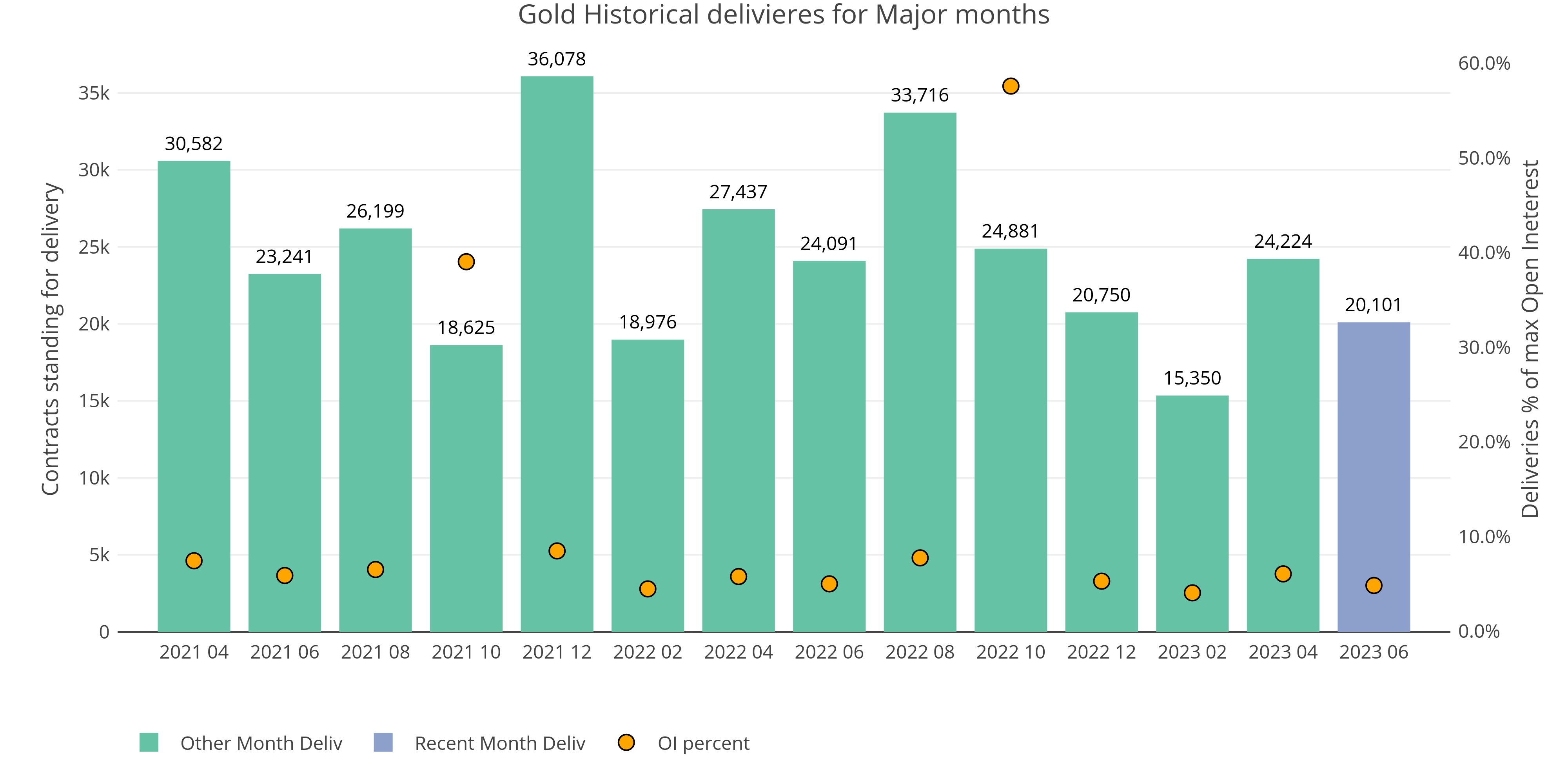

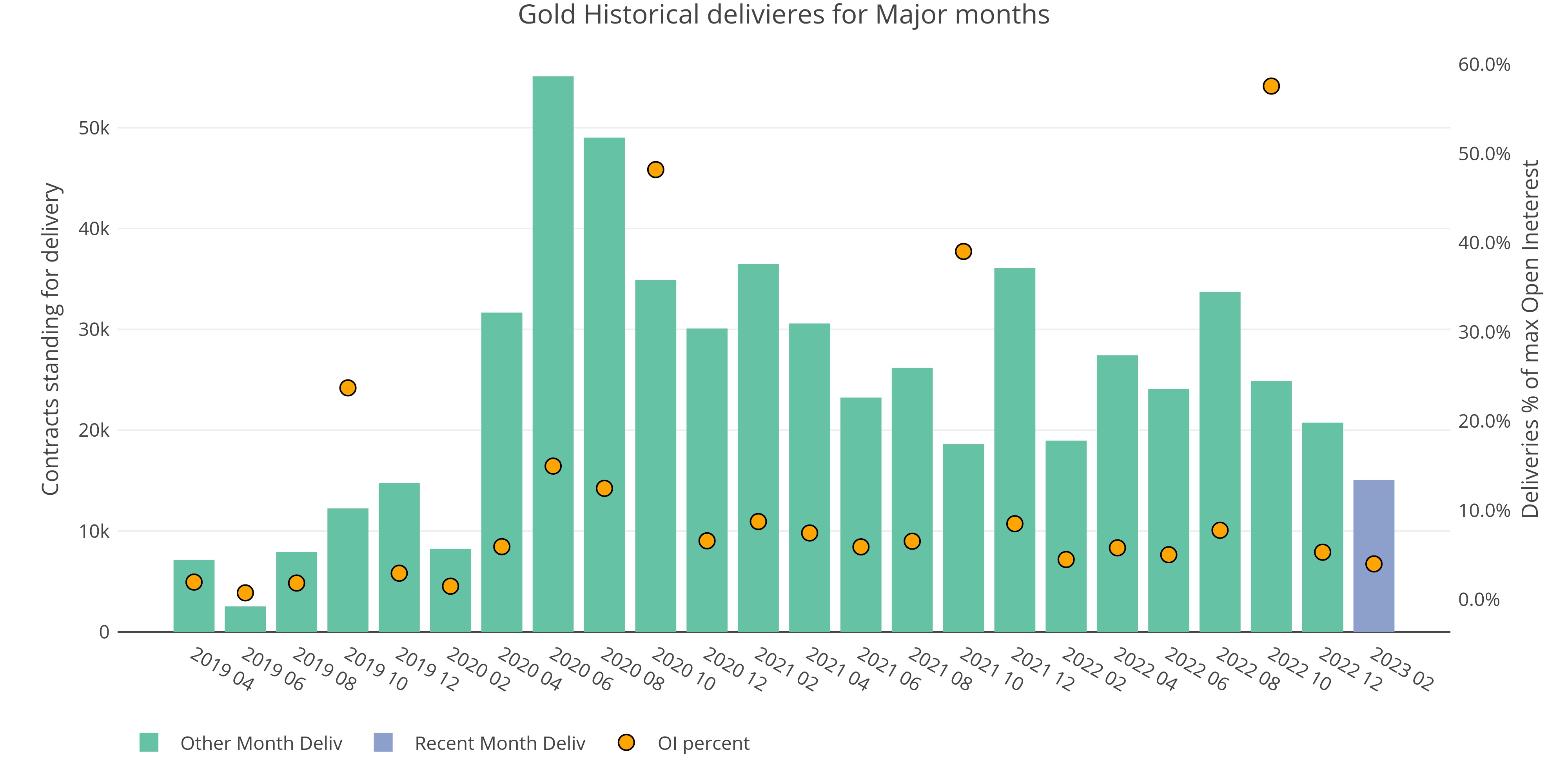

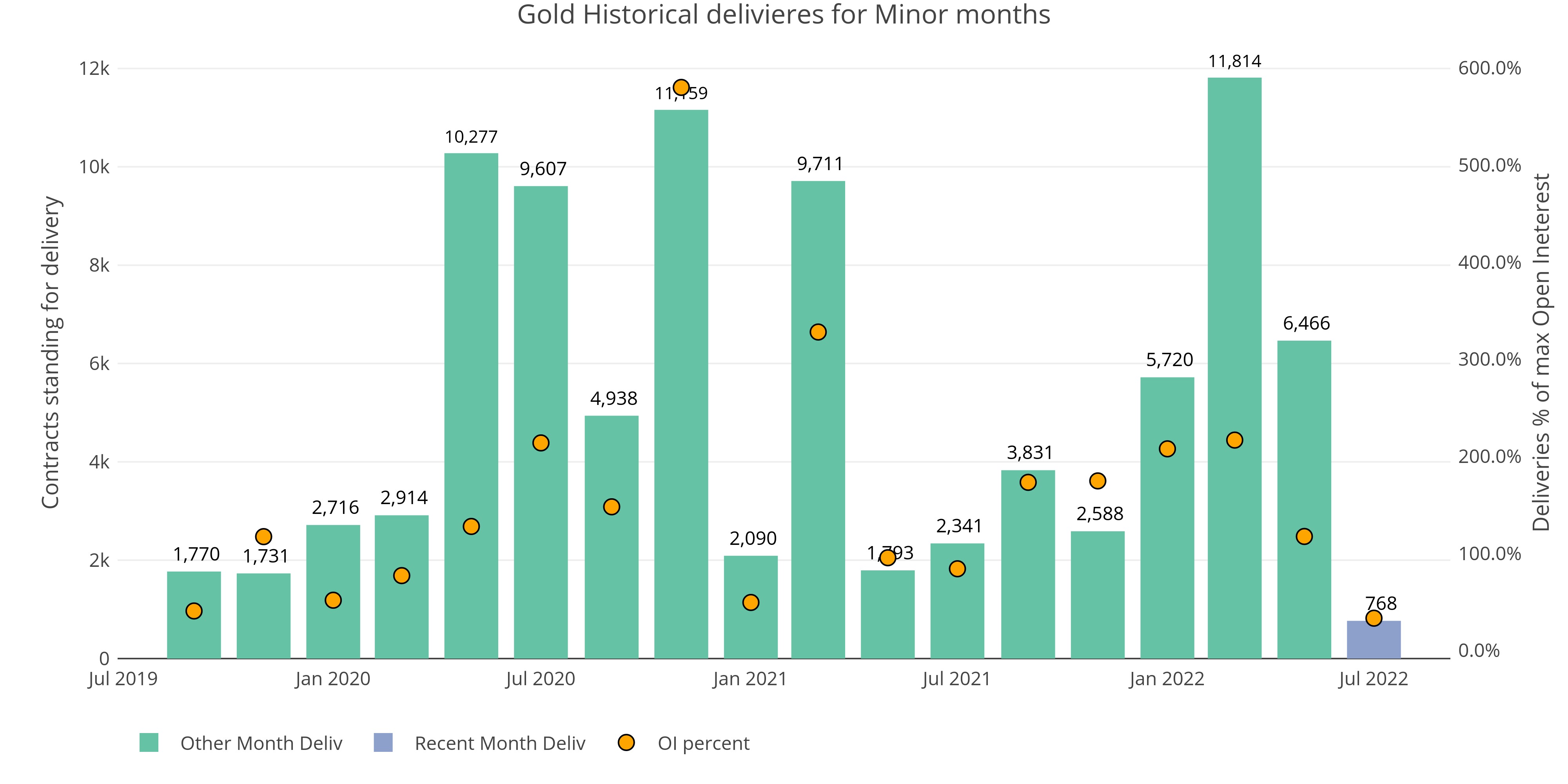

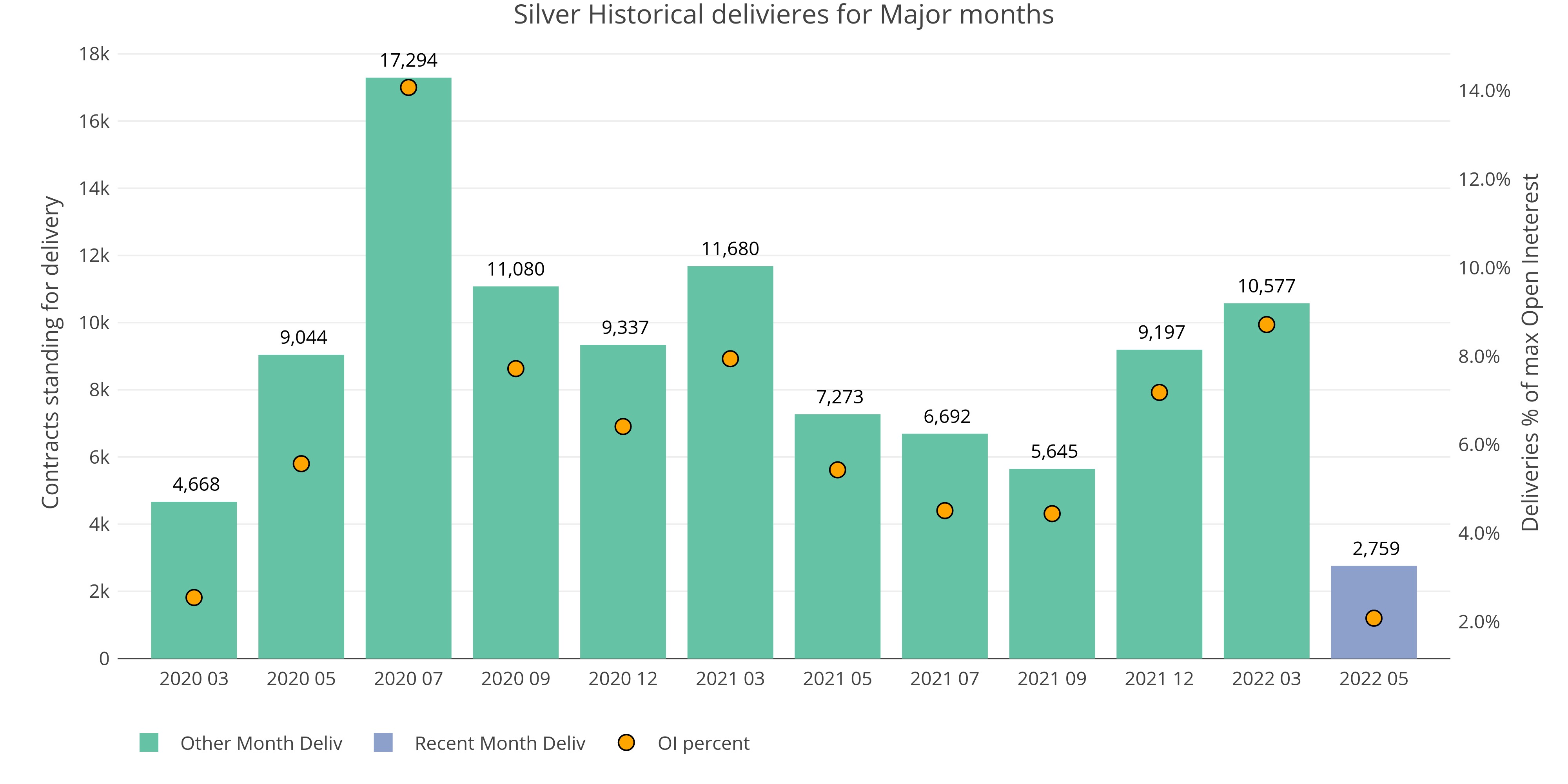

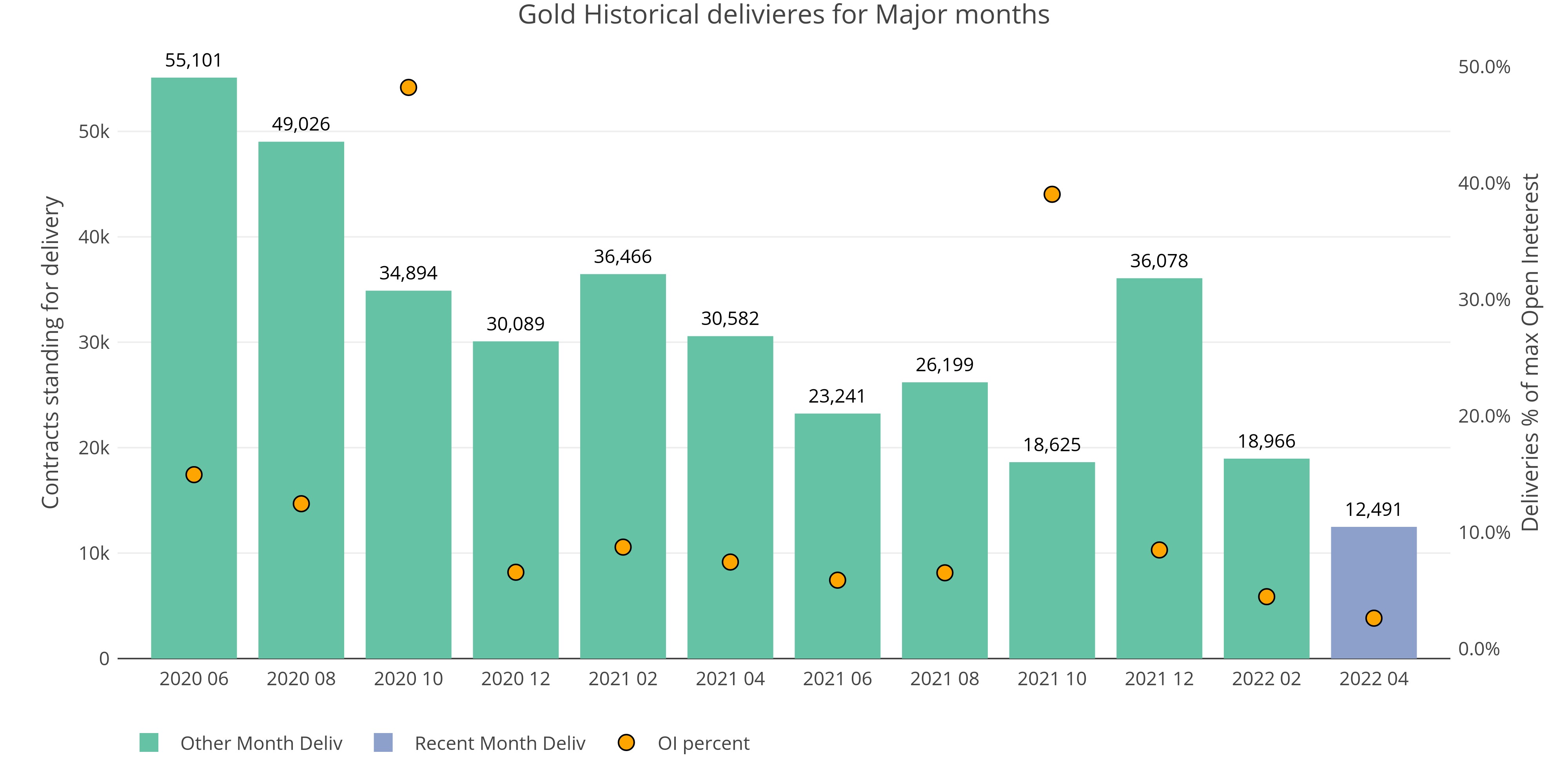

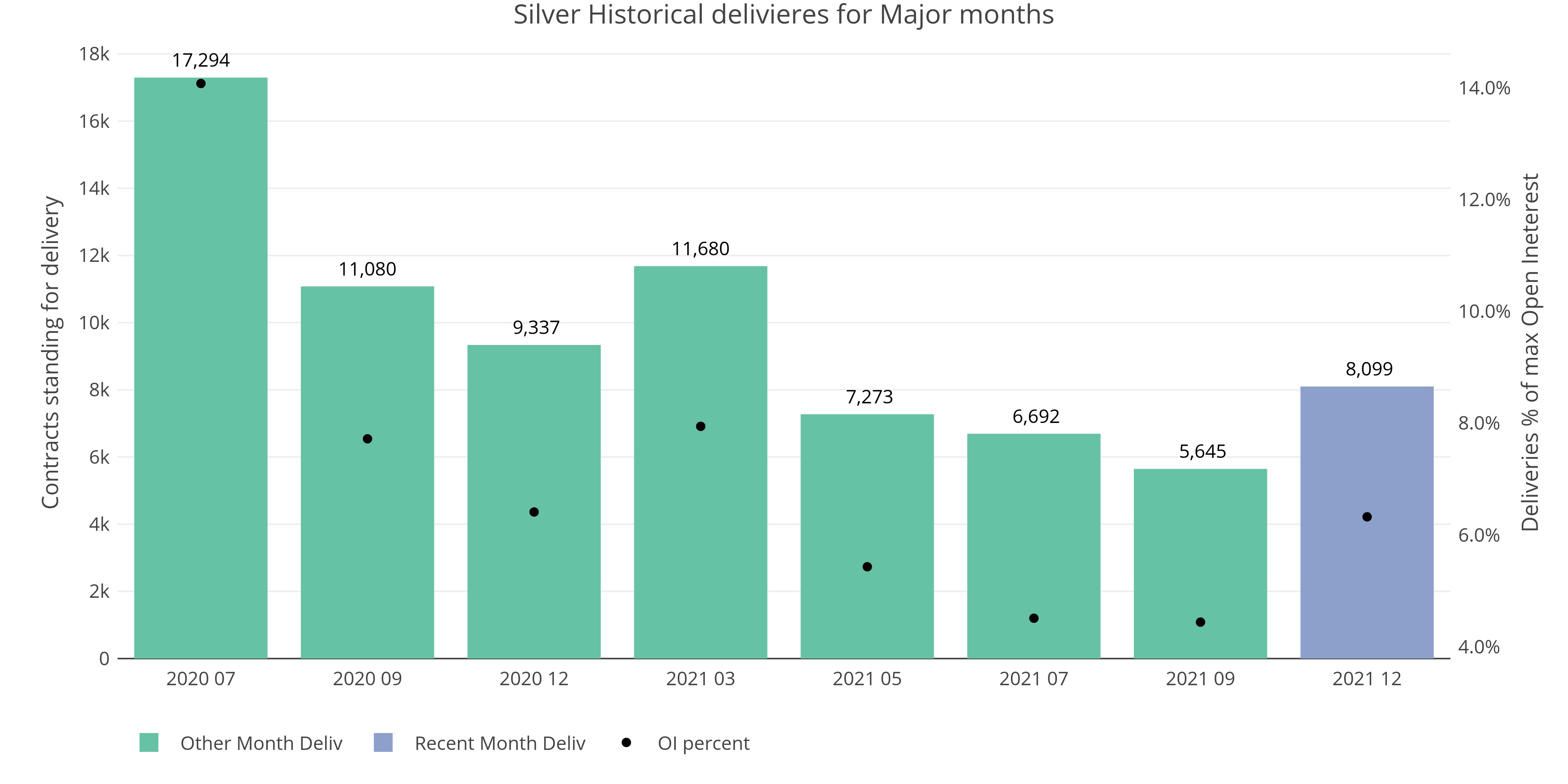

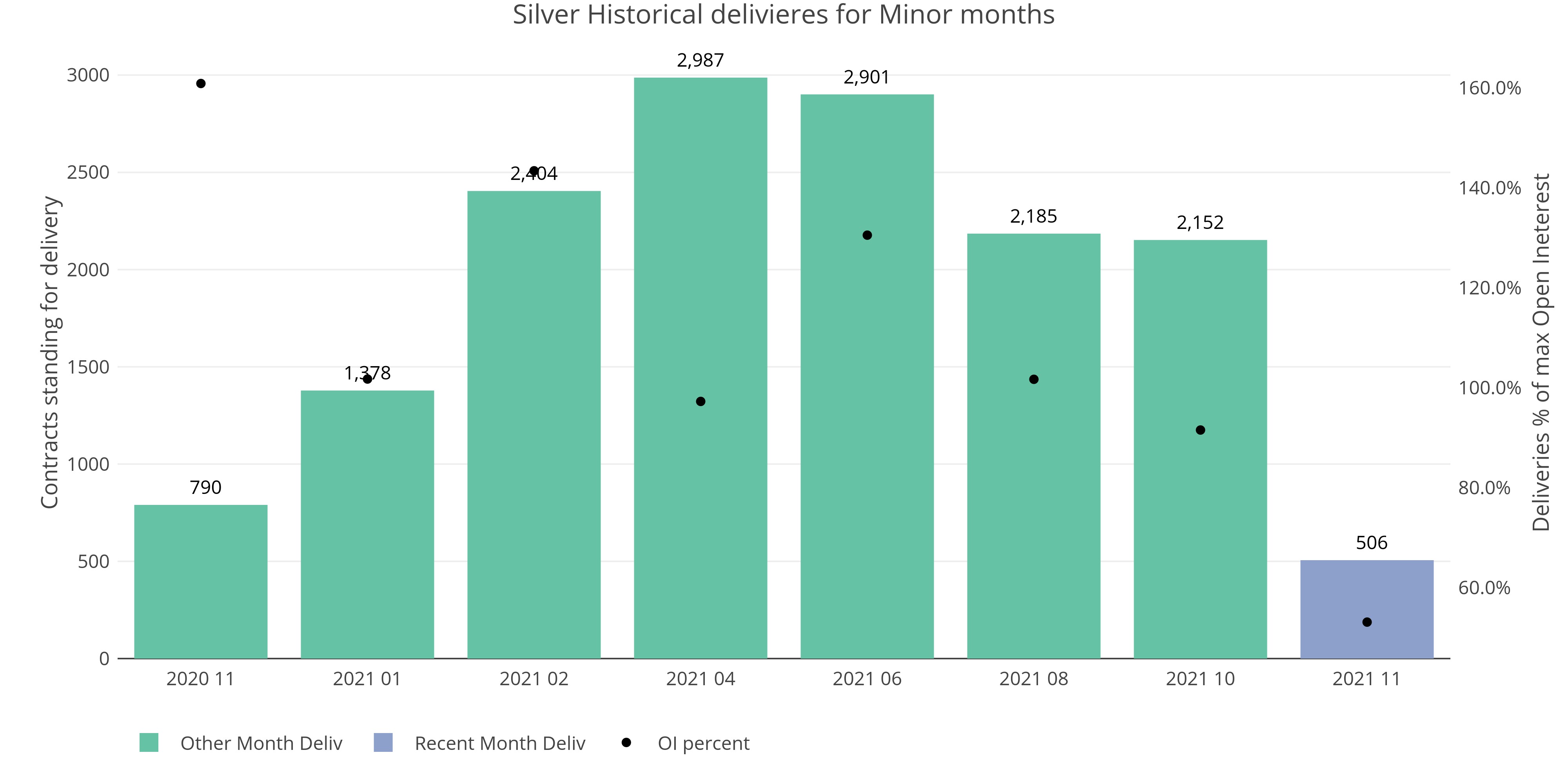

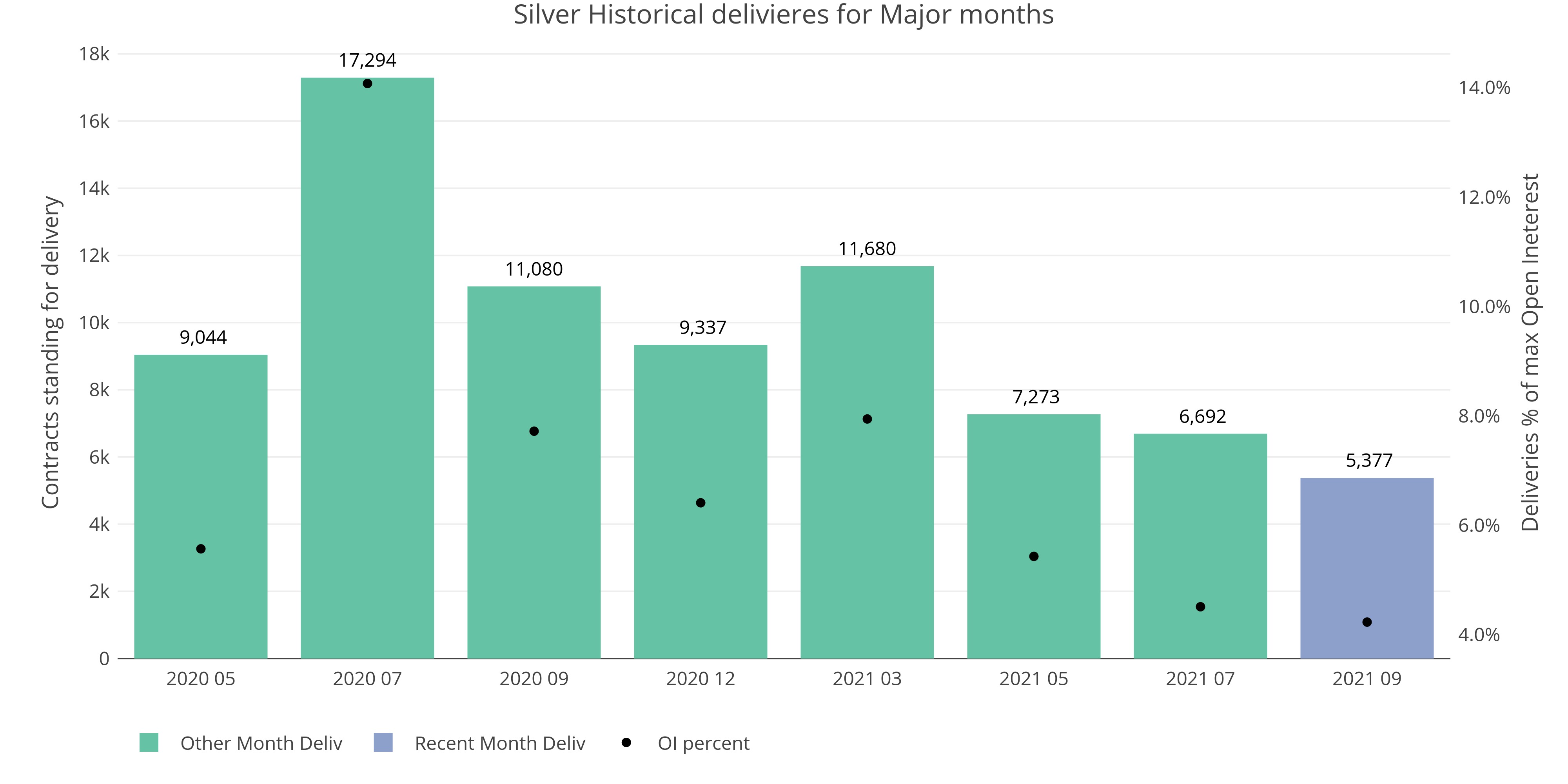

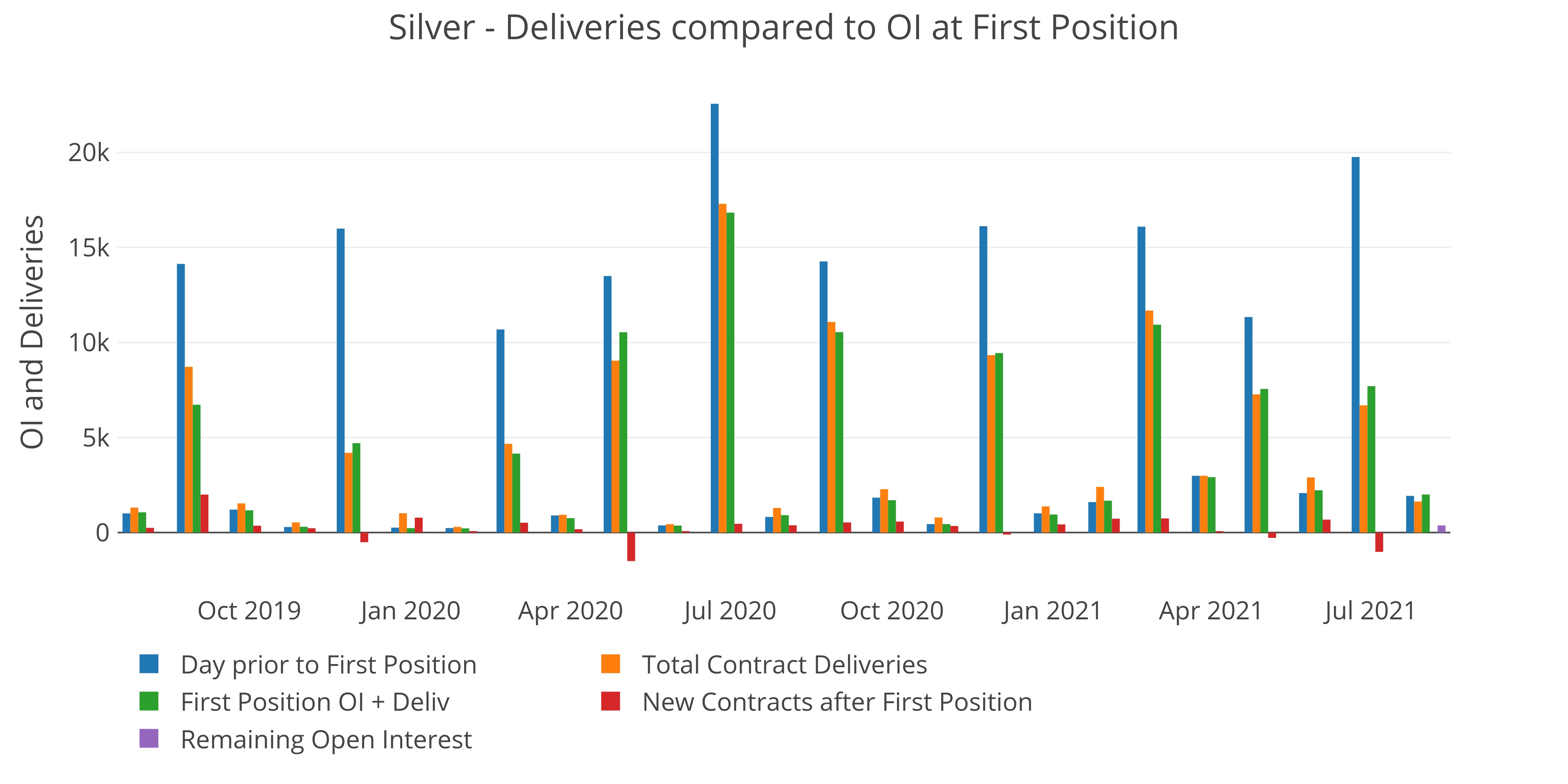

Comex Silver Delivery Volume Stays Strong as it Approaches a New All Time High

Gold delivery is off the highs but still very strong

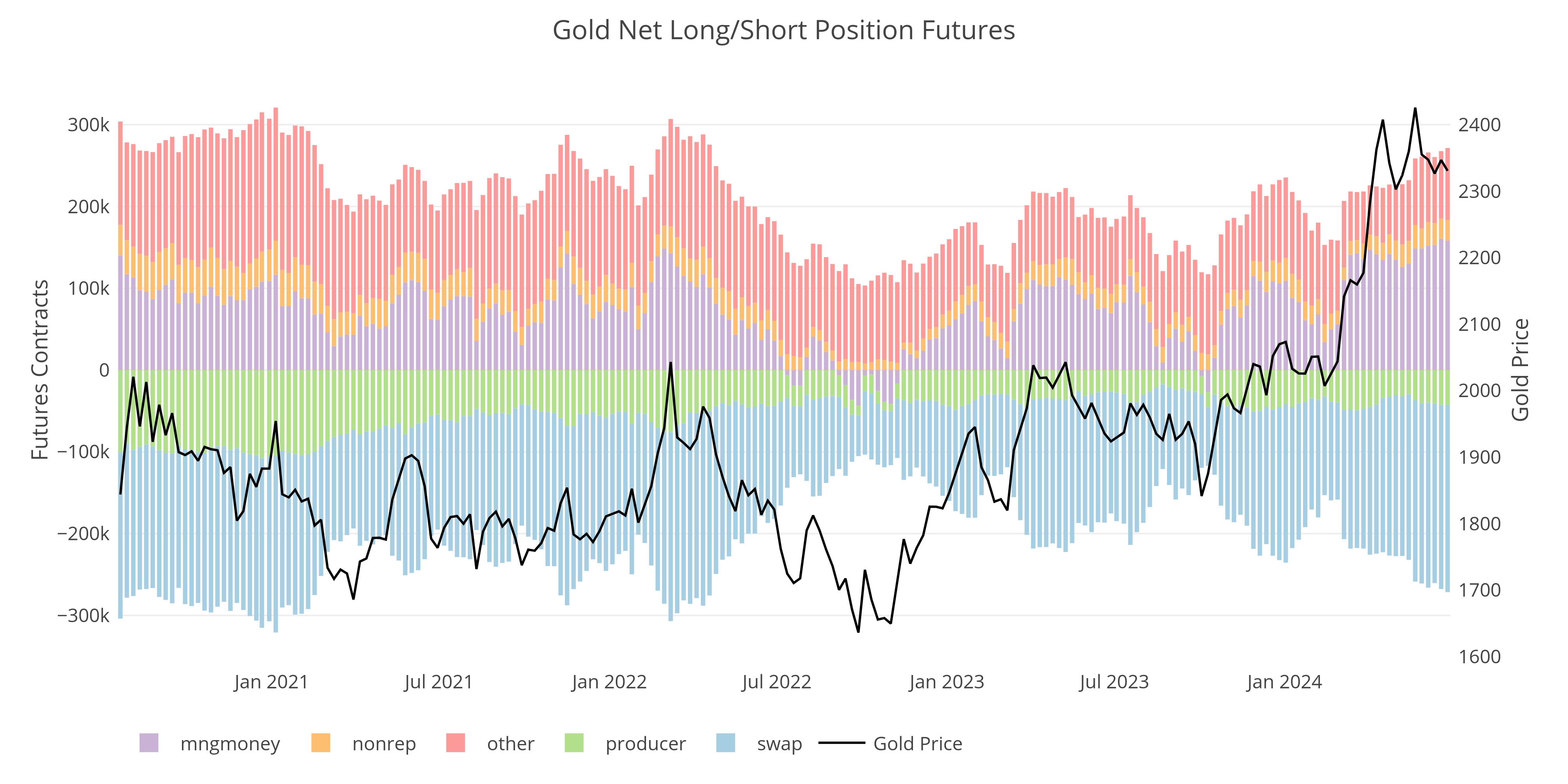

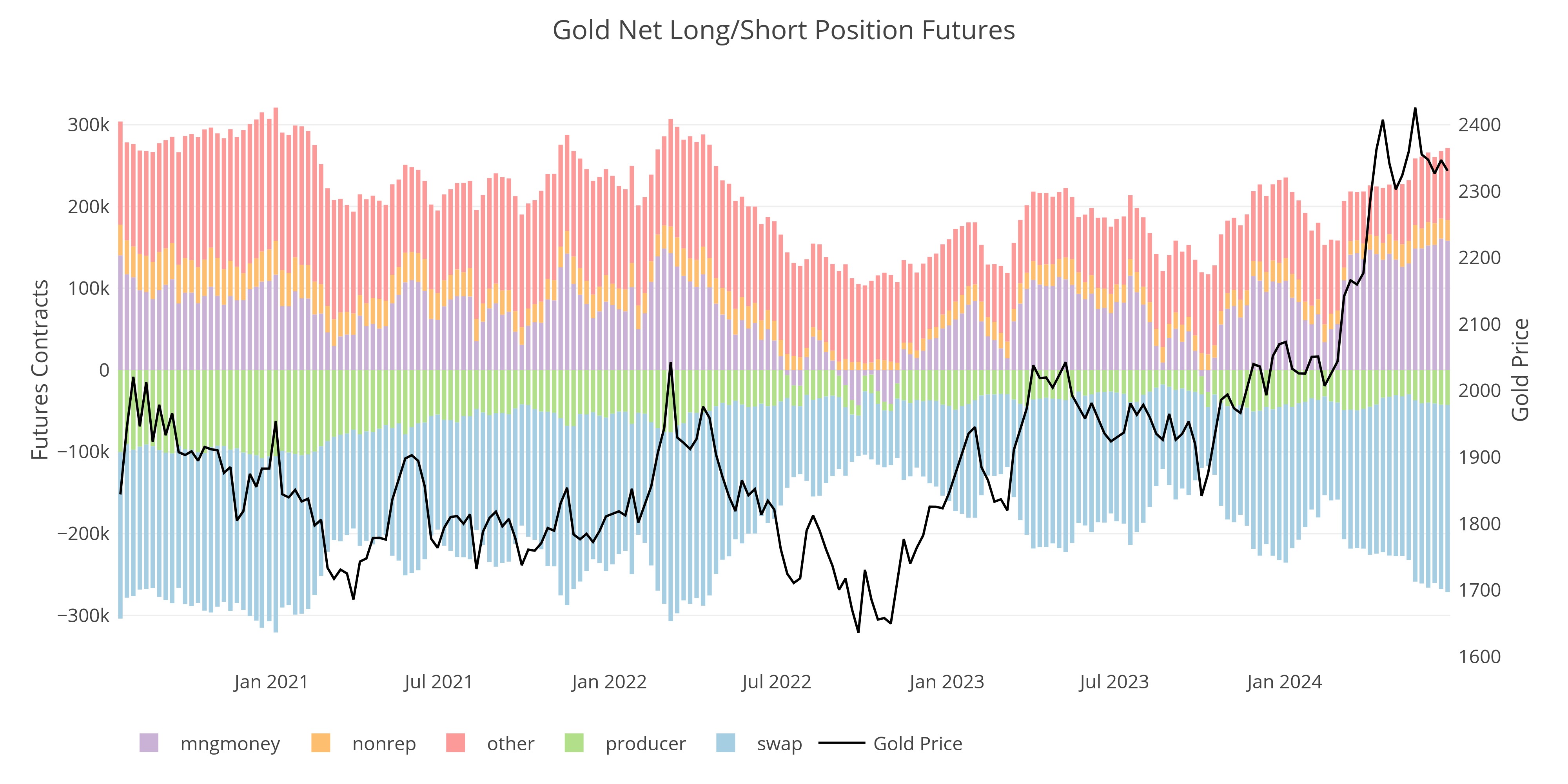

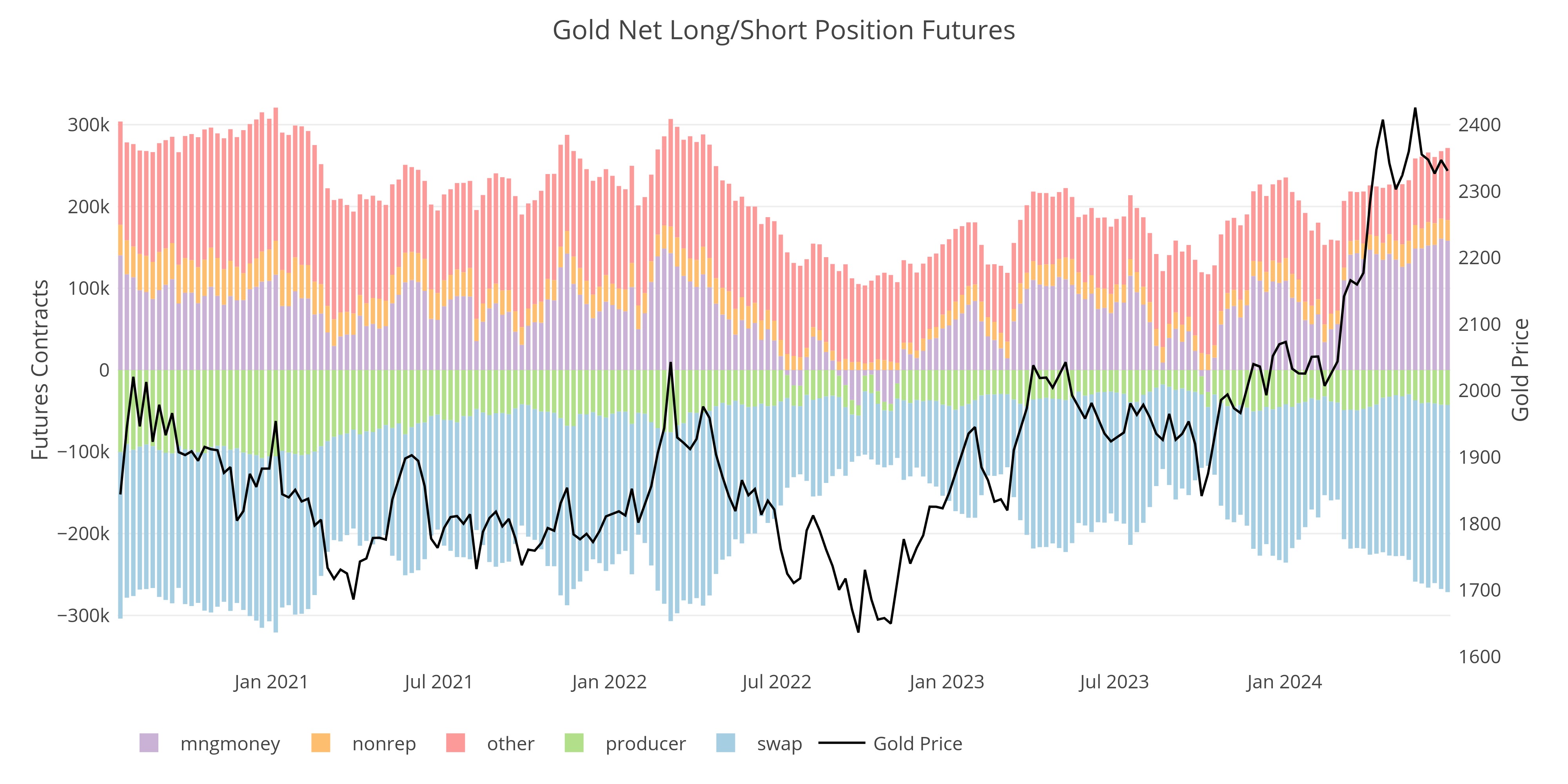

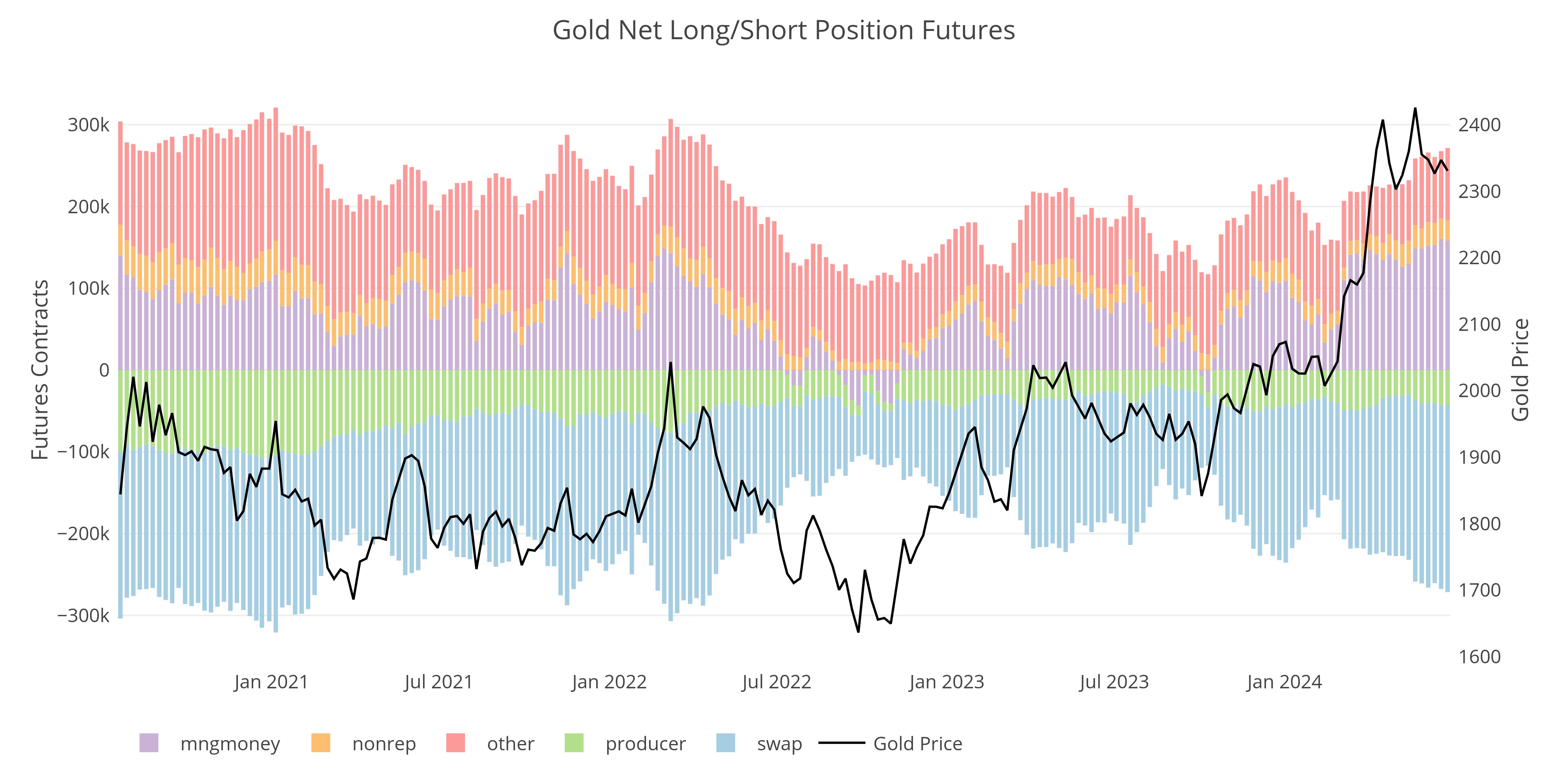

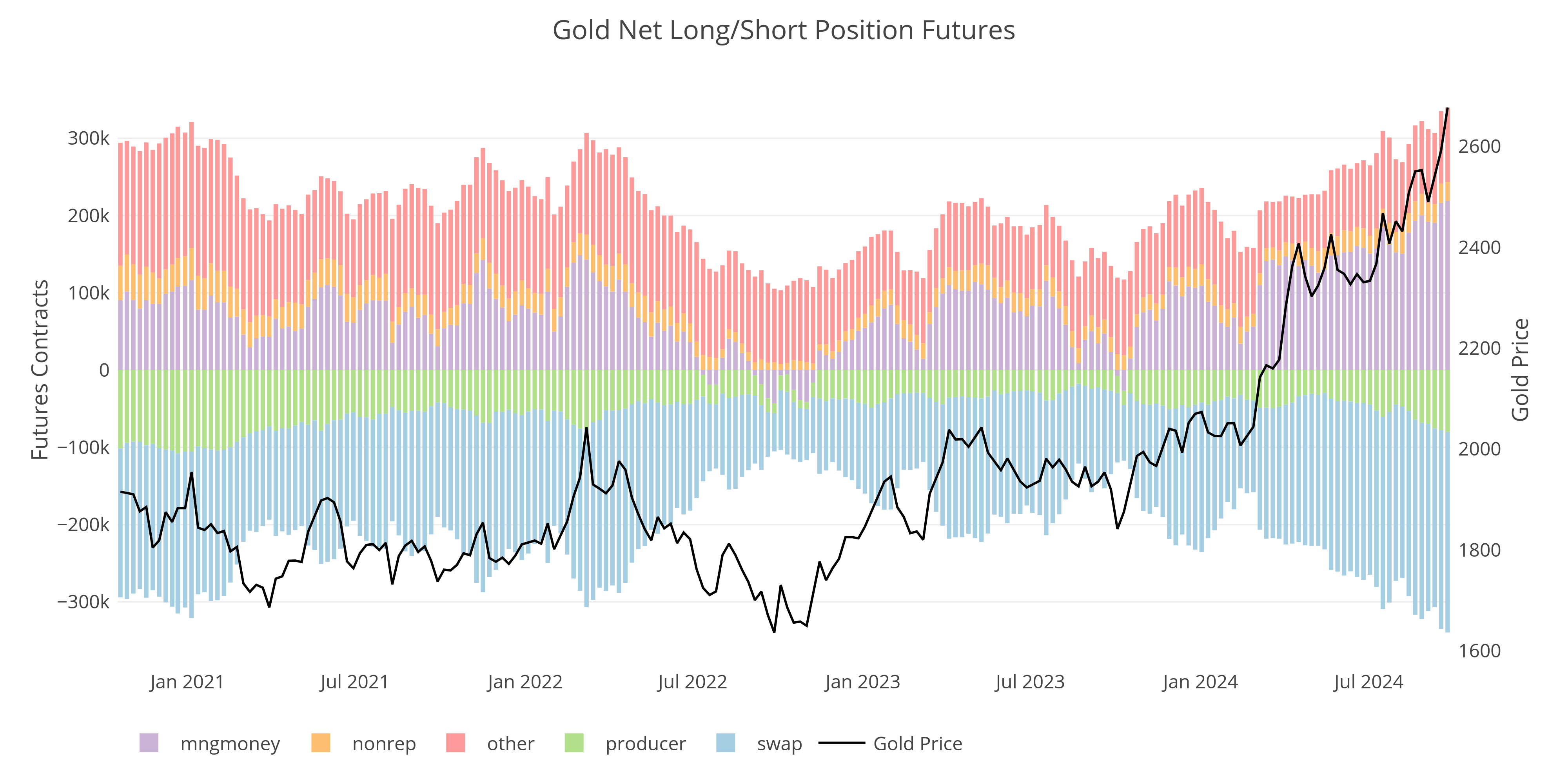

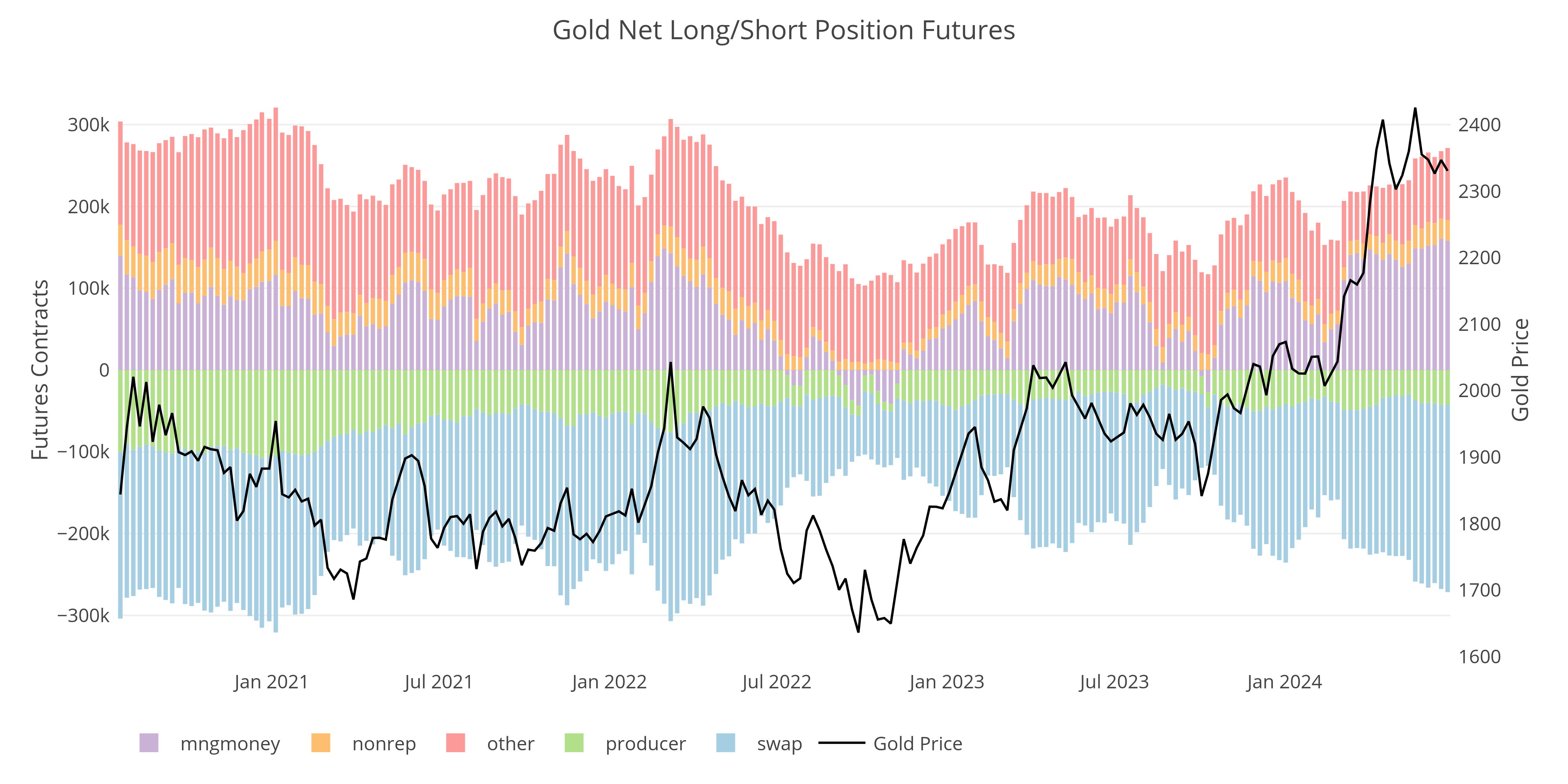

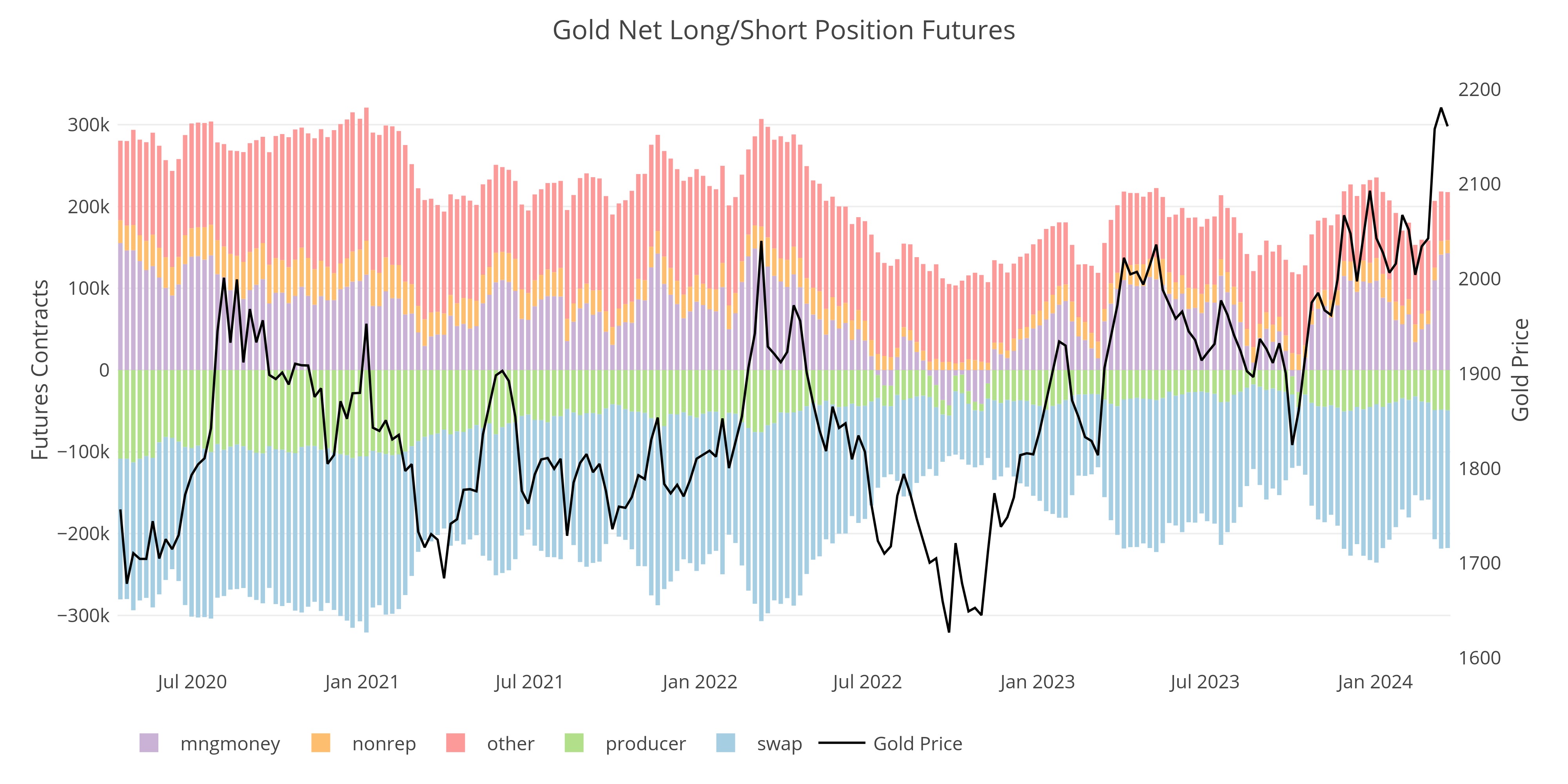

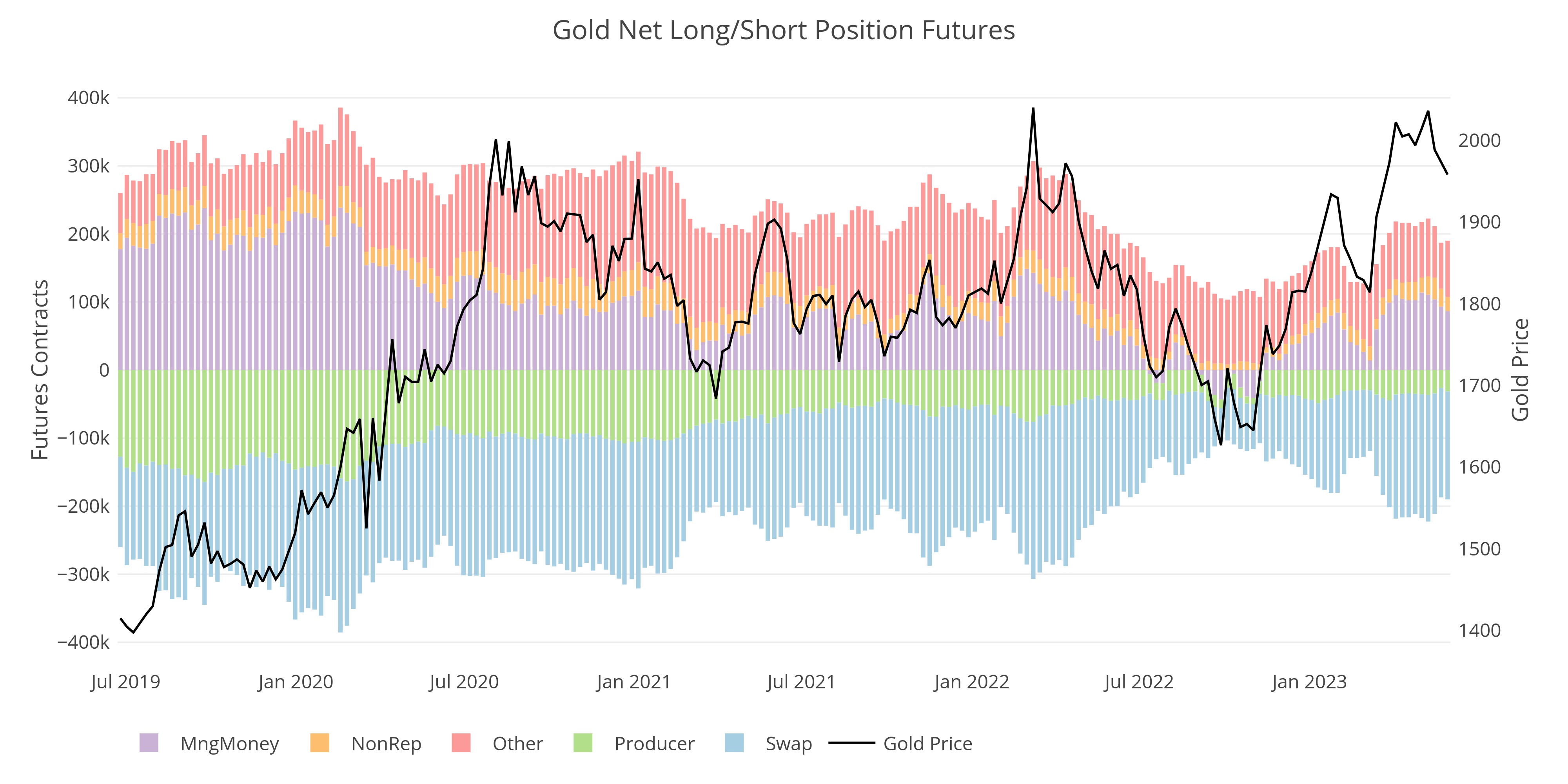

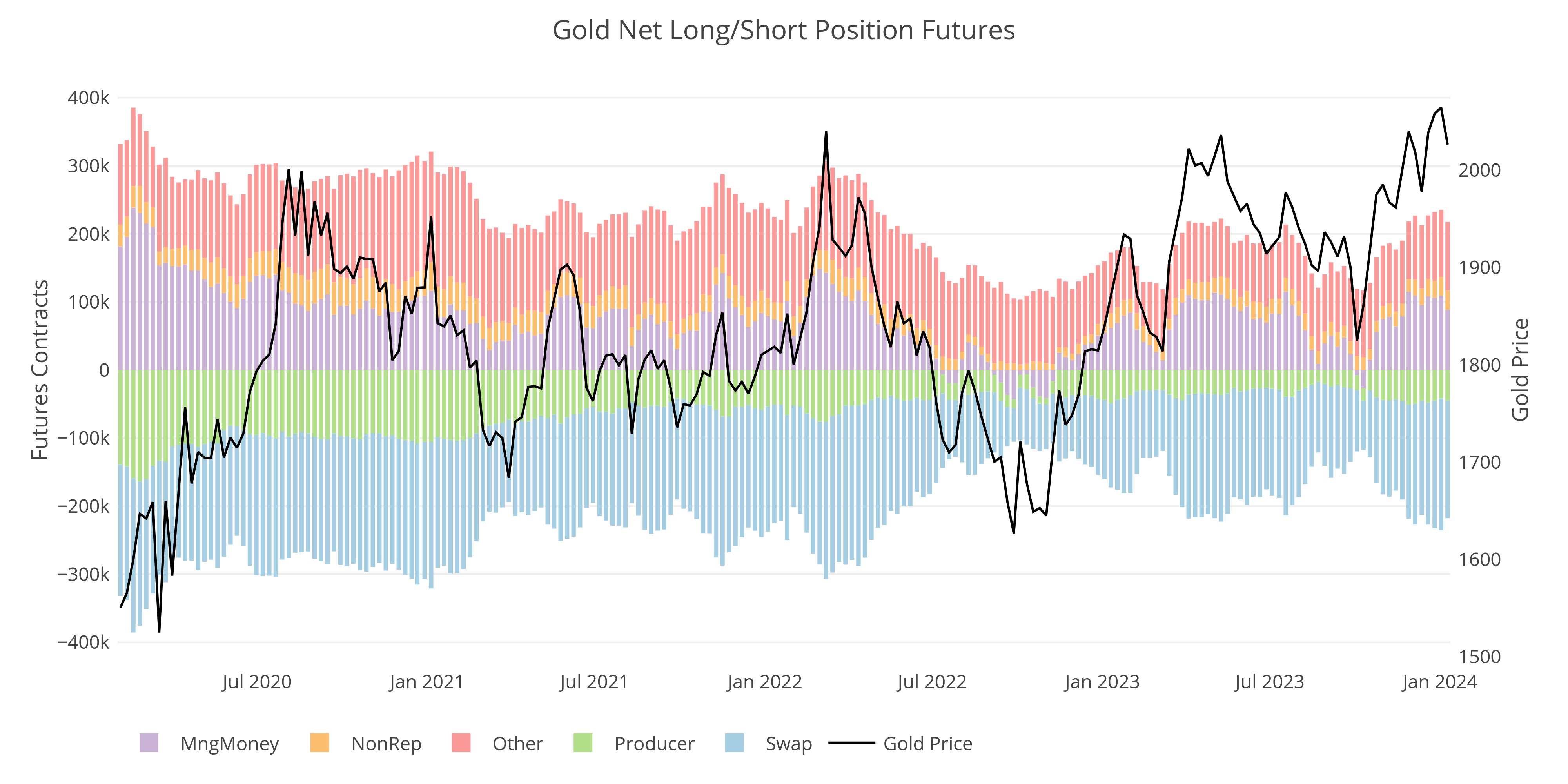

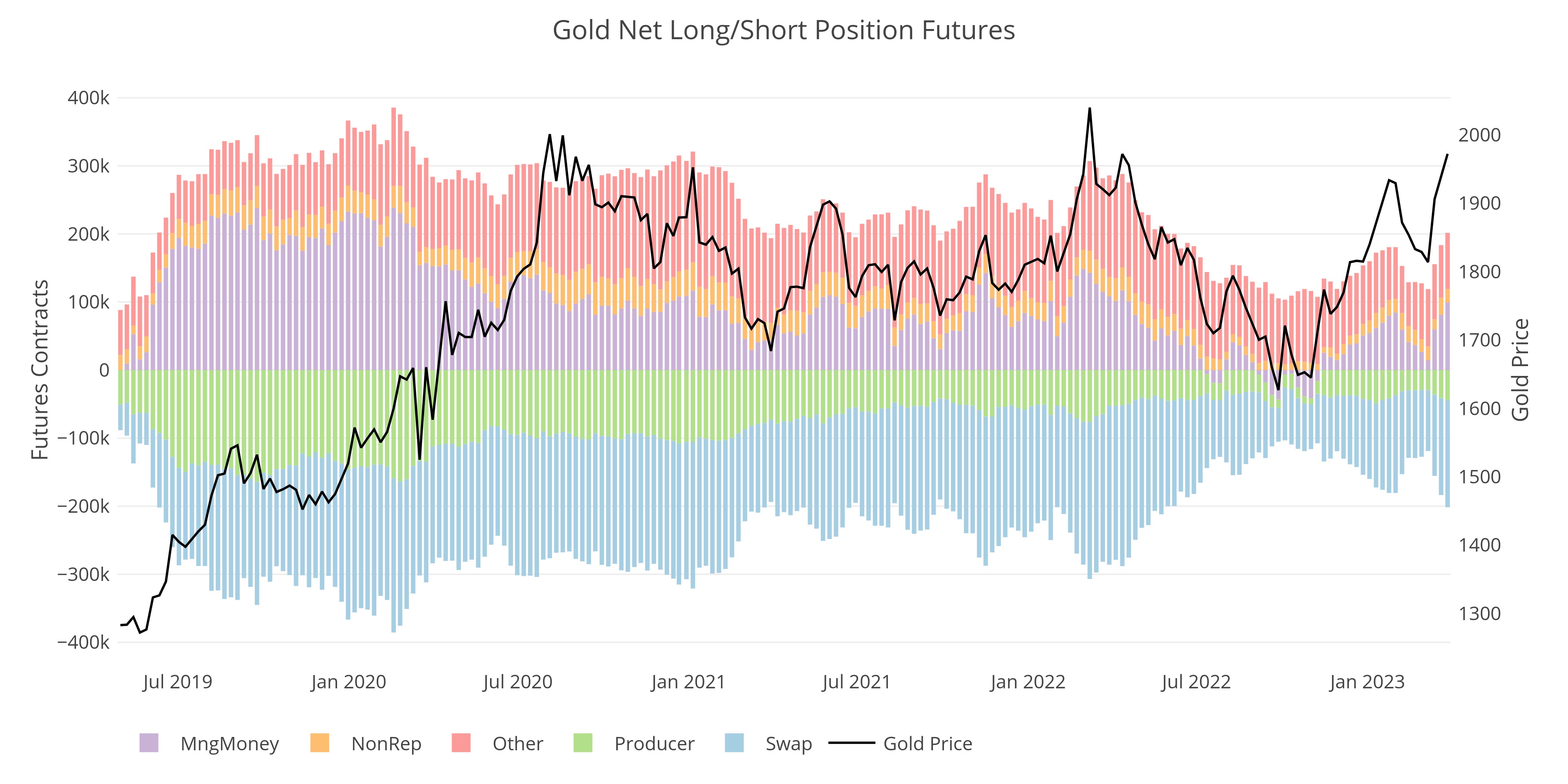

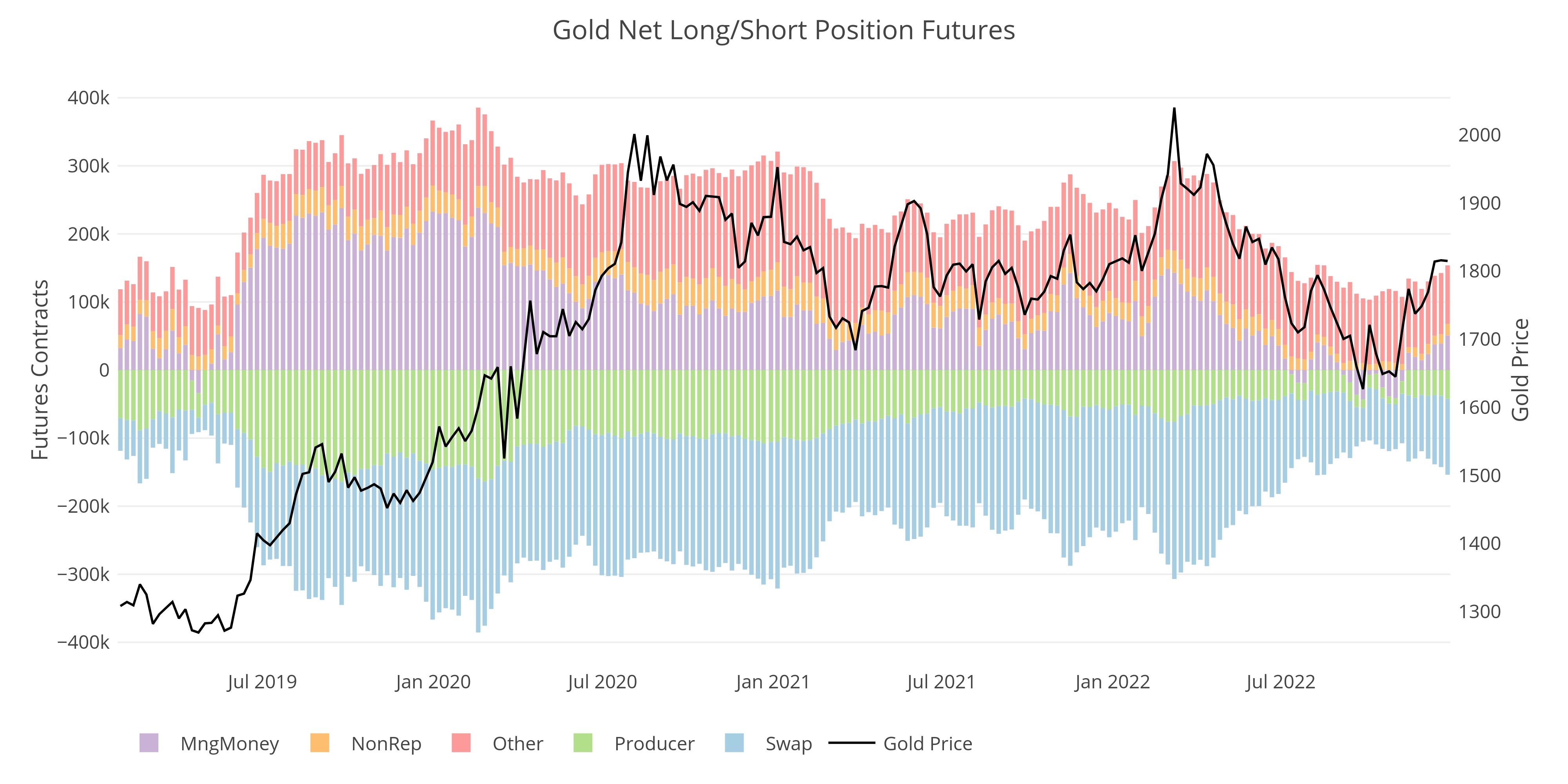

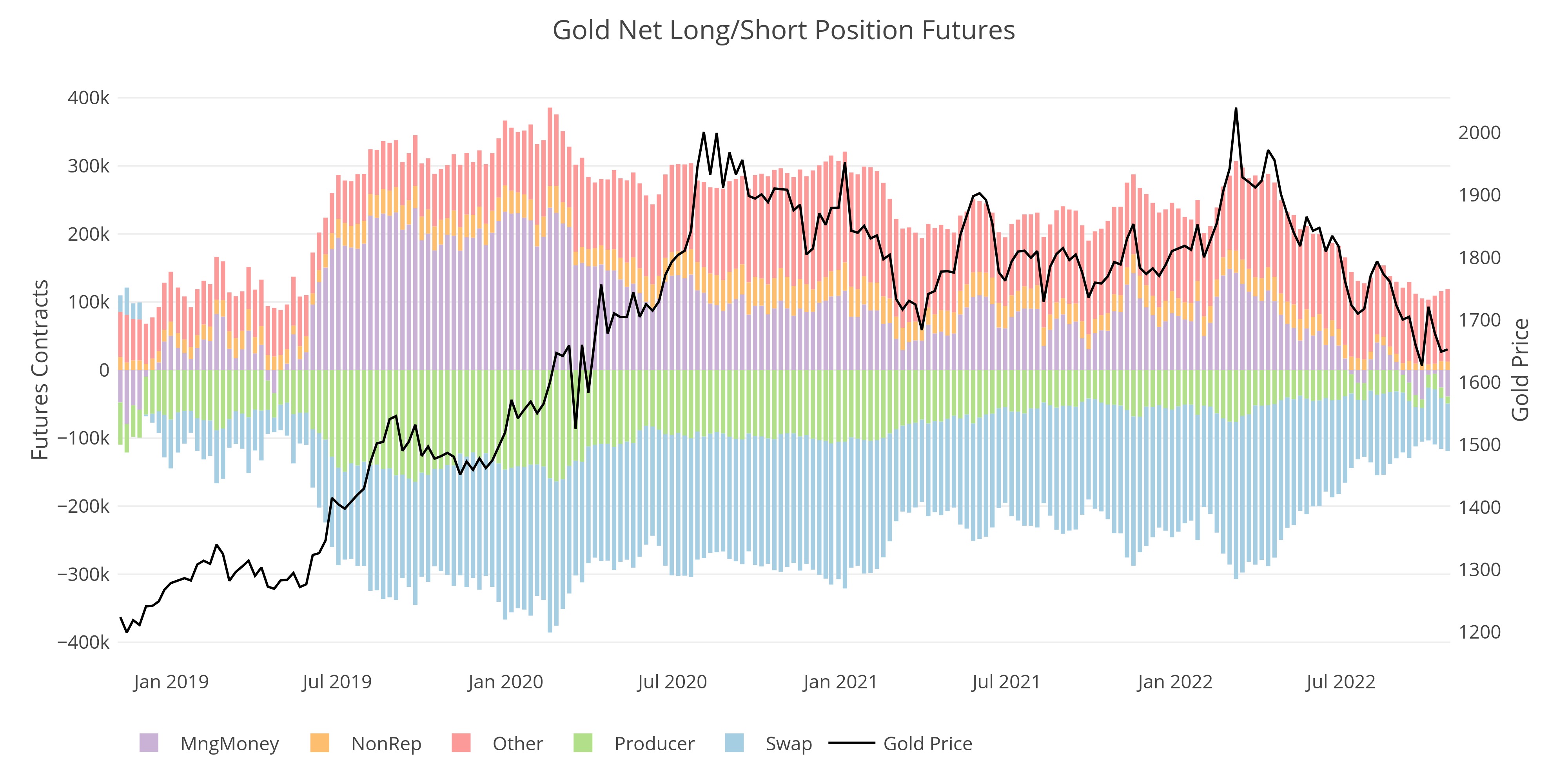

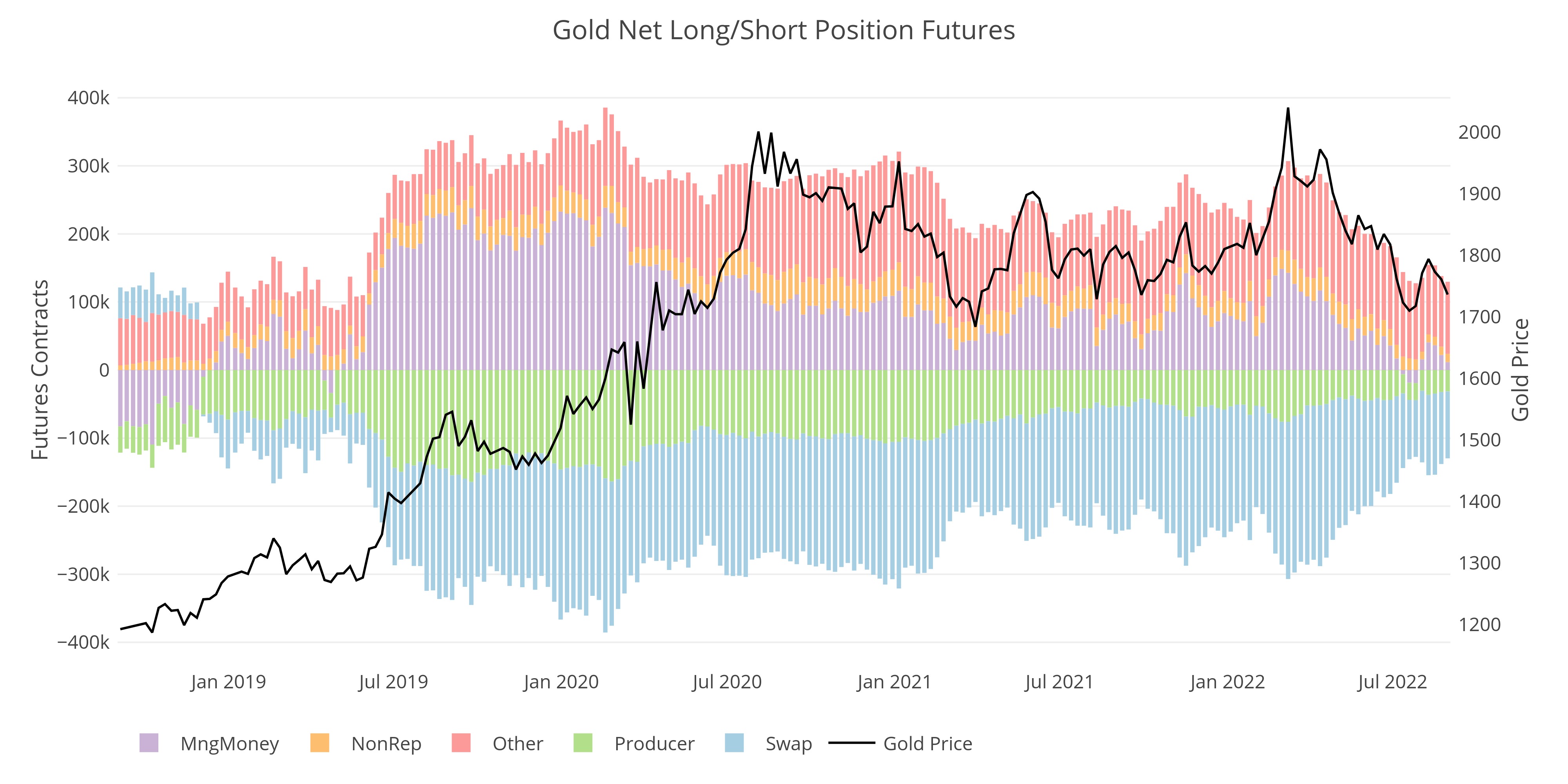

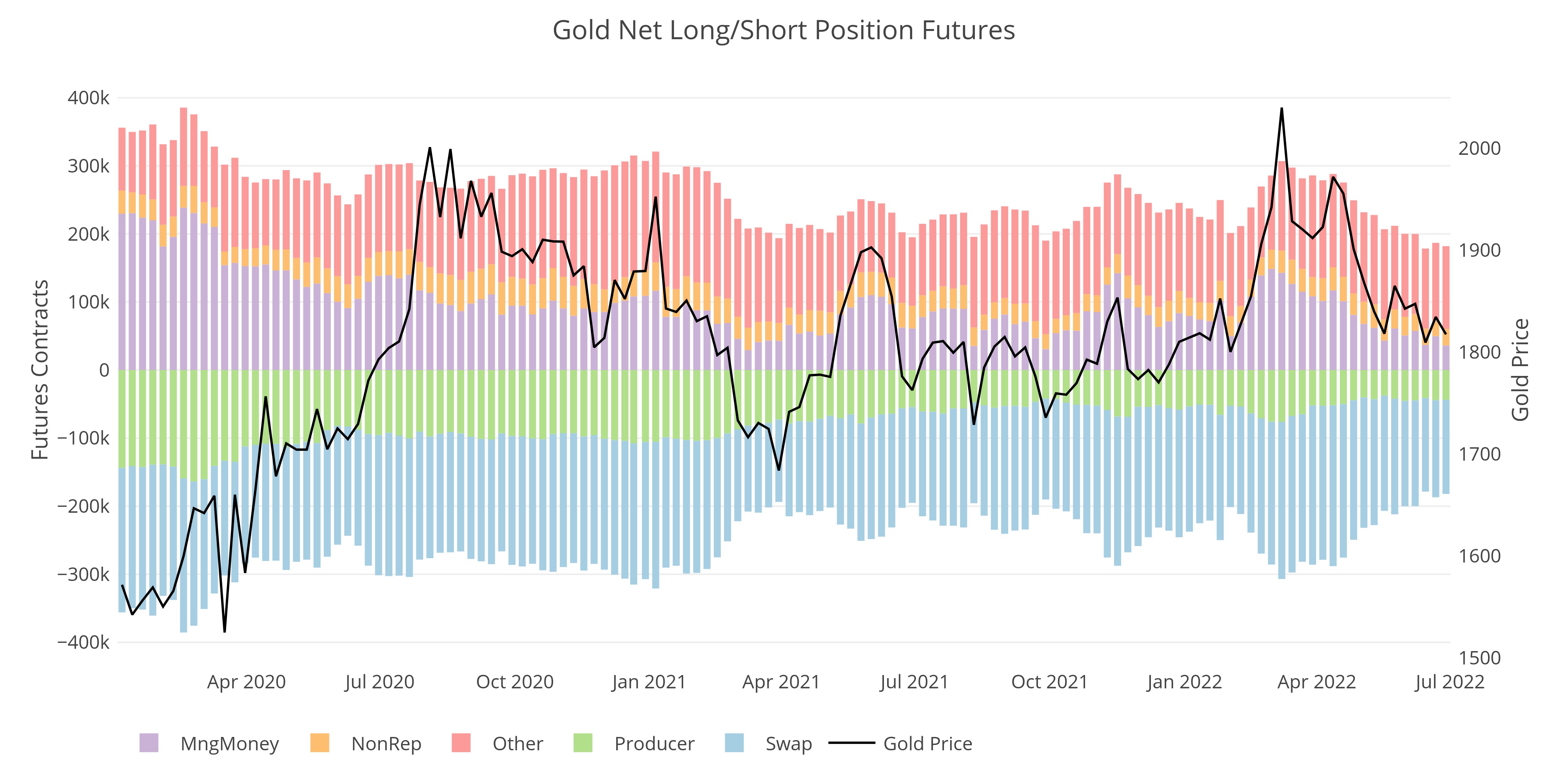

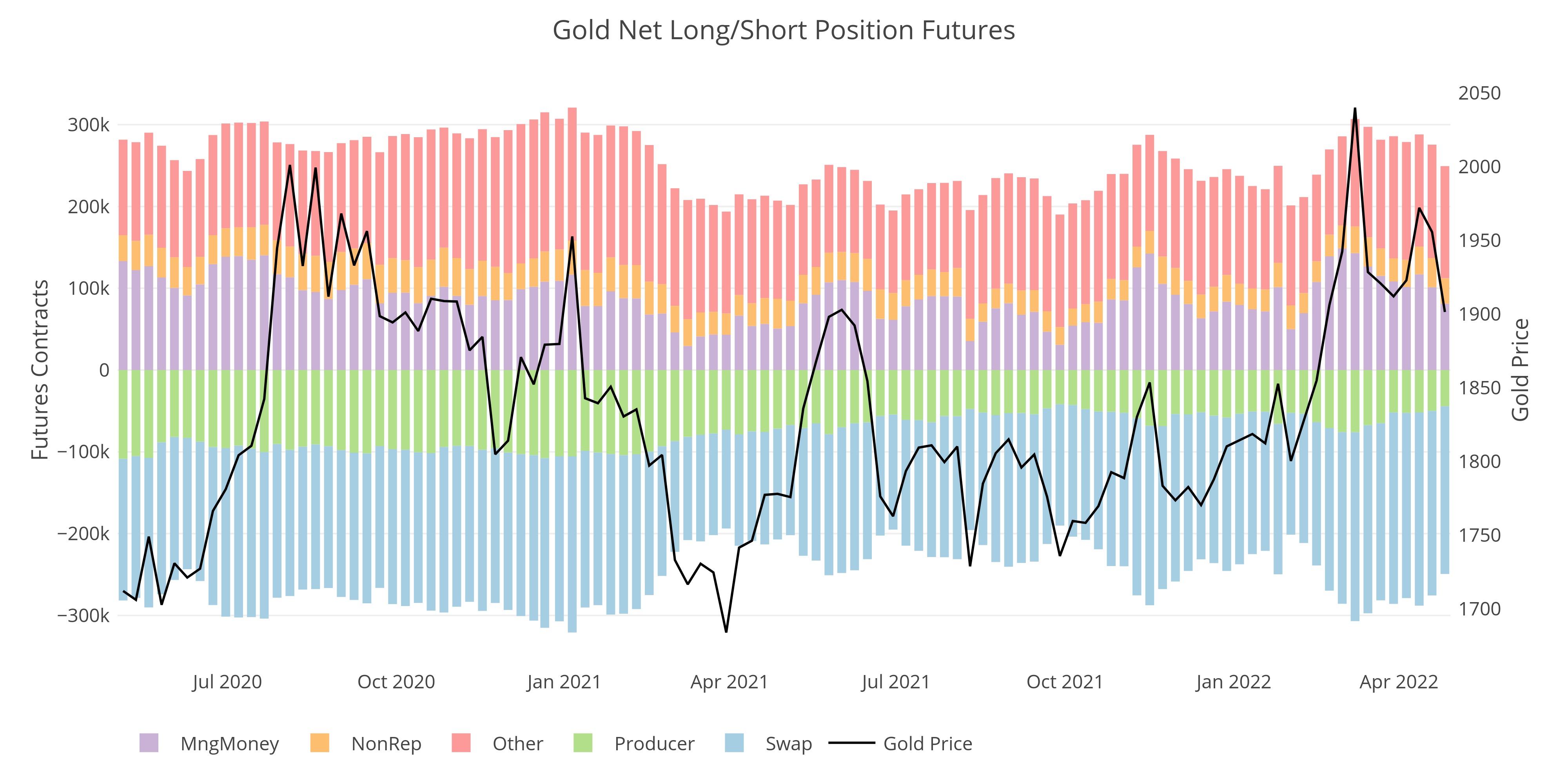

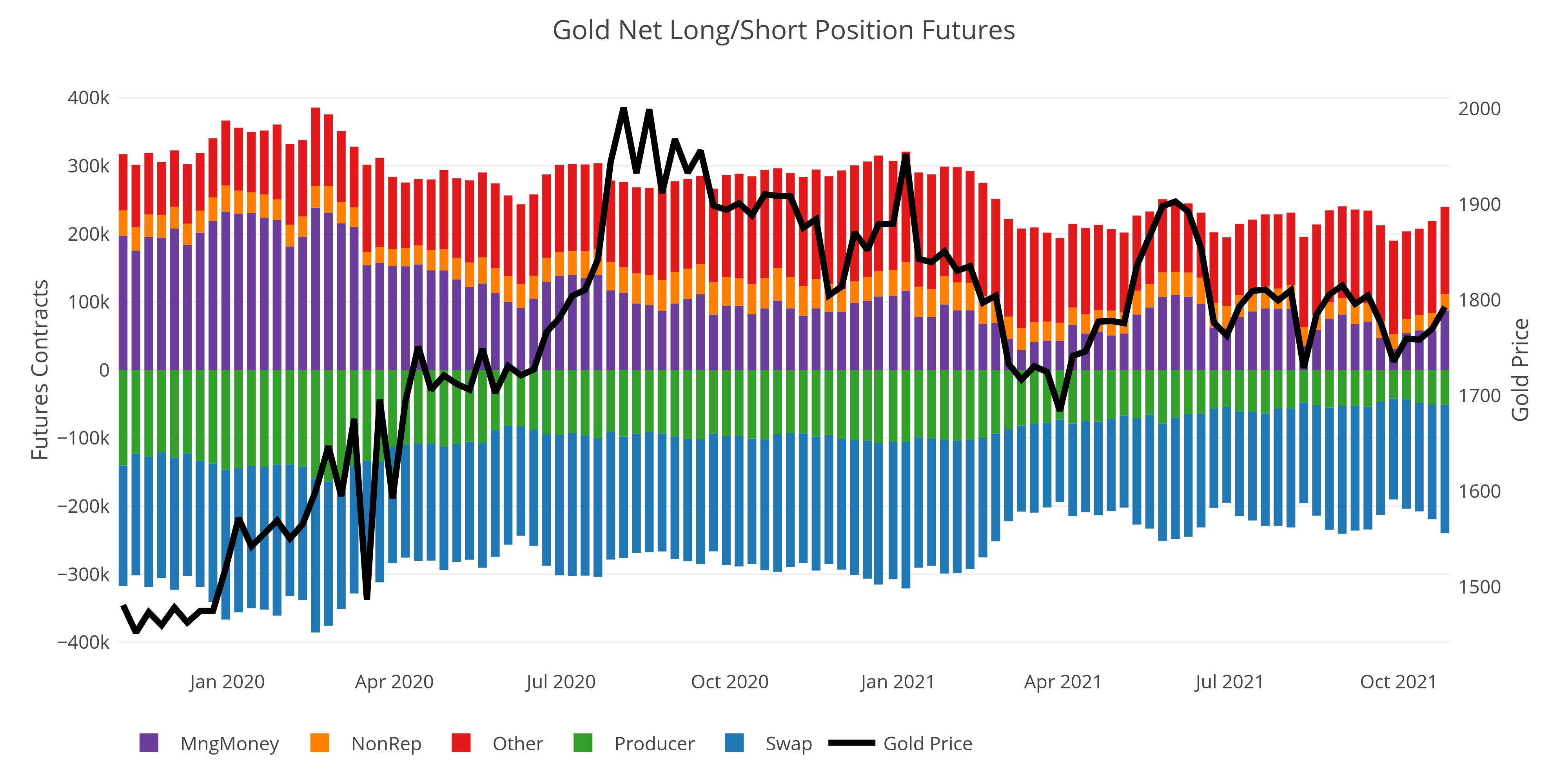

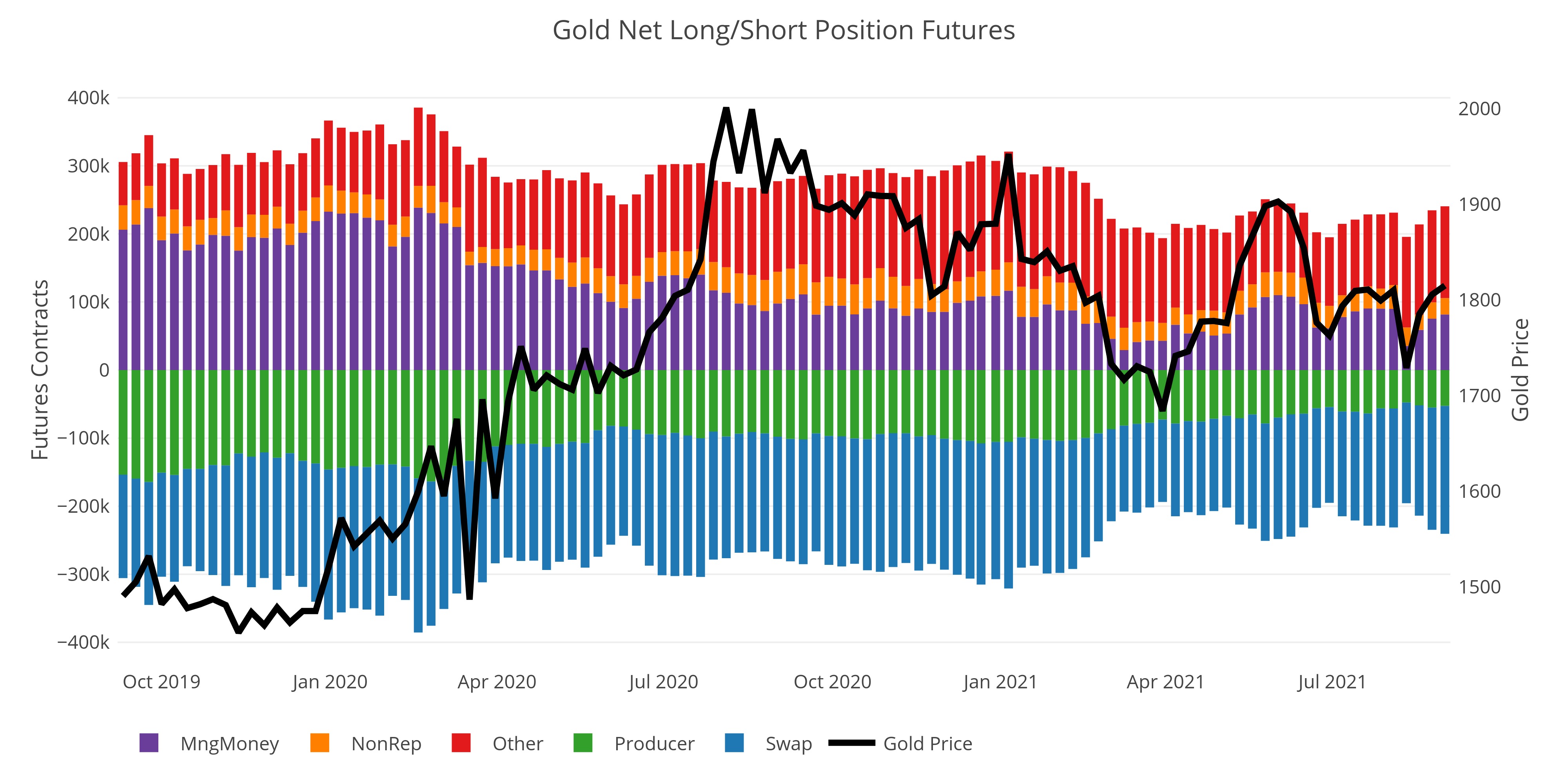

CFTC CoTs Report: Managed Money is Not Driving this Bus

Gold and silver are rising despite modest interest from Hedge Funds

13-Week Money Supply Grows by 3.7% Following Seasonal Trend

Current growth is almost exactly the average of the last 10 years

The Technicals: Silver Catches Up, Both Metals Have Many Bullish Indicators

Nothing in the data suggests the current move is over-done

Jobs: Firing the Head of the BLS Resulted in Positive Revisions for the First Time in 2025

In a rare move, the Household survey outperformed the Headline Report

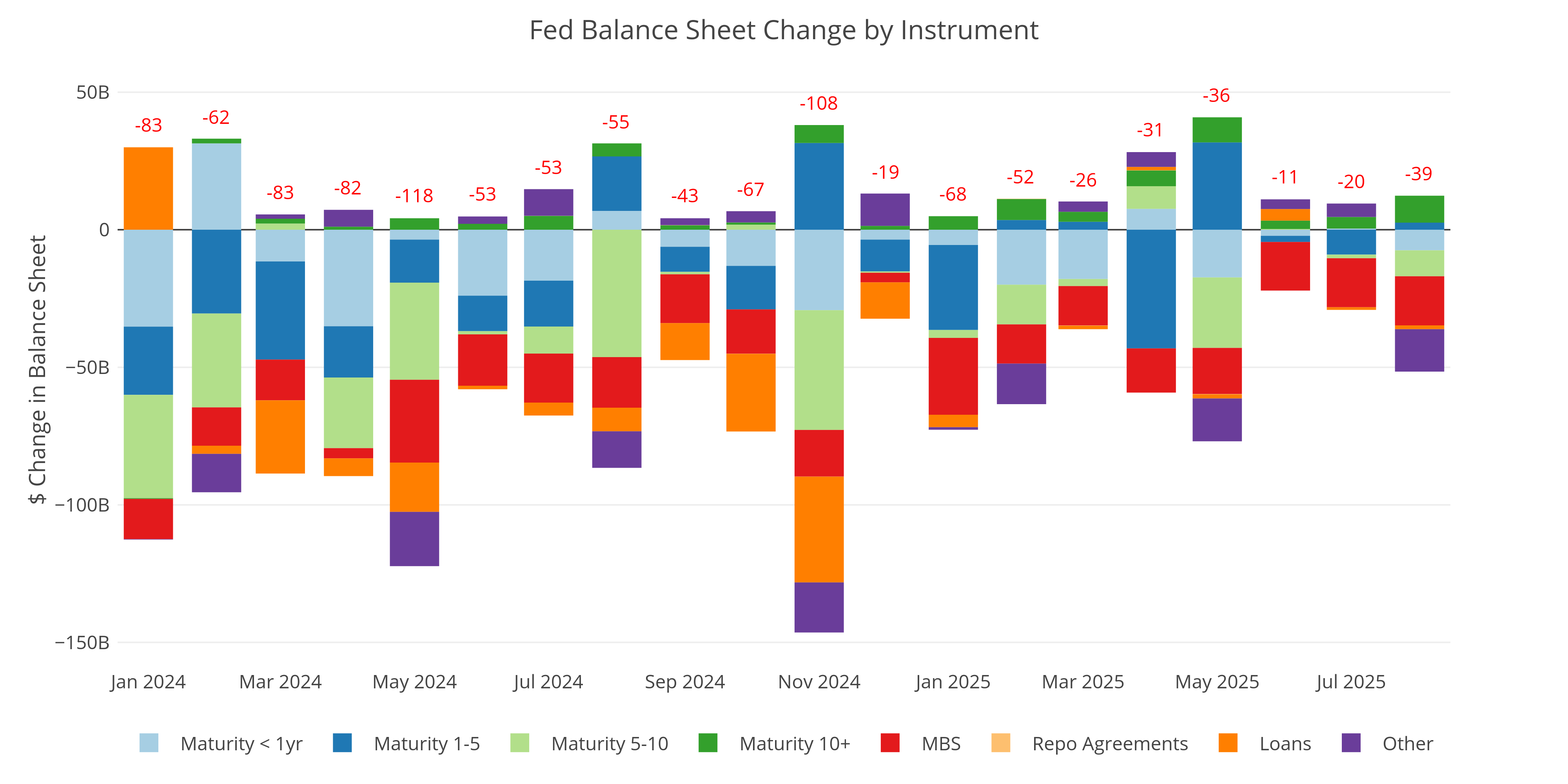

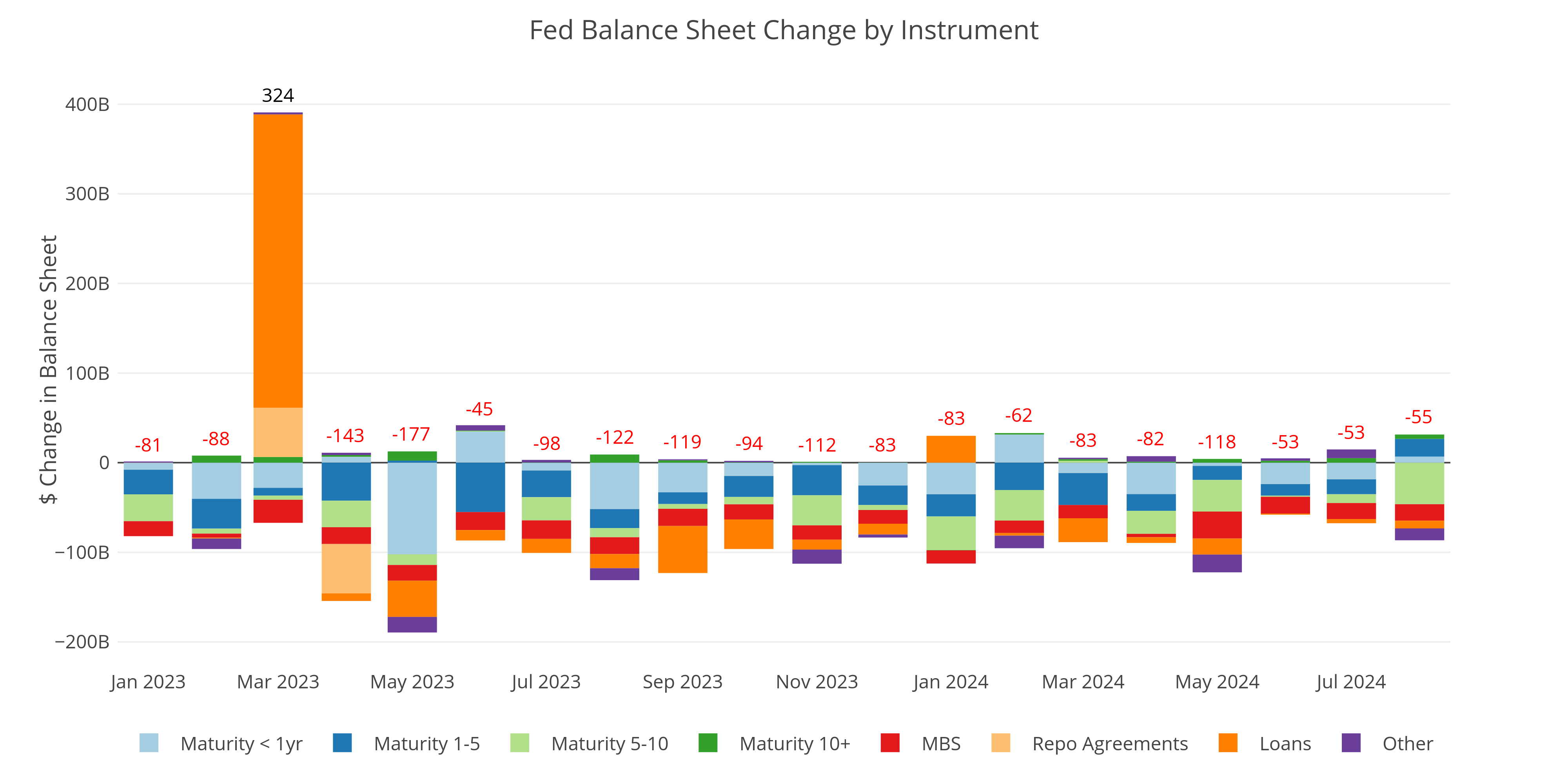

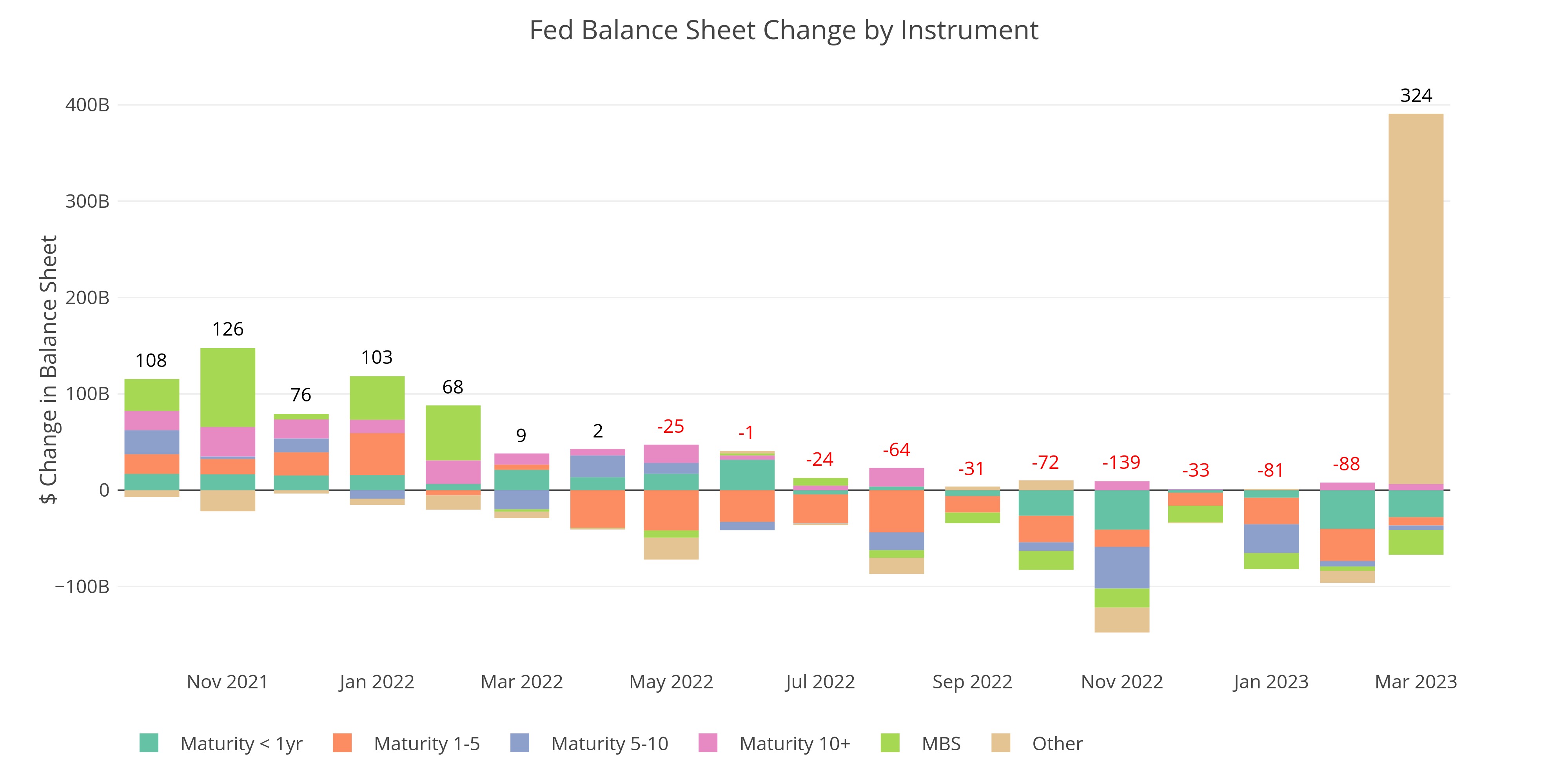

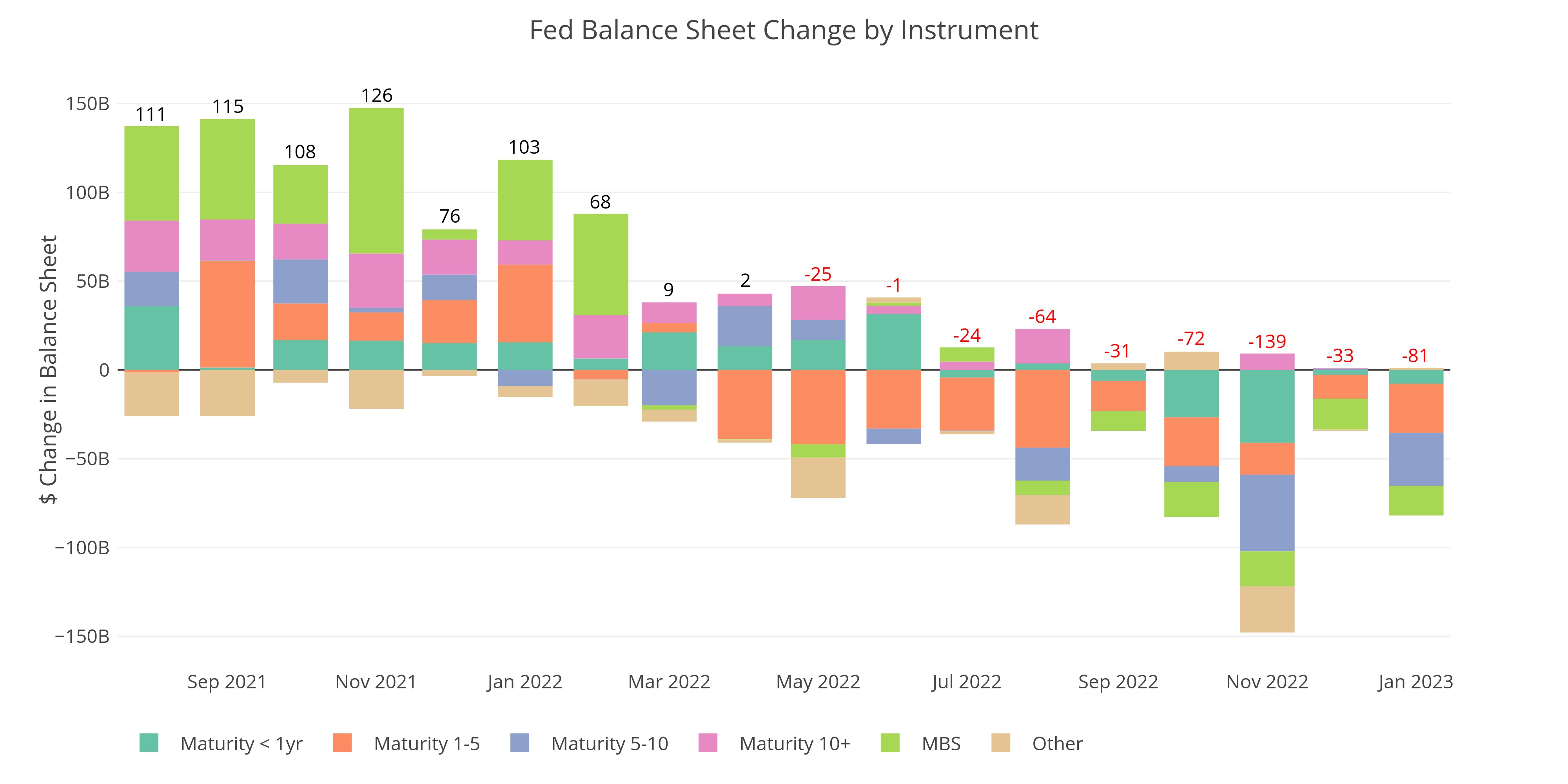

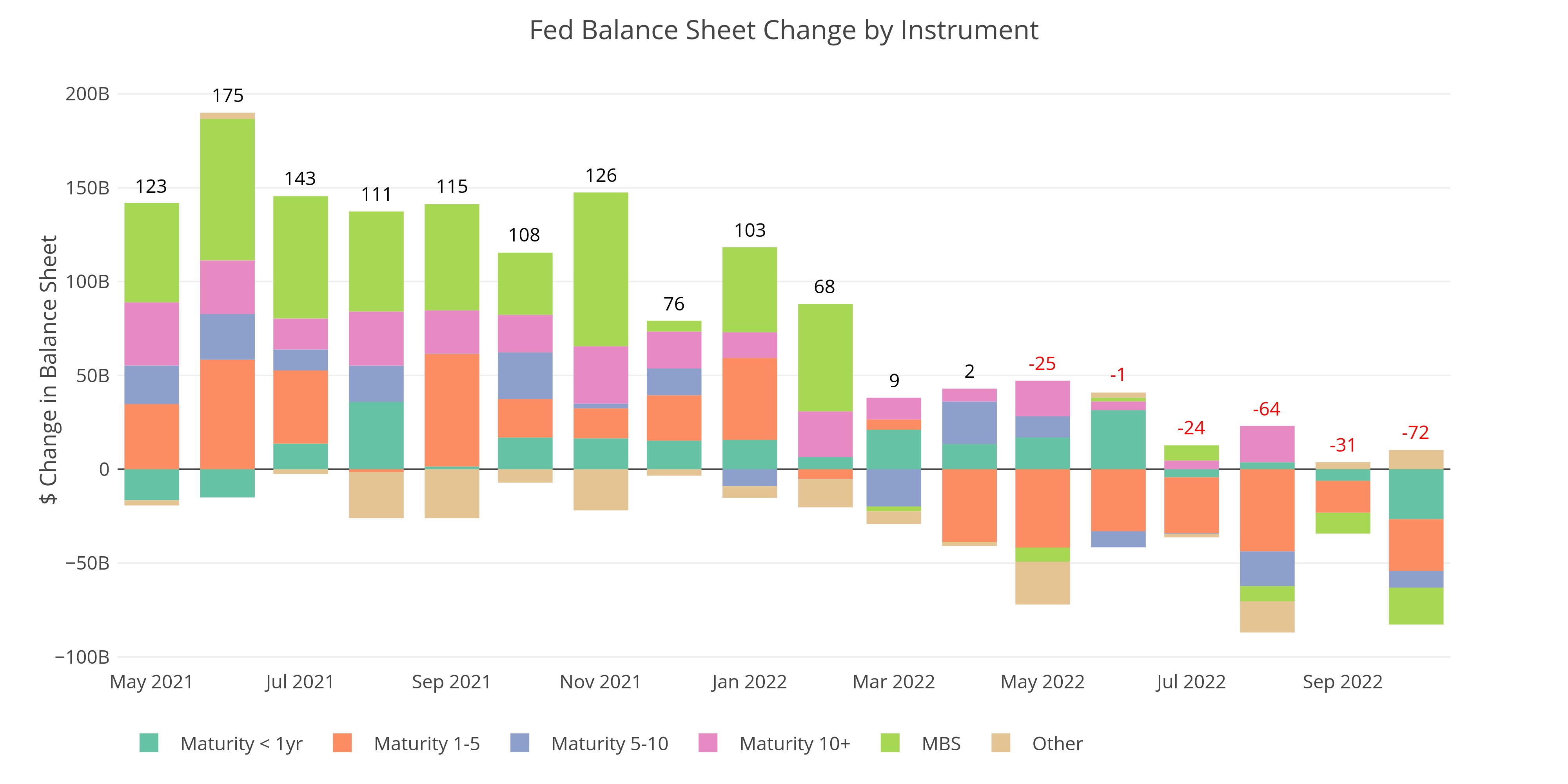

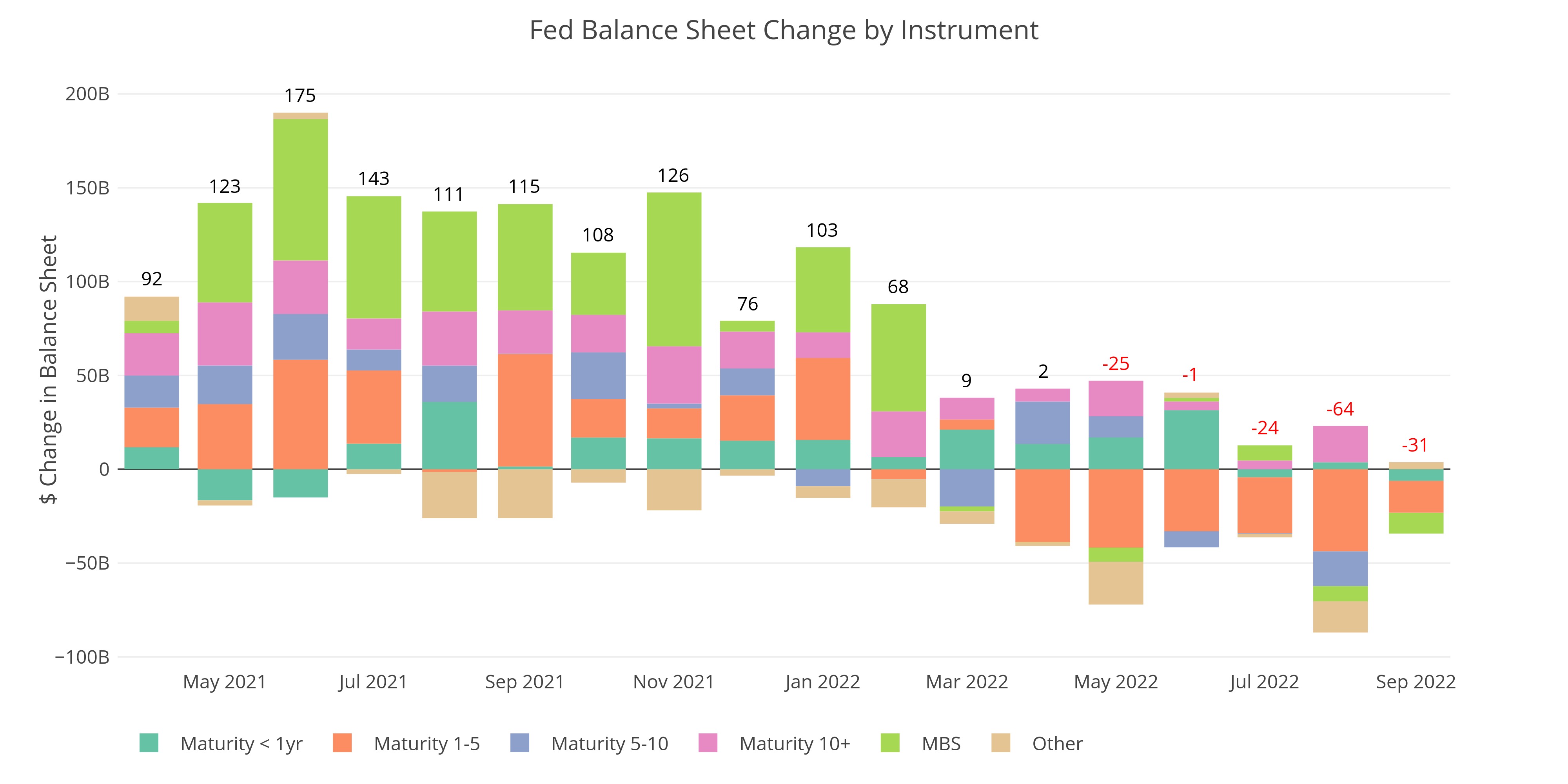

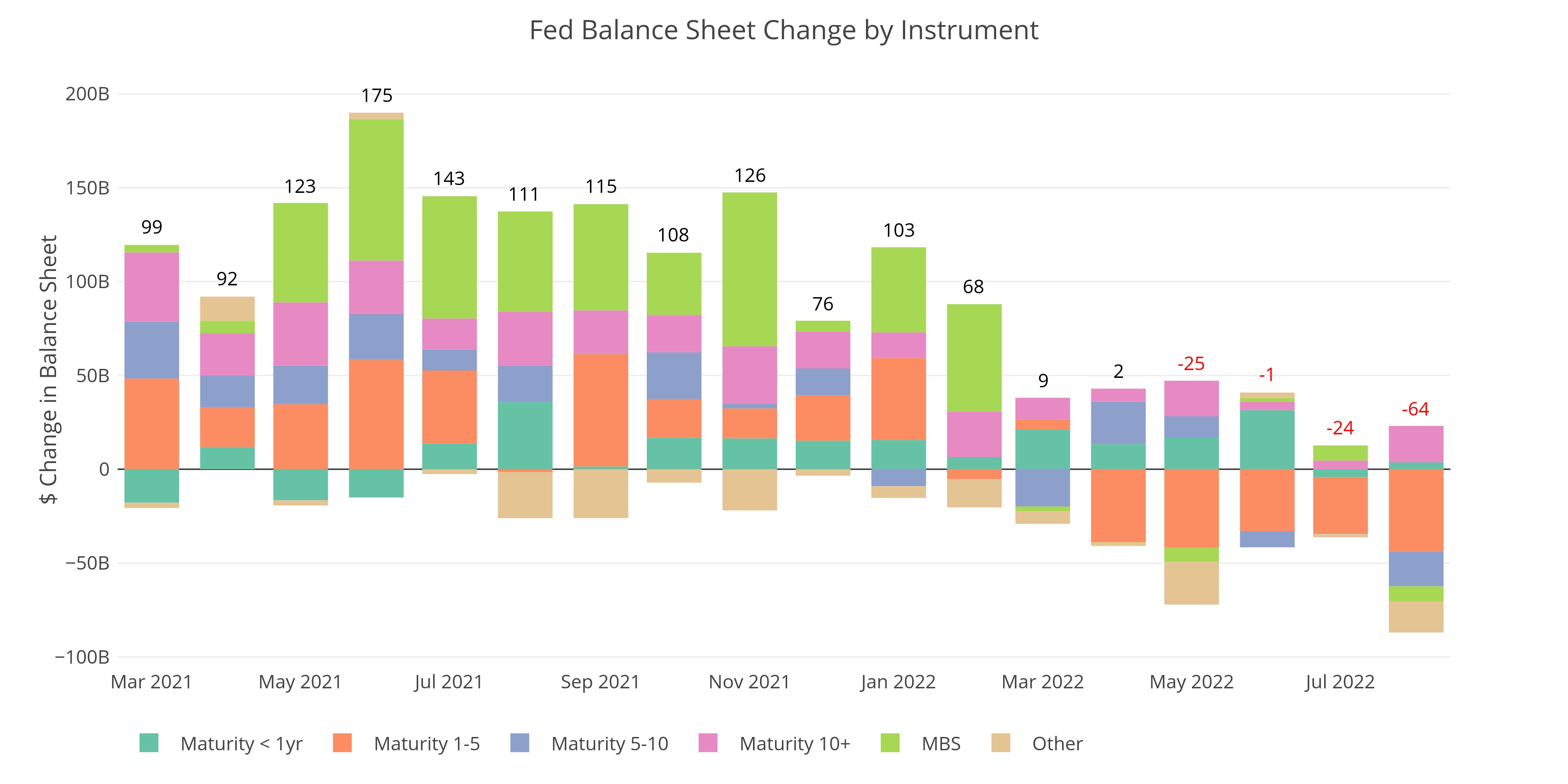

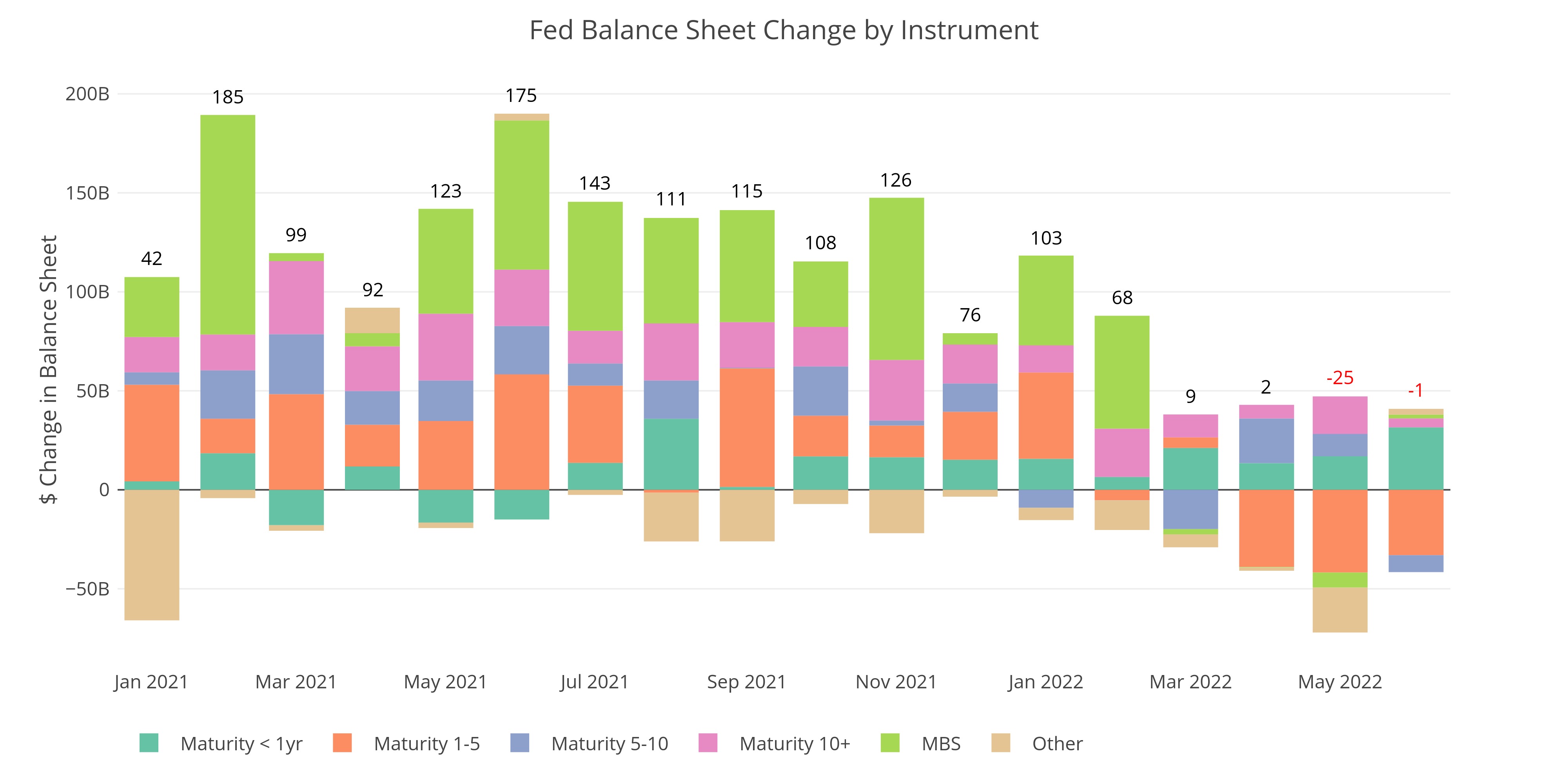

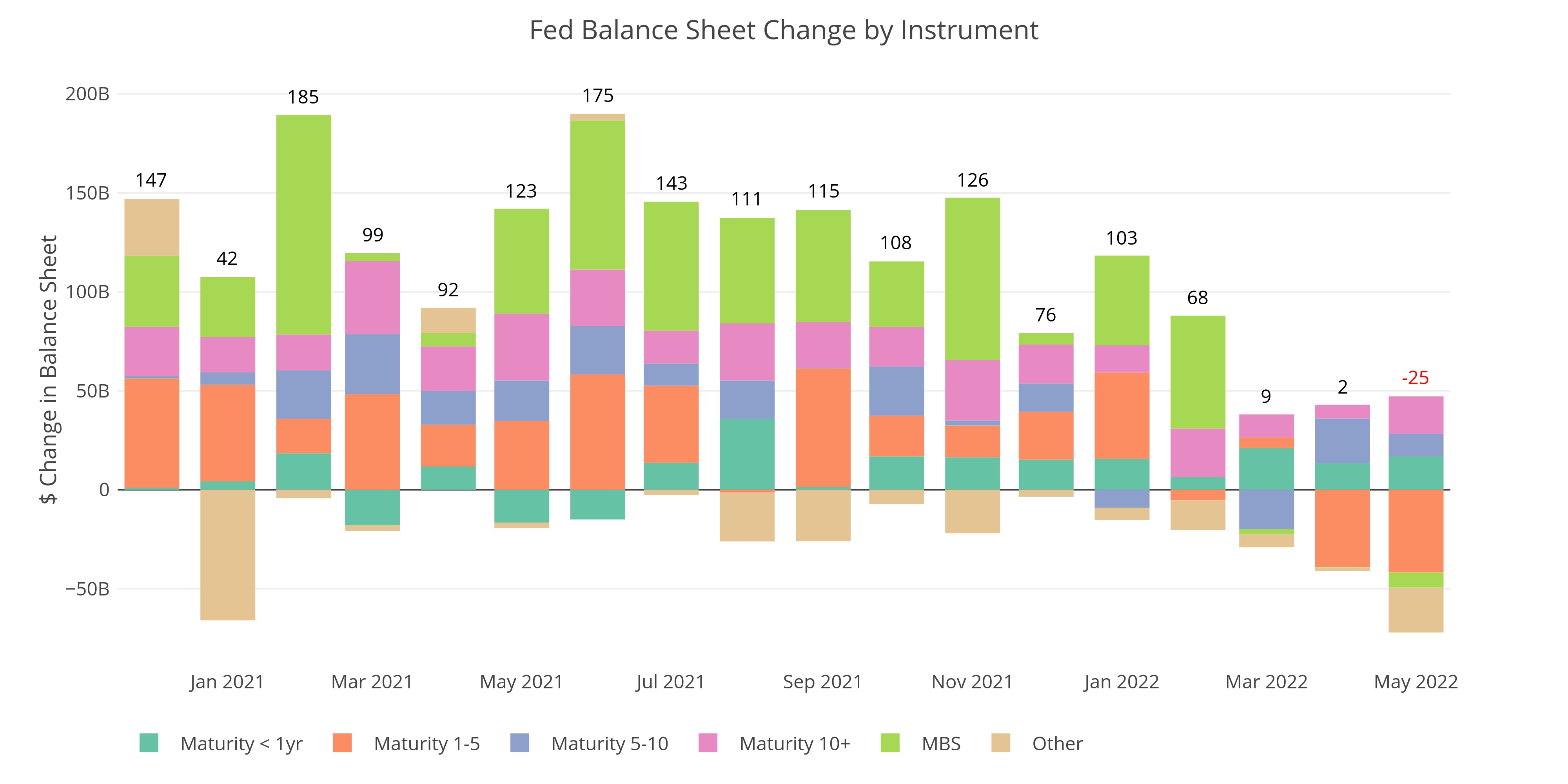

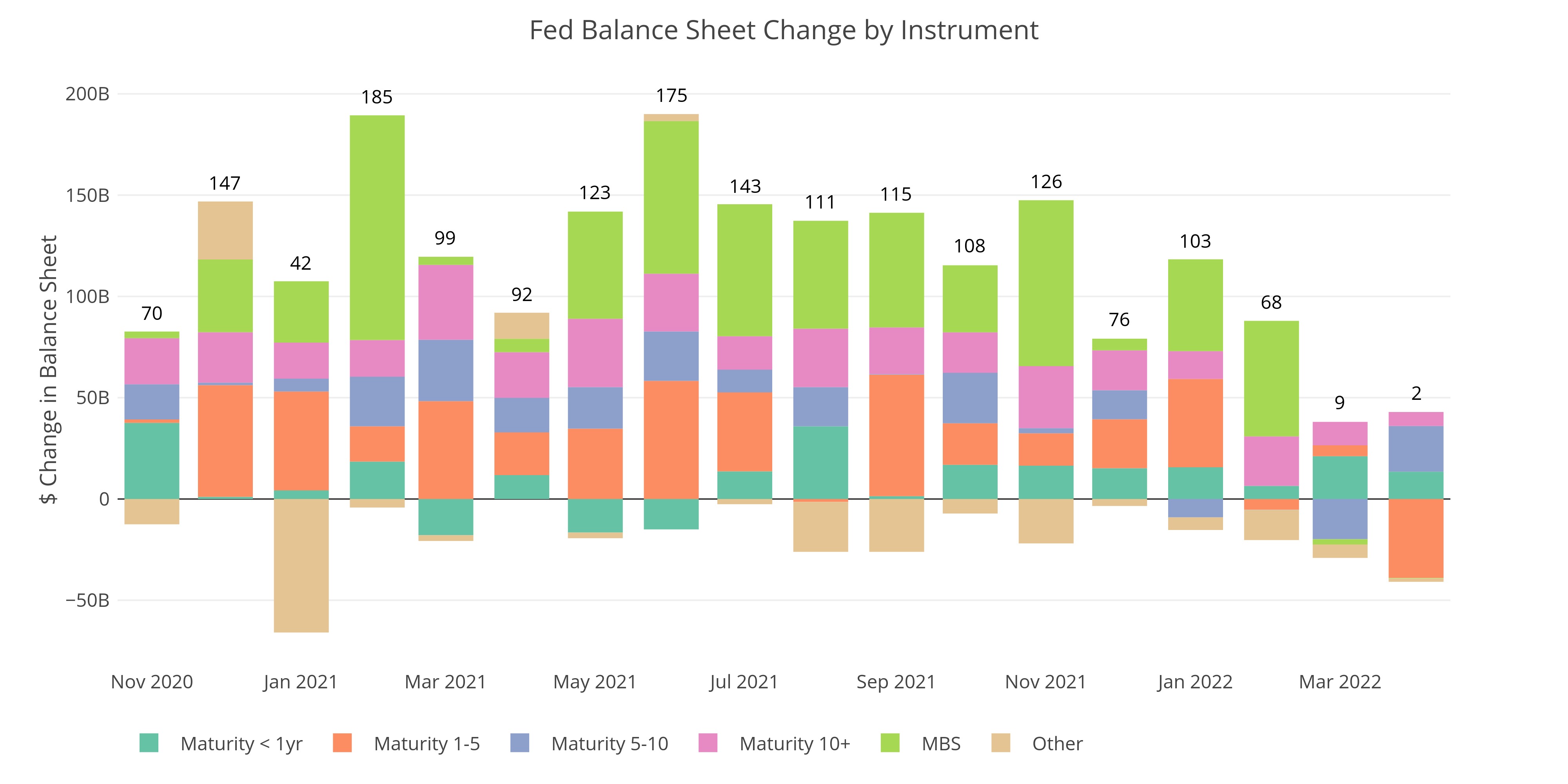

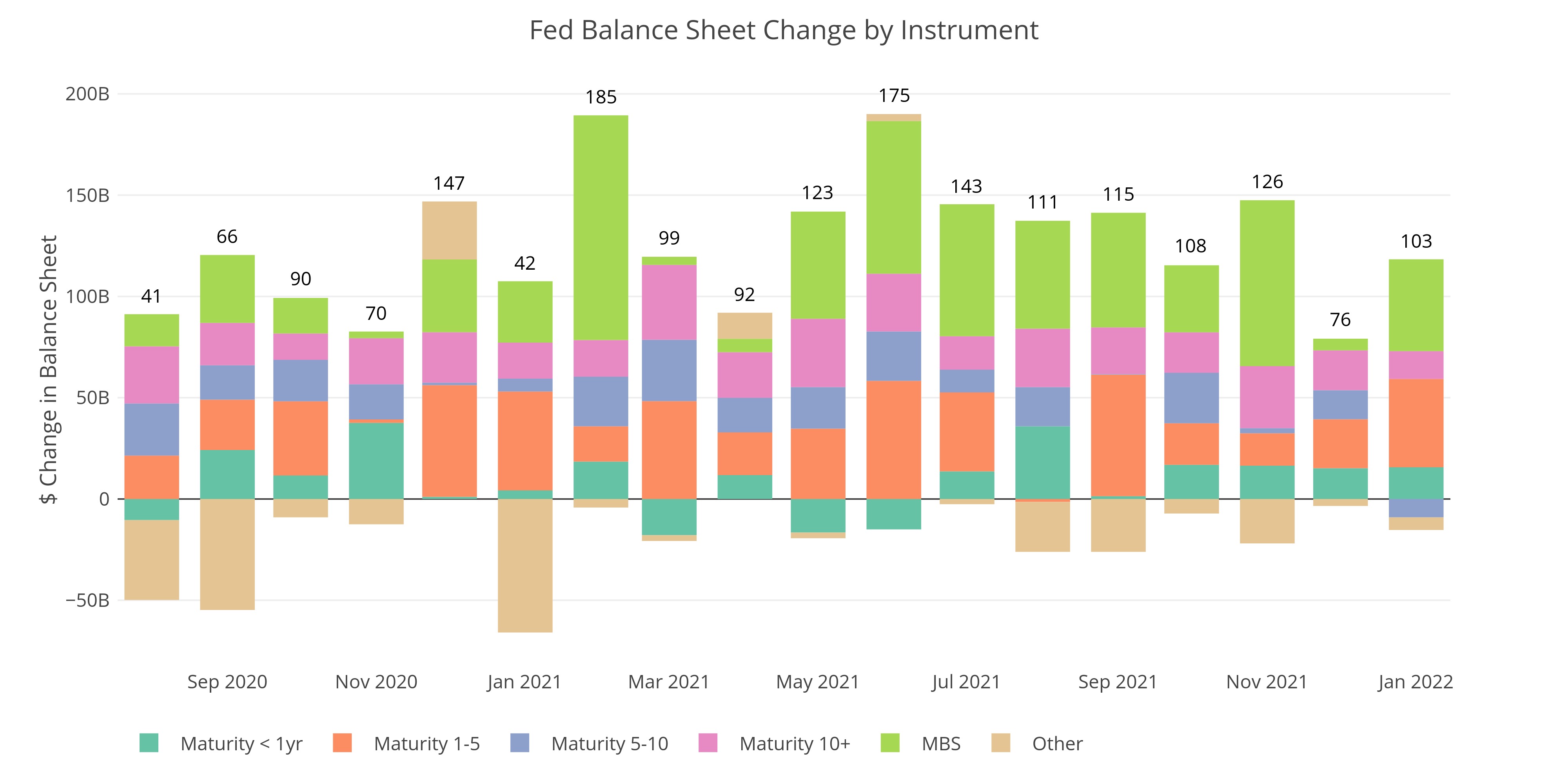

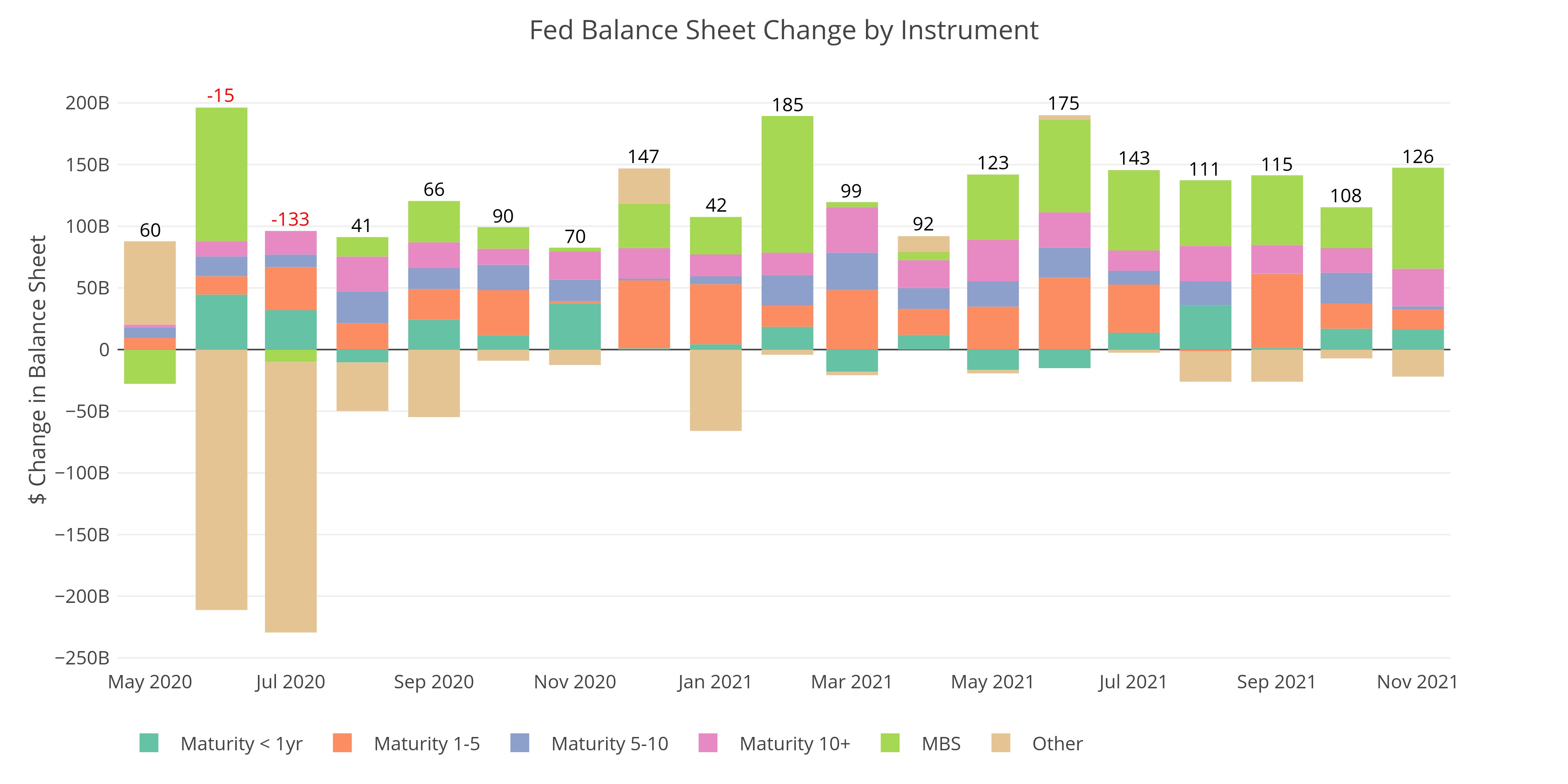

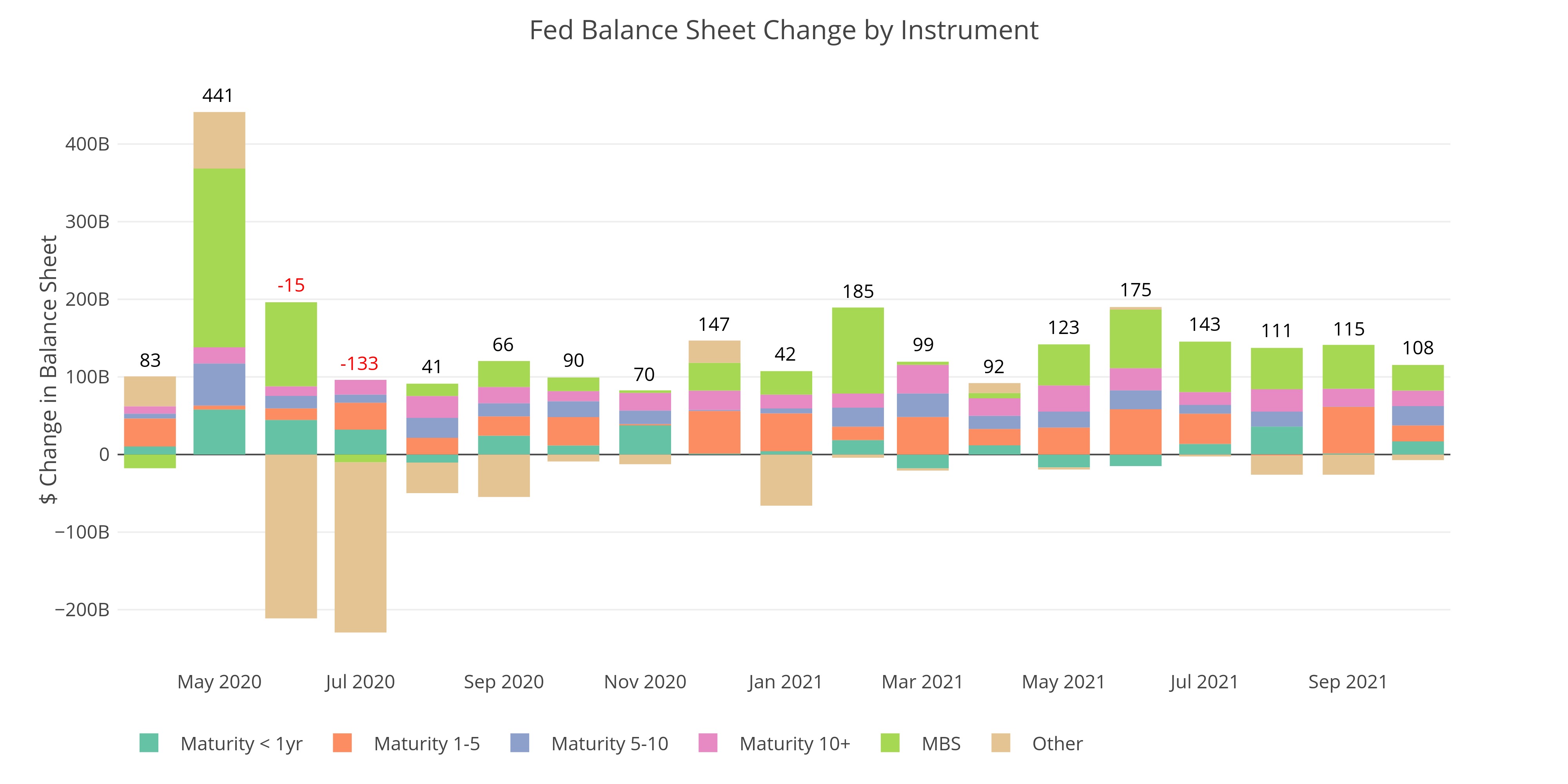

Will Trump's Fed Bring Back QE?

QT Continues to slow

13-Week Money Supply Starts Accelerating

Trump meddling in the Fed likely means Money Sypply will begin ramping up quite dramatically

Comex Deliveries Return to Normal - For Now

Delivery Volumes still remain elevated but nothing like earlier this year

Jobs: Seven Straight Months of Downward Revisions

Headline report continues to underperform the Household Survey

It's Silver's Turn: Delivery Demand on the Comex Continues Higher

Gold has returned to normal levels while silver continues to see elevated demand

13-Week Money Supply Slows into the Summer Months

Slowdown is not enough to give concern for the market

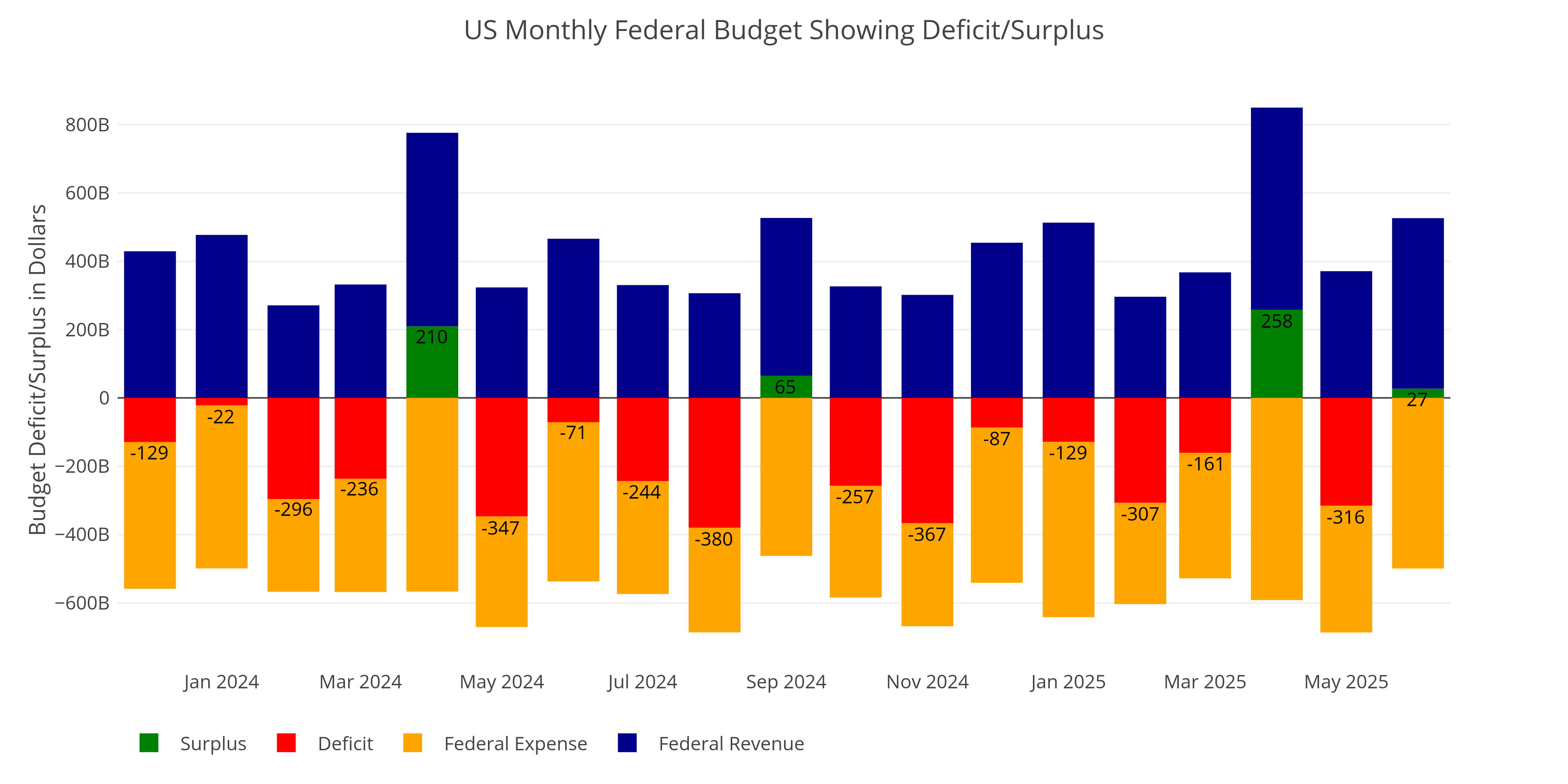

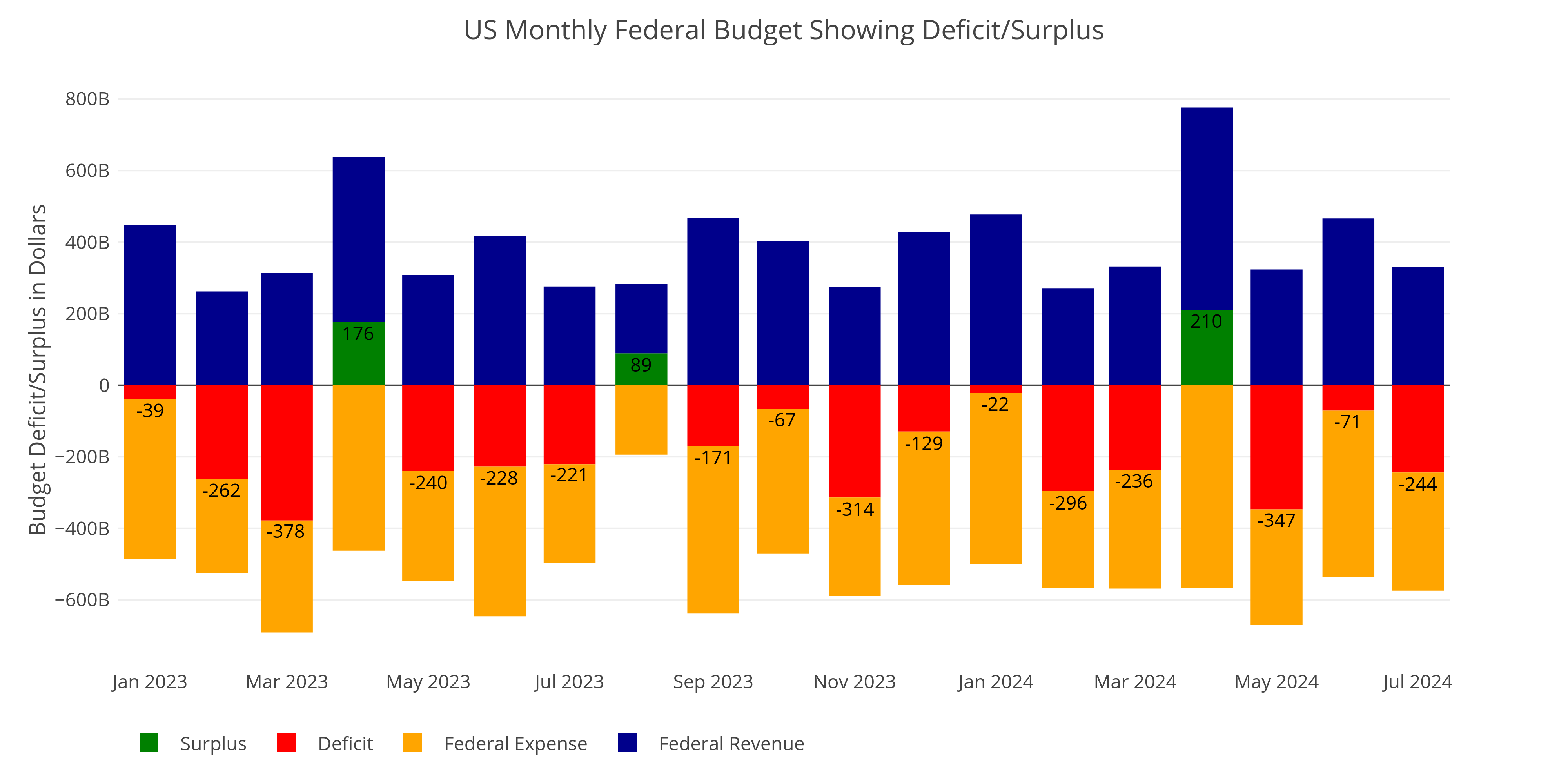

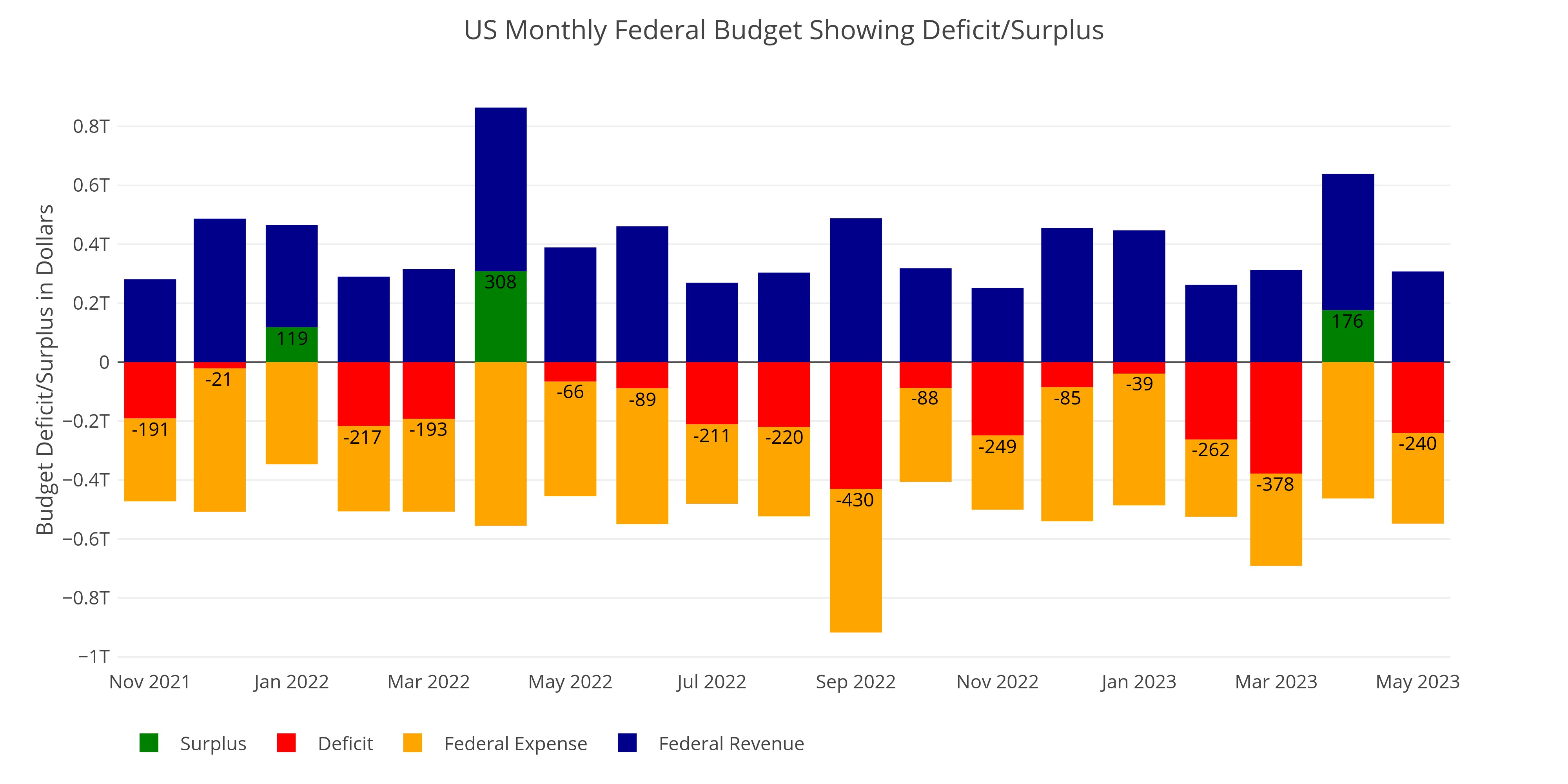

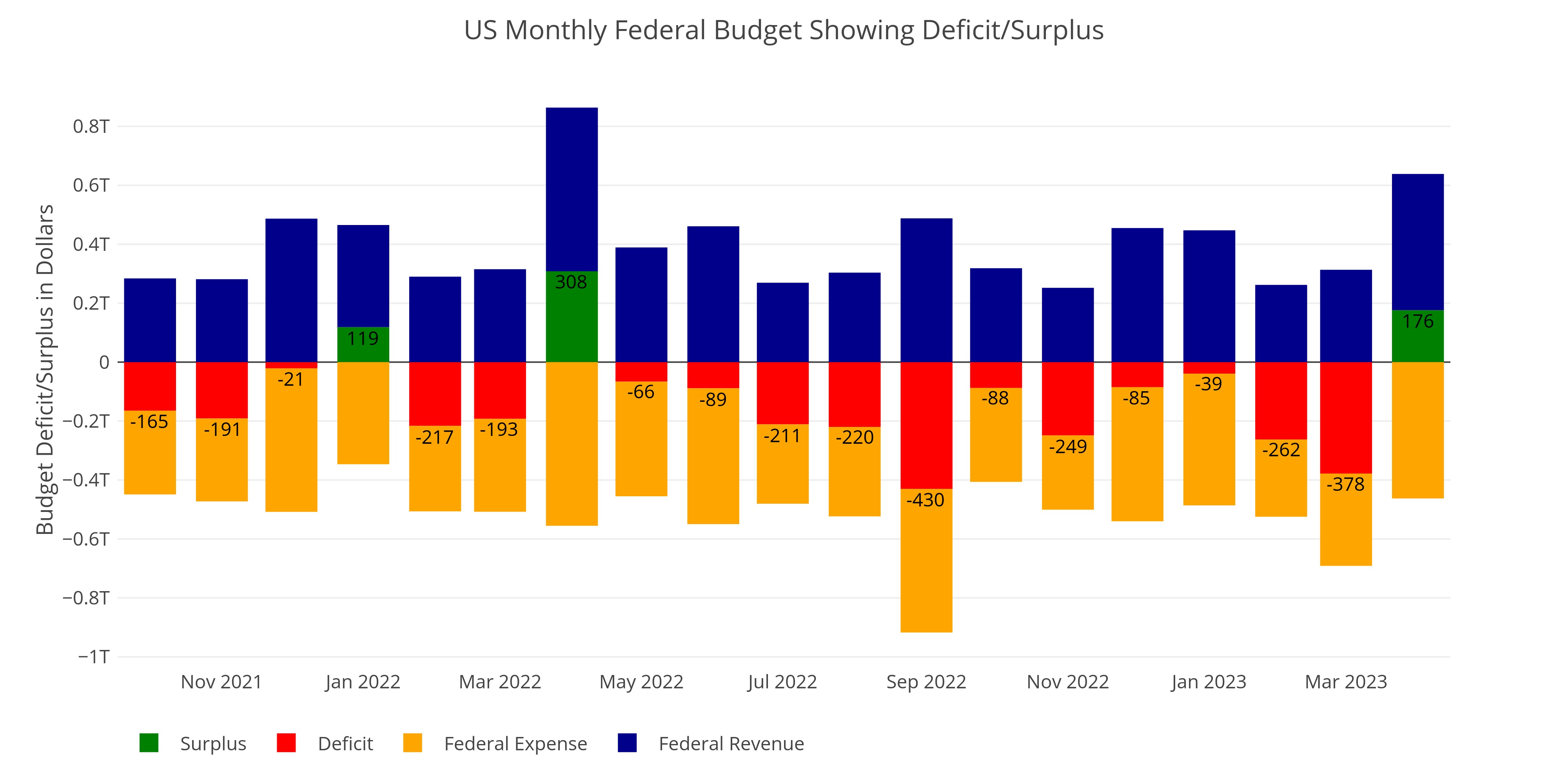

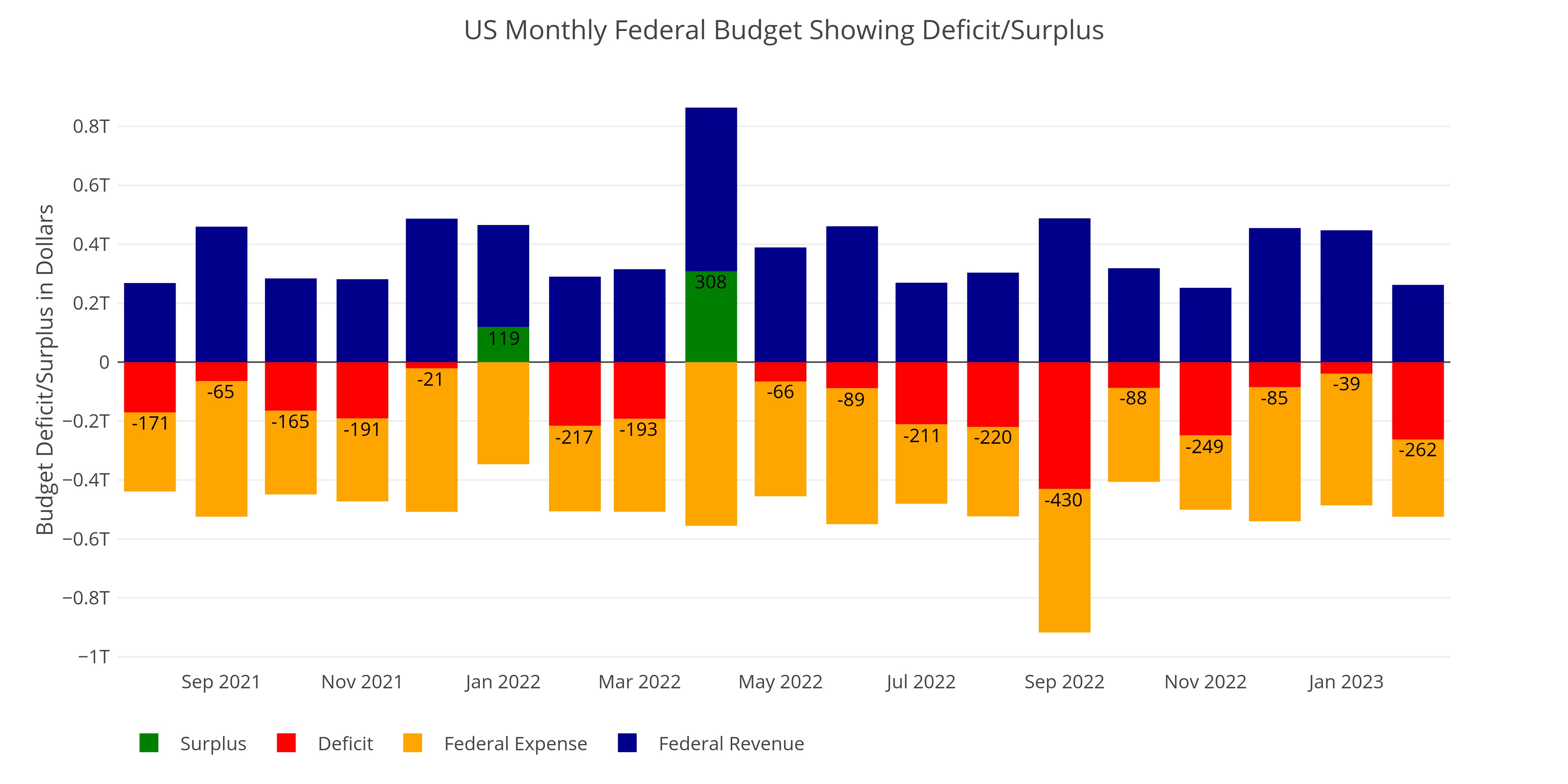

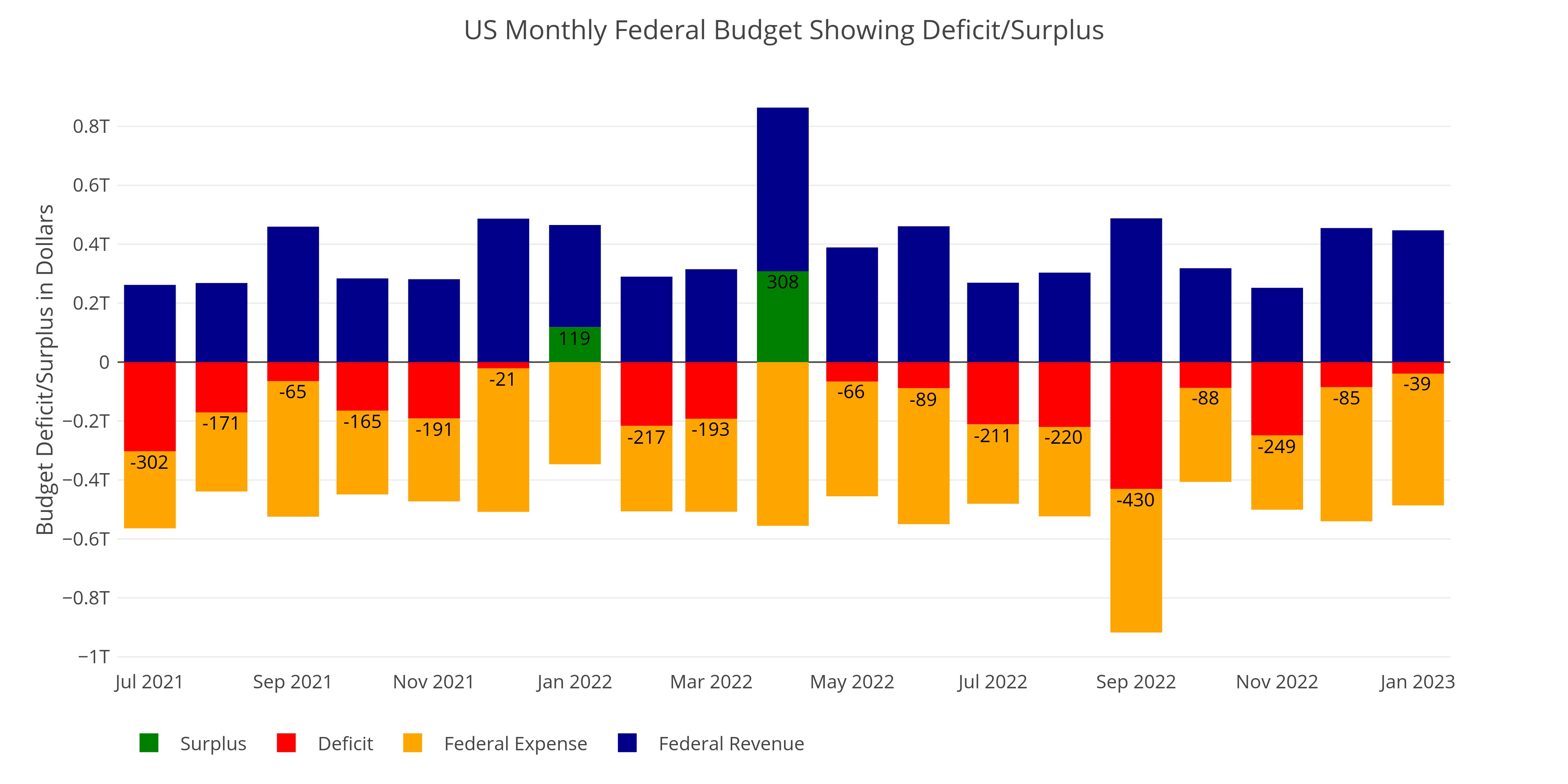

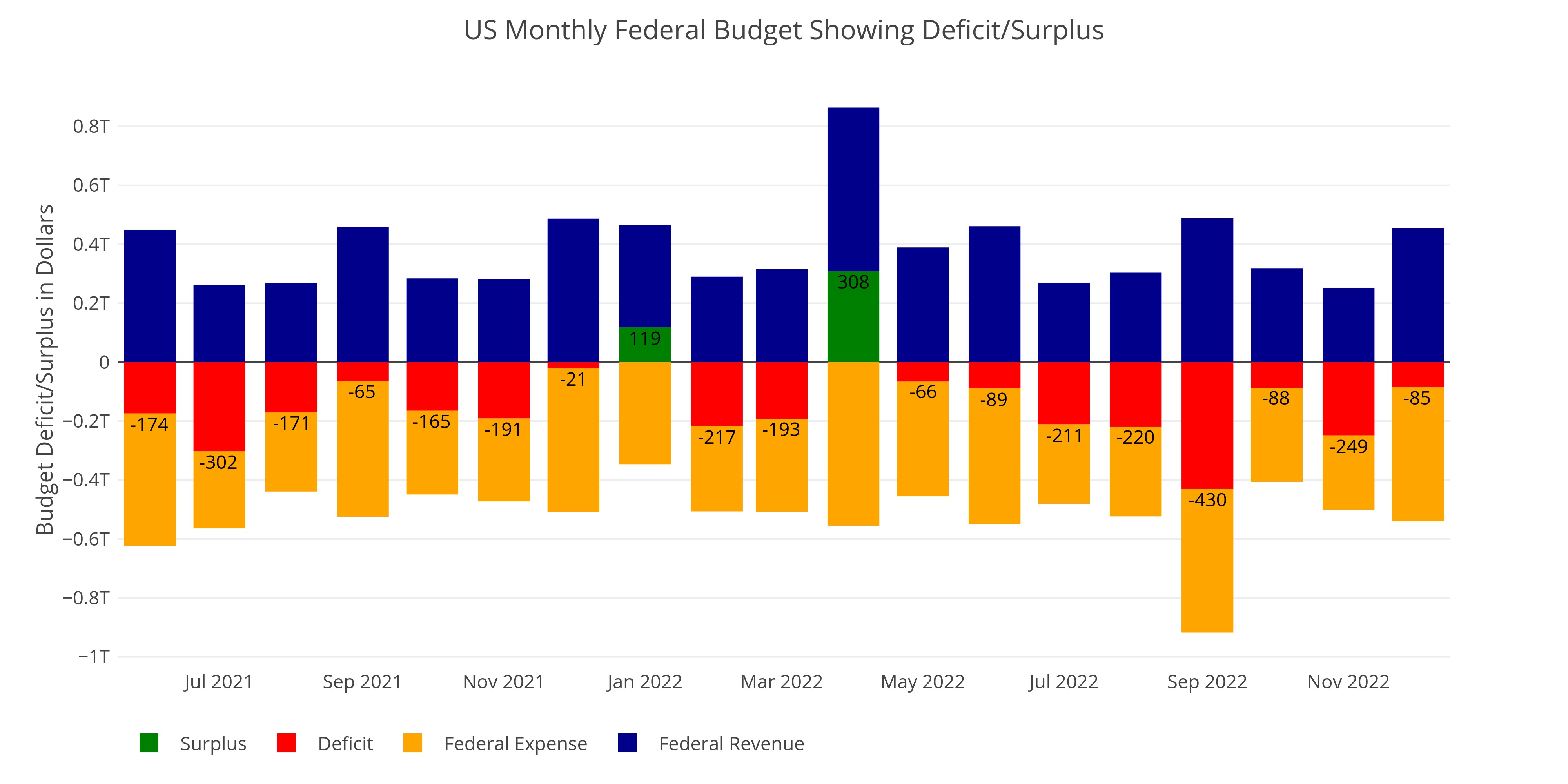

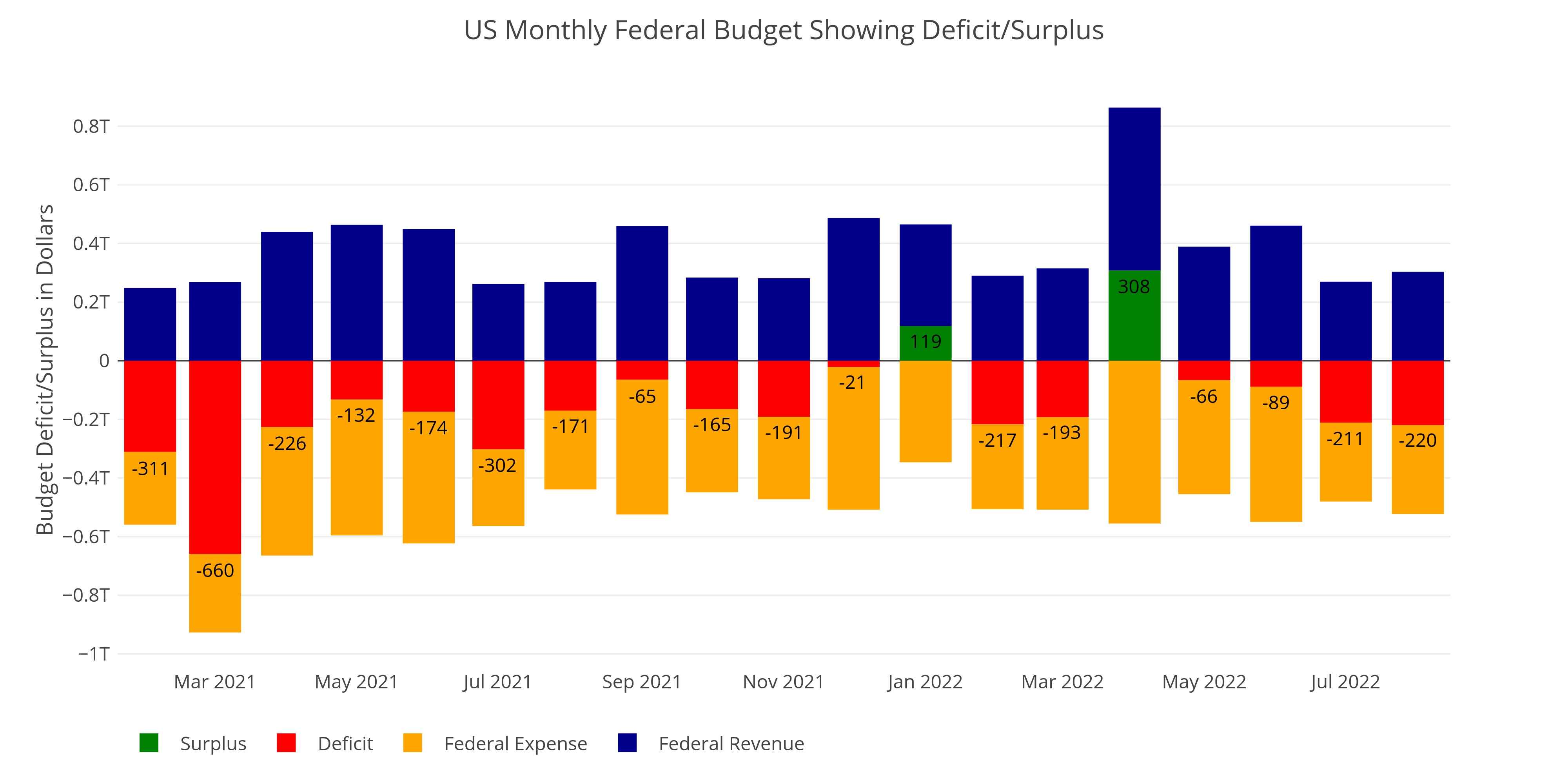

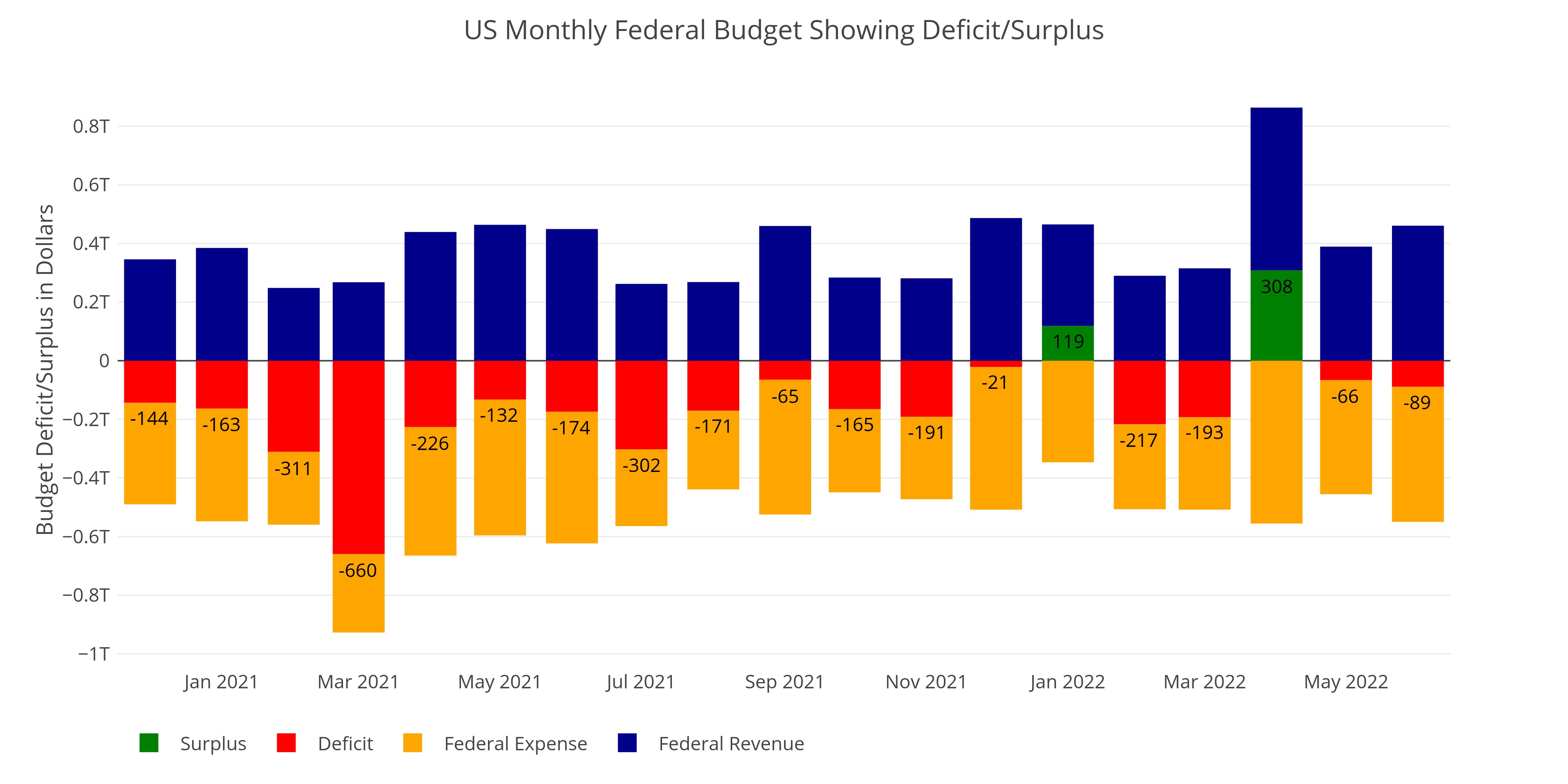

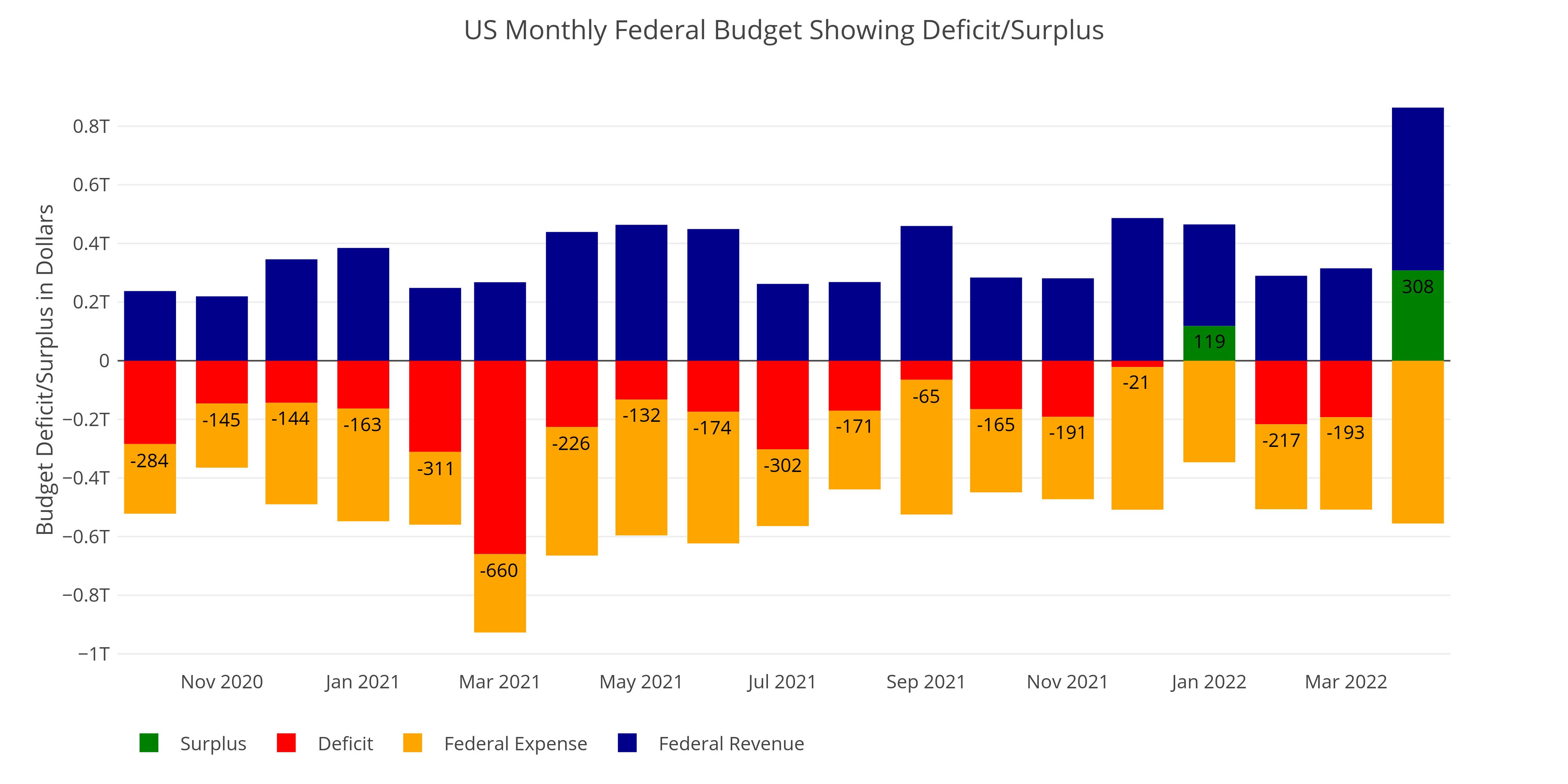

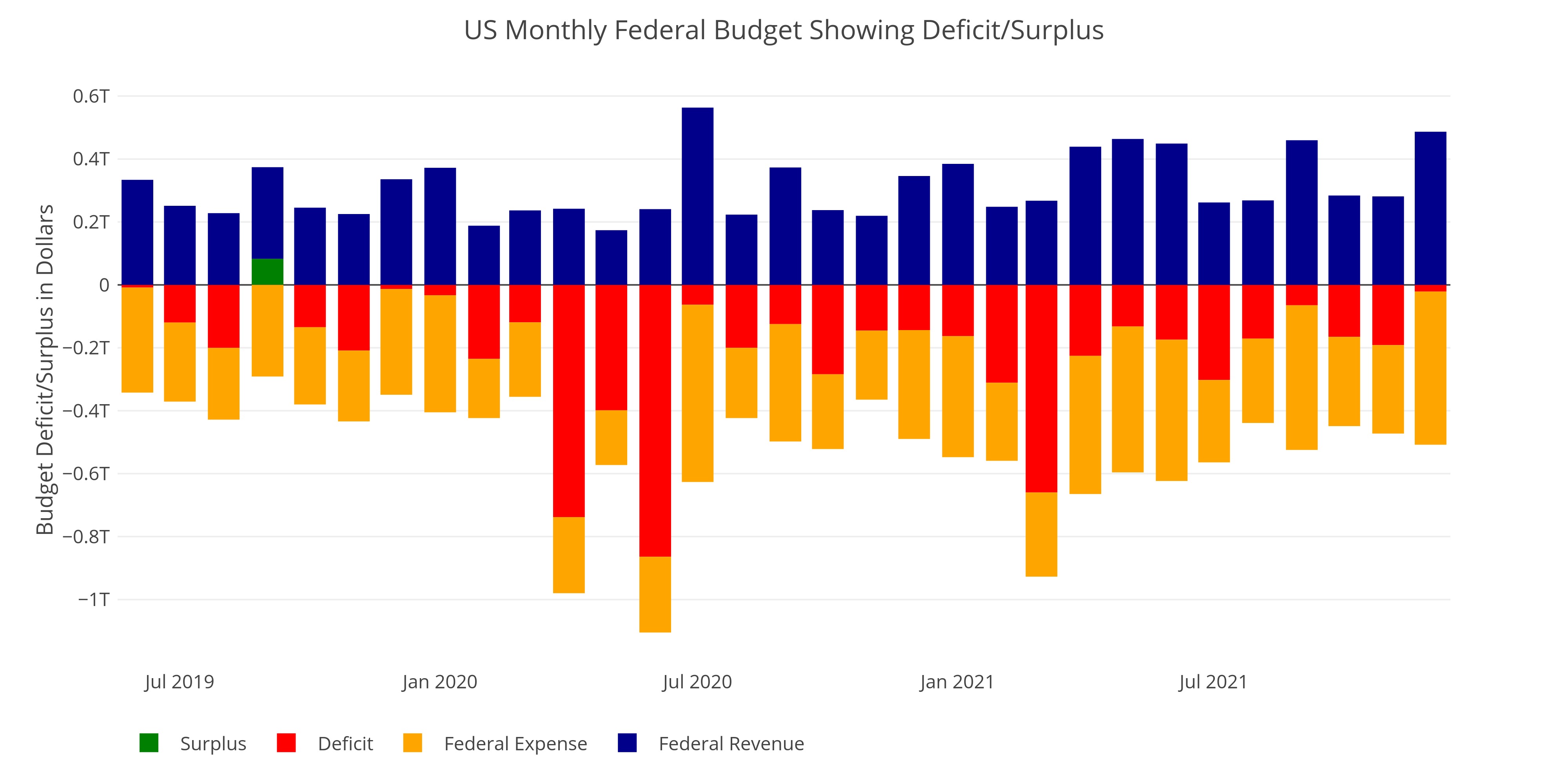

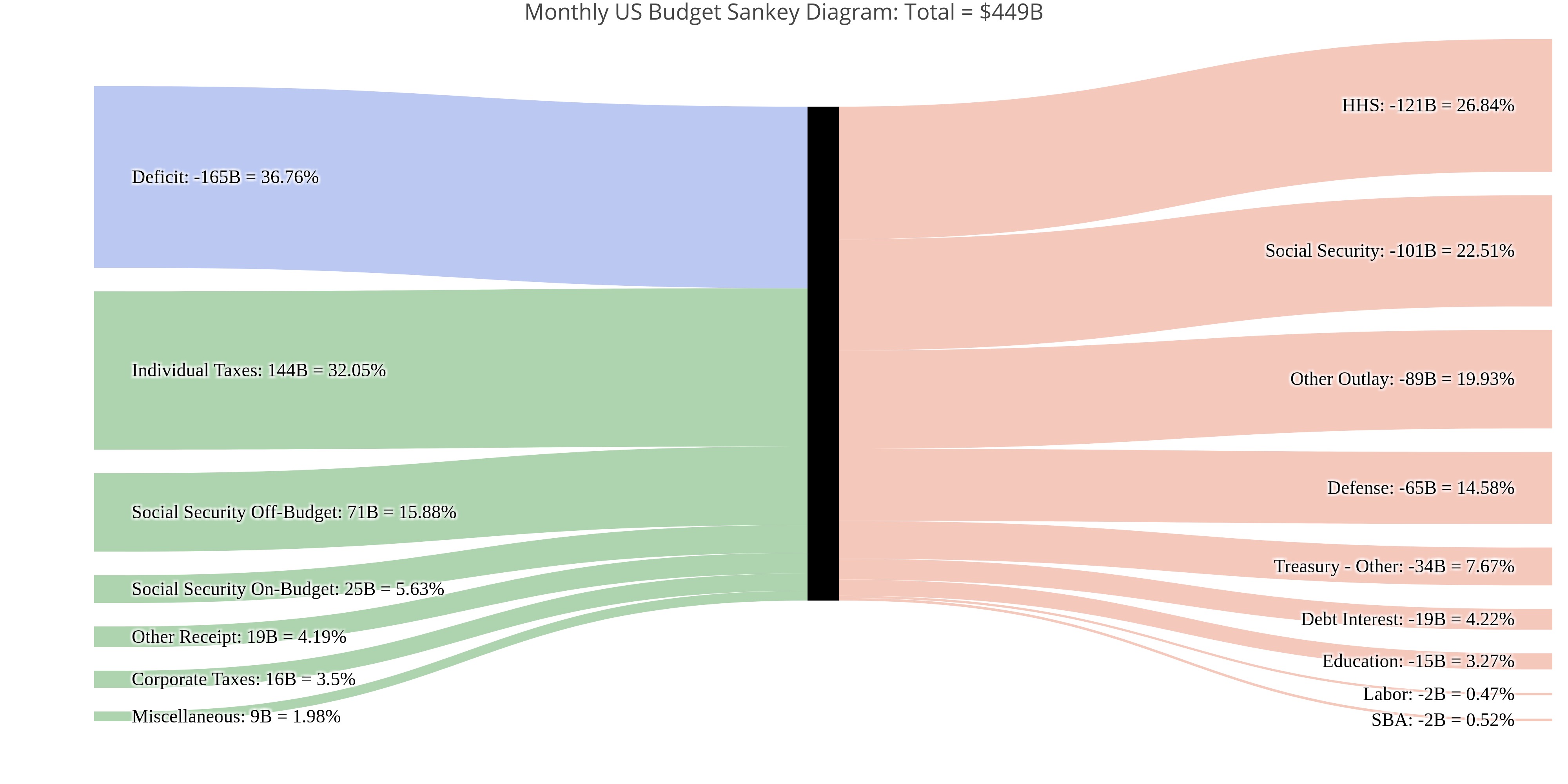

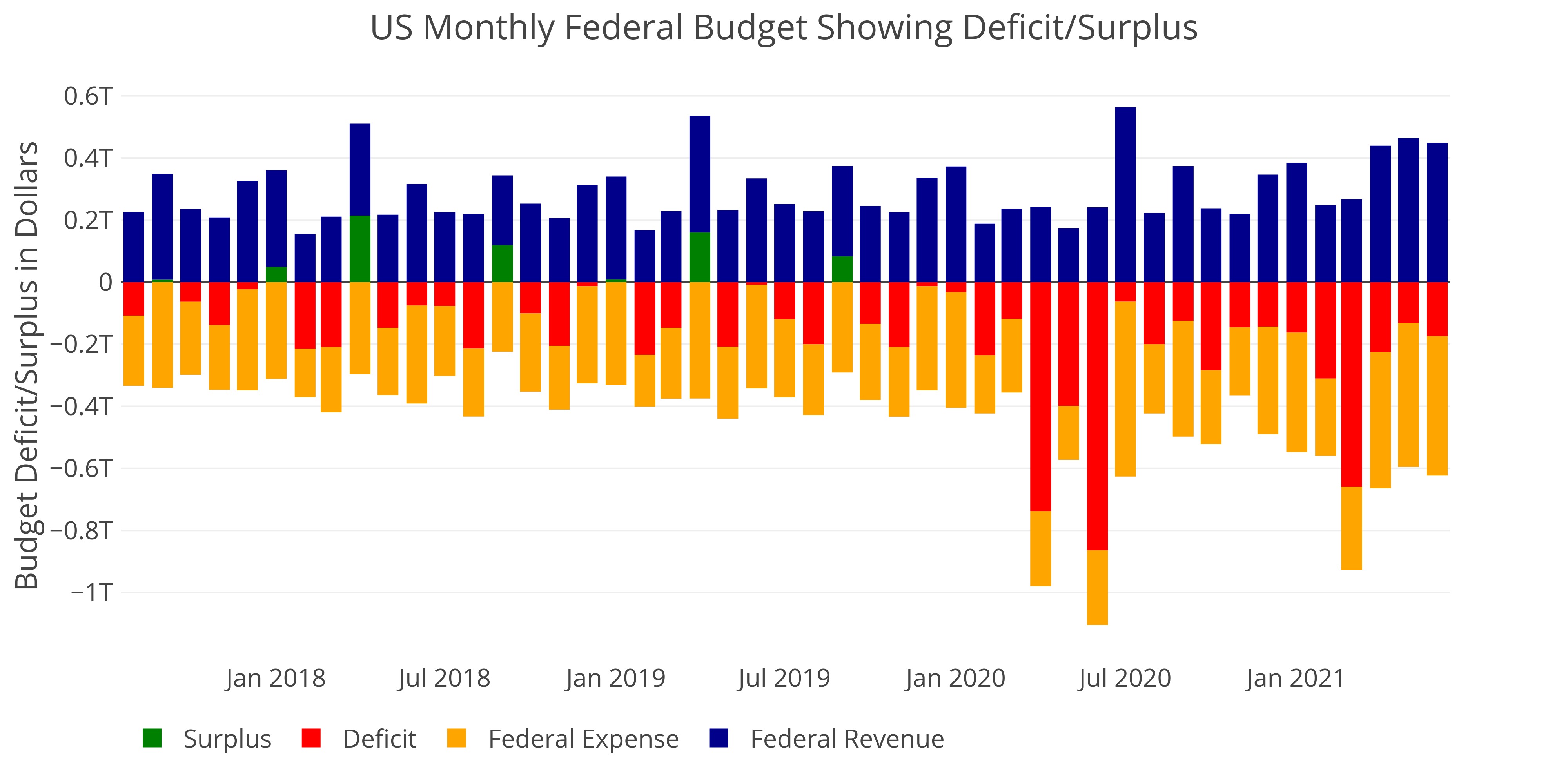

Federal Budget: Government has its best quarter since 2022

Despite a good quarter, little is being done to address deficits long-term

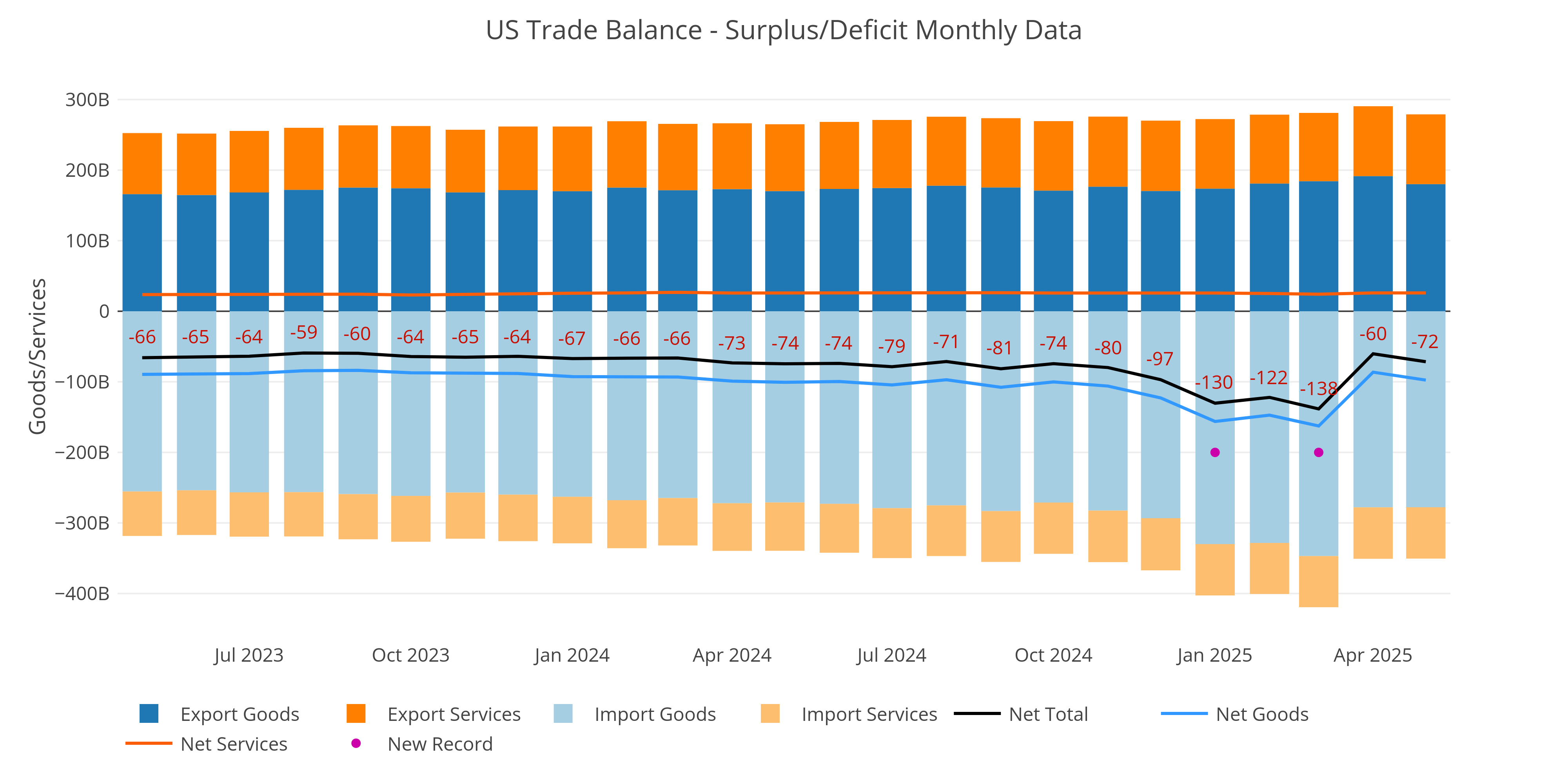

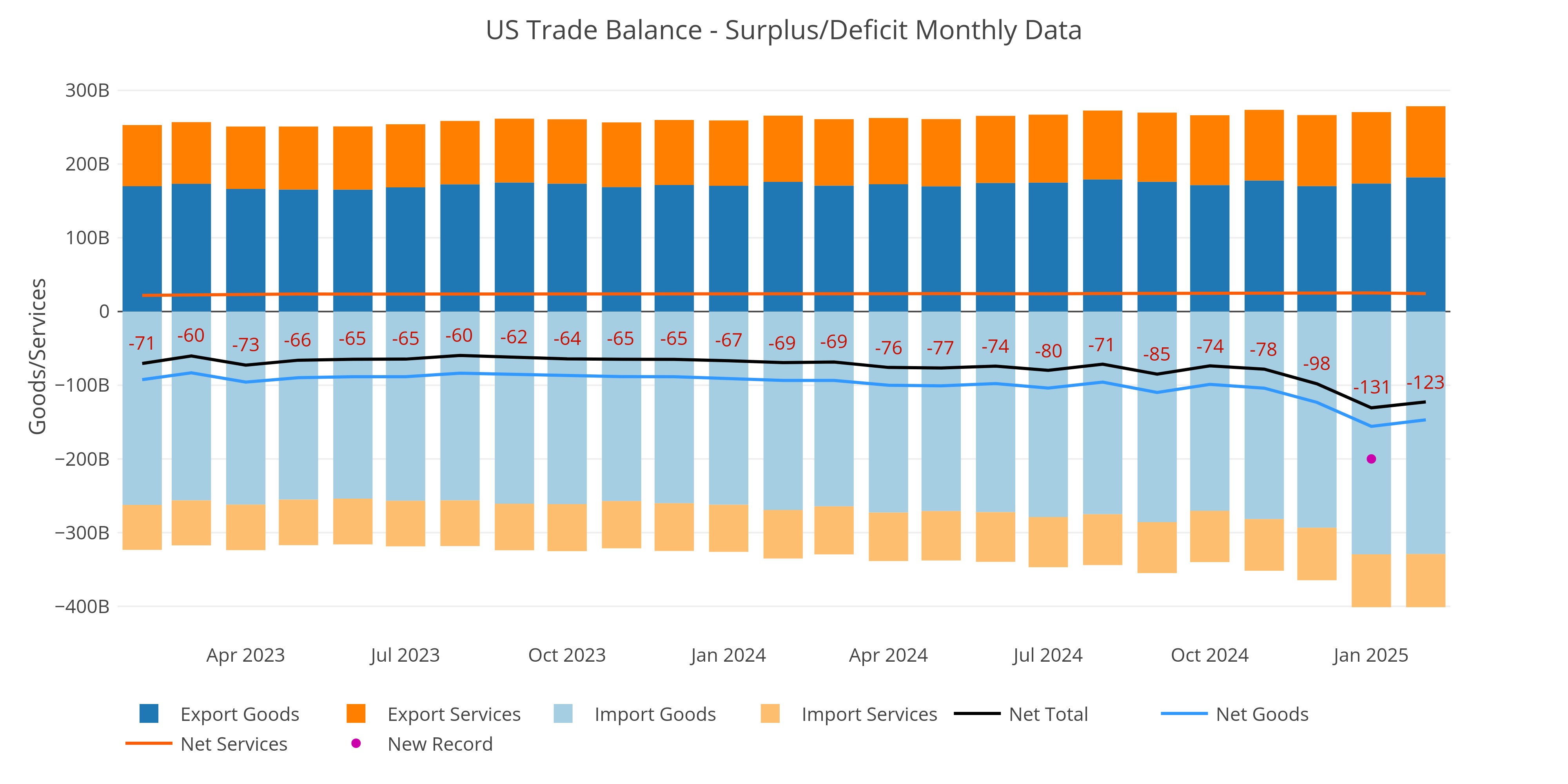

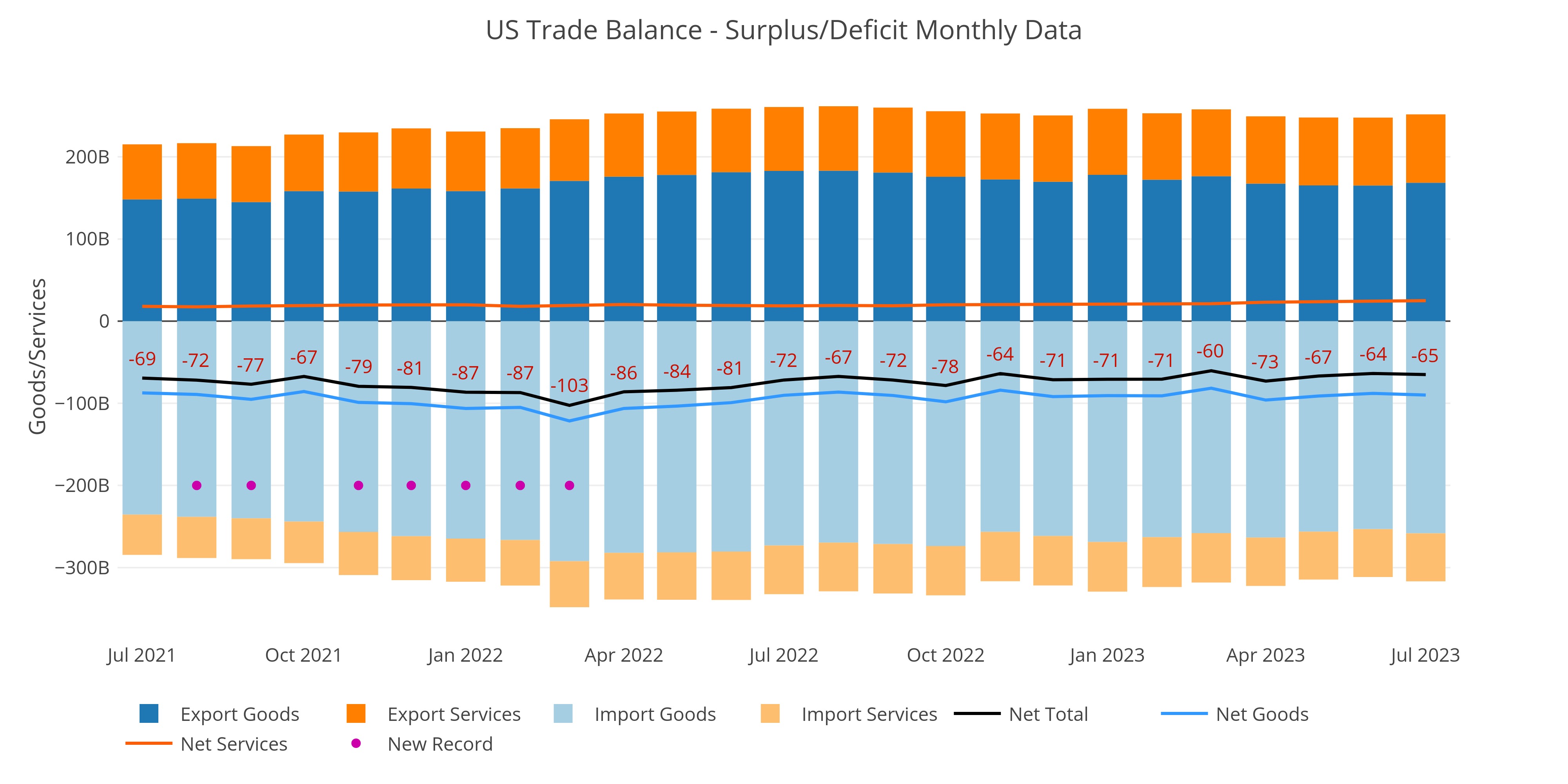

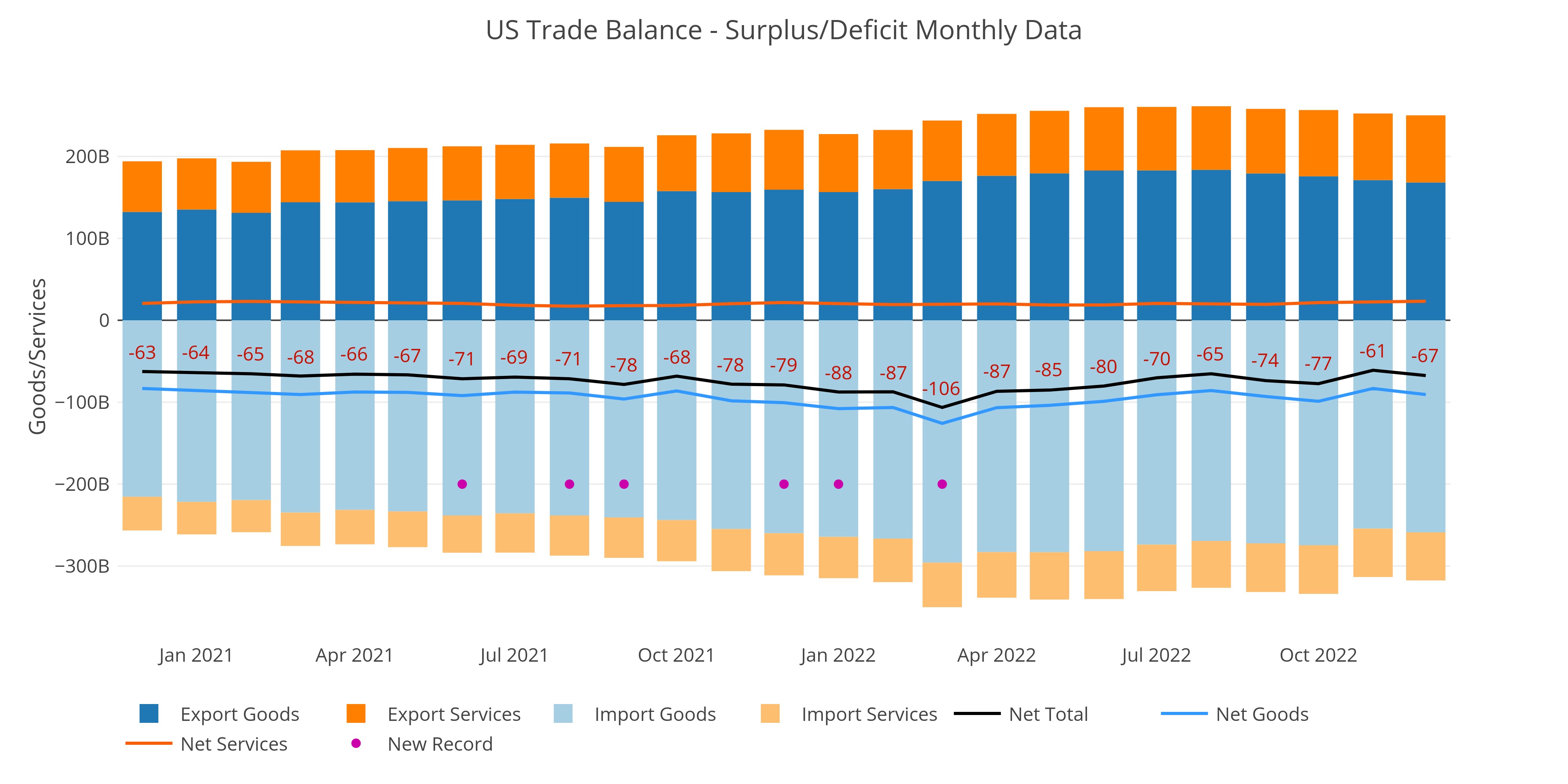

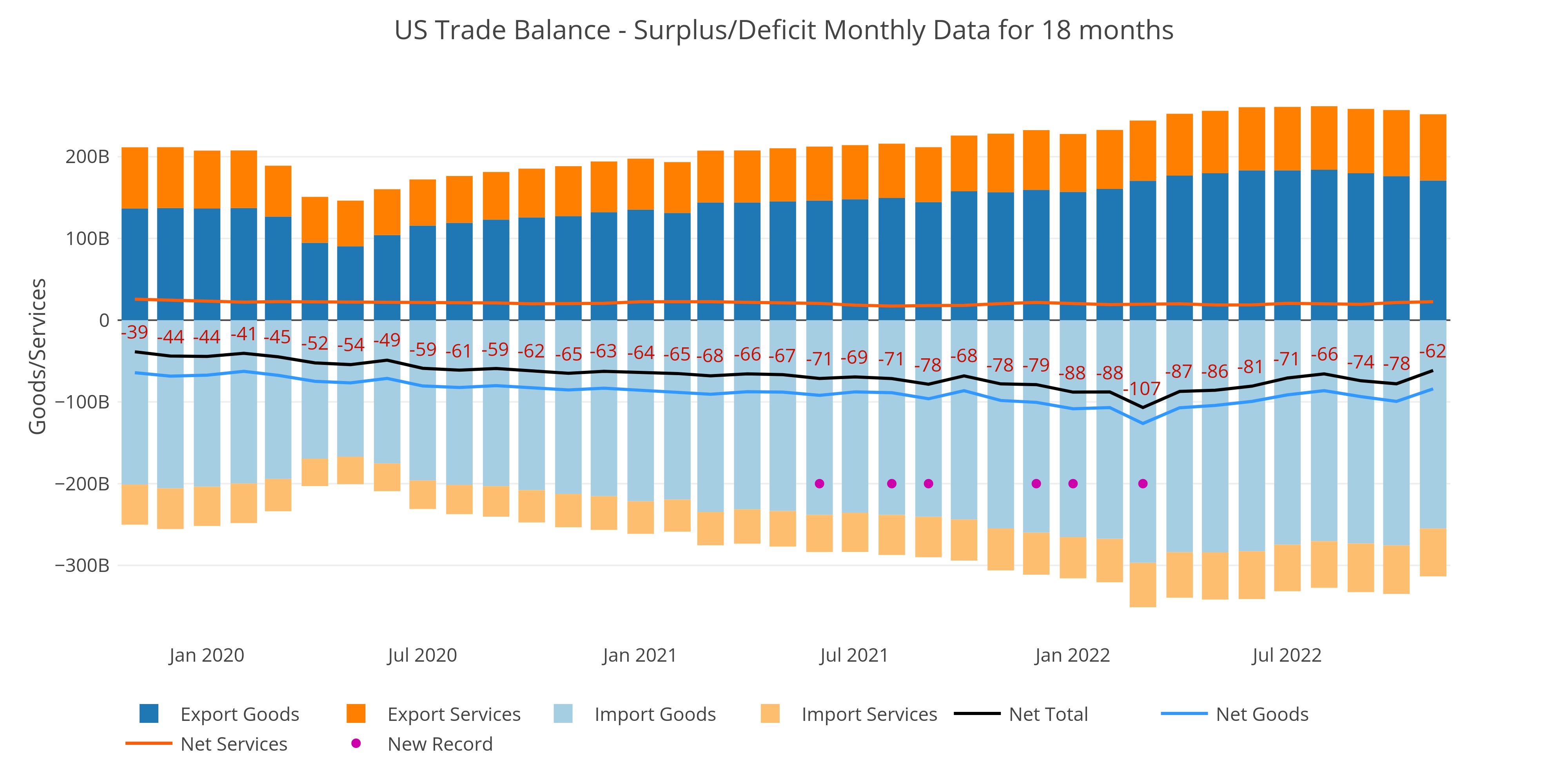

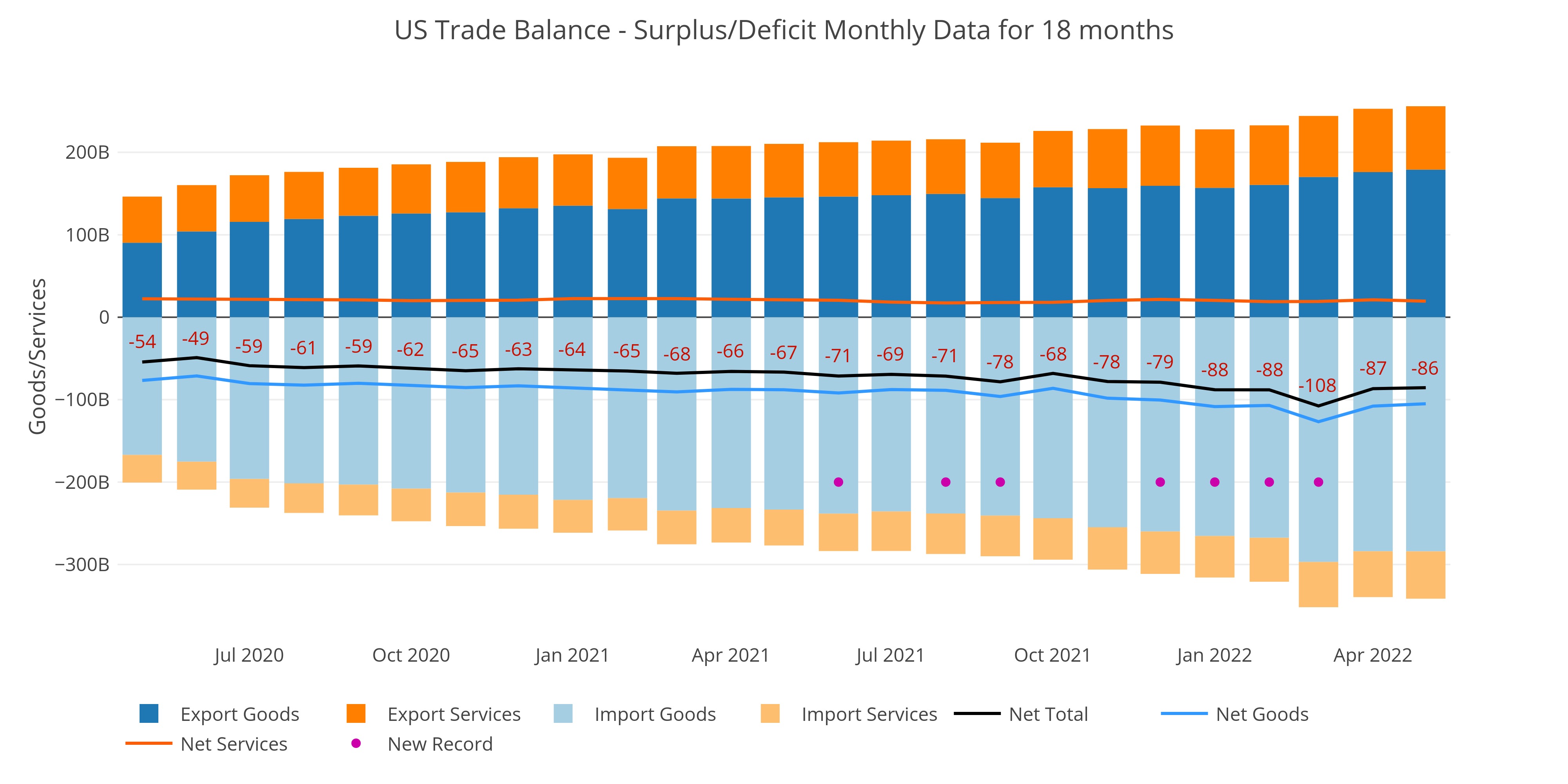

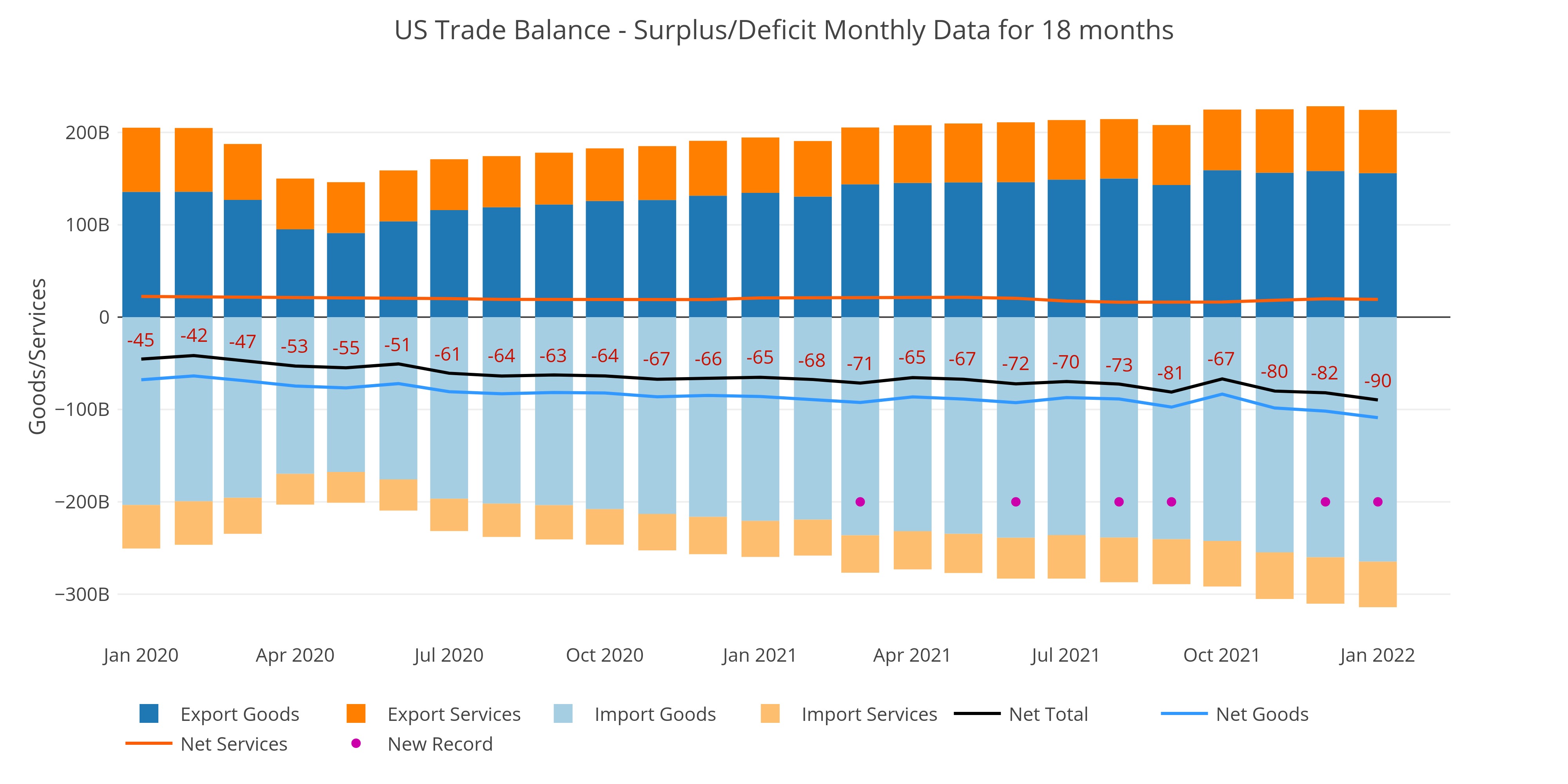

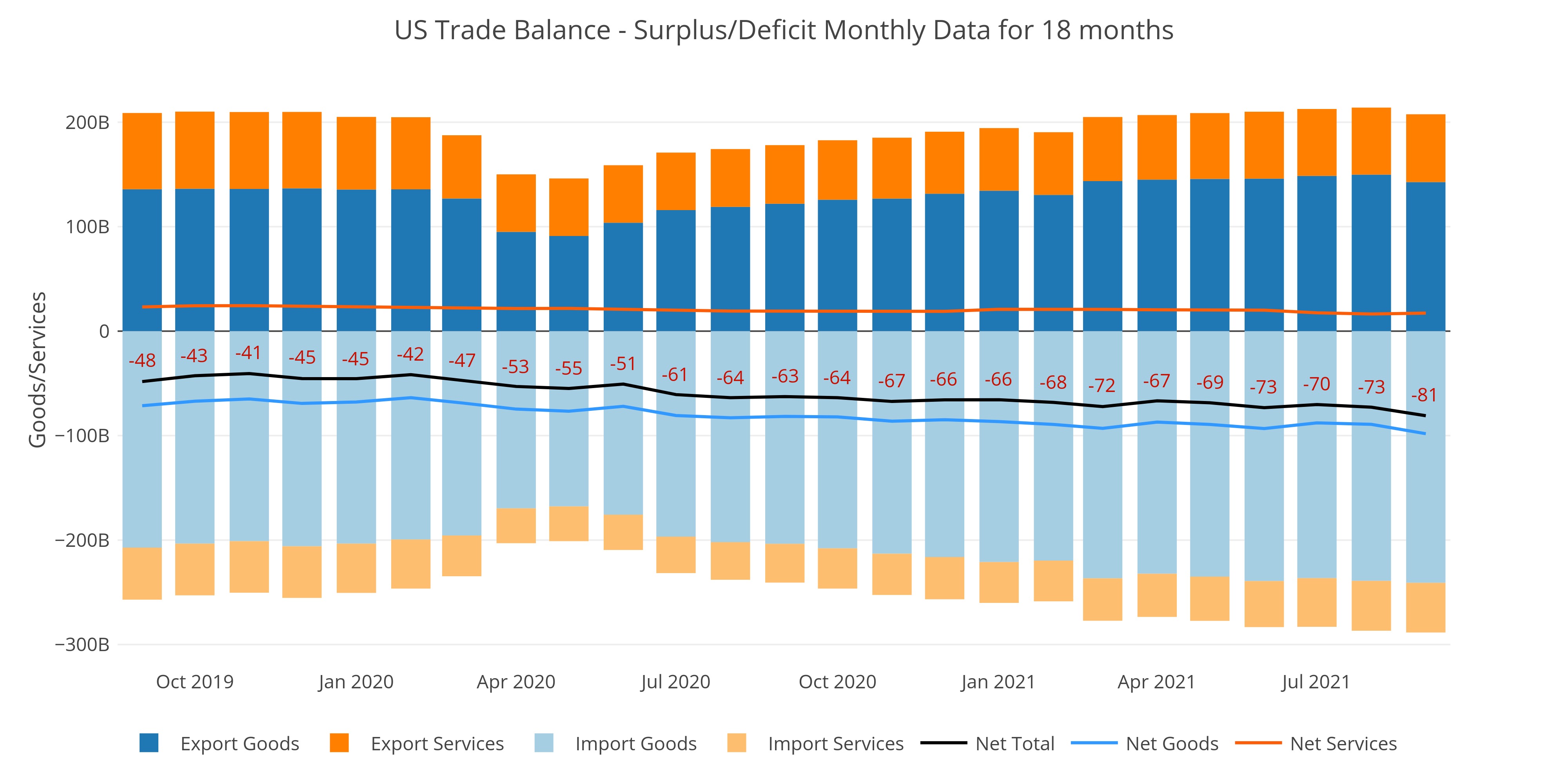

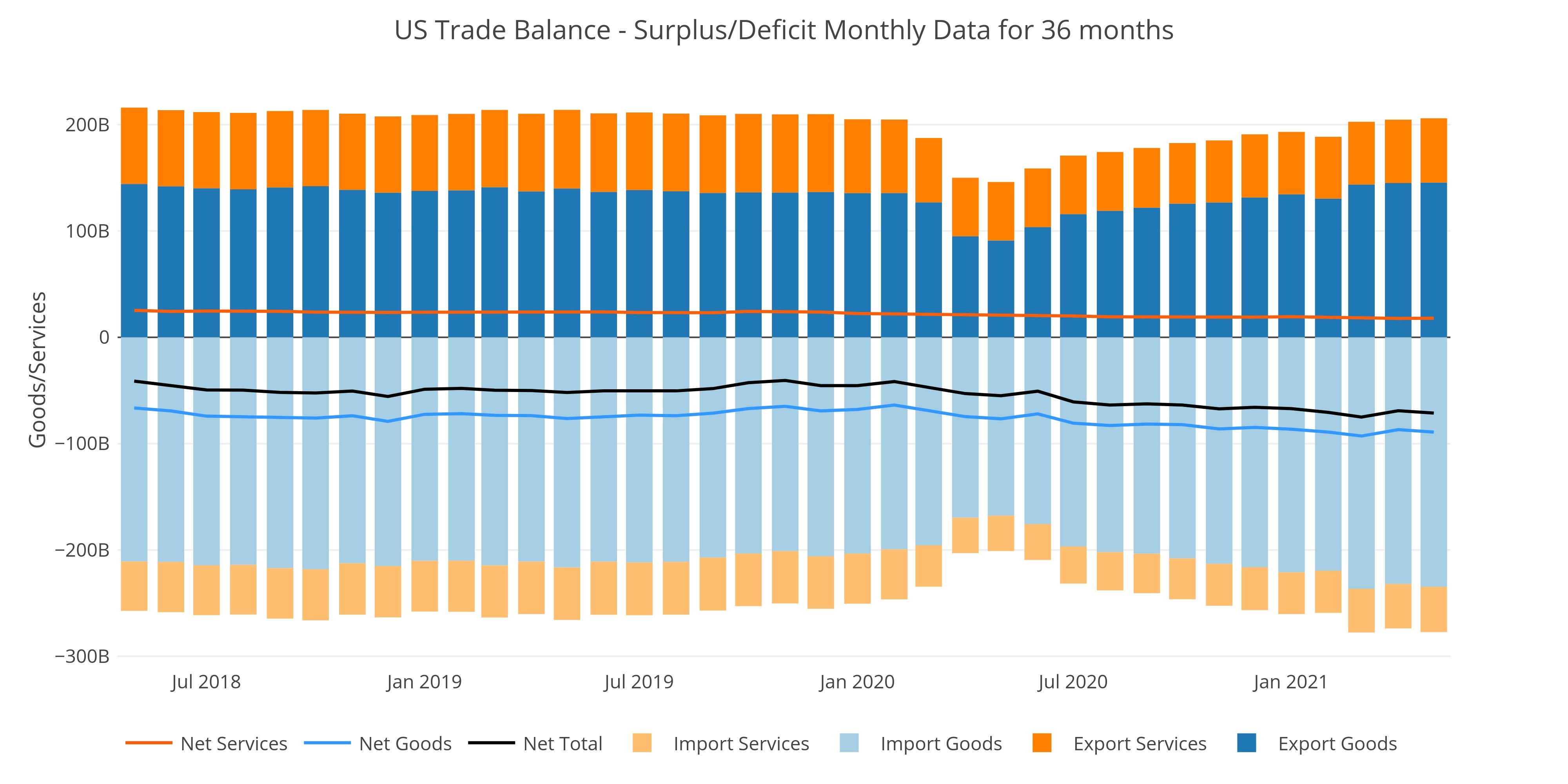

Trade Deficit Returns to Pre-Tariff Trend

The Tariffs will not accomplish their stated objectives

Jobs: QCEW Shows 2024 Job Reports were the Biggest Overstatement in 15 years

Headline report continues to diverge from the Household Survey and QCEW

CFTC CoTs Report Confirms there is Little Froth in the Gold Market

Managed Money has bet wrong on gold in 2025

It's Silver's Turn: Delivery Demand on the Comex Continues Higher

Gold has returned to normal levels while silver continues to see elevated demand

13-Week Money Supply Growth Accelerates, Bucking Seasonal Trends

Summer is usually a cool down period for 13-week growth rates

The Technicals: Gold Bull Market Still Looks Very Strong

The gold price still has plenty of forces to push it higher

Jobs: Household Survey and Downward Revisions Paint a Much Bleaker Employment Picture

Without January, the household survey would be deeply negative

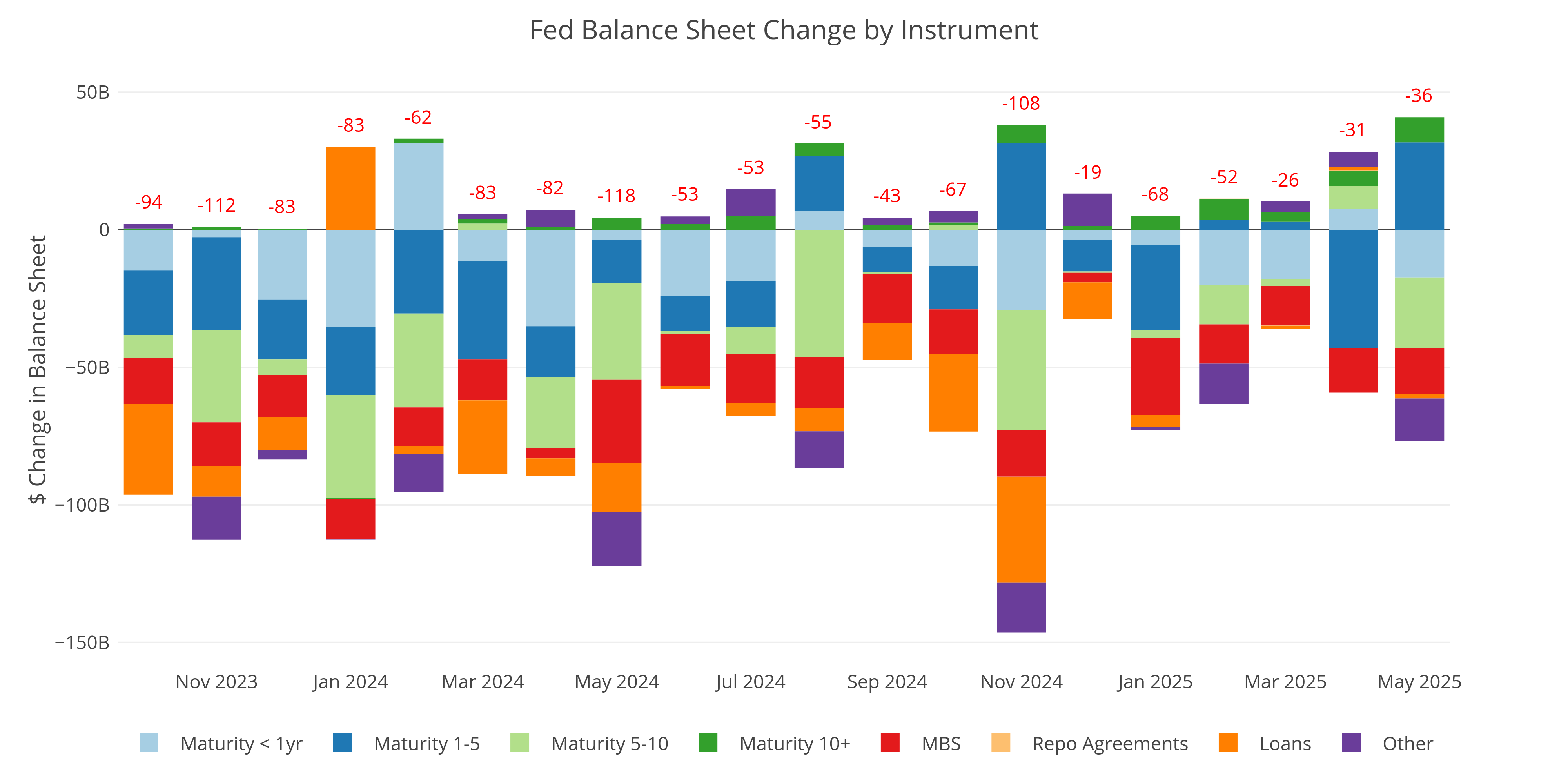

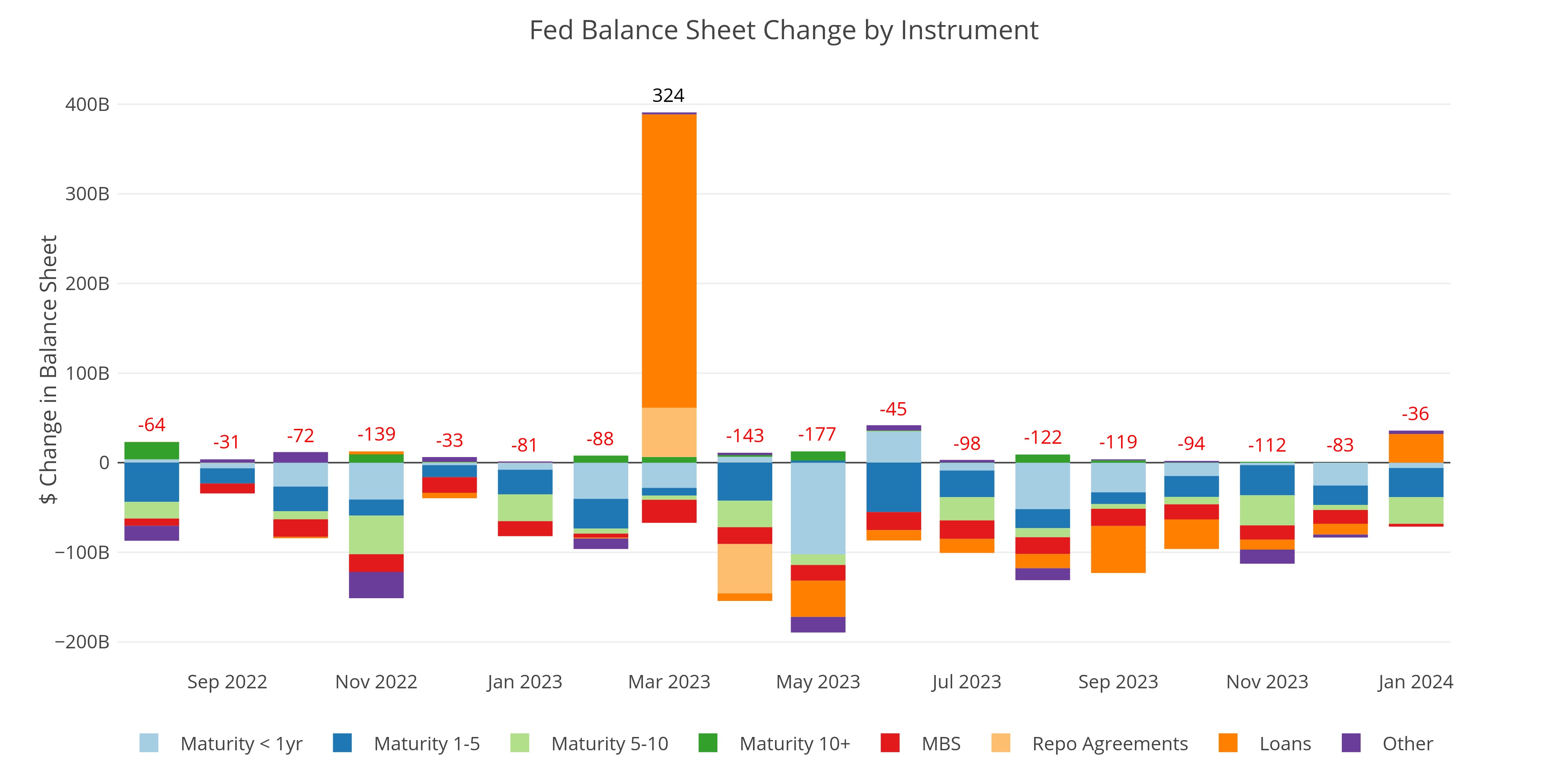

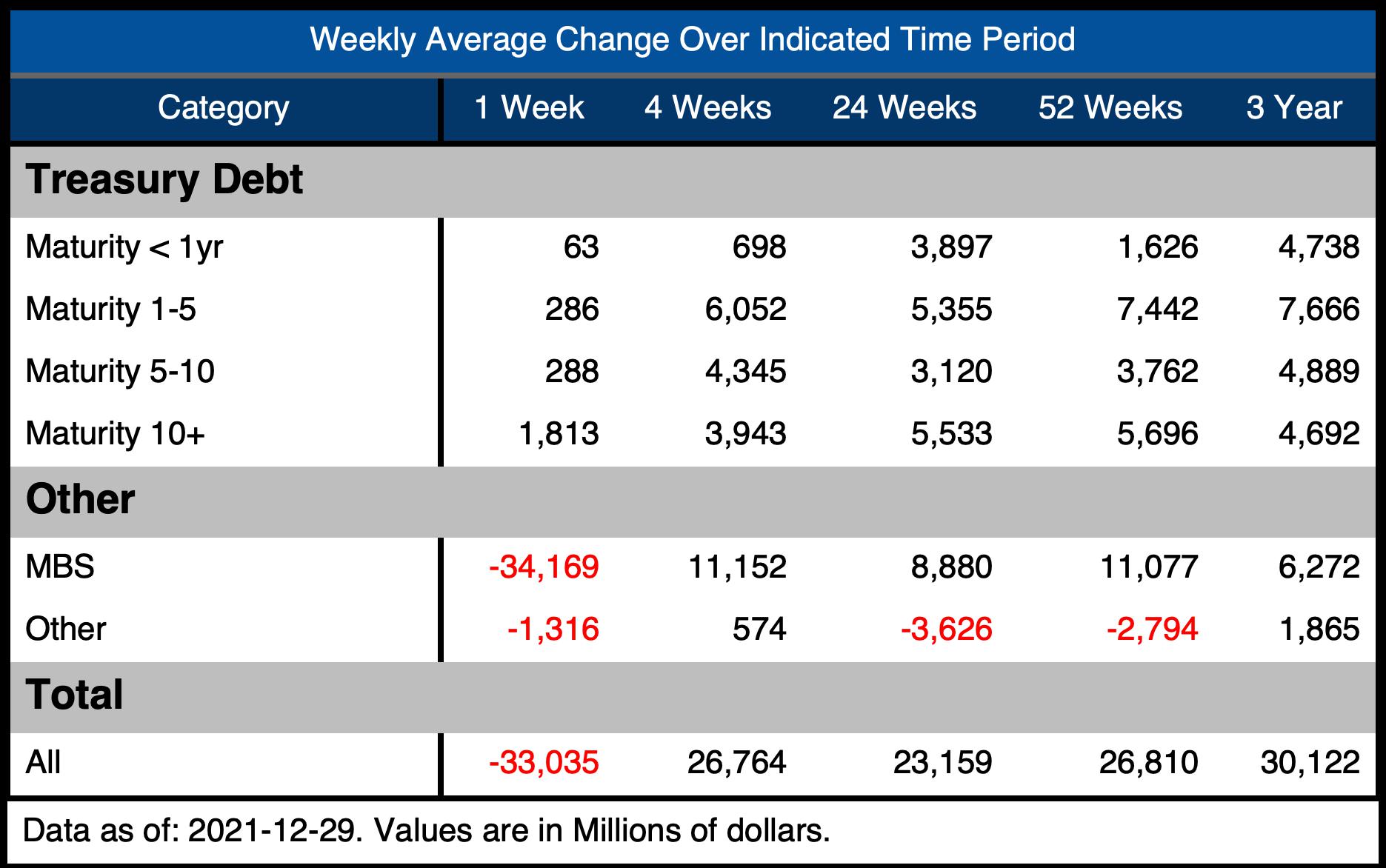

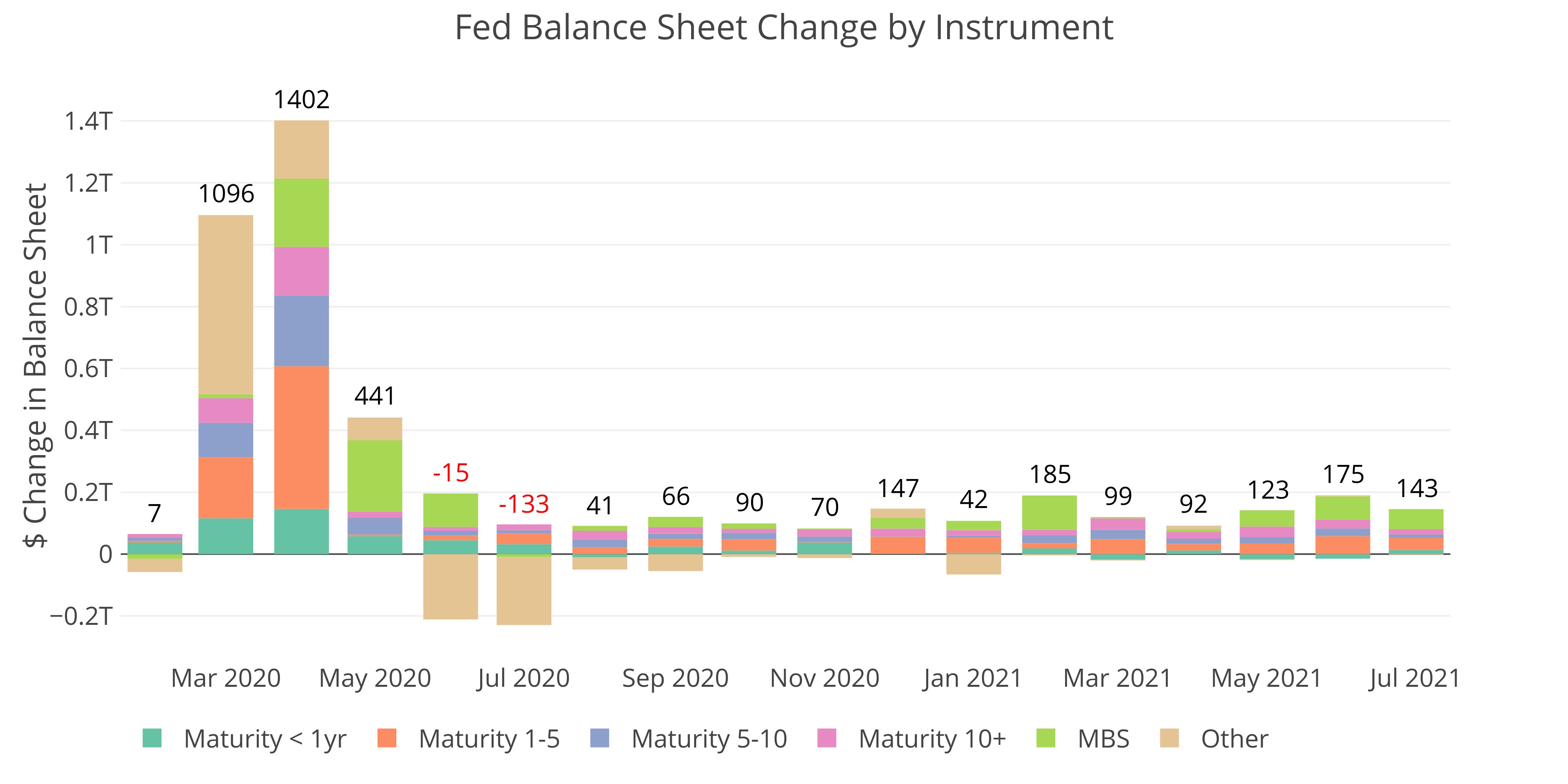

The Fed Drops QT to $5B a Month - Ensuring the Balance Sheet Will Stay Bloated

$5B a month is essentially nothing on a balance sheet of over $6T

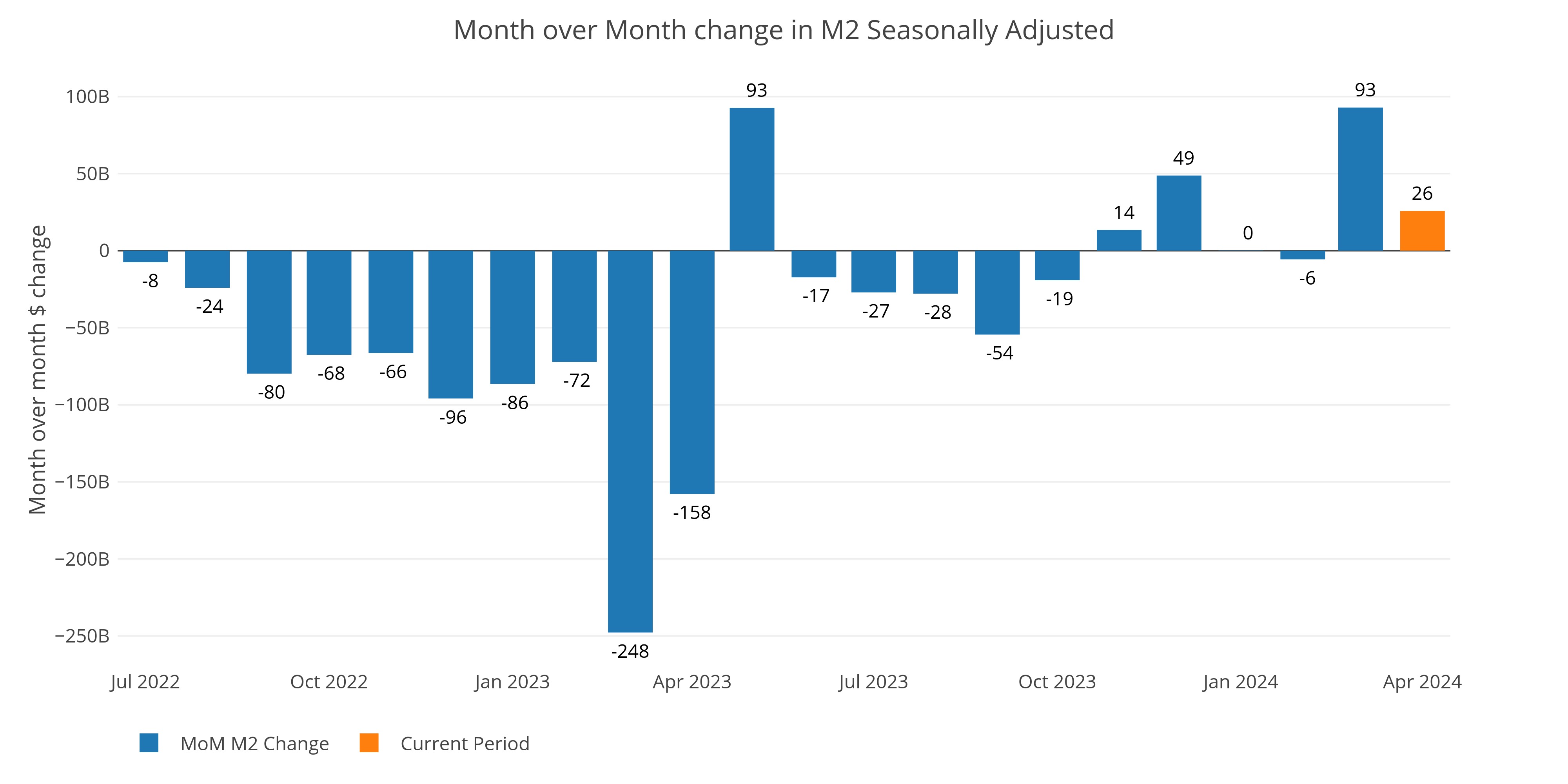

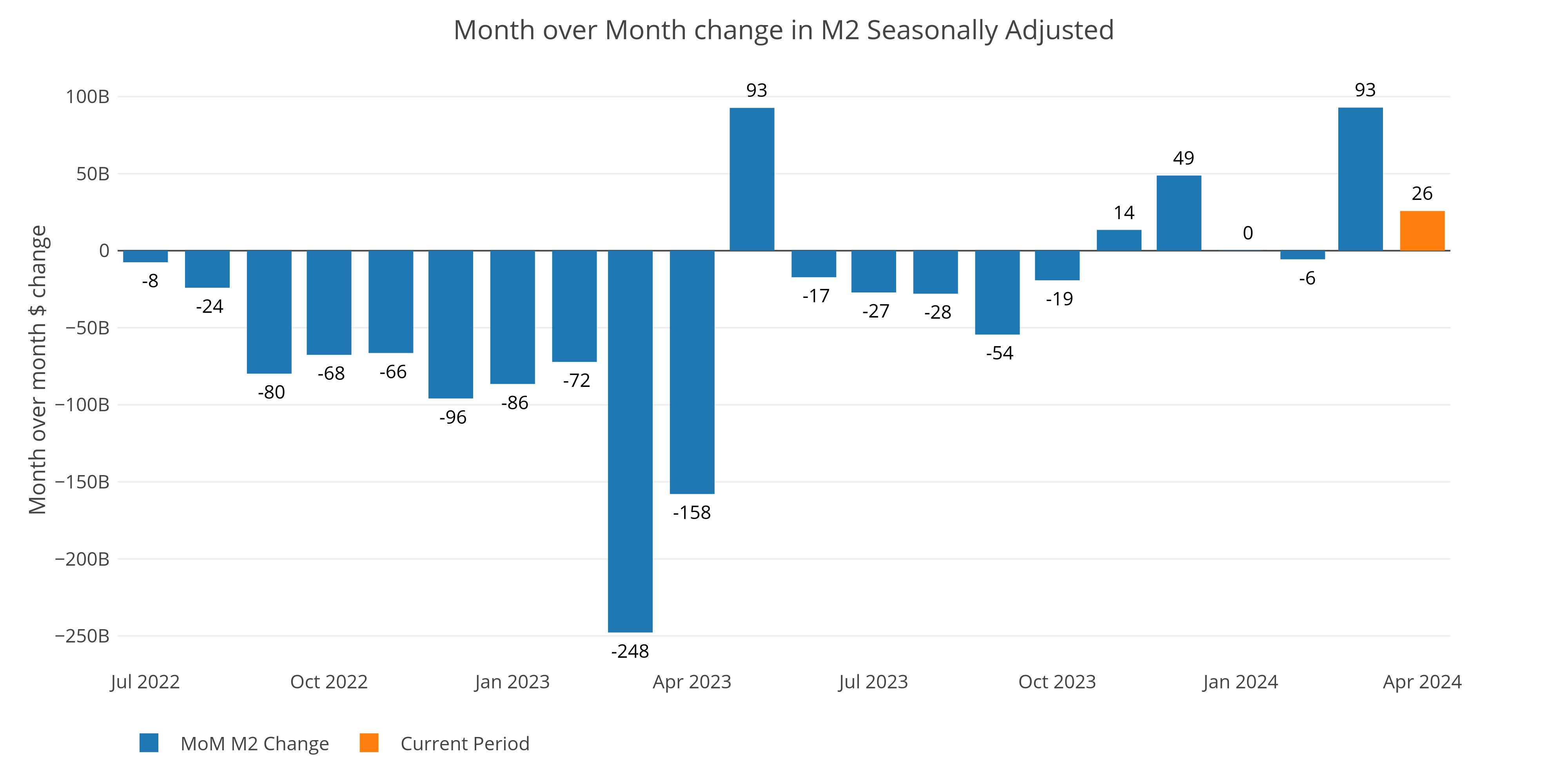

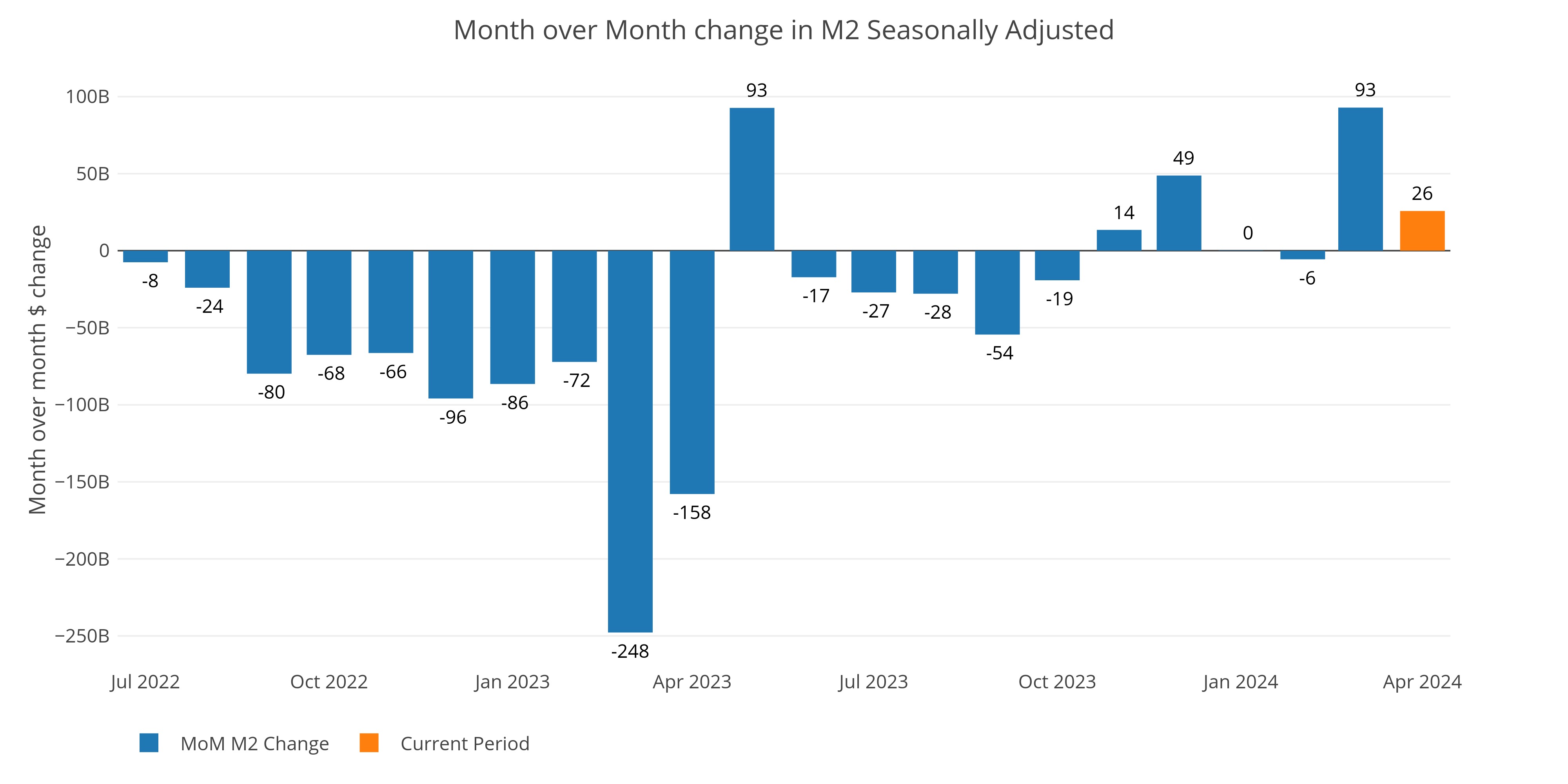

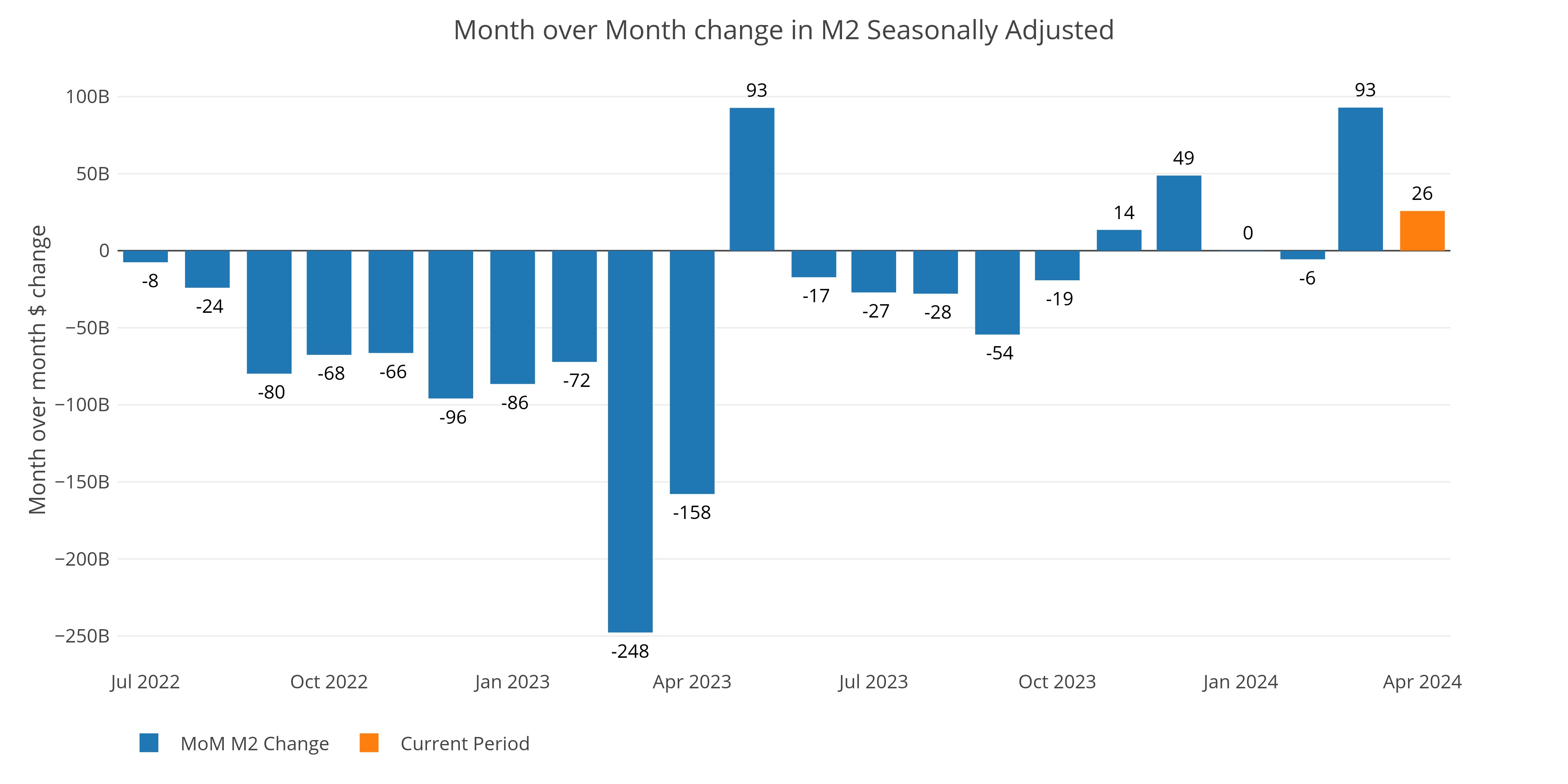

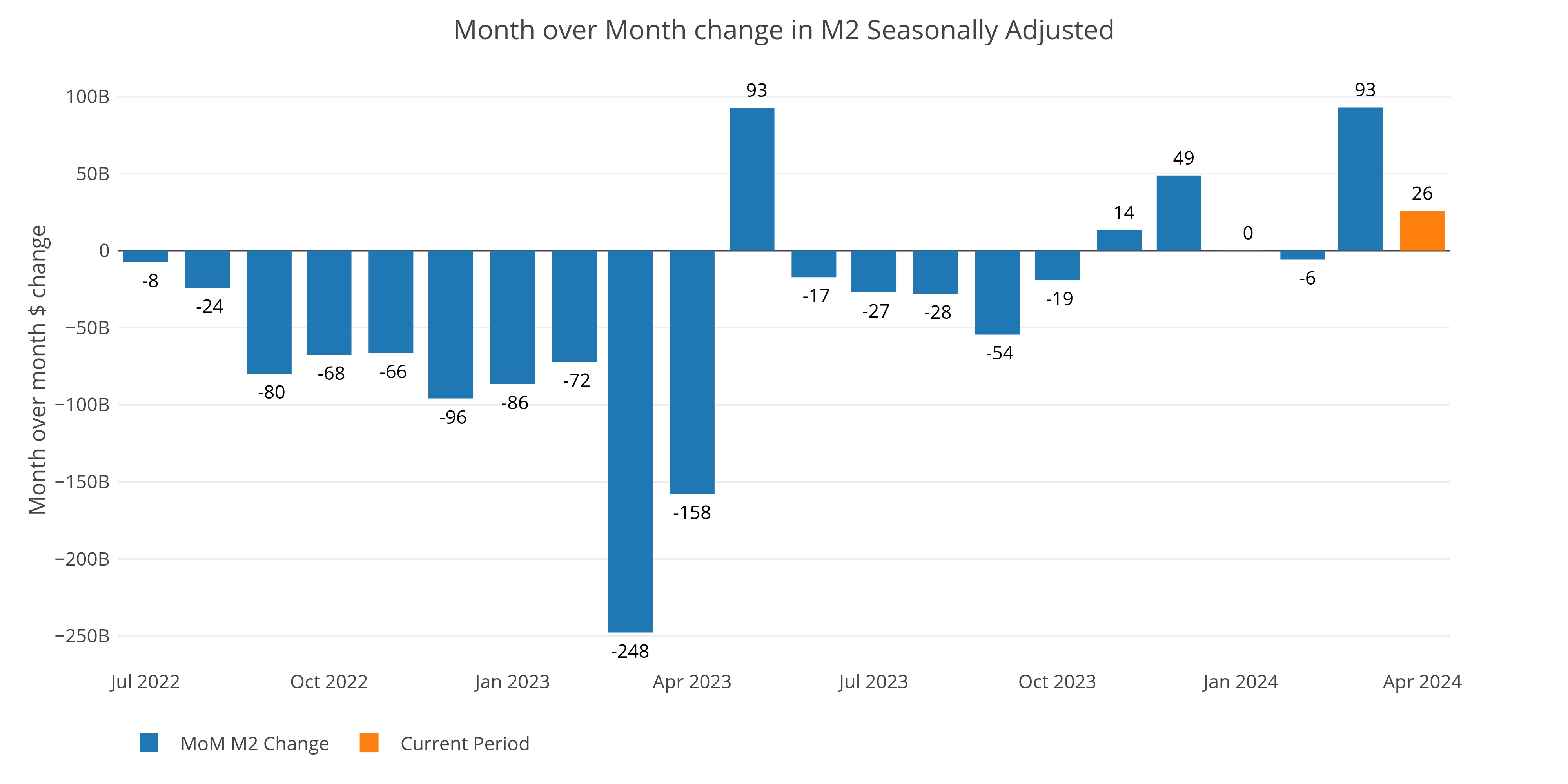

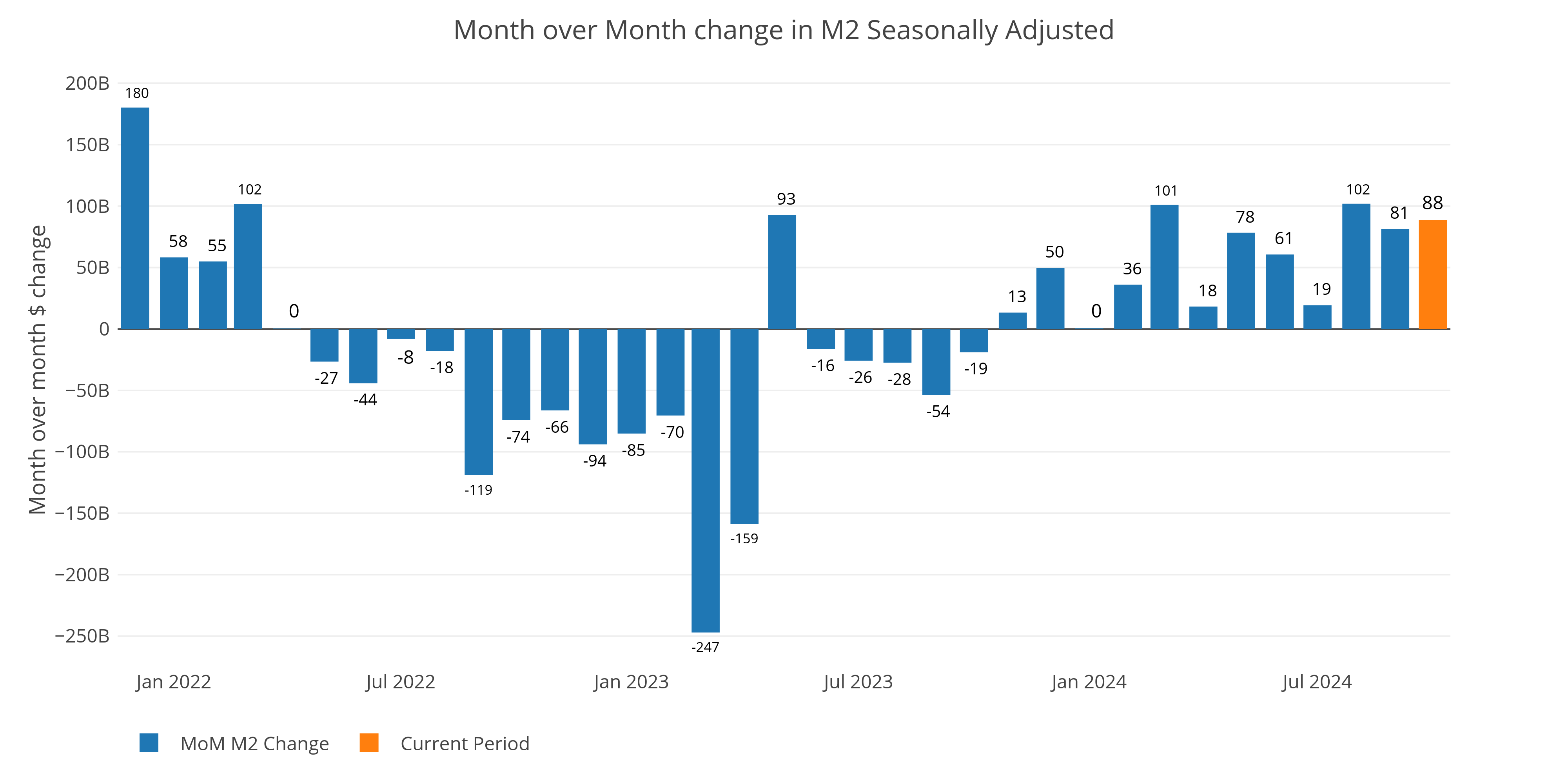

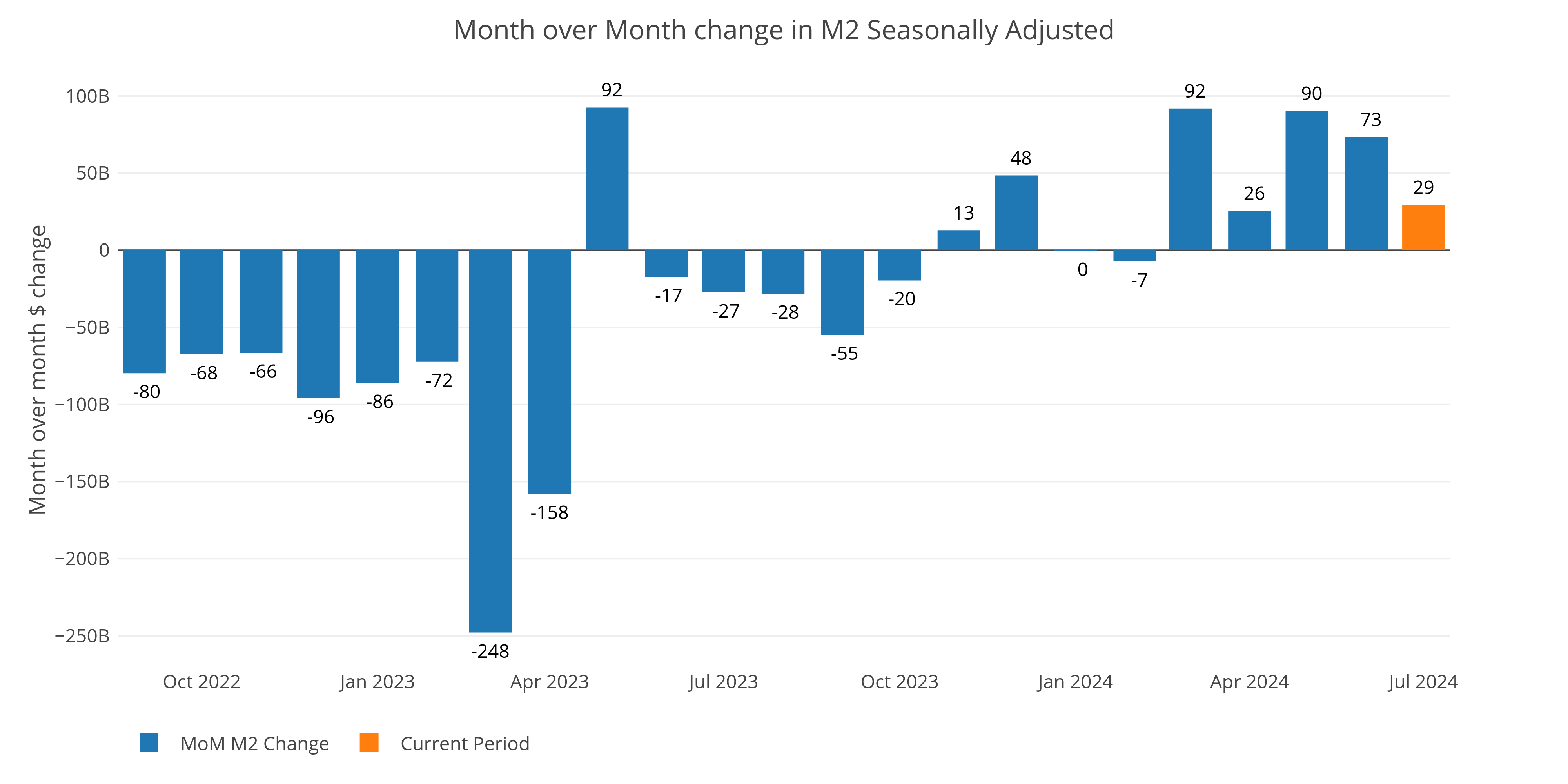

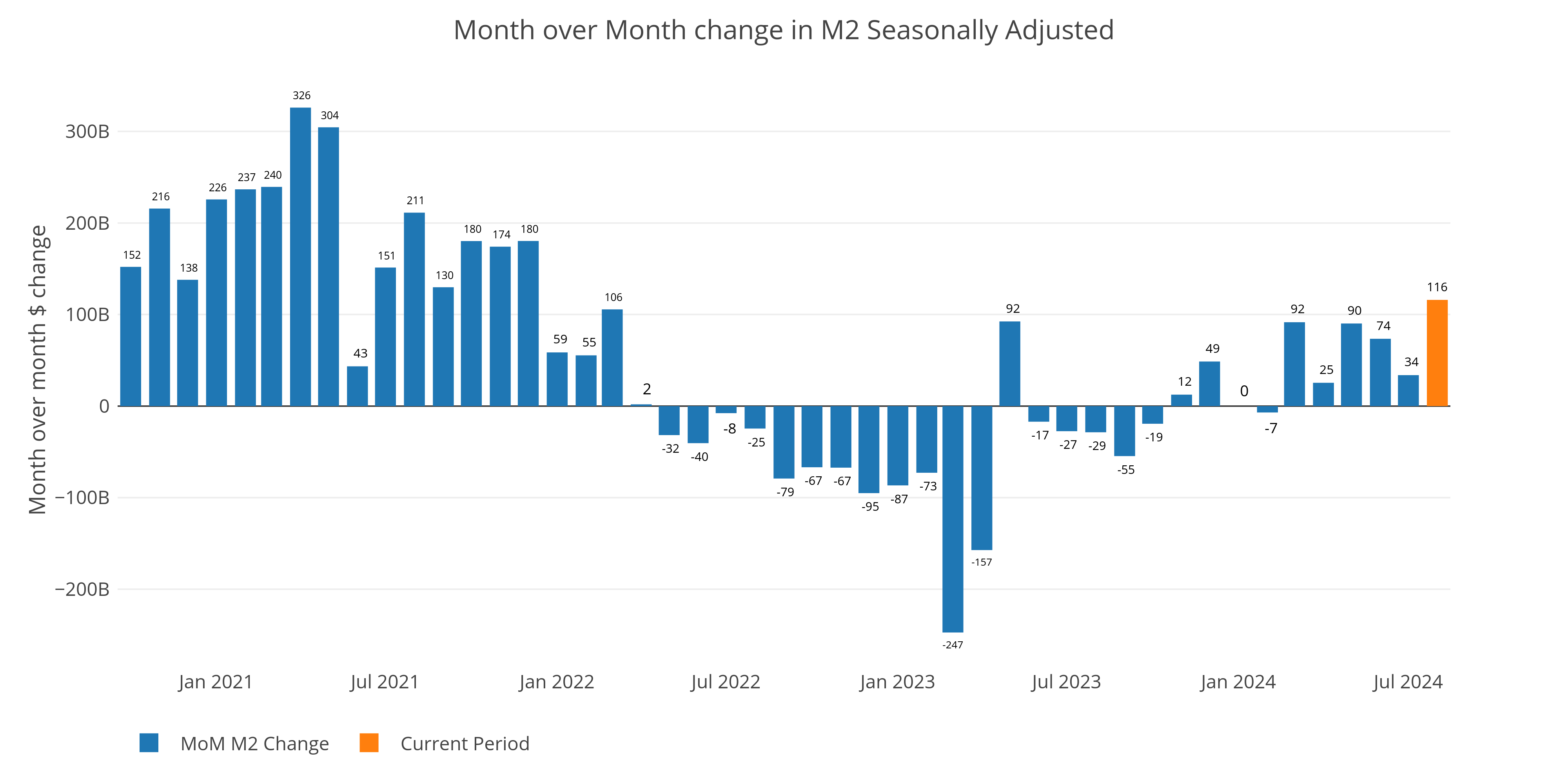

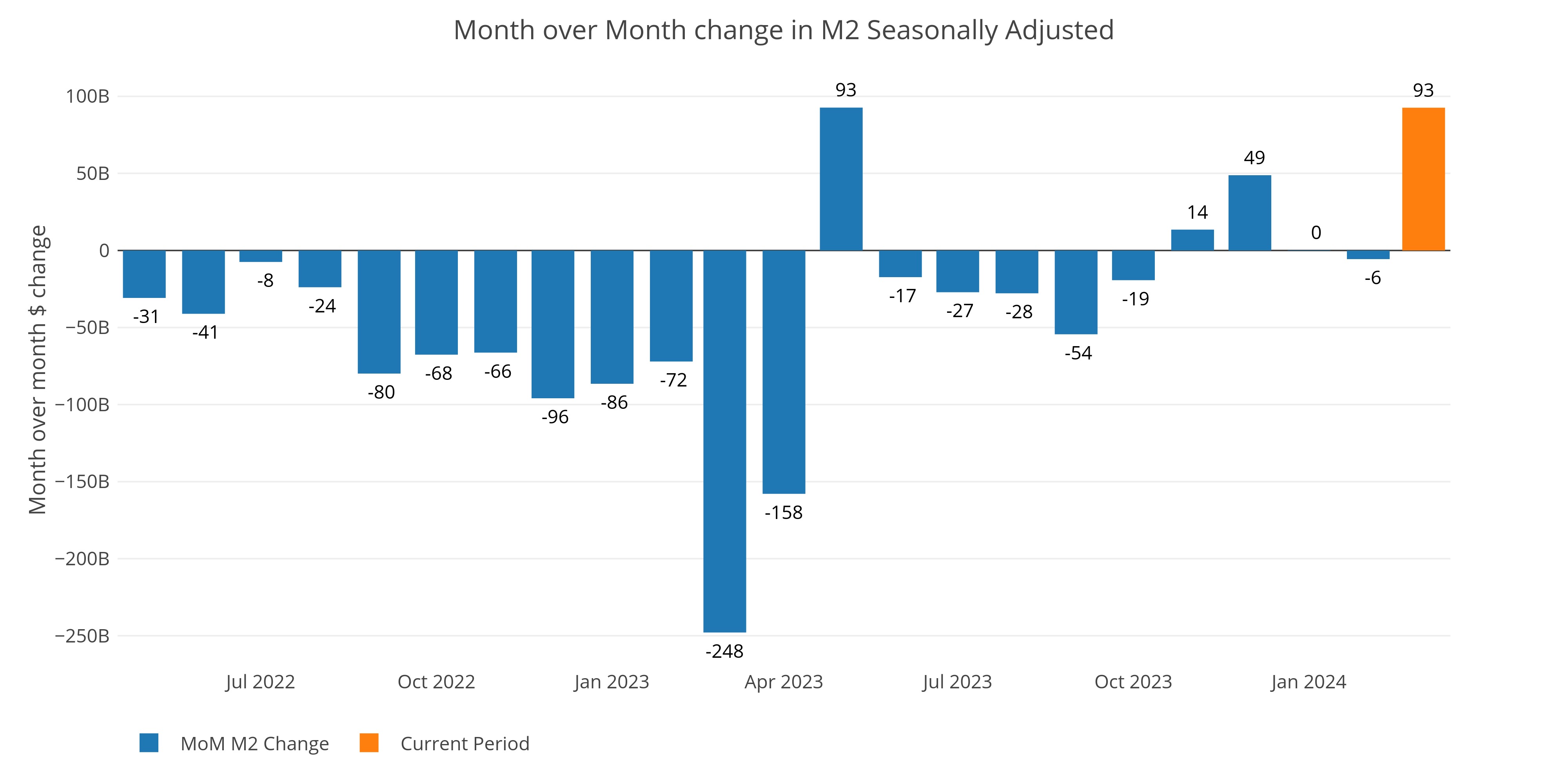

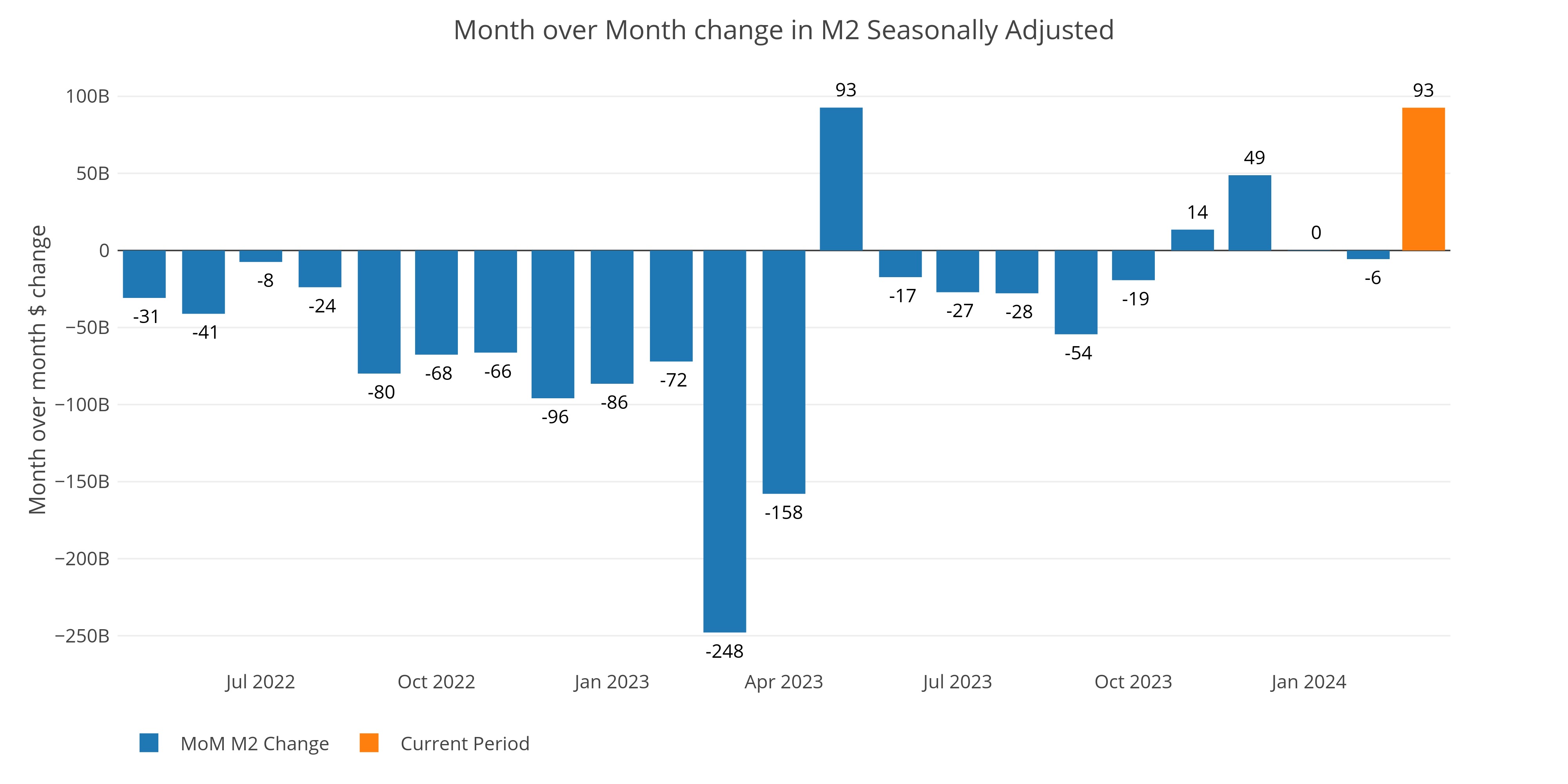

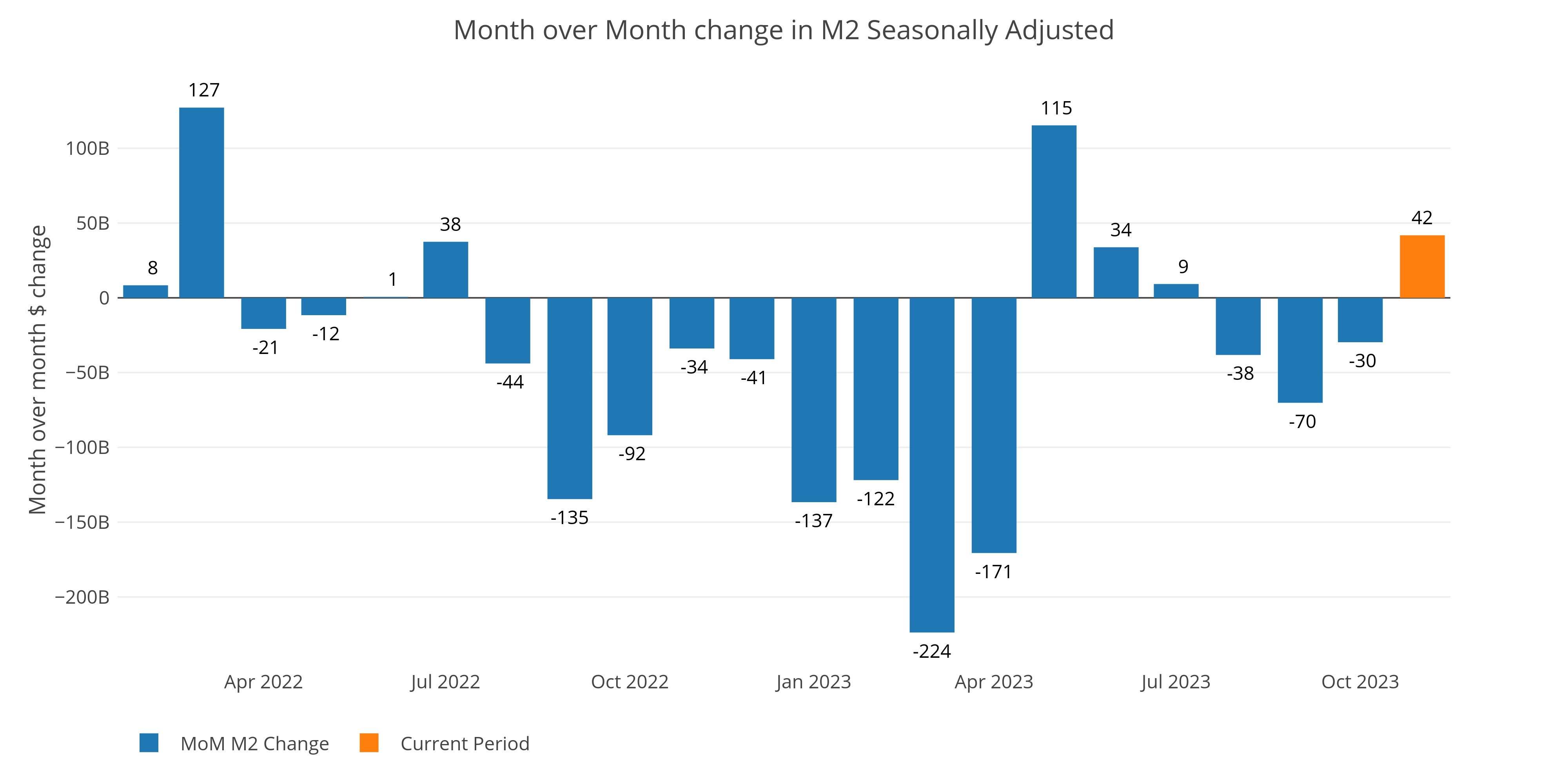

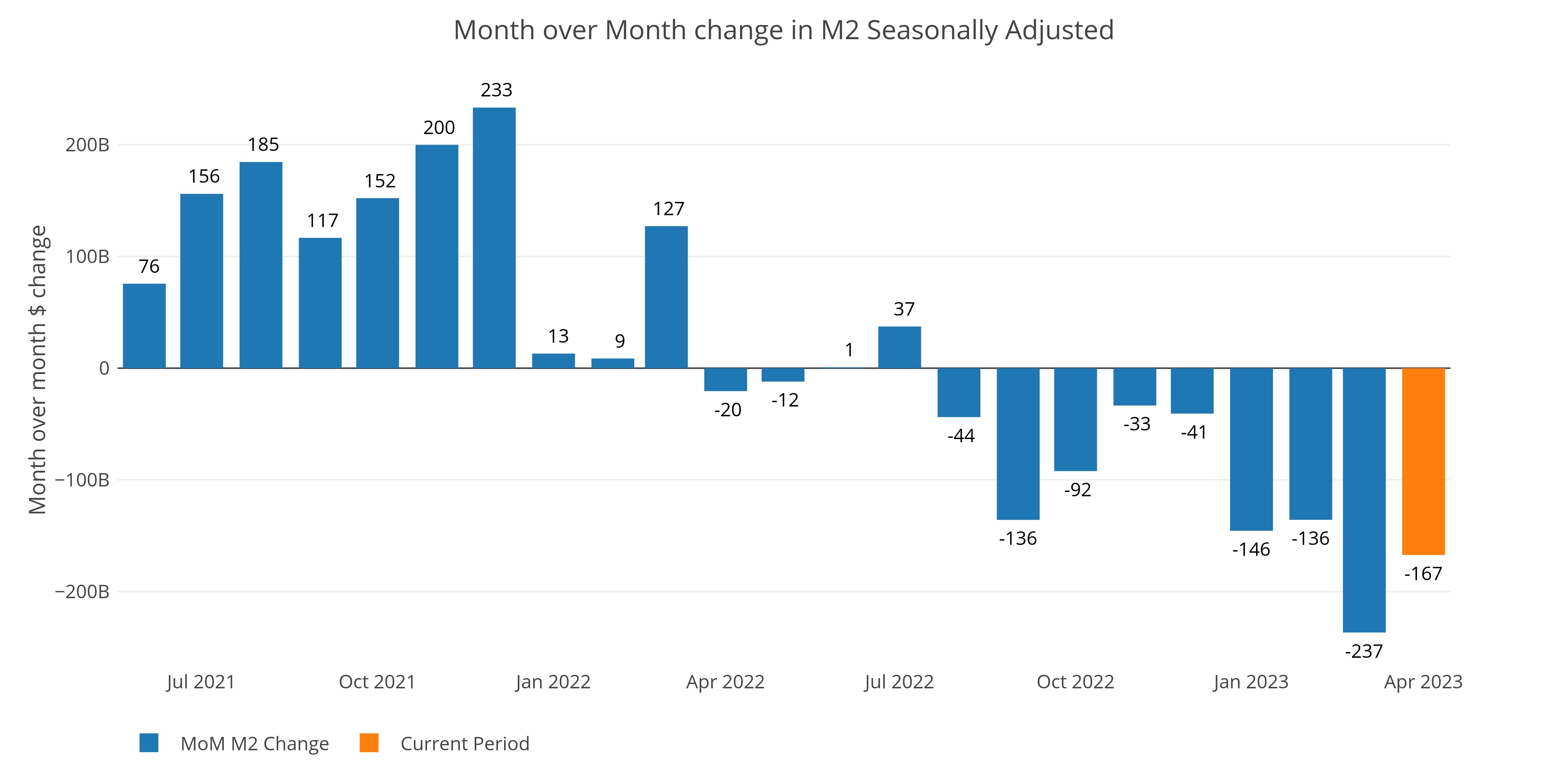

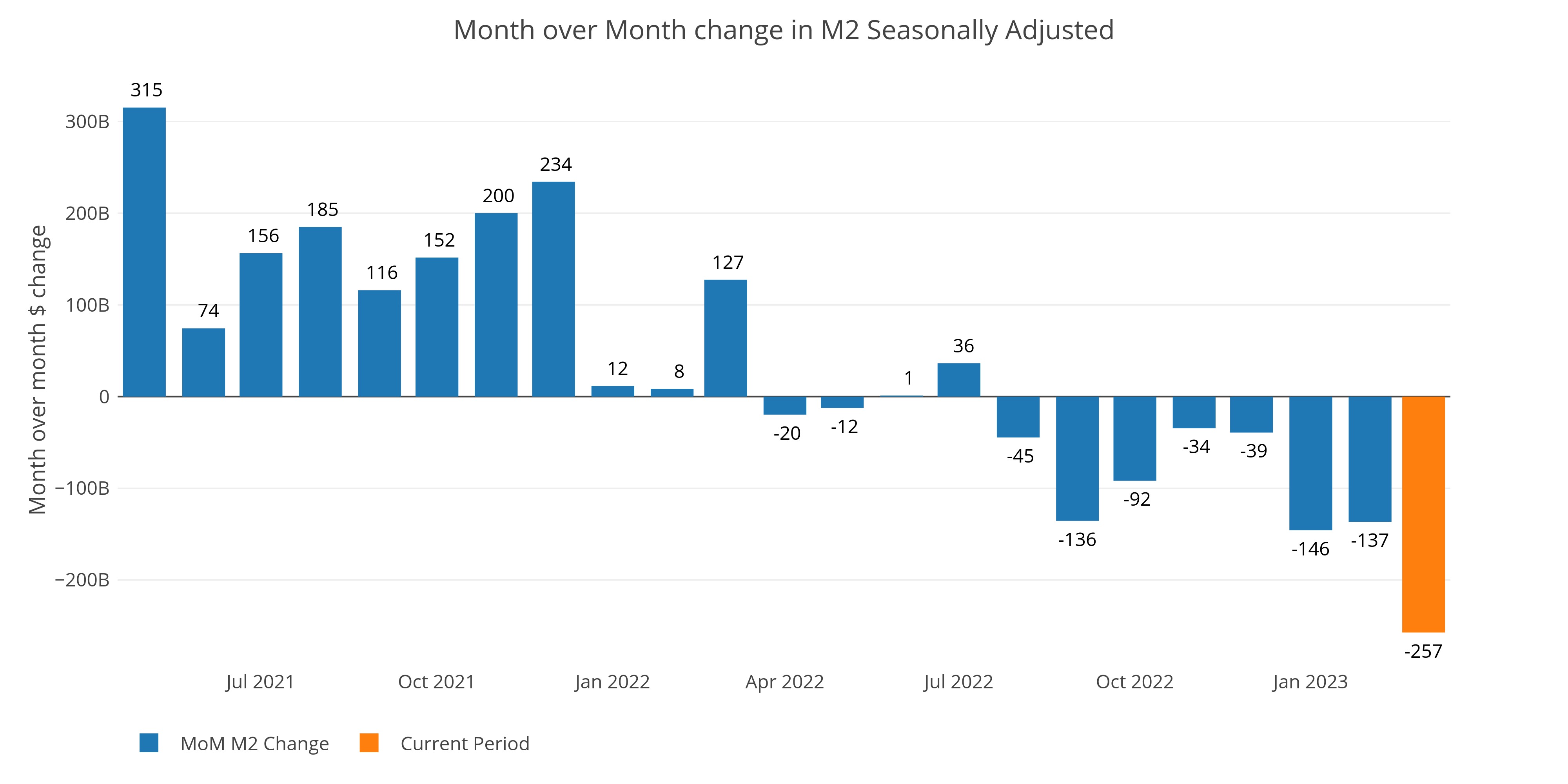

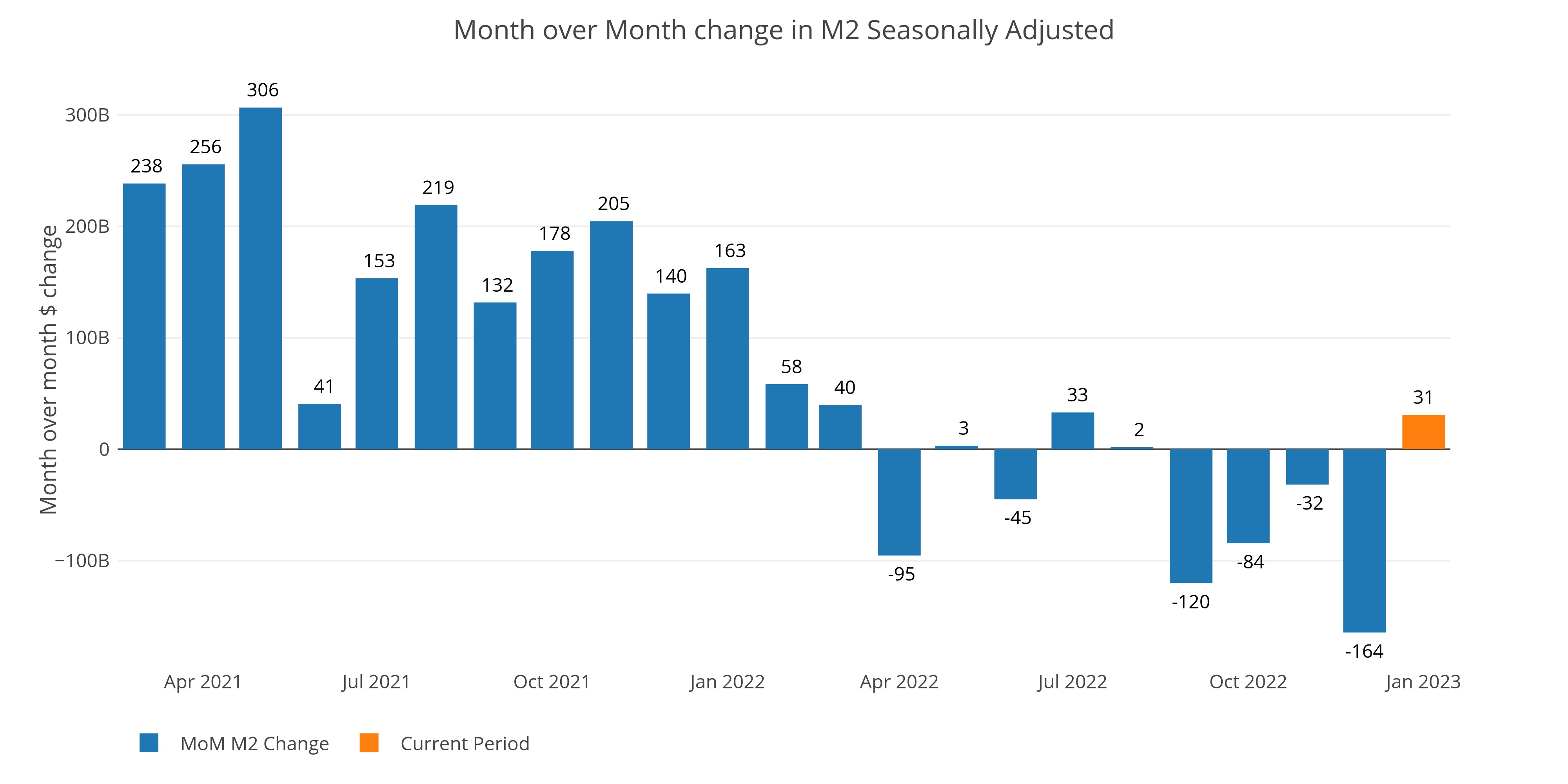

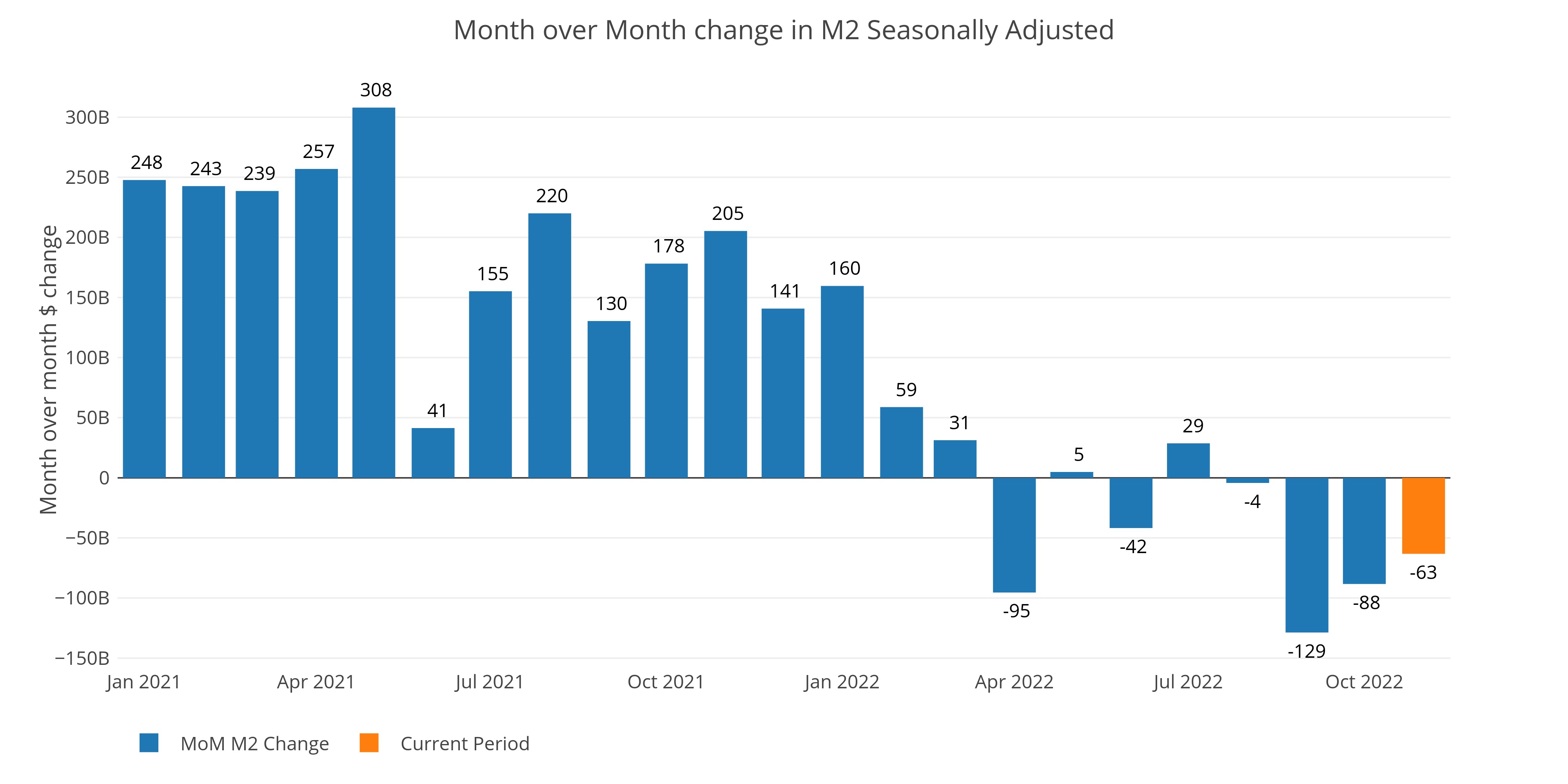

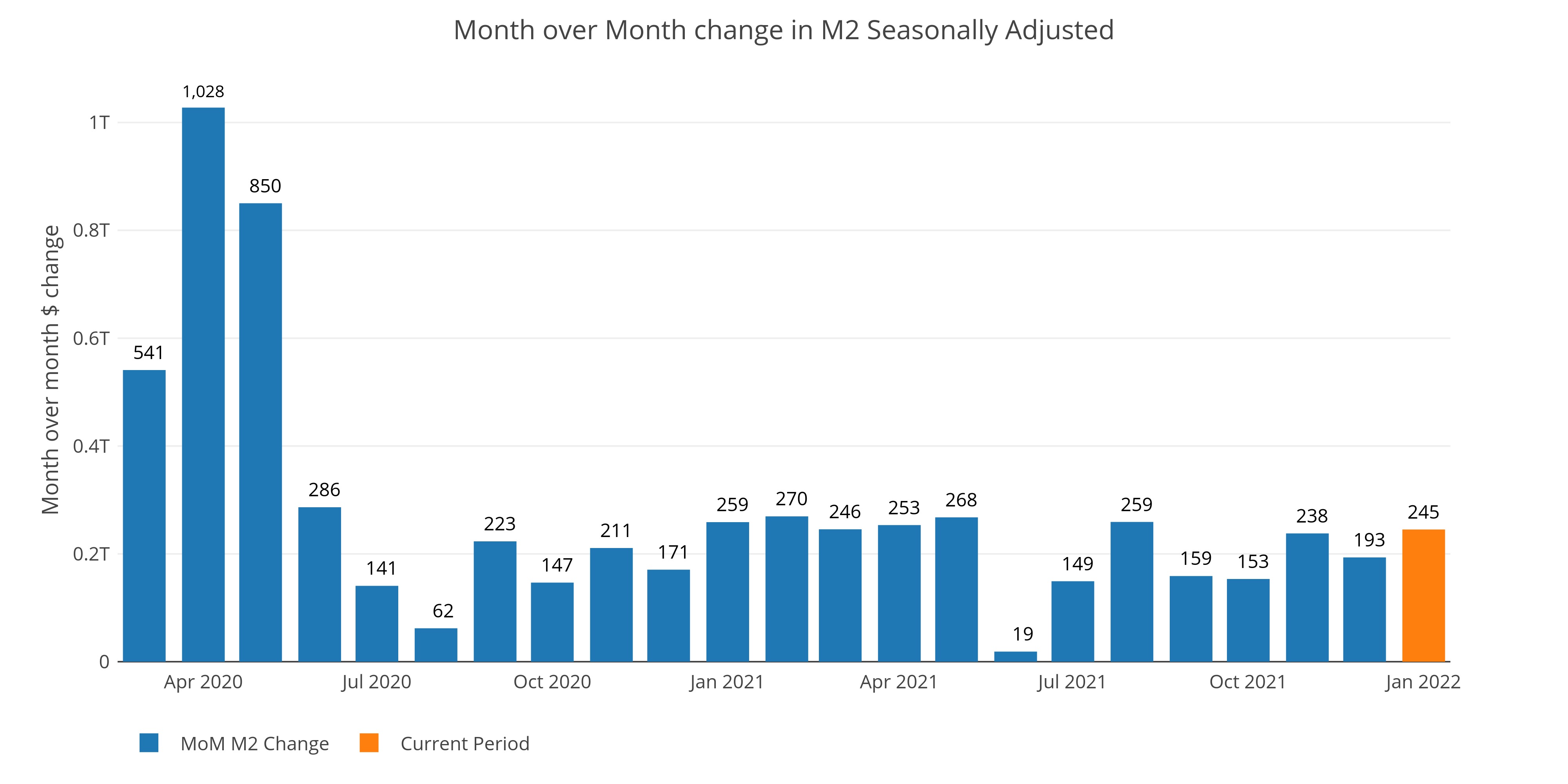

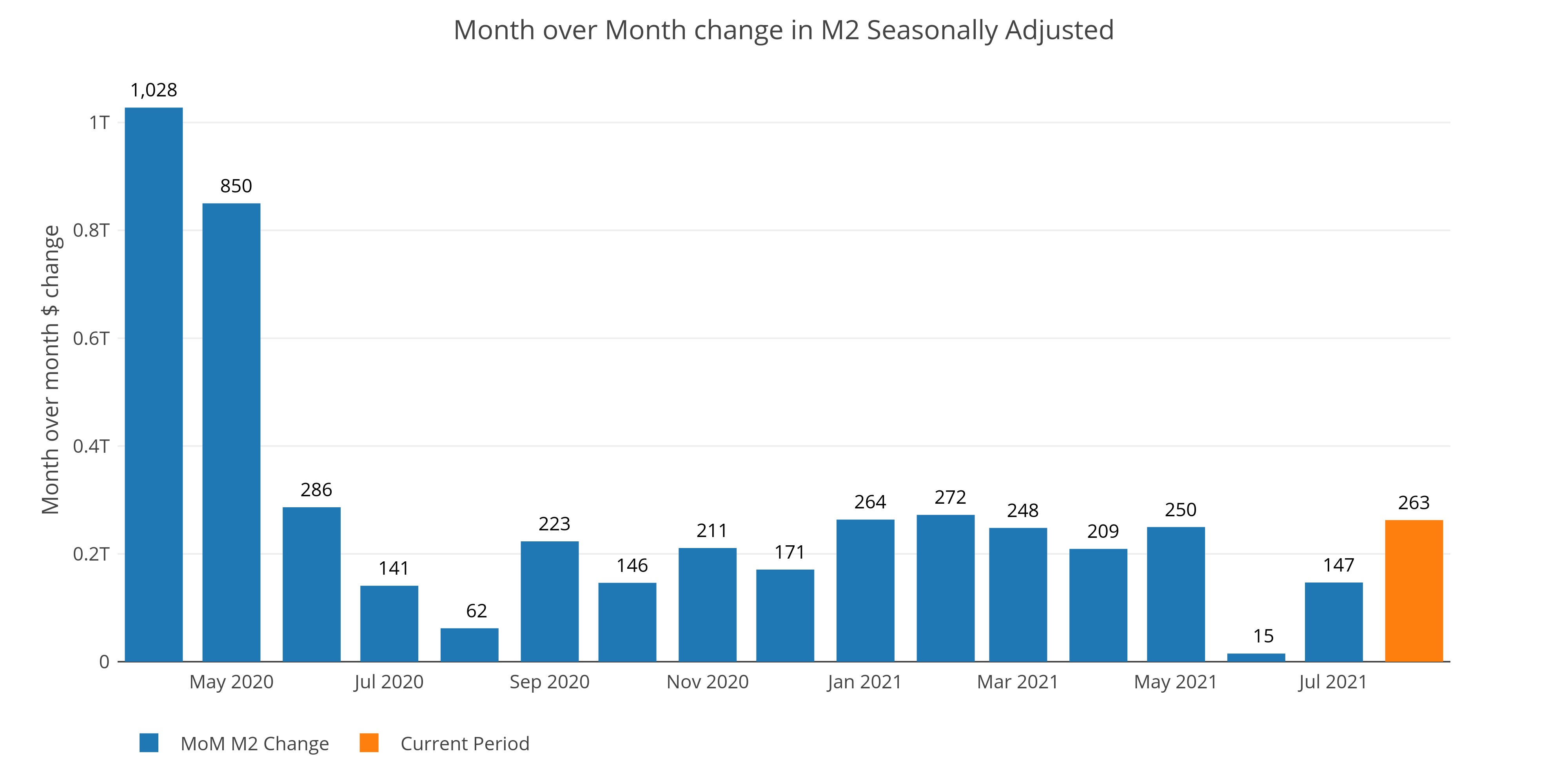

M2 Money Supply Grows by Most in 2 Years

13 week growth has started accelerating again

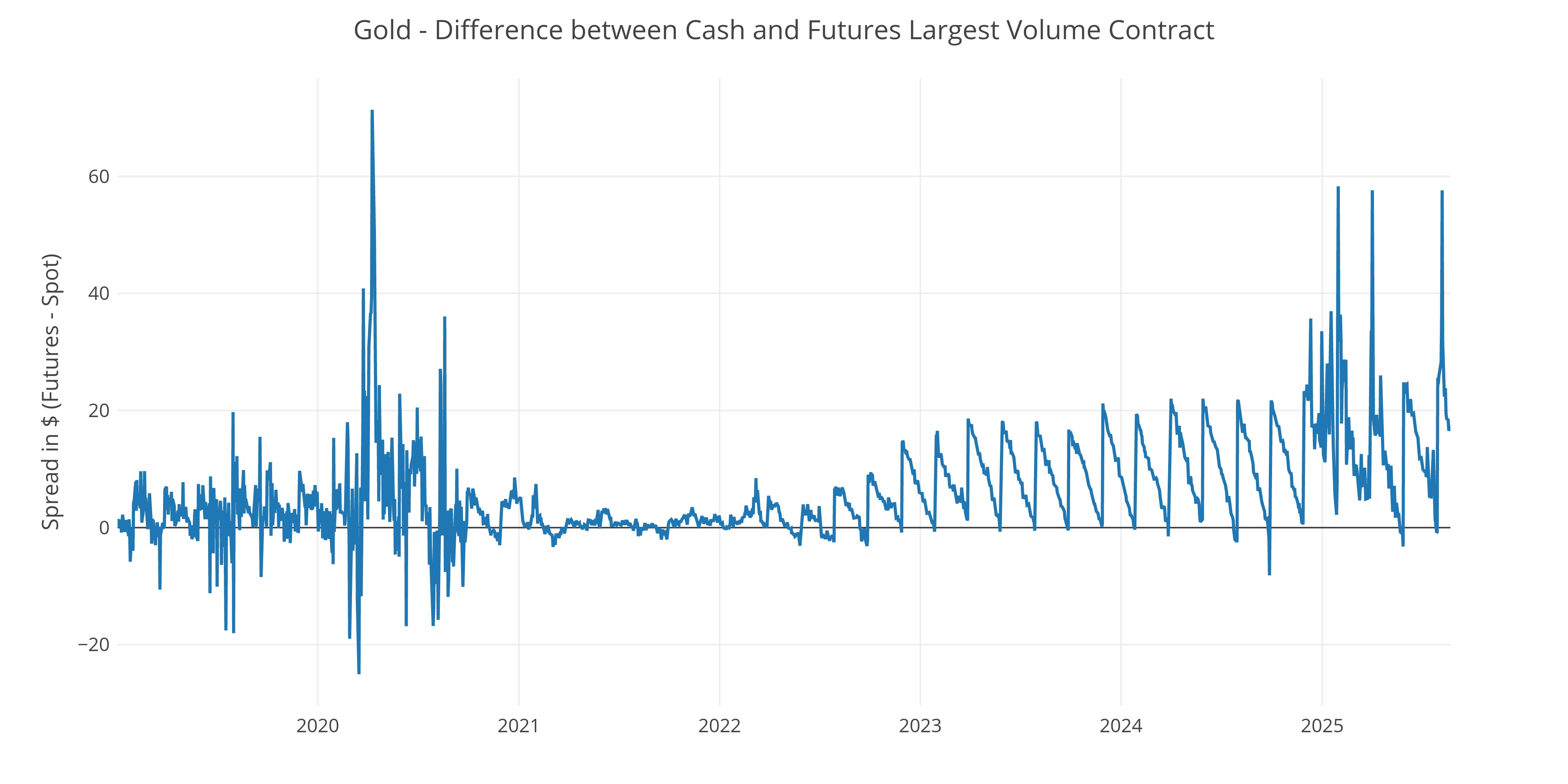

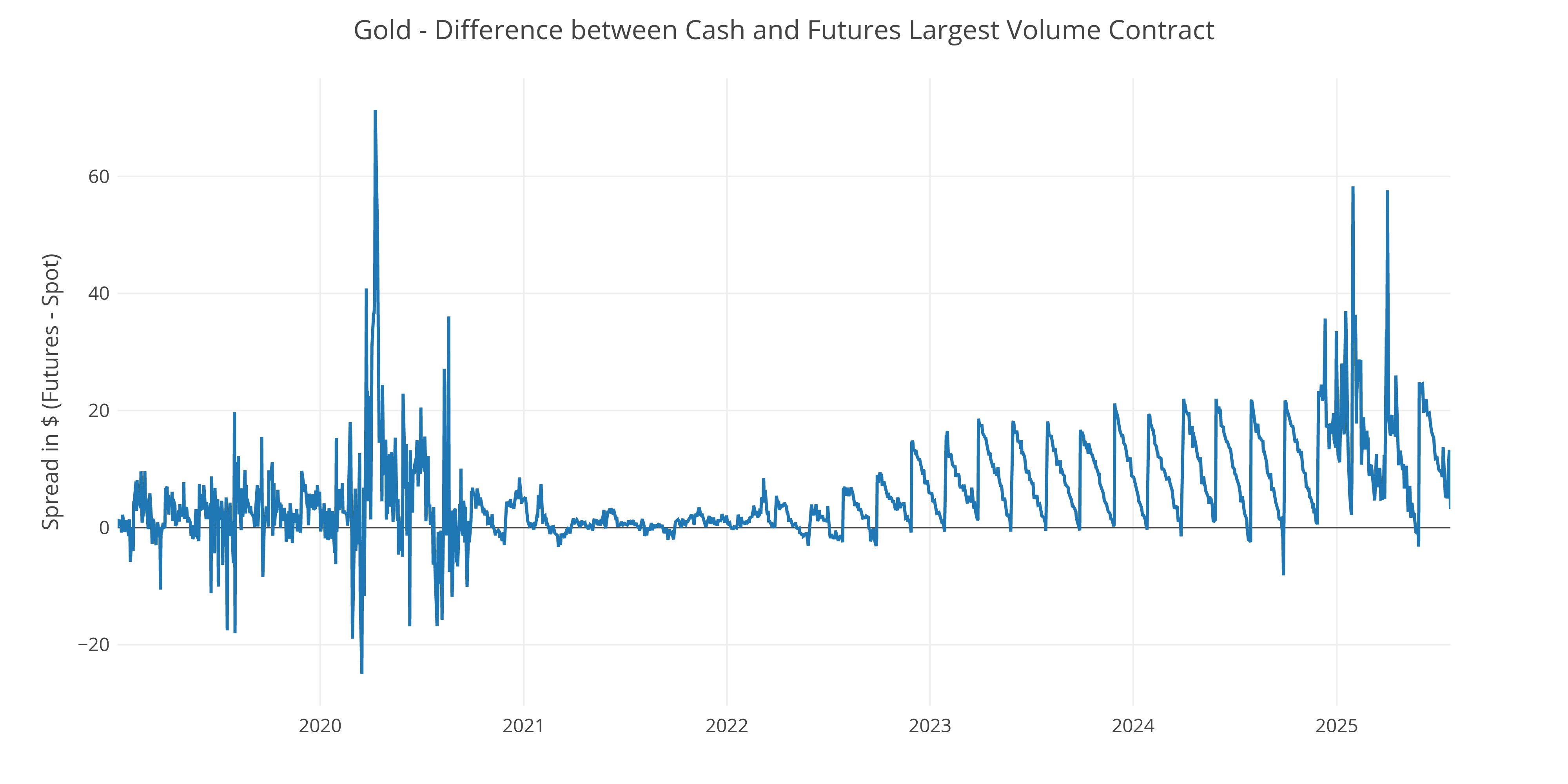

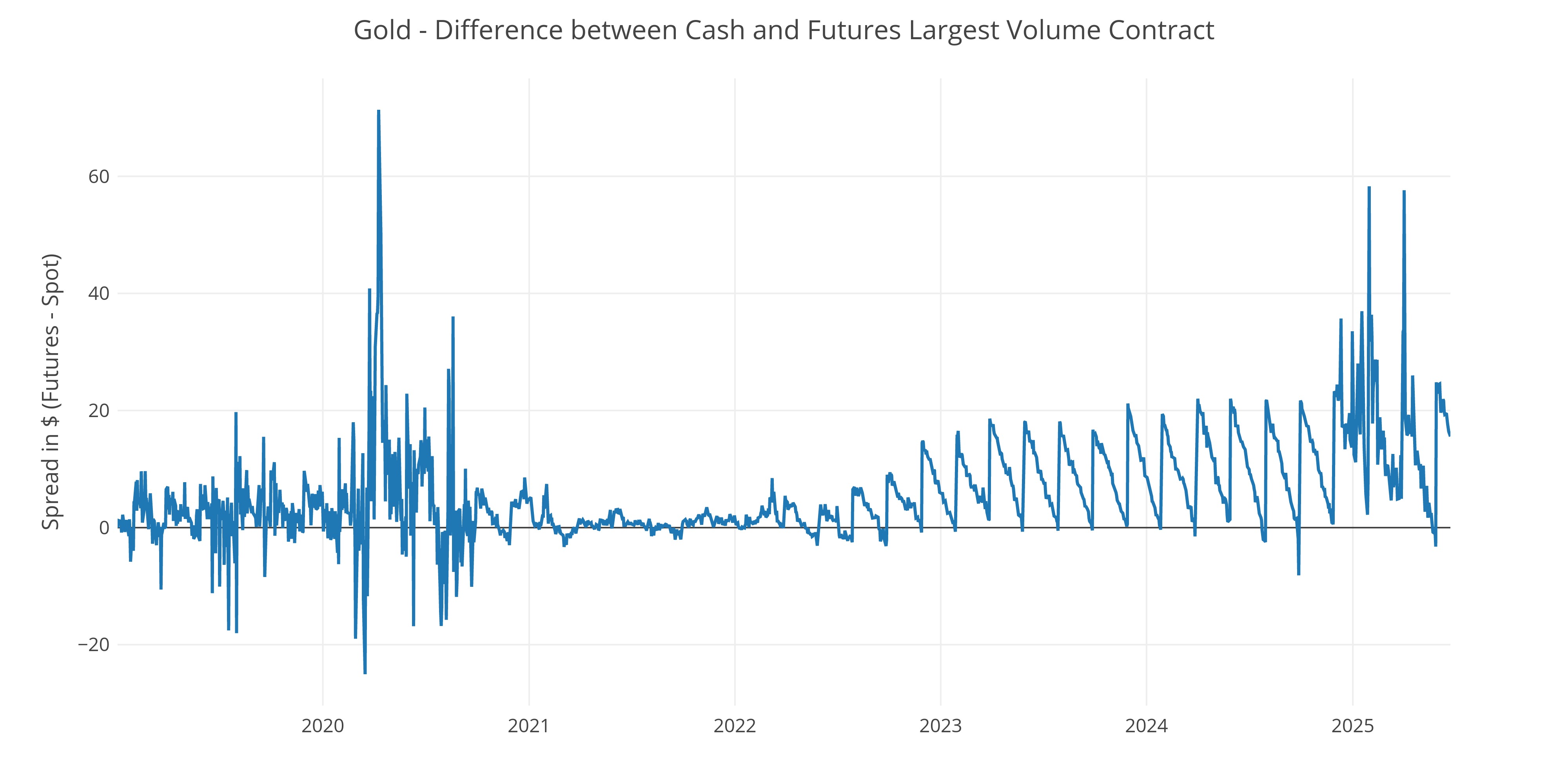

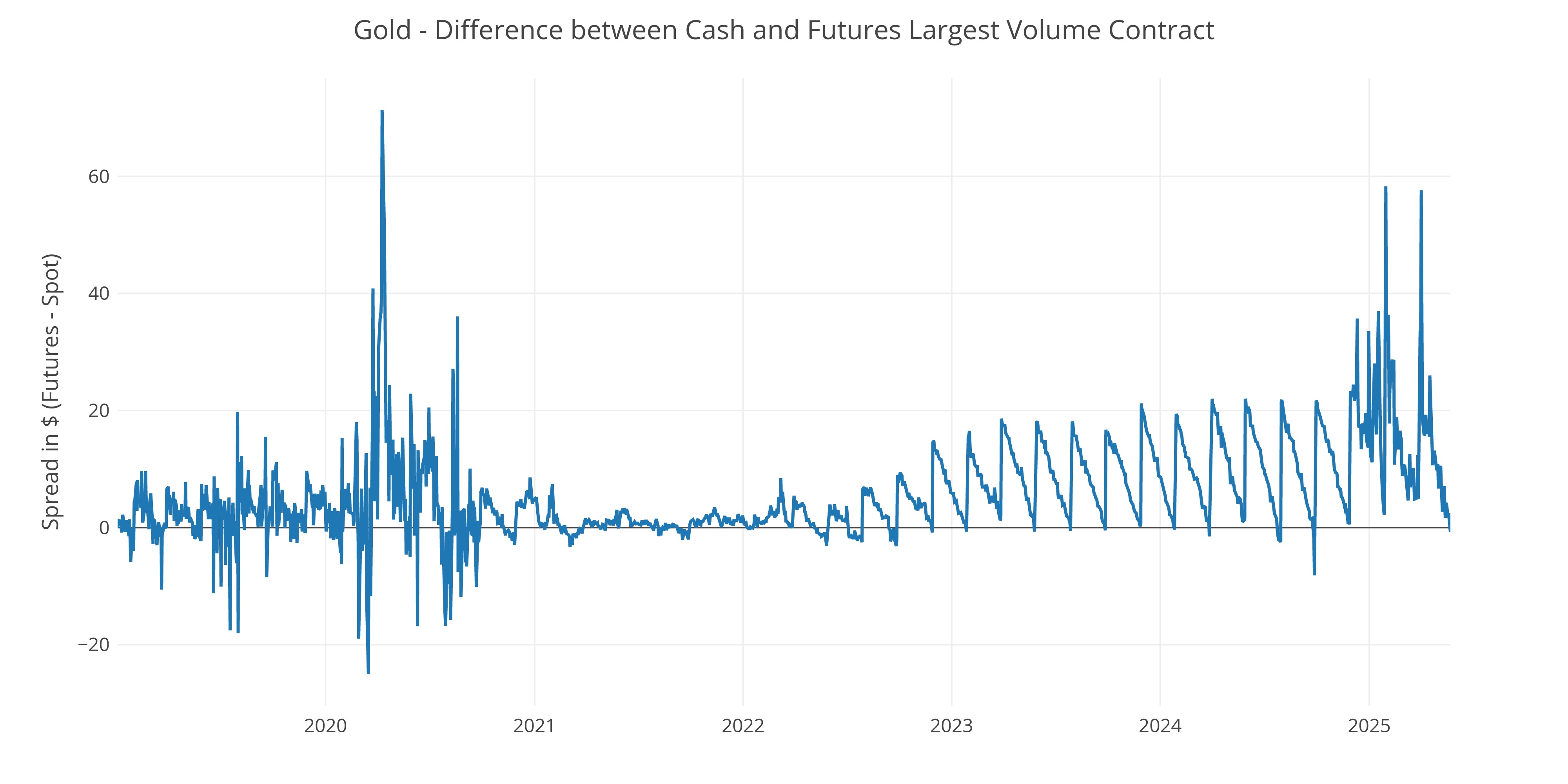

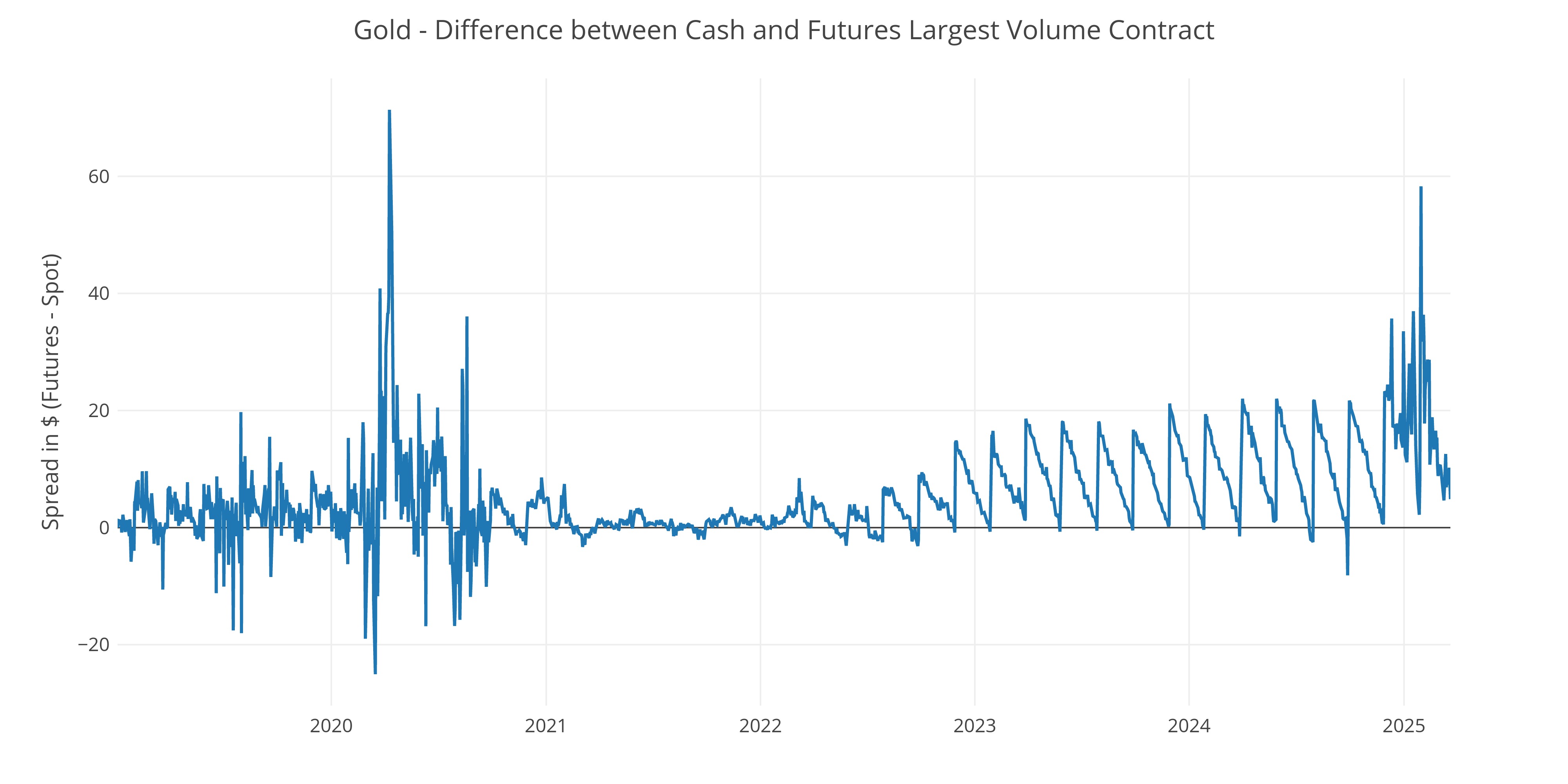

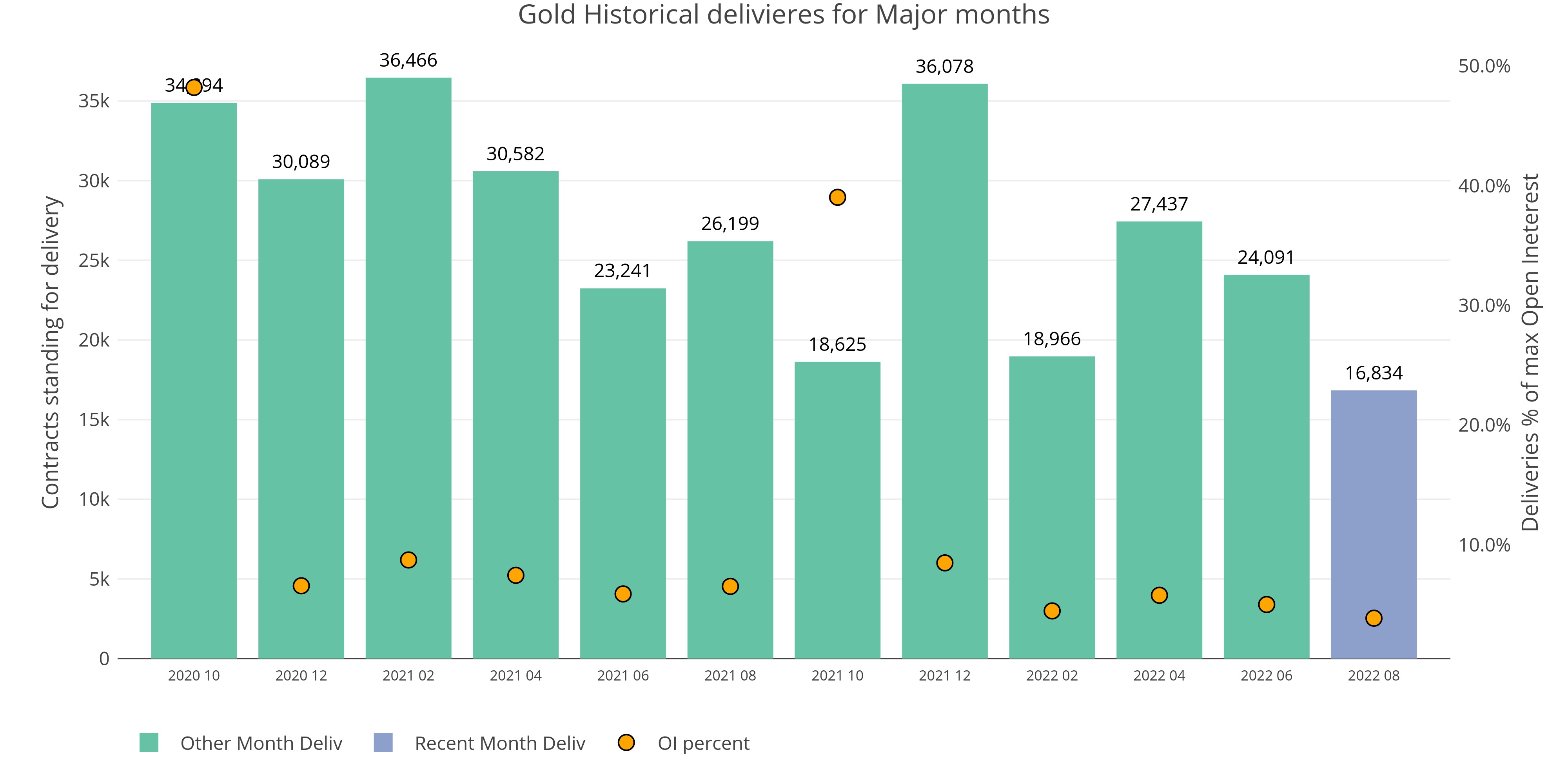

Delivery Demand on the Comex Remains at Record Levels

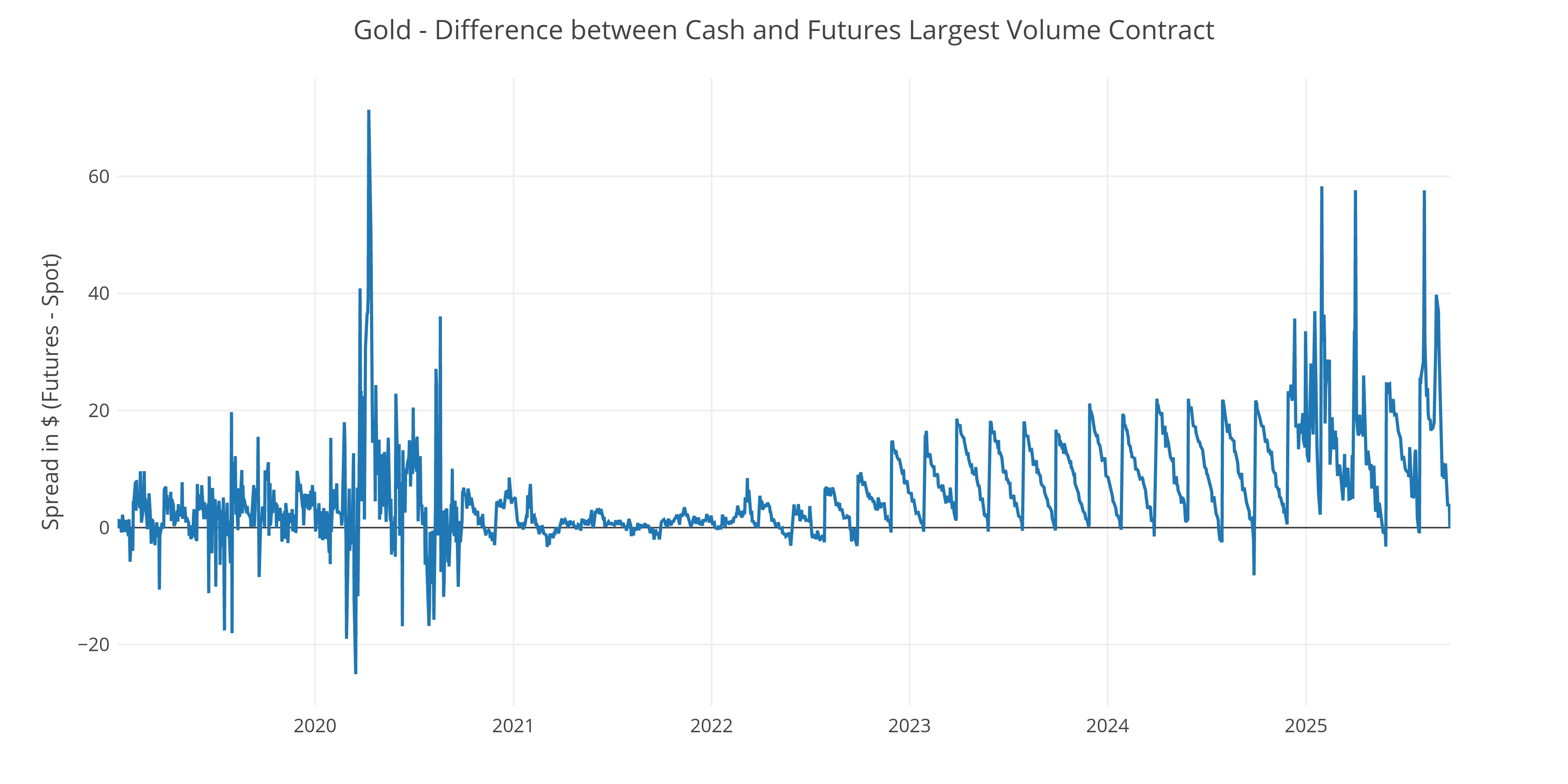

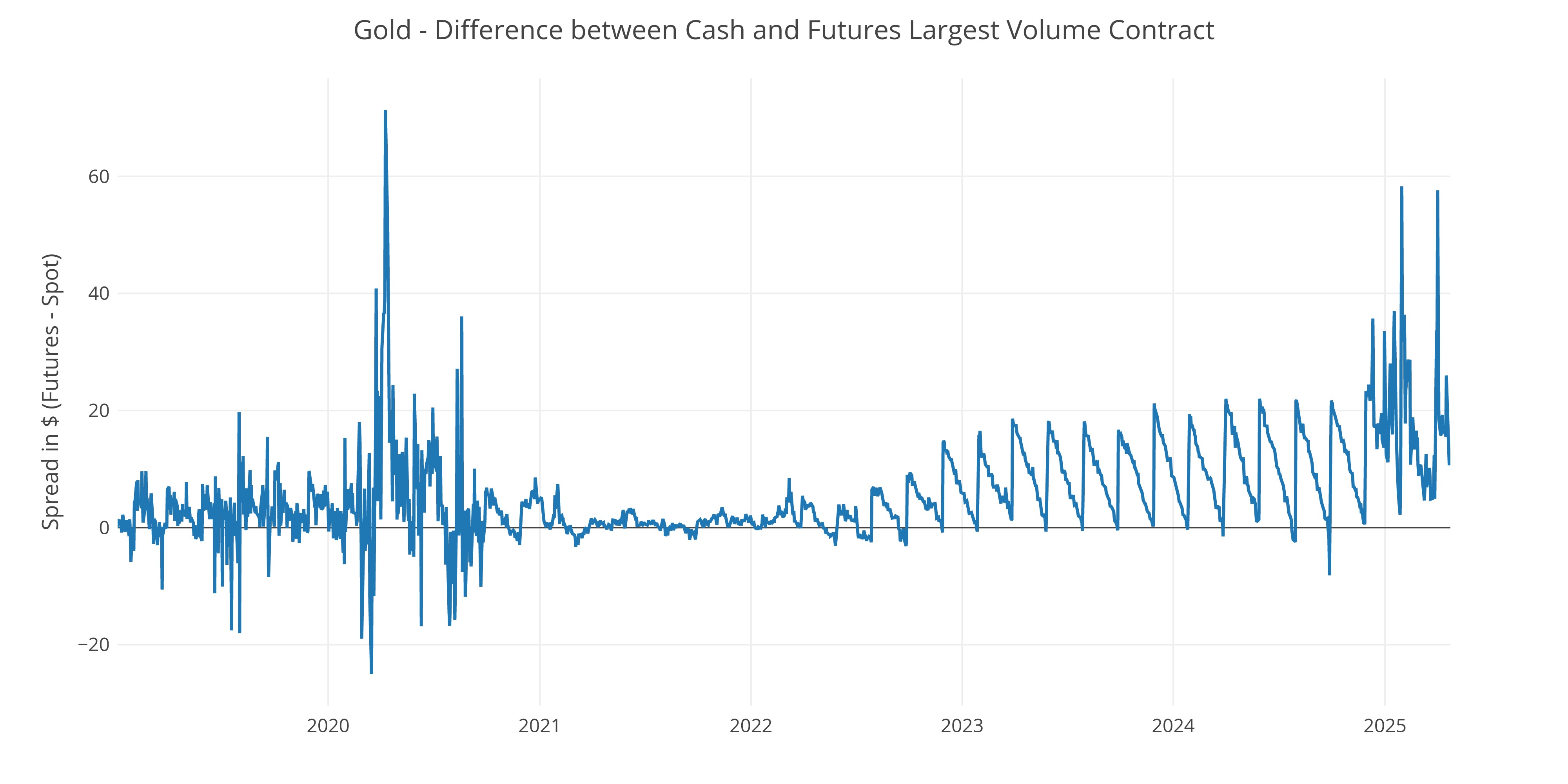

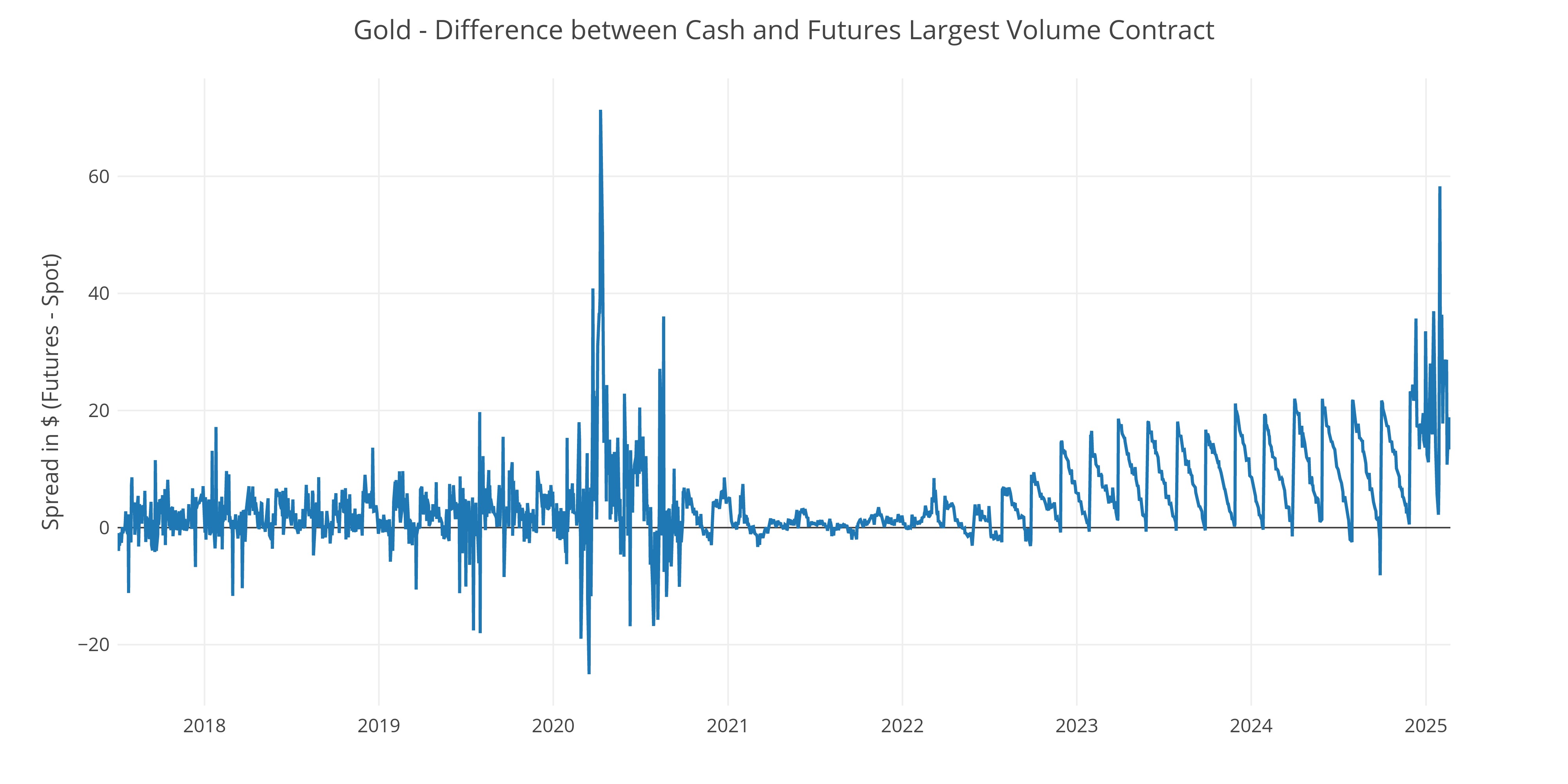

Despite the arbitrage opportunity collapsing, deliveries continue unabated

Treasury Has Paid Out $941B in Interest Over the Last 12 Months

Debt ceiling has been hit, prompting extraordinary measures by the Treasury

Treasury Has Paid Out $941B in Interest Over the Last 12 Months

Debt ceiling has been hit, prompting extraordinary measures by the Treasury

Jobs: Last Three Months Saw Downward Revisions of 57k on Average

This report was decent but may get revised lower

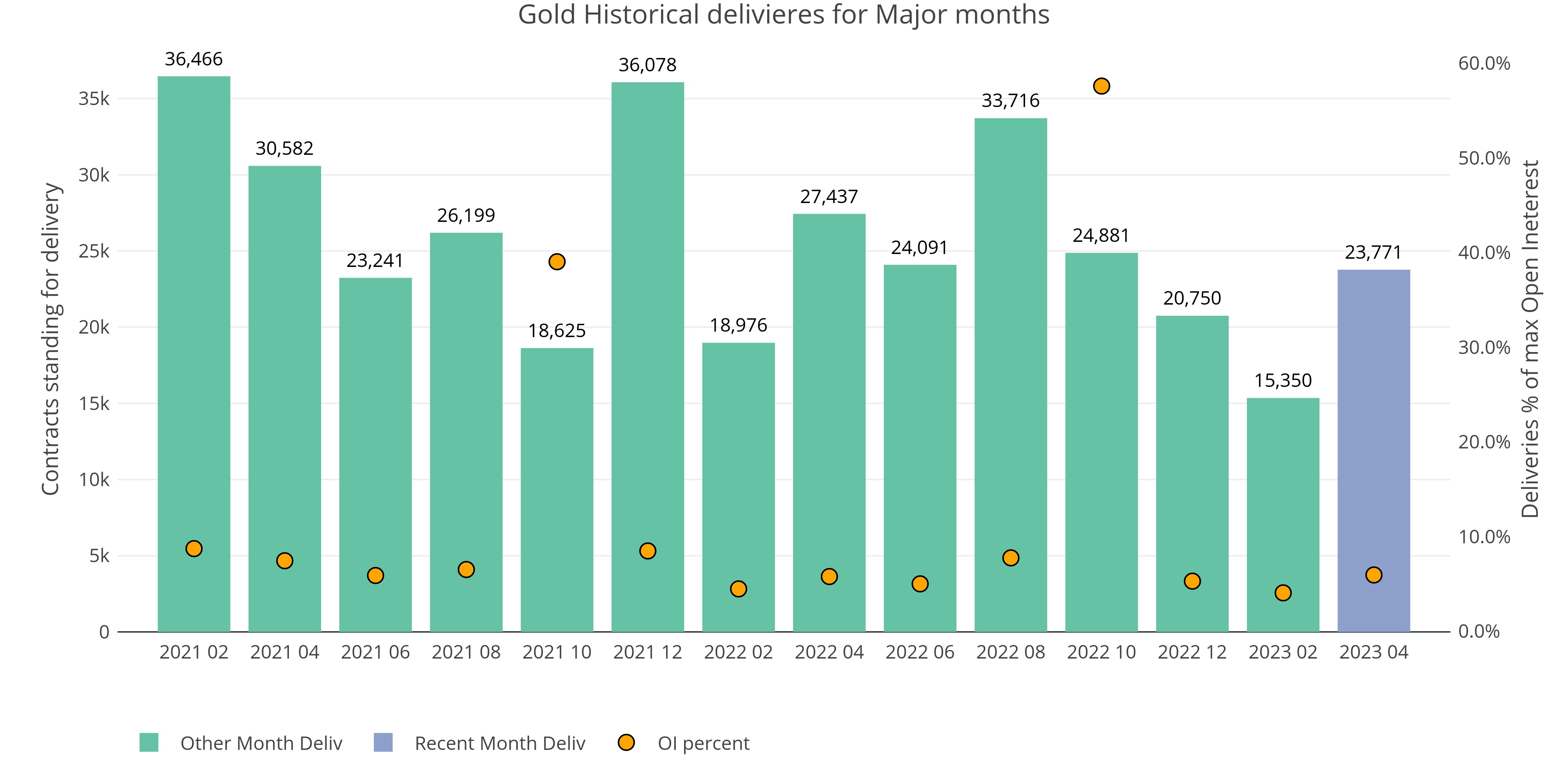

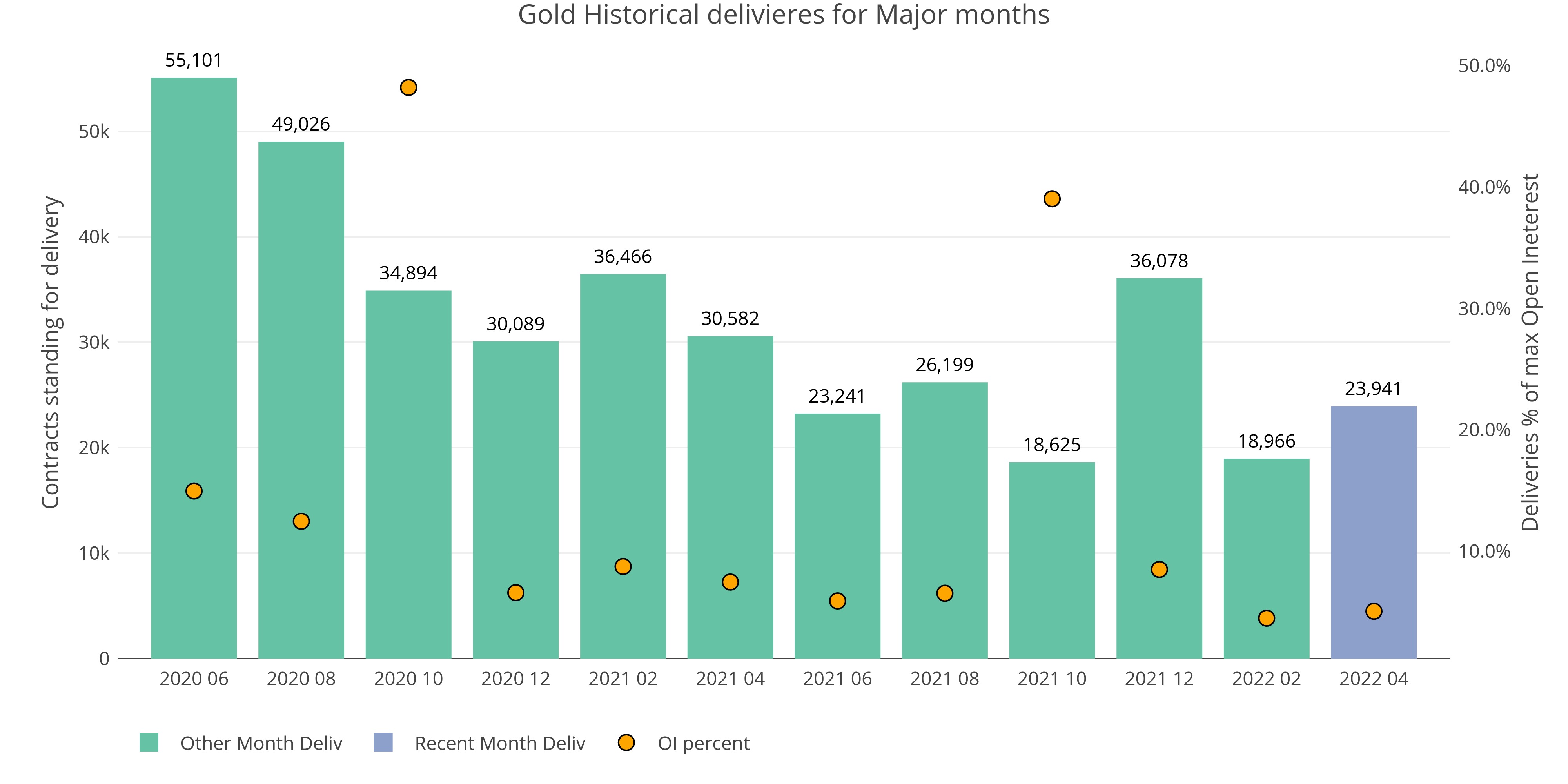

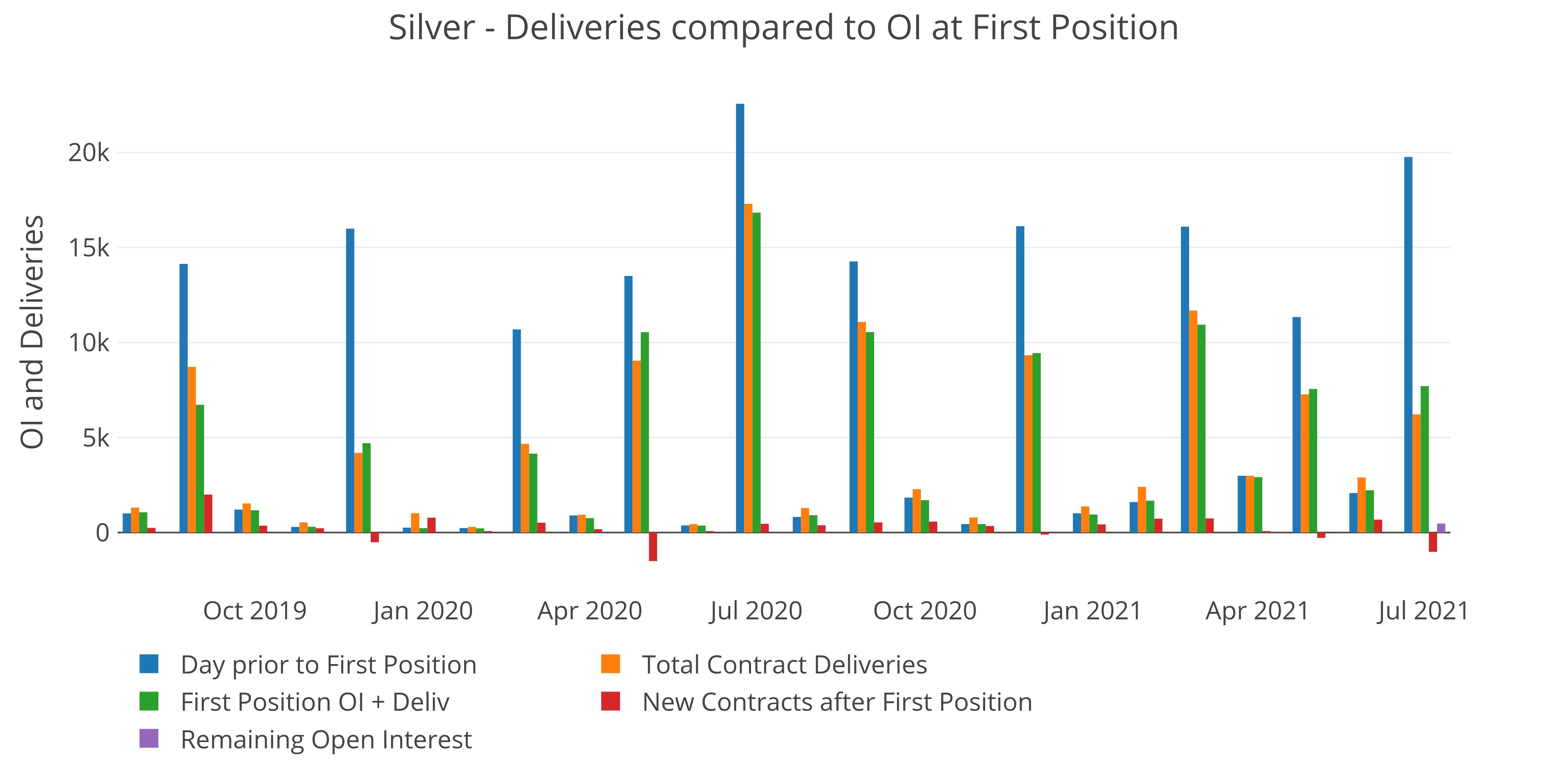

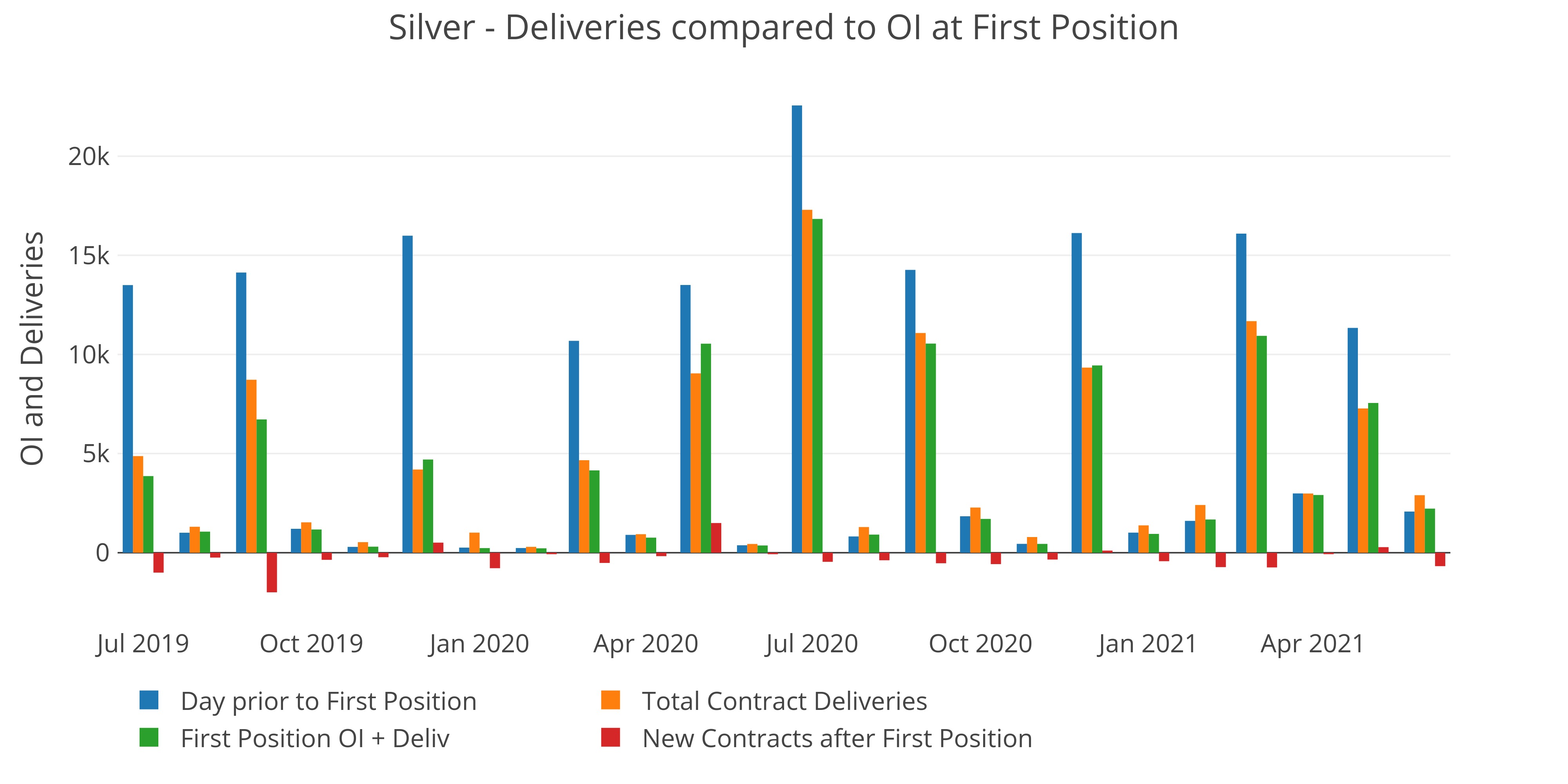

Did Someone Call the Comex Bluff?

A massive number of contracts are opened and then cash settled on day 1 of delivery

13-Week Money Supply Growth Continues to Decelerate

Money Supply still growing but at a slower pace

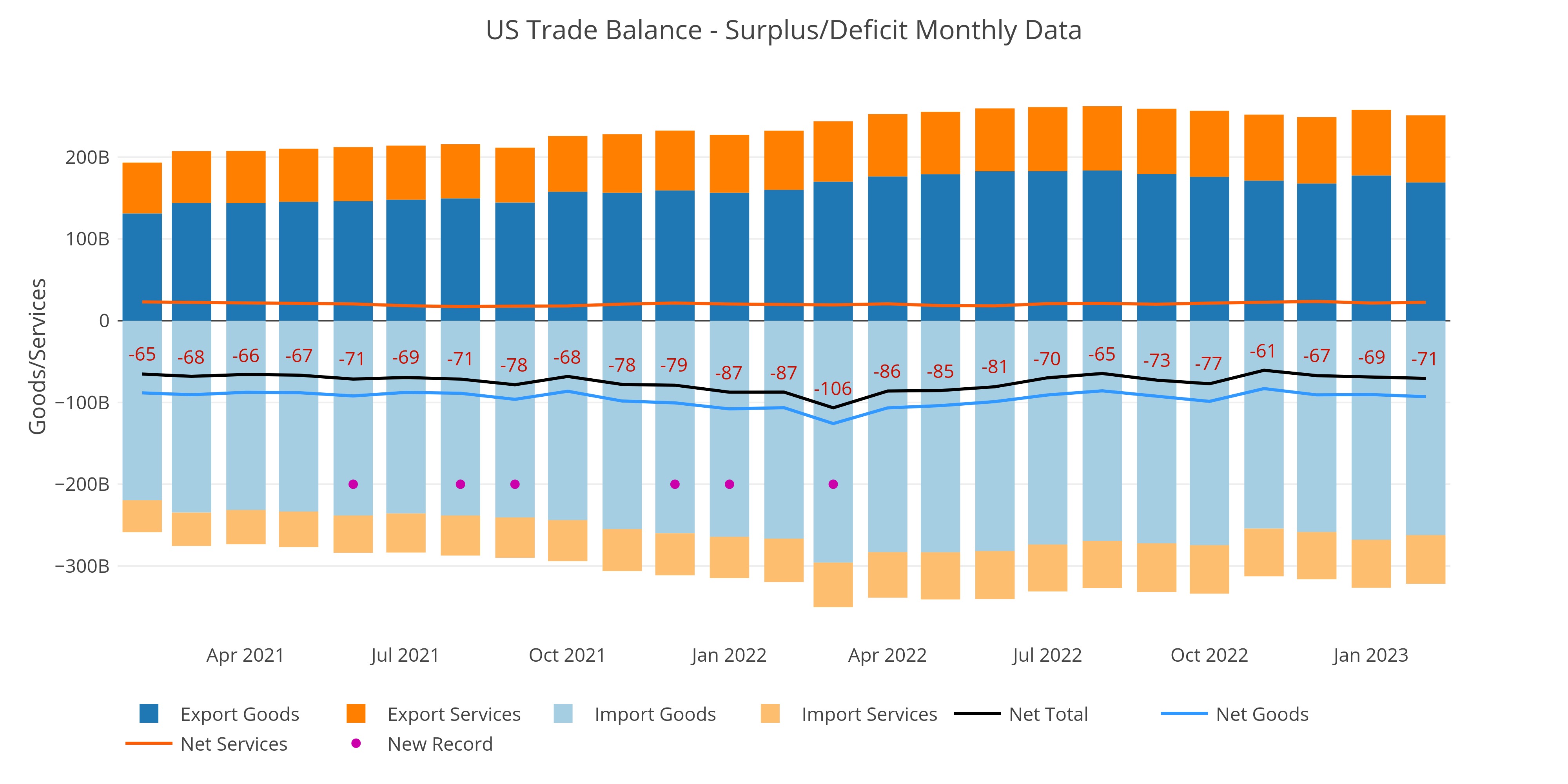

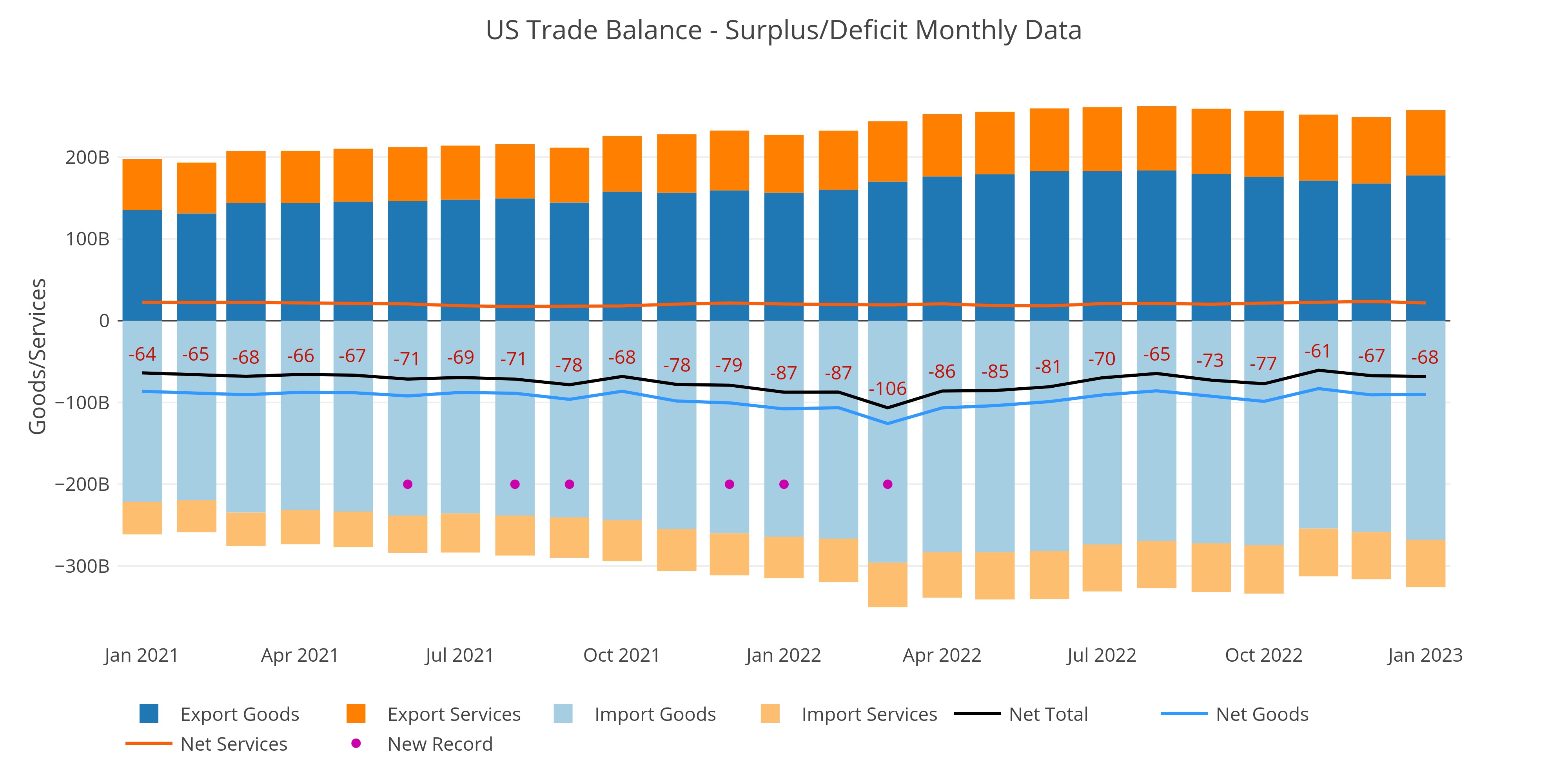

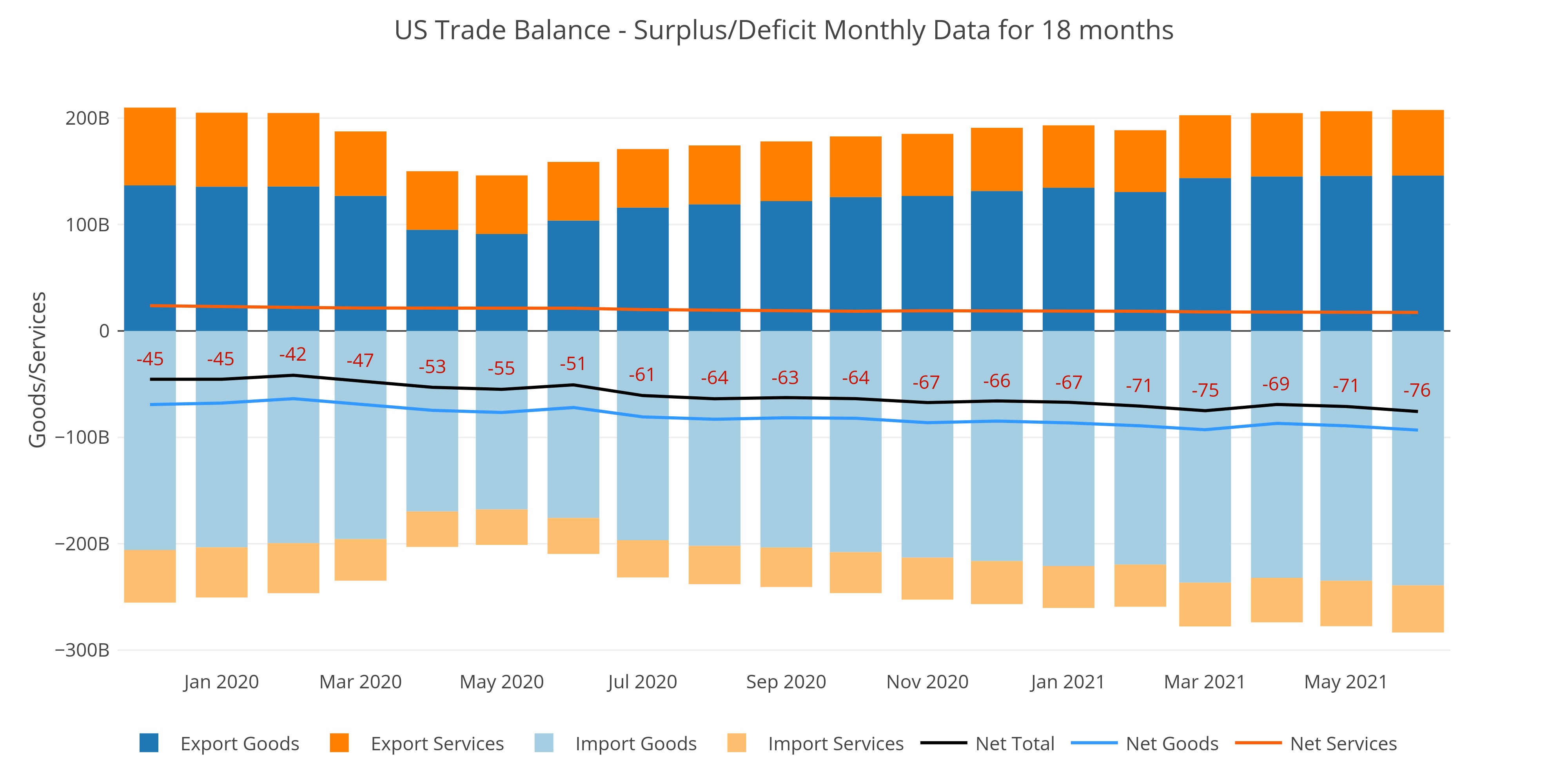

Trade Deficit Surges to Highest Level in Six Months

how long can the US benefit from the reserve currency?

M2 Grows for a 16th Straight Month

13 Week Money Supply has been decelerating for 5 weeks though

Comex Delivery Volumes Remain at Very High Levels

How much more gold does London have?

The Technicals: Gold Price Does Not Look Frothy

The biggest risk is if Central Banks stop buying

Jobs: QCEW and Household Survey Continue to Show a Weak Labor Market

The loss in government jobs has not yet materialized

Jobs: QCEW and Household Survey Continue to Show a Weak Labor Market

The loss in government jobs has not yet materialized

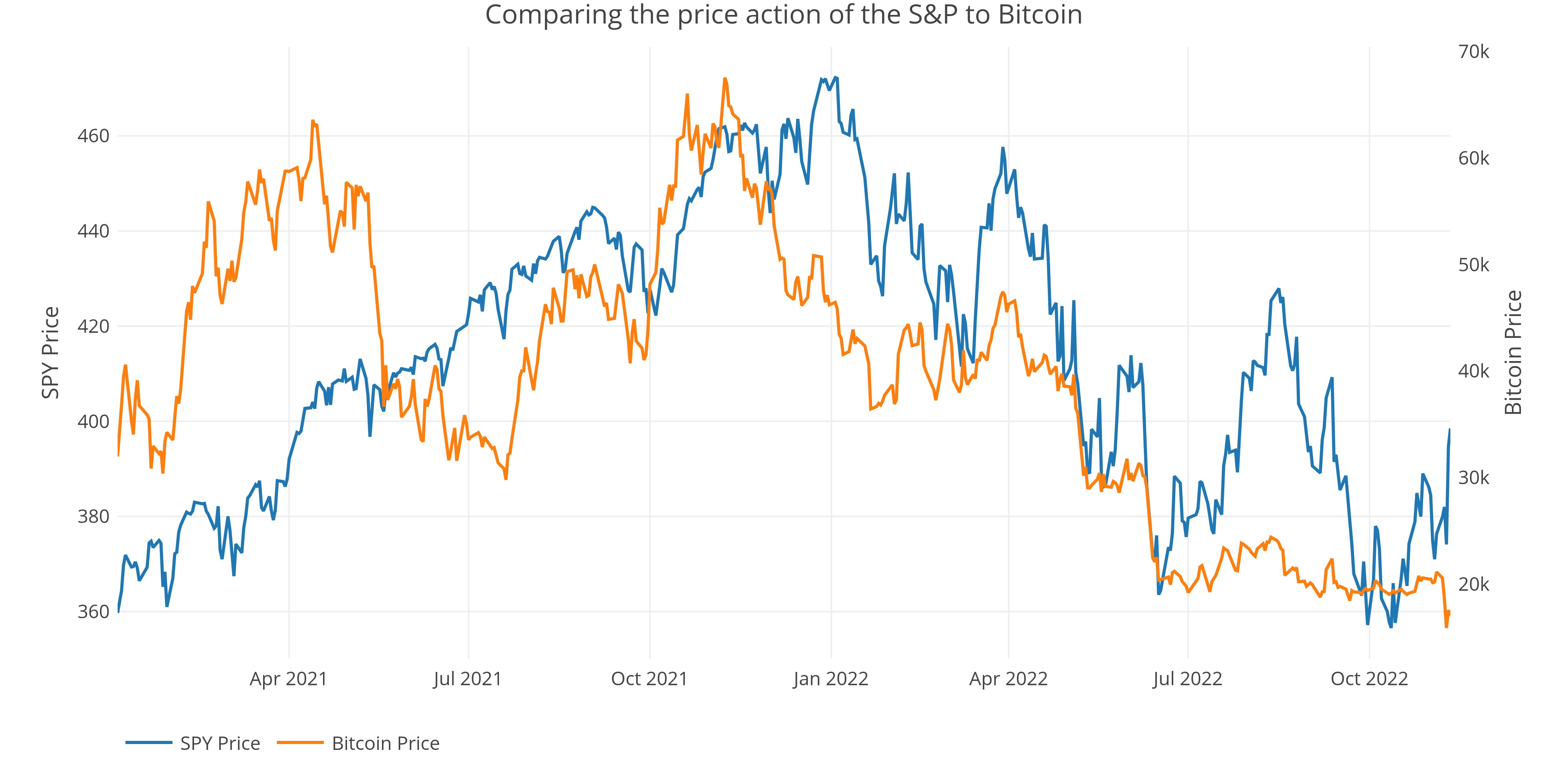

Has Slowing Money Supply Growth Led to a Directionless Stock Market?

Money supply growth has been slowing of late

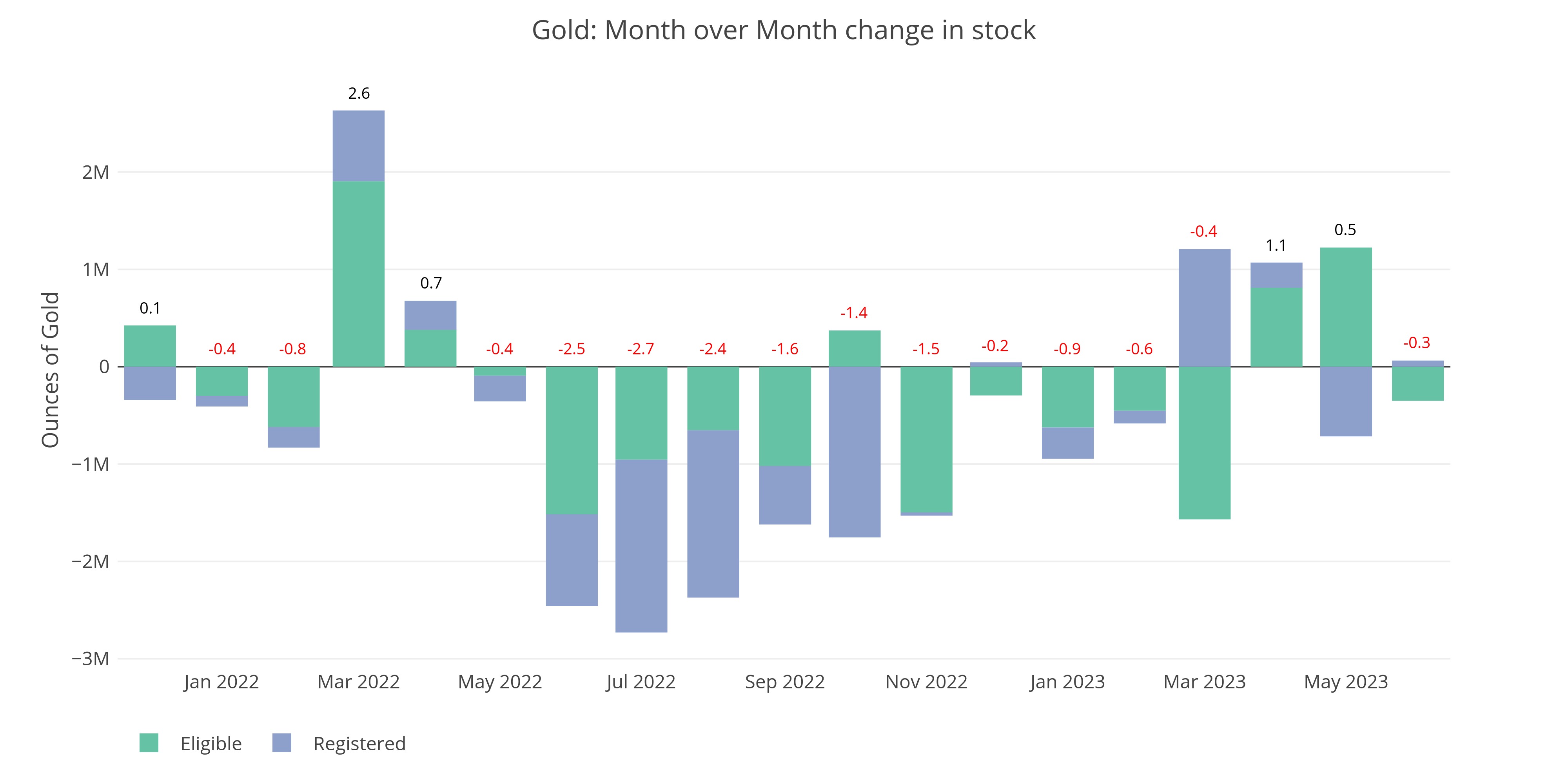

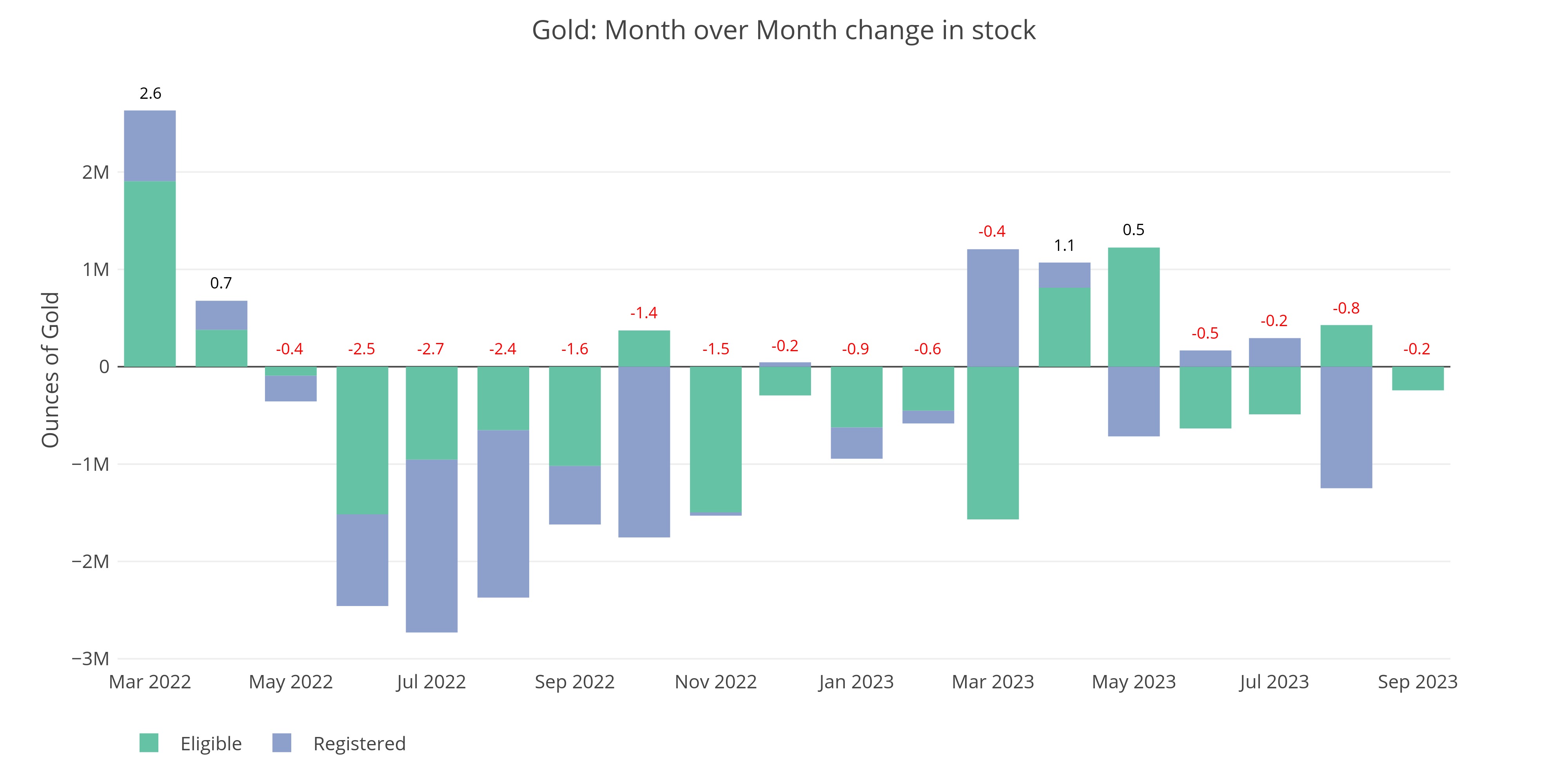

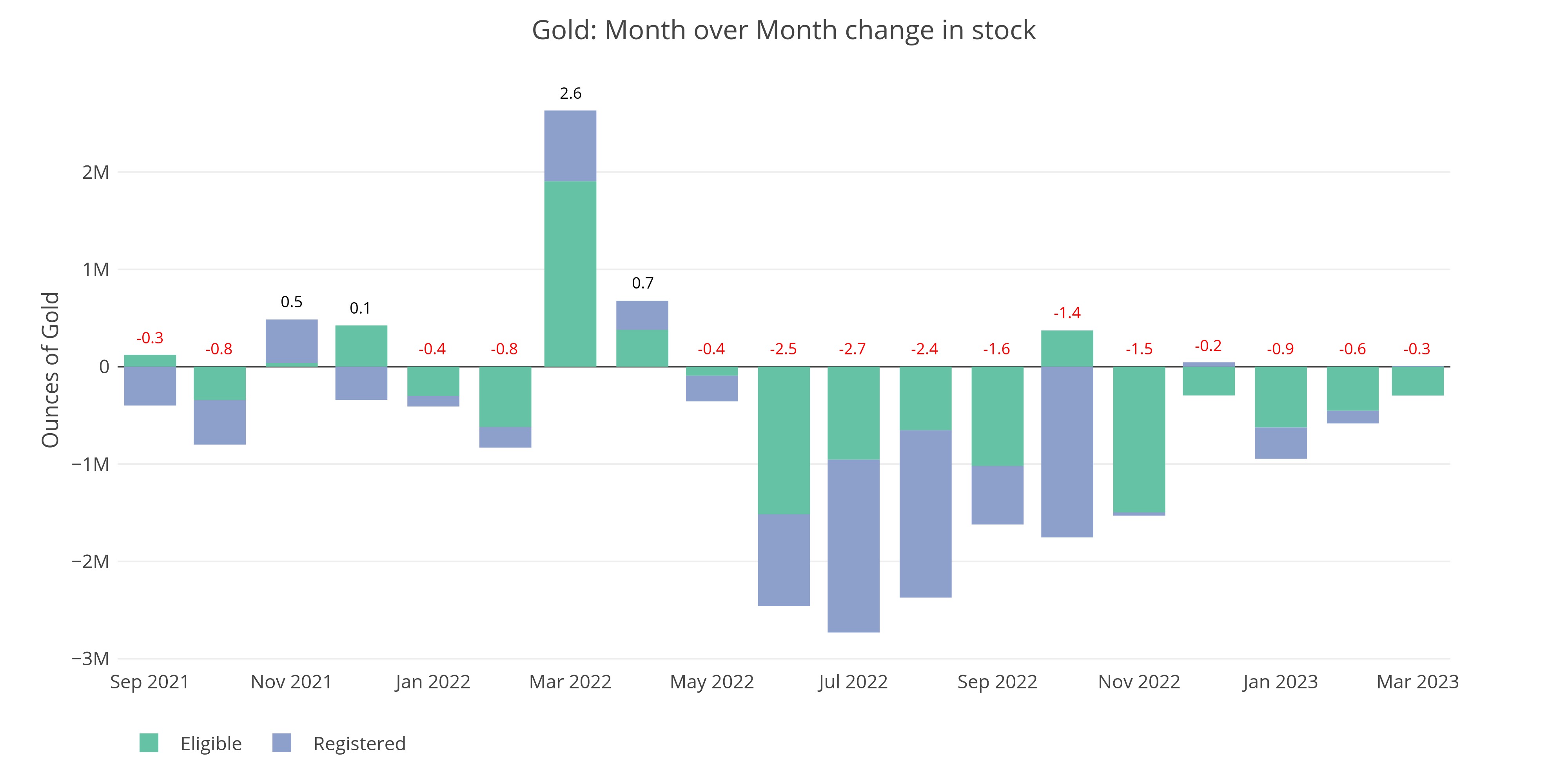

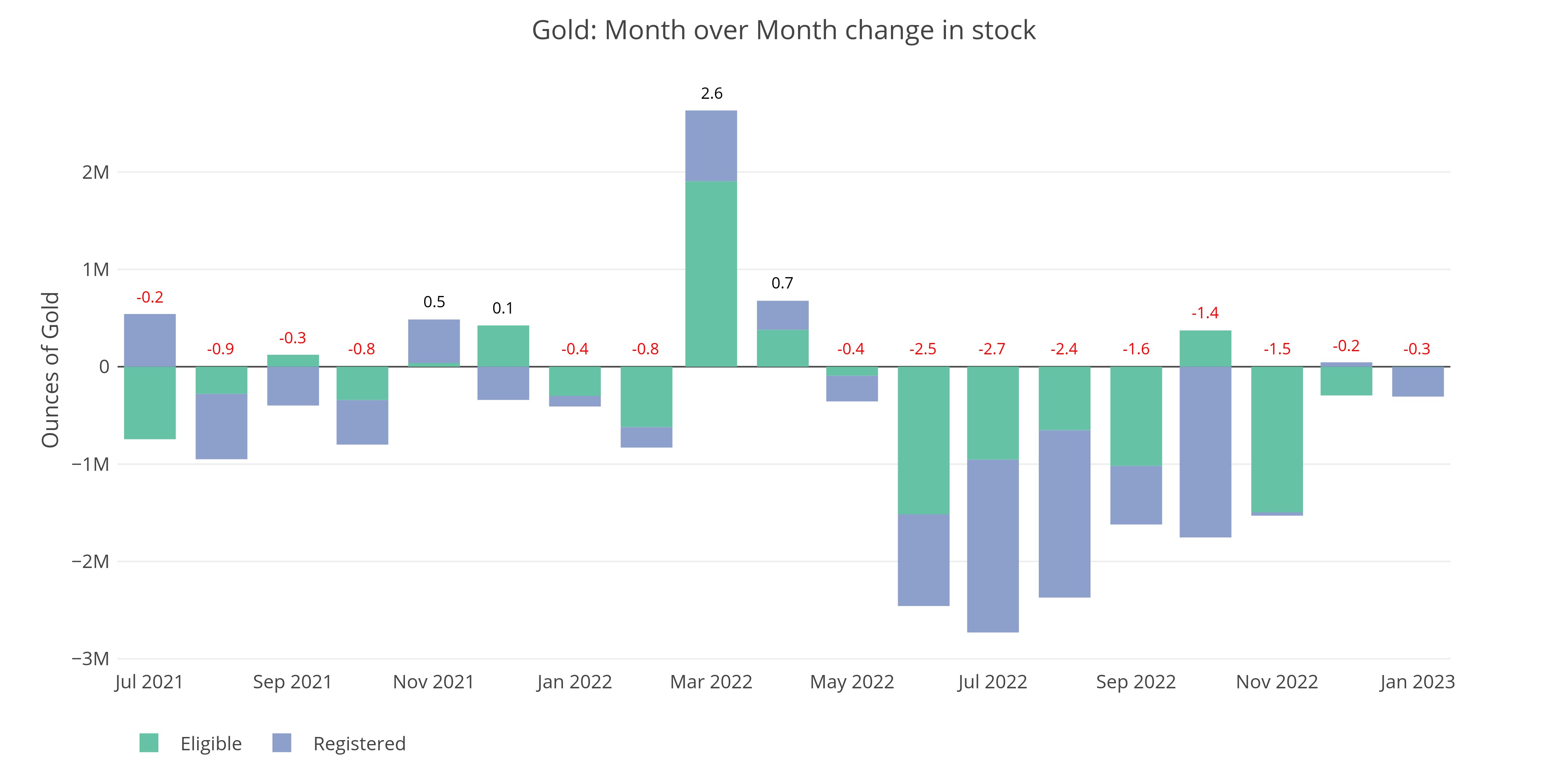

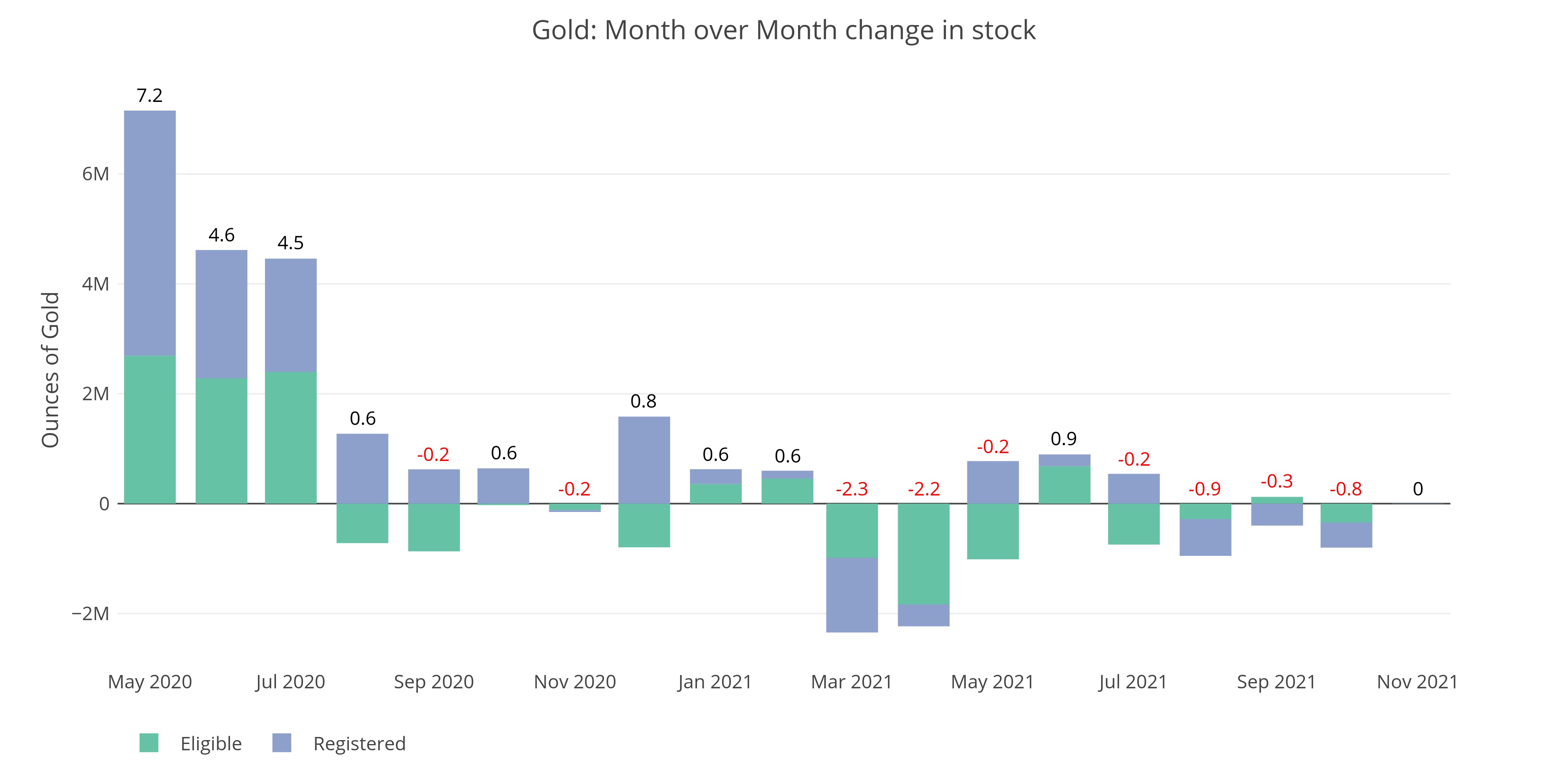

Did an Arbitrage Opportunity Expose the Weakness in the London Gold Market?

The physical gold market remains under immense pressure

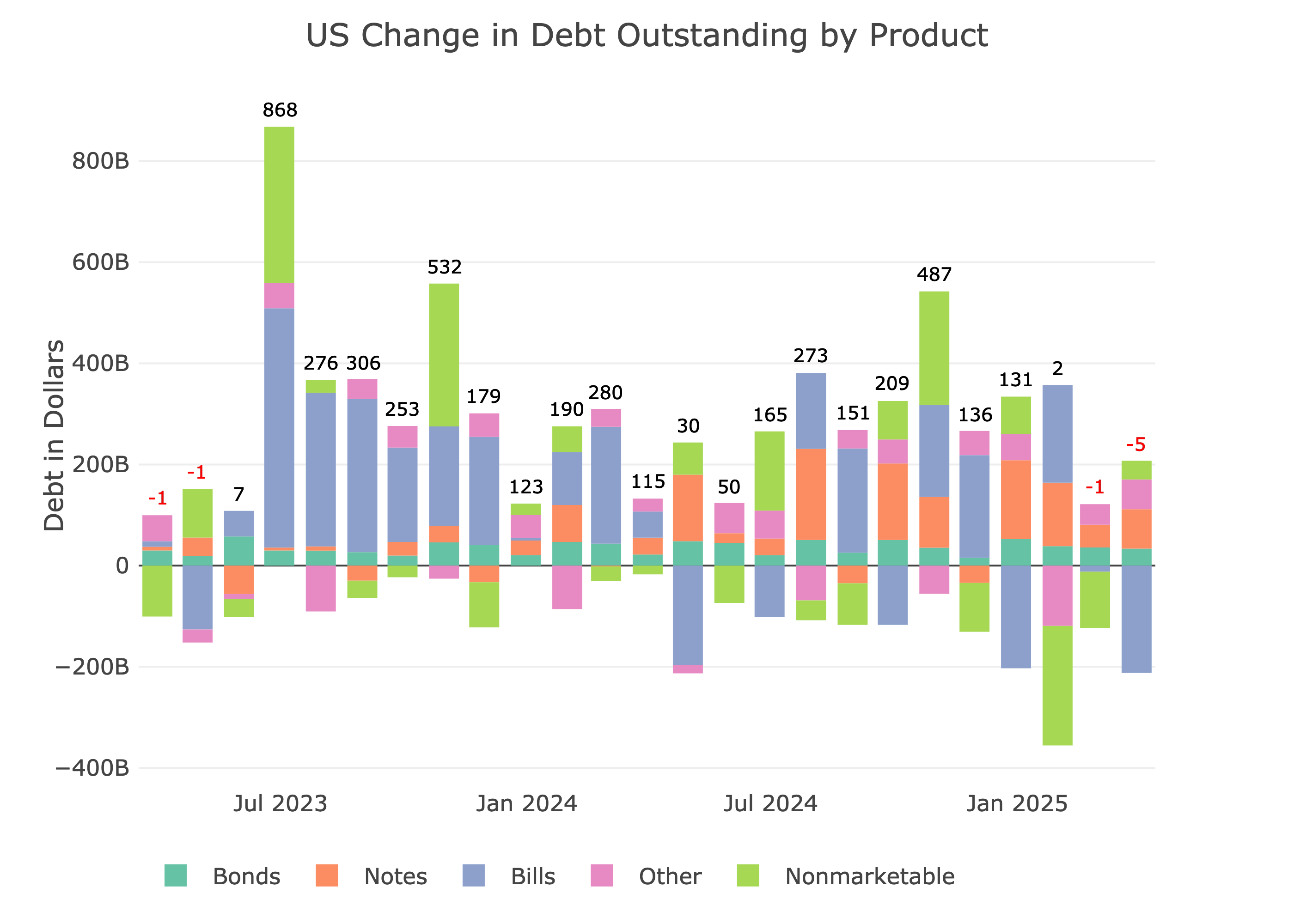

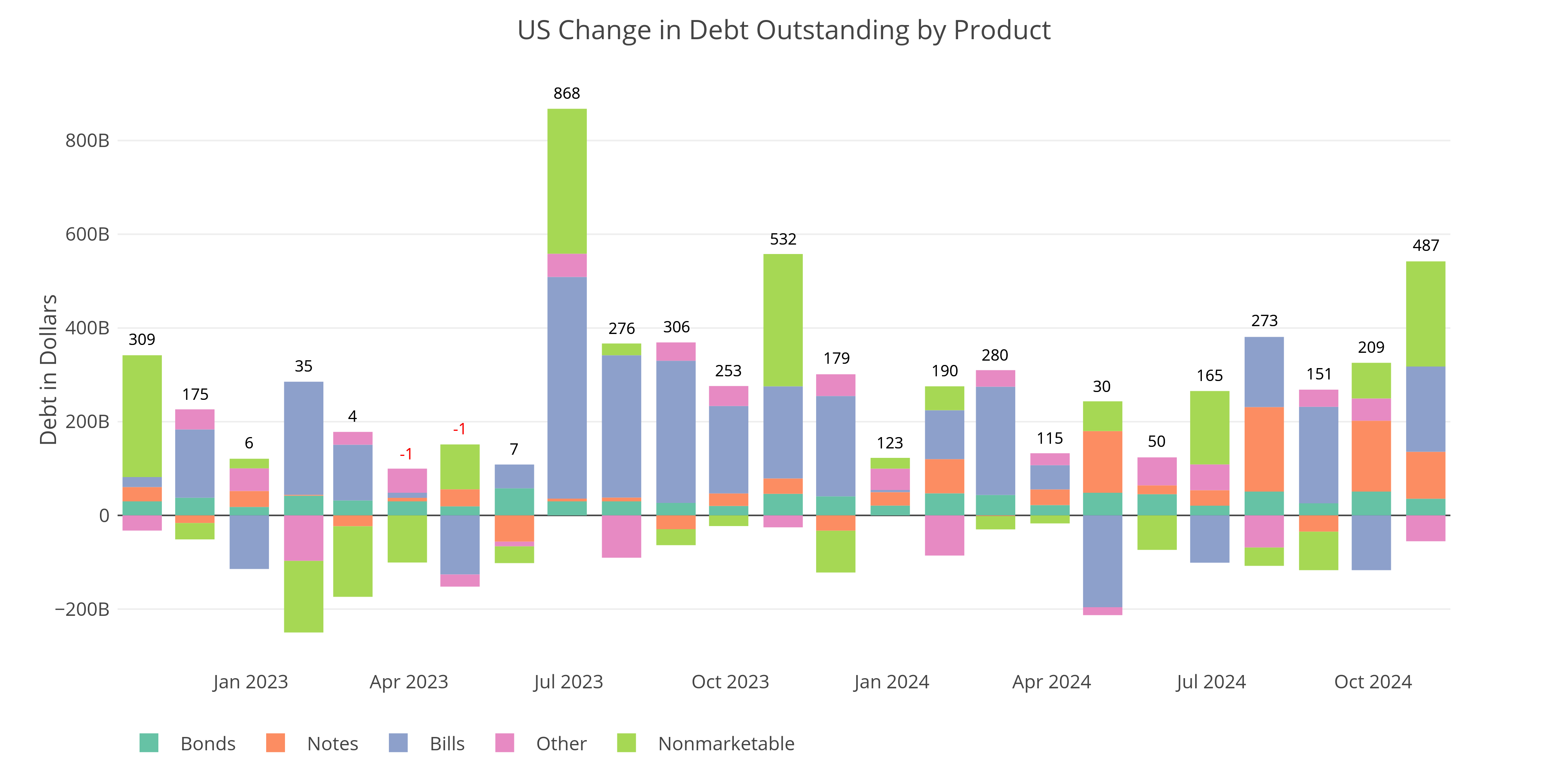

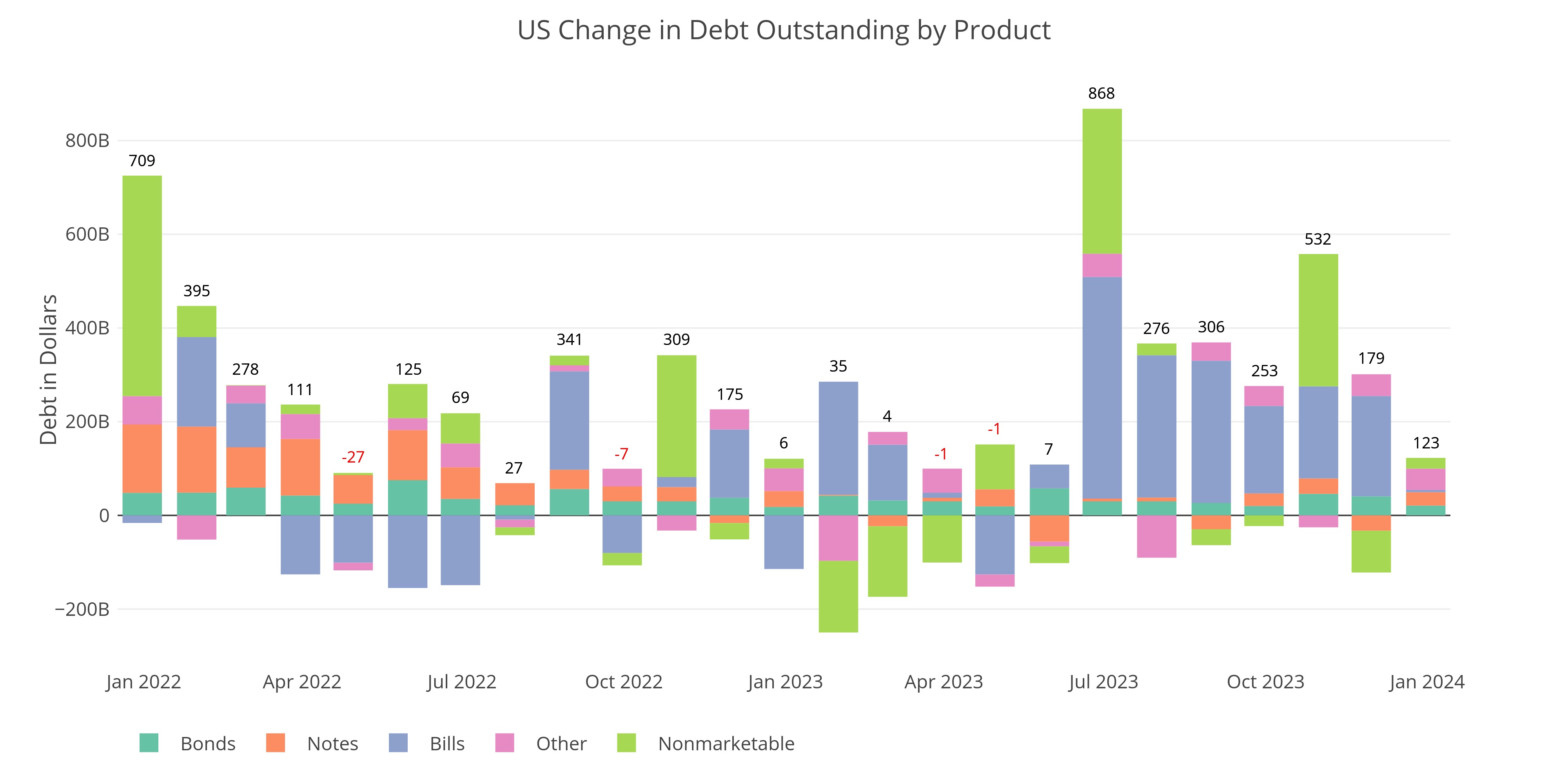

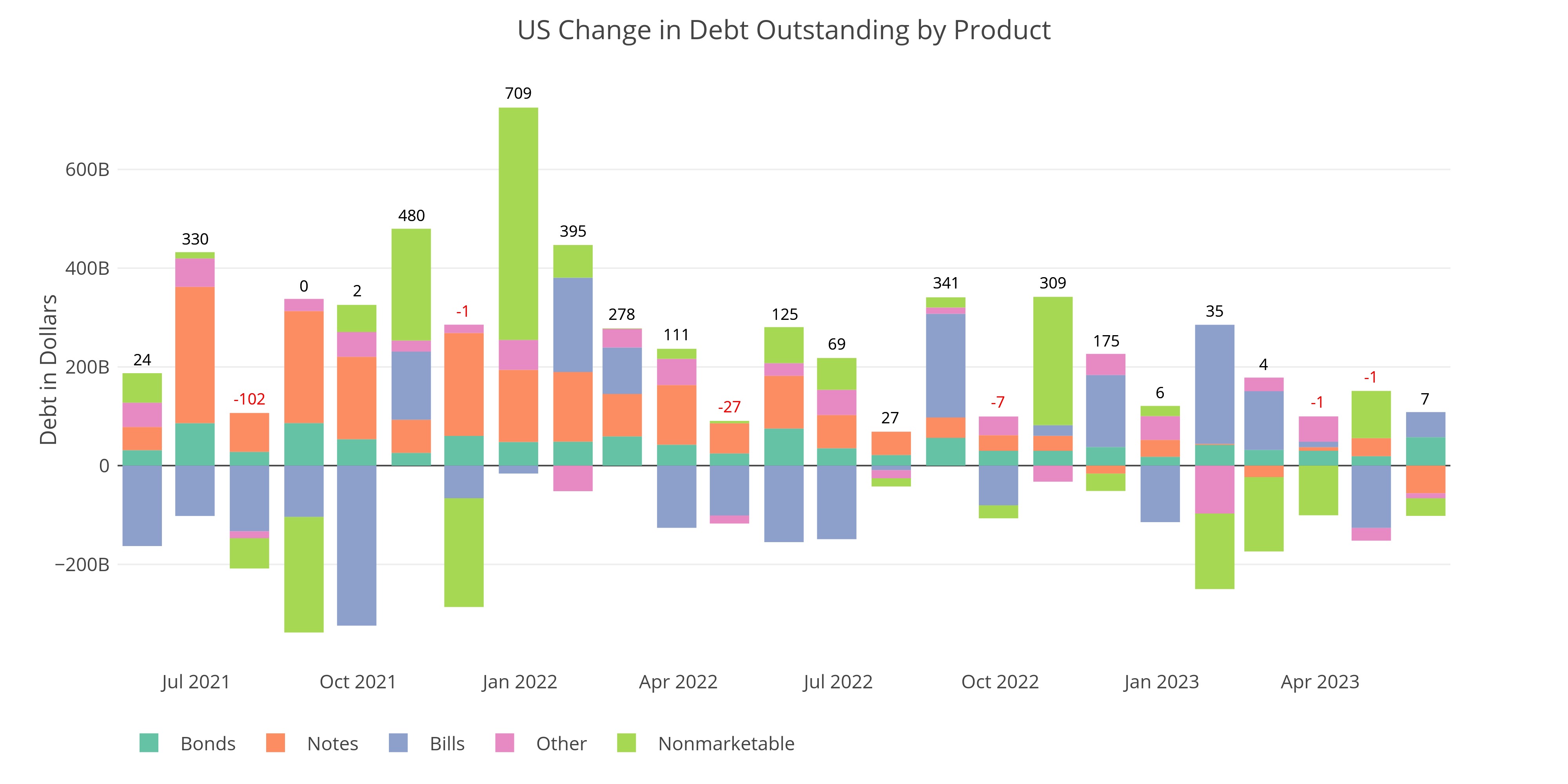

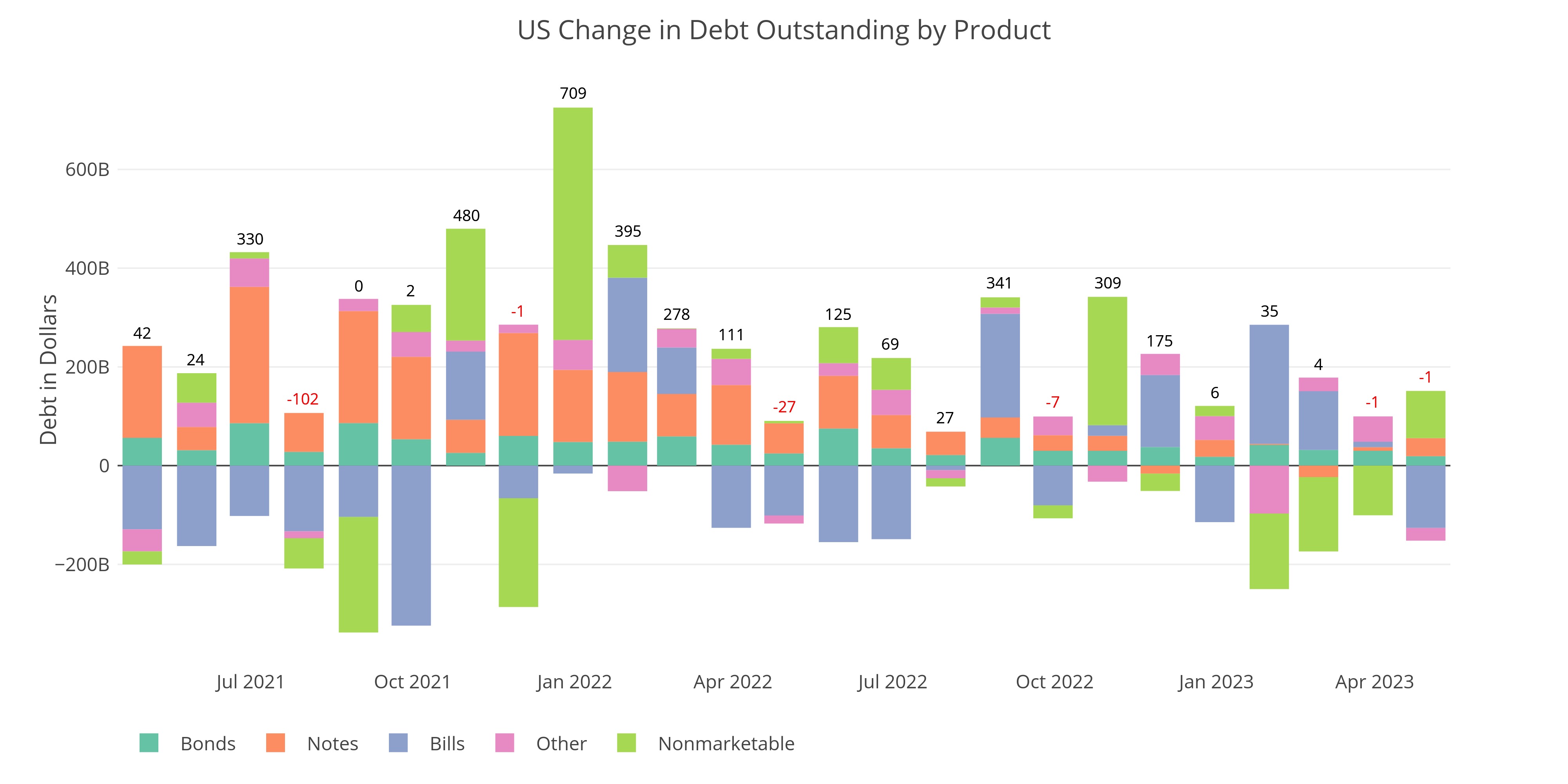

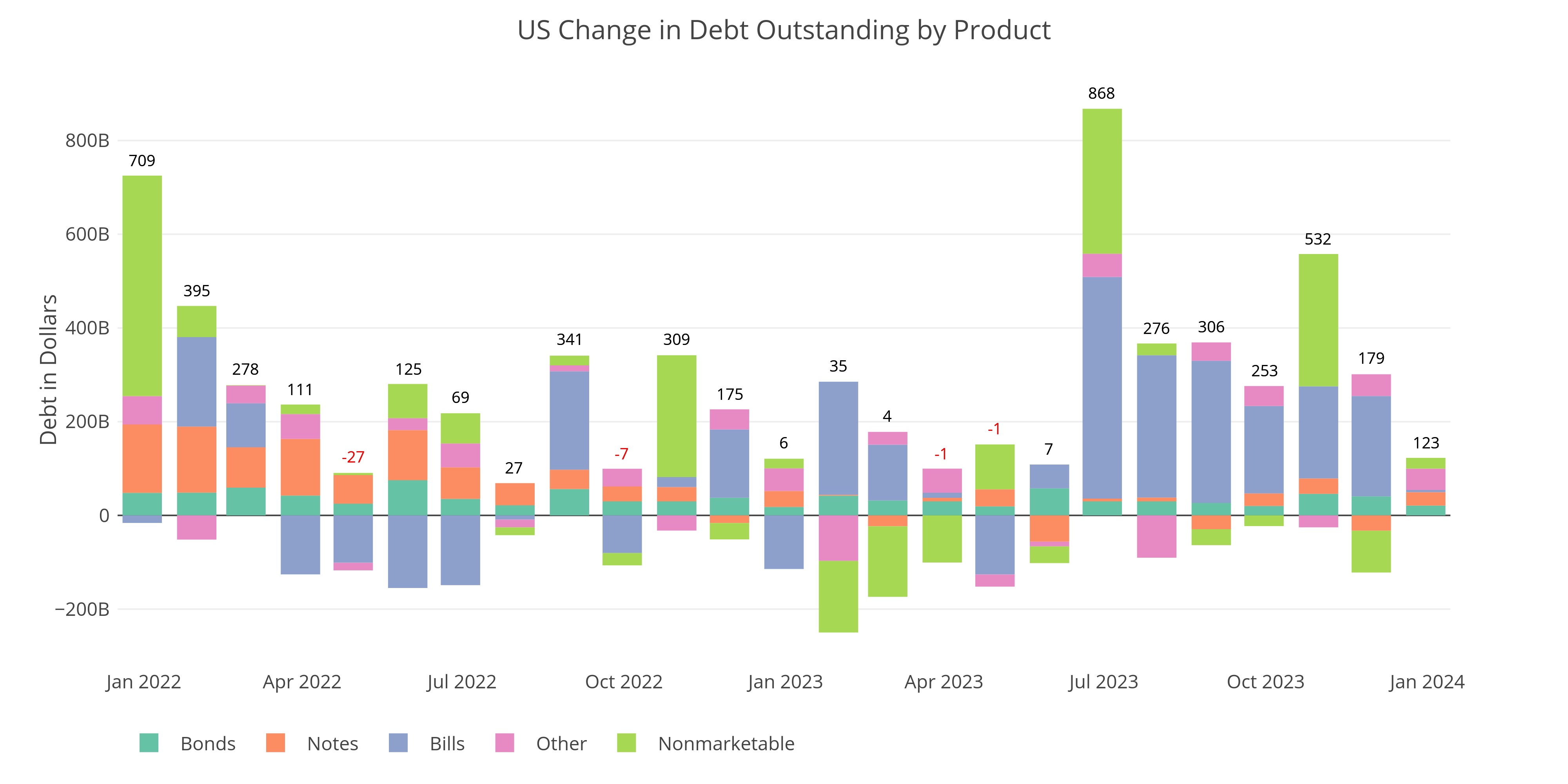

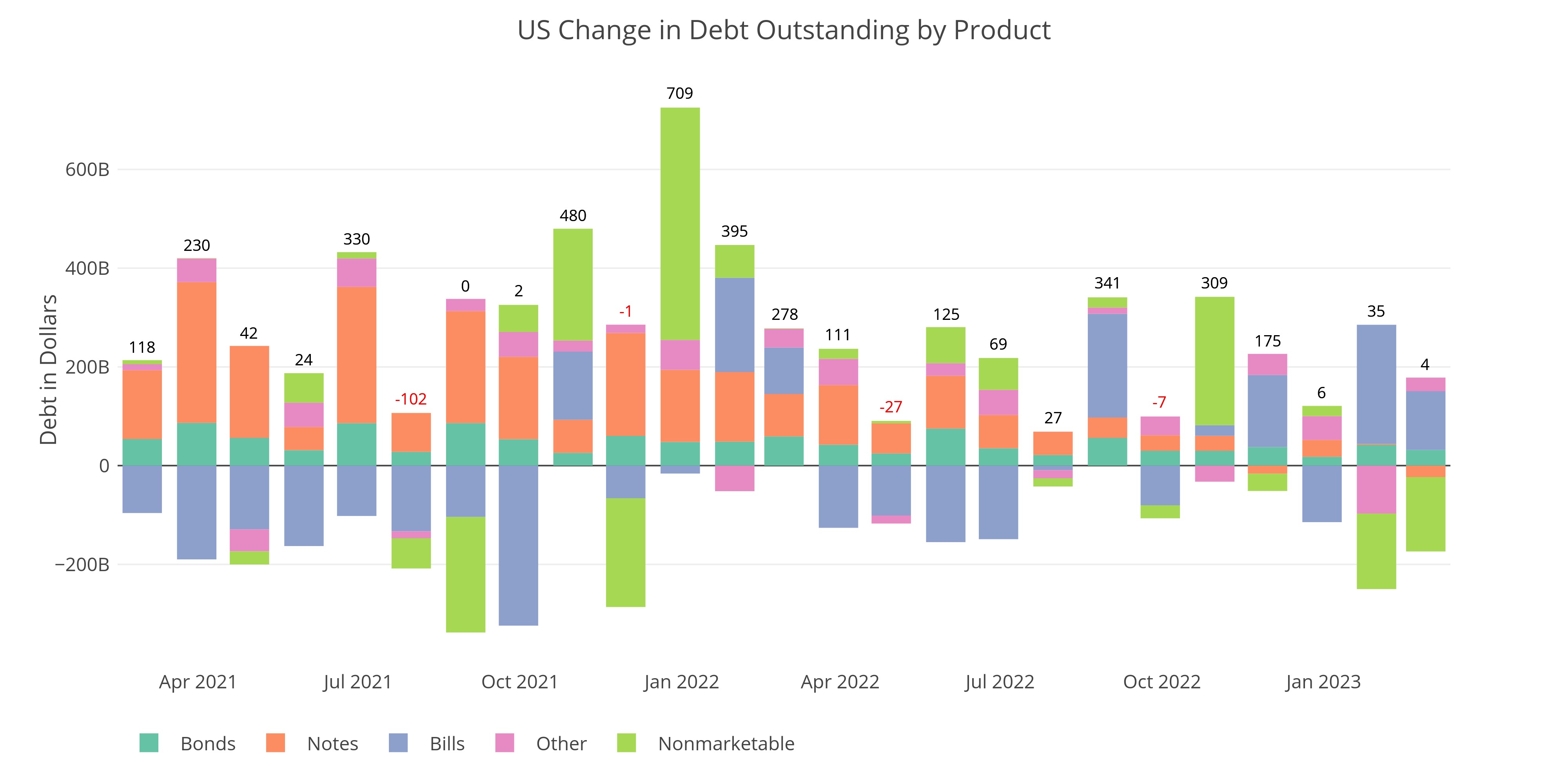

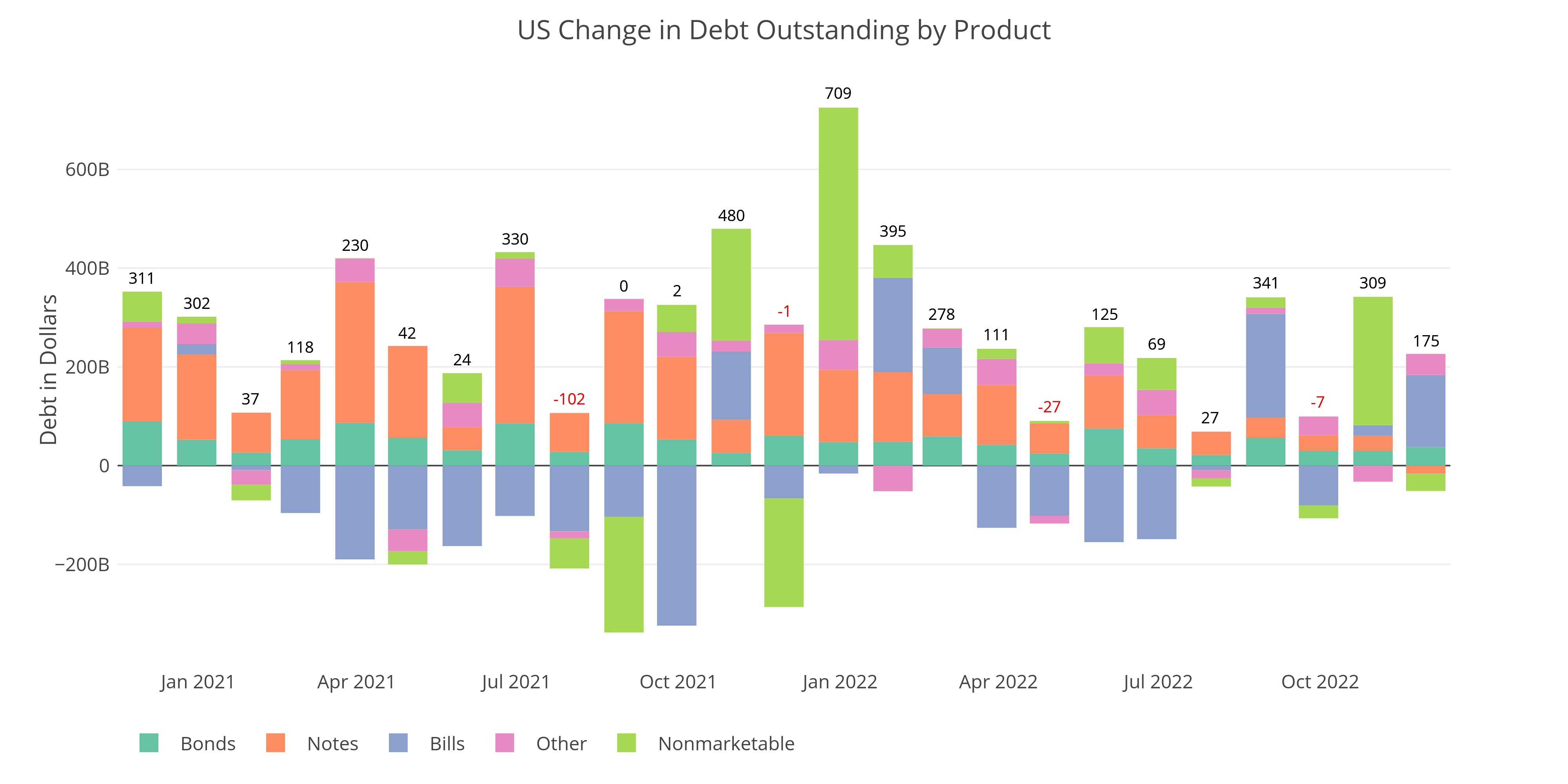

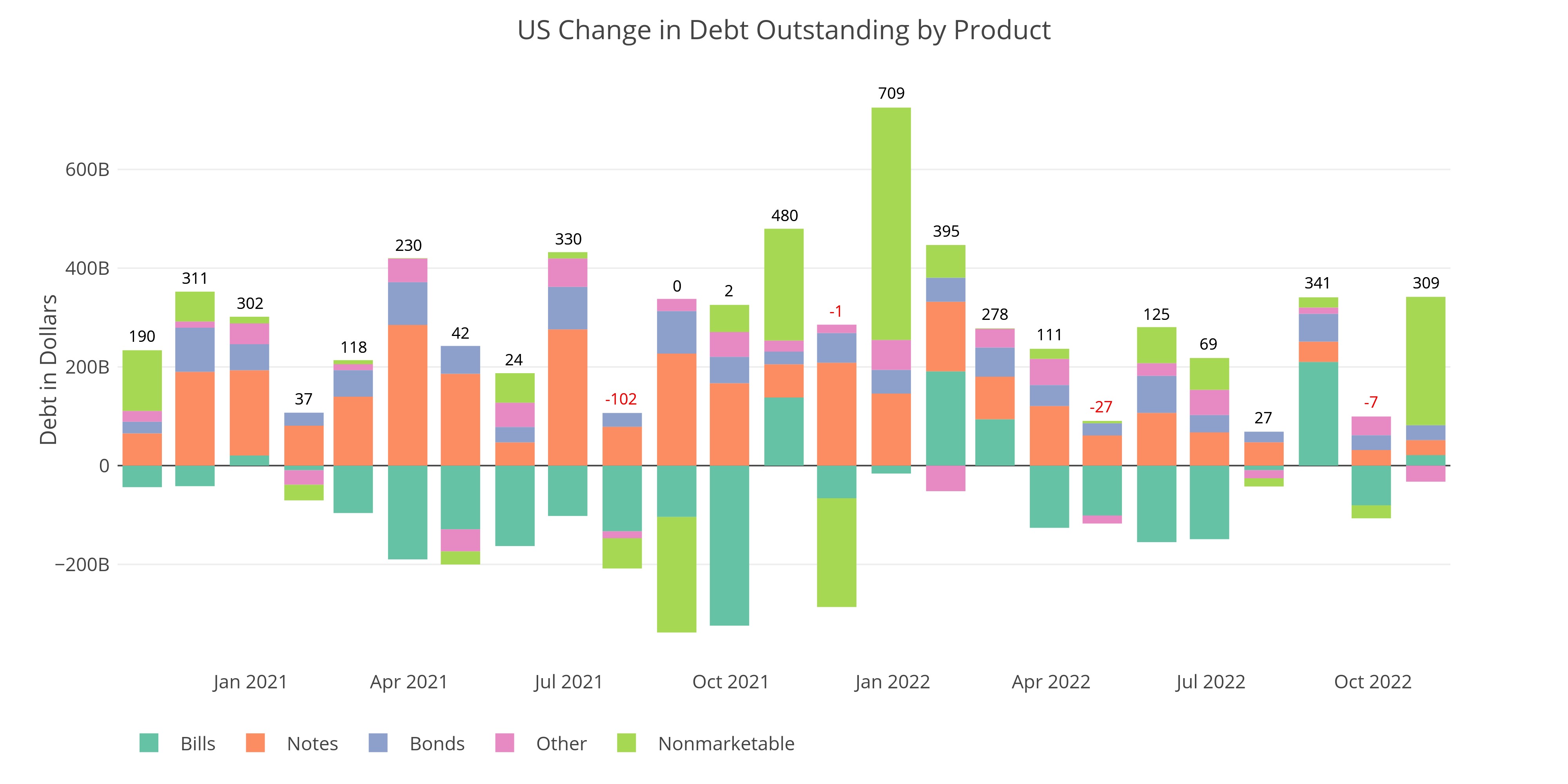

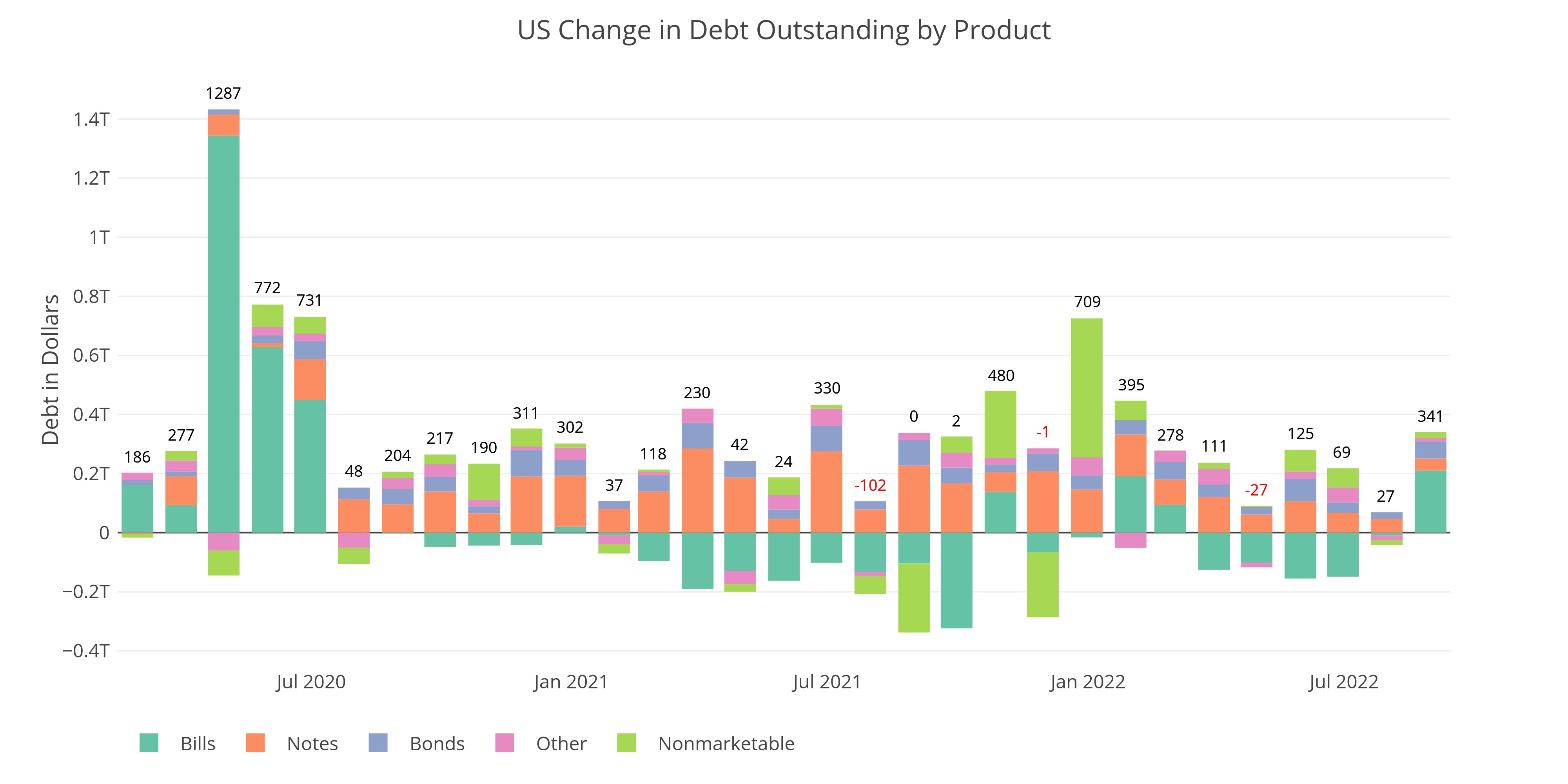

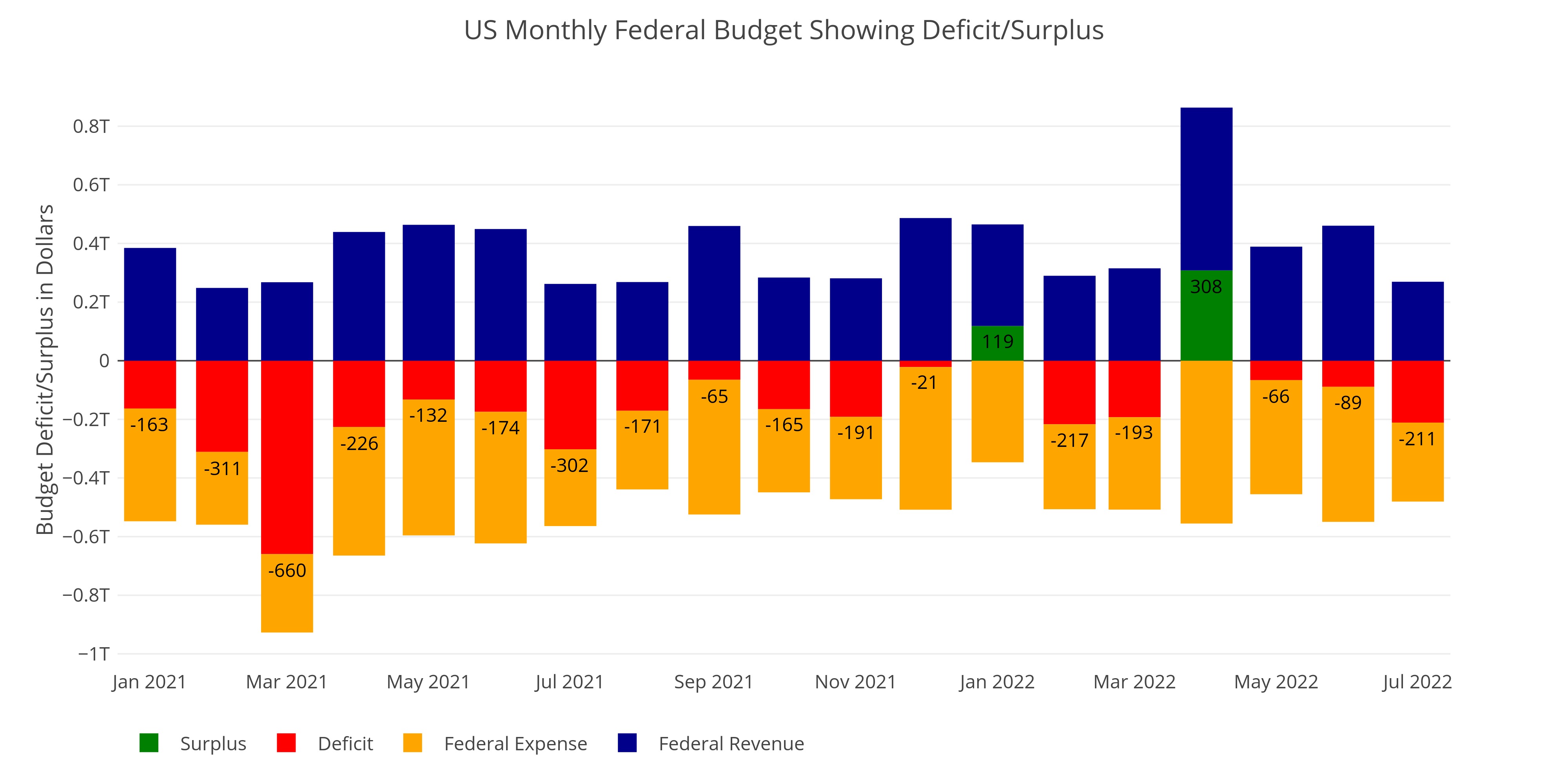

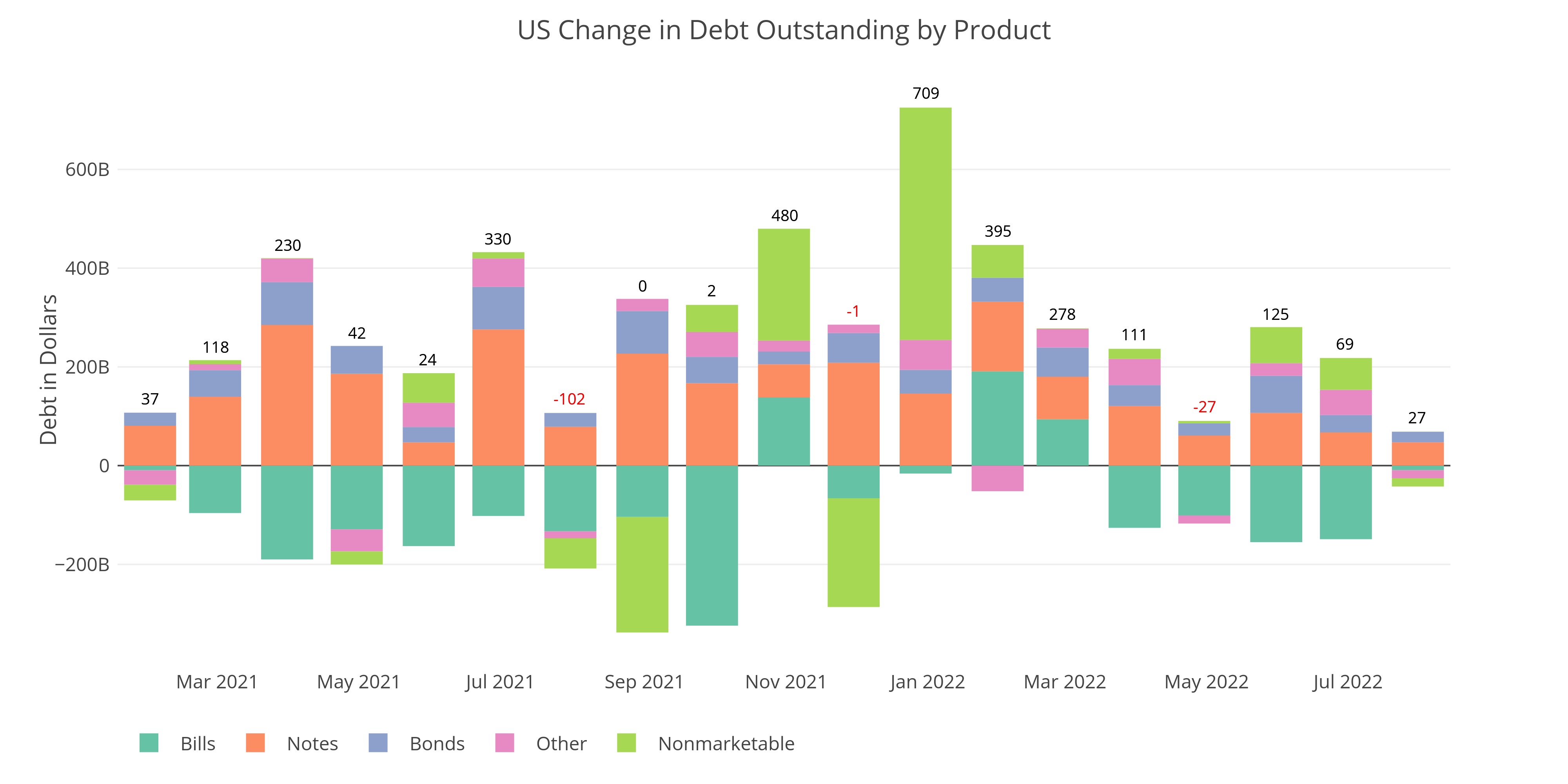

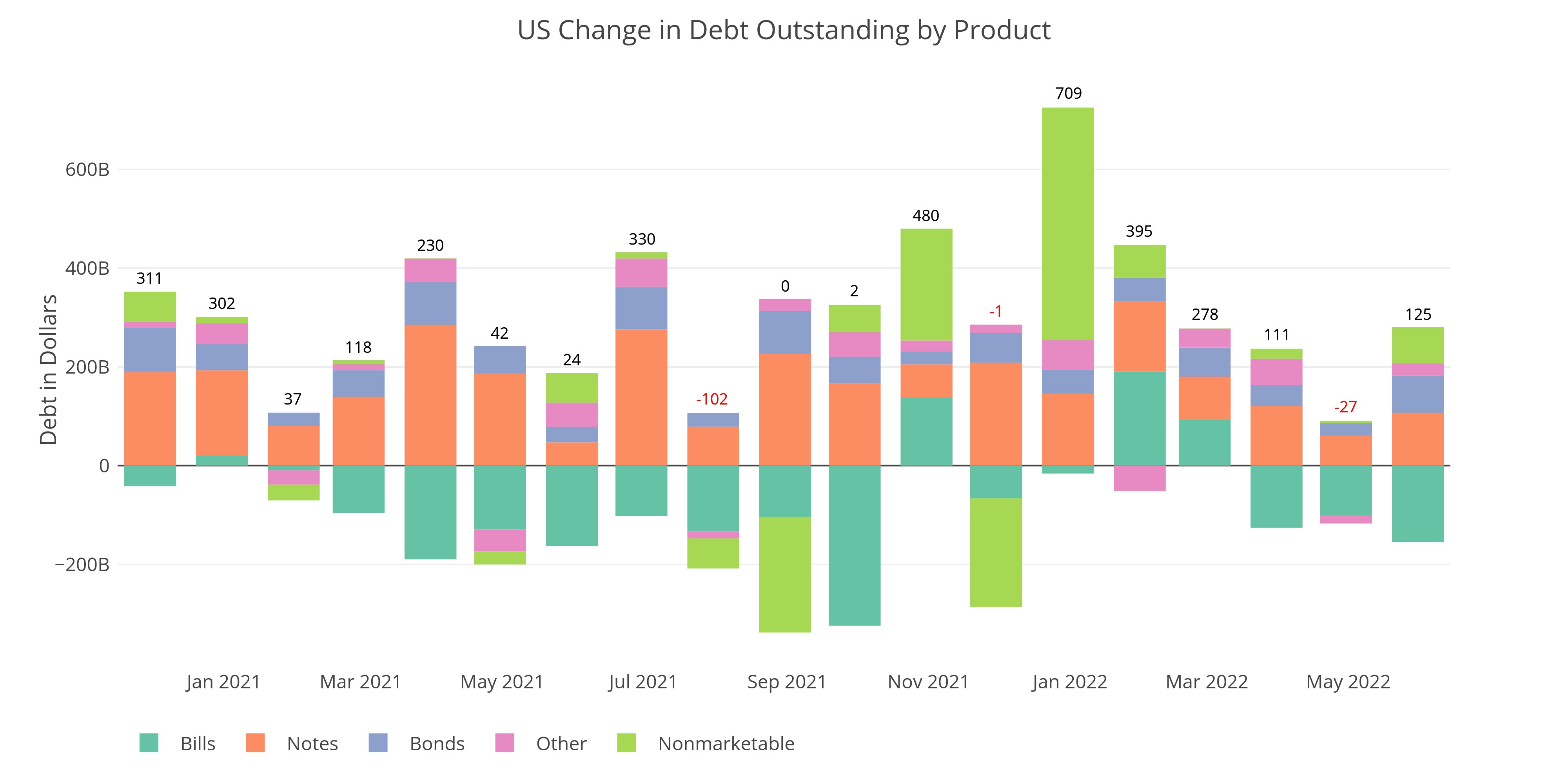

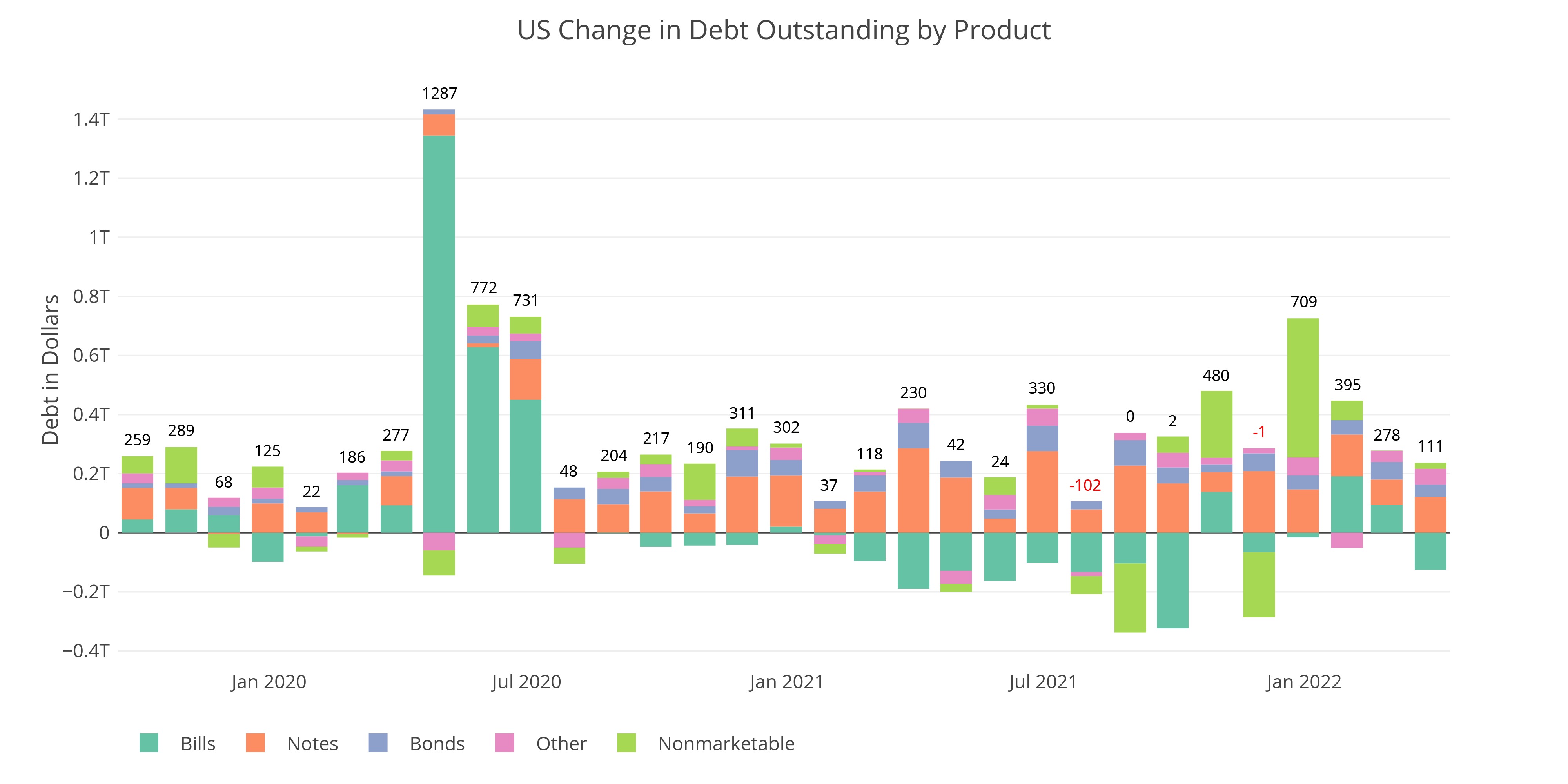

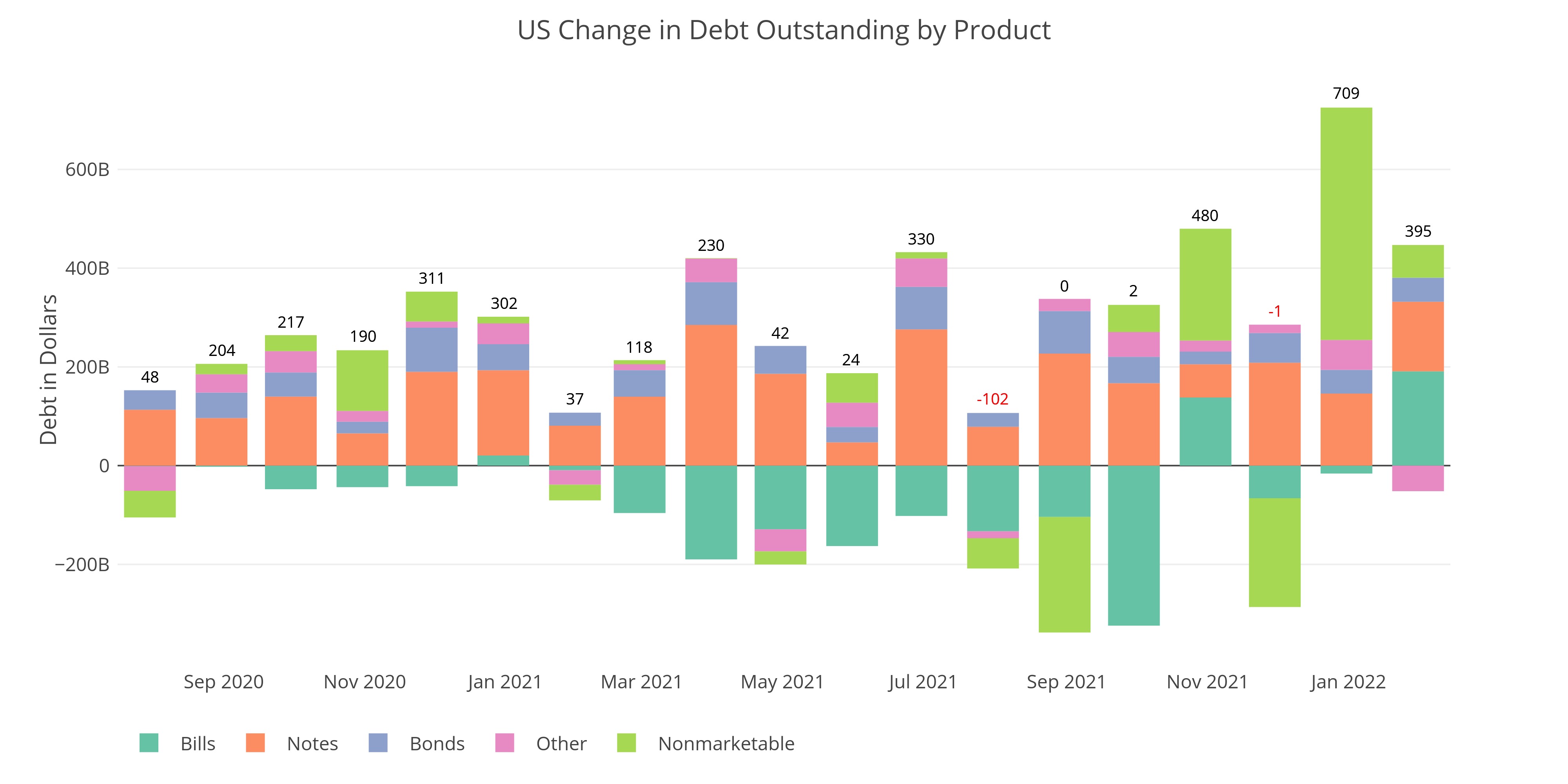

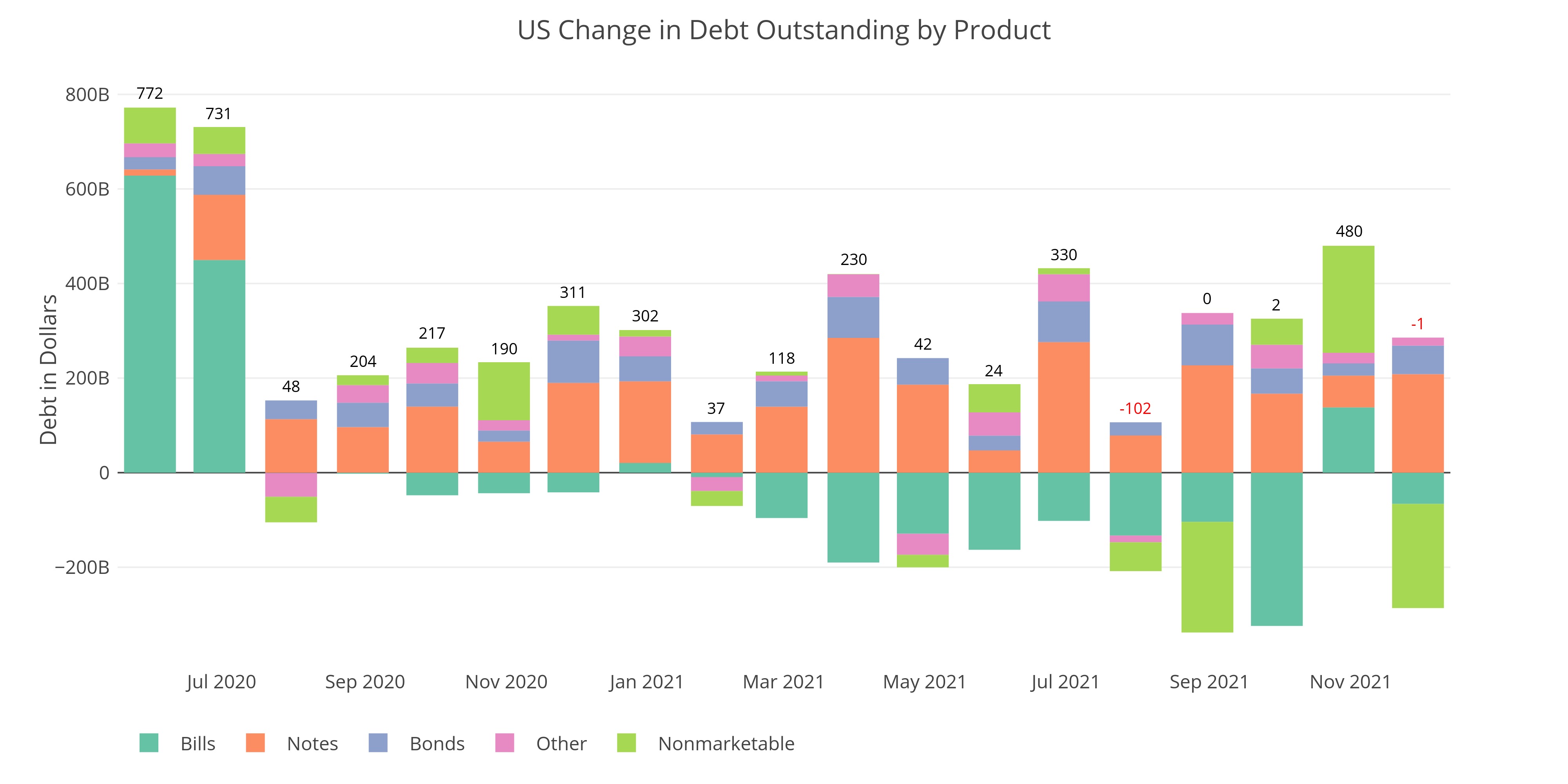

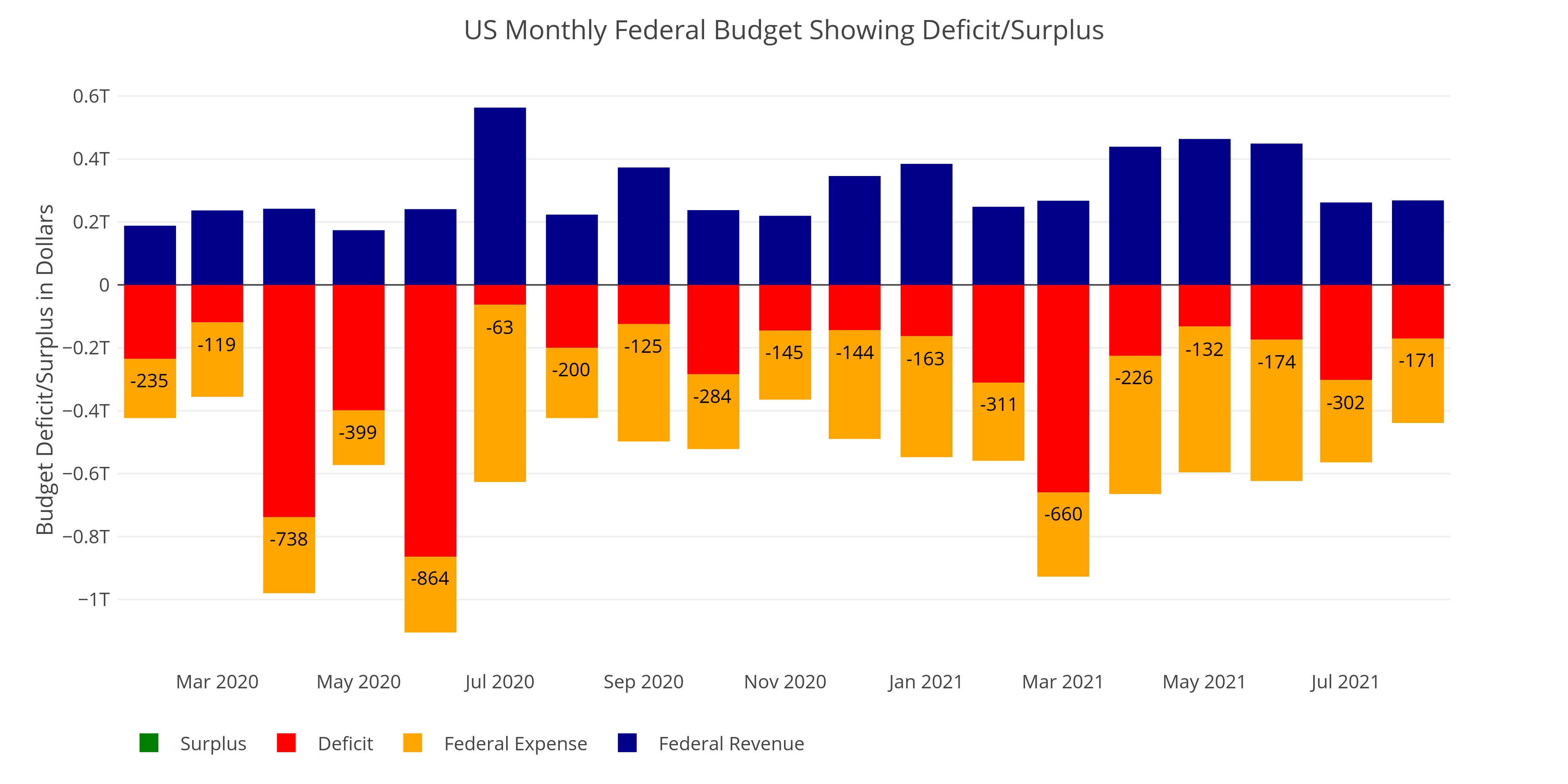

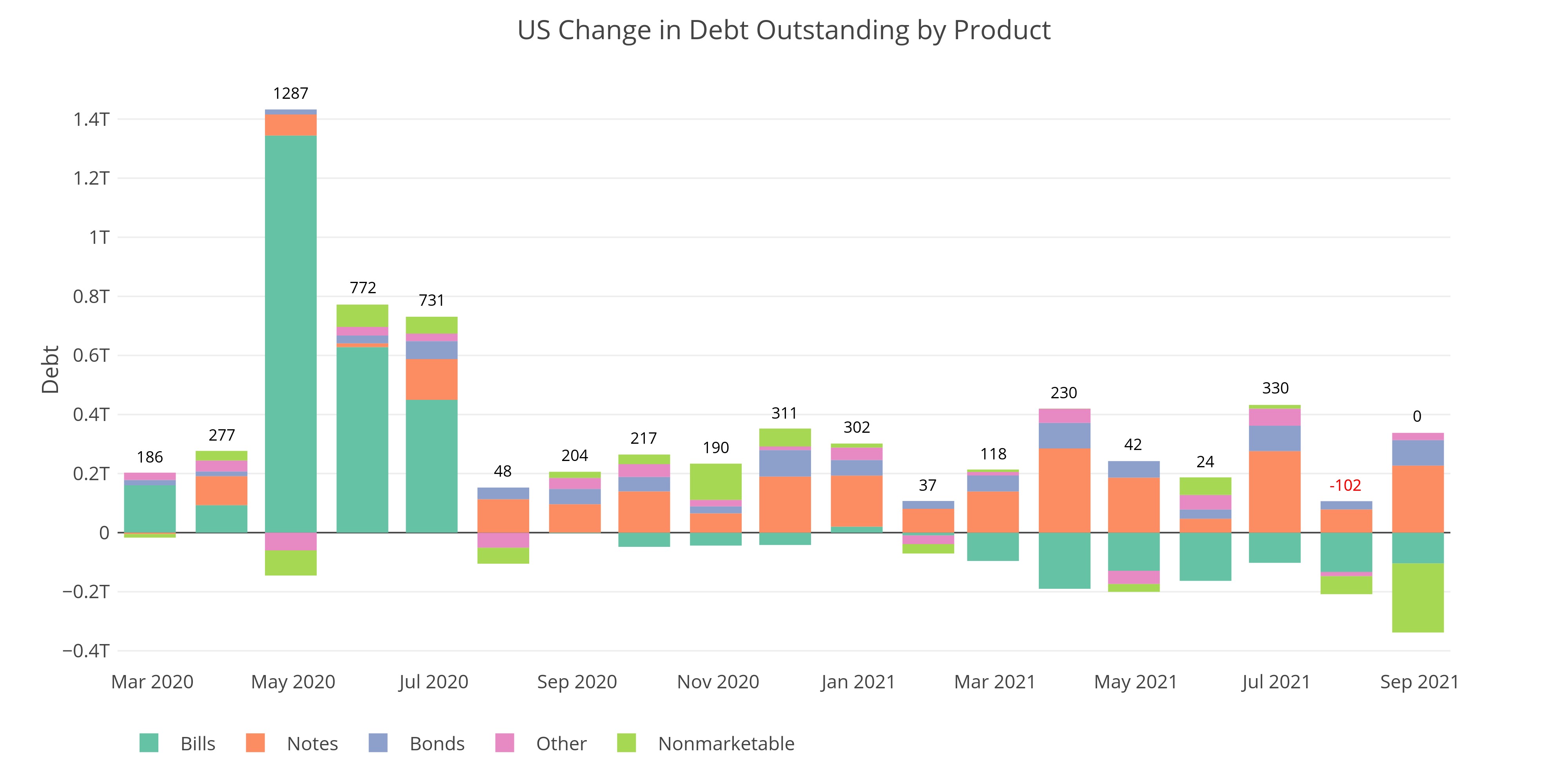

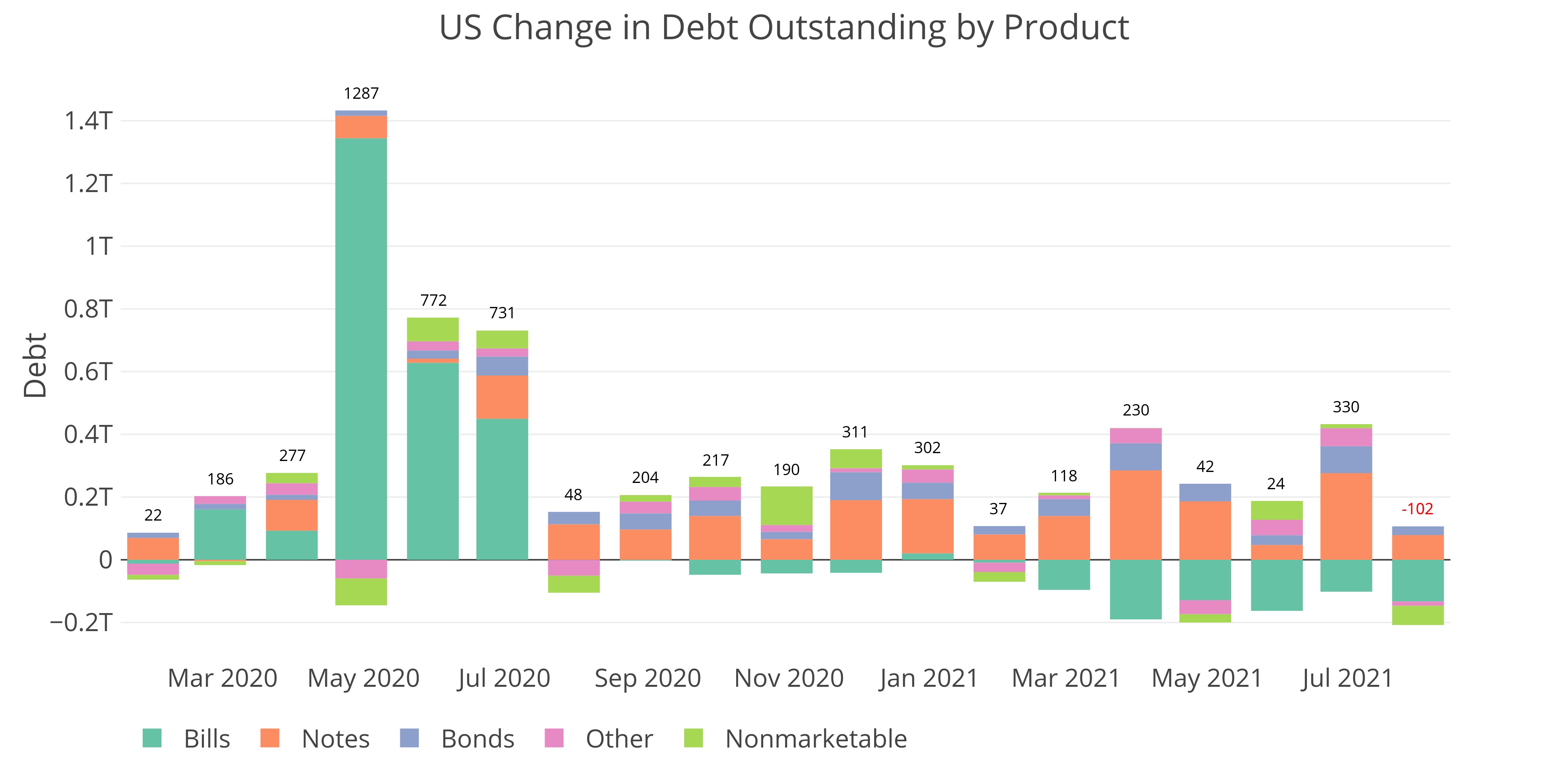

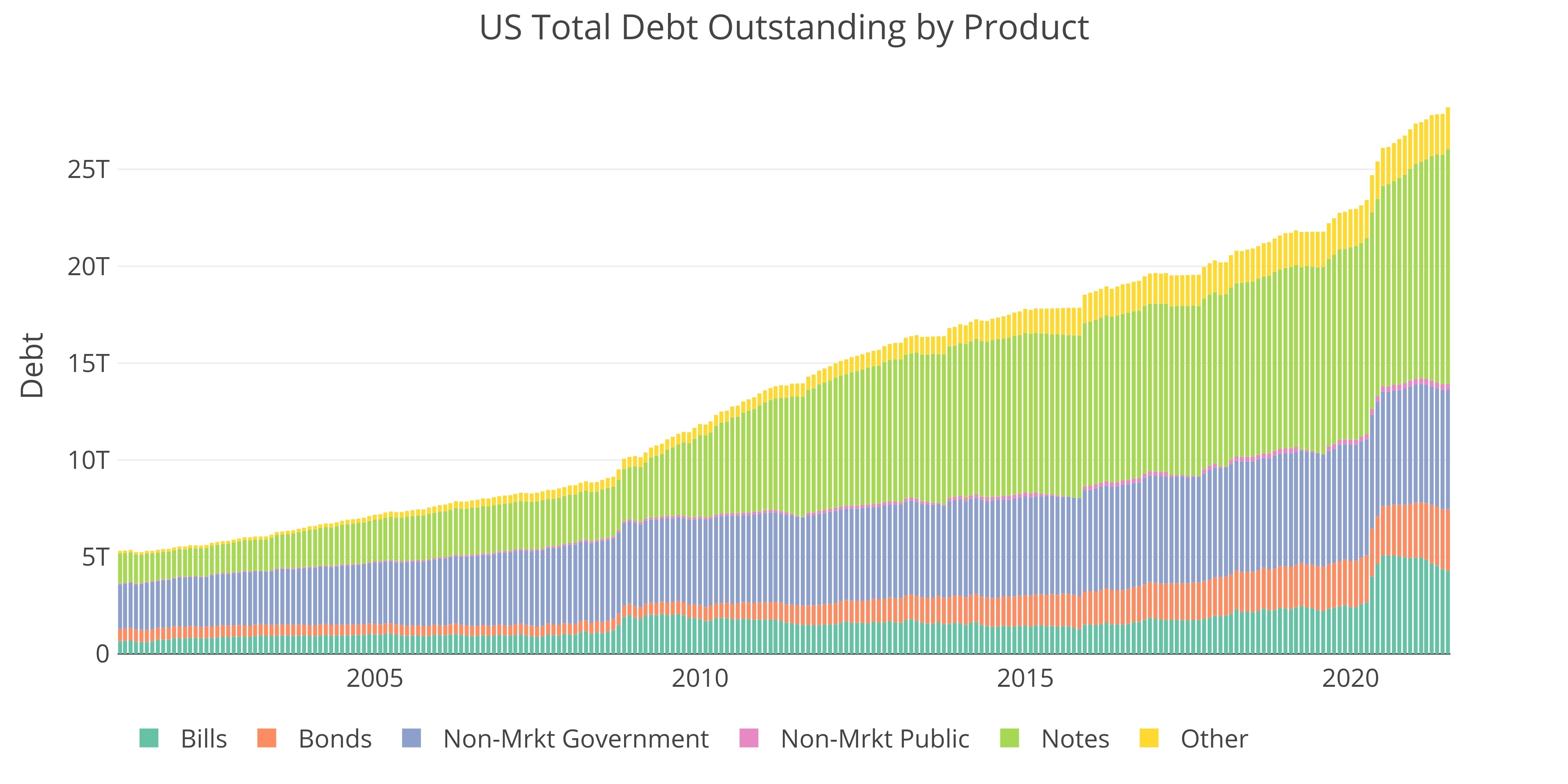

Treasury Adds $2.2T of debt in 2024

Majority of debt is short-term

Money Supply Growth Continues to Accelerate

13 week growth reaches highest level in at least 60 weeks

Is Someone Attacking the Comex? January Sees $5.2B in Gold Deliveries

Massive delivery volume requires emergency influx of inventory

The Technicals: Short-Term Caution, Medium-Term Bullish

In the short-term there could be more choppiness, but it should resolve soon

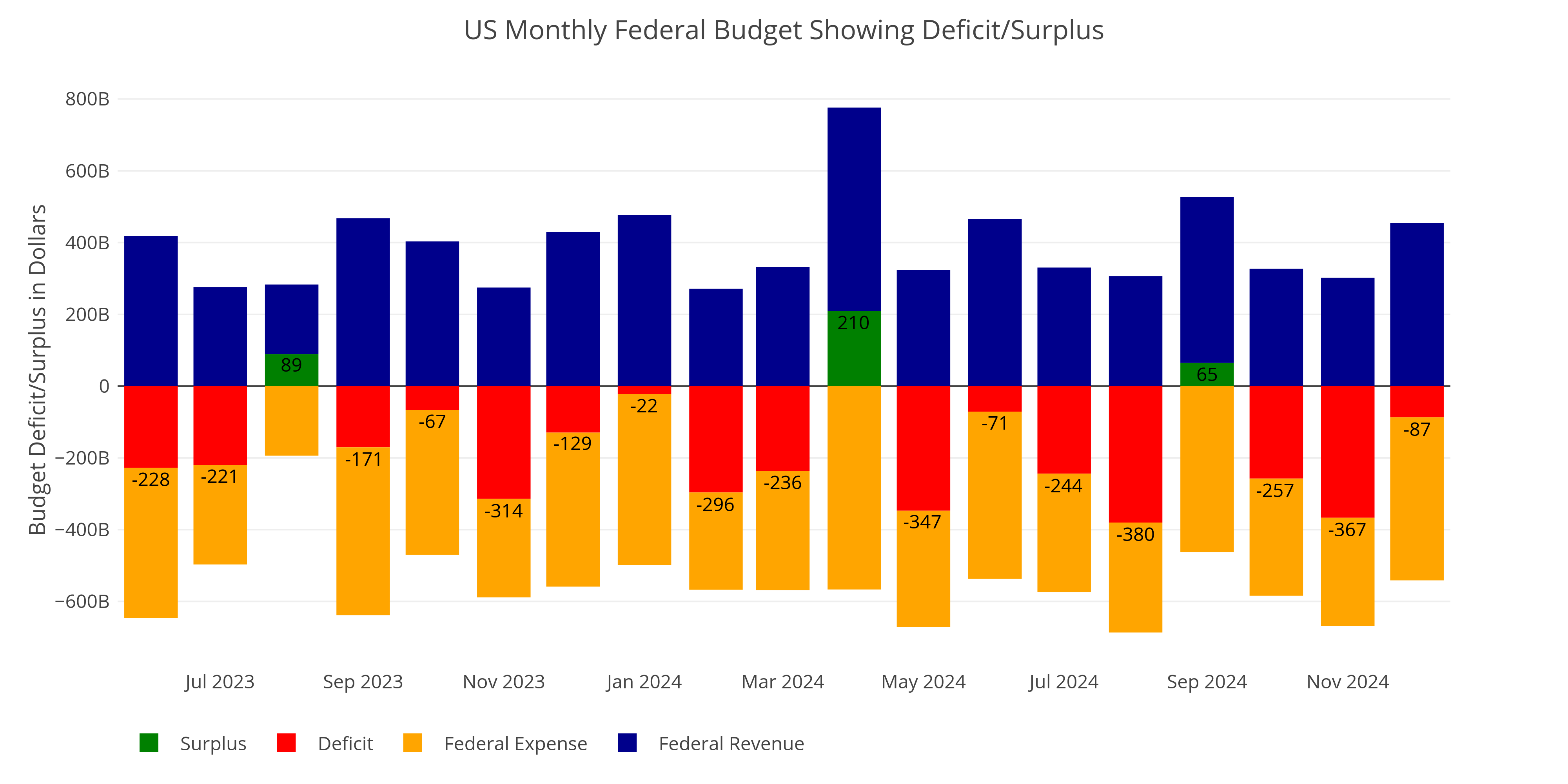

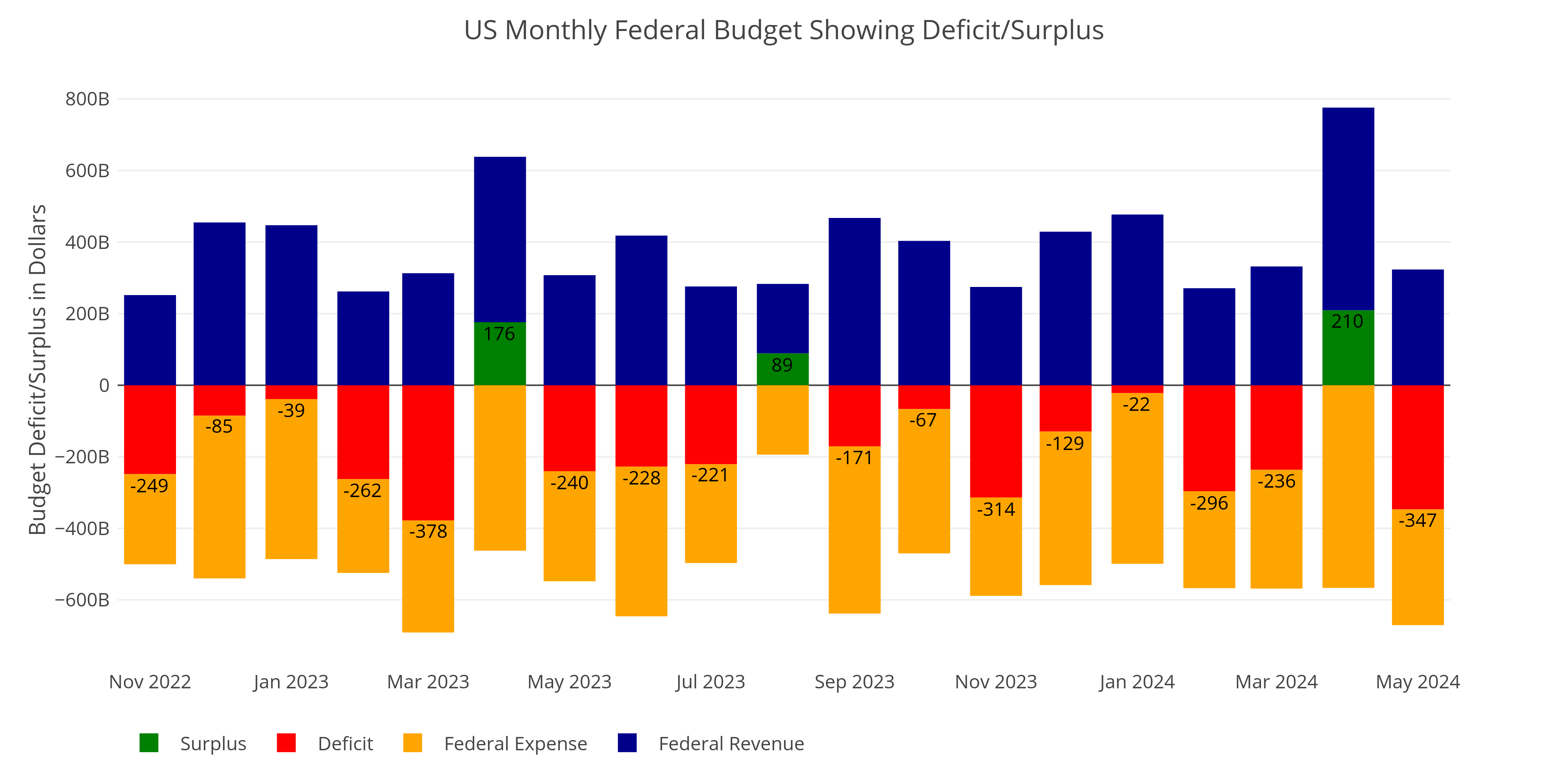

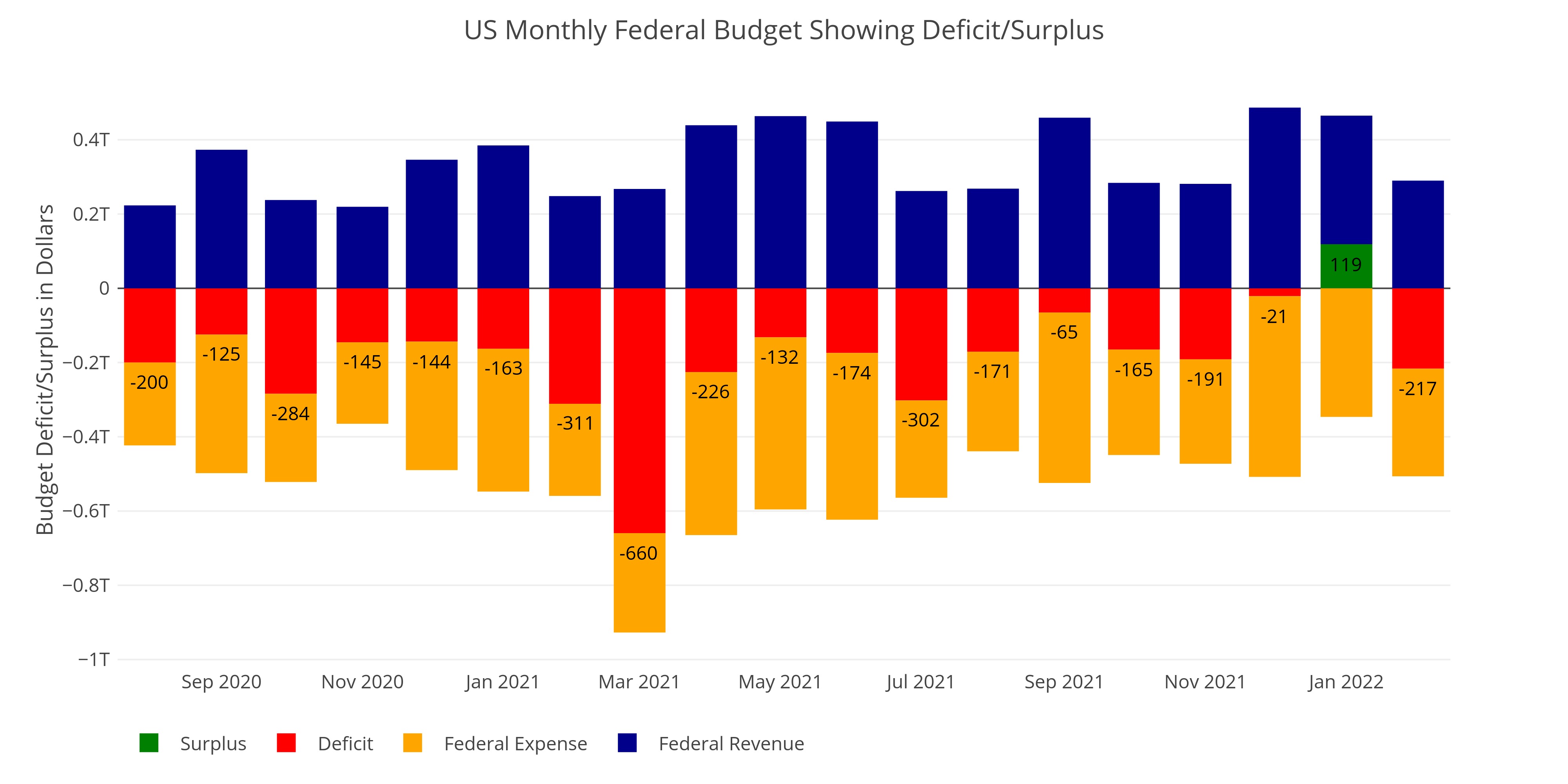

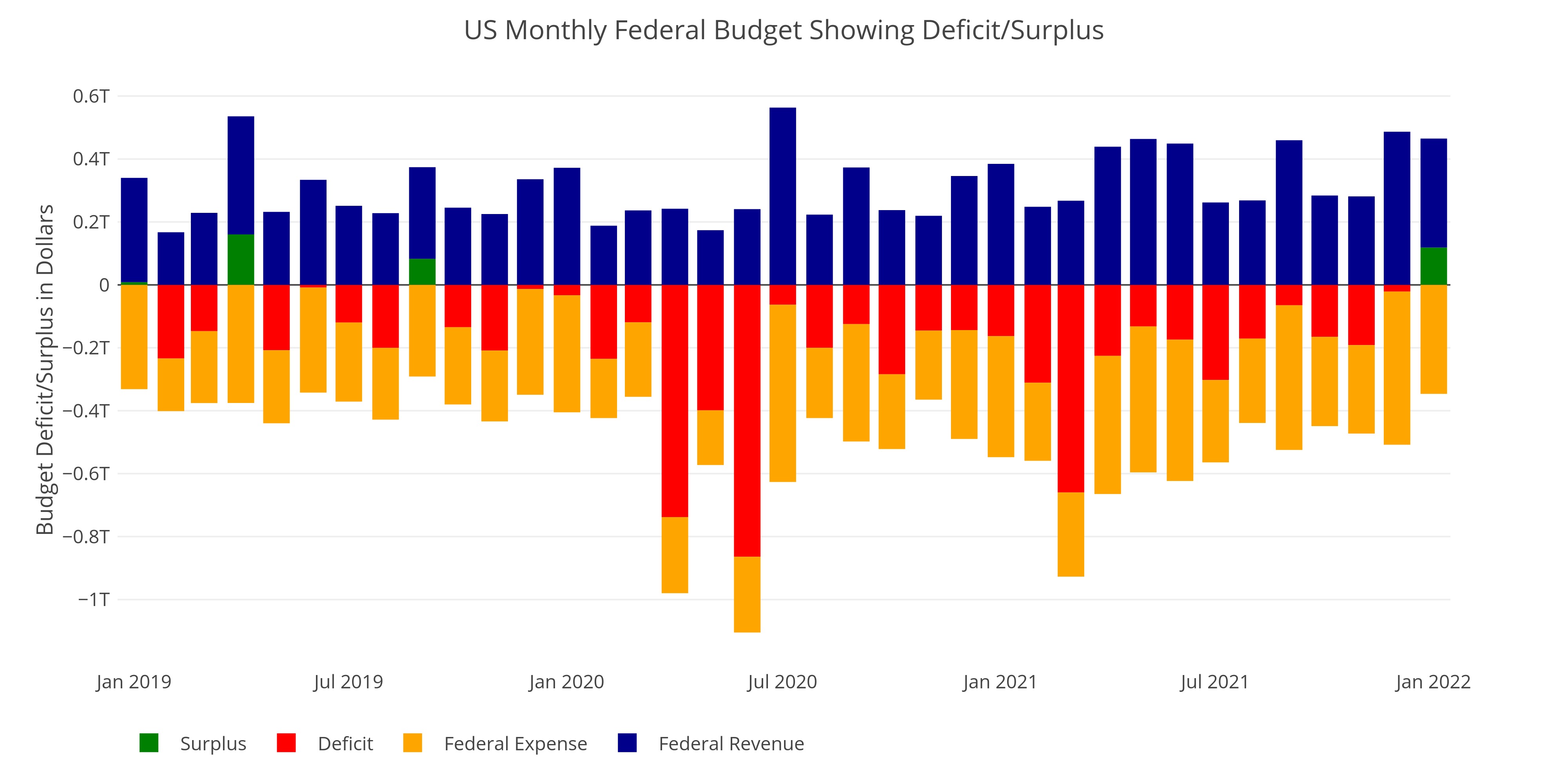

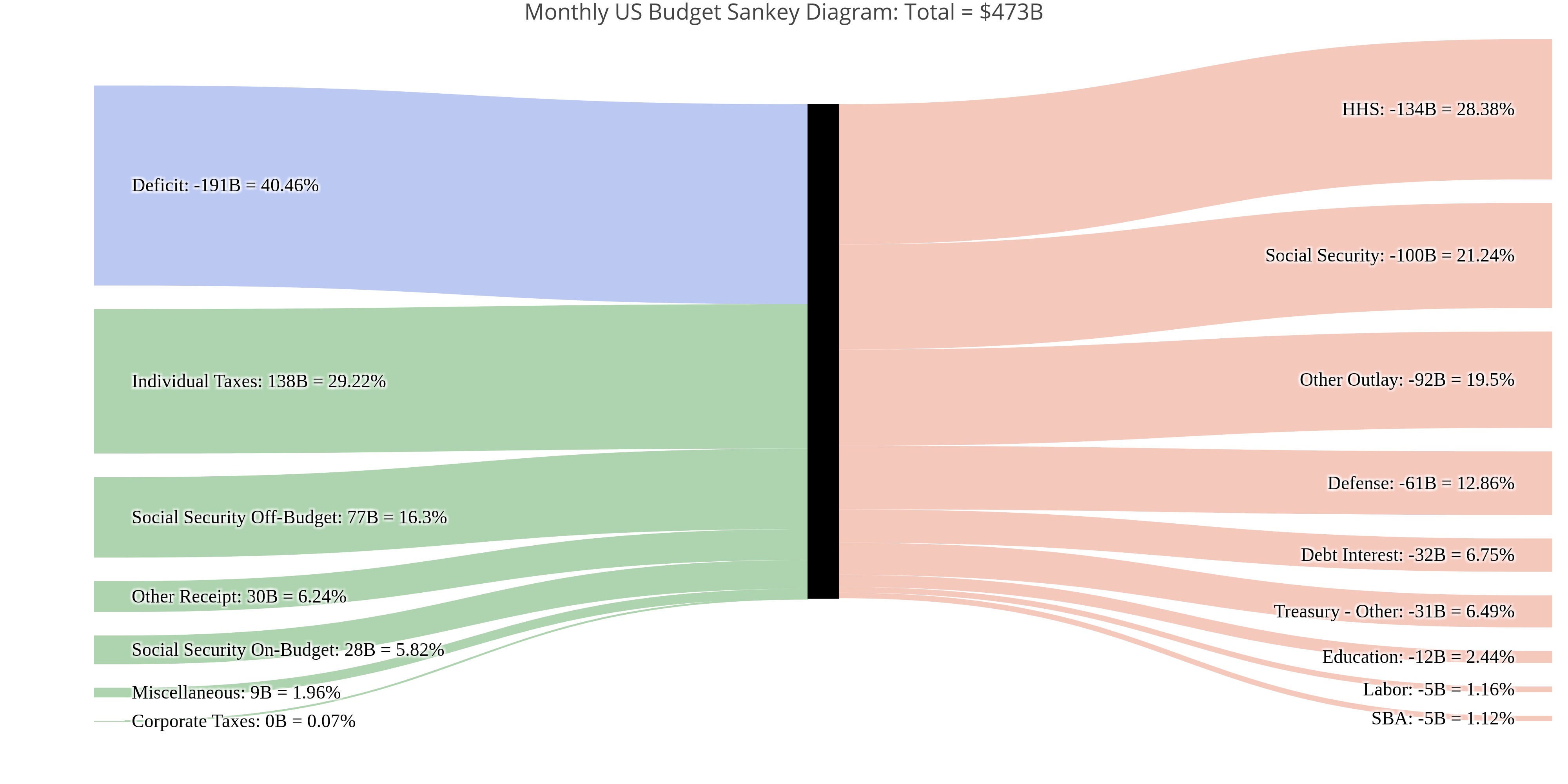

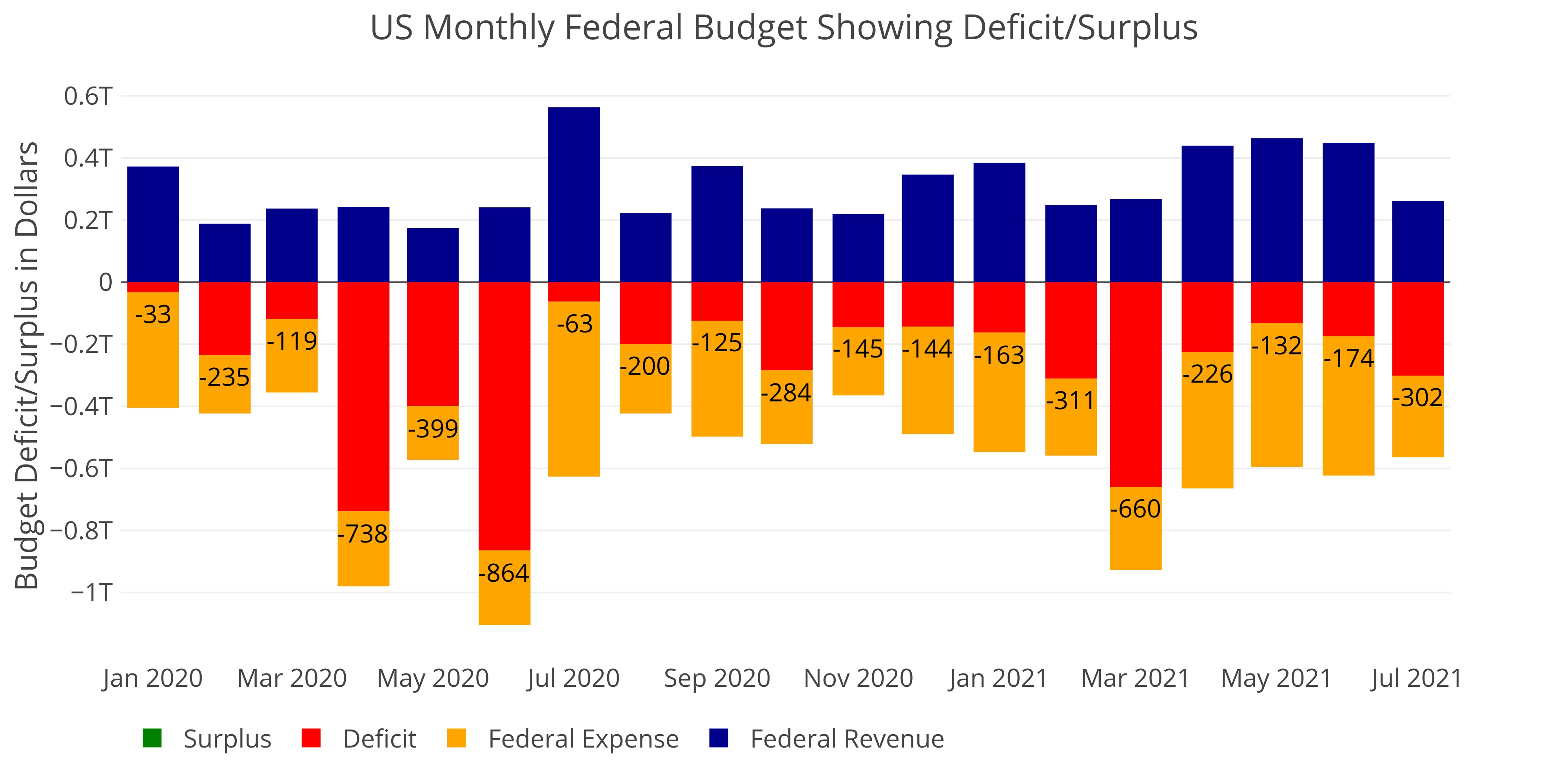

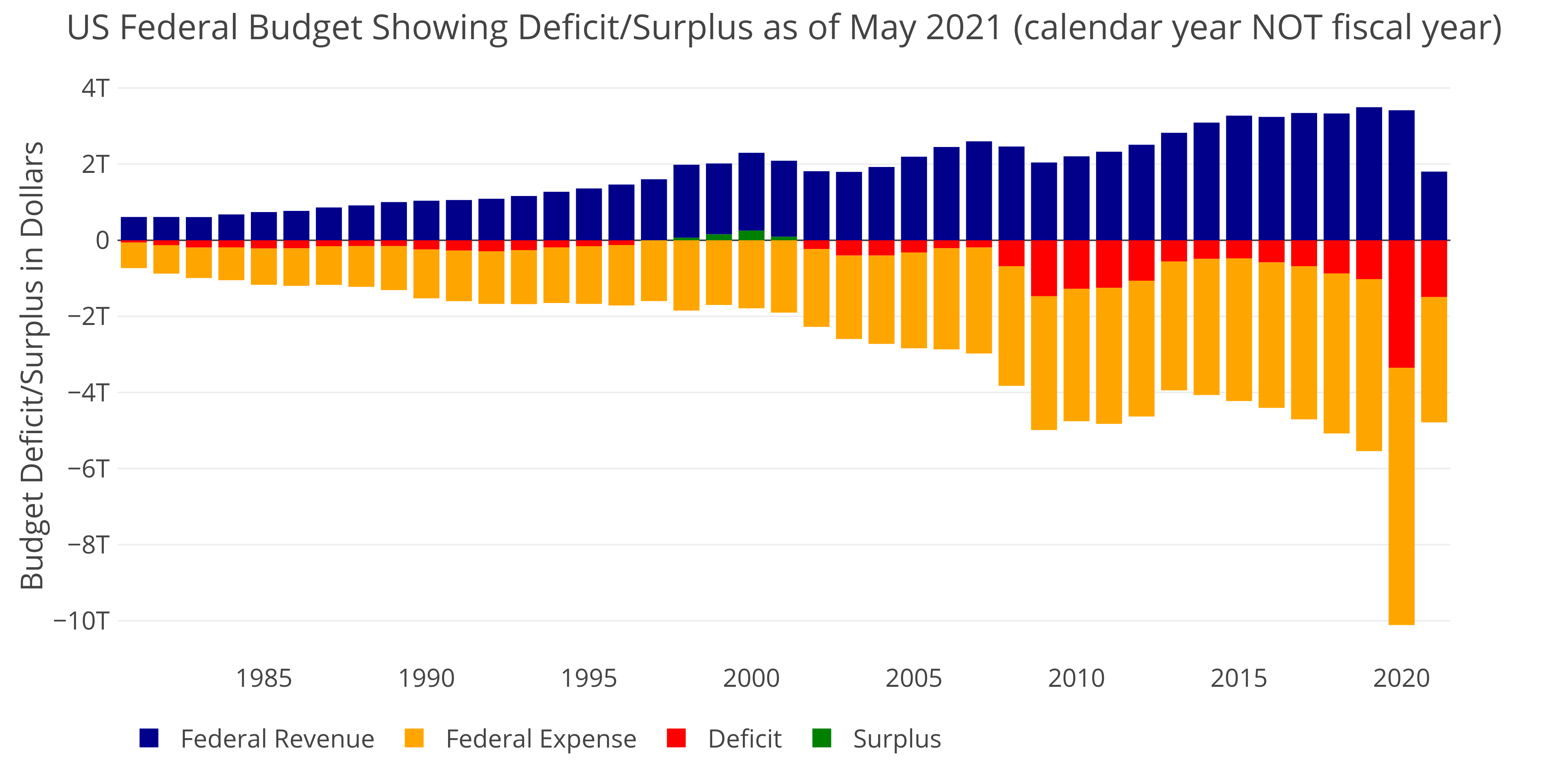

Federal Budget: 2024 Spending Exceeds Covid years

Q4 2024 was plain ugly

Federal Budget: Q1 2025 - DOGE has not Moved the Needle

A lot of fuss for not a lot of gain

Jobs: Household Survey Finishes the Year 75% Below the Headline Report

A strong December does not make up for a really bad year overall

Jobs: Don't be confused by the 2M jump in the Household Survey

This is a one time revision

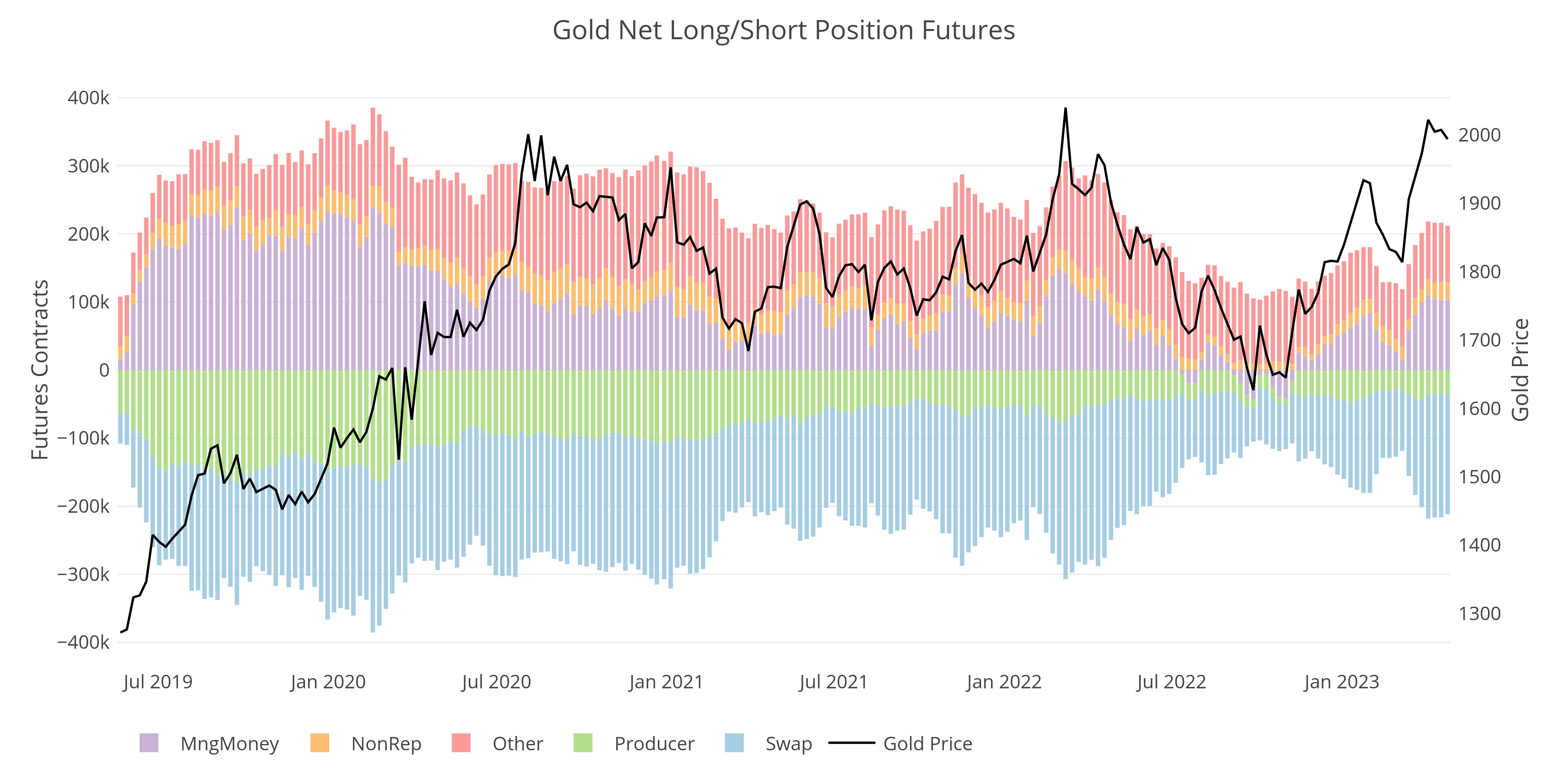

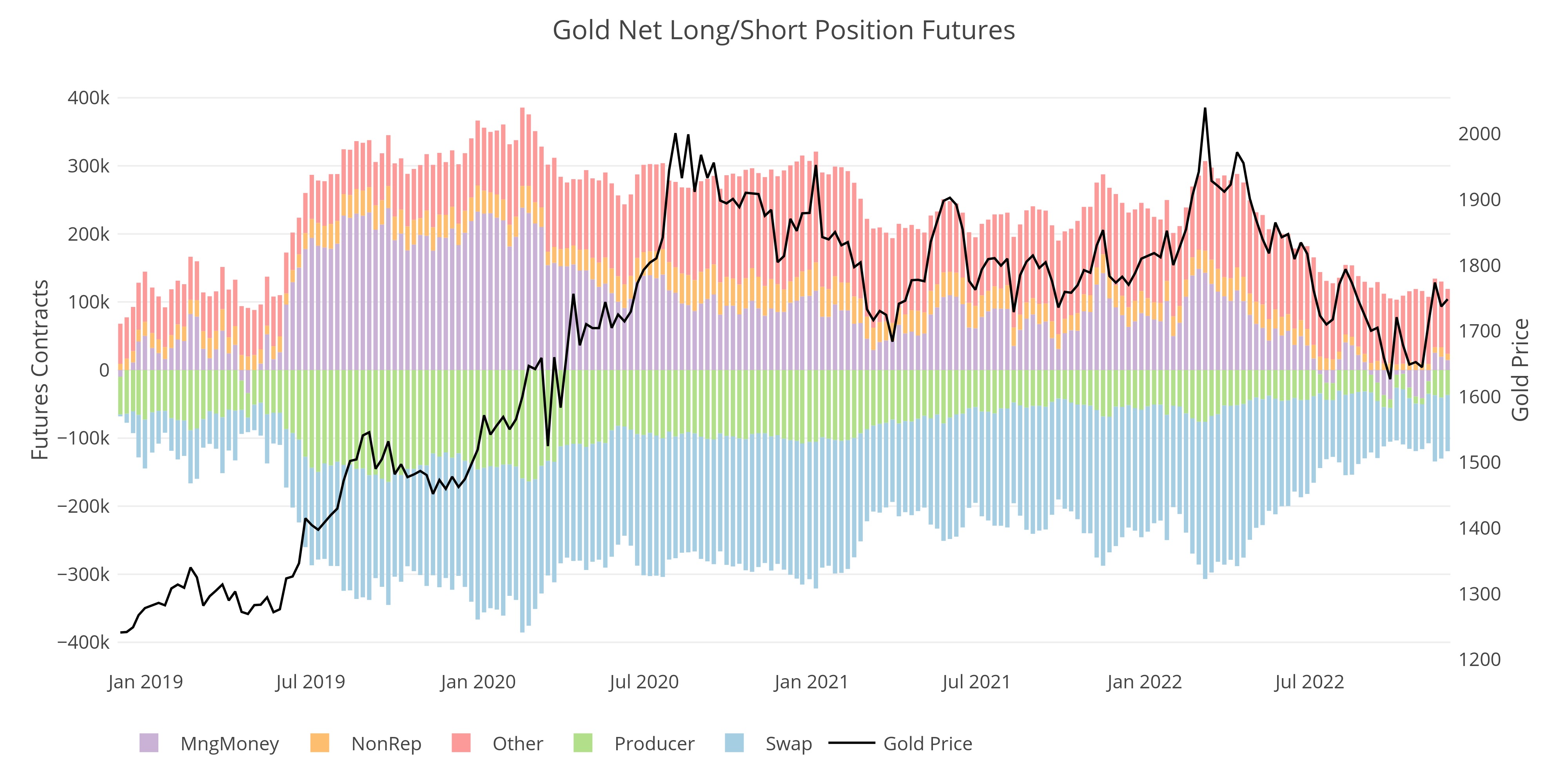

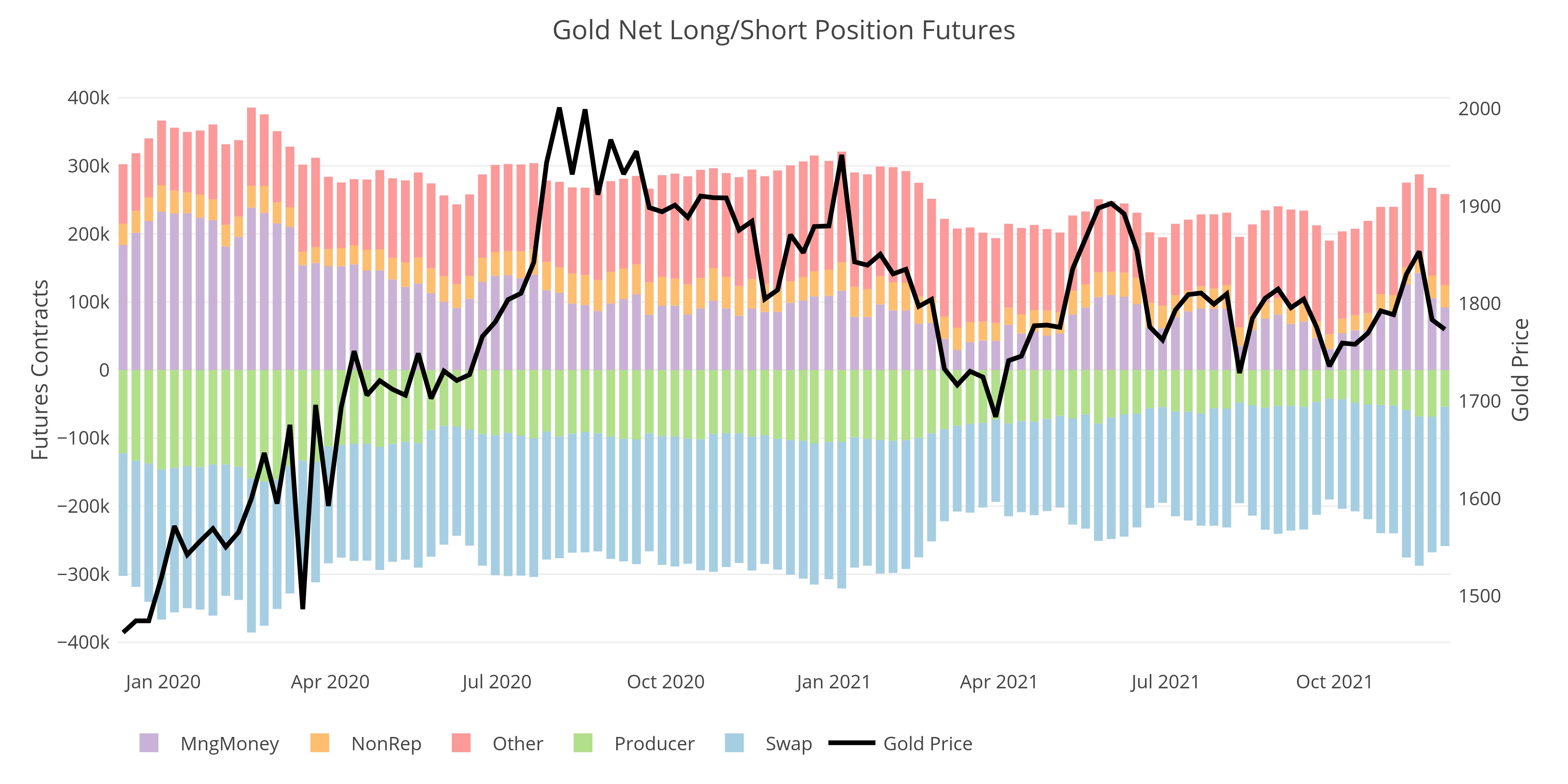

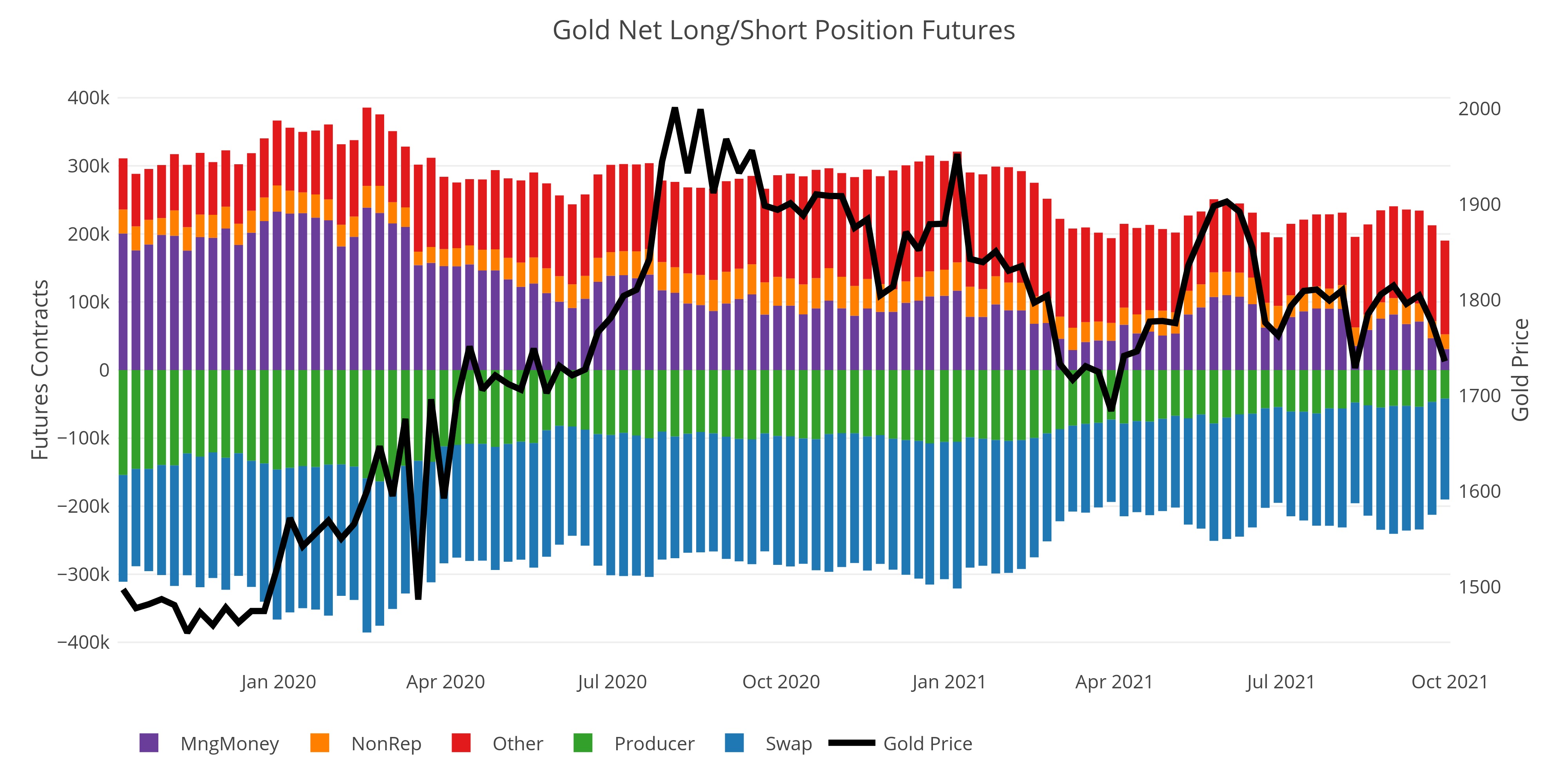

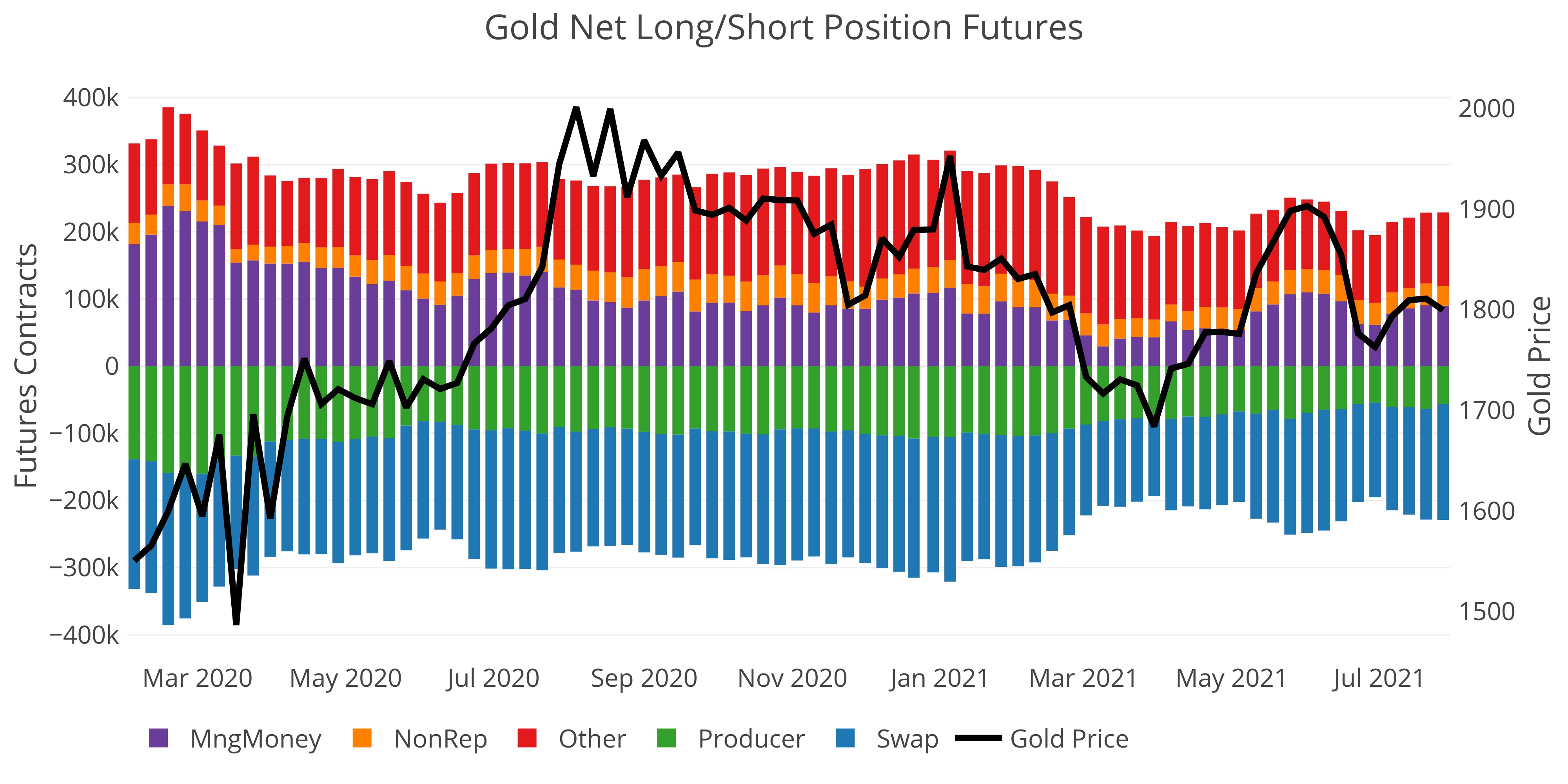

CFTC CoTs Report: Be Advised - Gold is Overbought Among Hedge Funds

A quick exit could see a big down move in gold

CFTC CoTs Report: Managed Money has Lost Control of the Gold Market

Manaeg Money maintains control over Silver (for now)

Money Supply Growth Continues to Accelerate

13 week growth reaches highest level in at least 60 weeks

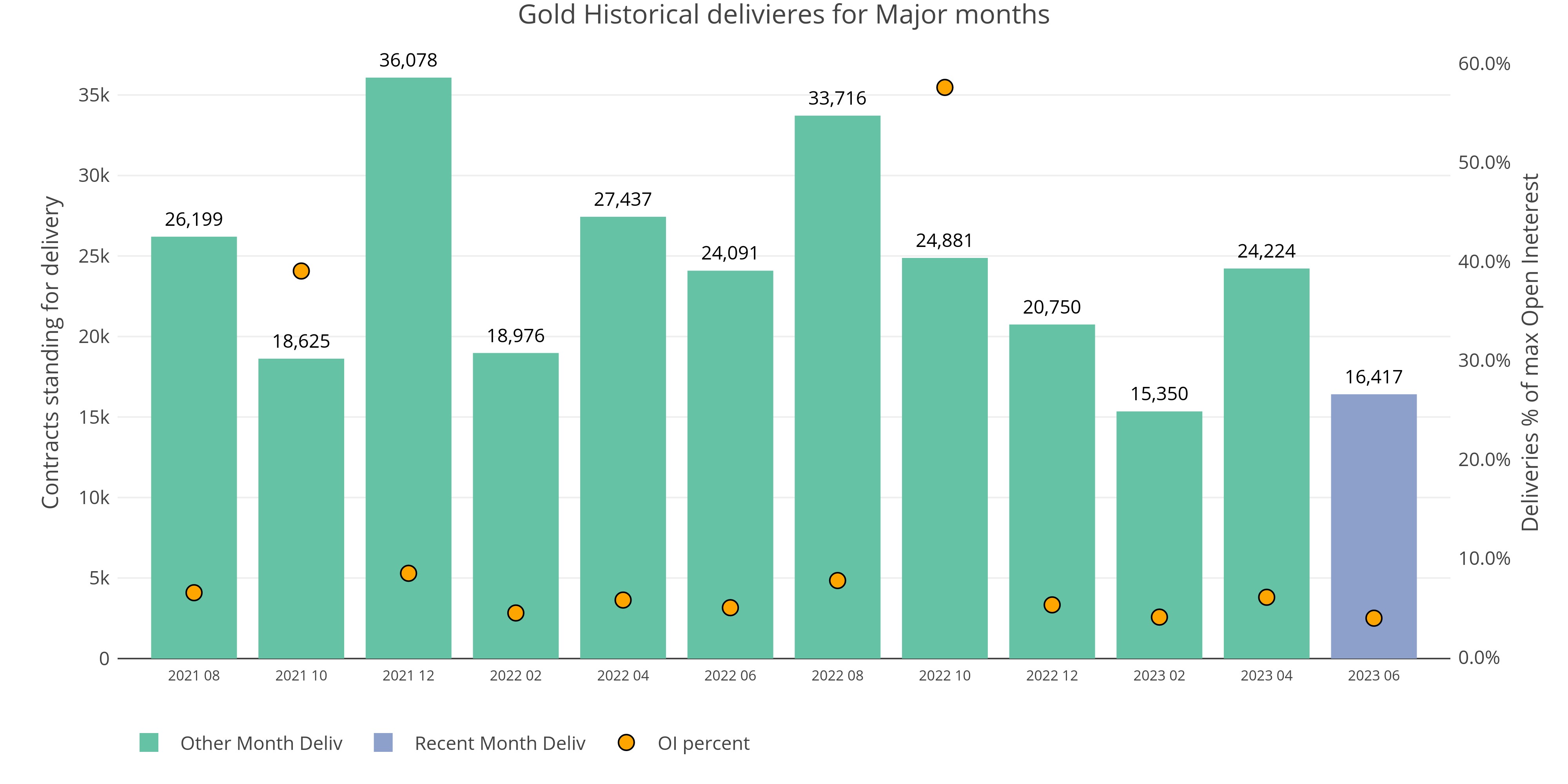

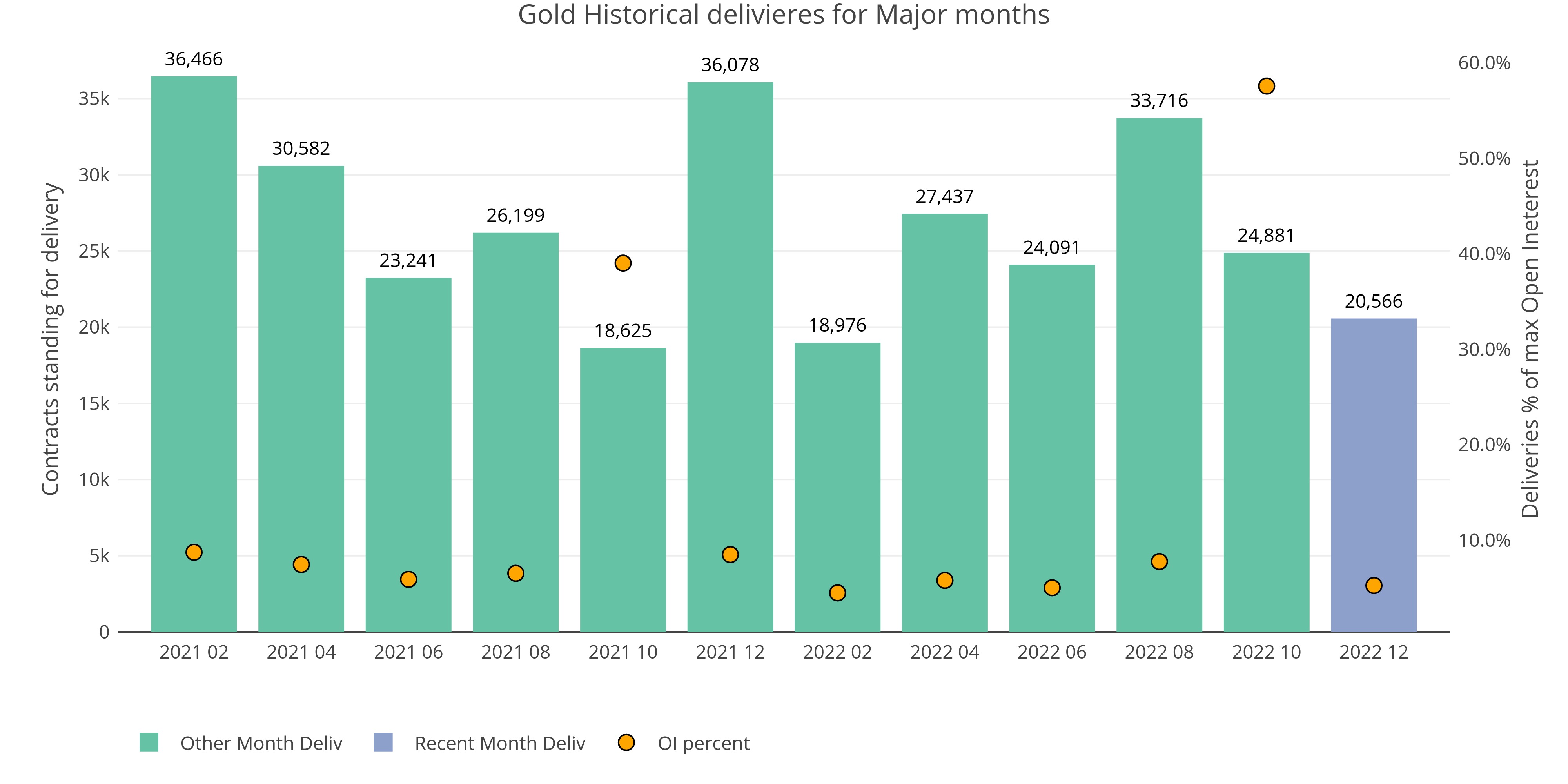

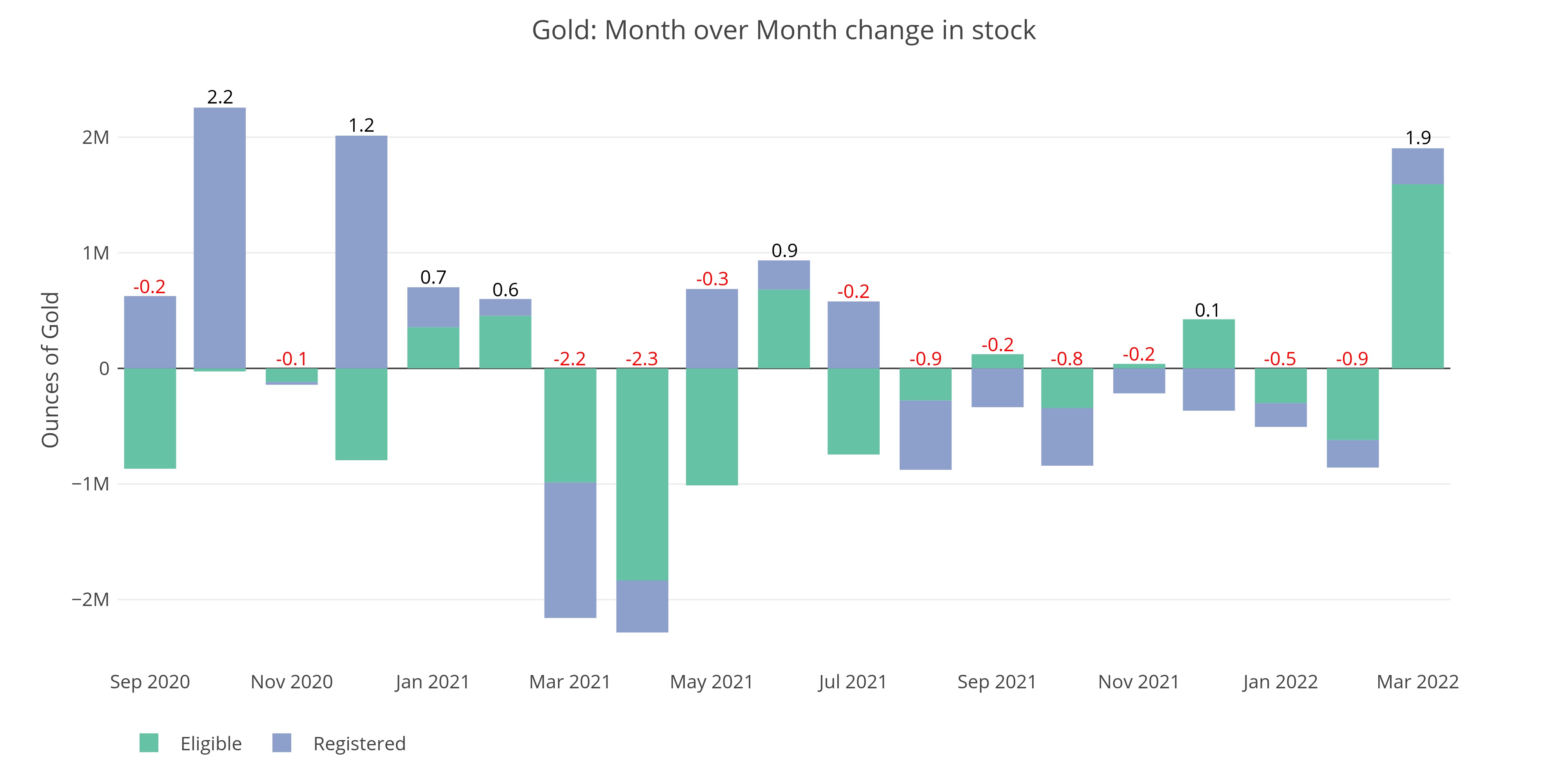

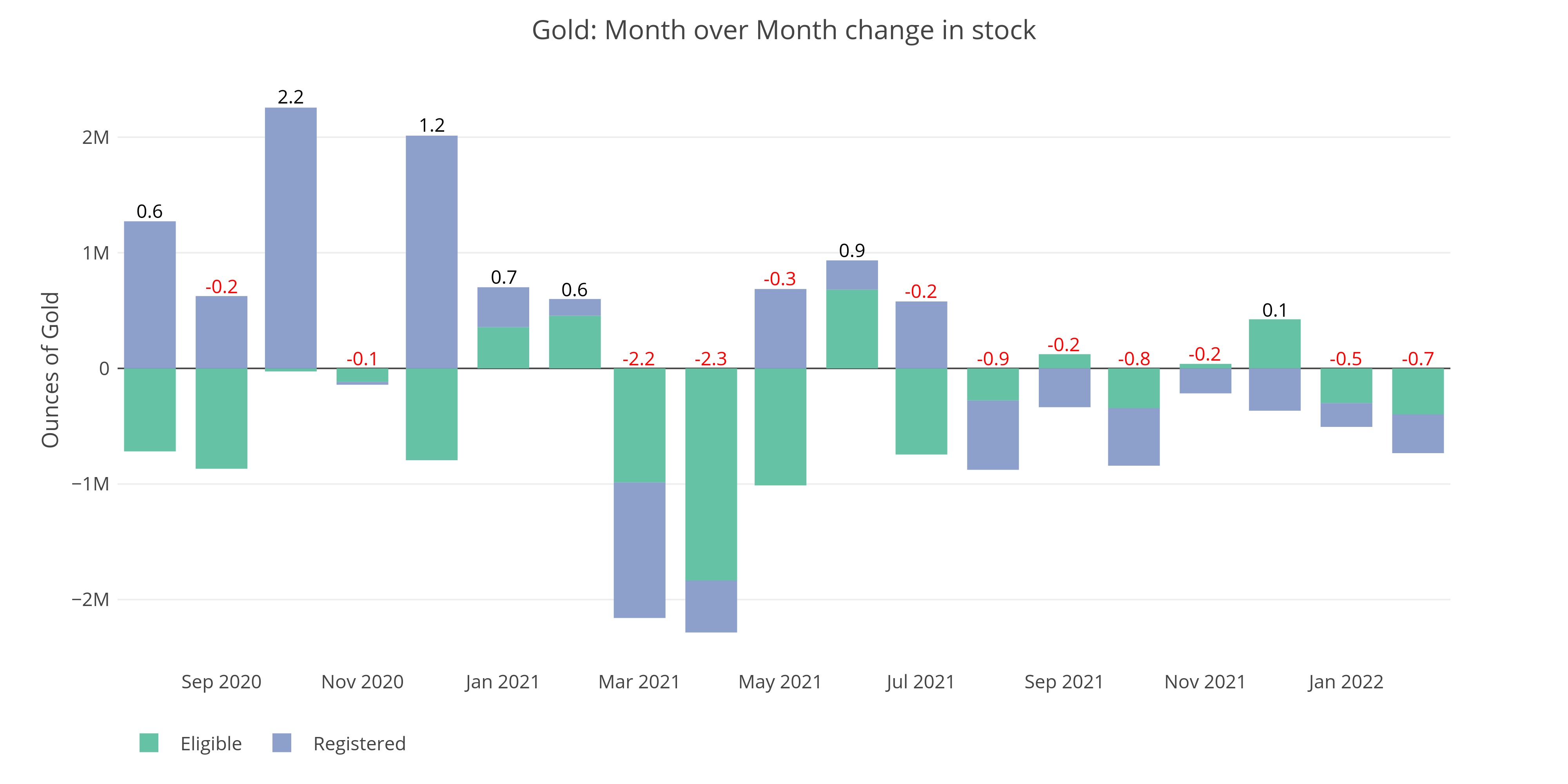

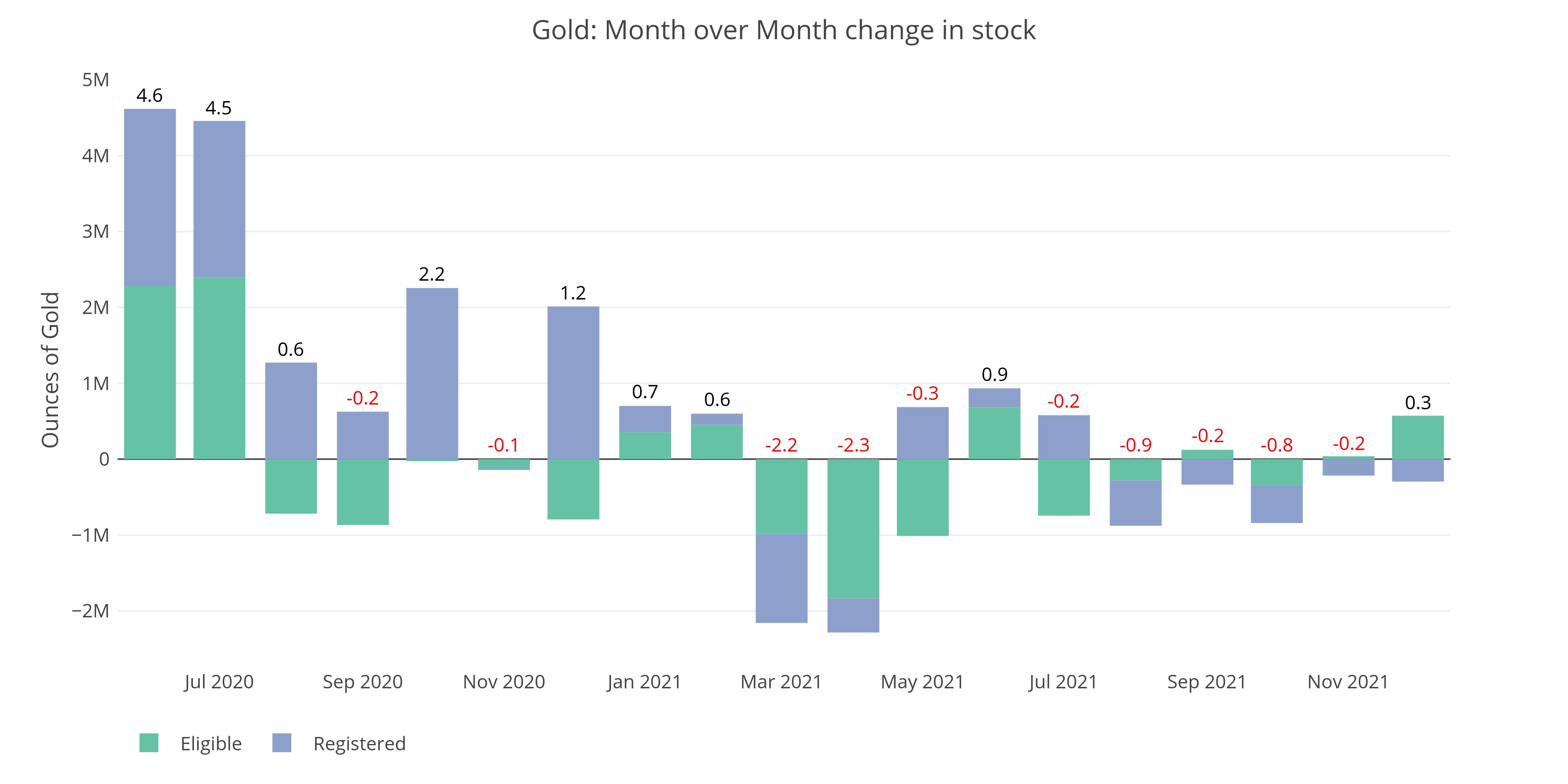

Comex: December Sees Huge Delivery Volume and a Surge in Inventory

What is driving the surge in inventory?

Jobs: Household Survey Shows Negative Job Gains YTD

Household Survey and QCEW are both in bad shape

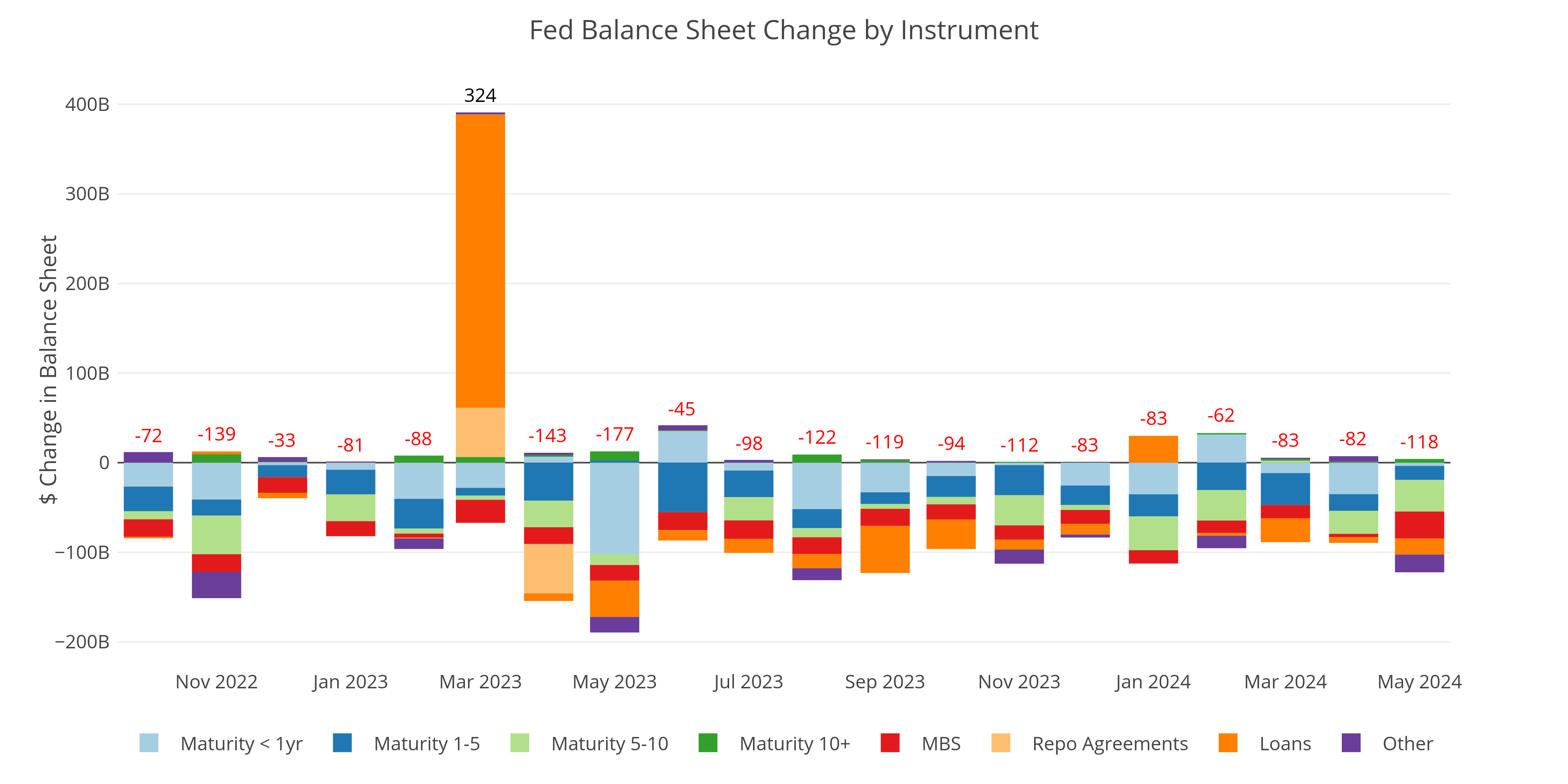

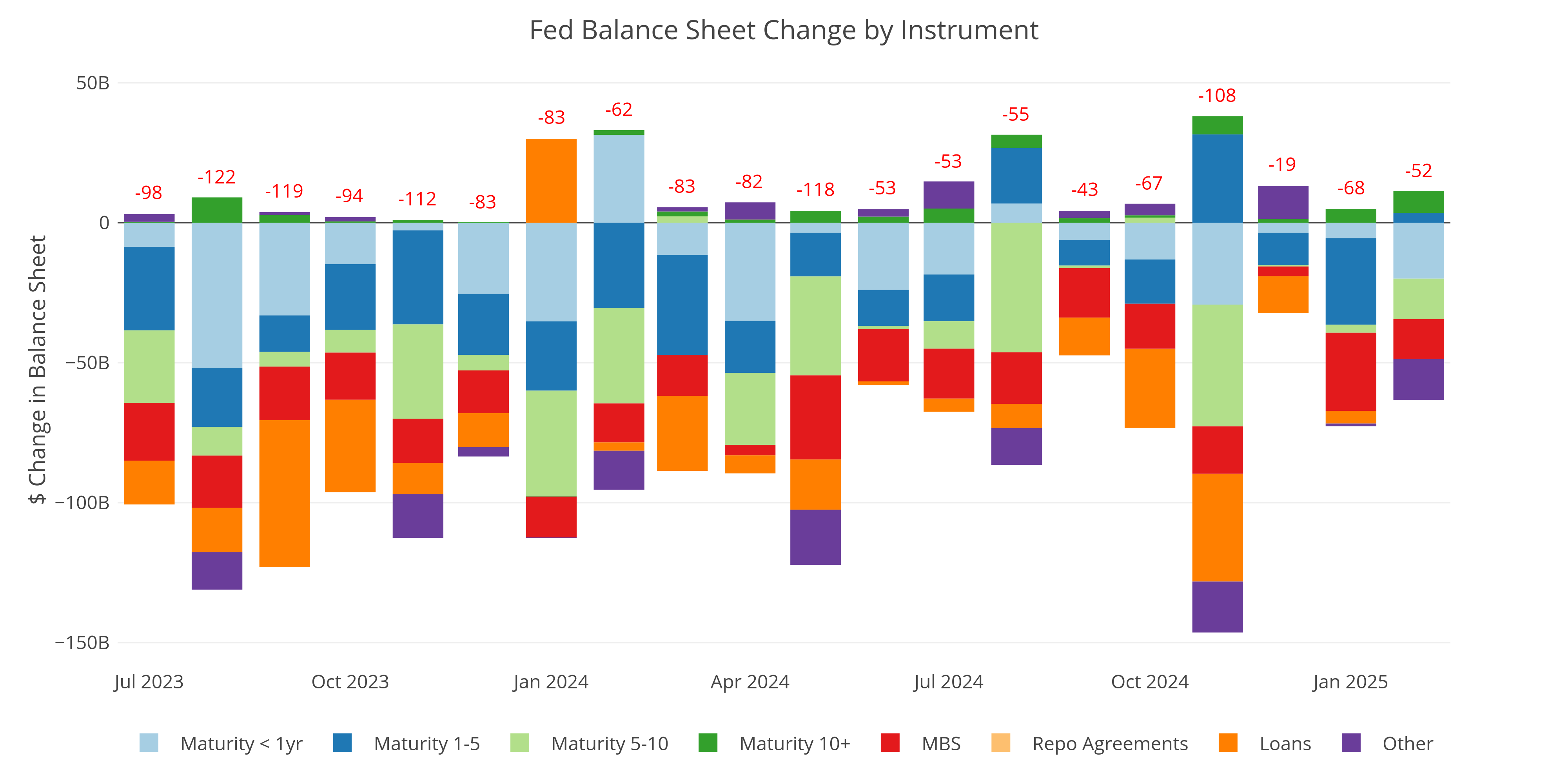

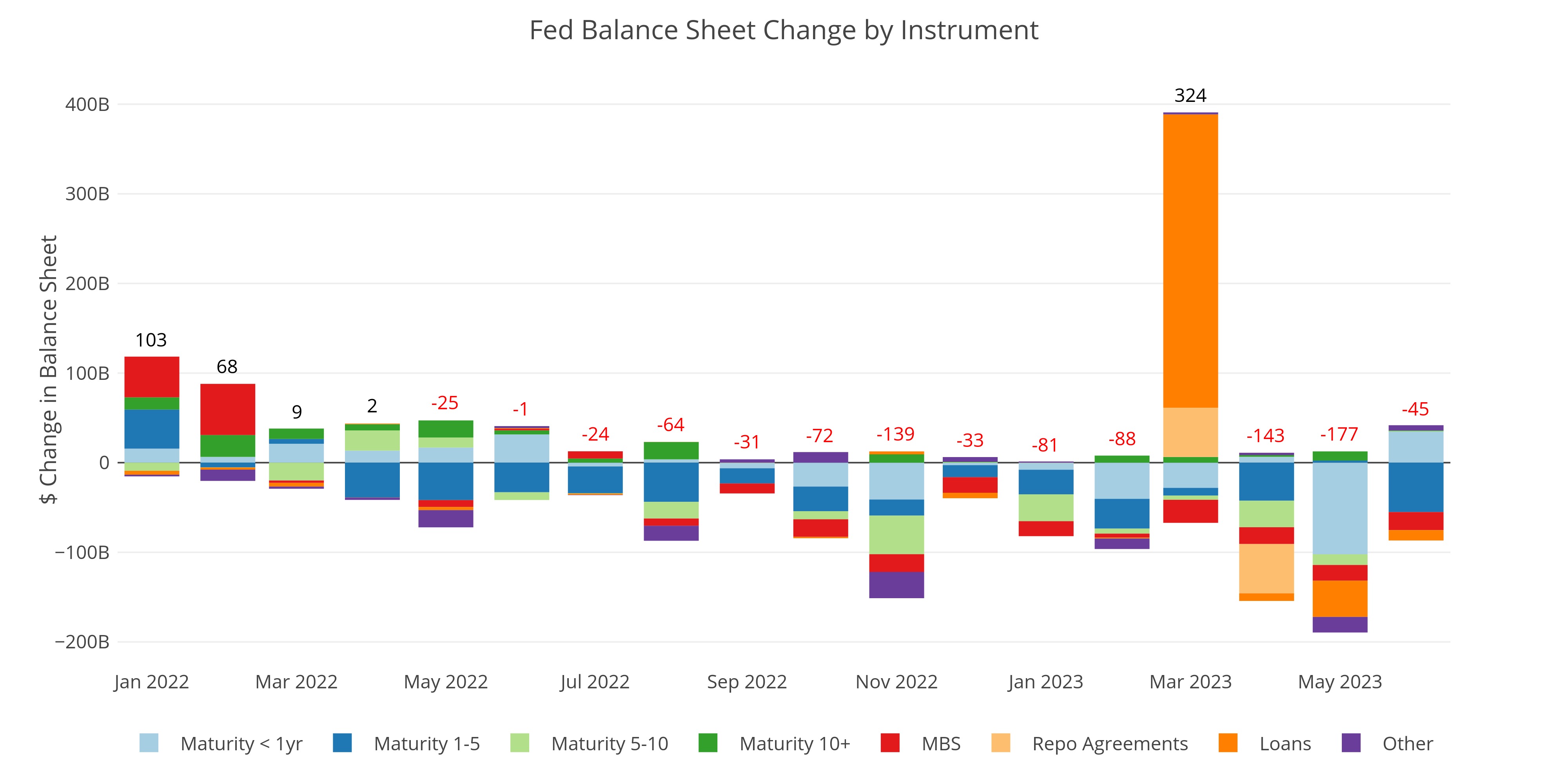

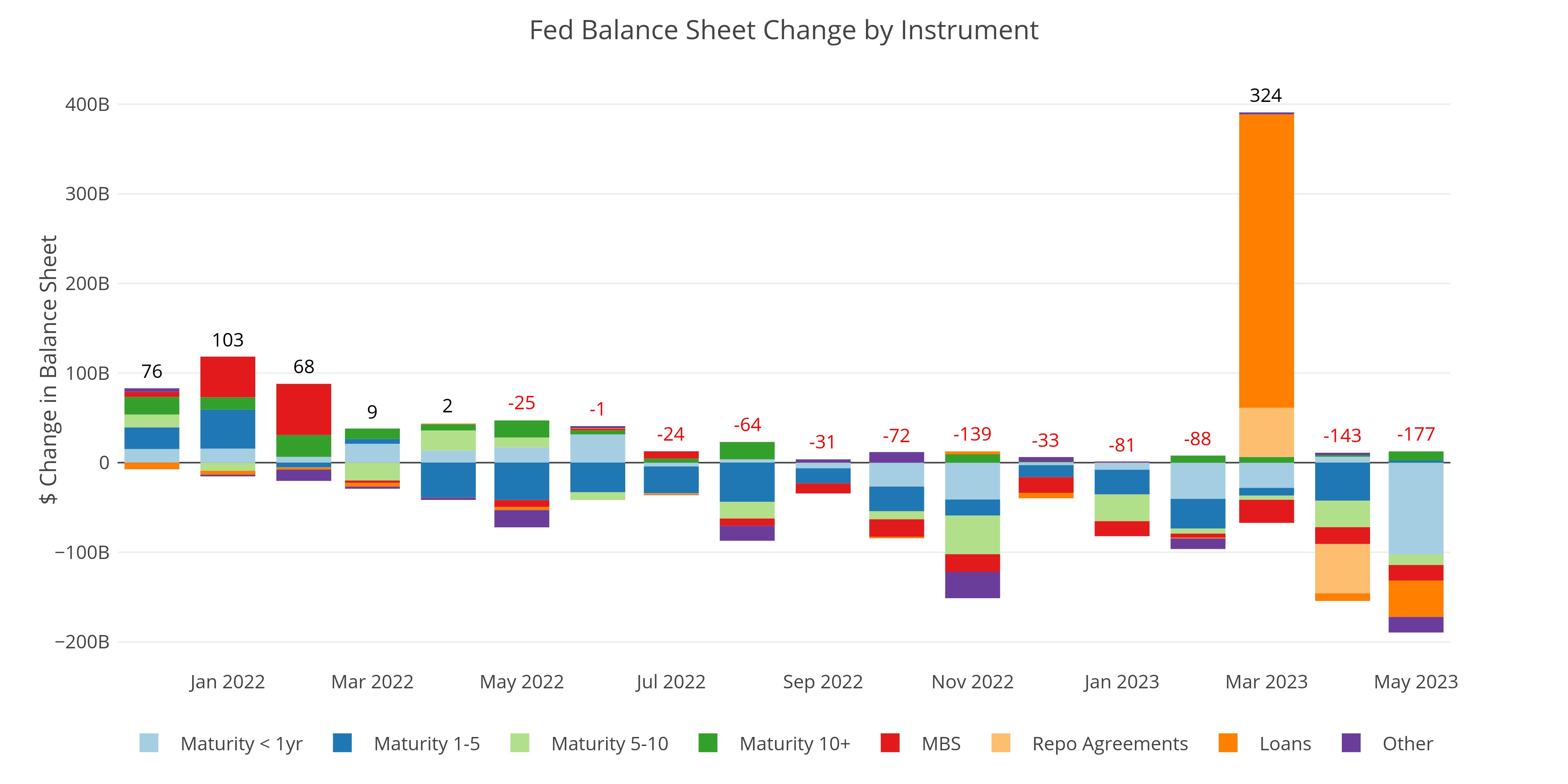

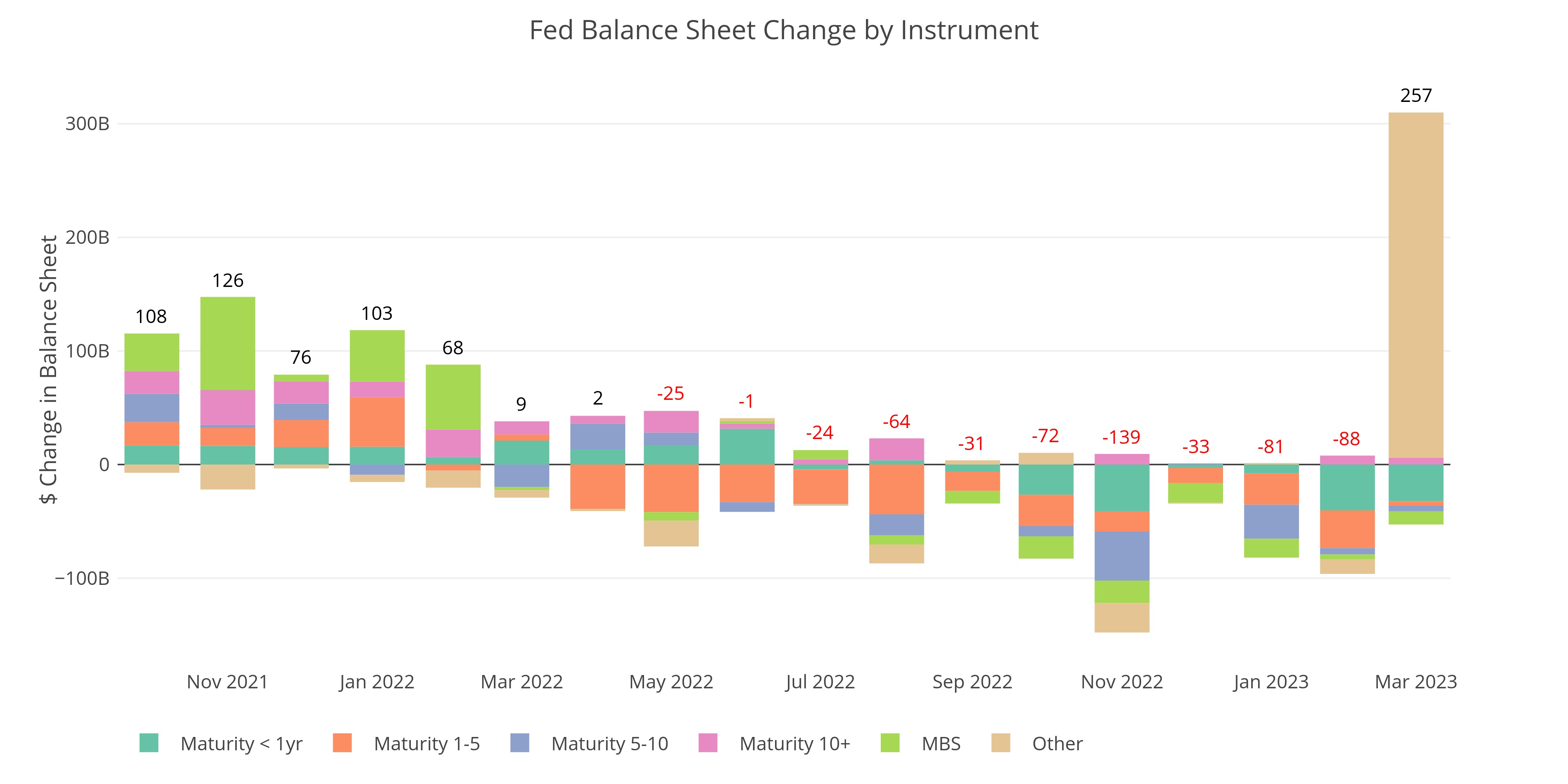

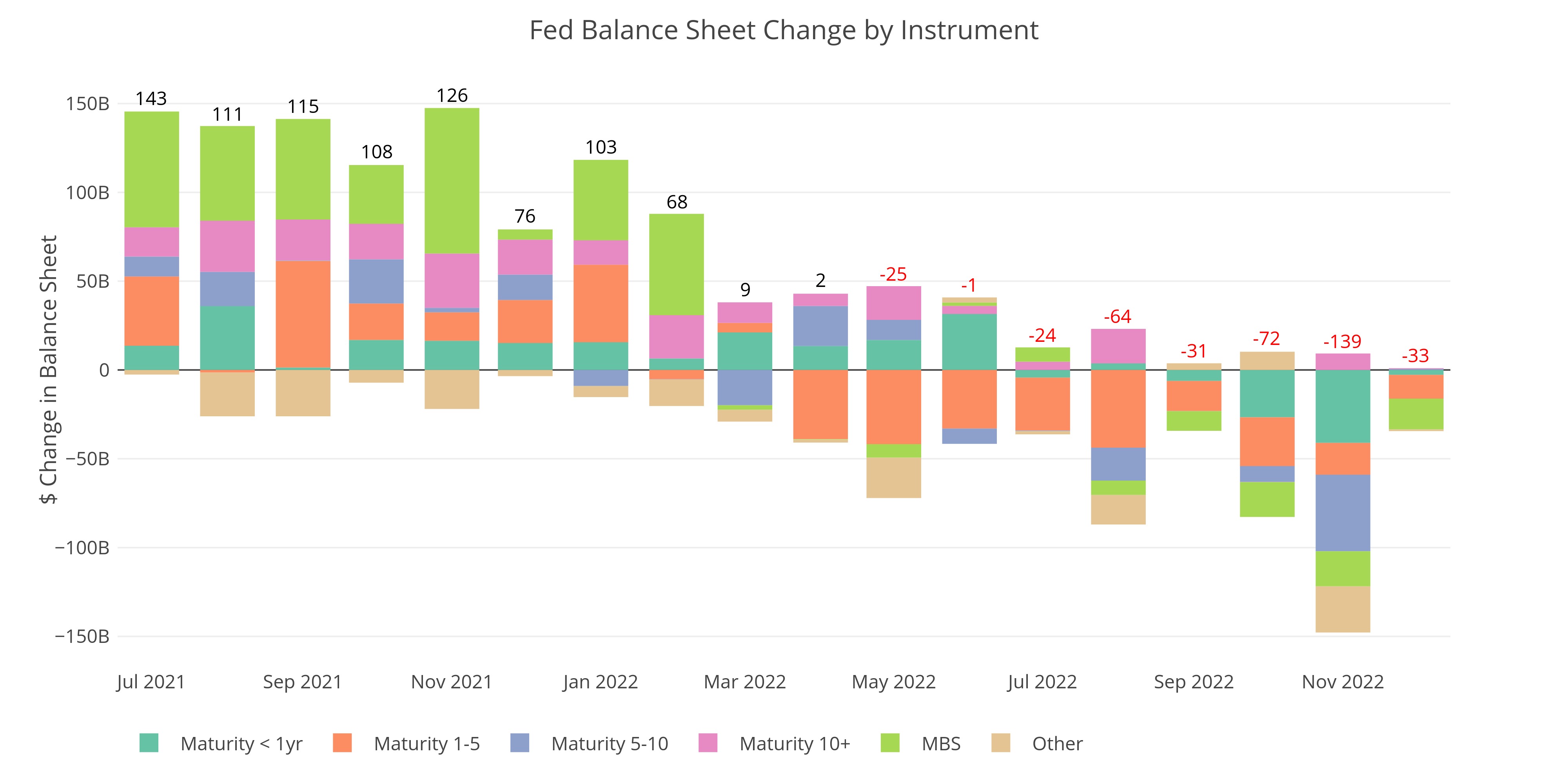

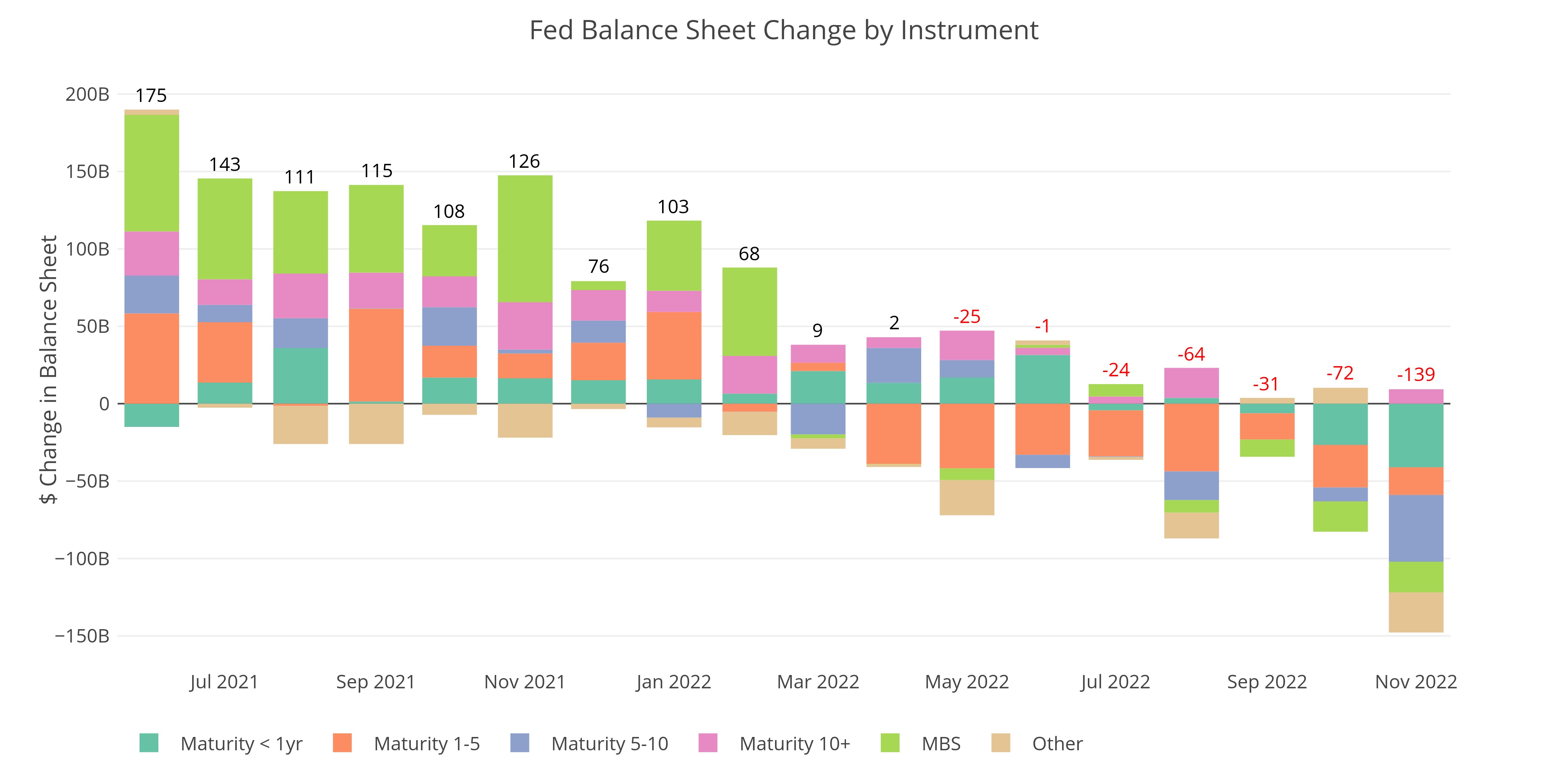

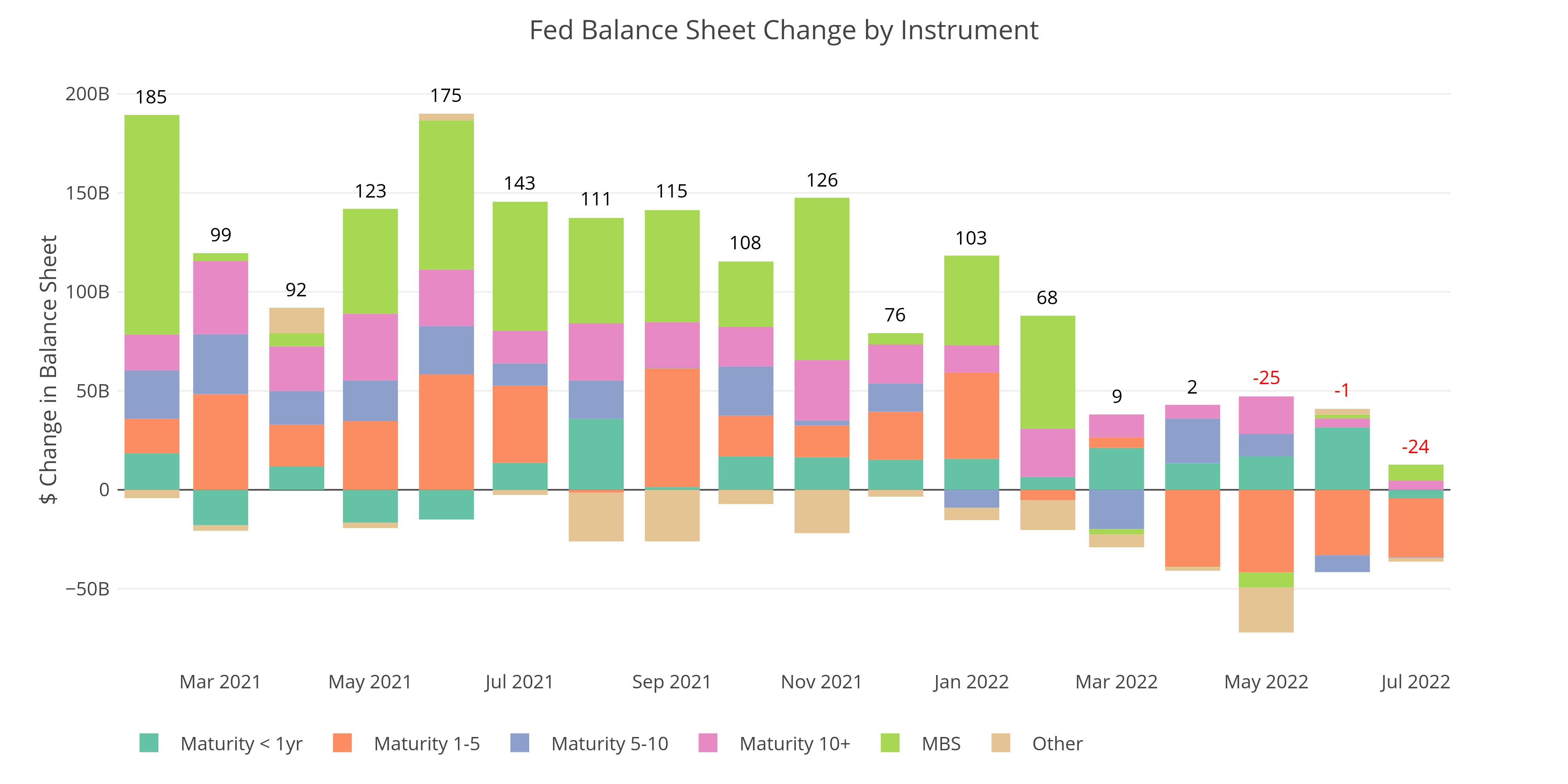

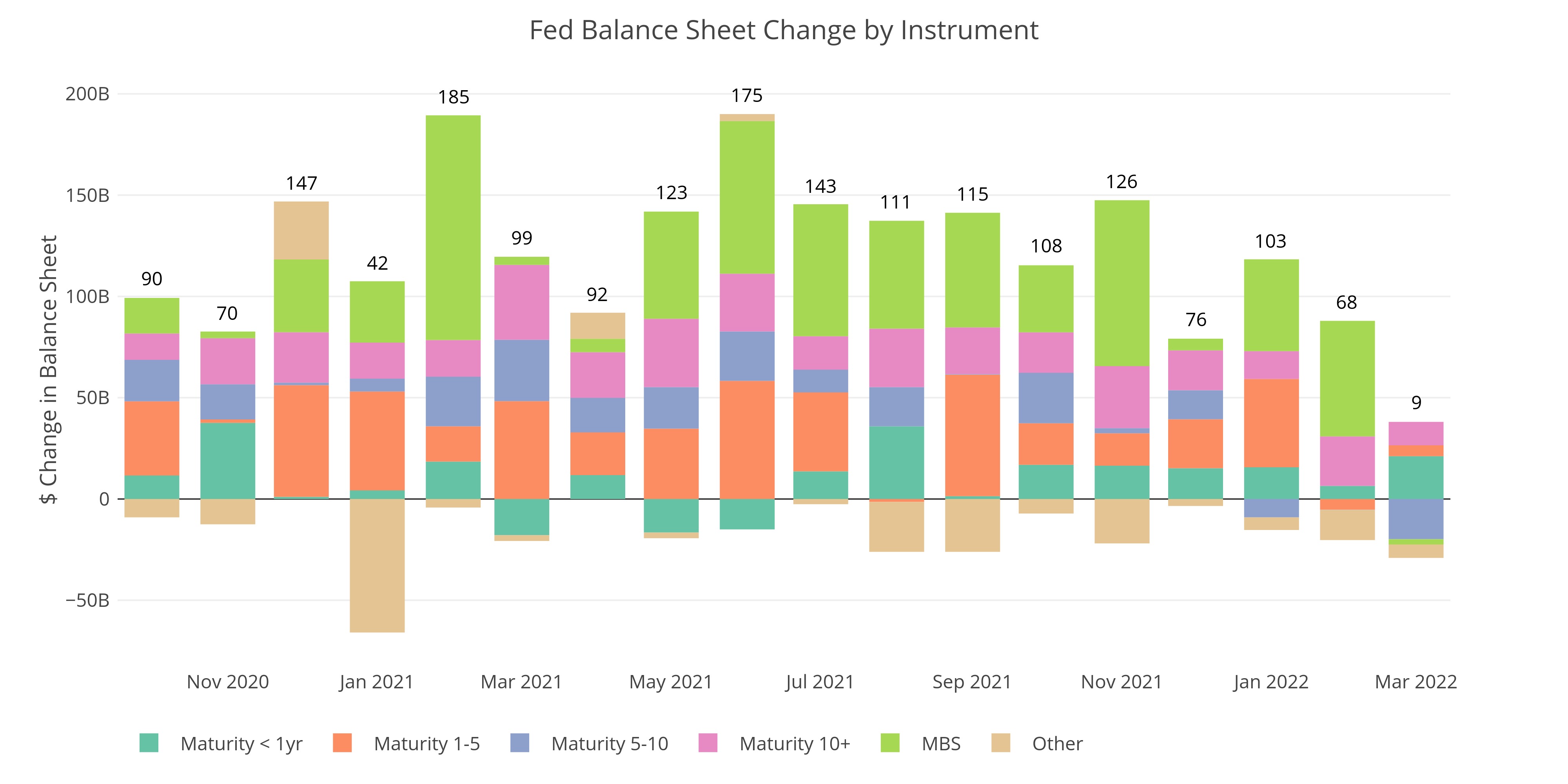

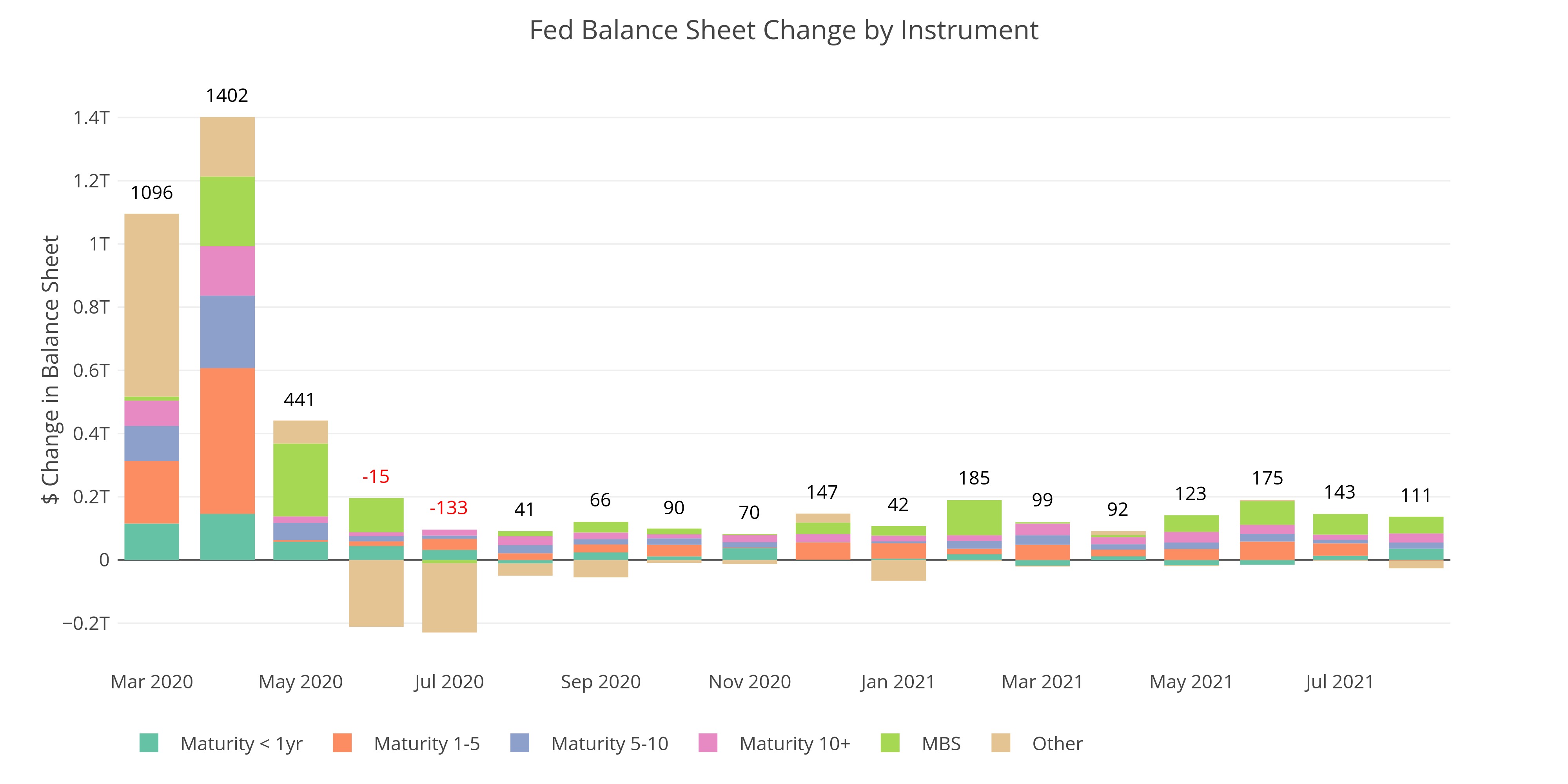

The Fed Dramatically Slows the Pace of QT

Fed nearing end of QT entirely

Money Supply Growth Continues to Accelerate

13 week growth reaches highest level in at least 60 weeks

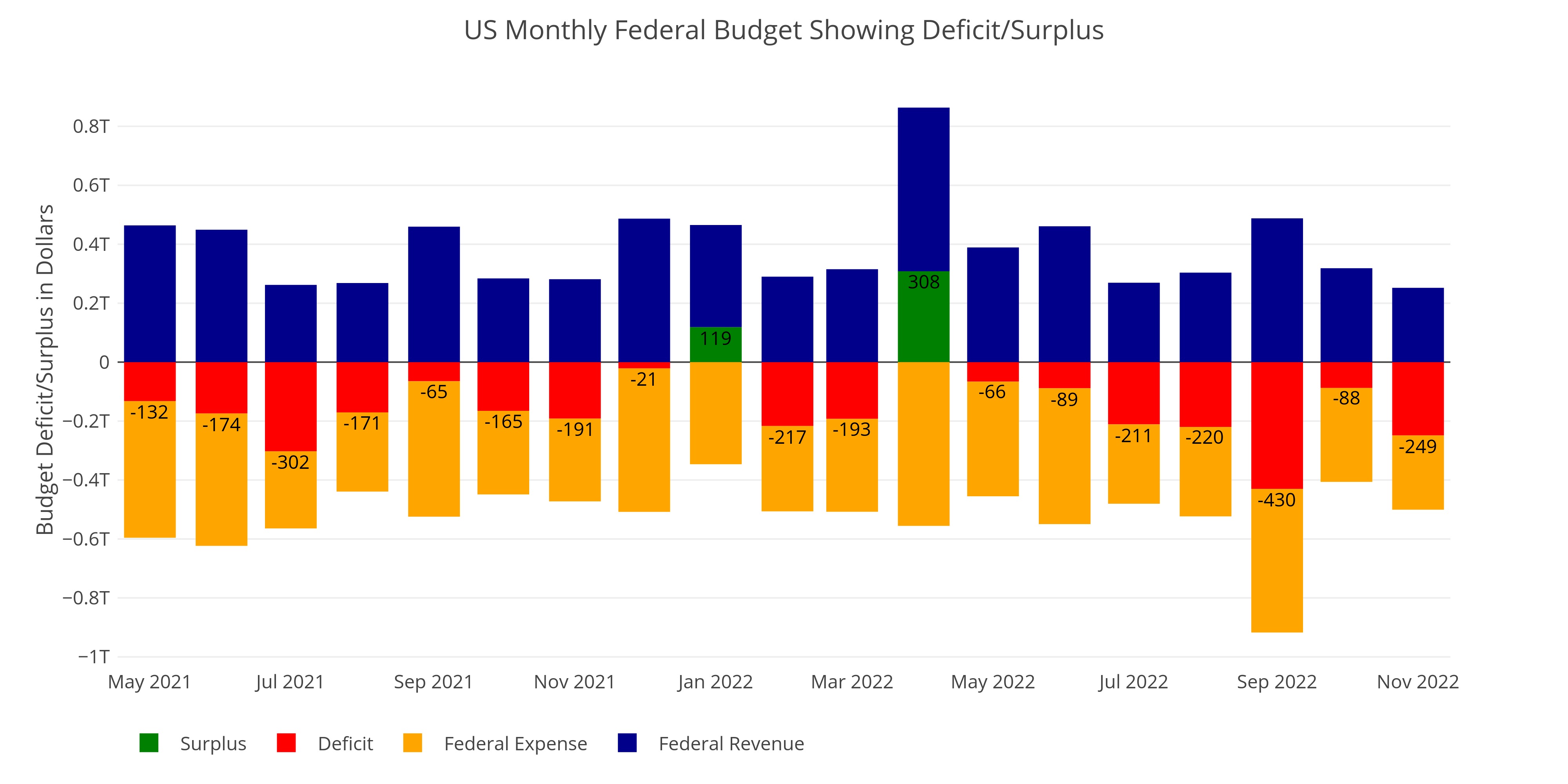

Federal Budget: Trump Inherits an Absolute Fiscal Mess - $1.8T Annual Deficit

We are way past the point of being unsustainable

Treasury Adds $1.1T of debt in last 4 months and $2T YTD

Majority of debt is short-term

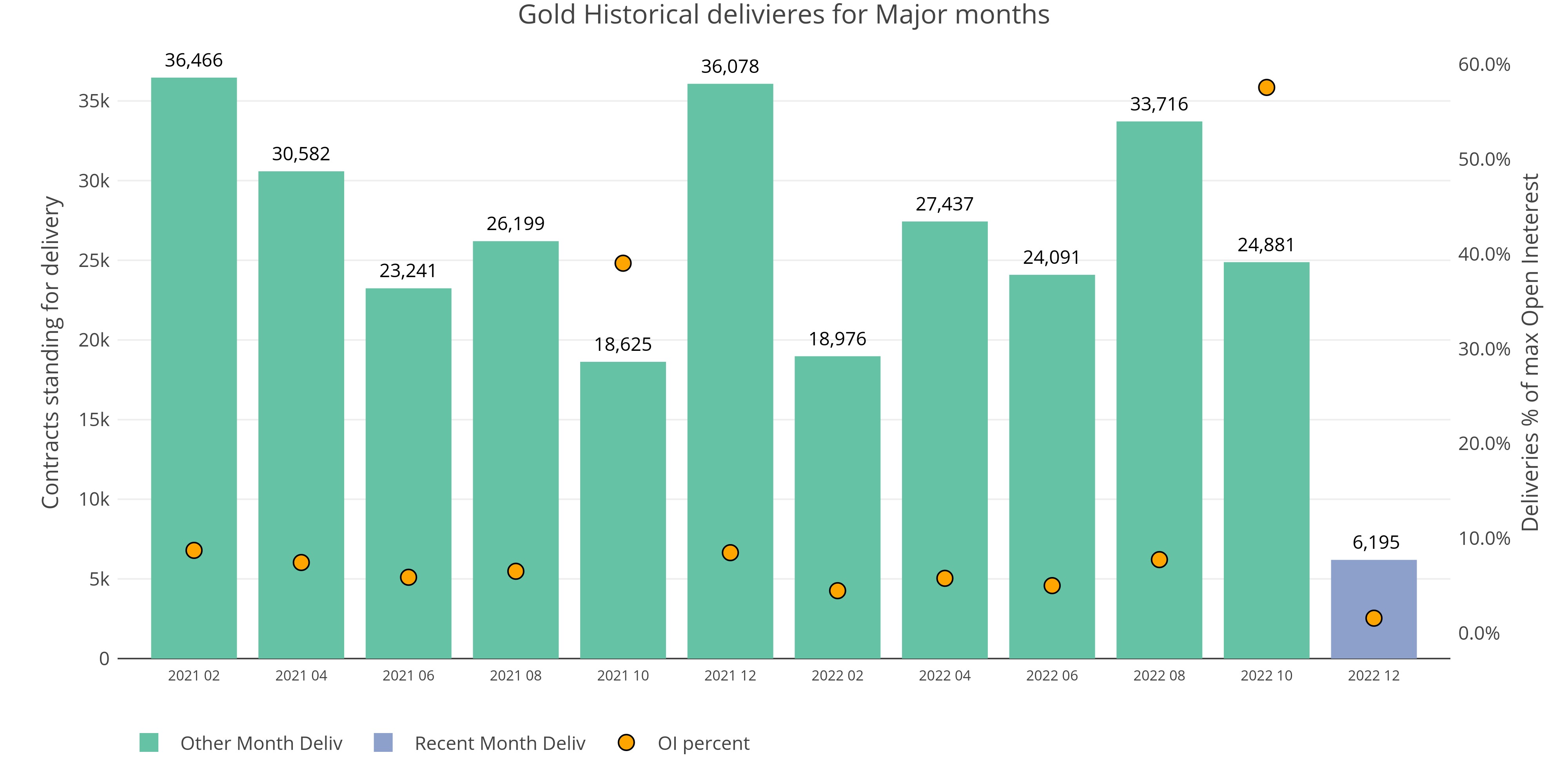

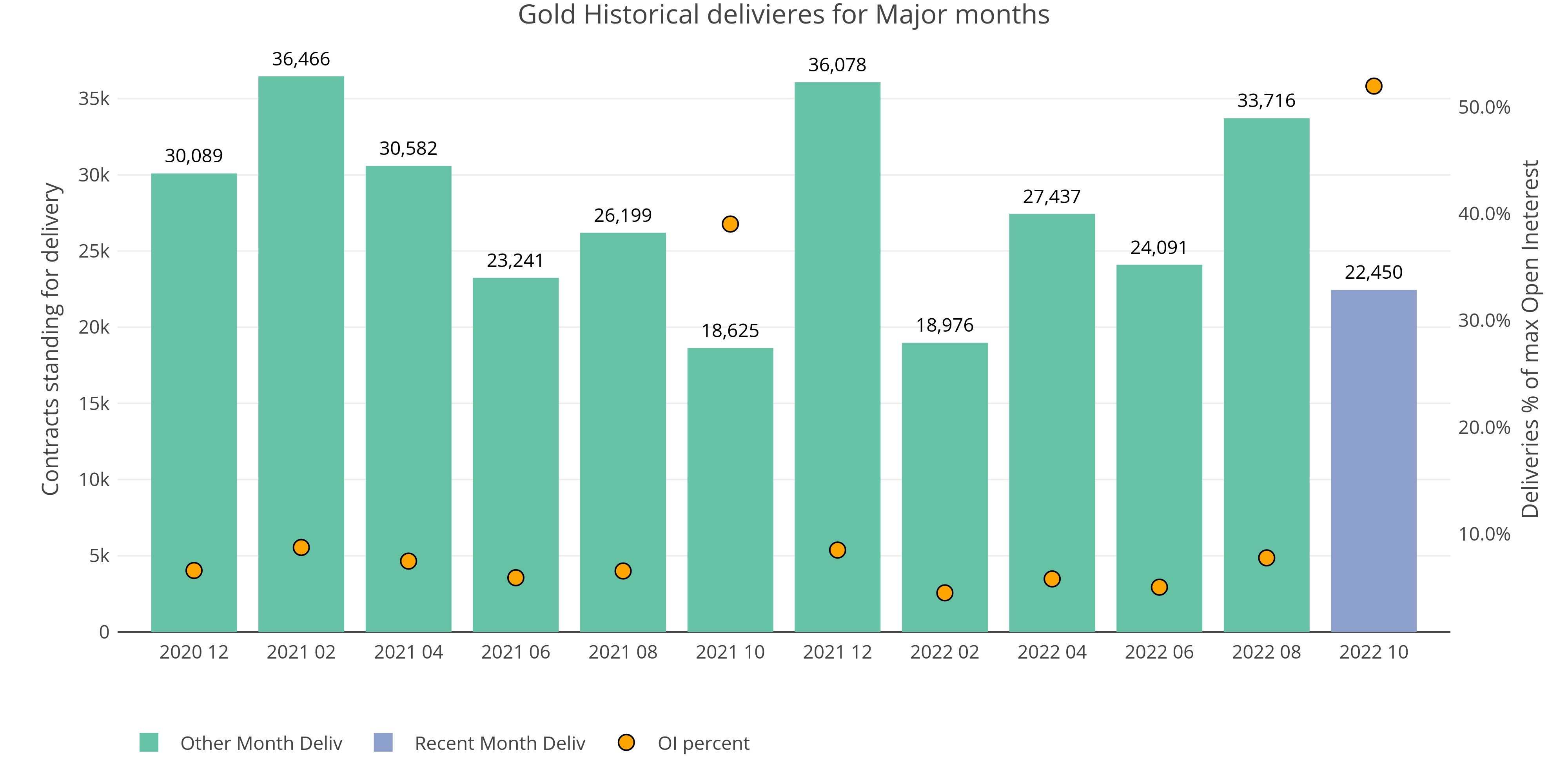

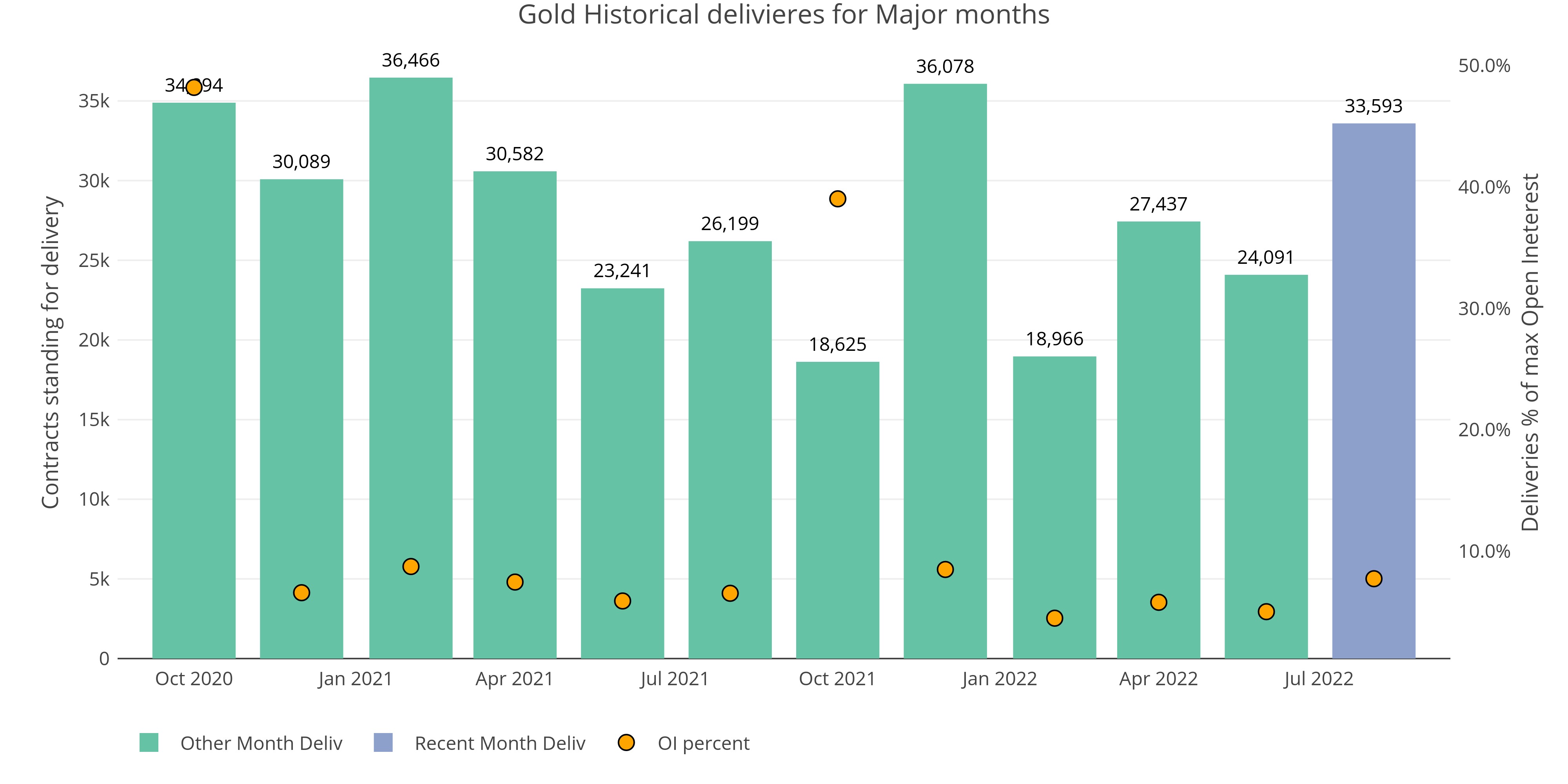

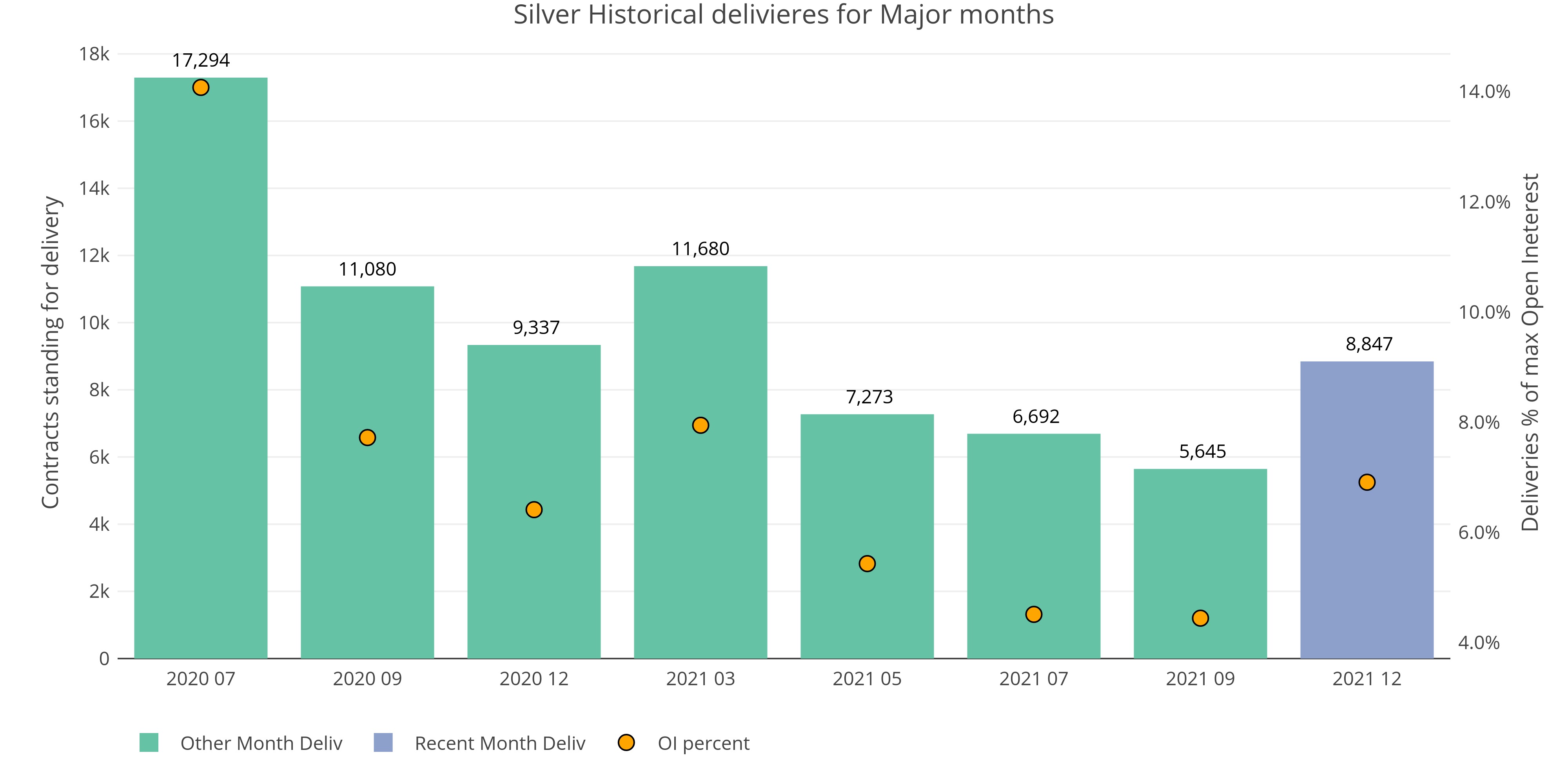

Will December Comex Delivery Confirm Election Sell-Off is Over?

Physical demand has been keeping prices elevated

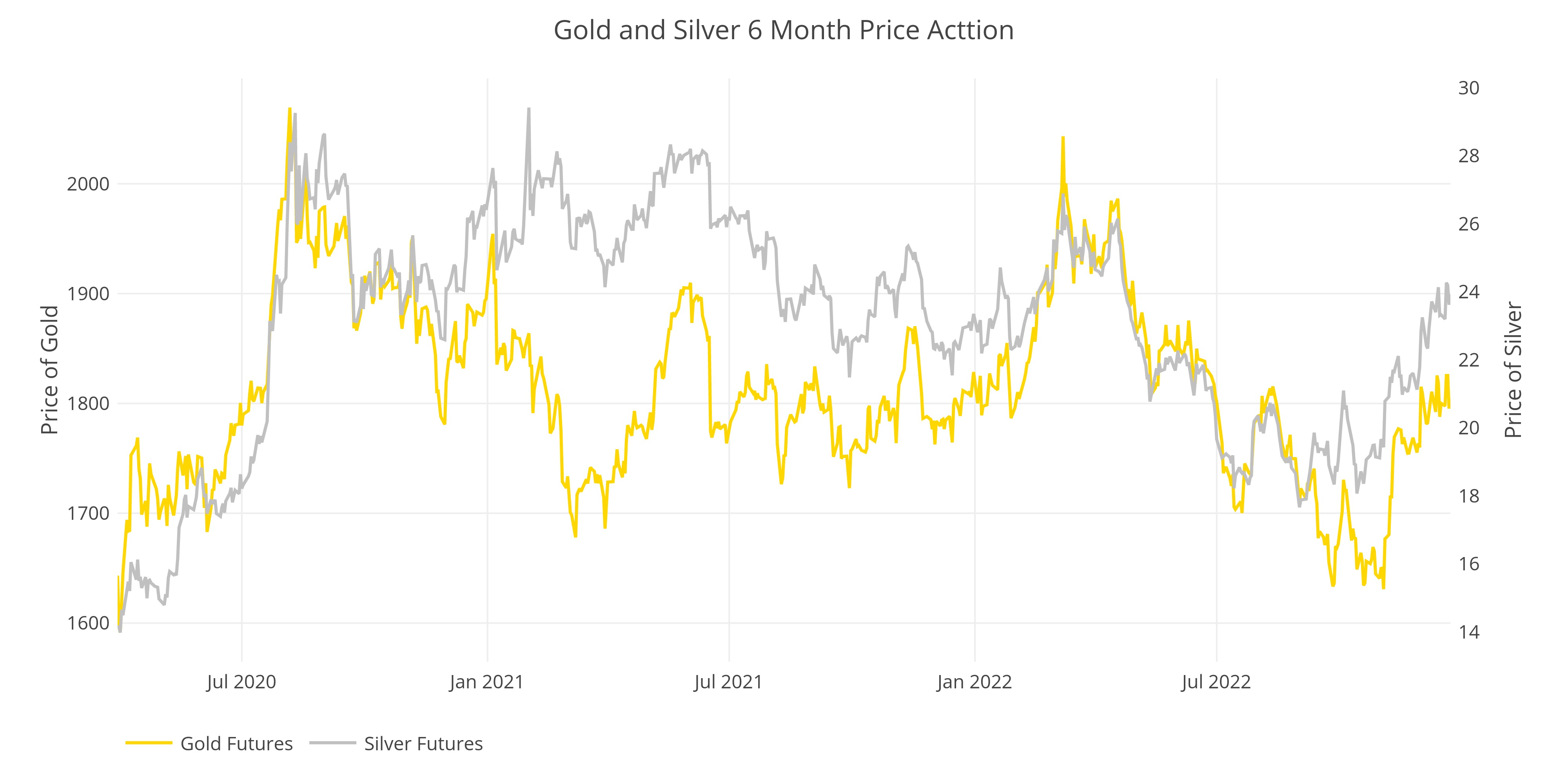

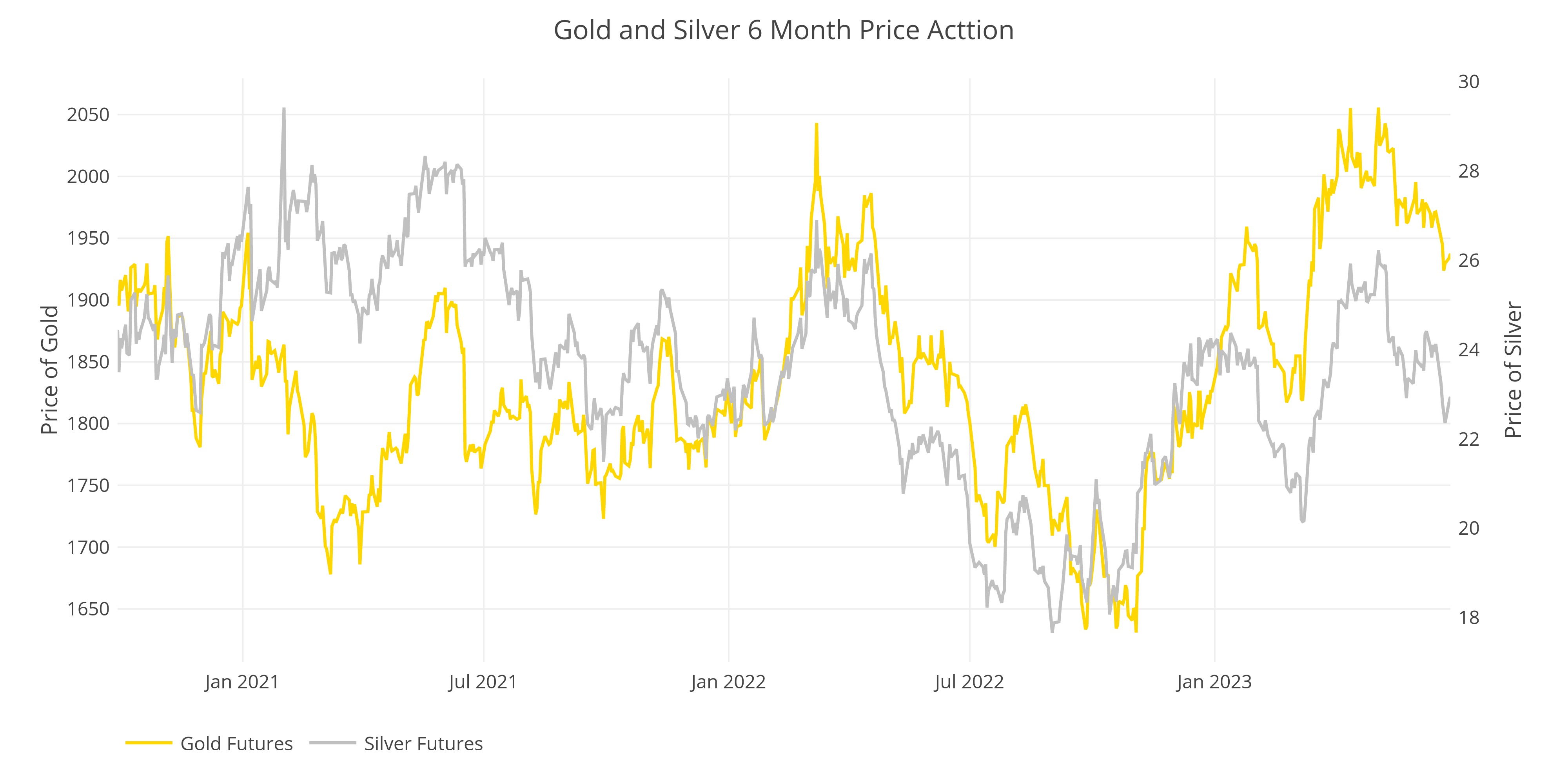

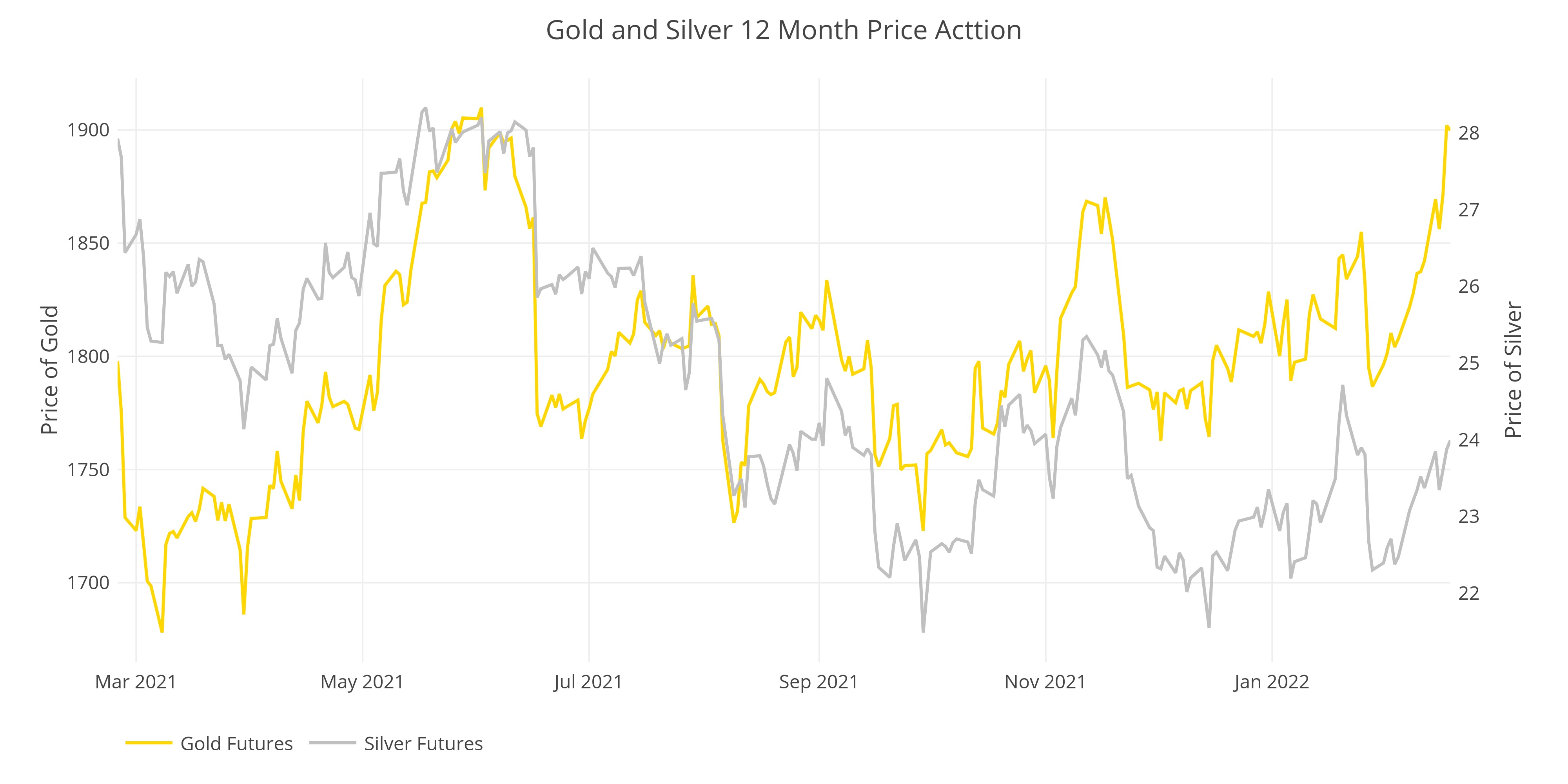

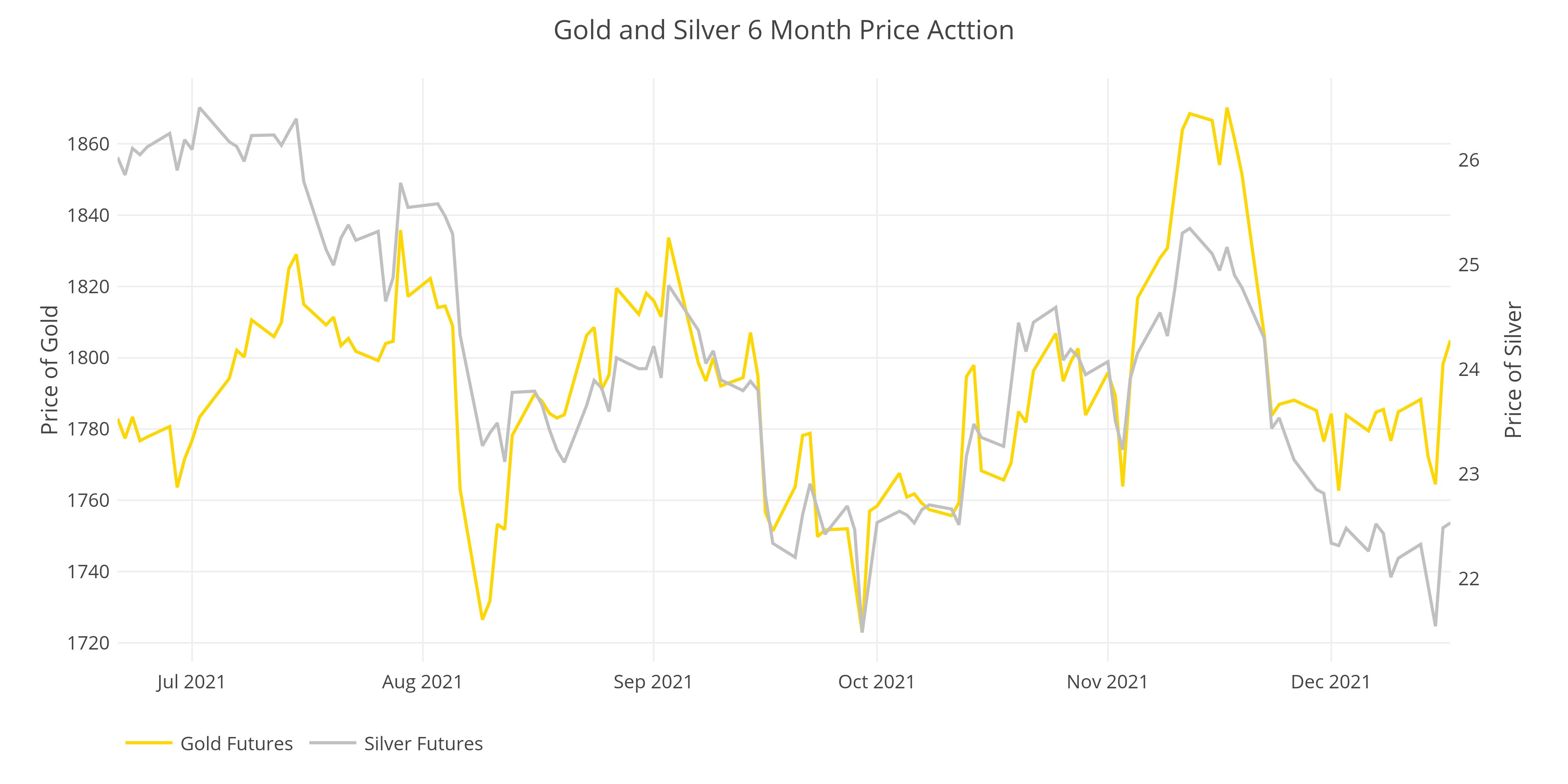

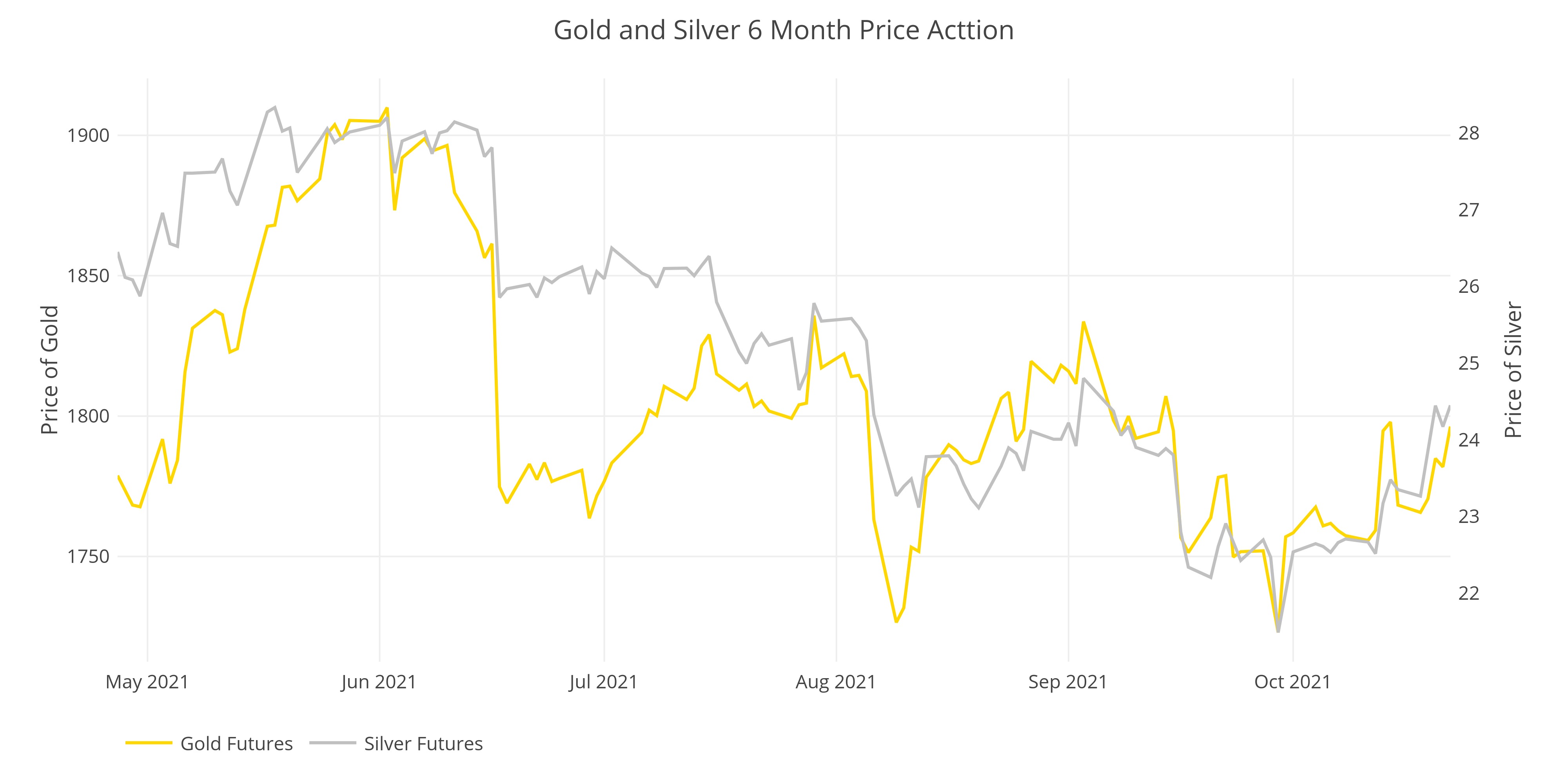

The Technicals: Gold Still Looks Good, Silver Looks Even Better

The setup is bullish

Jobs: Household Survey Finally Tops Headline Number

It does not make up for all the previous weakness

Jobs: Household Survey Finally Tops Headline Number

Is the strong report tied to the upcoming election

CFTC CoTs Report: Be Advised - Gold is Overbought Among Hedge Funds

A quick exit could see a big down move in gold

August Money Supply Grows by Most Since December 2021

13 week also growing

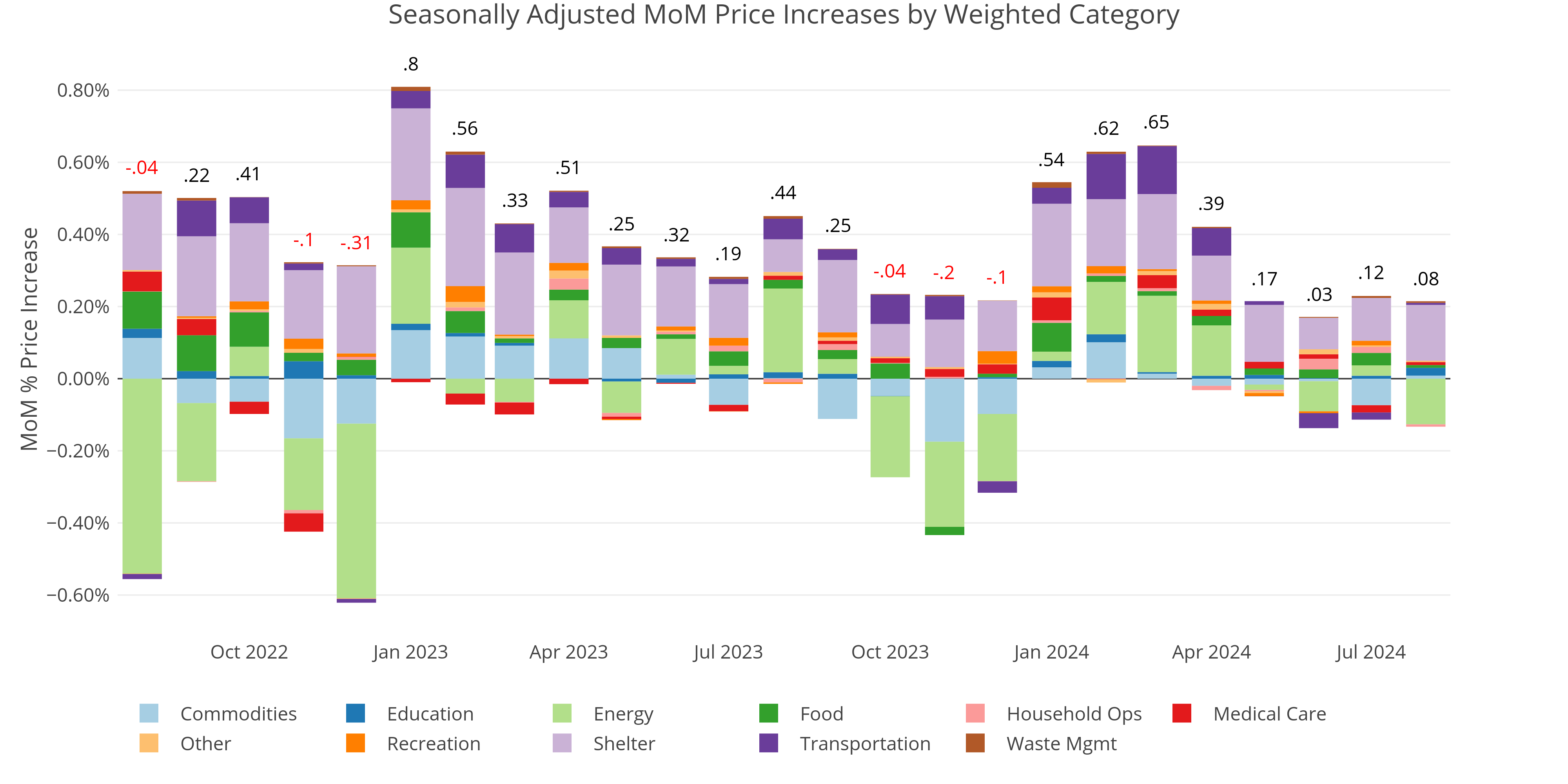

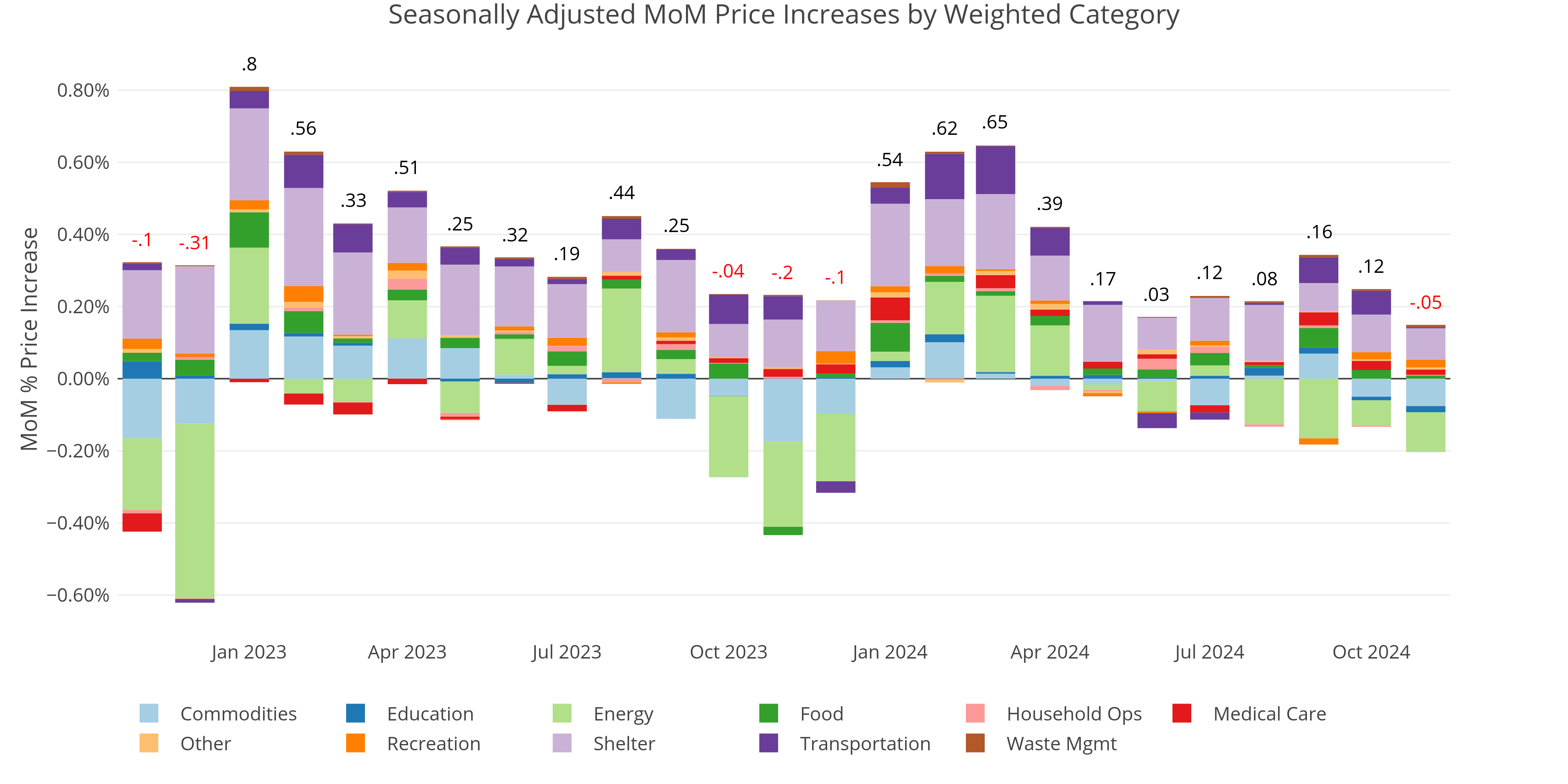

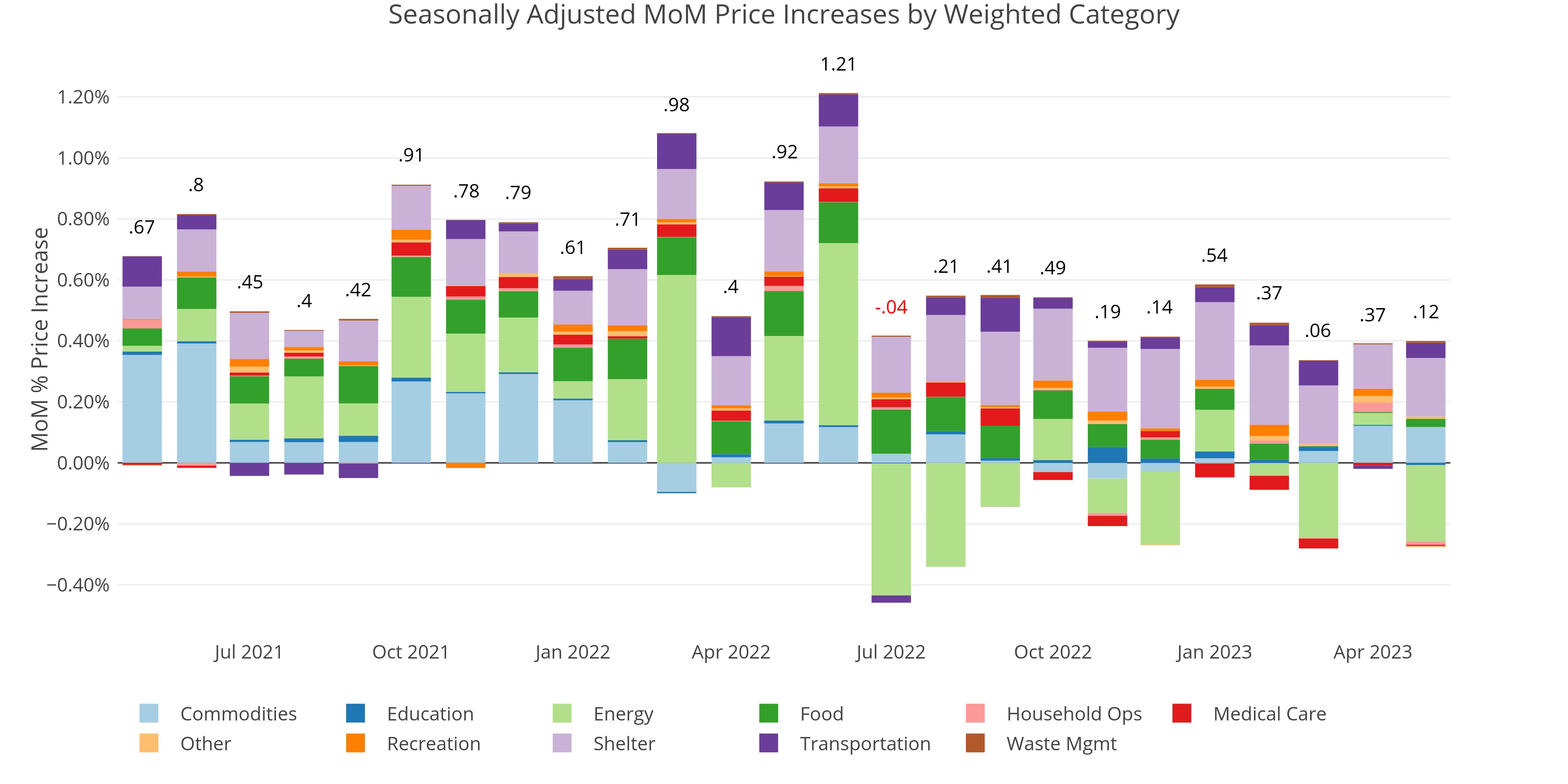

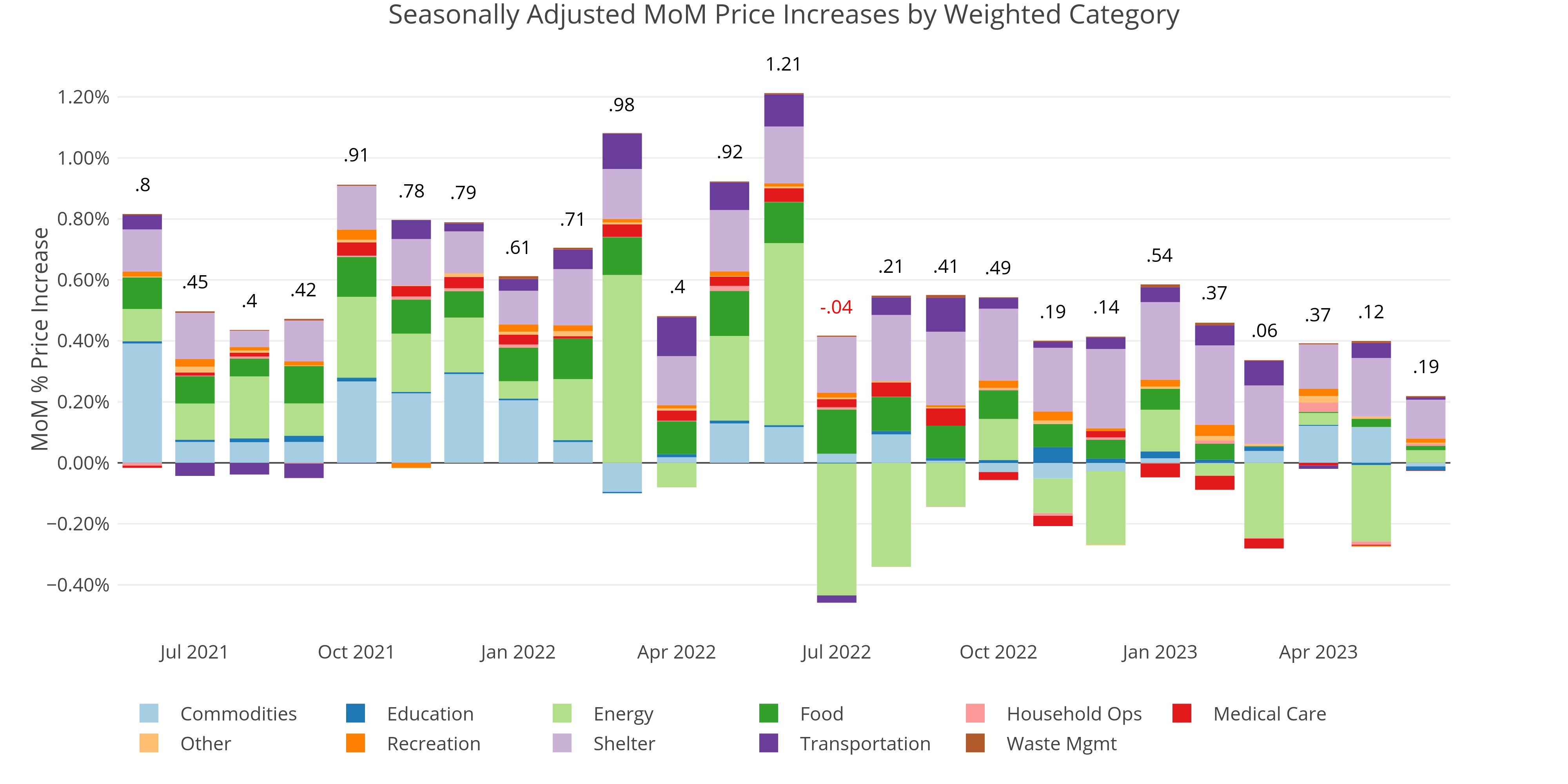

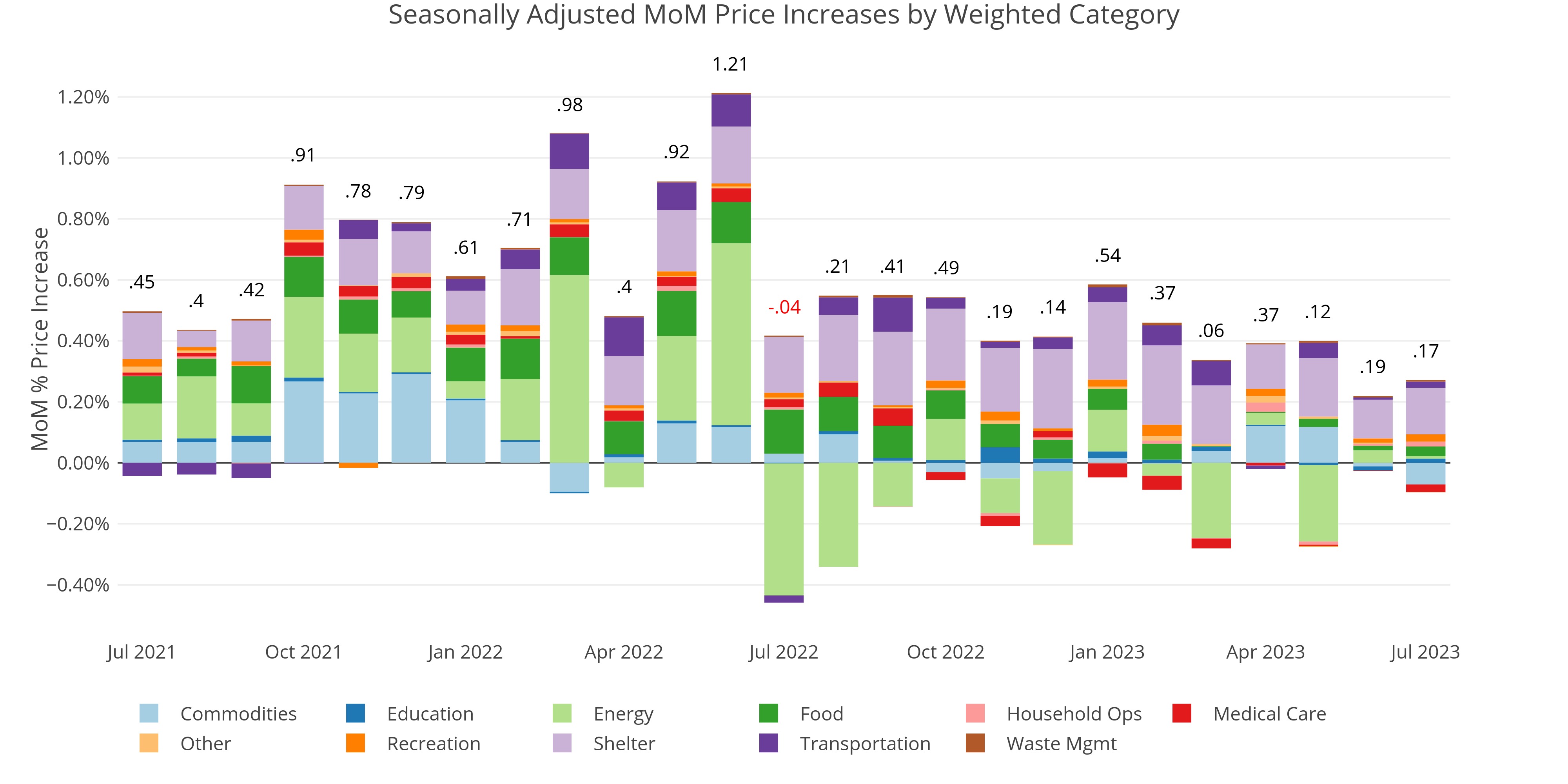

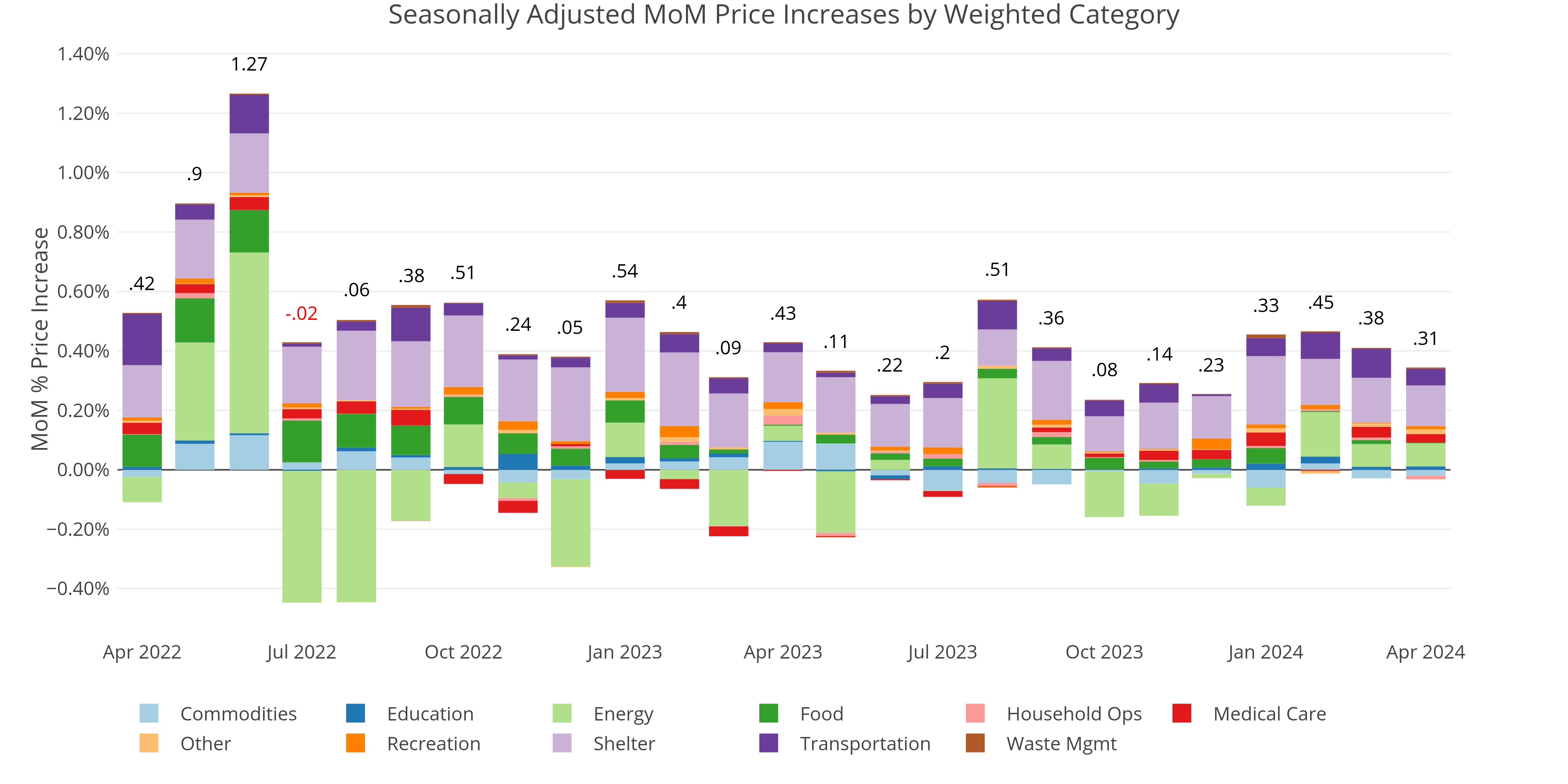

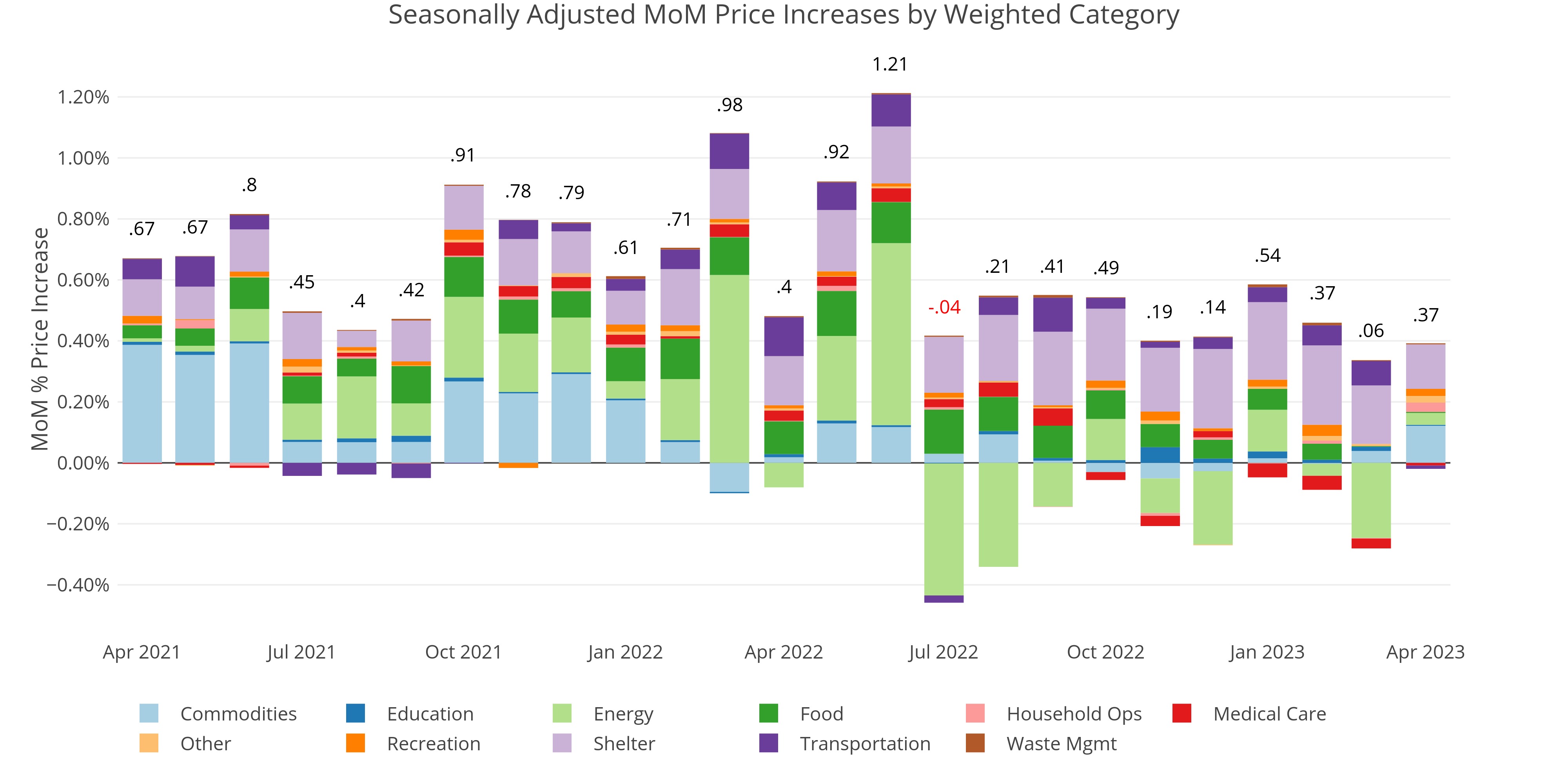

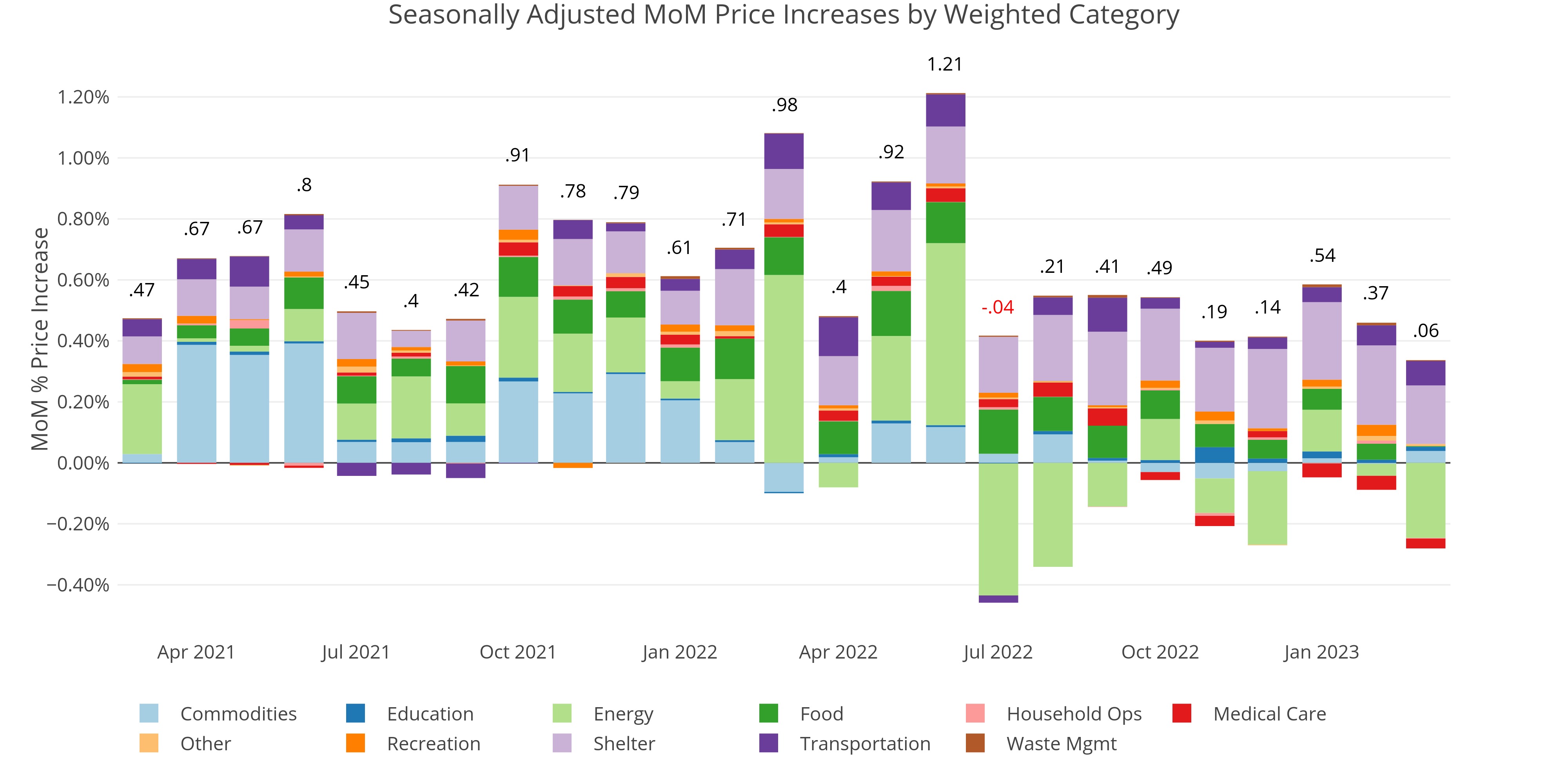

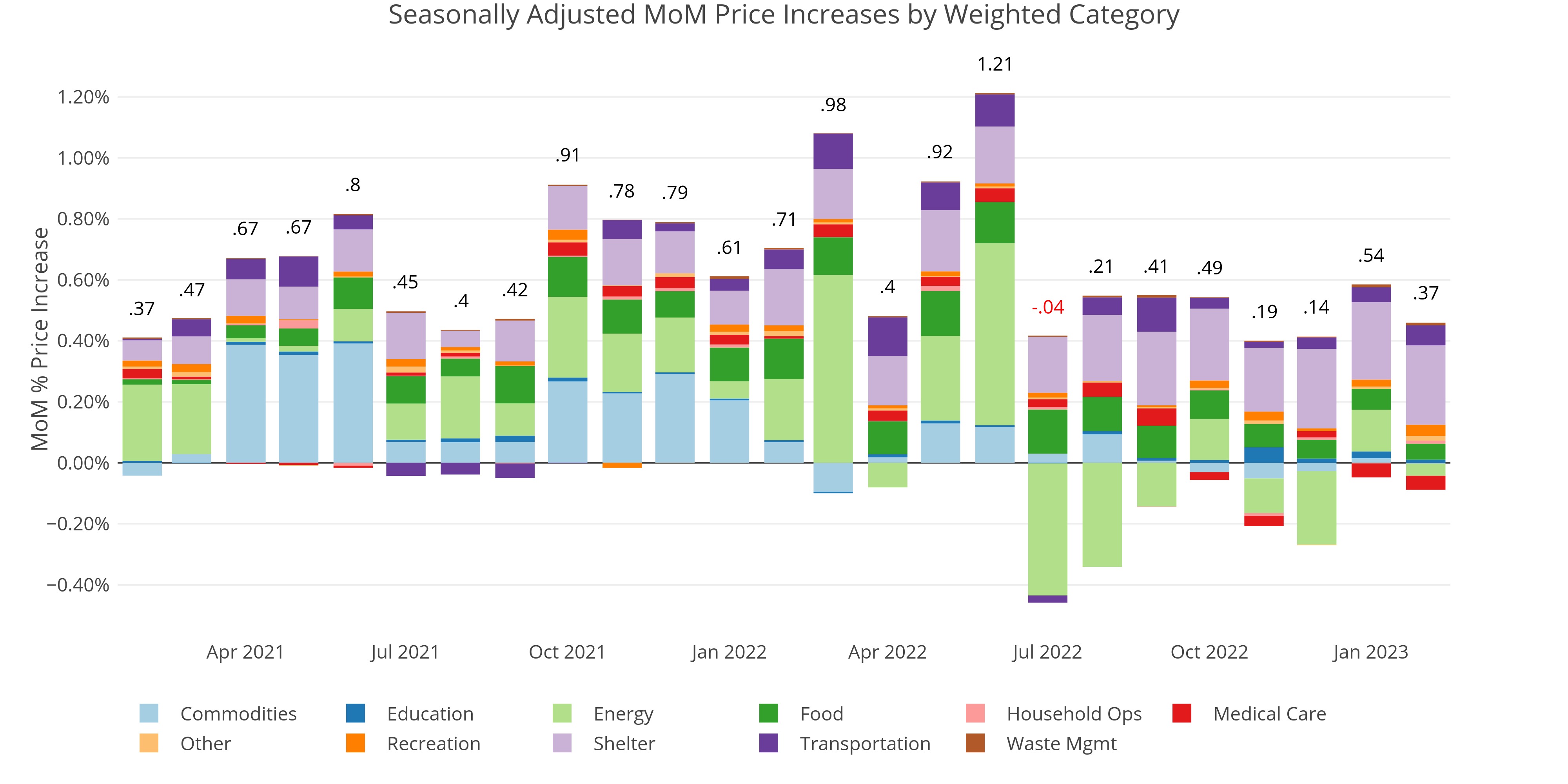

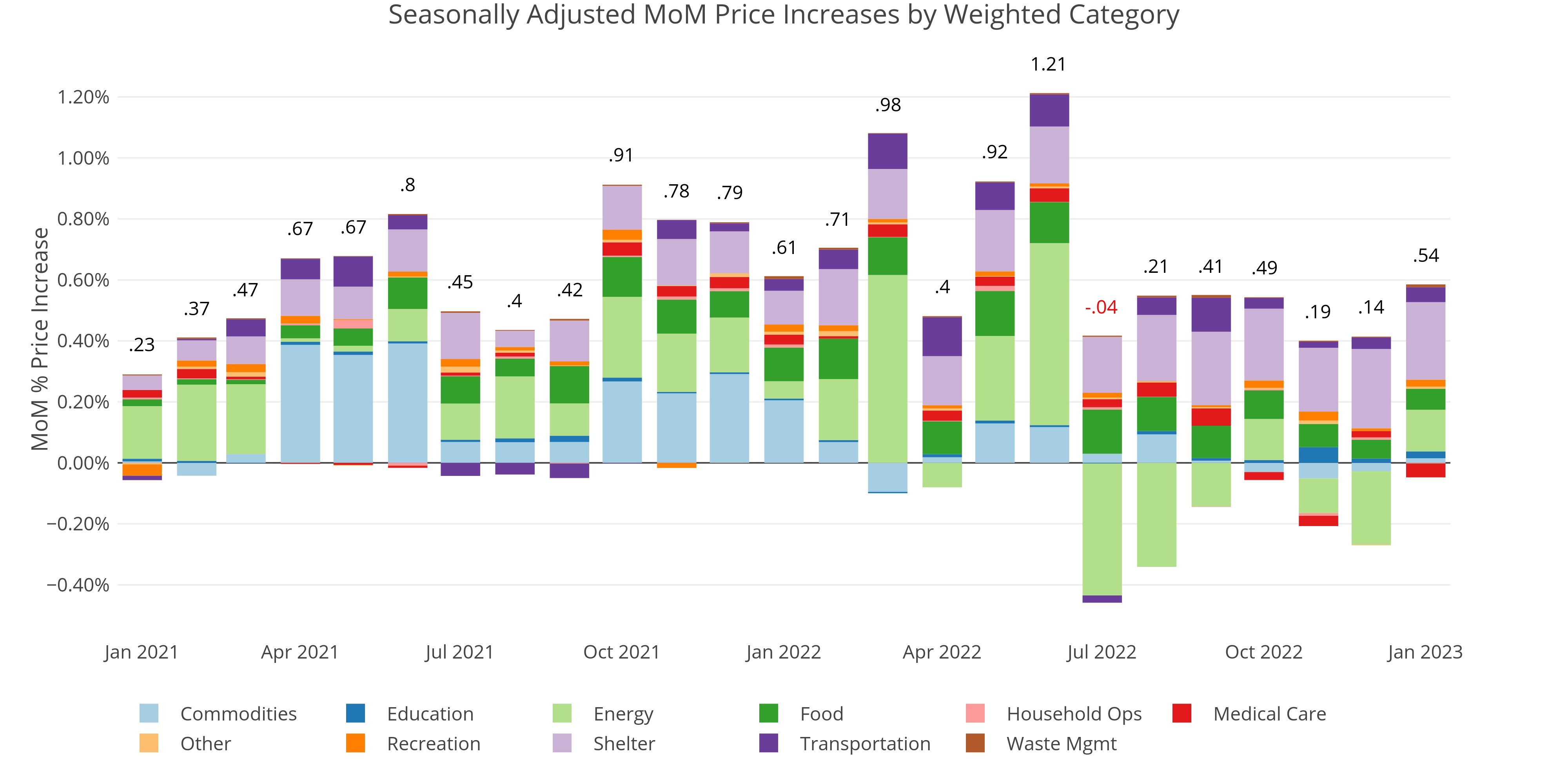

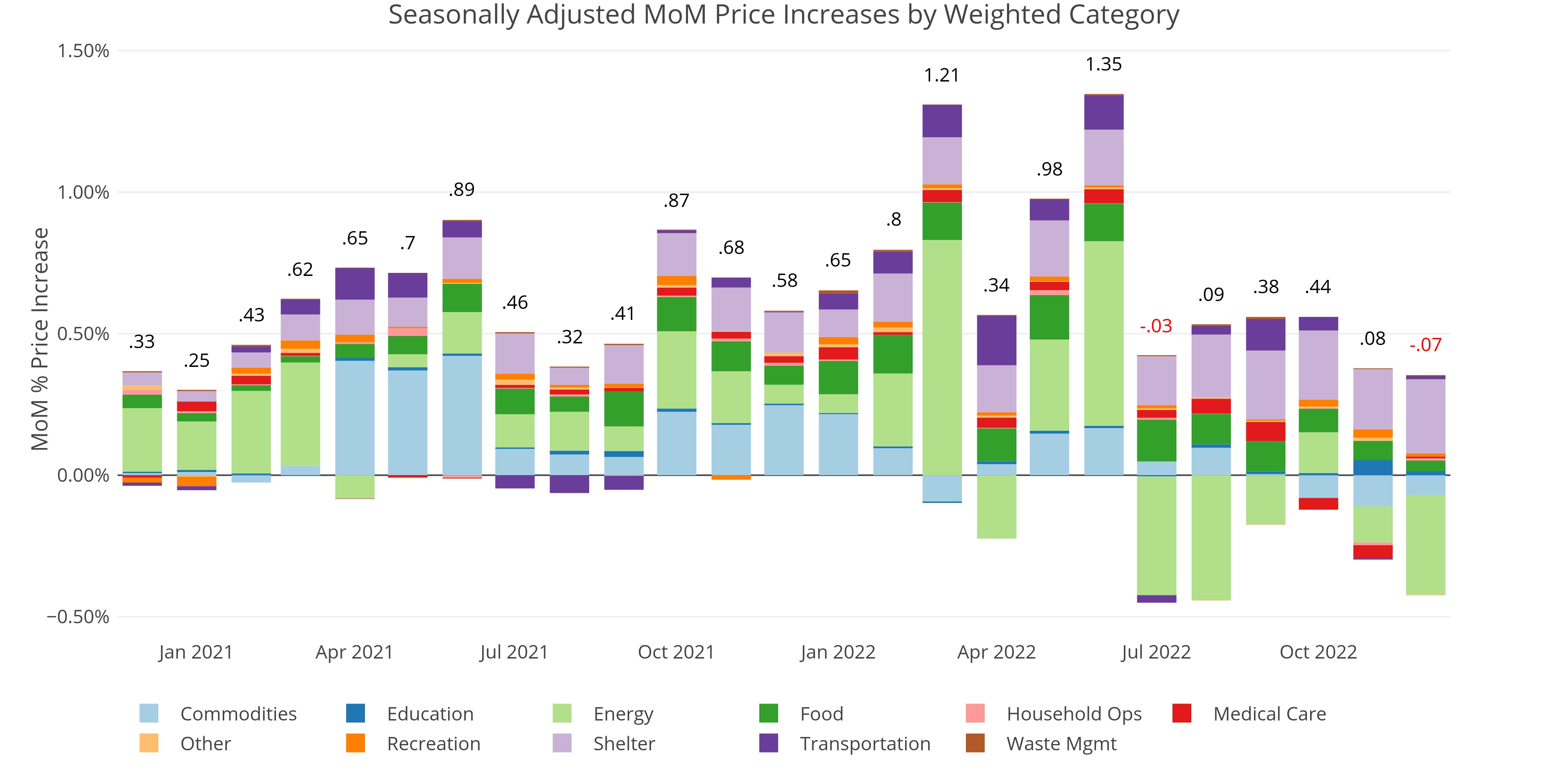

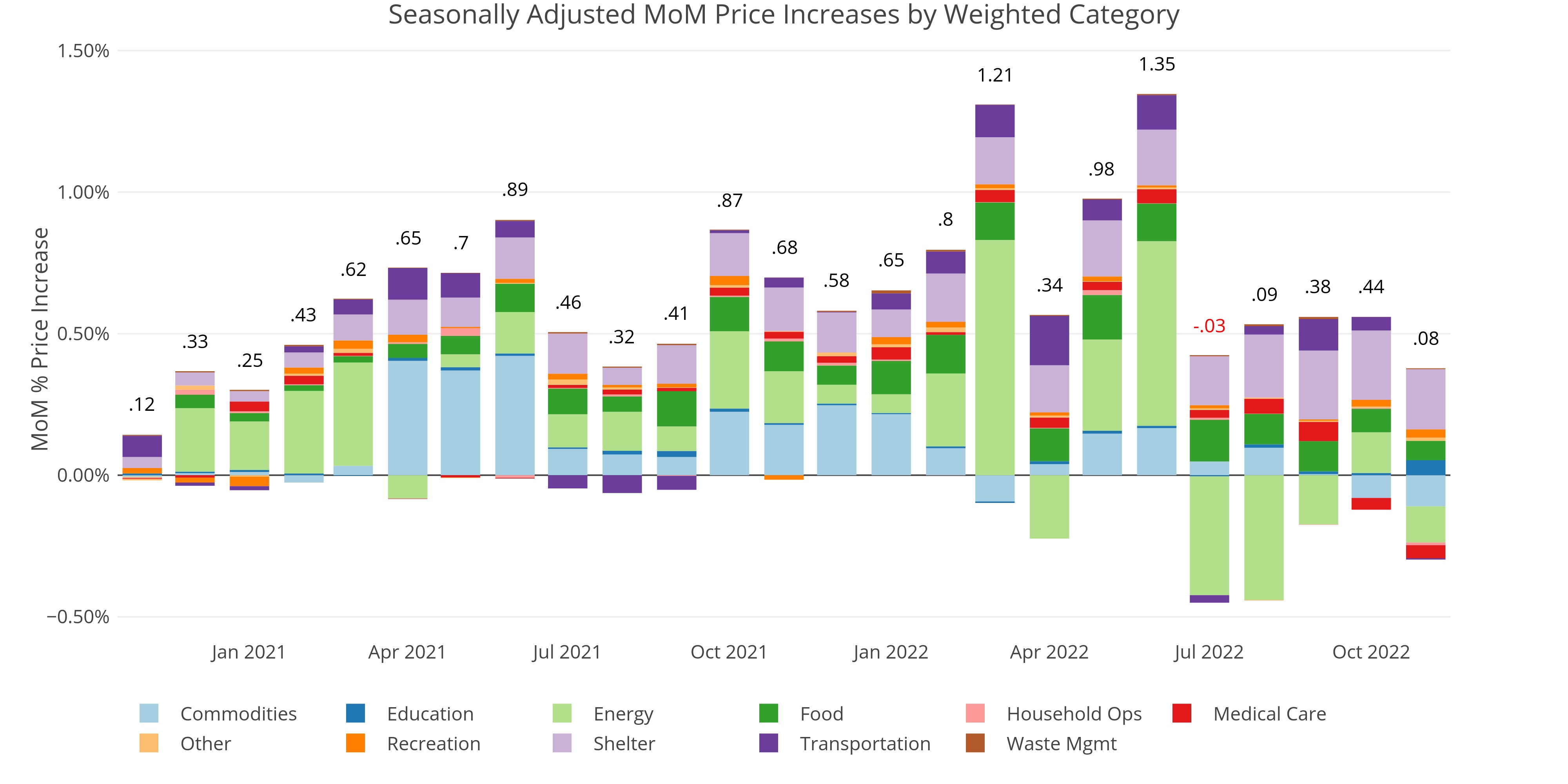

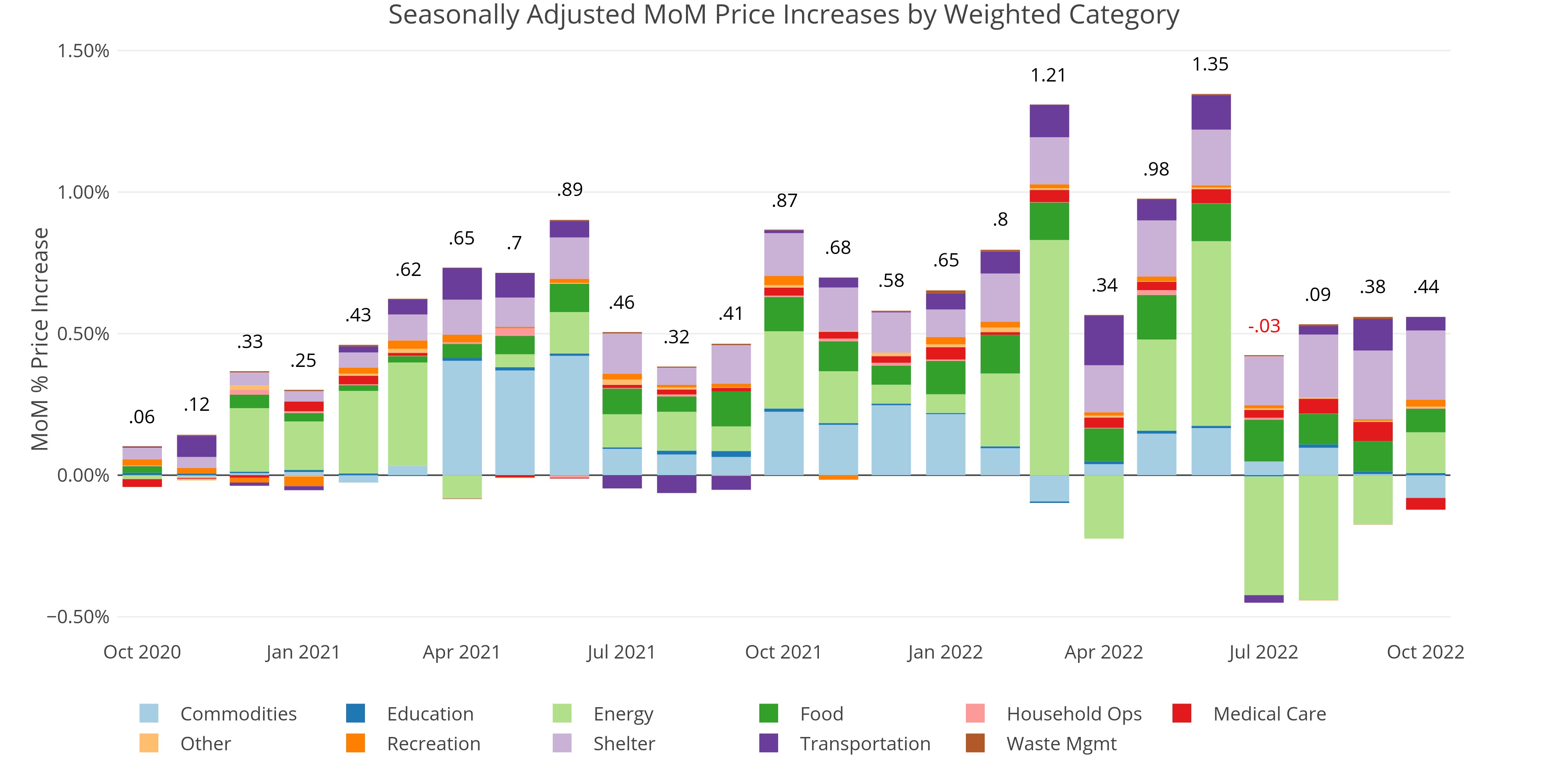

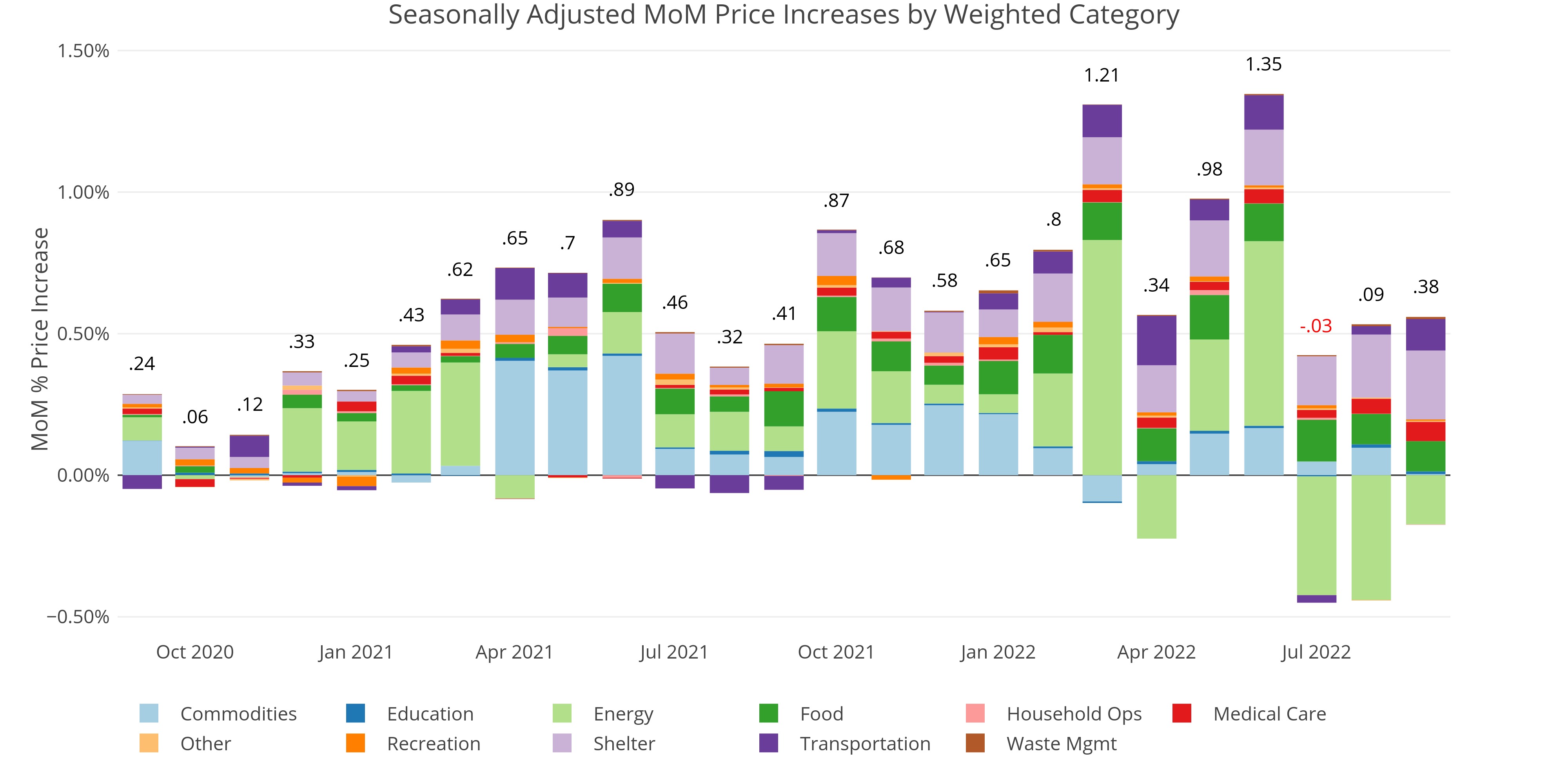

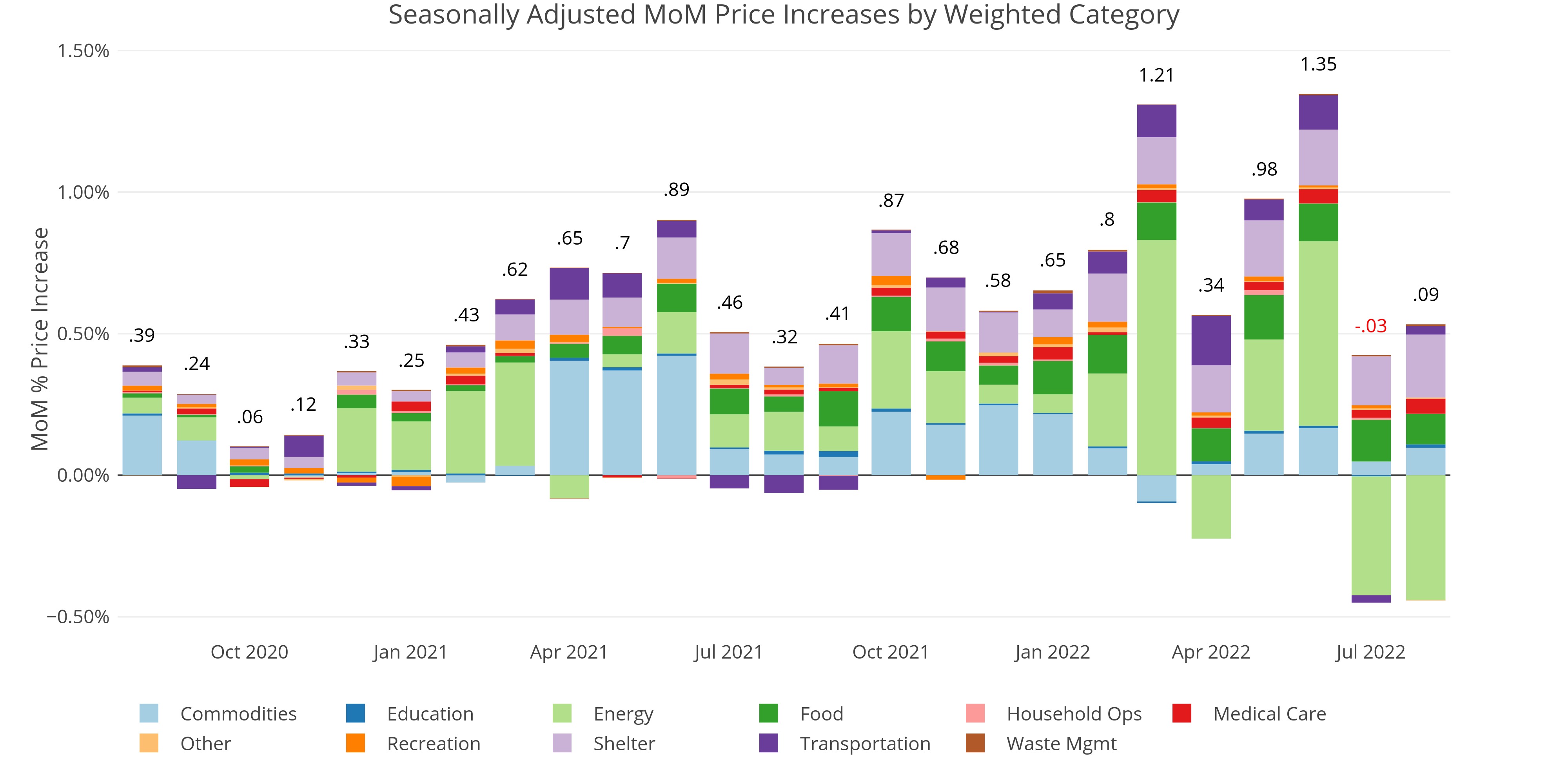

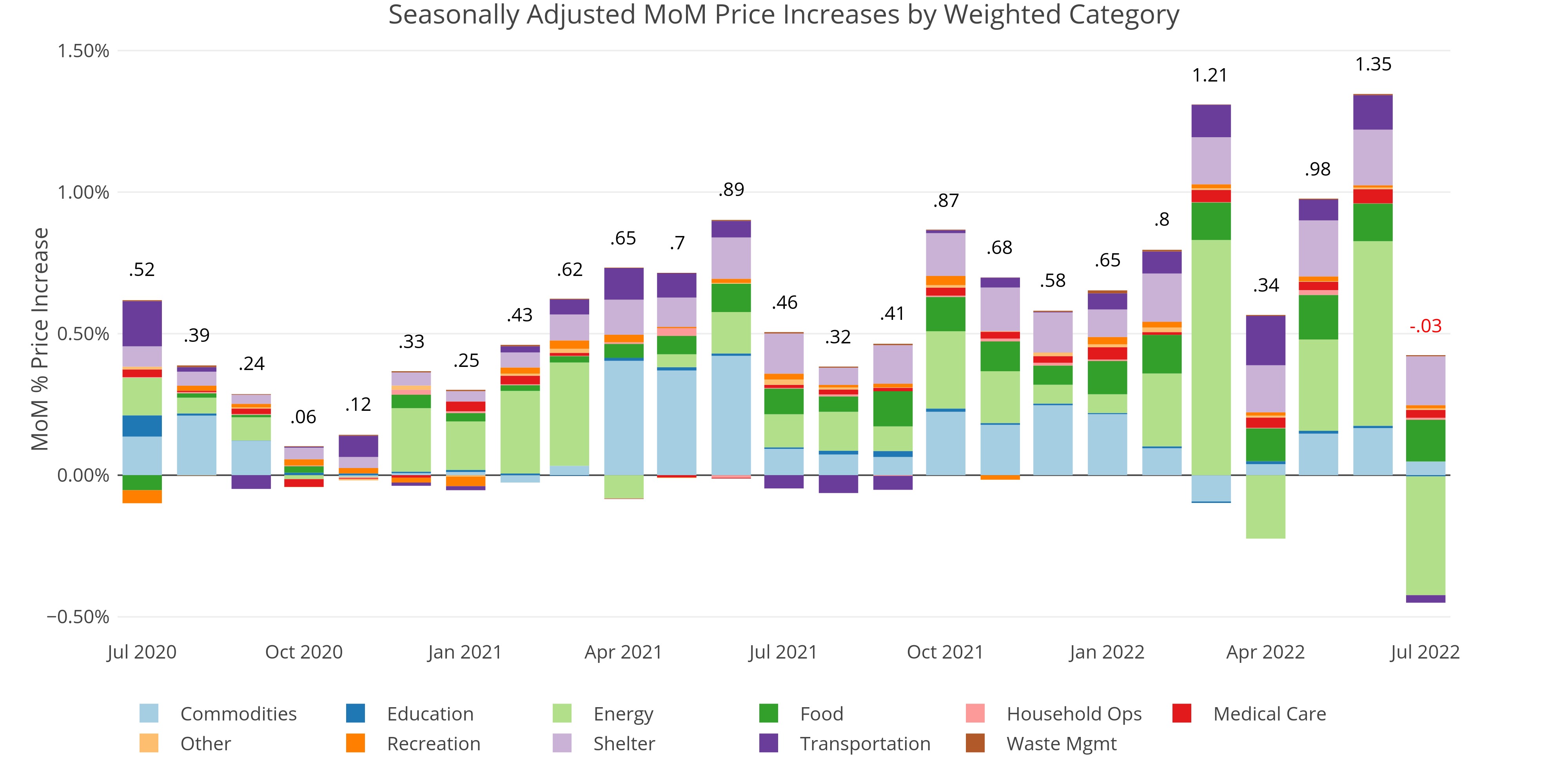

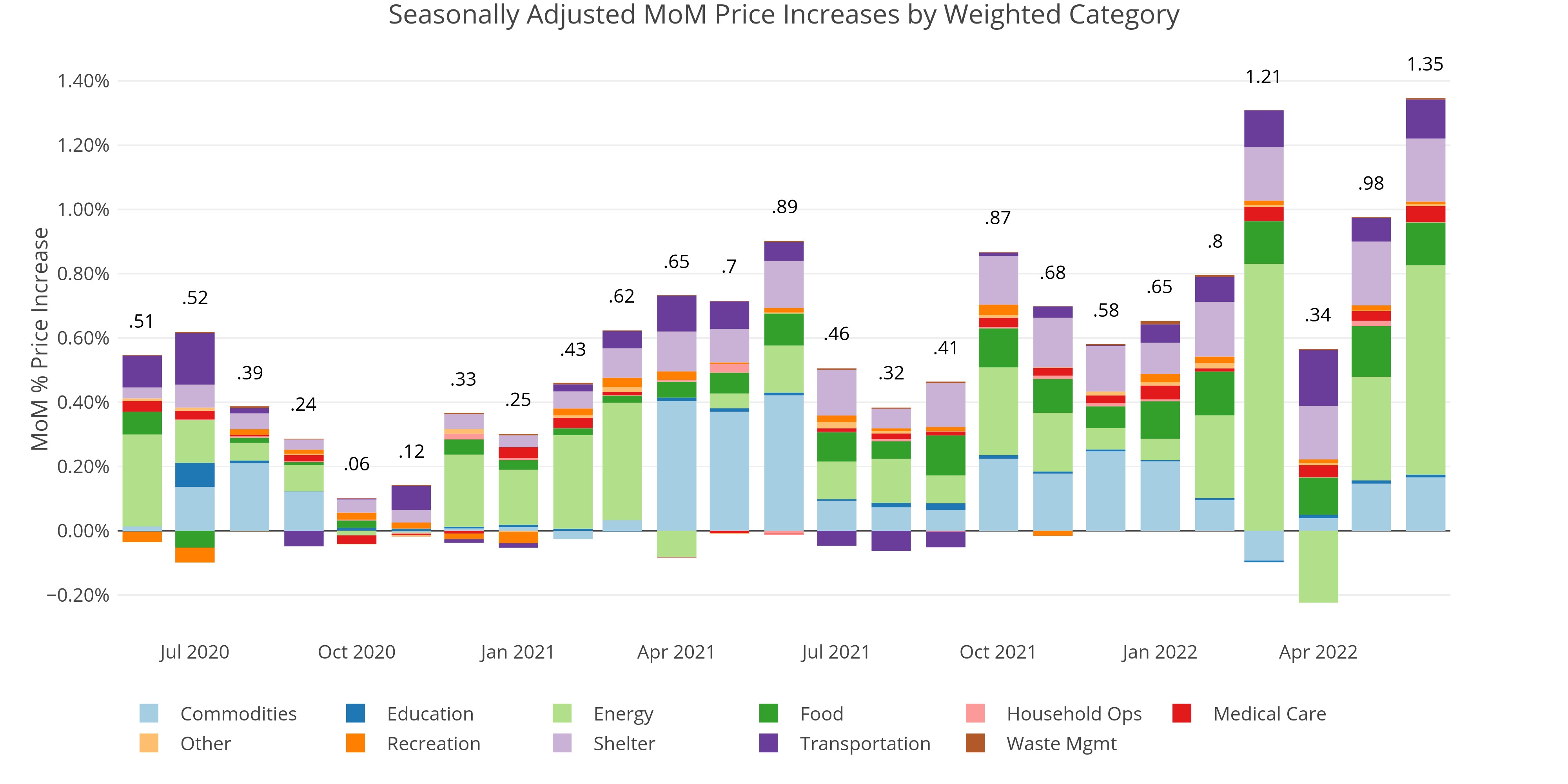

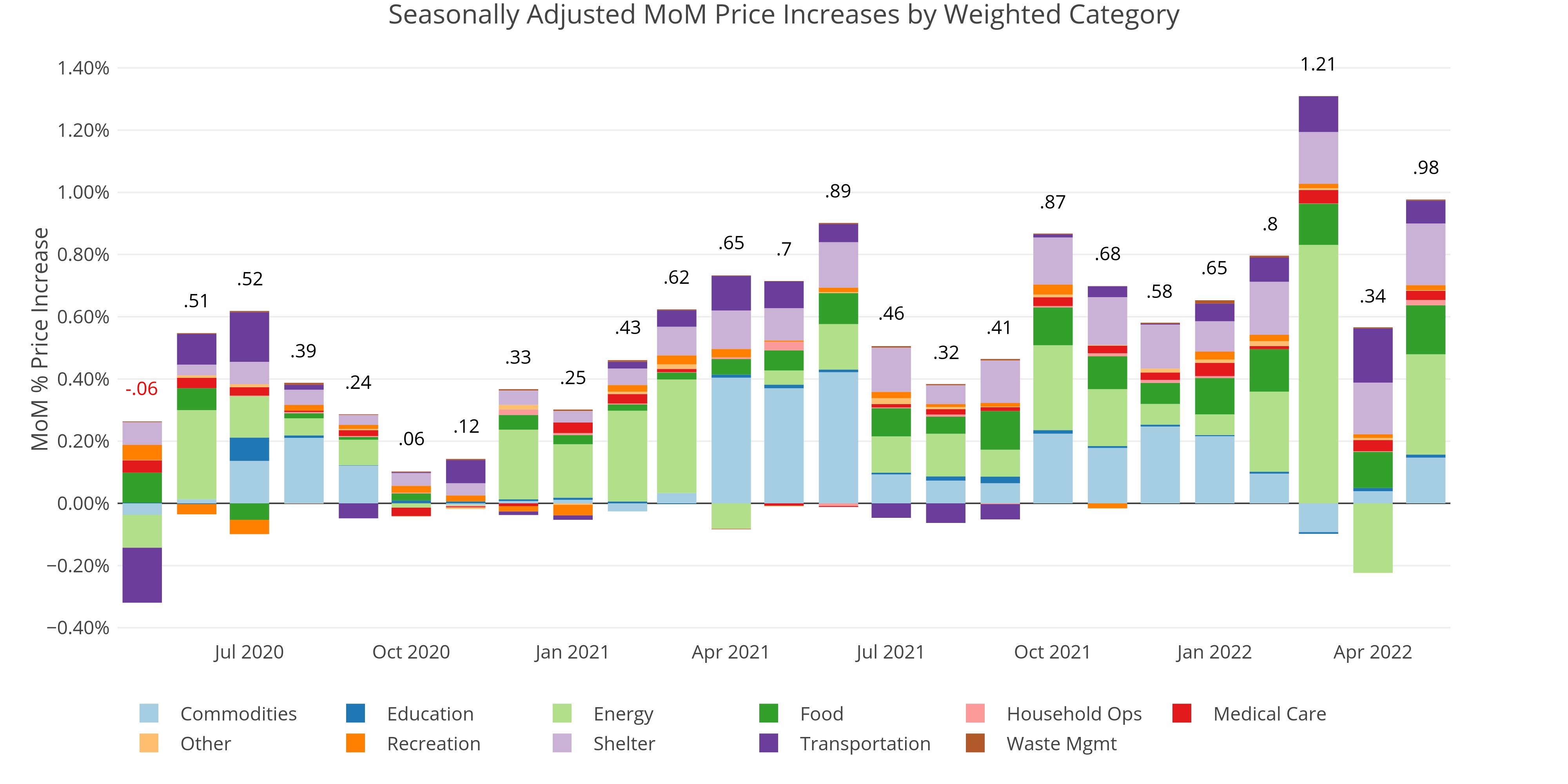

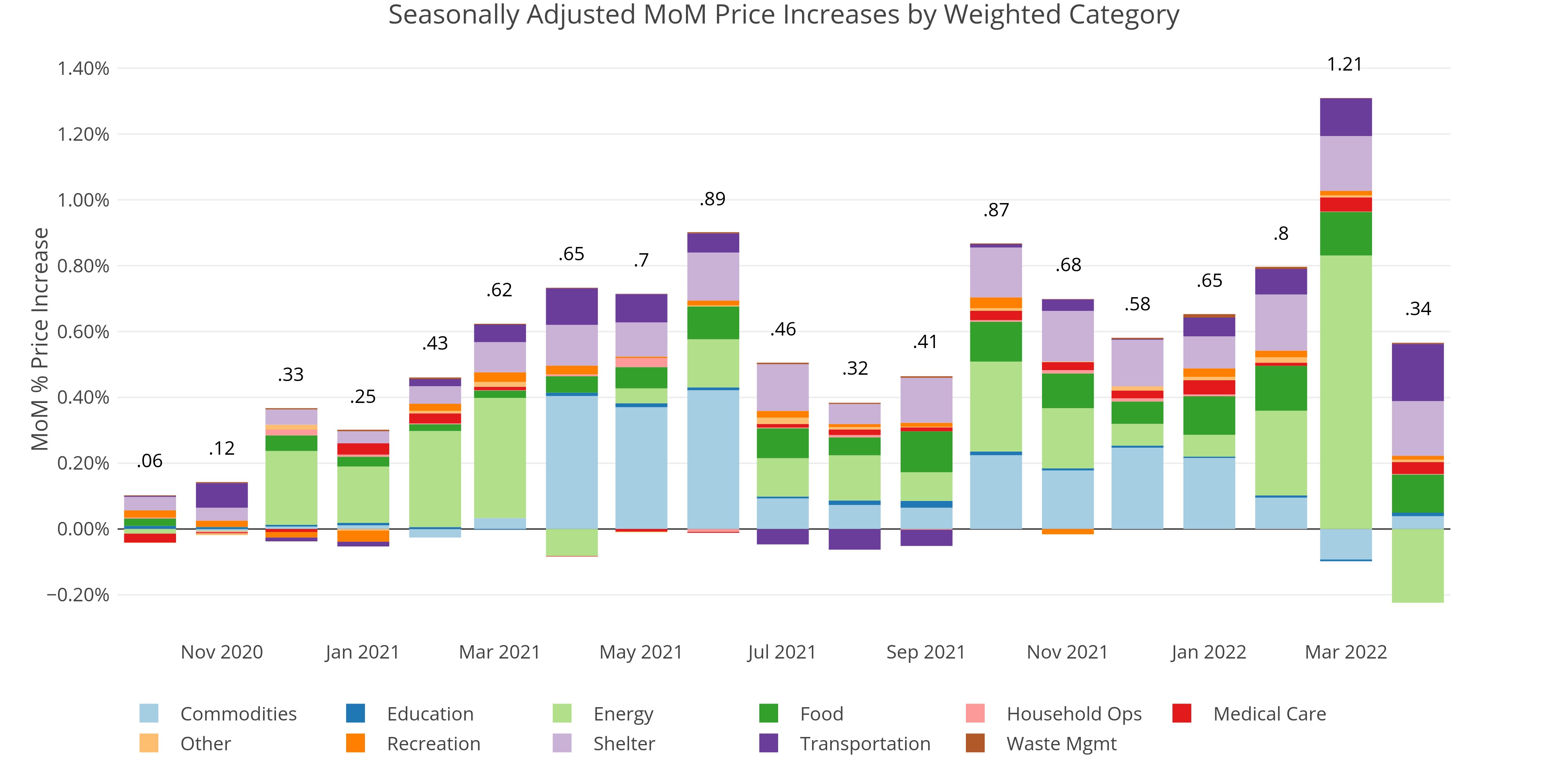

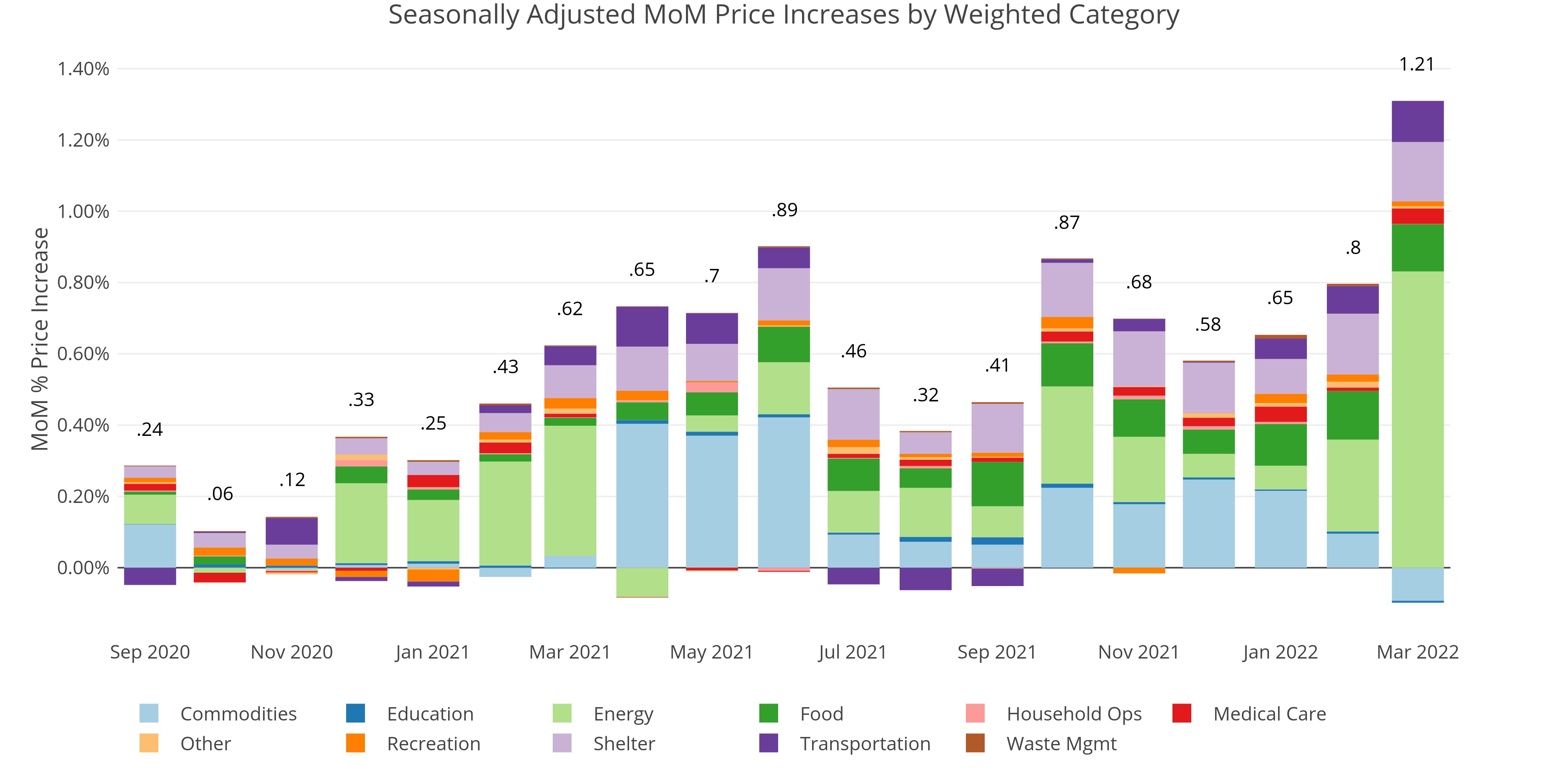

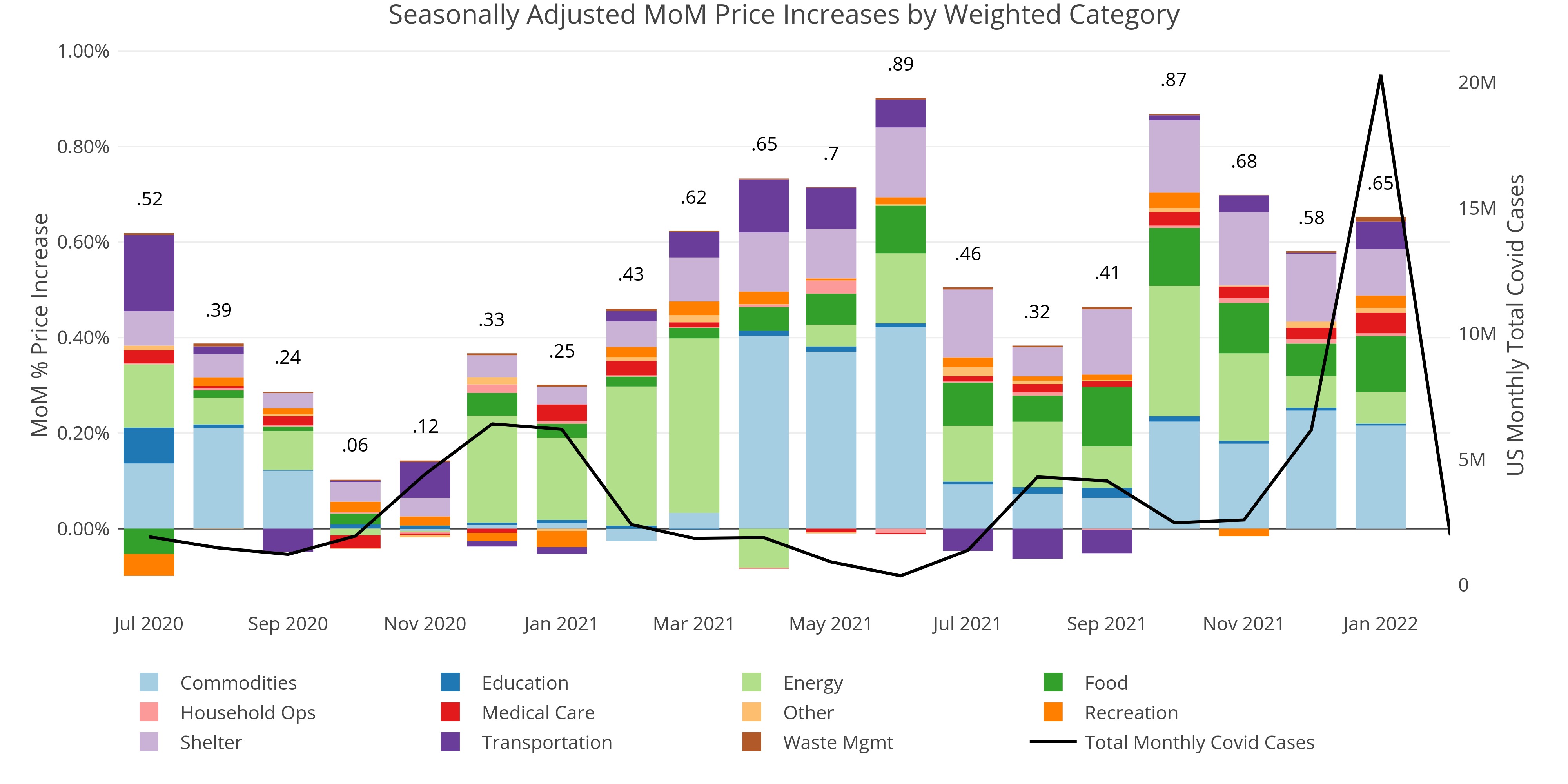

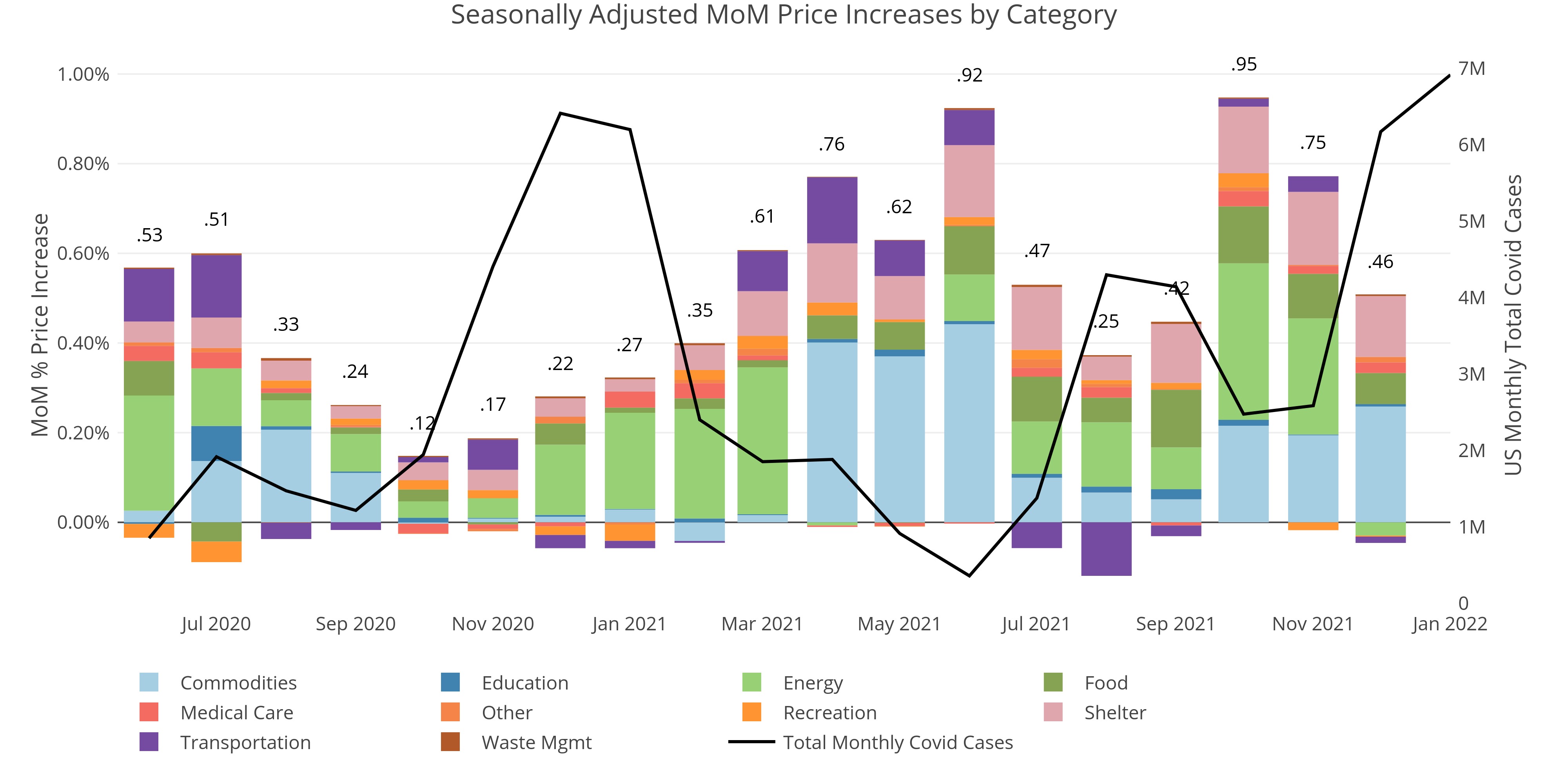

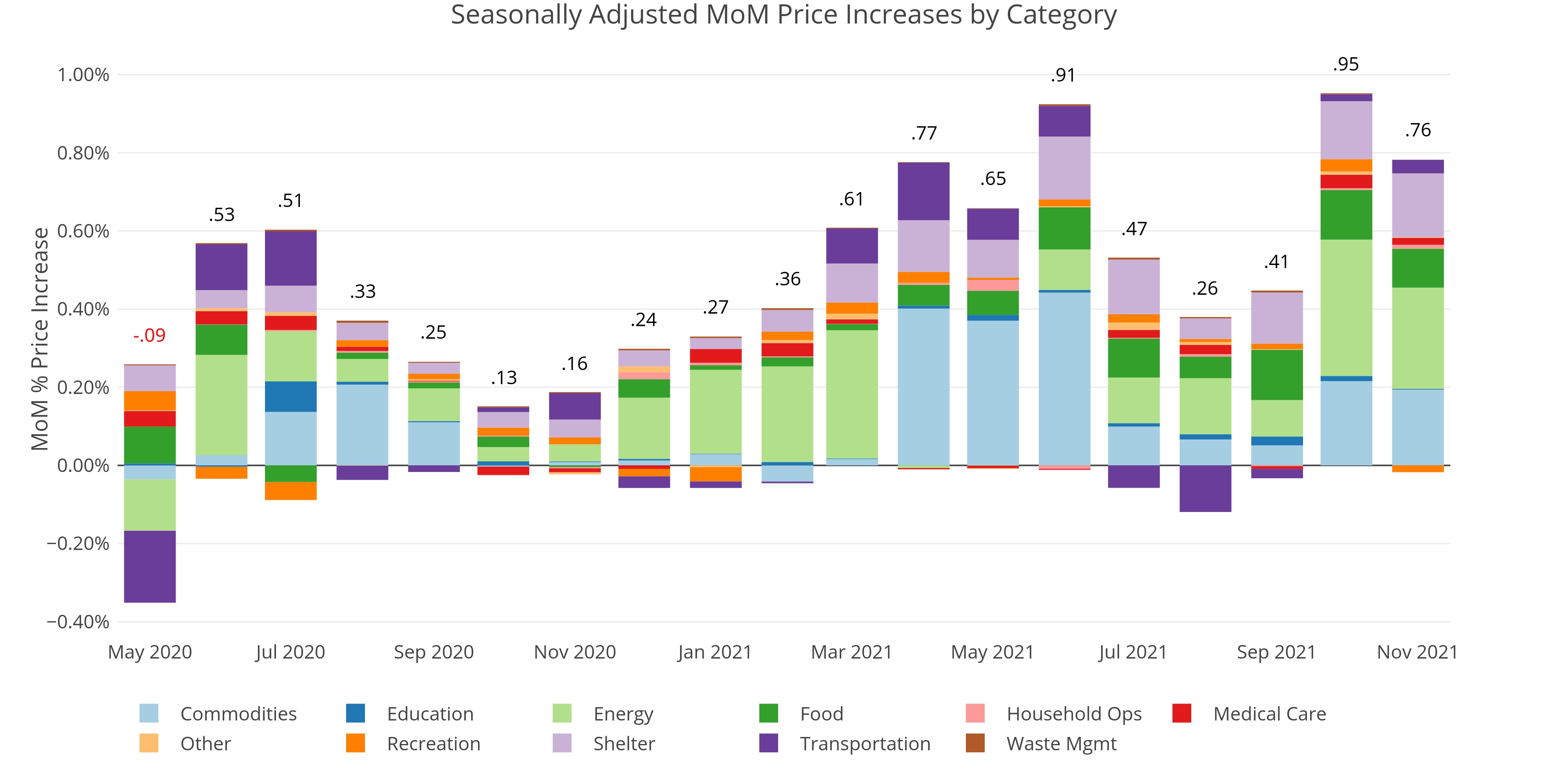

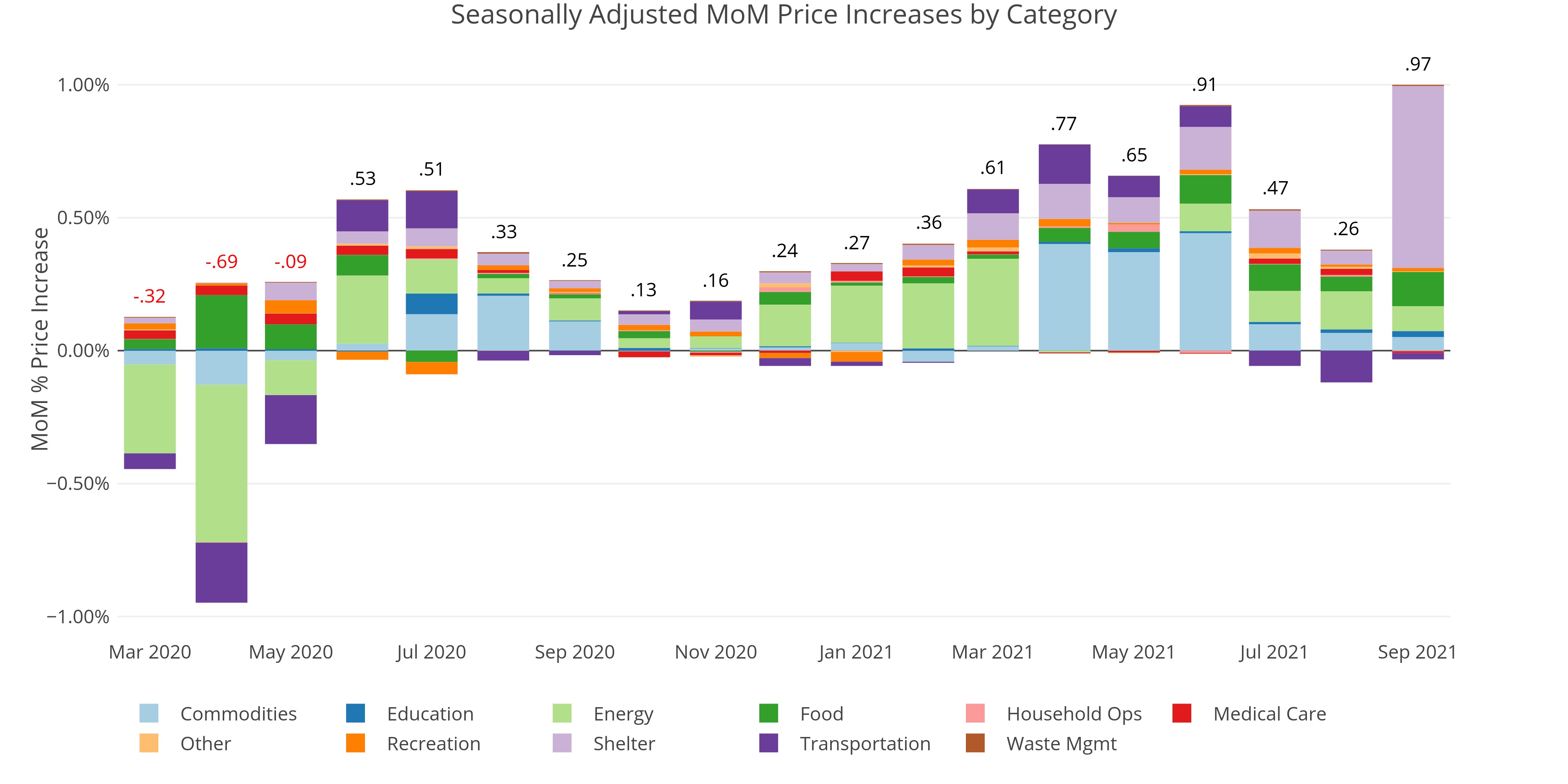

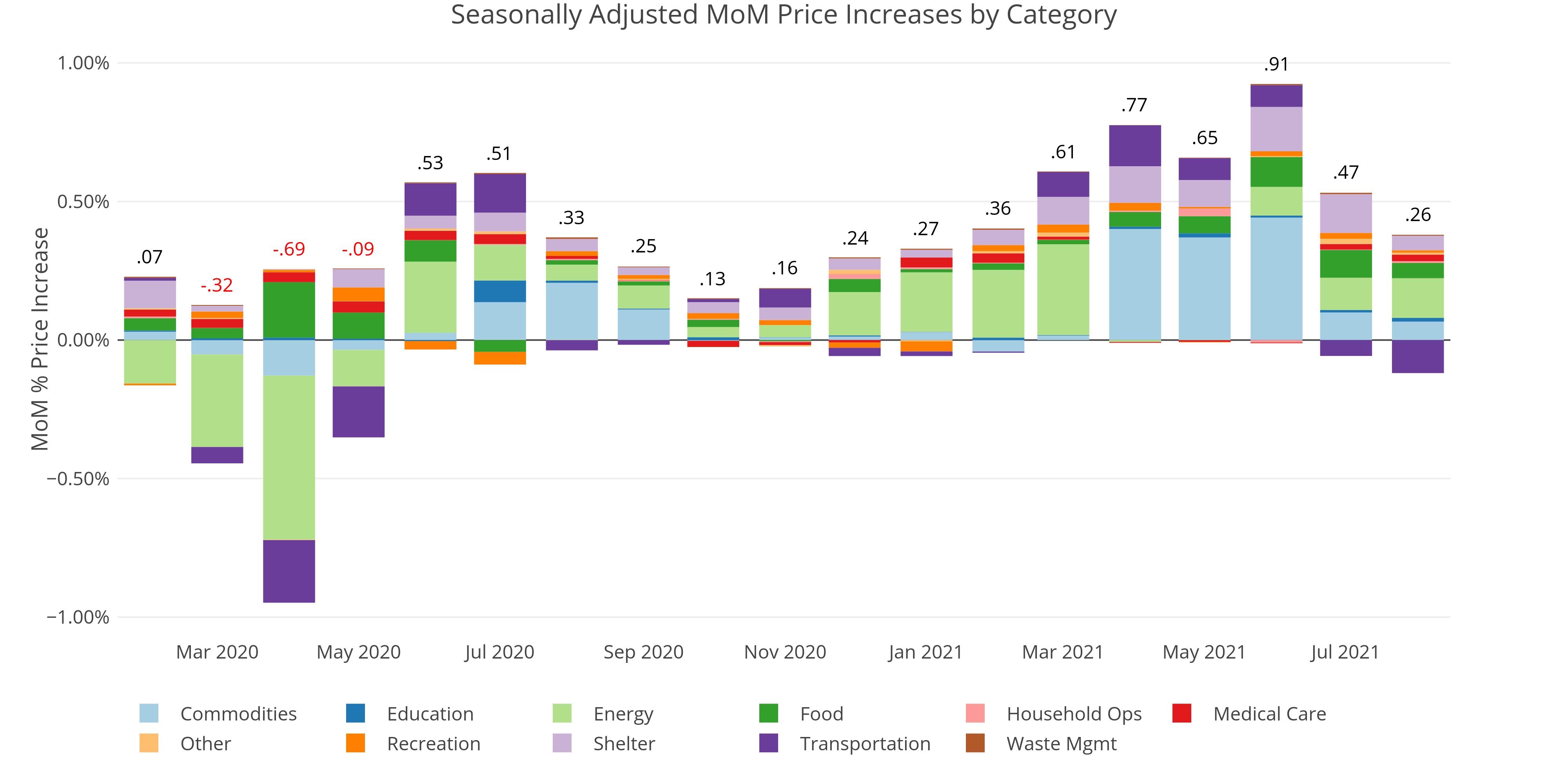

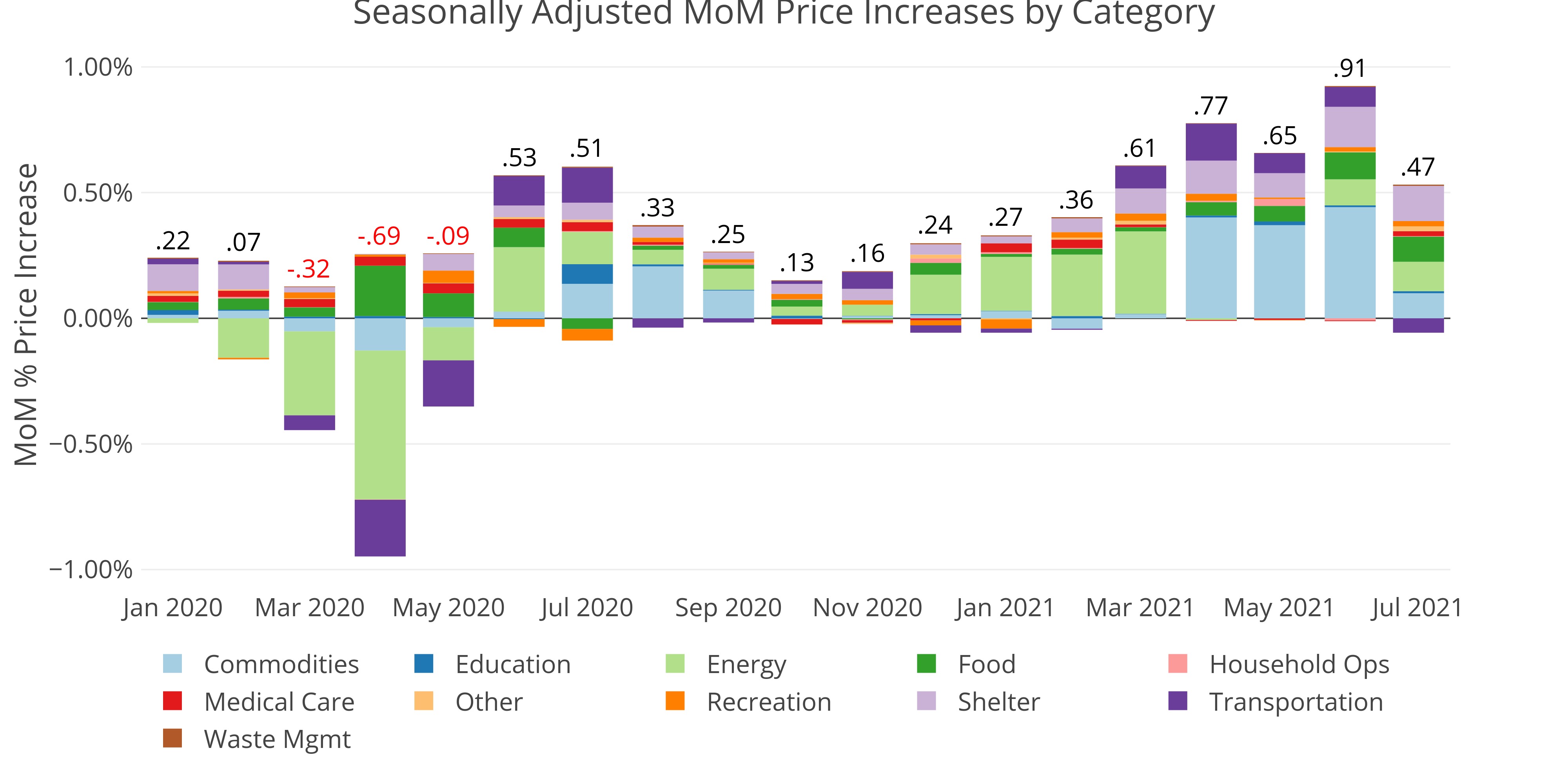

Six of Eight Fed Inflation Categories are Above the 12-month Trend

Fed is not making much progress anymore

CPI: Shelter Prices are Rising 4.7% YoY

Energy is still hiding a bad inflation number

Jobs: A Weak Report is Even Weaker in the Details

Household Survey Continues to Show Extreme Weakness

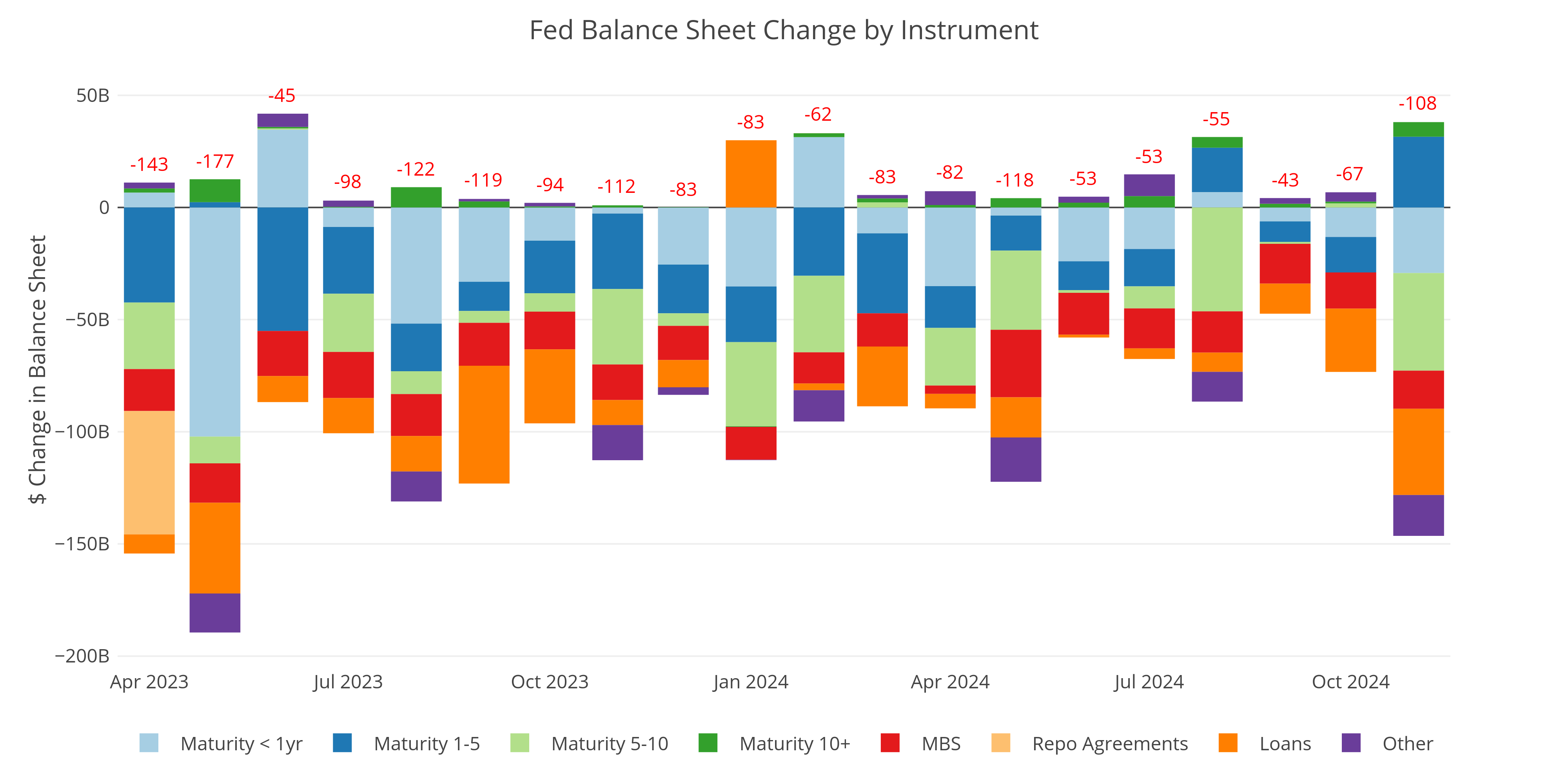

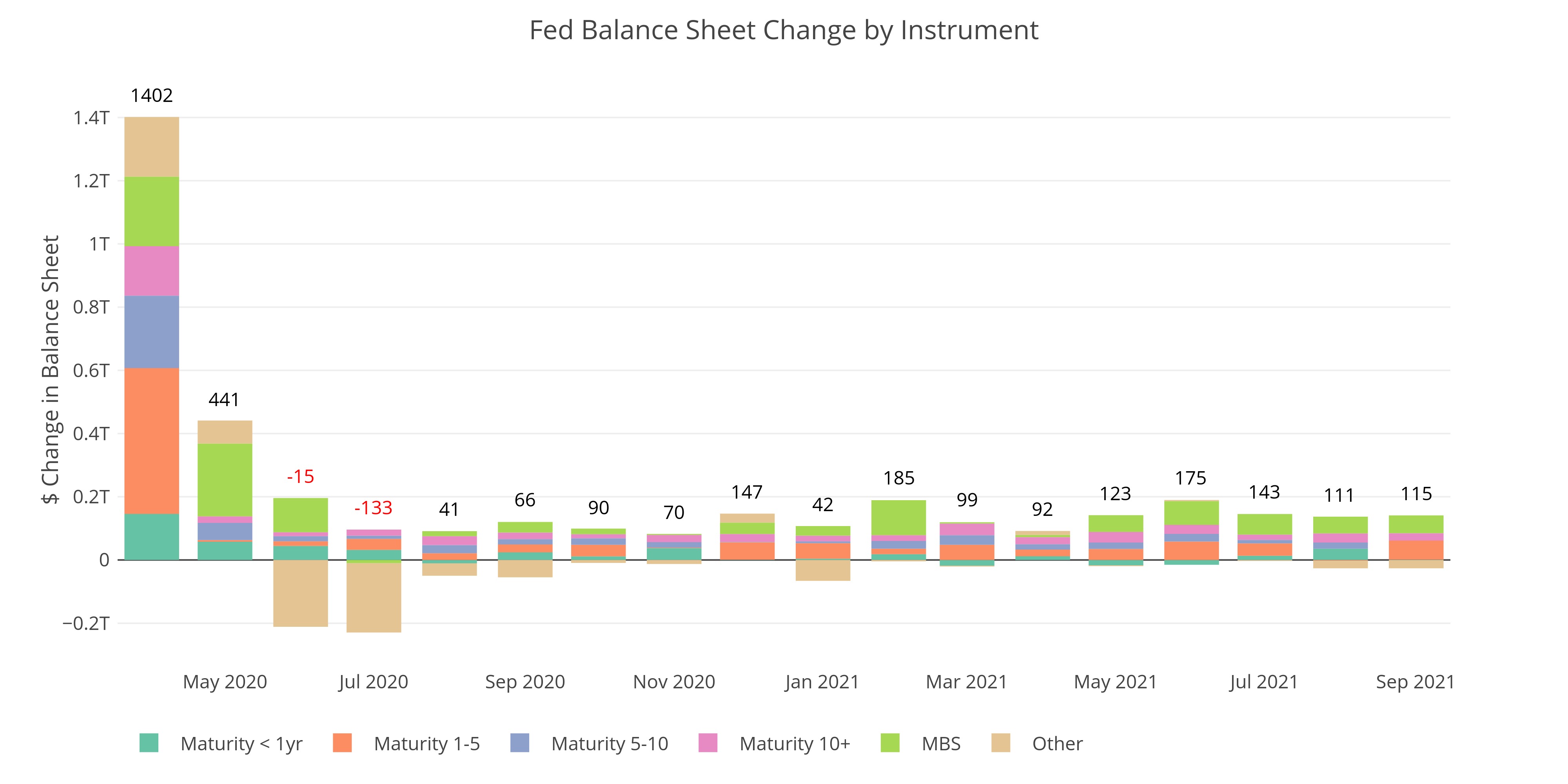

Fed Shrinks Balance Sheet by Nearly $120B

Fed drops balance sheet across the spectrum

13 Week Money Supply Starts Rising

A big surge in recent weeks helps drive it higher

13 Week Money Supply Starts Rising

A big surge in recent weeks helps drive it higher

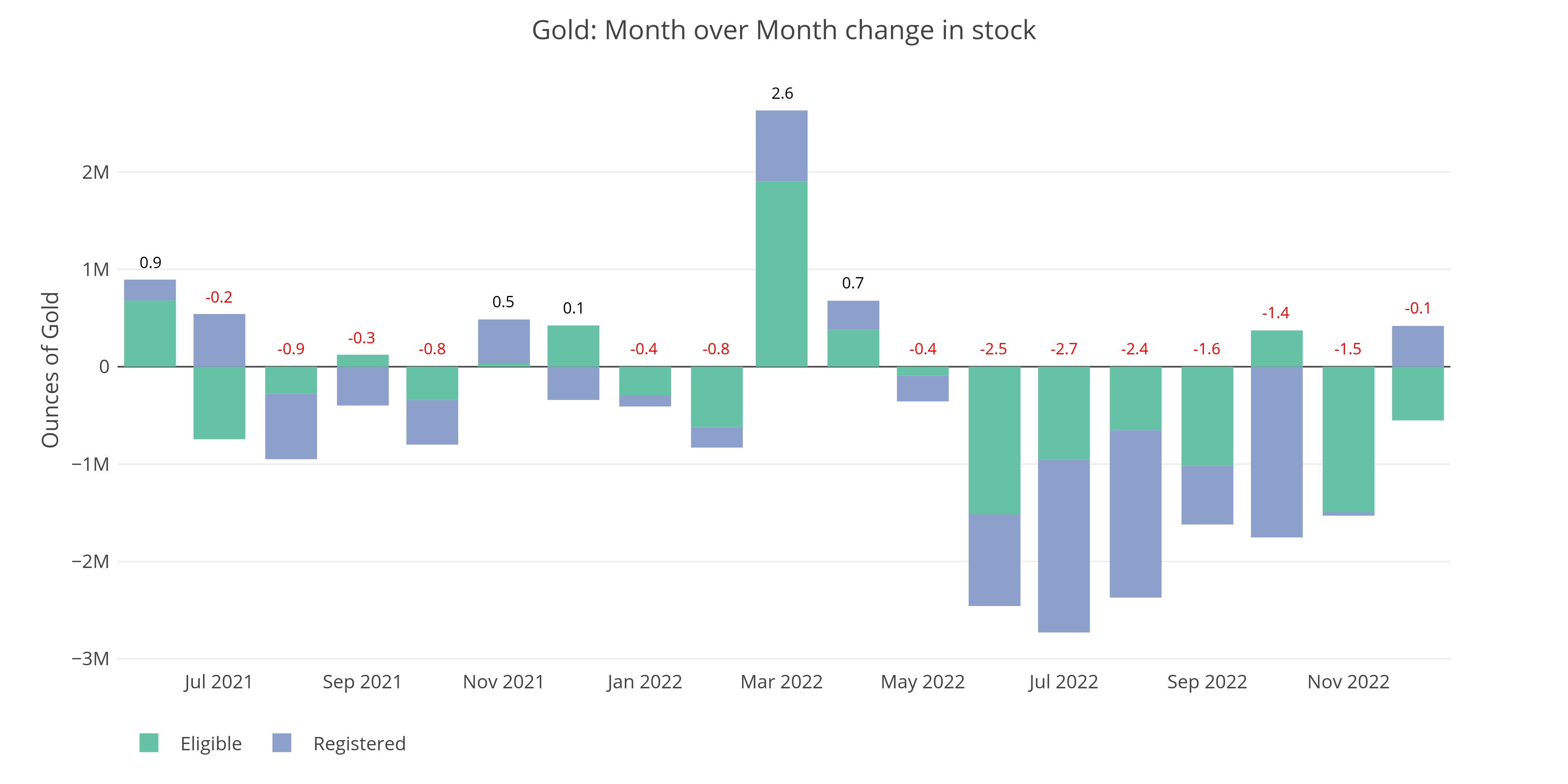

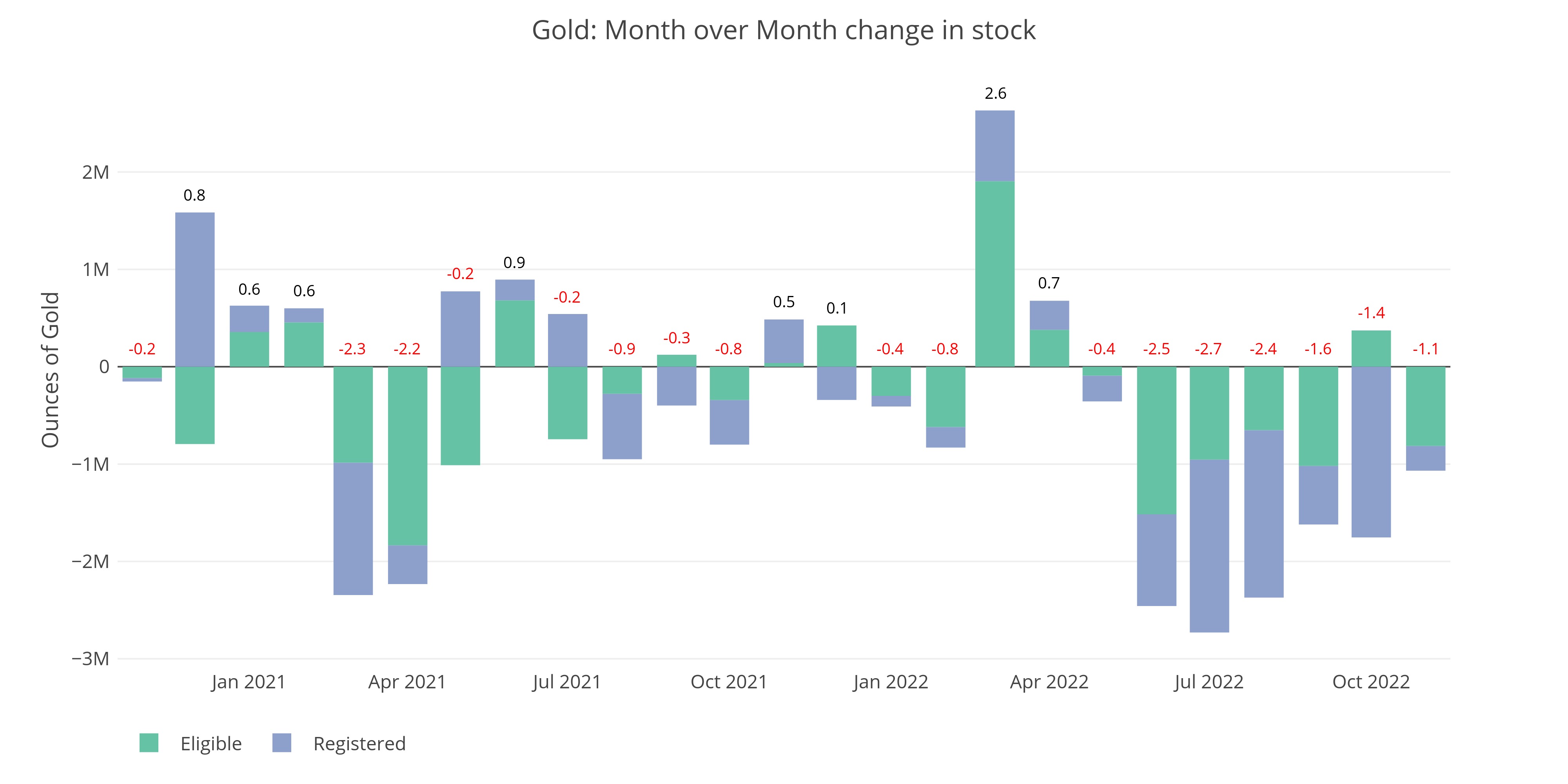

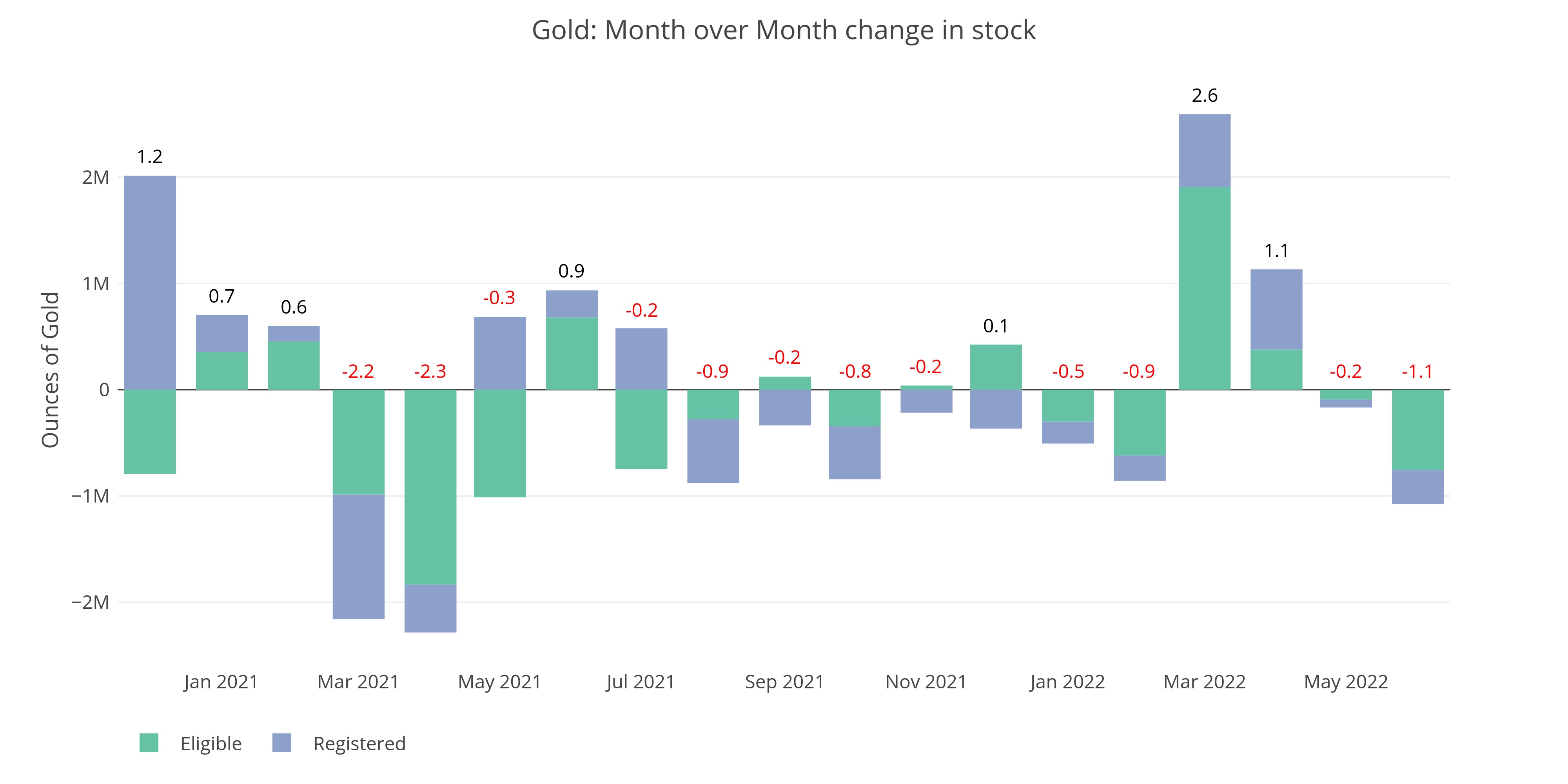

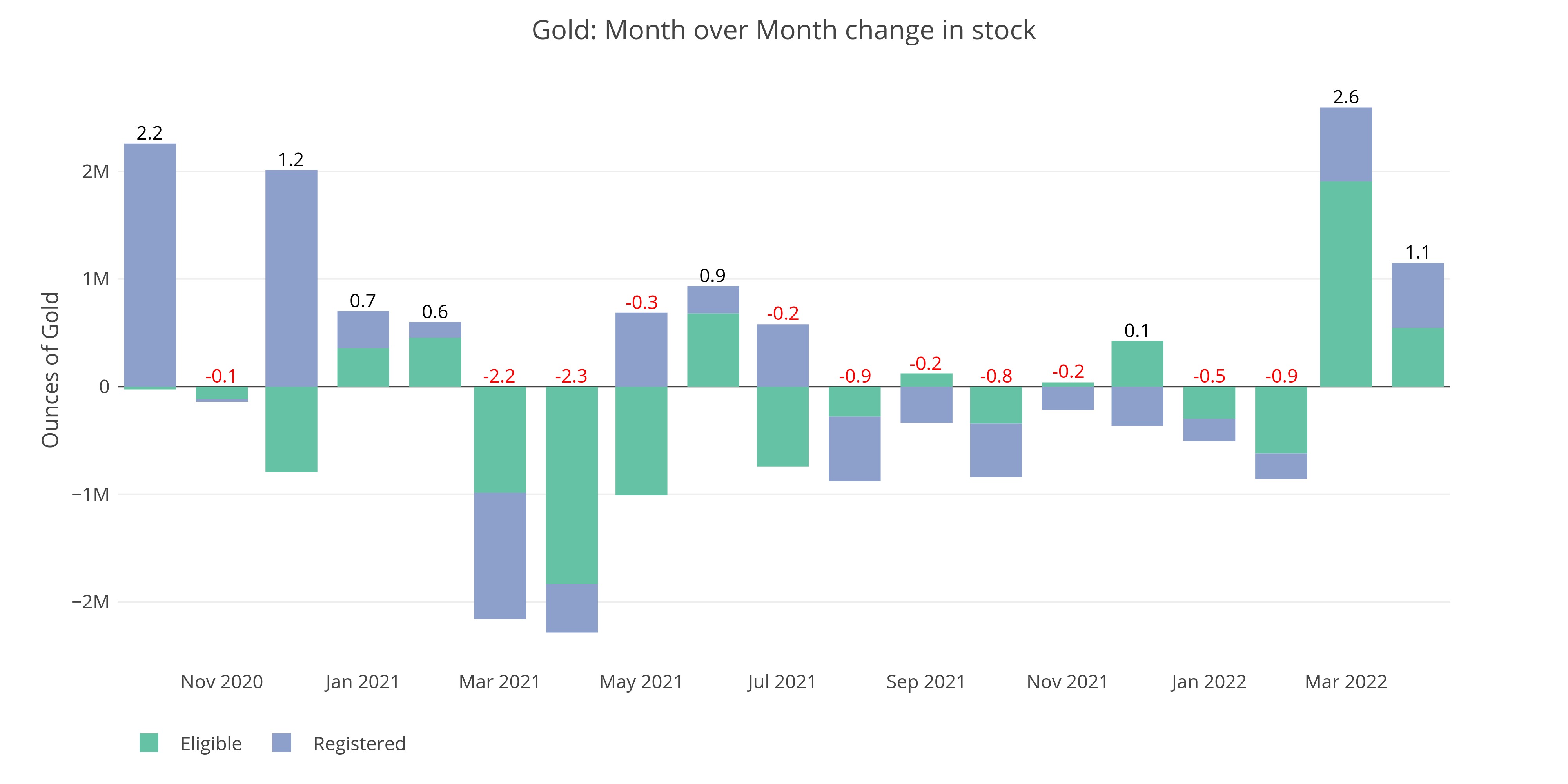

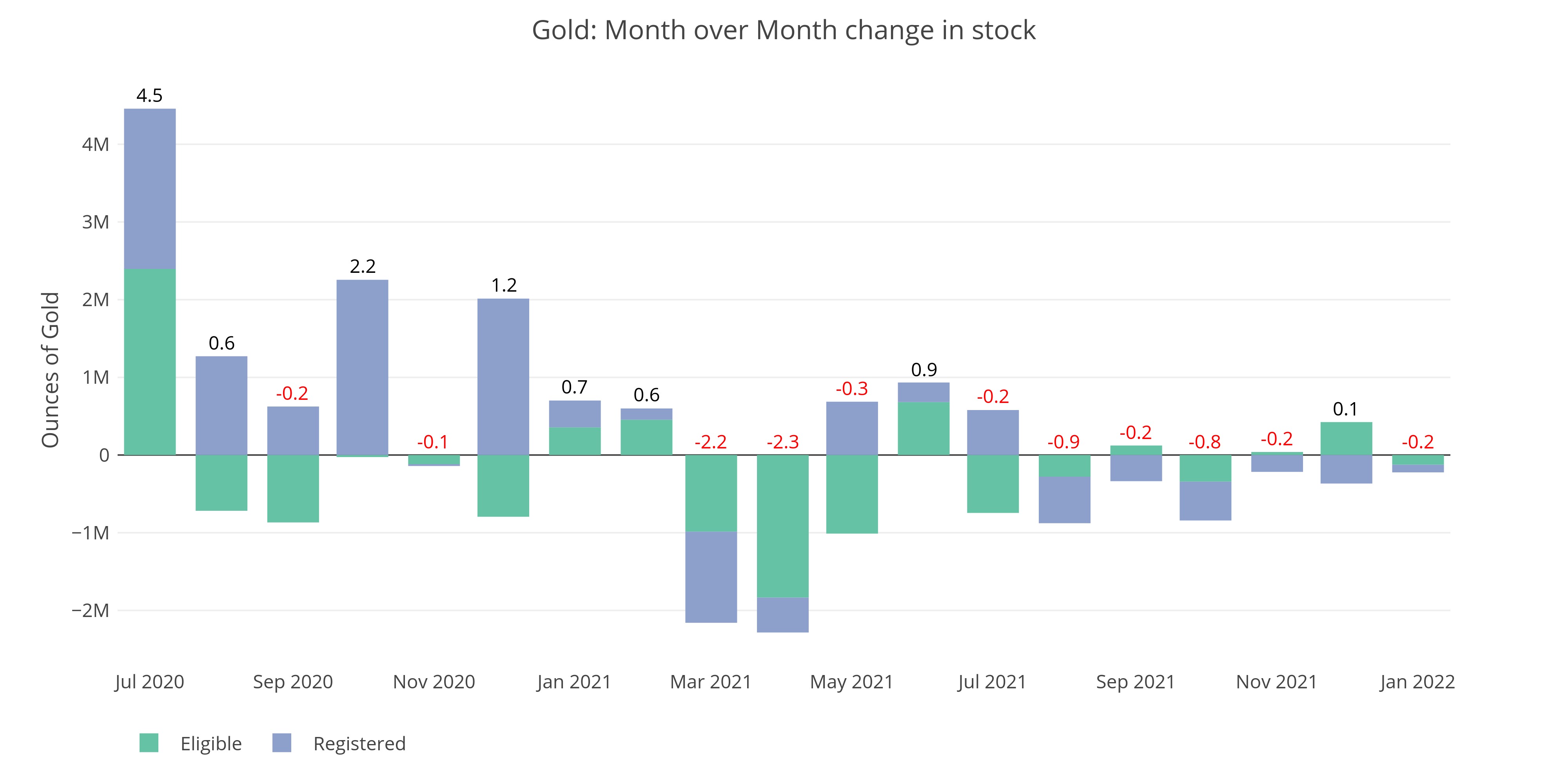

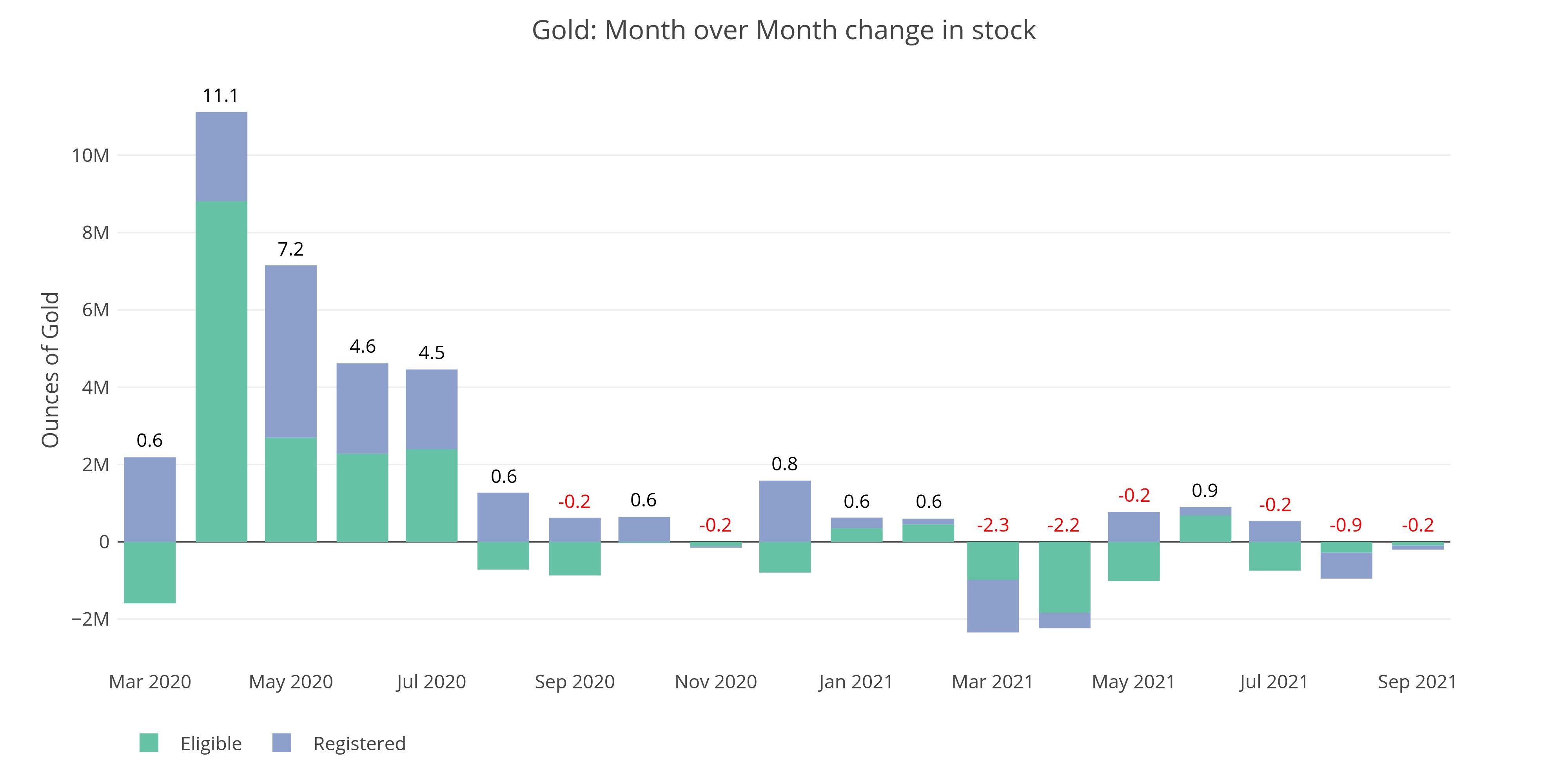

Comex Physical Gold: Demand Increases While Supply Falls

People are waking up

Comex Gold: October Open Interest is Double The Amount from Last Year

People are waking up

Comex Gold: October Open Interest is Double The Amount from Last Year

People are waking up

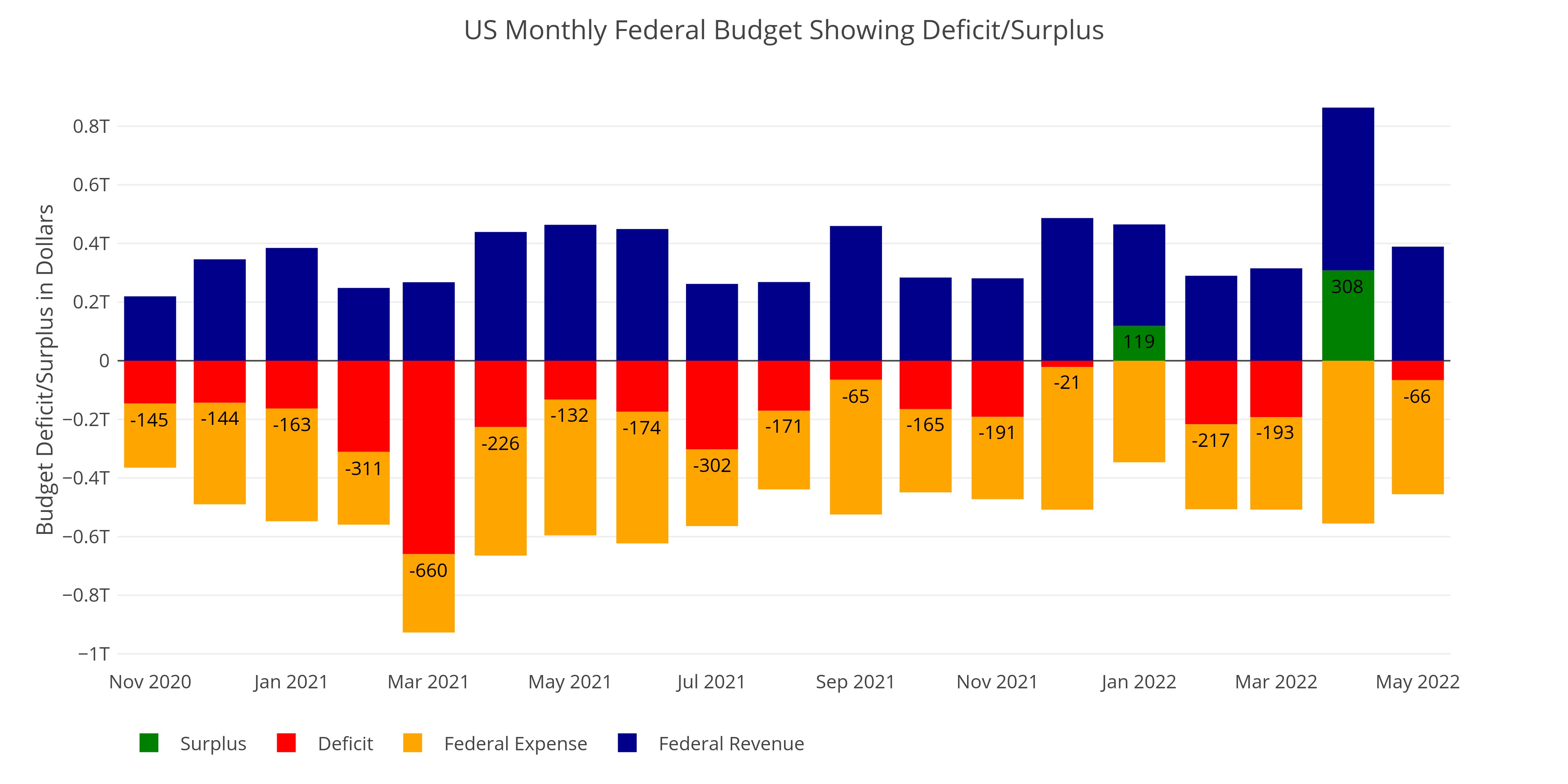

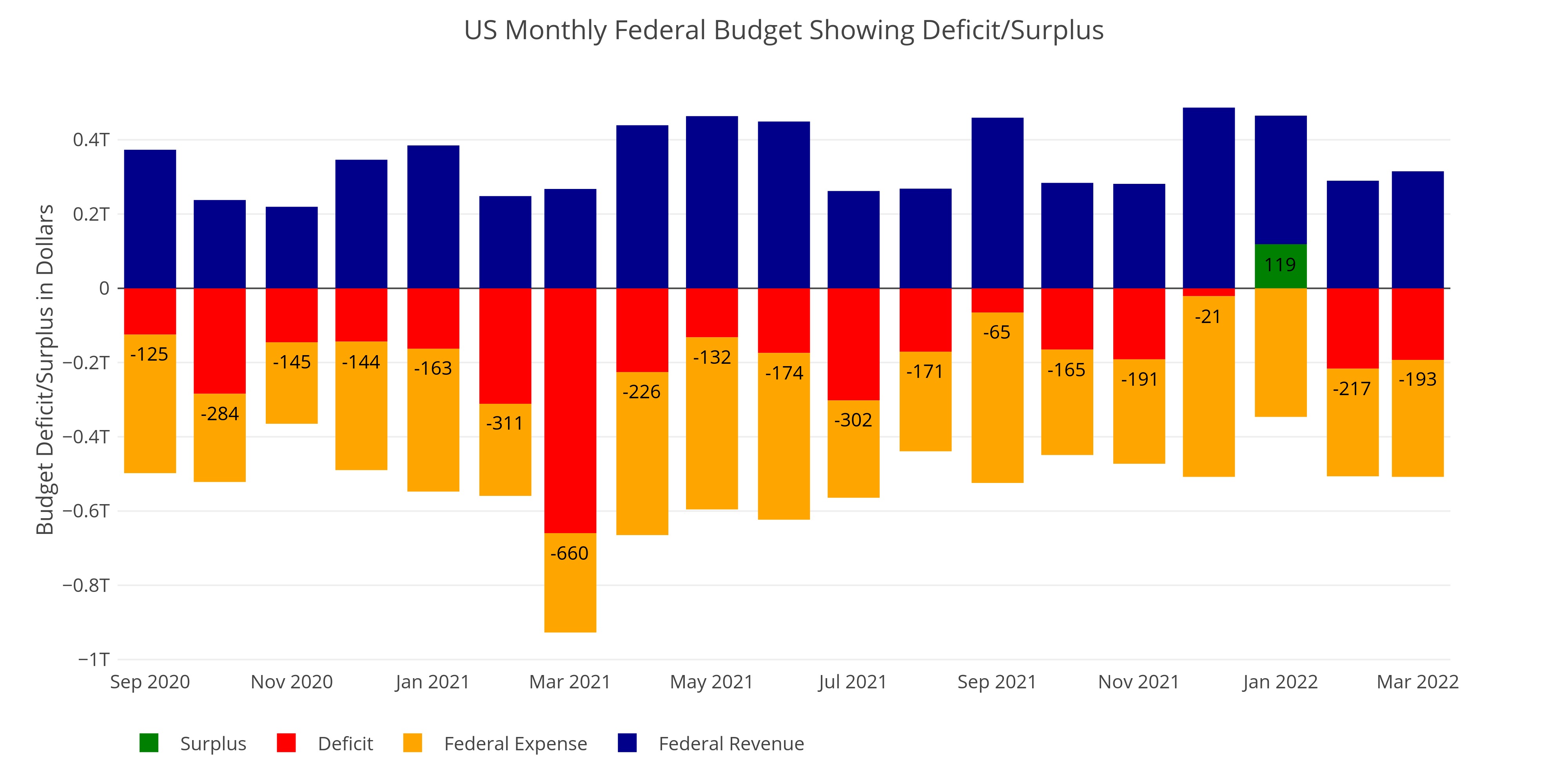

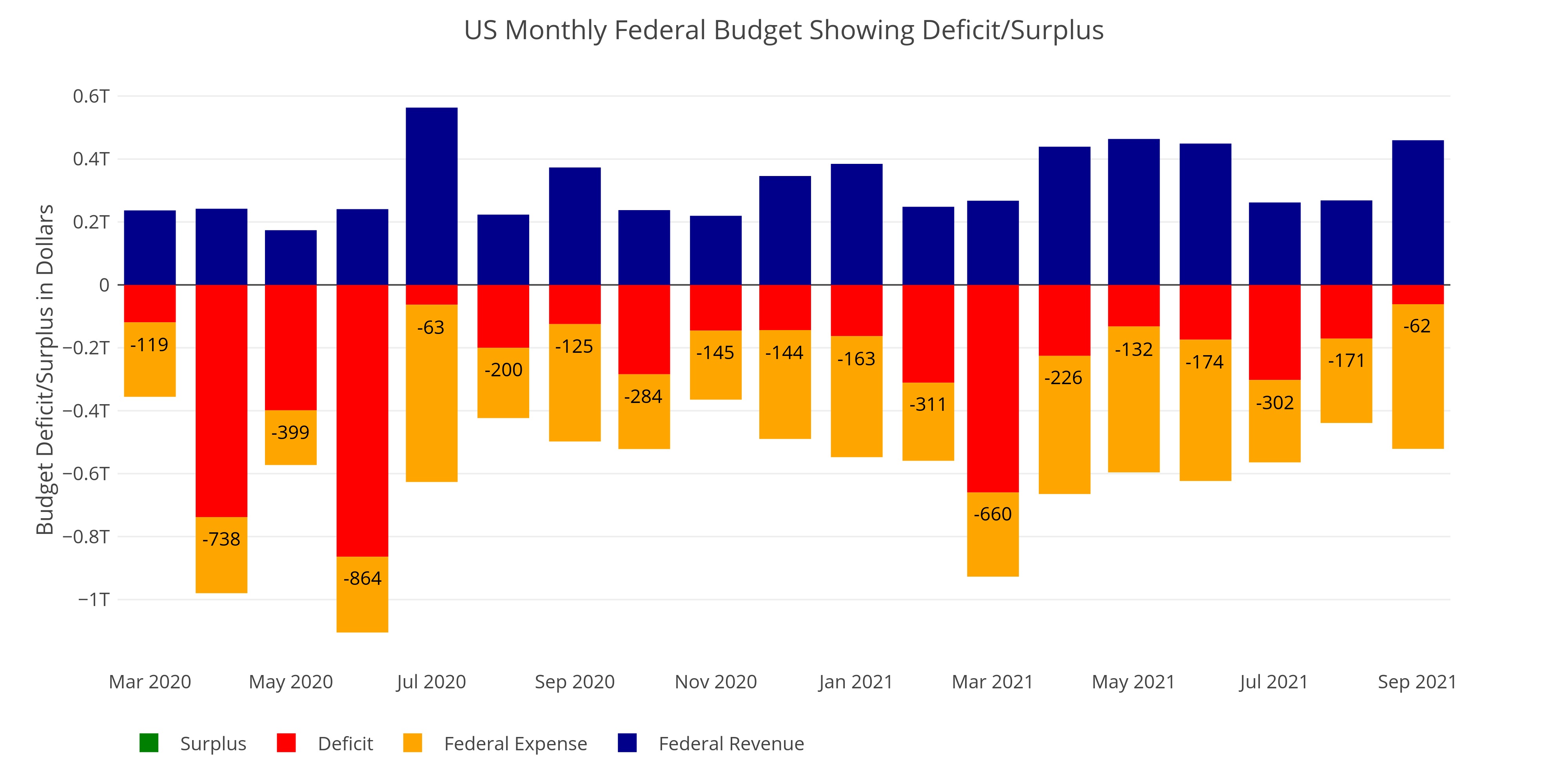

Federal Budget: May Deficit Soars to Almost 3x Above Average

Interest expense is nearing $1T

Federal Budget: Government Adds $662B of Debt in Three Months

Interest expense is nearing $1T

The Technicals: The Gold Market has Changed

Other variables point to a shallow correction

Comex: Gold Sees Highest Delivery Volume in Nearly 2 Years

Supply constraints are coming

13 Week Money Supply Hits Seasonal Stagnation

Money Supply more broadly increasing

Jobs: QCEW Shows Further Evidence of Wildly Inaccurate Headline Report

Two completely different labor markets

Treasury Finally Issues Some Long Term Debt

Majority of debt is short-term

Jobs: A Weak Report is Even Weaker in the Details

Household Survey Continues to Show Extreme Weakness

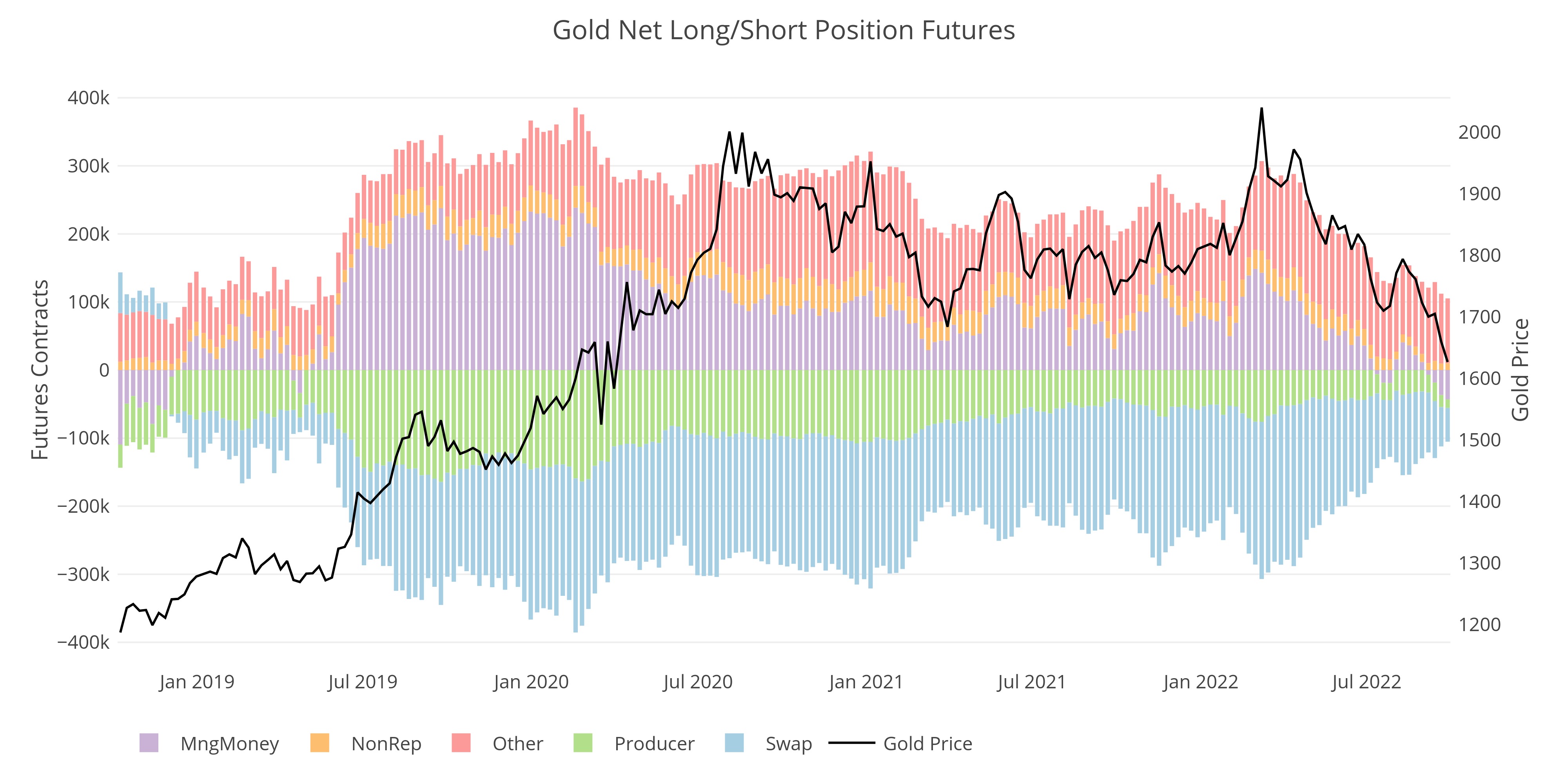

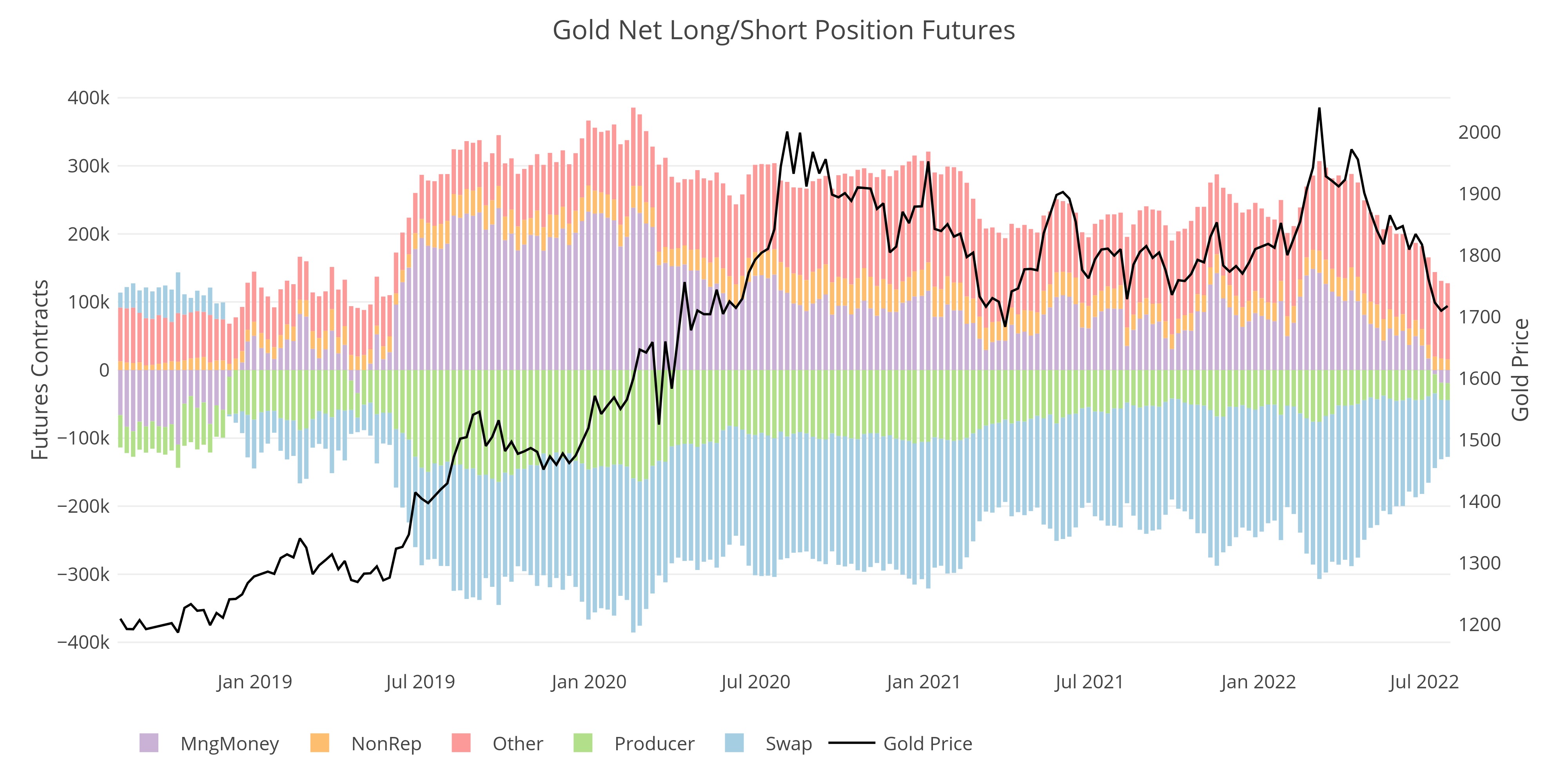

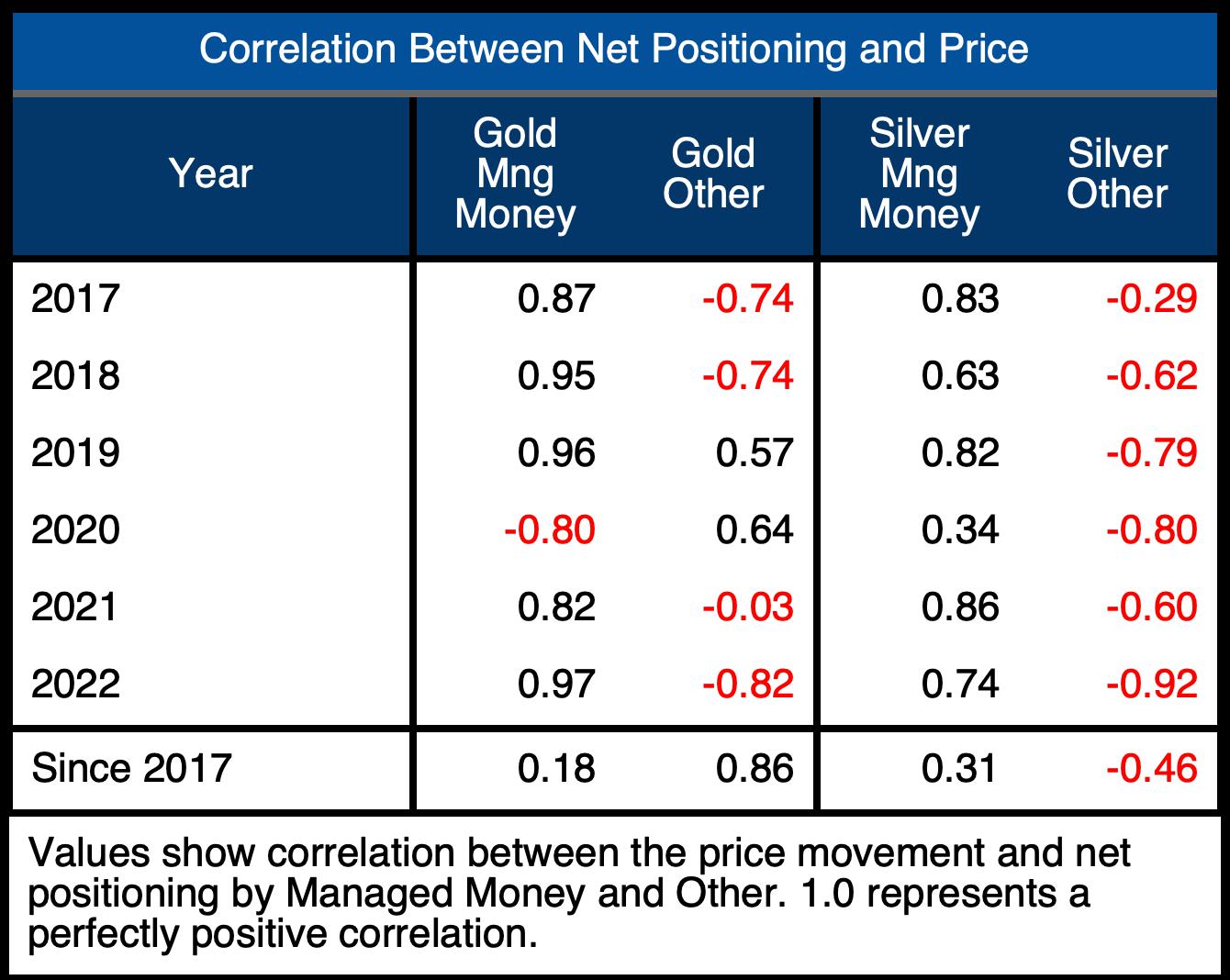

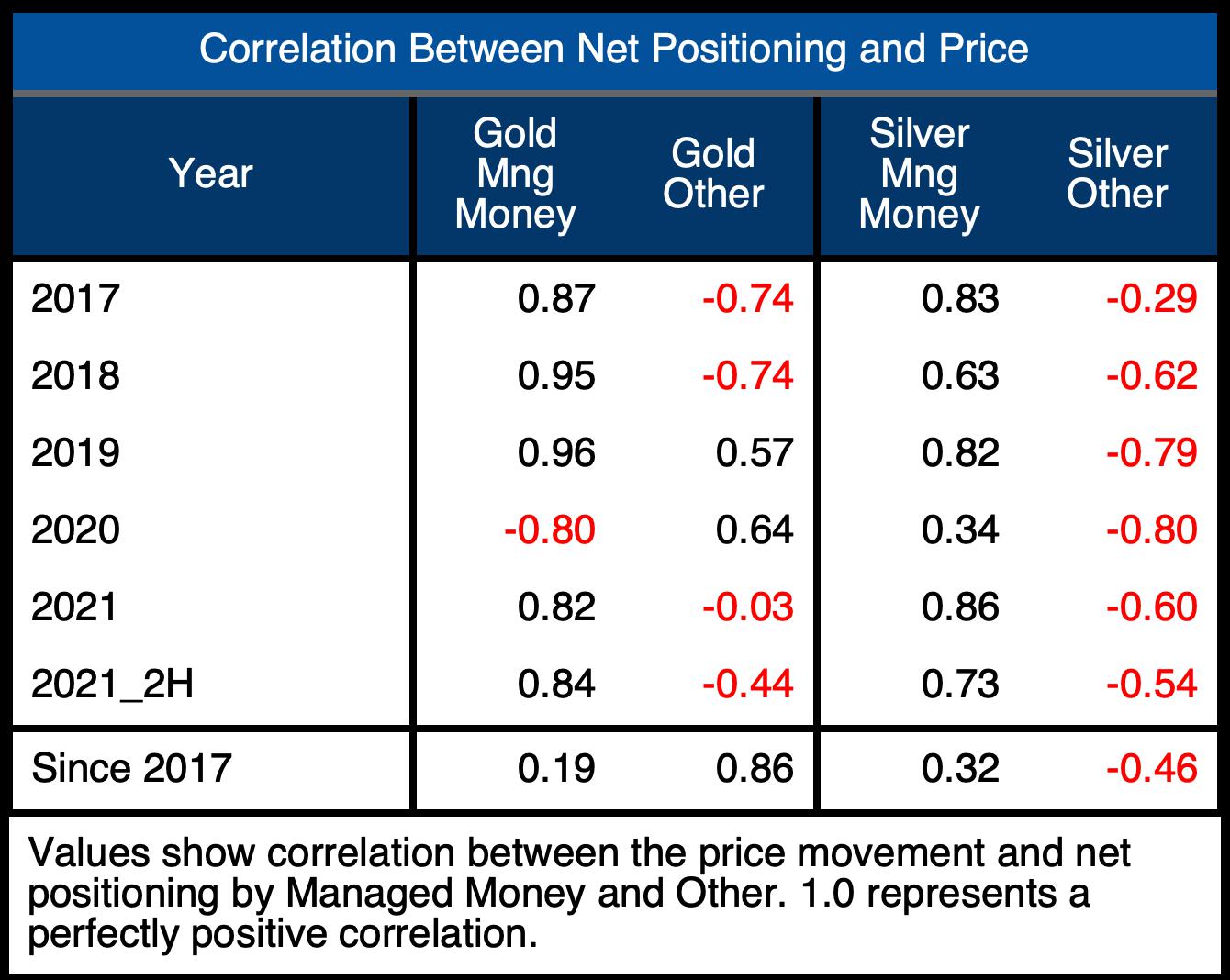

CFTC CoTs Report: Managed Money Still Driving Prices

Recent activity suggest price advances were not overbought

Money Supply is Moving Back Up

Fed Still Accommodative

Comex: Gold Sees Highest Delivery Volume in Nearly 2 Years

Supply constraints are coming

Federal Budget: Interest Payments Reach $750B

January is typically a surplus but is not this year

Jobs: You NEED to Look at the Household Survey

The divergences are getting even bigger

Fed Balance Sheet Shrinks by Smallest Amount in a Year

One year out since SVB went under

Money Supply Sees Some Deceleration

Fed Still Accommodative

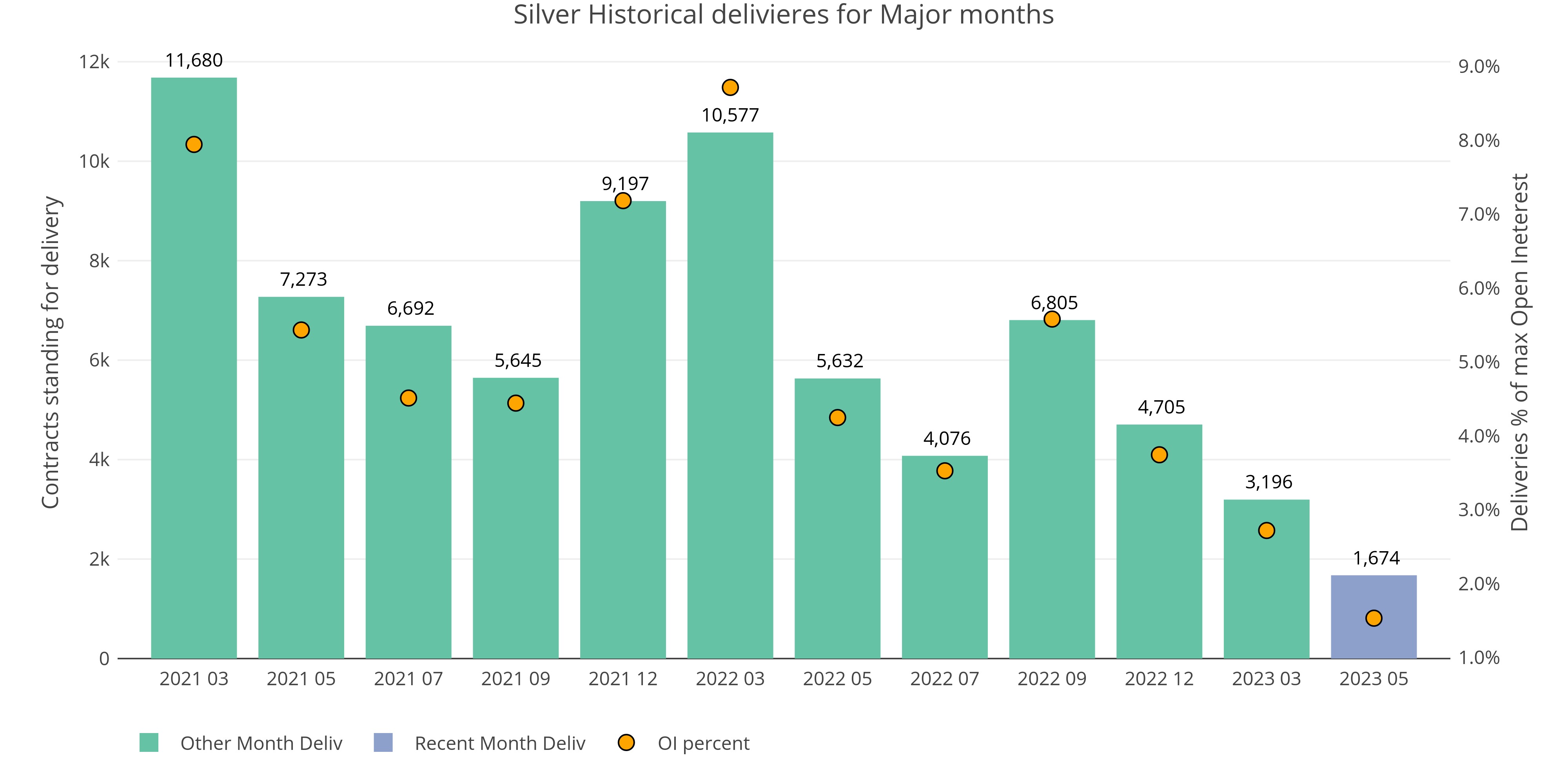

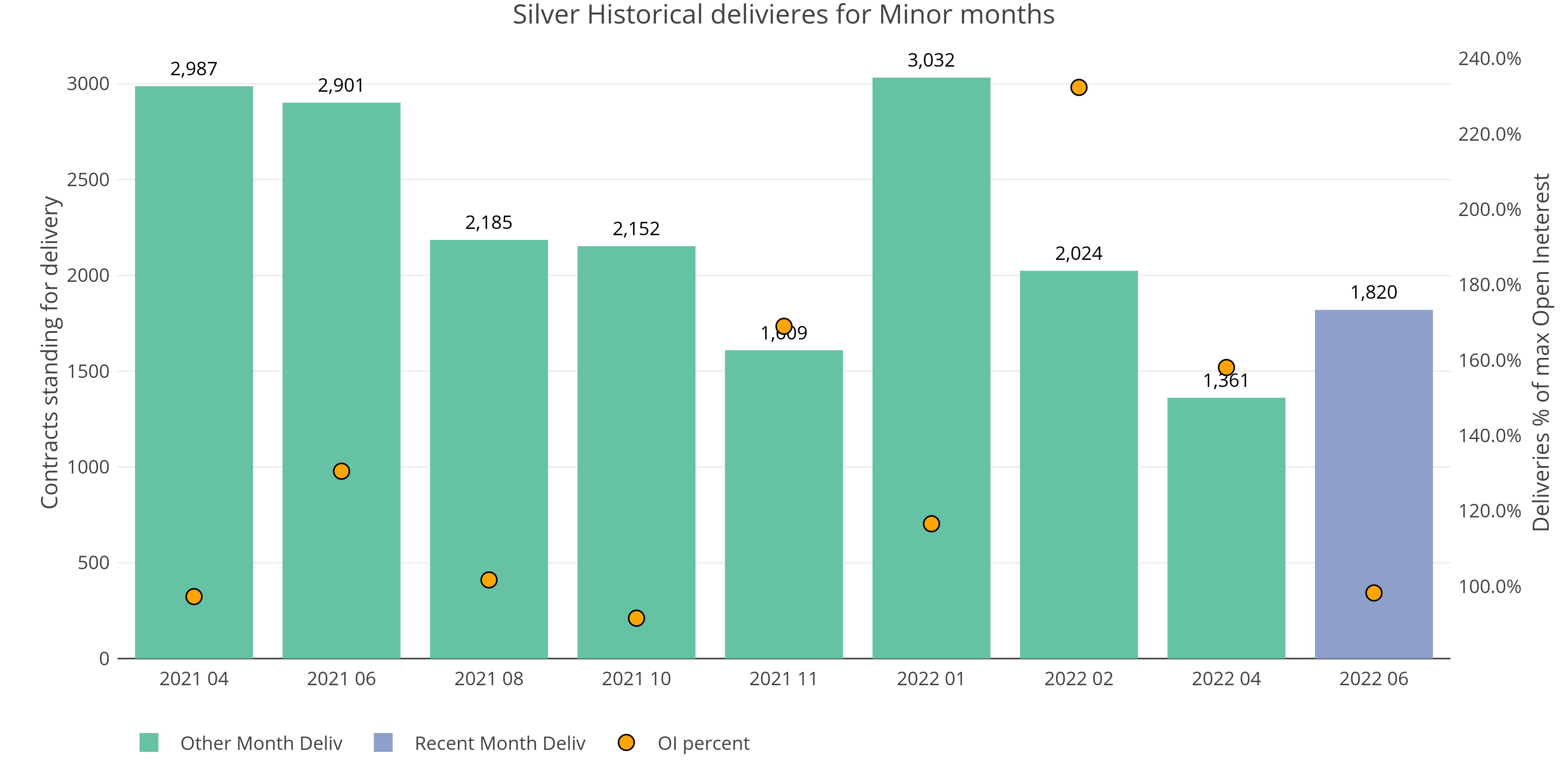

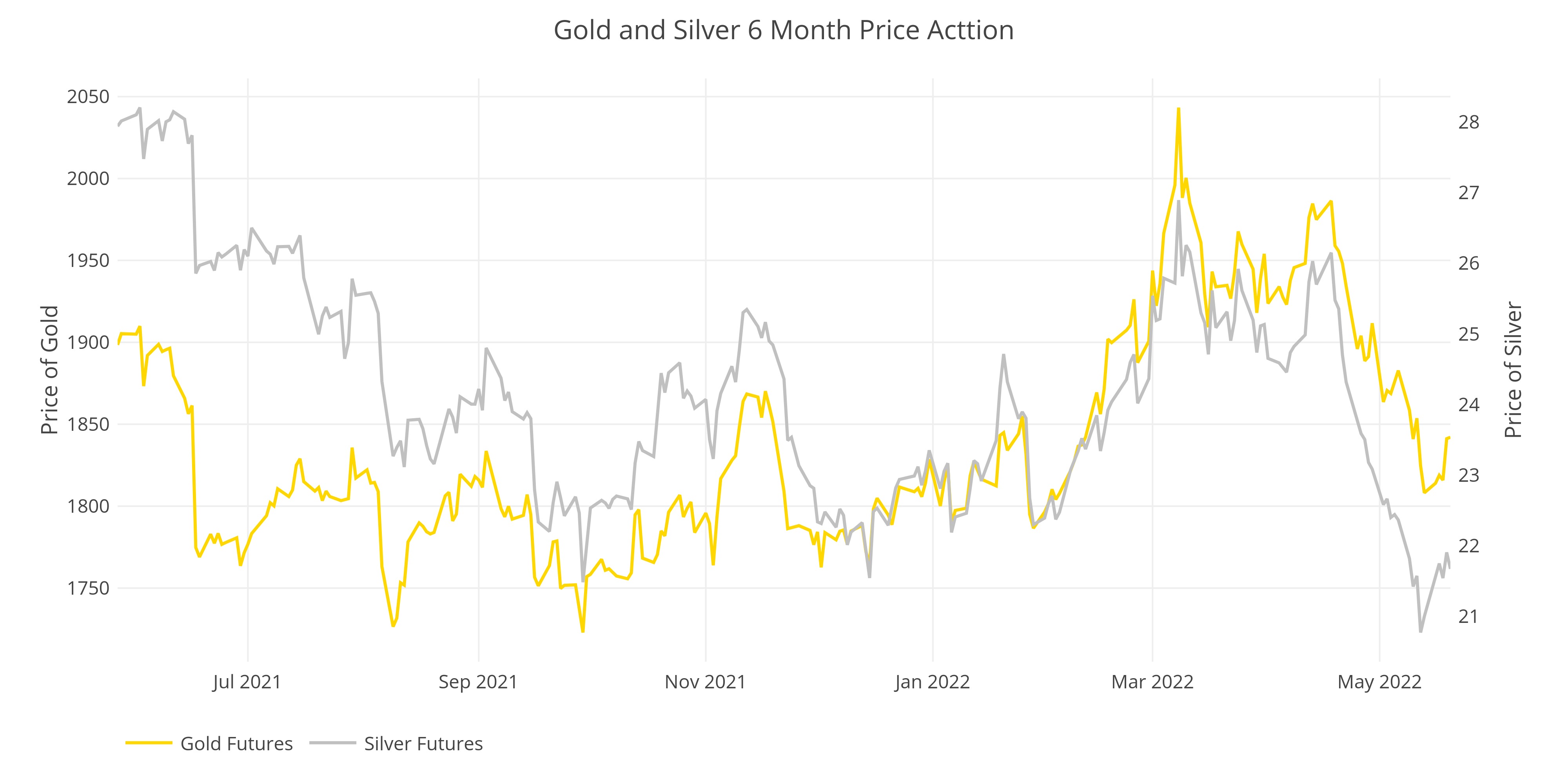

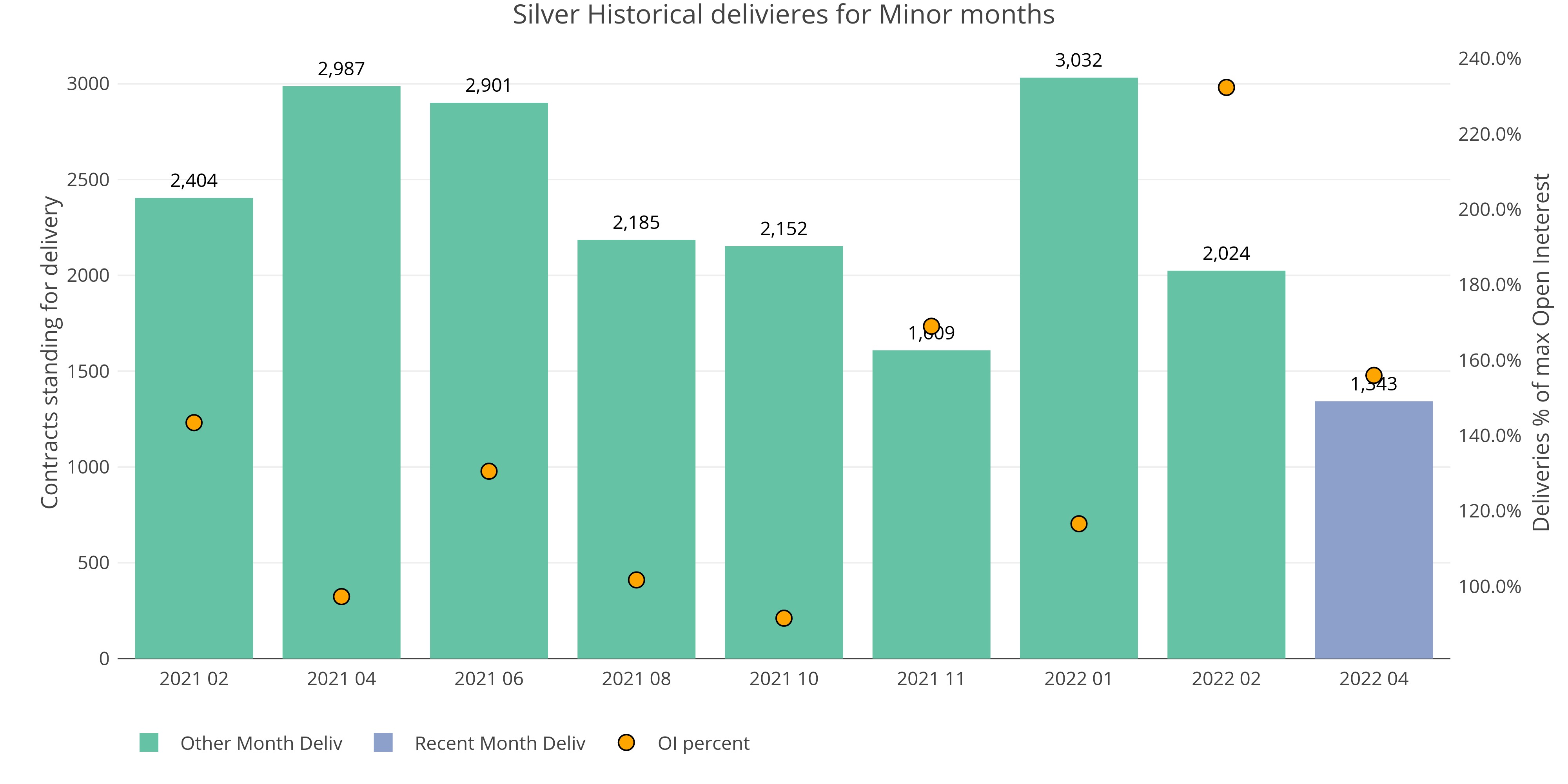

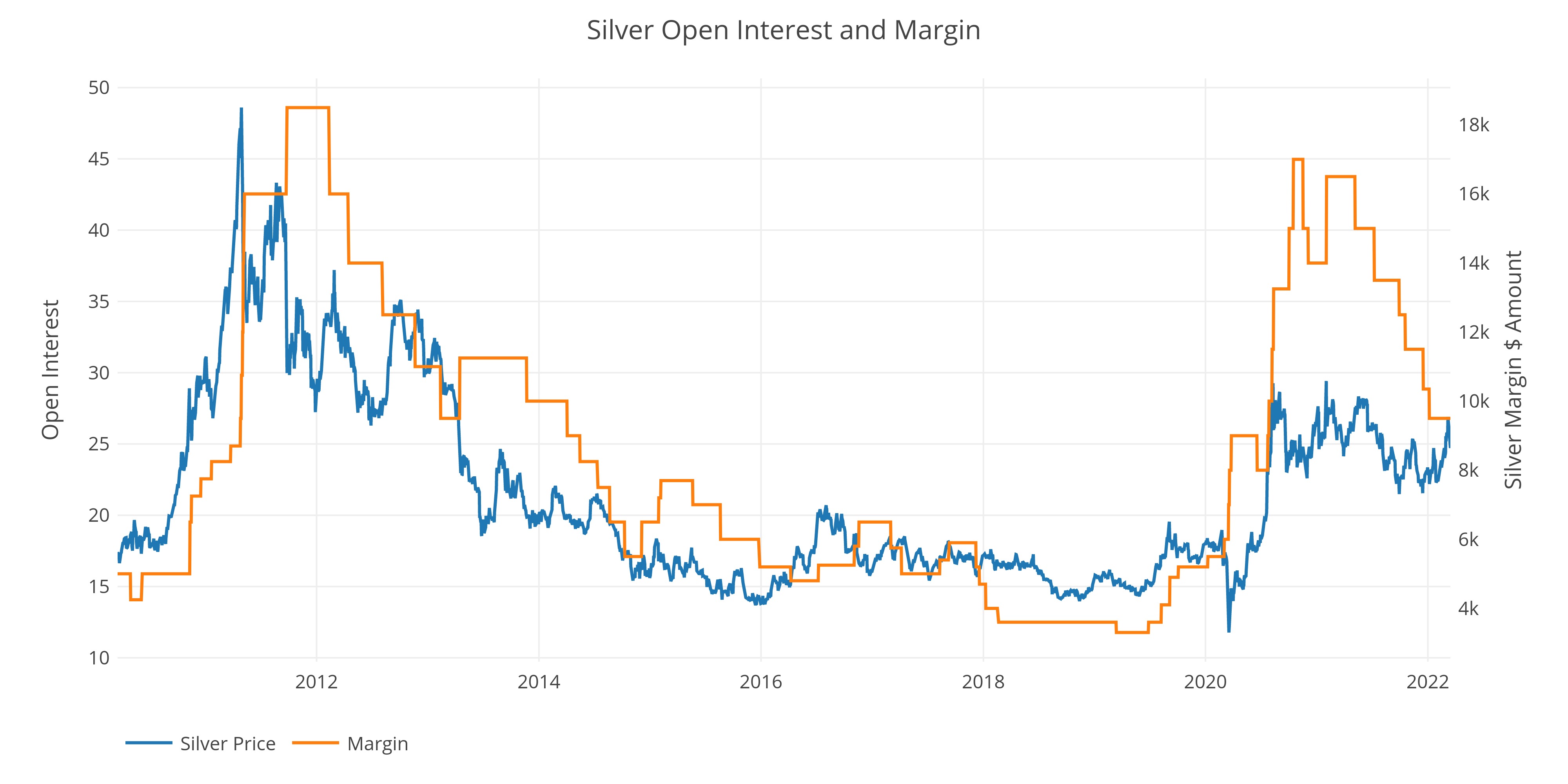

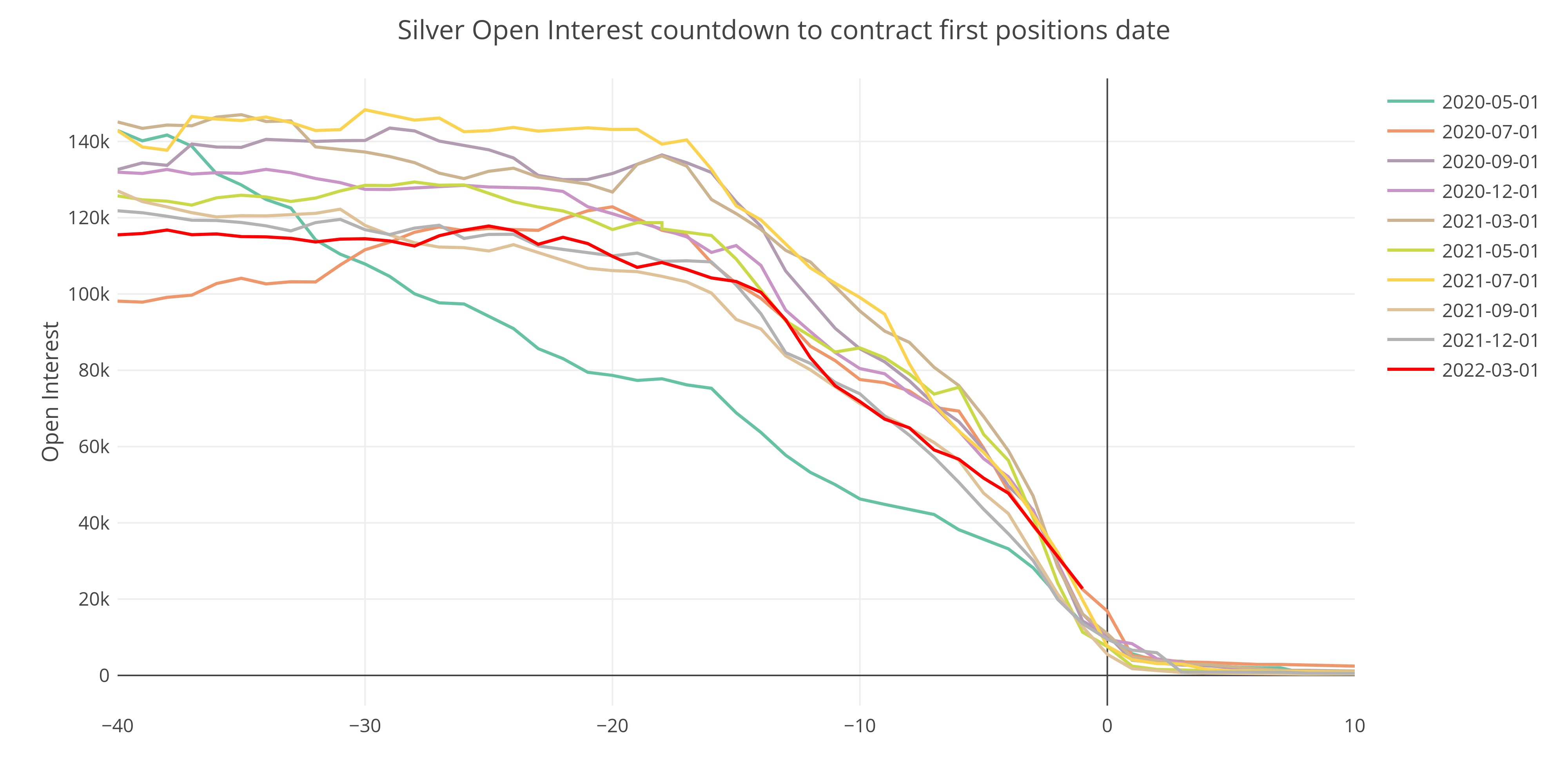

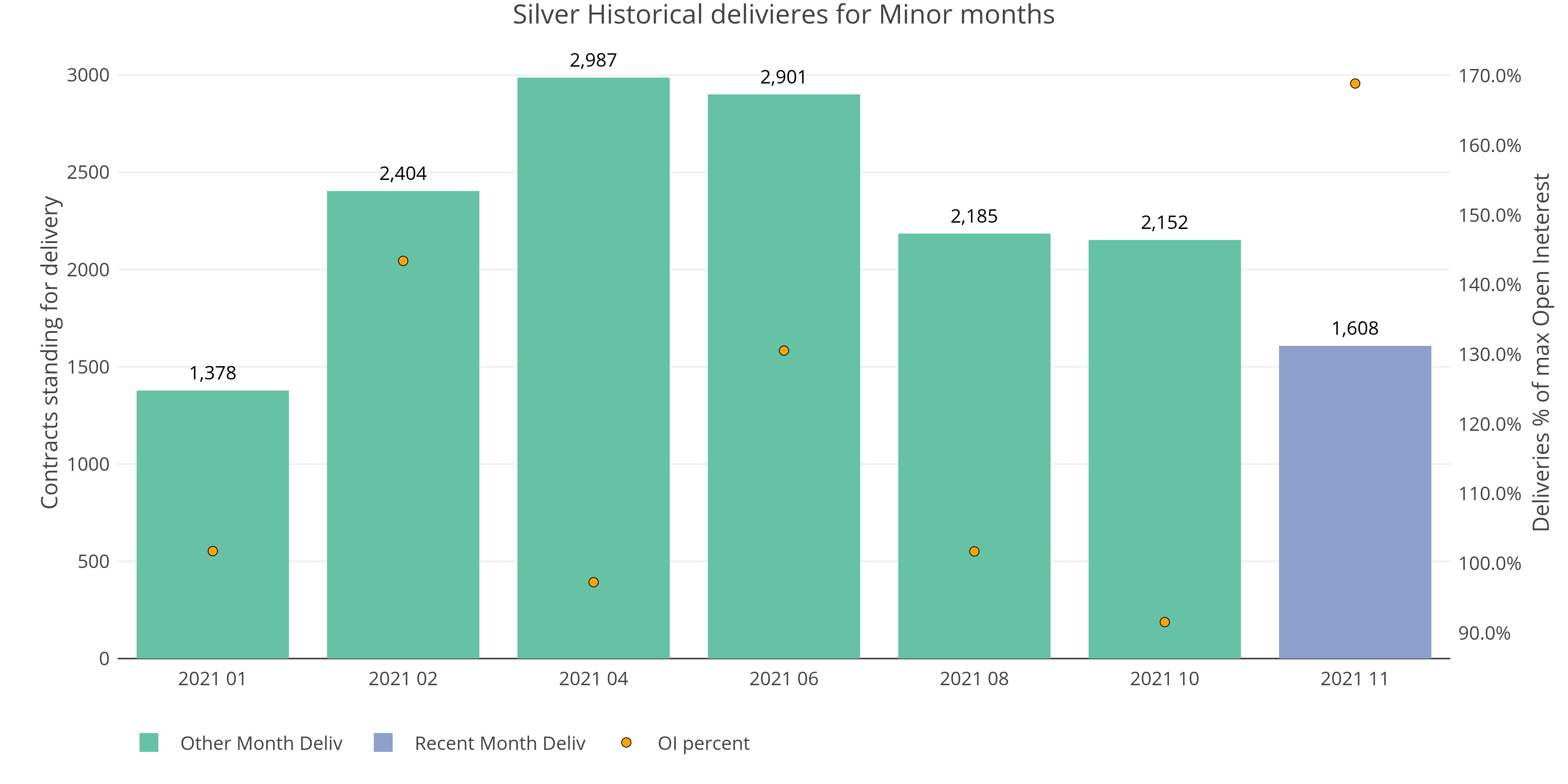

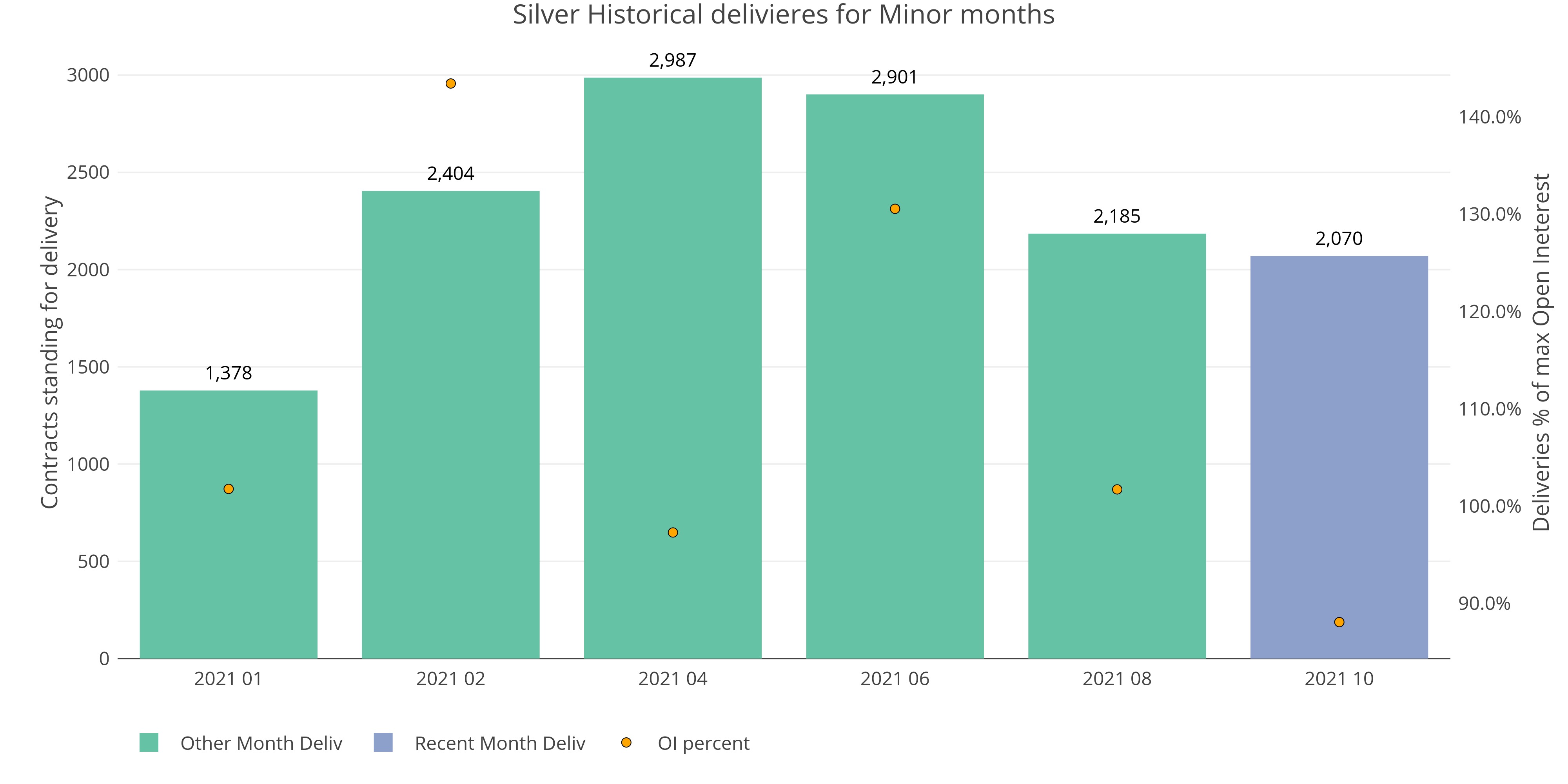

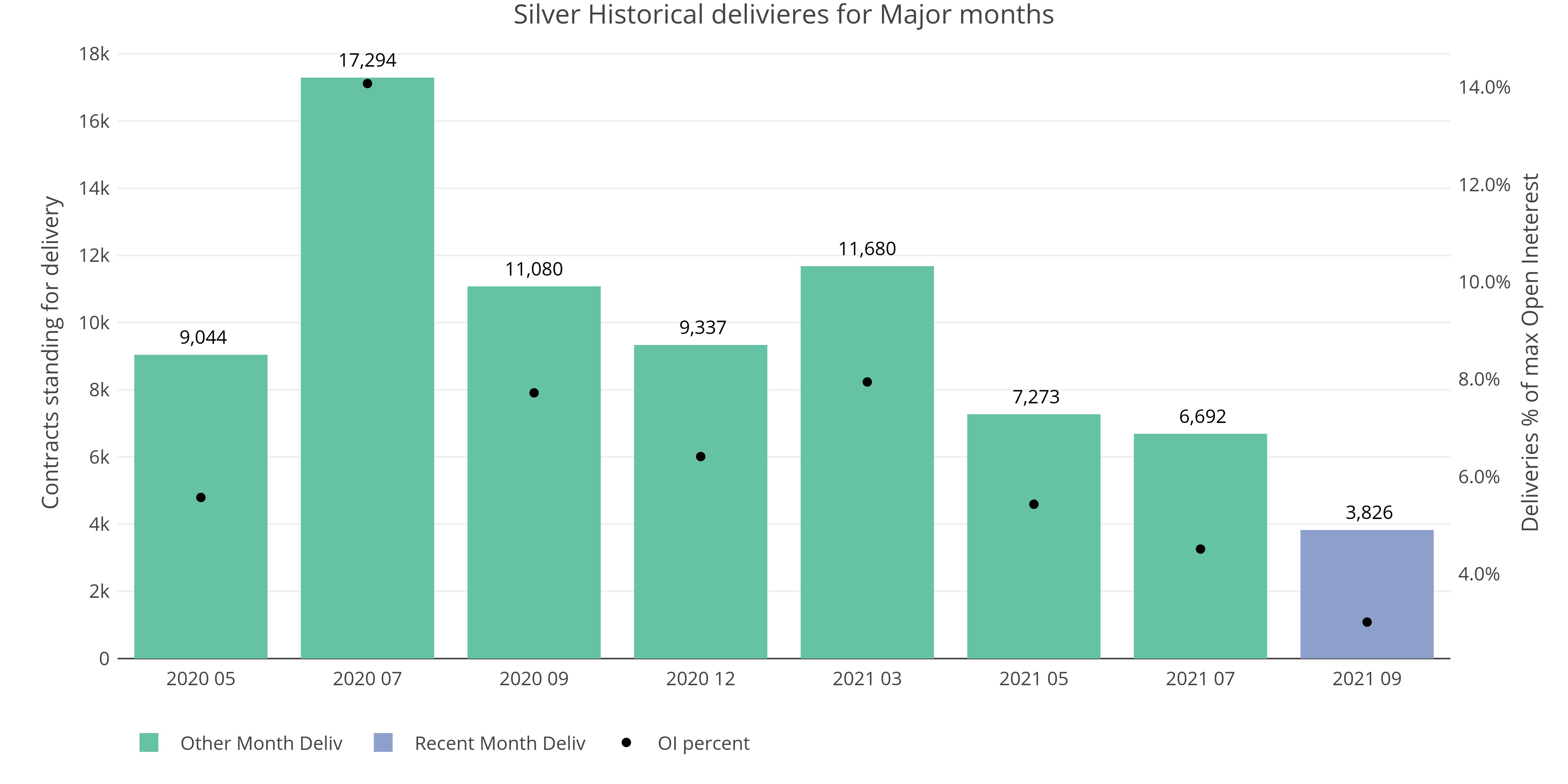

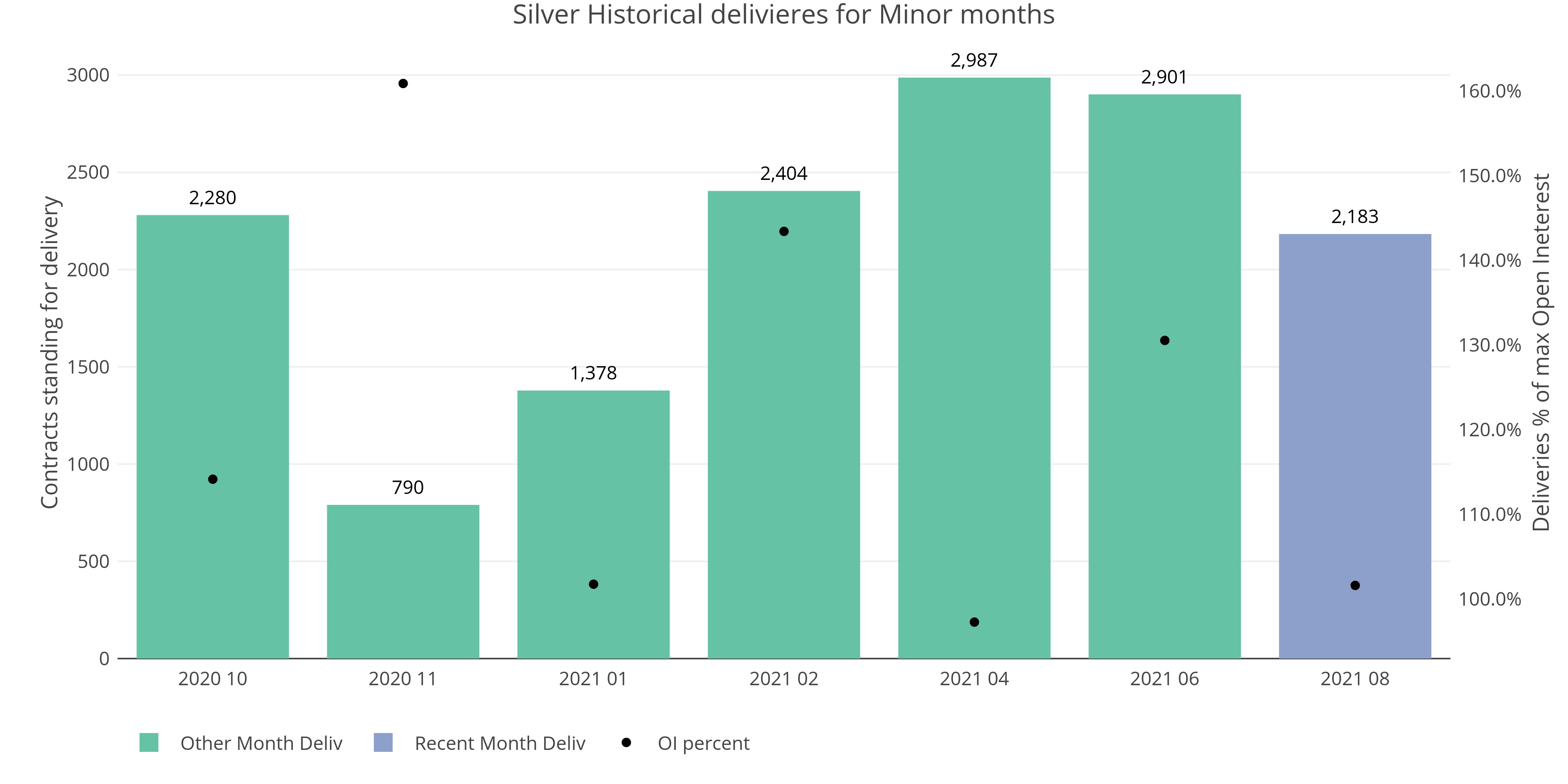

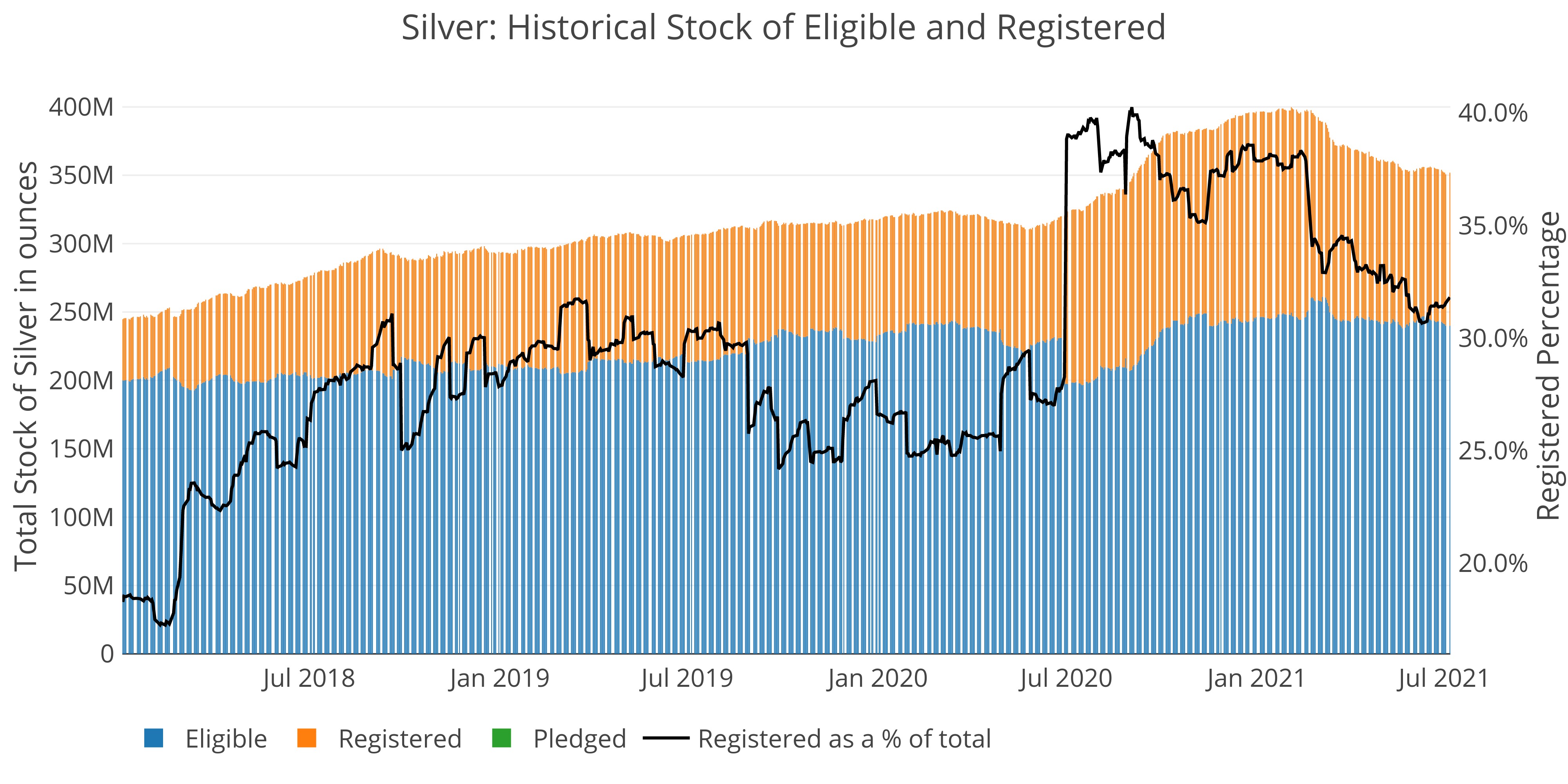

Is the Comex Showing an Impending Price Spike in Silver?

Interest is definitely elevated

The Technicals: Looking Beyond Price Action

Other variables point to a shallow correction

Jobs: Household Report is Way Below a Weak Headline Number

Biggest divergence to Household Survey

Is the Comex Showing an Impending Price Spike in Silver?

Interest is definitely elevated

Money Supply Sees Major Jump in Recent Weeks

Fed Still Accommodative

Jobs: Household Report Jumps but QCEW Shows Job Market is Not as Strong

QCEW Shows Weaker Reports

Yellen Continues Betting on Interest Rate Declines

Majority of debt is short-term

Money Supply Dips for First Time Since November

Fed Still Accommodative

CFTC CoTs Report: Managed Money Still Driving Prices

Recent activity suggest price advances were not overbought

Is Someone About to Stress the Comex

Gold is showing incredible strength

Jobs: Massive Revisions and Household Survey Tell the Real Story

Can Headline Number be Considered Reliable?

Money Supply Growth Continues to Support the Stock Market

Fed is no longer tight

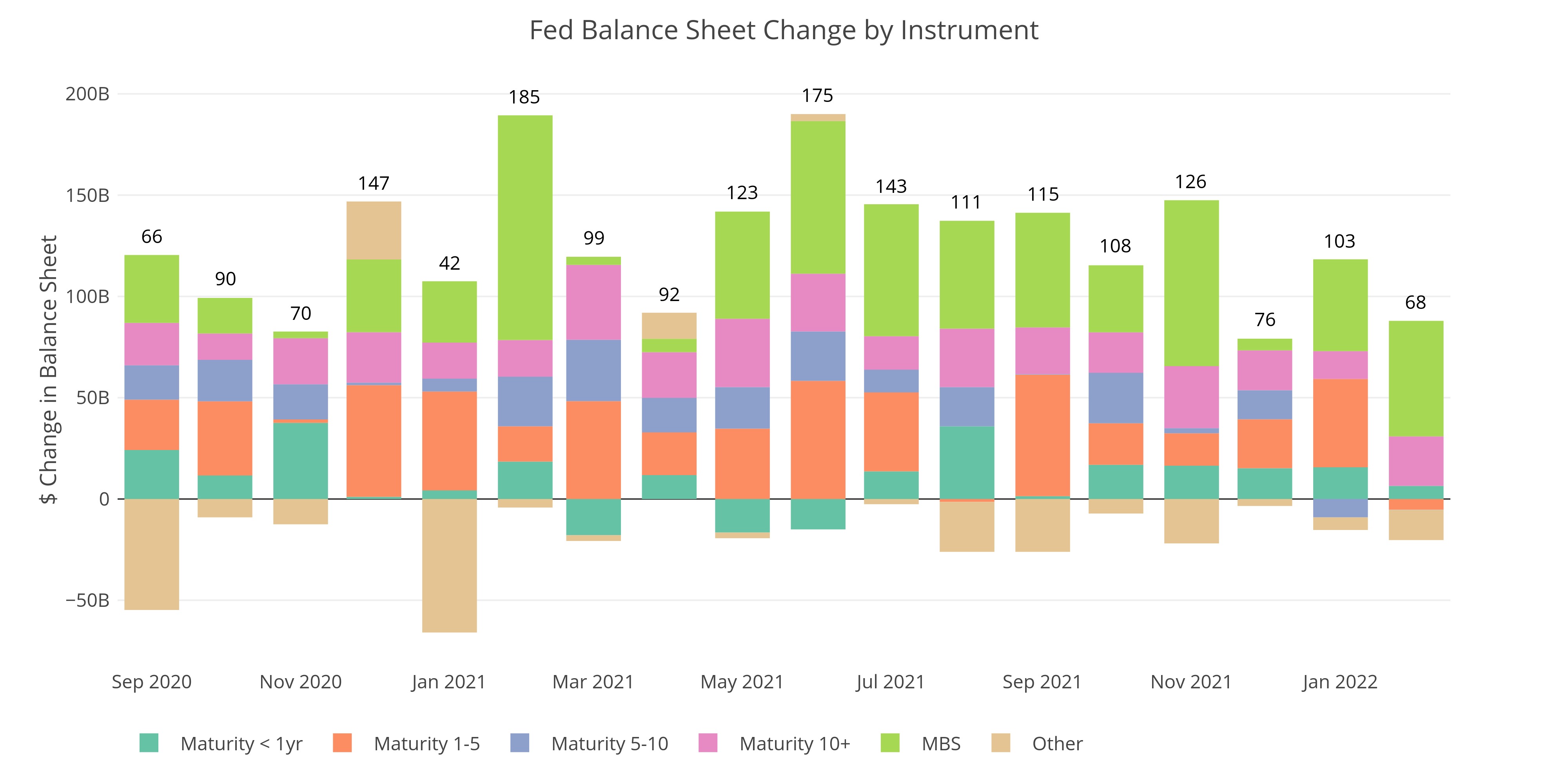

The Fed Continues With QT, and Winds Down Emergency Measures

The Yield Curve inversion may be coming home to roost

Comex Delivery Volumes Reach Highest Levels in Months

Both metals are above trend

Federal Budget: Interest Payments Reach $750B

January is typically a surplus but is not this year

Jobs: The Household Survey Tells a Different Story

Headline number continues to defy logic

Janet Yellen Bets $2T that Rates Will NOT be Higher For Longer

Yellen is not gambling, she is making an informed decision

Fed Misses the Target Again

MBS Reduction has still never come close

Rebound in Money Supply Will Prove Too Little, Too Late

The fall in liquidity will lead to a crisis

Rebound in Money Supply Will Prove Too Little, Too Late

The fall in liquidity will lead to a crisis

Comex Countdown: The Pressure Grows in Silver and Platinum

Both metals are above trend

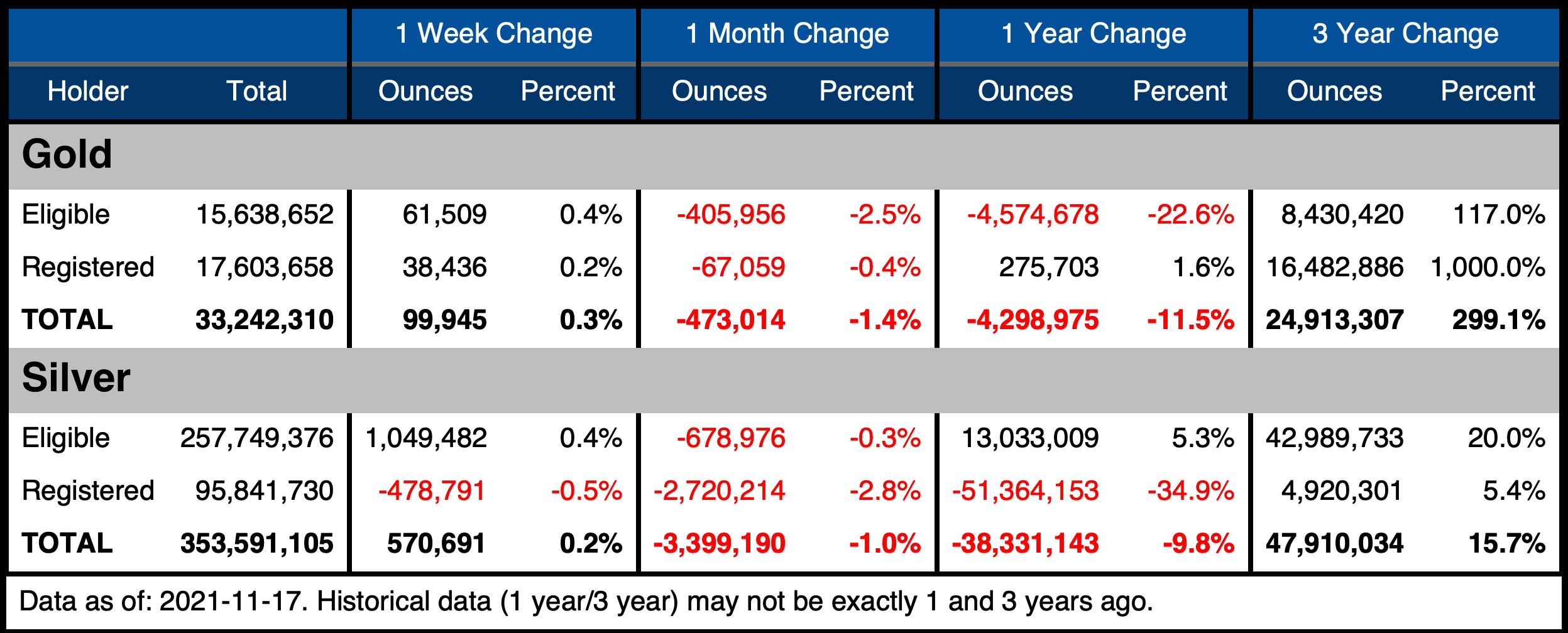

Comex Now Has 28 Paper Claims for Each Physical Ounce of Registered Silver

Increase will likely be undone soon

Comex Now Has 28 Paper Claims for Each Physical Ounce of Registered Silver

Increase will likely be undone soon

Federal Budget: TTM Deficit Surges by an Incredible $980B YoY

Revenue windfall continues to dissipate

Energy Disguises a Pretty Bad Inflation Number

The YoY drop was expected

Energy Disguises a Pretty Bad Inflation Number

The YoY drop was expected

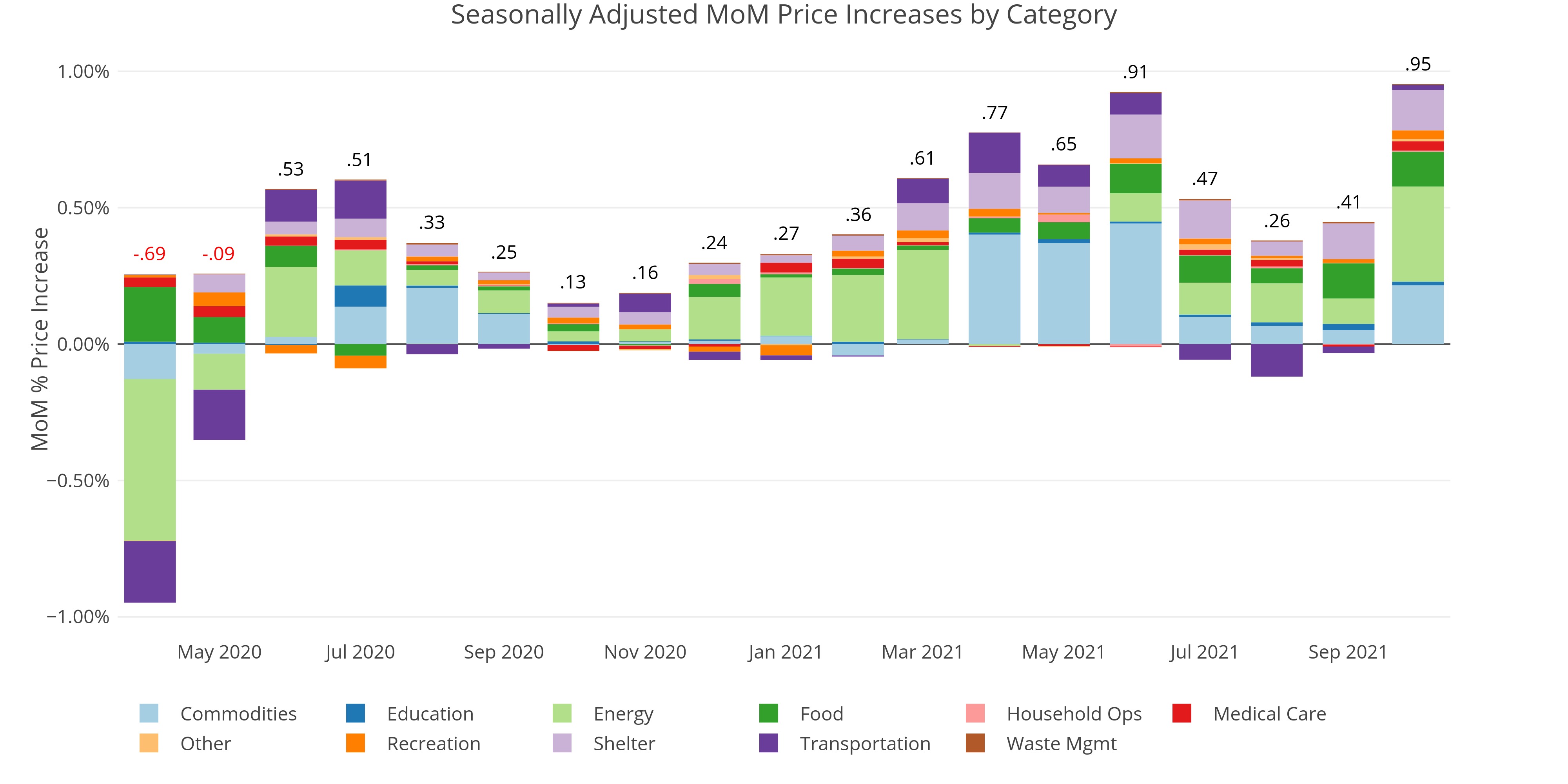

Inflation is Proving to be Quite Sticky

Fed is not making much progress anymore

Energy Disguises a Pretty Bad Inflation Number

The YoY drop was expected

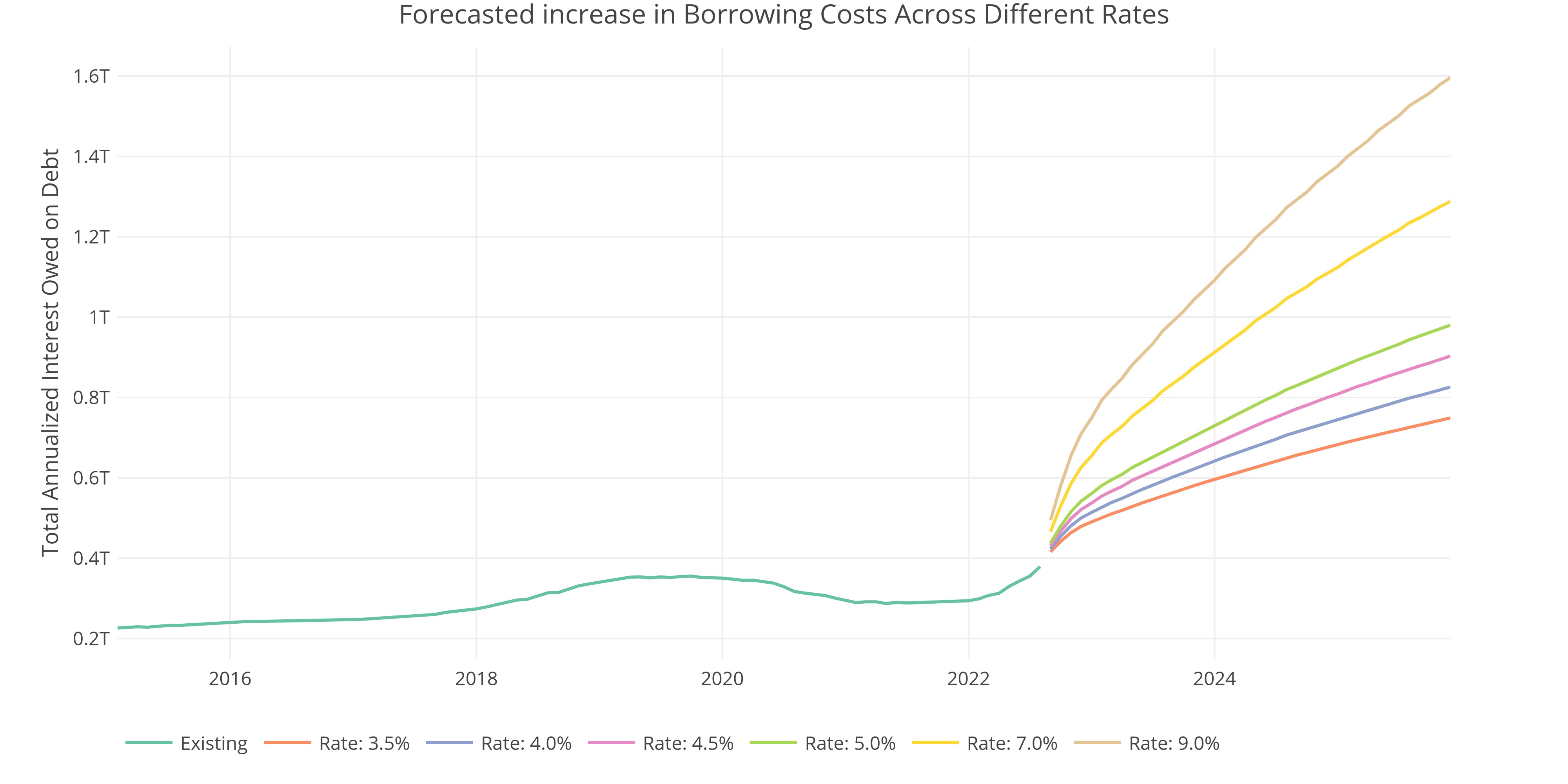

Will the Next Debt Ceiling Debate Conclude in Abolishment?

How much debt will acrue over the next two years?

Trade Deficit Surges to Highest Level in Six Months

how long can the US benefit from the reserve currency?

Trade Deficit Surges to Highest Level in Six Months

how long can the US benefit from the reserve currency?

CFTC CoTs Report: Managed Money Drives Price Drop

Recent activity suggest price advances were not overbought

CFTC CoTs Report: Managed Money Drives Price Drop

Recent activity suggest price advances were not overbought

Jobs: The Household Survey Tells a Different Story

Headline number continues to defy logic

Jobs: The Household Survey Tells a Different Story

Headline number continues to defy logic

Fed Reduces Treasury Bill Balance By Over $100B in May

What are they preparing for?

Fed Reduces Treasury Bill Balance By Over $100B in May

What are they preparing for?

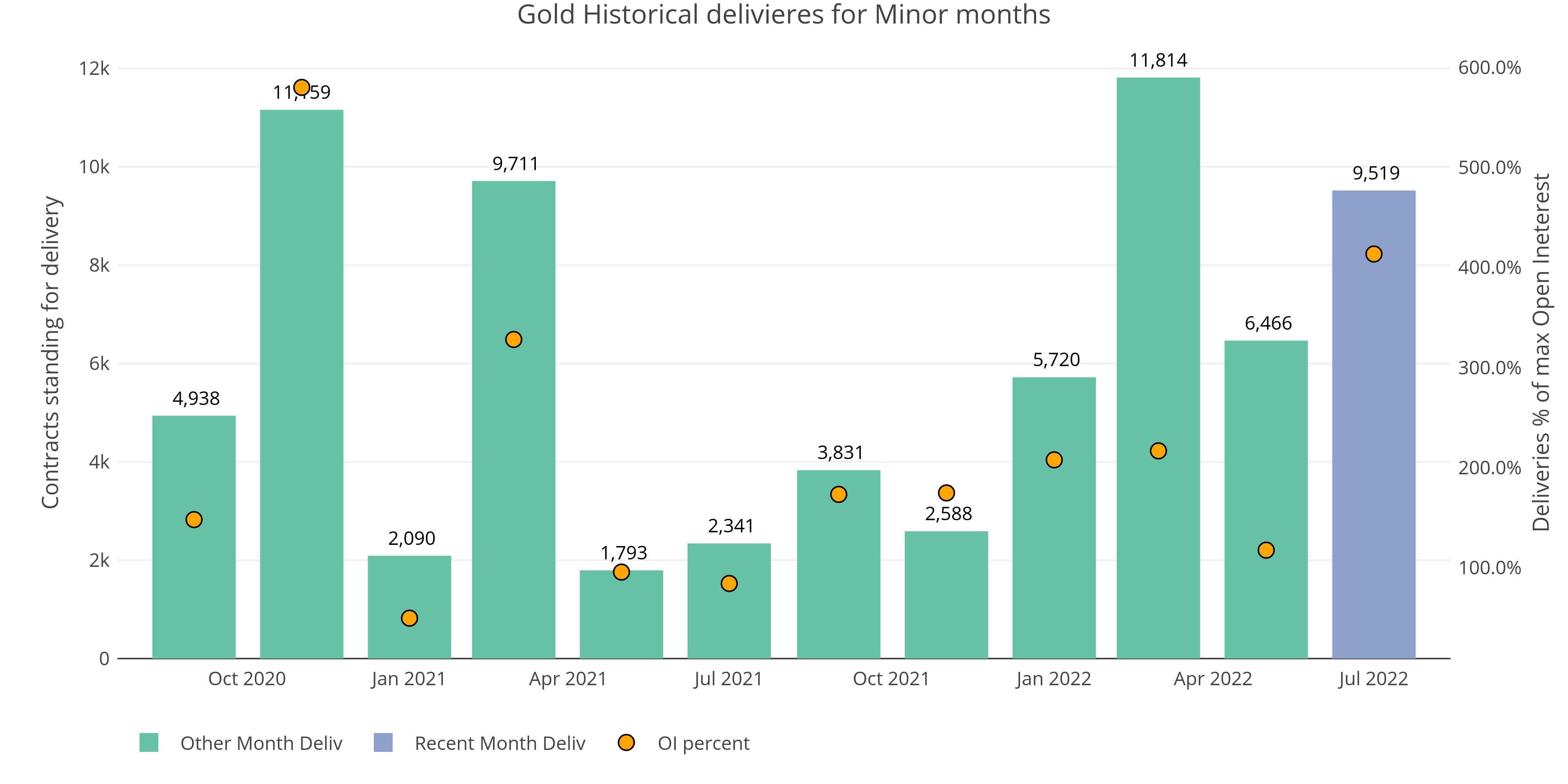

Gold Has Record Number of Contracts Cash Settle to Start June Delivery

How much metal is really left?

Comex Delivery Countdown: June Shows Promise

Both metals are above trend

13-Week Money Supply Growth Crashes to -7.2%

The fall in liquidity will lead to a crisis

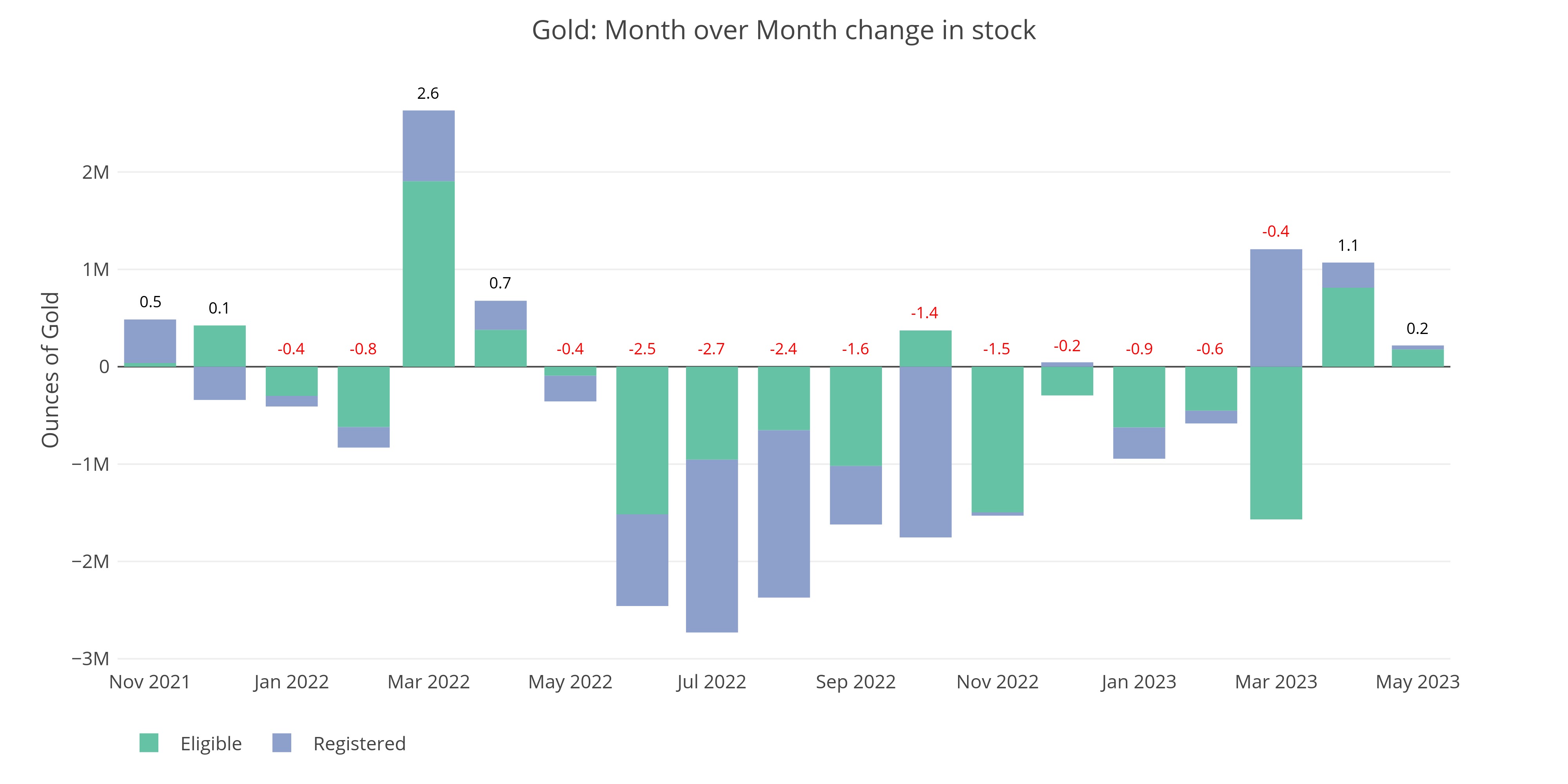

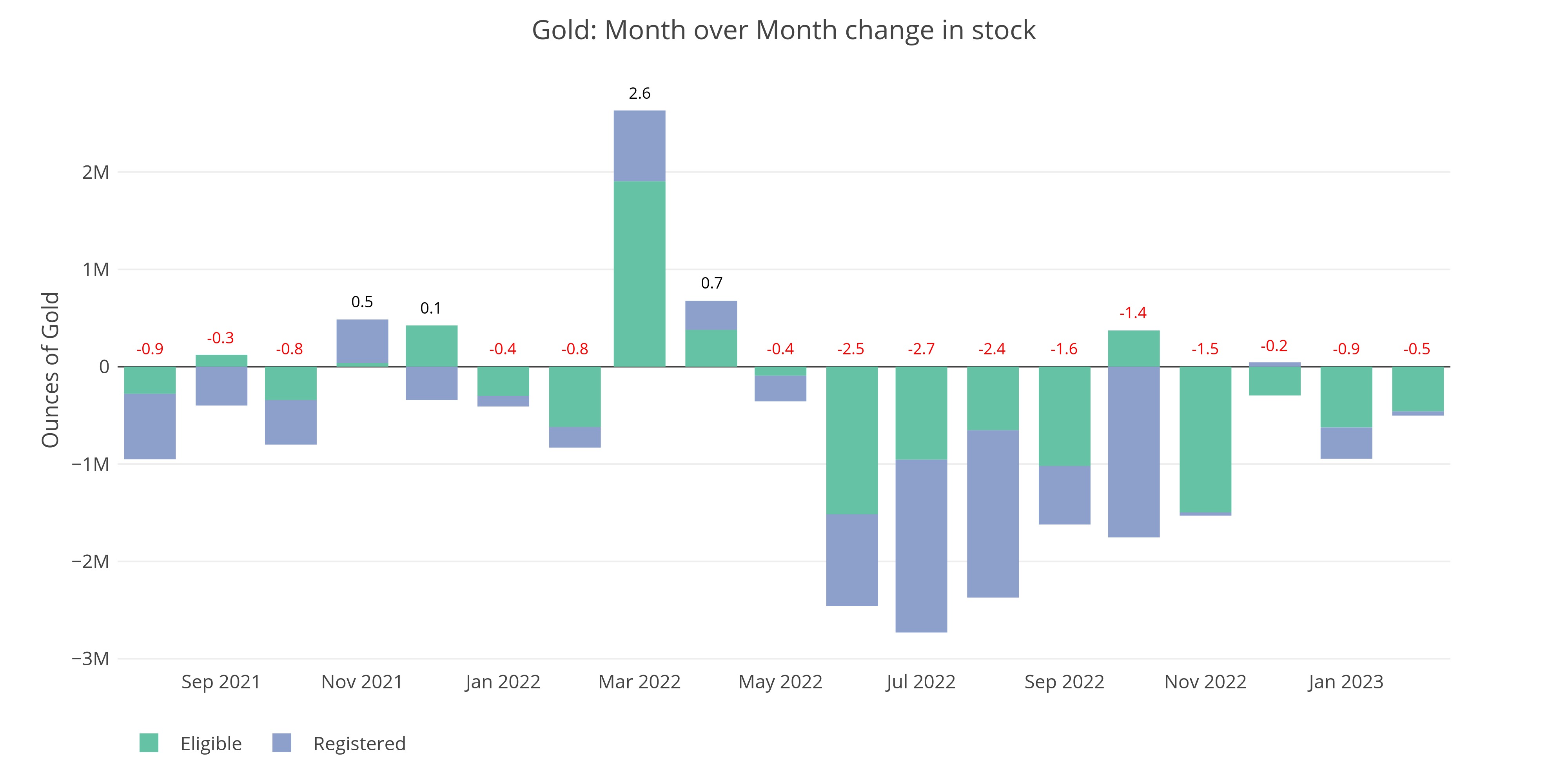

Comex Increase in Inventories does Little to Move the Needle

Increase will likely be undone soon

Inflation is Proving to be Quite Sticky

Fed is not making much progress anymore

Federal Budget: TTM Deficit Surges to $1.9T as Tax Revenues Collapse

Revenue windfall continues to dissipate

The CPI is Two Months Away From Bottoming Before the Next Leg Up

The next move up will be vicious

Multiple Factors Turn a Weak Employment Report Strong

Birth Death model and Adjustments boost job numbers

US Debt: Net Interest to Exceed $700B by November

Debt Ceiling Still in Play

US Debt: Net Interest to Exceed $700B by November

Debt Ceiling Still in Play

Gold Contracts for Immediate Delivery Explode Higher

JP Morgan restocks supplies

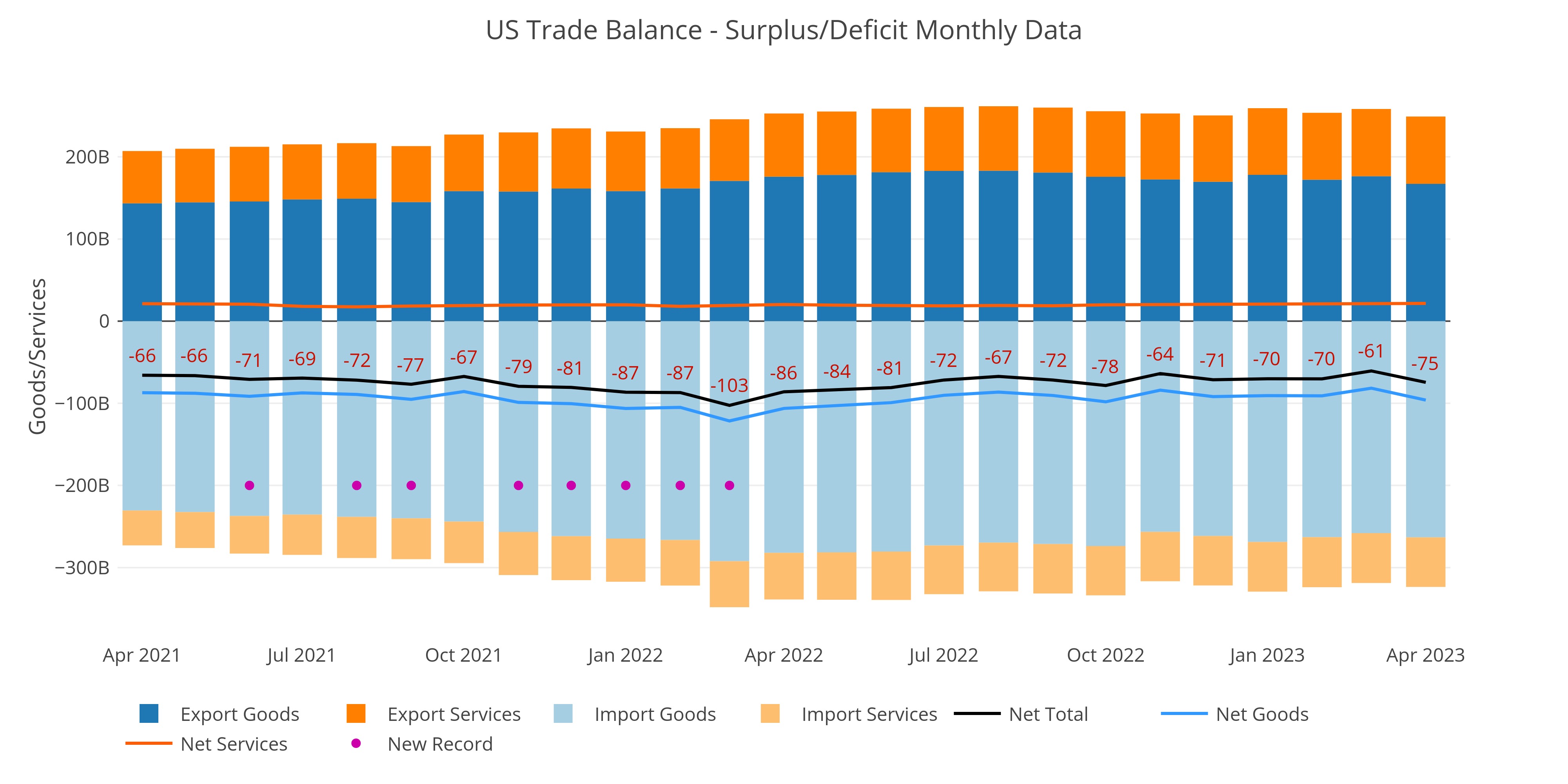

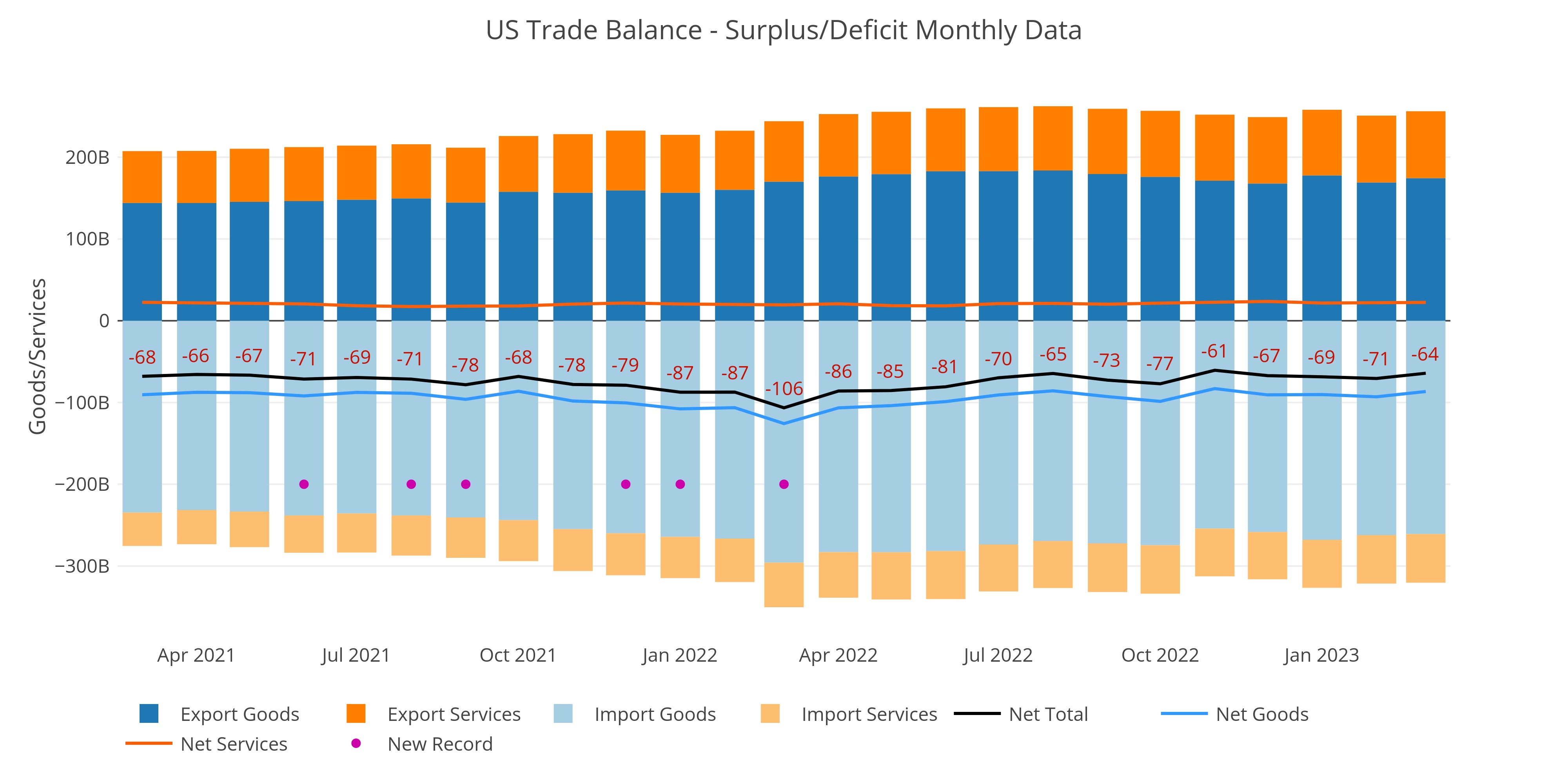

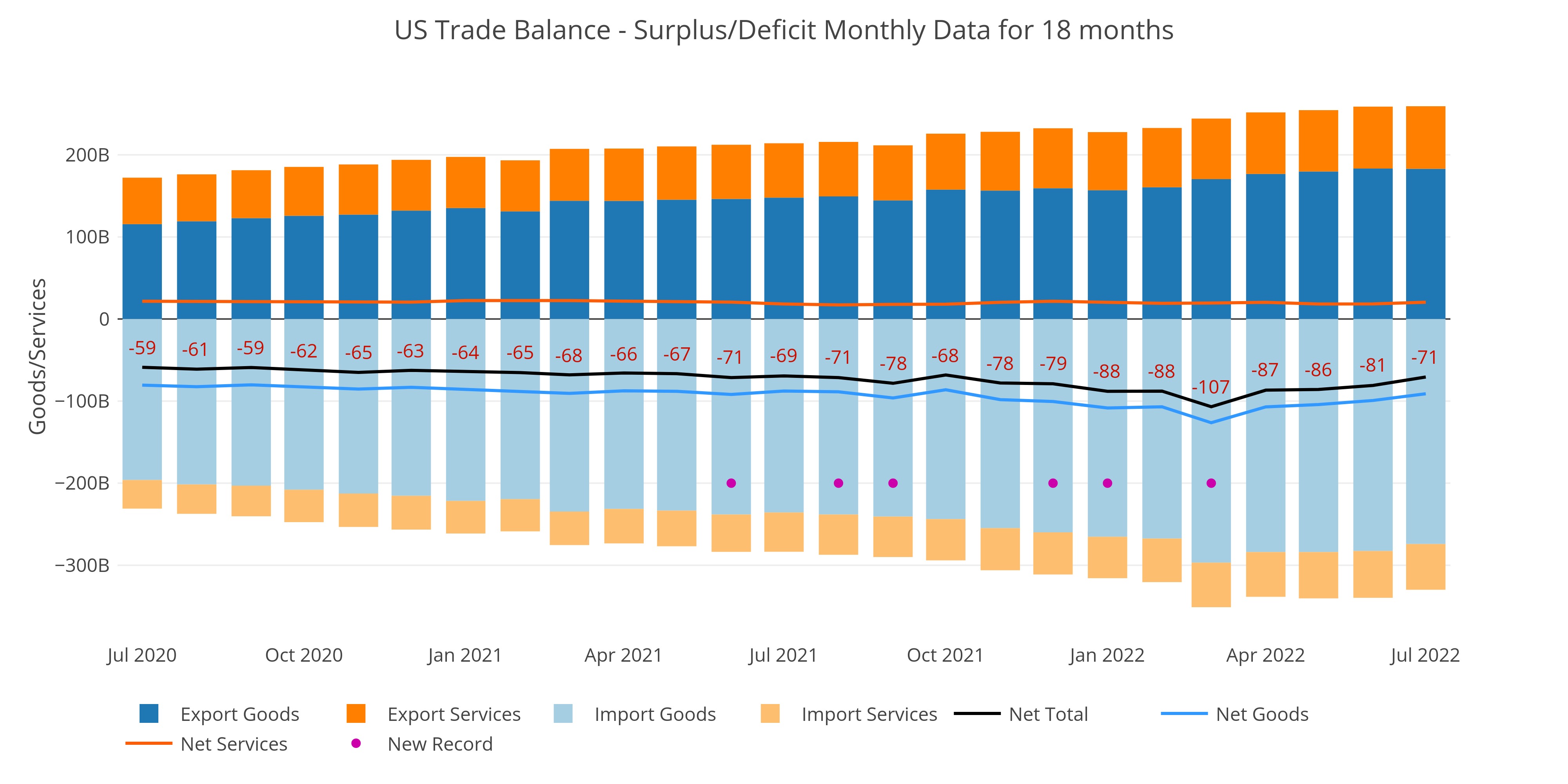

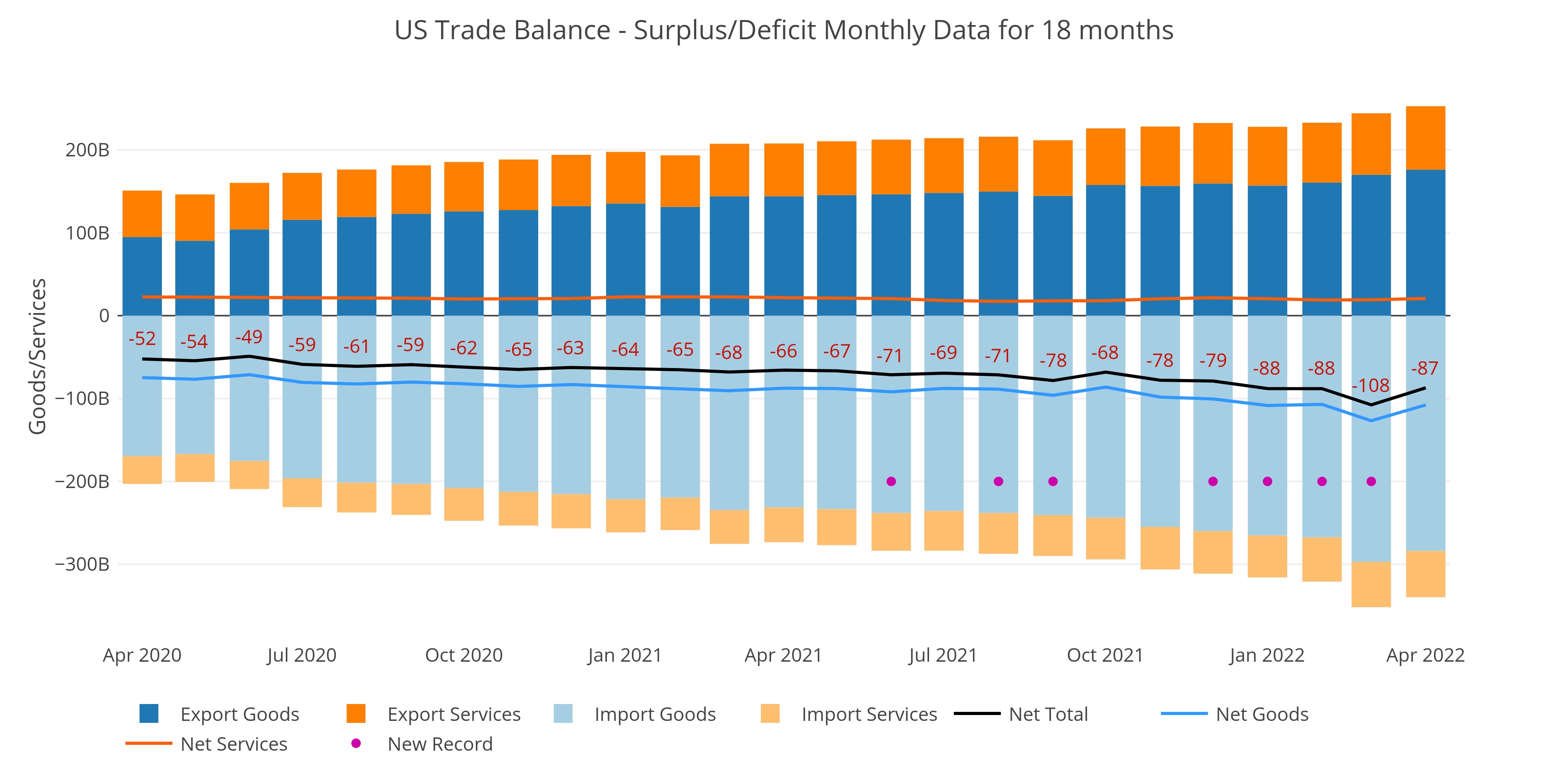

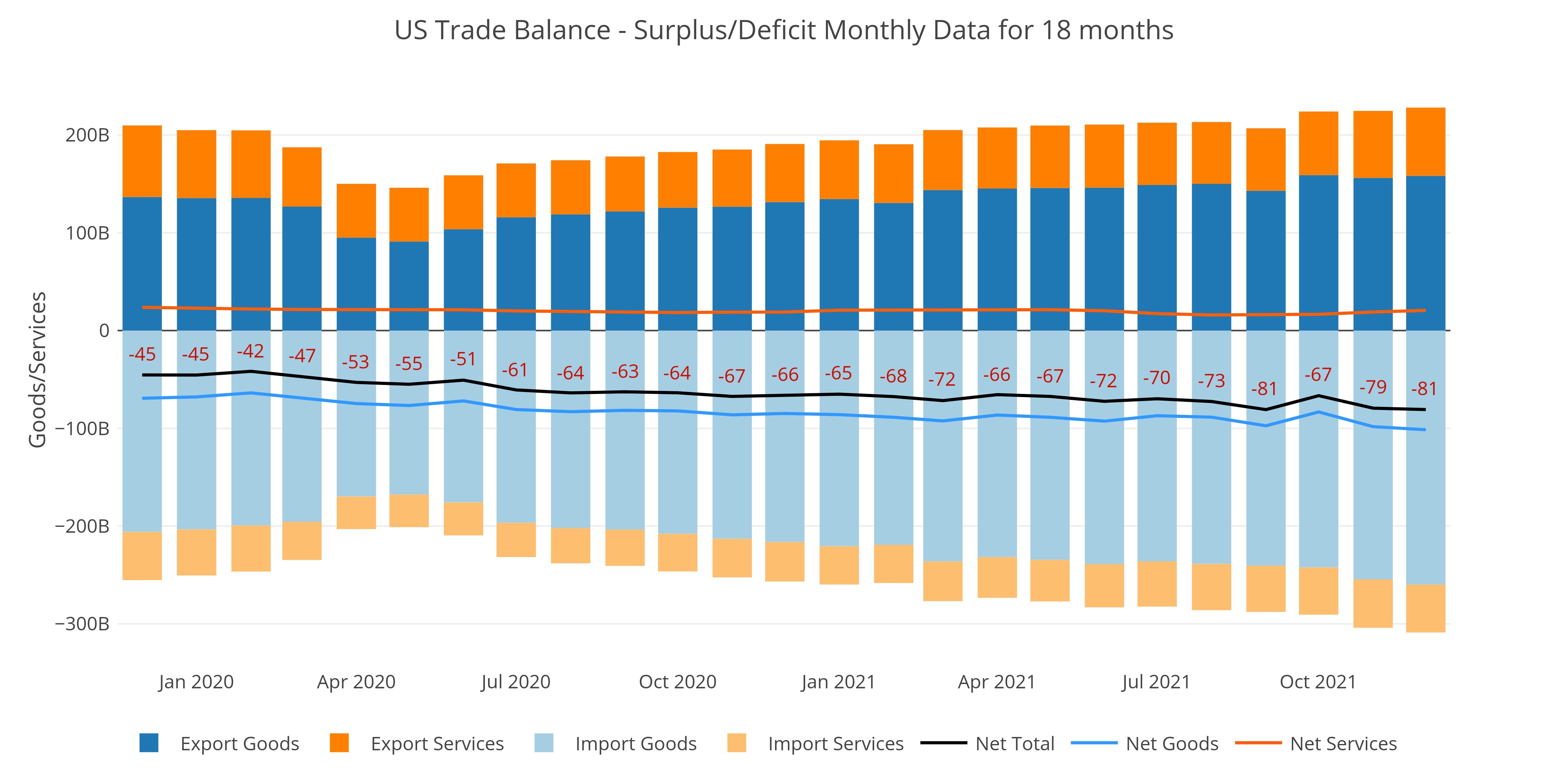

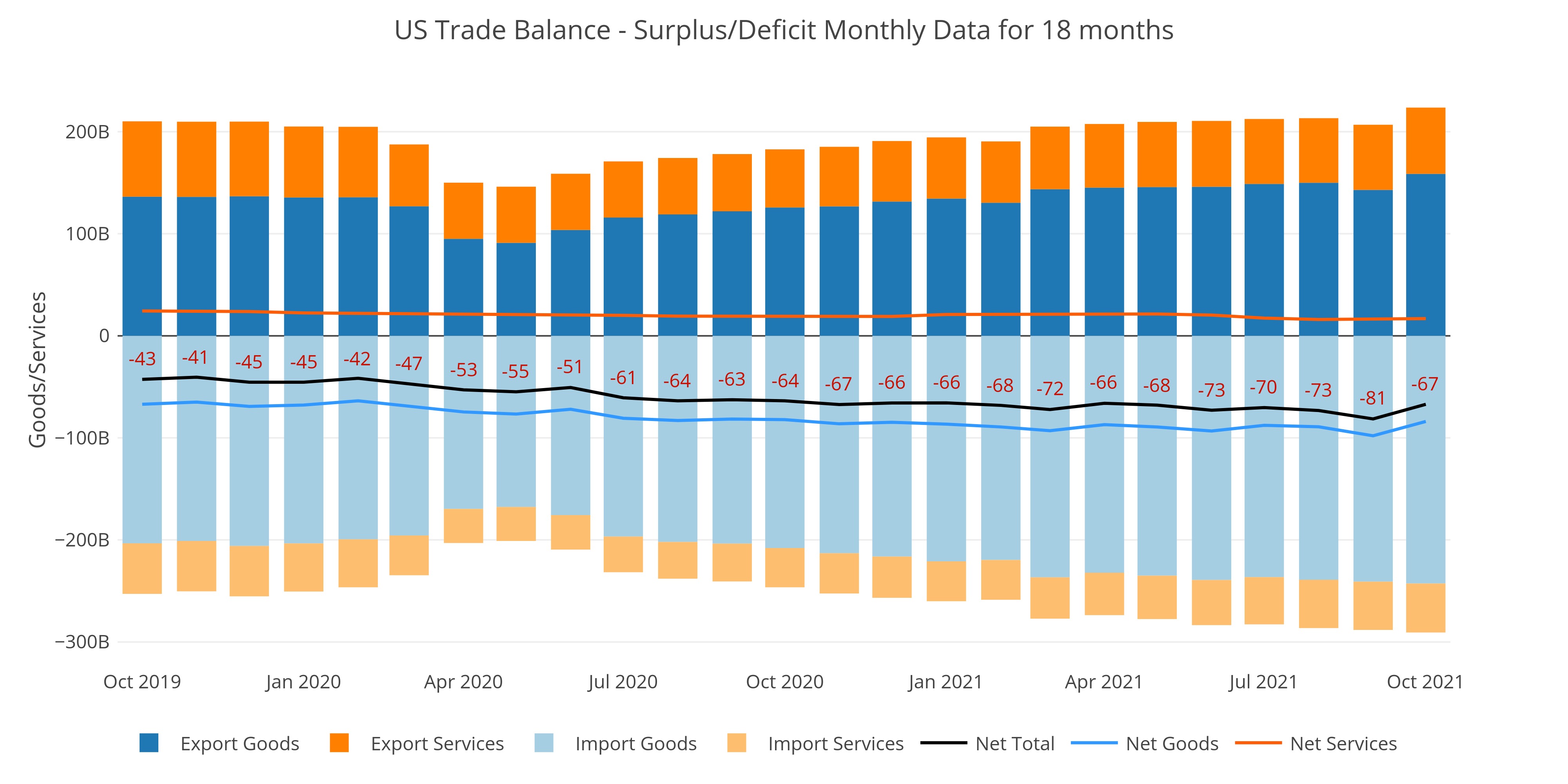

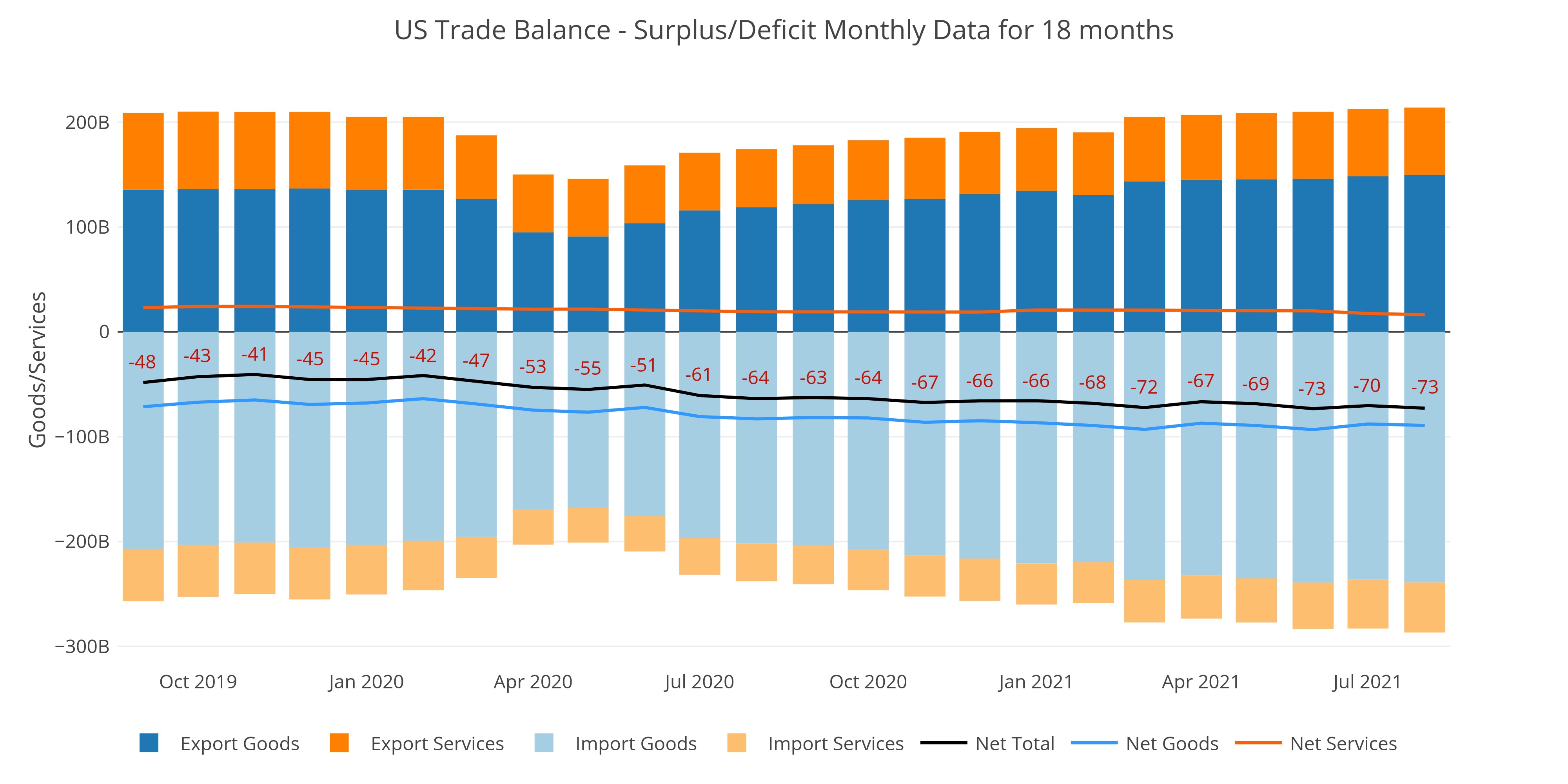

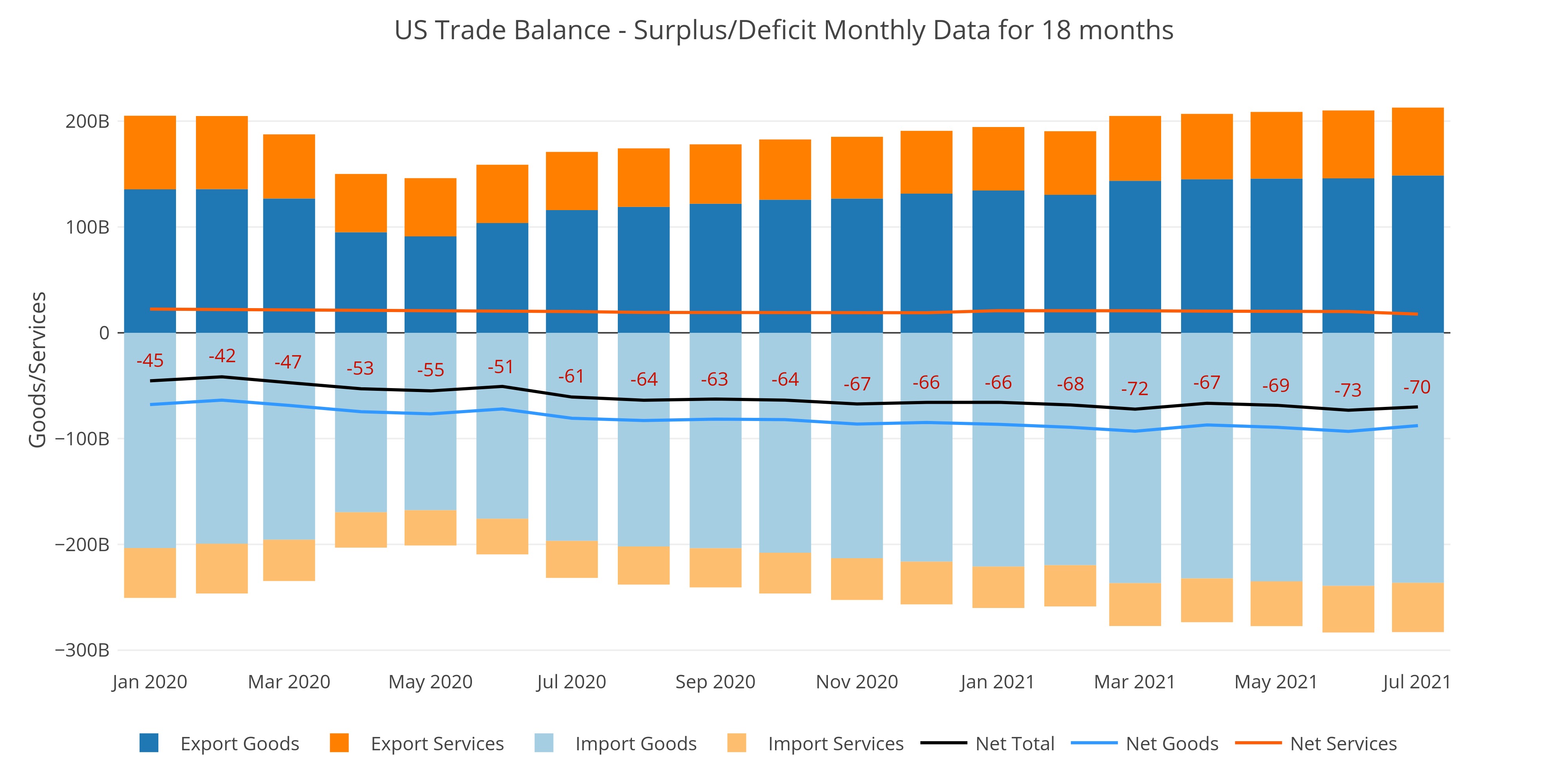

Falling Trade Deficit Suggests a Weakening US Economy

Inflation is also taking a bite

CFTC CoTs Report: Price Drivers Go Beyond the Futures Market

Maaneged Money is still in control, but there are other factors at play

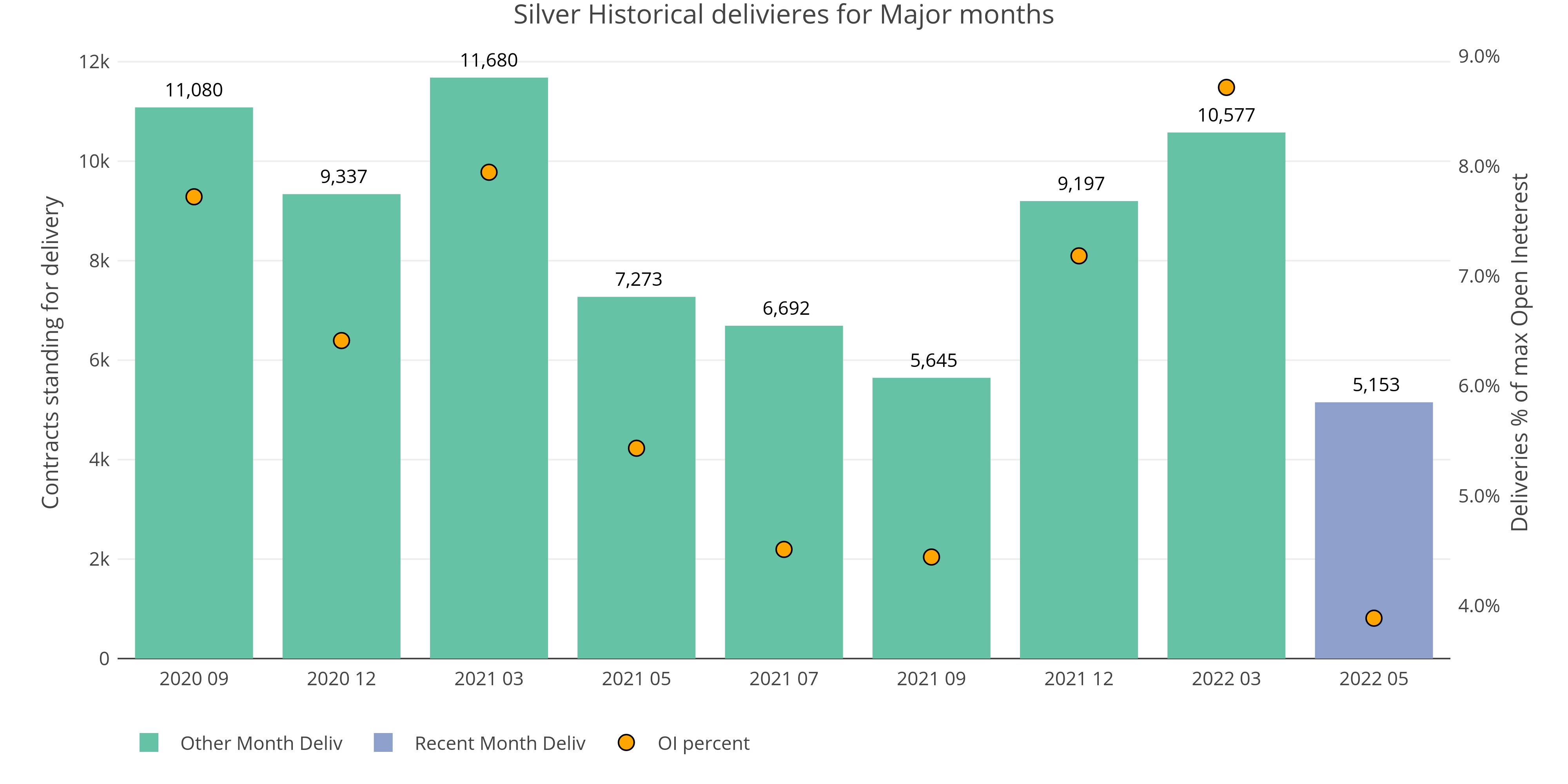

Silver Sees Record Number of Contracts Close in Final Day

Comex is up against the wall

Bank Term Funding Program Reaches New All-Time High

Don't let the reduction fool you

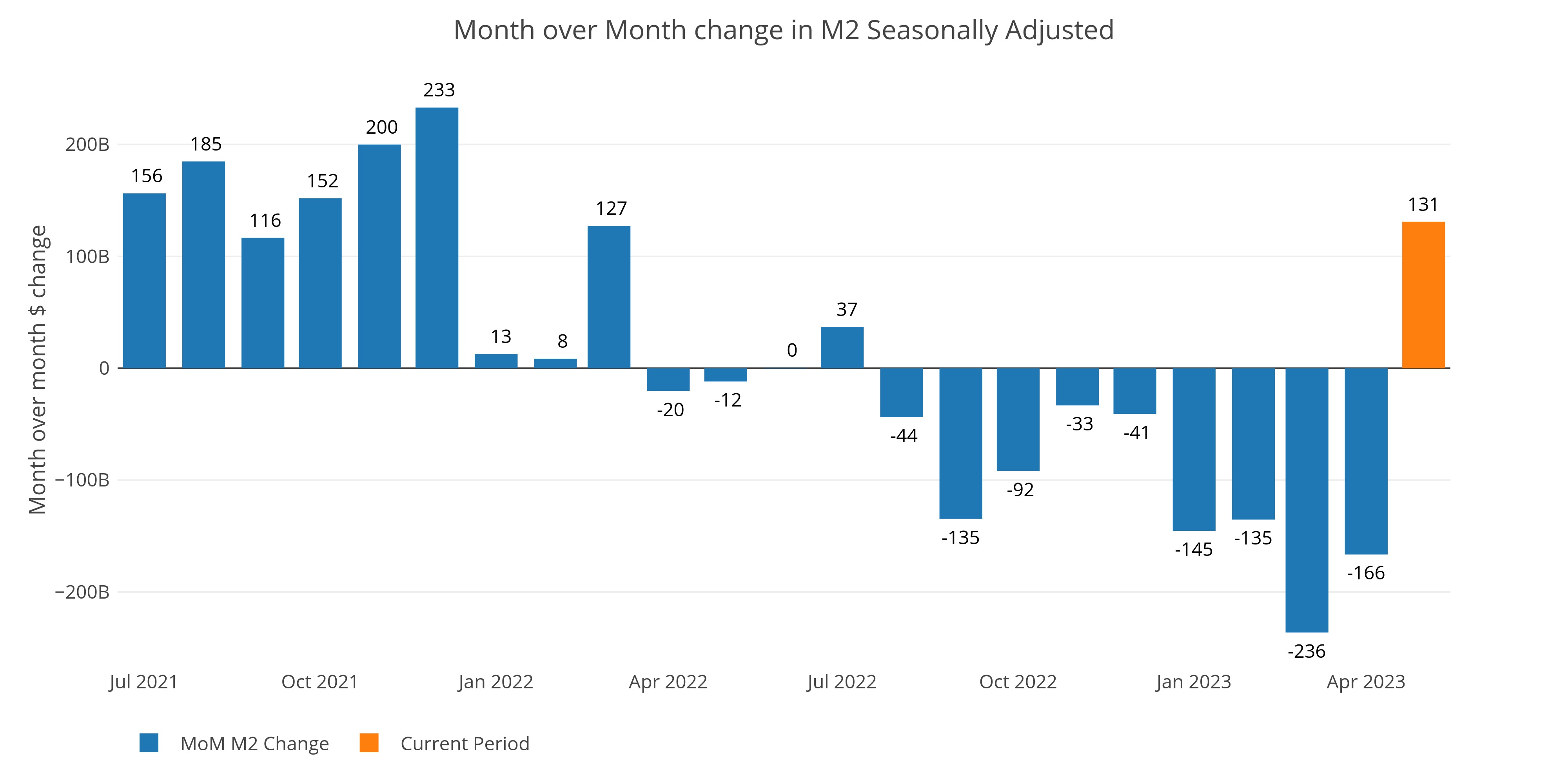

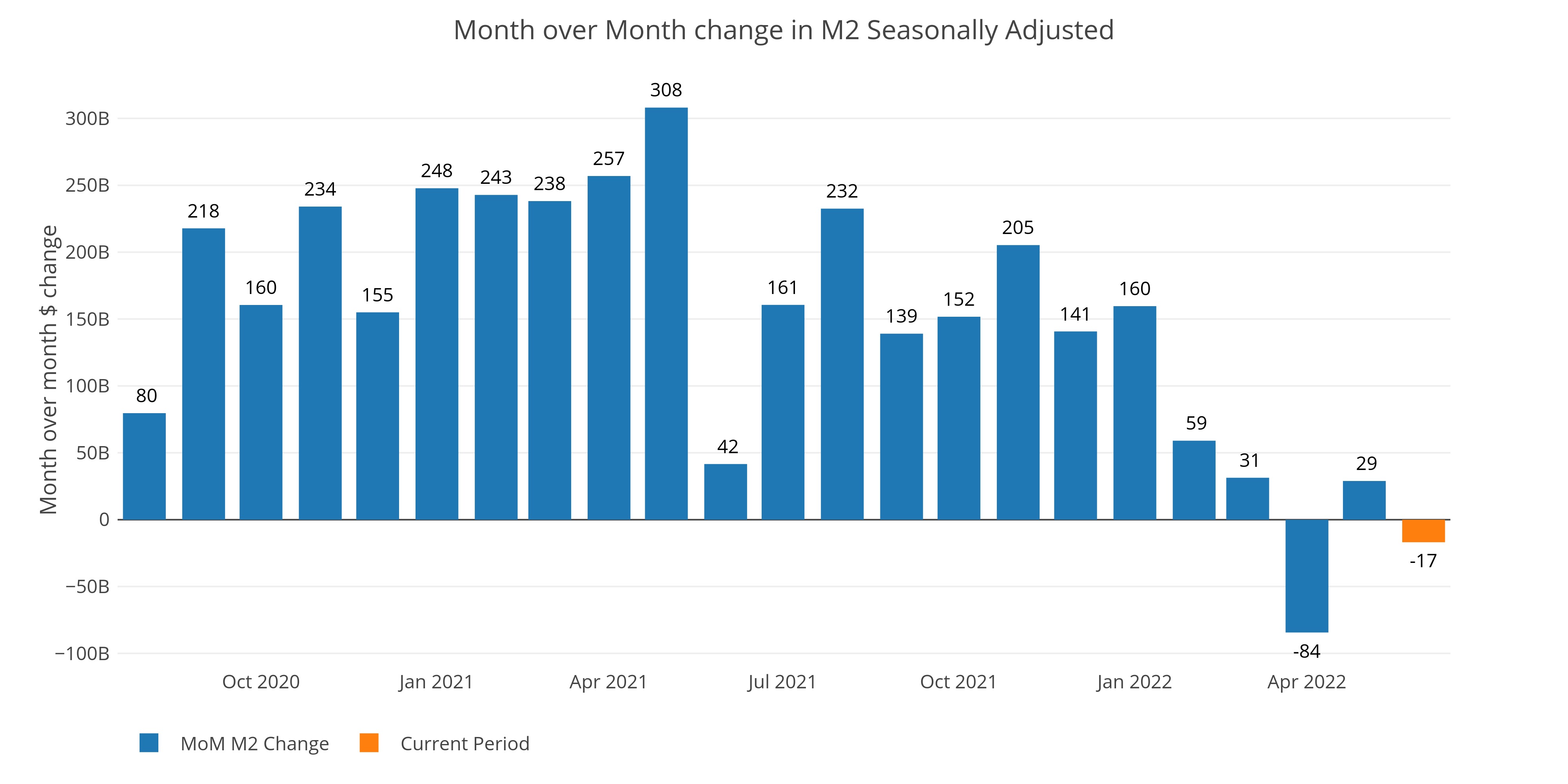

13-Week Money Supply Reaches New All-Time Low

Adjusted M2 also contracts by largest amount ever

Comex Update: Silver Shorts Could be in Trouble

Gold has also seen decent strength

JP Morgan on the Ropes in Gold as Silver Coverage Reaches Record Low

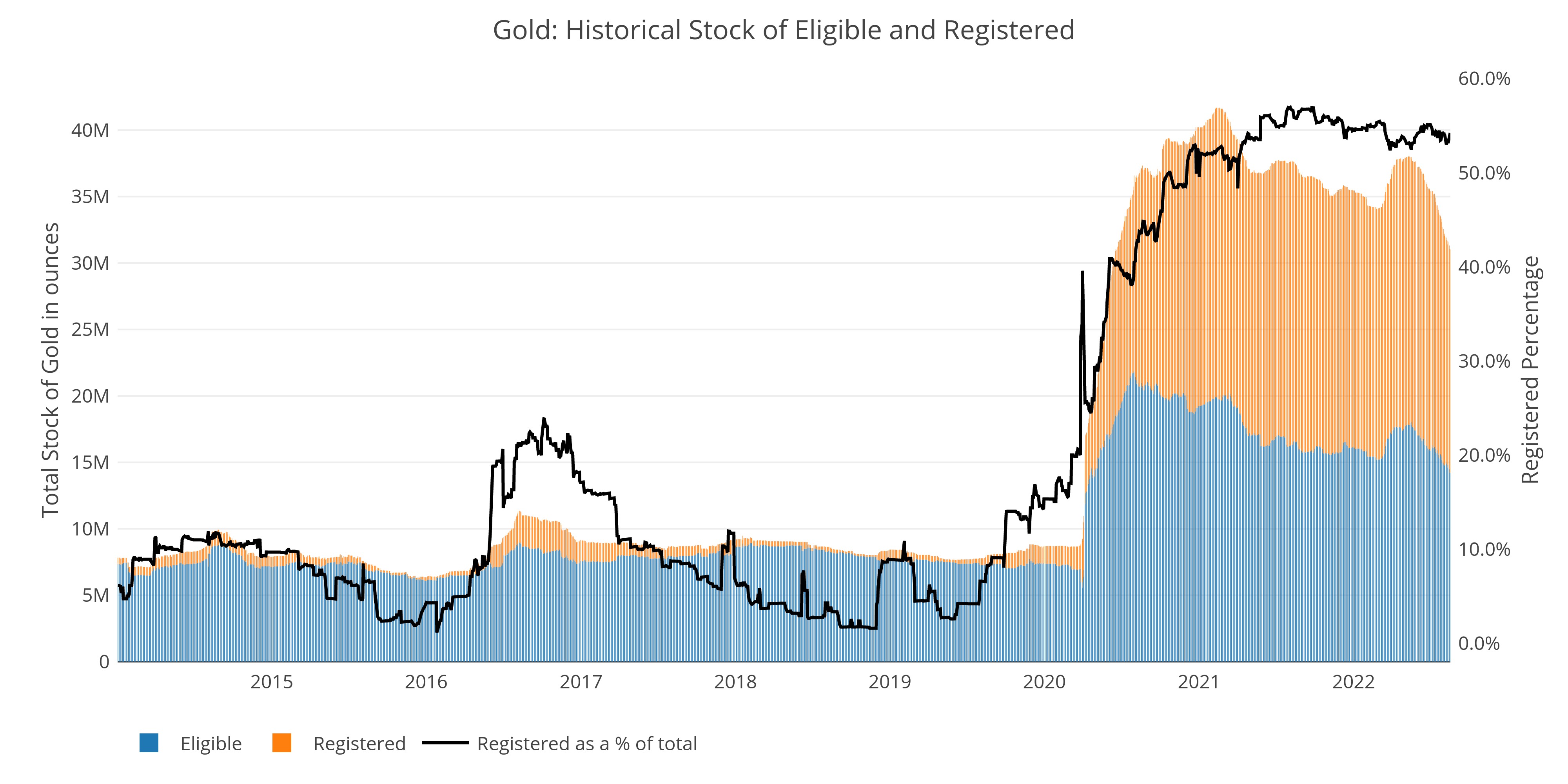

Silver Registered Ratio reaches new all-time high

Getting the CPI back to 2% is a Fantasy

The Fed is running out of time

TTM Net Interest Expense Exceeds Half a Trillion Dollars

The Fed is out of room to move

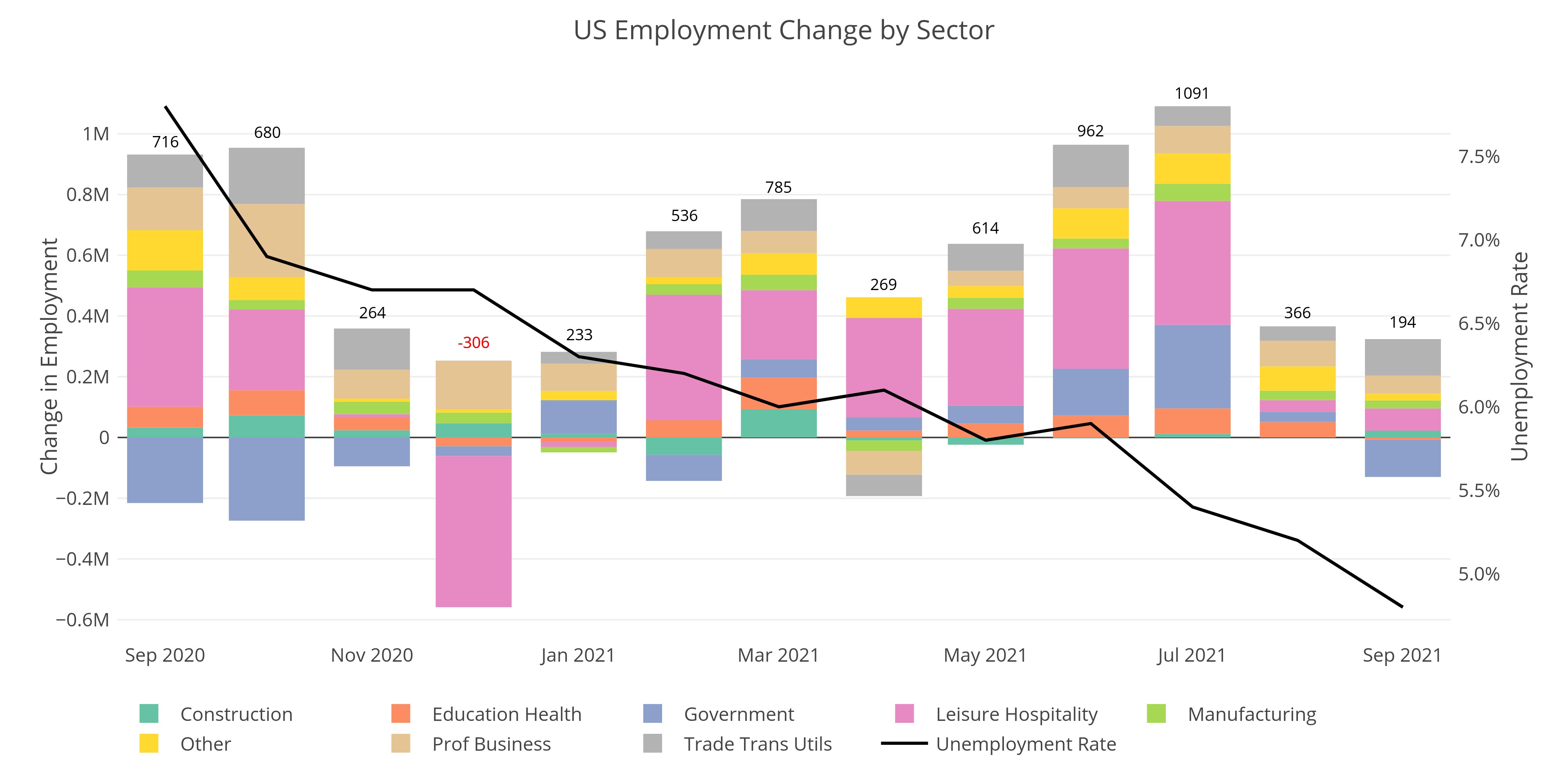

Jobs Report: 7 of 8 Categories Below 12-month Trend

Household Survey is much larger than the headline report

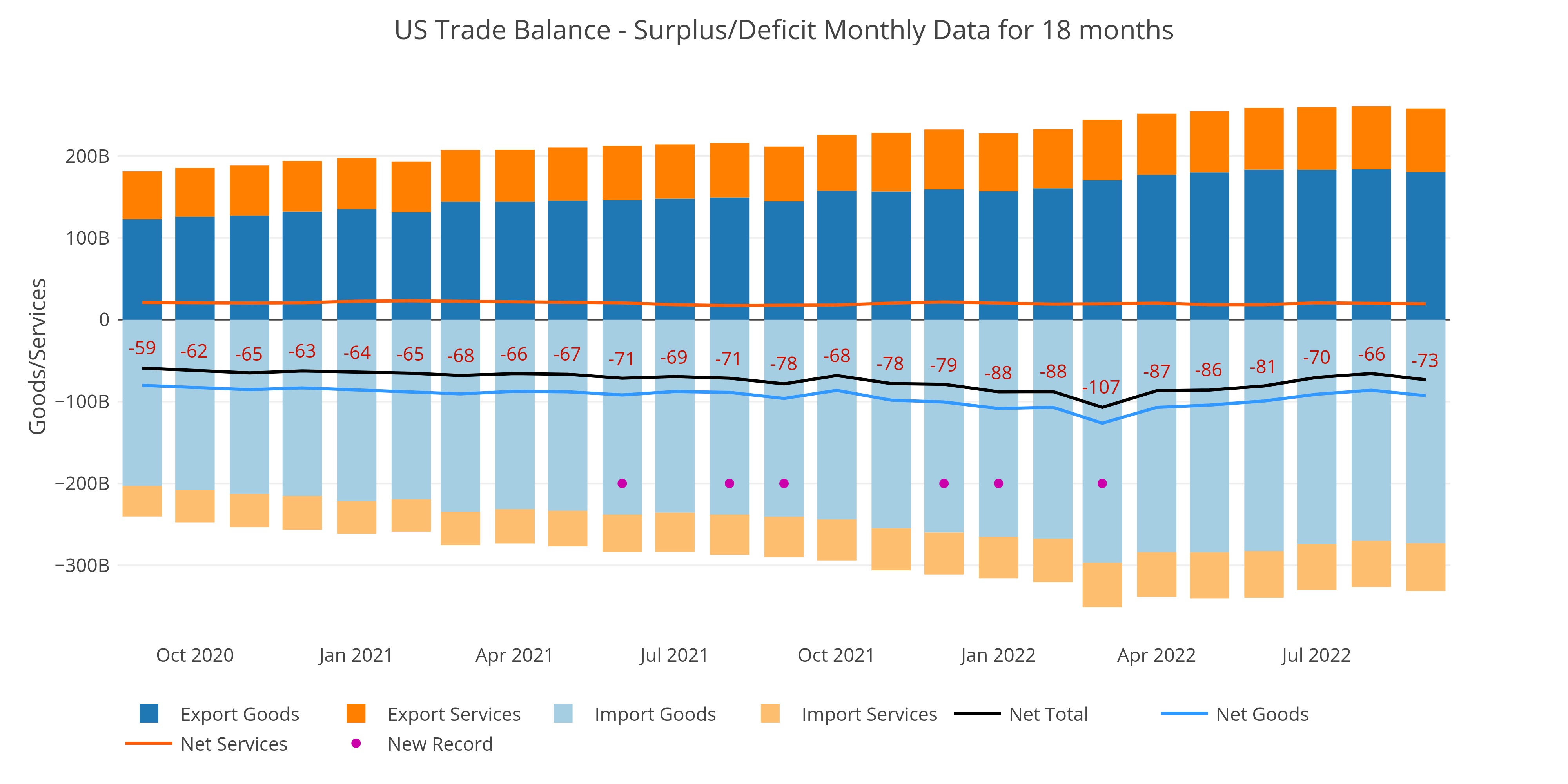

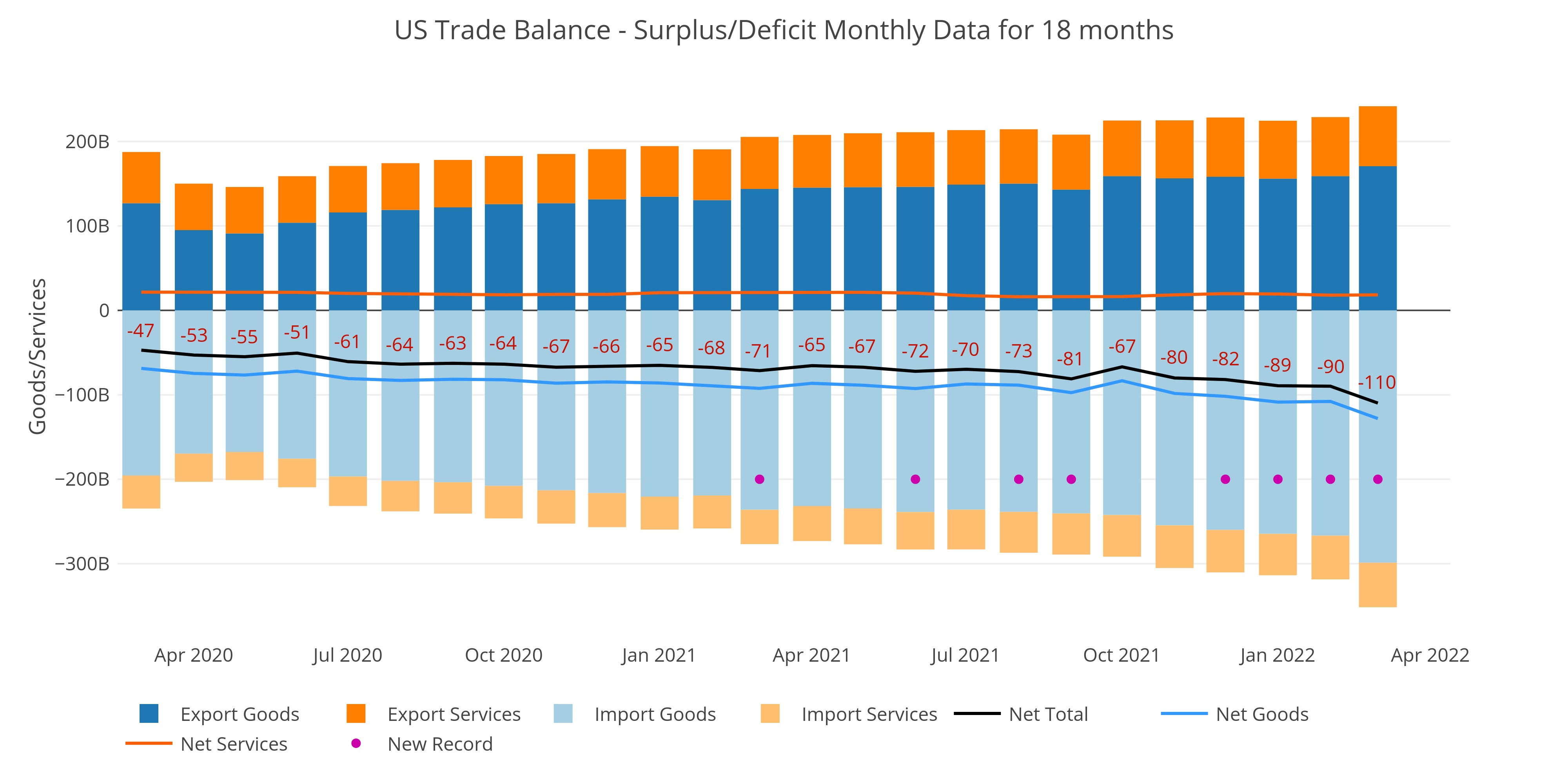

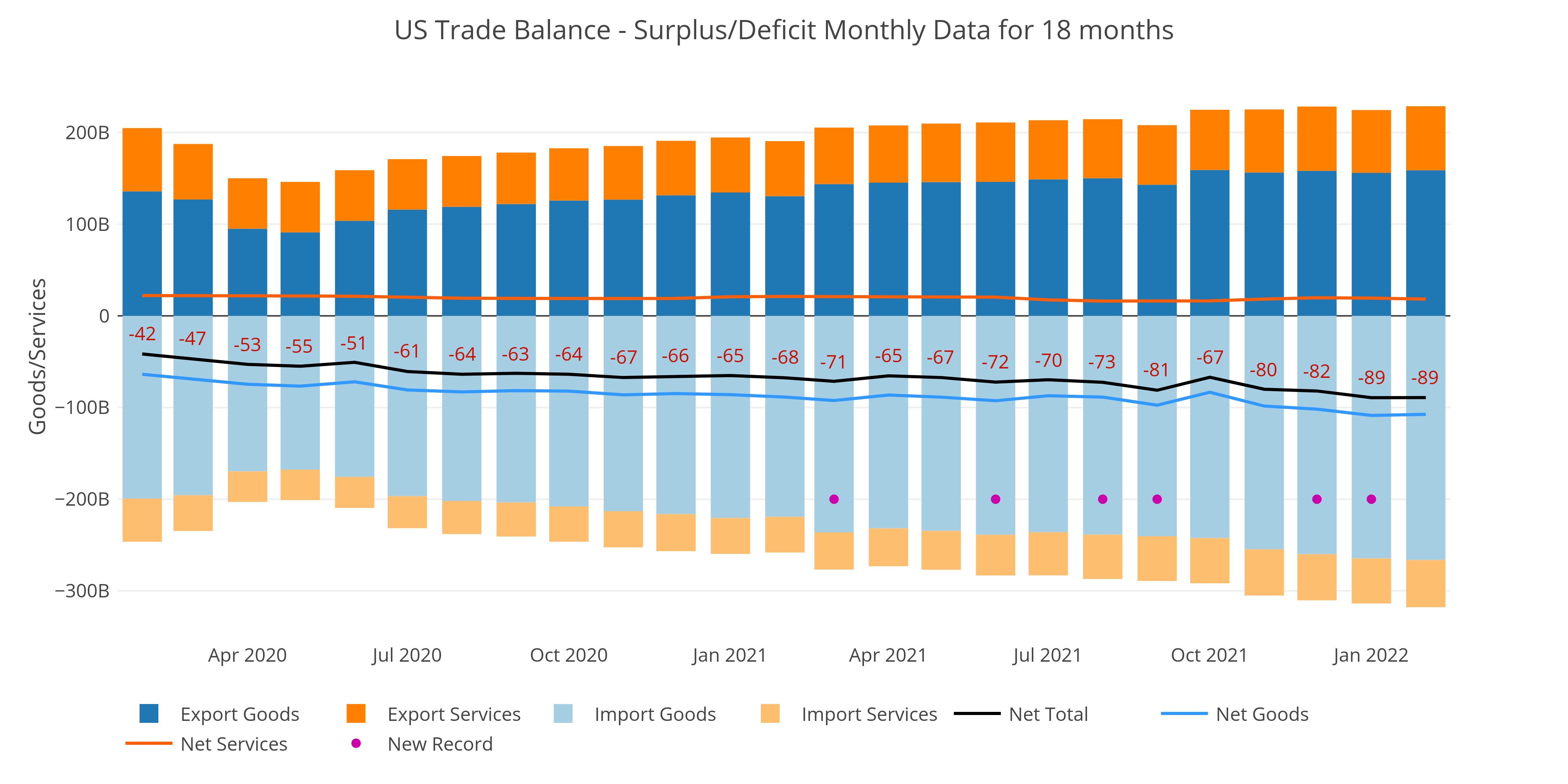

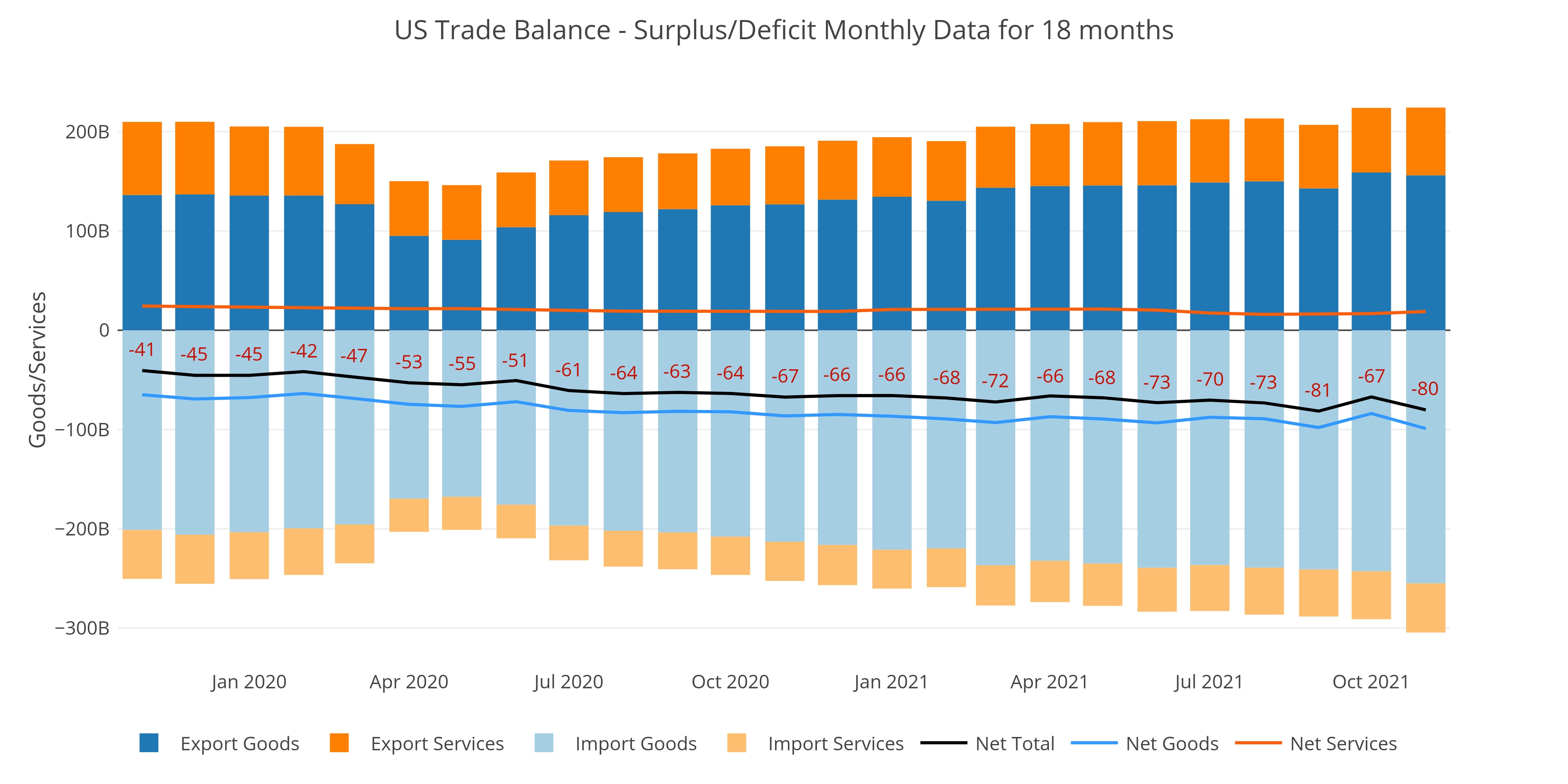

Services Surplus Falls 7.3% MoM

TTM Trade Deficit Still Near $1T

CFTC CoTs Report: Price Drivers Go Beyond the Futures Market

Maaneged Money is still in control, but there are other factors at play

Comex Reins in Platinum but Sees Gold Deliveries Rise

Silver exodus continues

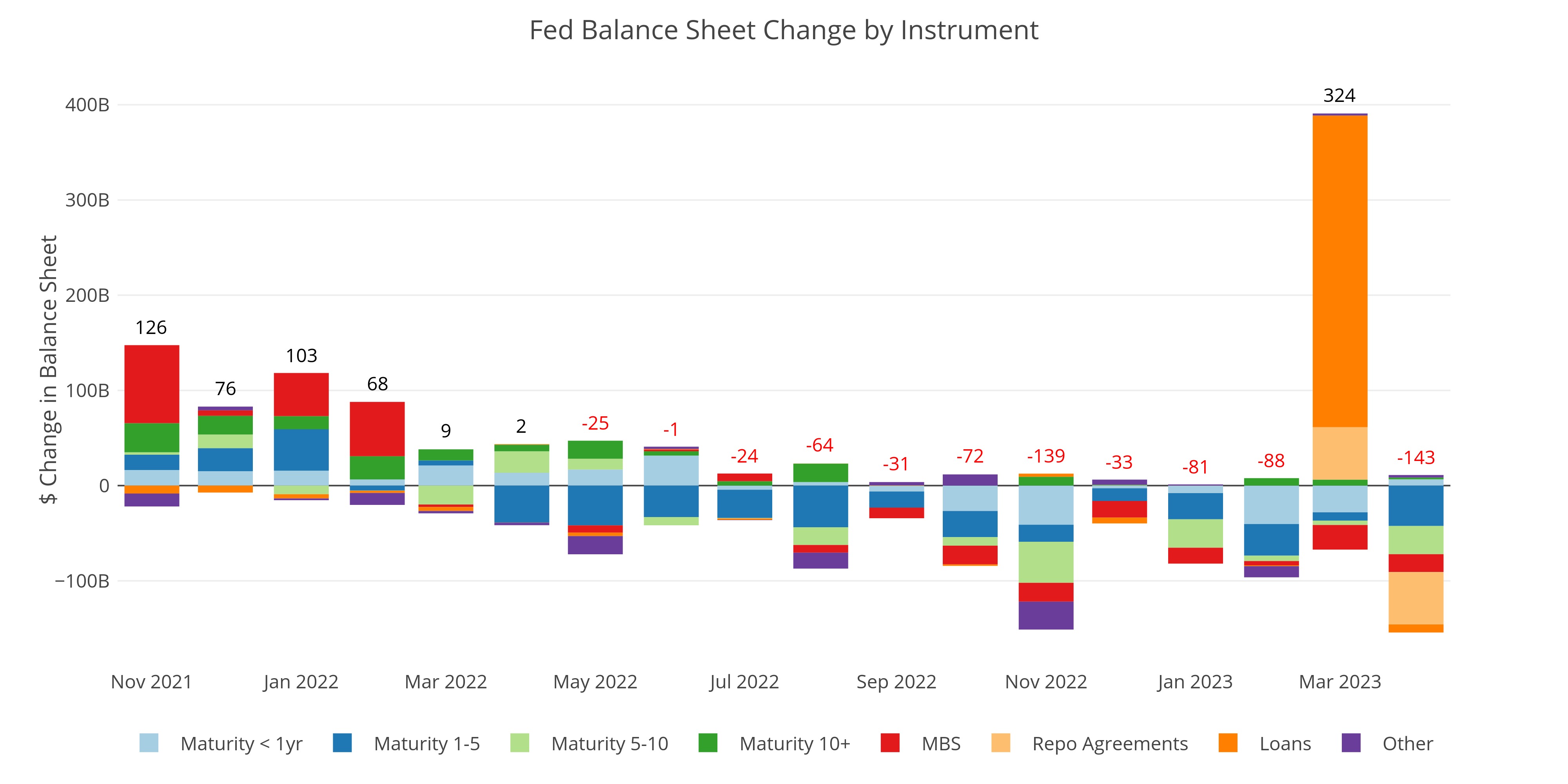

The Fed Prints $324B in March As QE Restarts

The Fed is now losing money

Money Supply is Flashing Red

Something else will break soon

Comex Update: Delivery Volume Slows Even as Prices Rise

The market is looking "too" quiet

If the Ongoing Comex Vault Run Picks up Steam, it Will Be Game Over Immediately

How much longer can the Comex sustain these outflows?

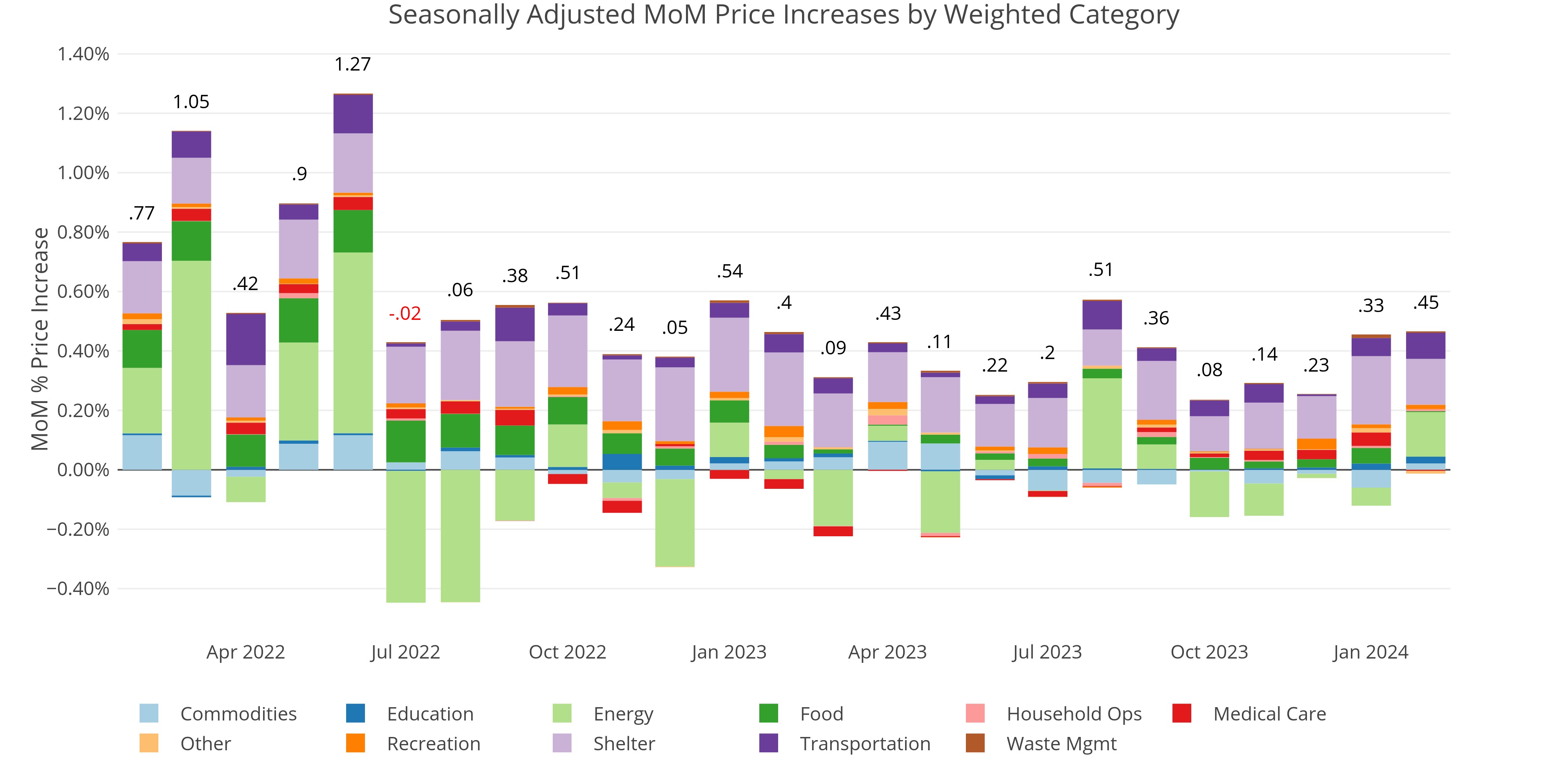

Falling Energy Prices Disguise a Relatively Hot CPI

What happens when Energy turns back up?

Household Survey is 40% below Headline Number

Employment is a lagging indicator

Treasury Prints Second Largest February Budget Deficit Ever

Deficits continue to move in the wrong direction

Services Surplus Falls 7.3% MoM

TTM Trade Deficit Still Near $1T

Annualized Interest Up $230B or 75% Since Last Year

Debt Ceiling Still in Play

Comex Results: Silver Has 60% of March Open Interest Roll in Final Day

More strange activity at the Comex

Money Supply Remains Well Below Trend

This market needs more drugs

Comex Update: Palladium Contracts Represent 280% of Available Metal with 2 Days to Go

Silver looks strong heading into First Notice

The Fed Books a Loss of $126B in February

Reduction in MBS has stqgnated

Comex Vaults: Gold Sees Nearly 5% Inventory Decline in a Month

How much longer can the Comex sustain these outflows?

CPI: Relief from the SPR Drain has Ended

CPI annualizes to over 6.6%

Budget Deficit YoY: Revenues Fall as Expenses Rise

Net Interest continues moving up

The Treasury Begins Extaordinary Measures (again)

Interest costs are exploding upwards

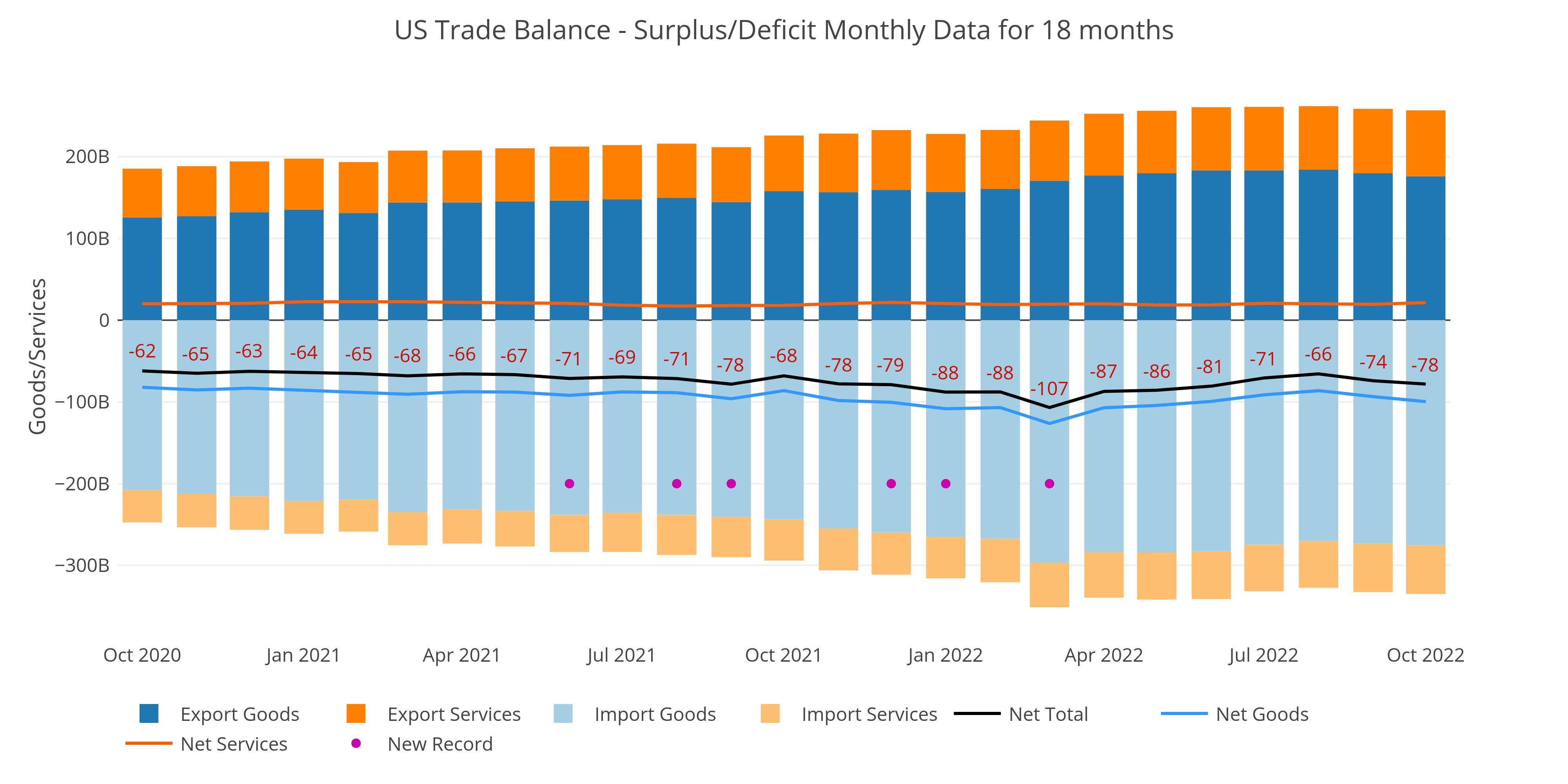

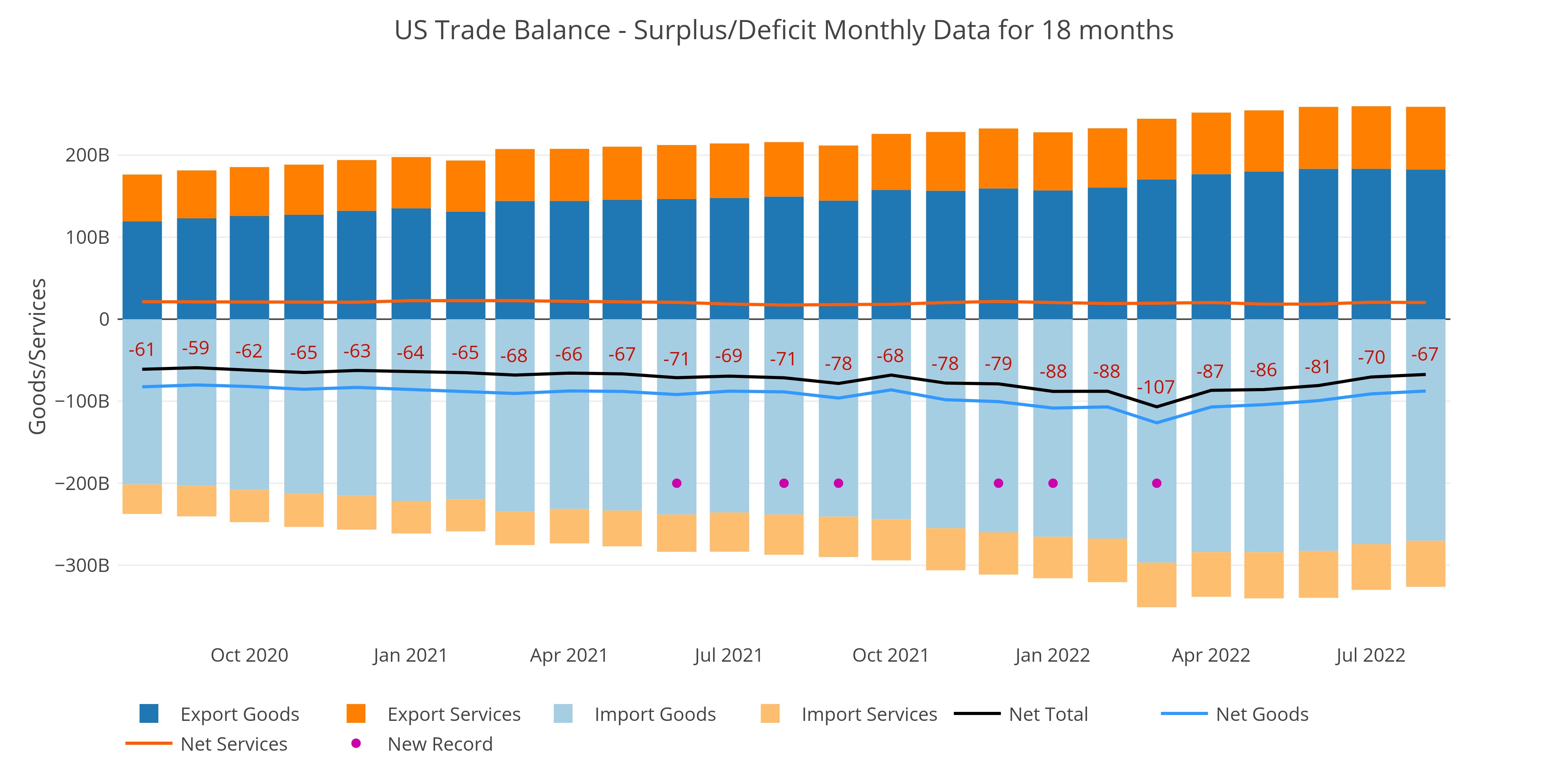

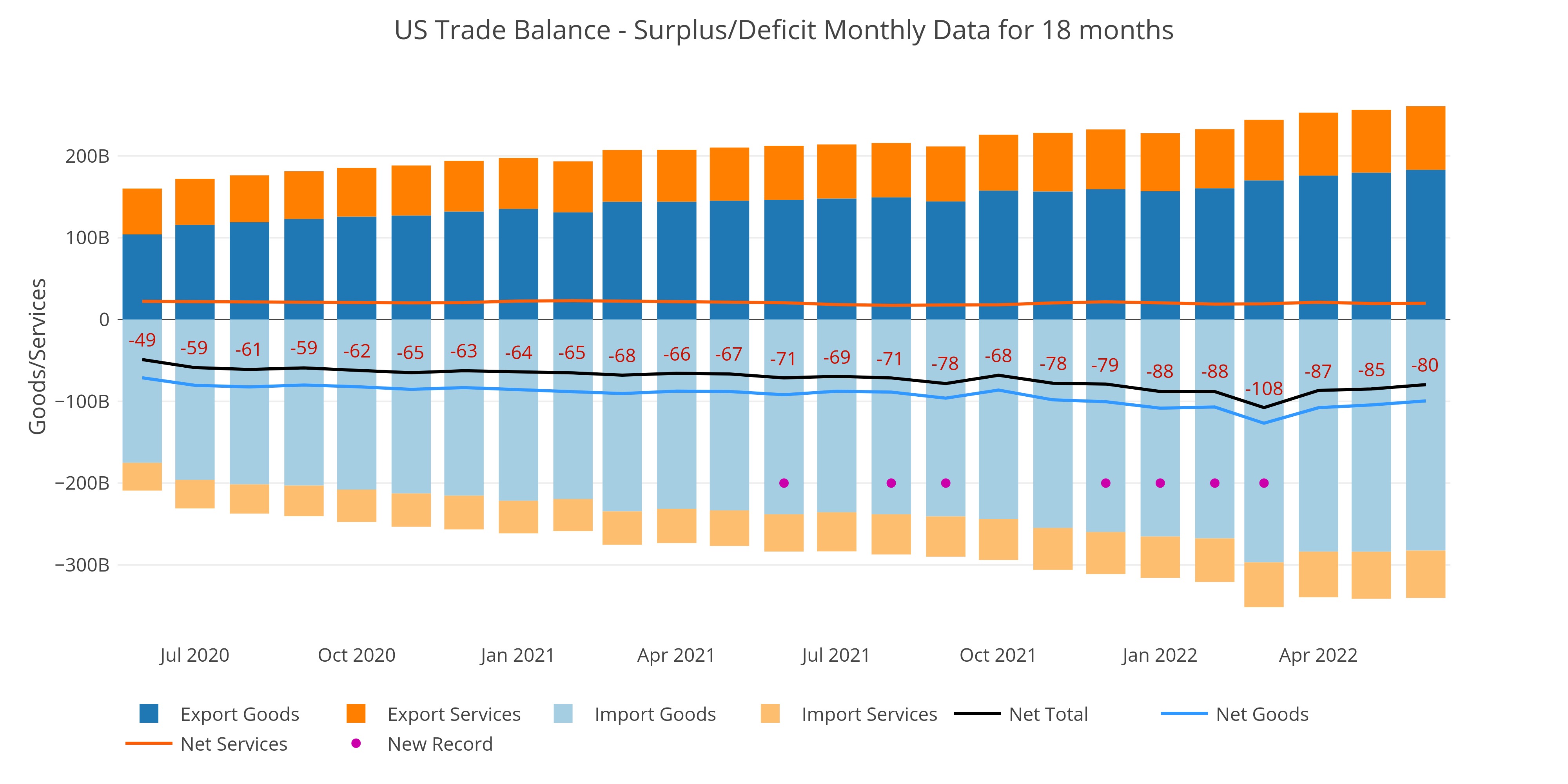

2022 Trade Deficit Signals Inflation Closer to 15%

Goods consumption is likely flat or down, people are just paying more

Is it Time to Drop the "L" in the BLS?

How does the current report give with anything we have seen over the last few months?

Comex Results: Gold Sees Massive One Day Roll While Silver Adjustments Break Records

More strange activity at the Comex

QT Falls Short Yet Again and the Fed Lost Almost $100B in January

The balance sheet tightening is not going as planned

Comex Update: Gold Deliveries Pick Up Late in the Contract

Gold is middle of the pack

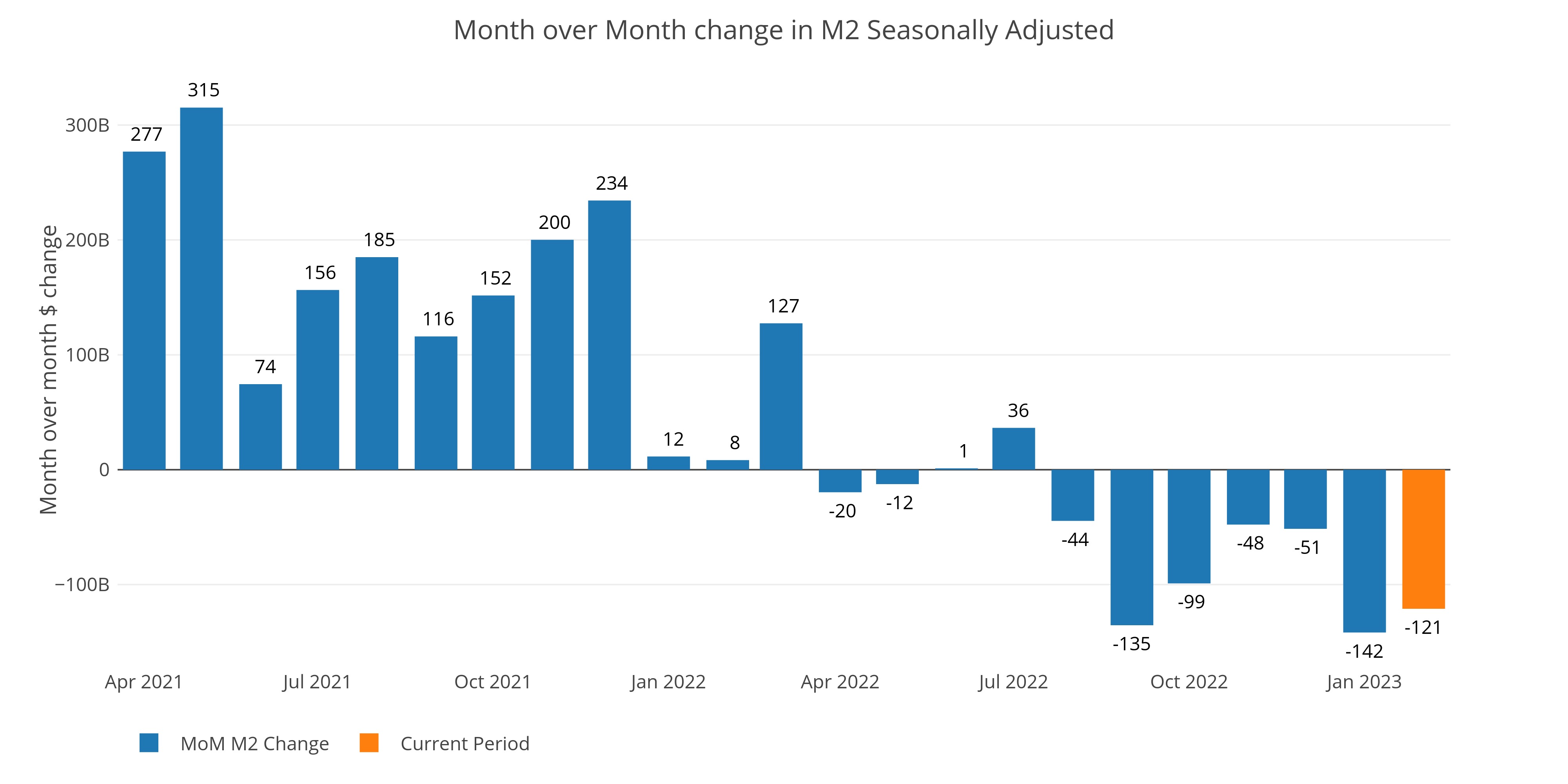

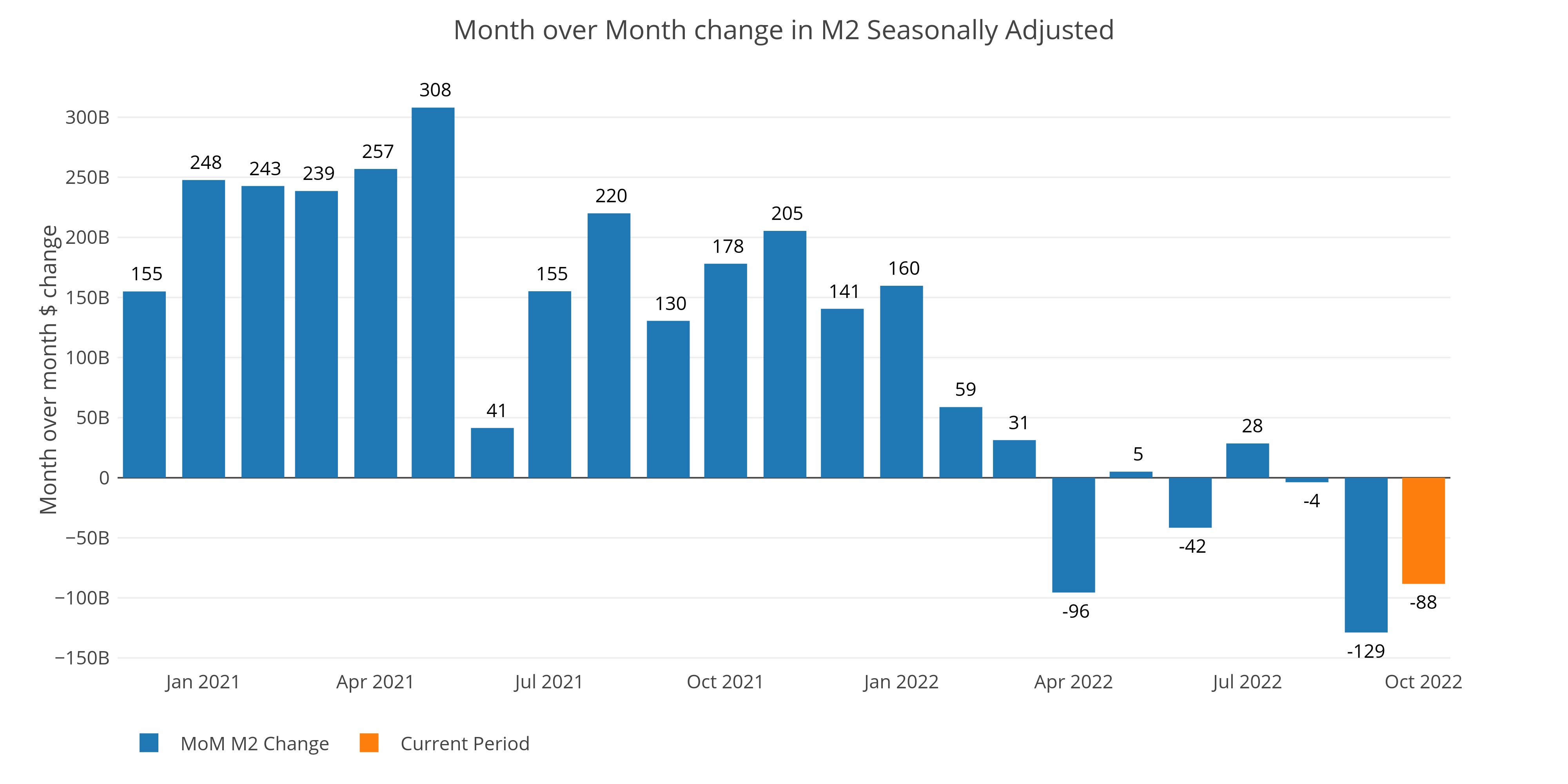

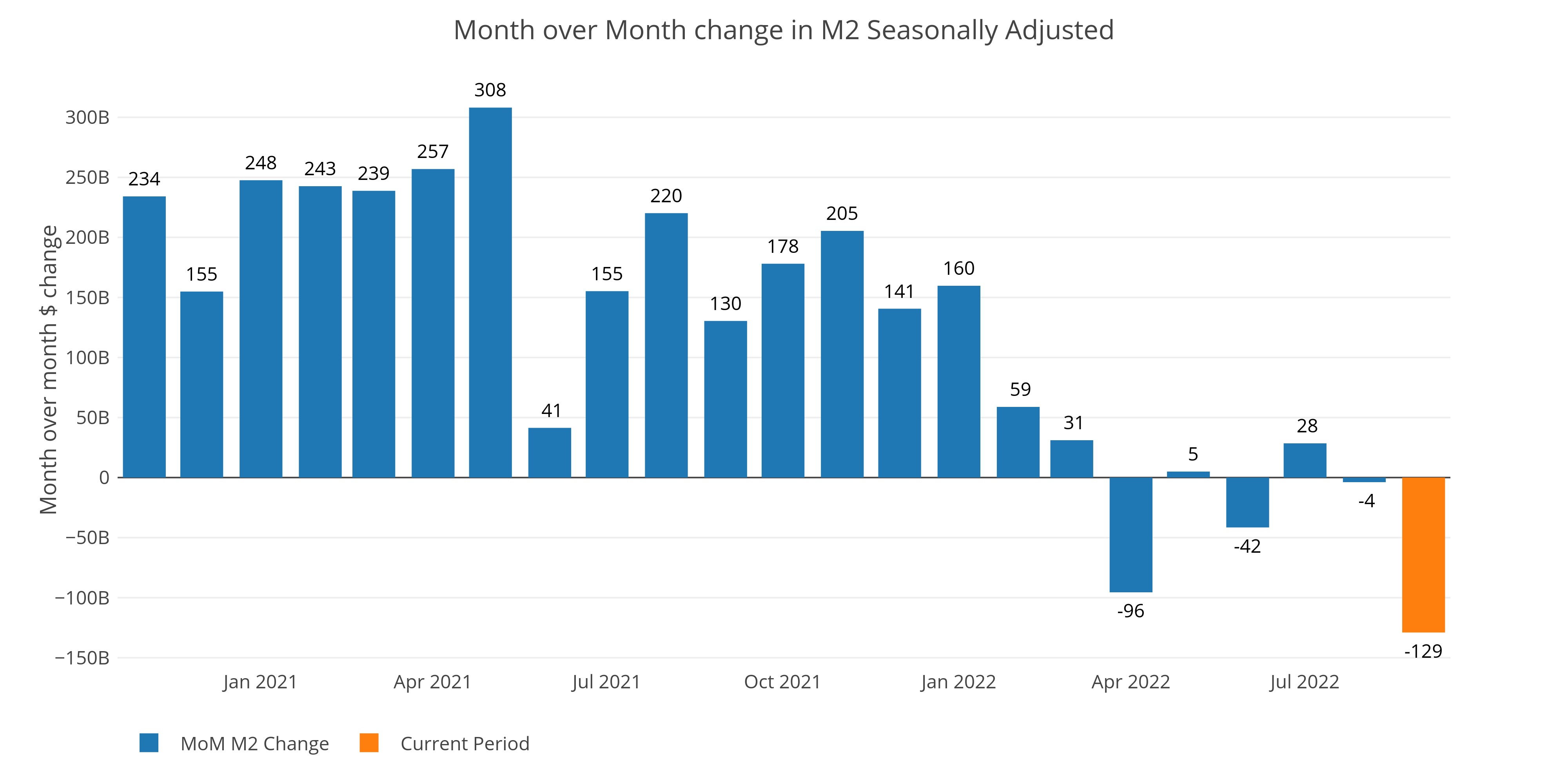

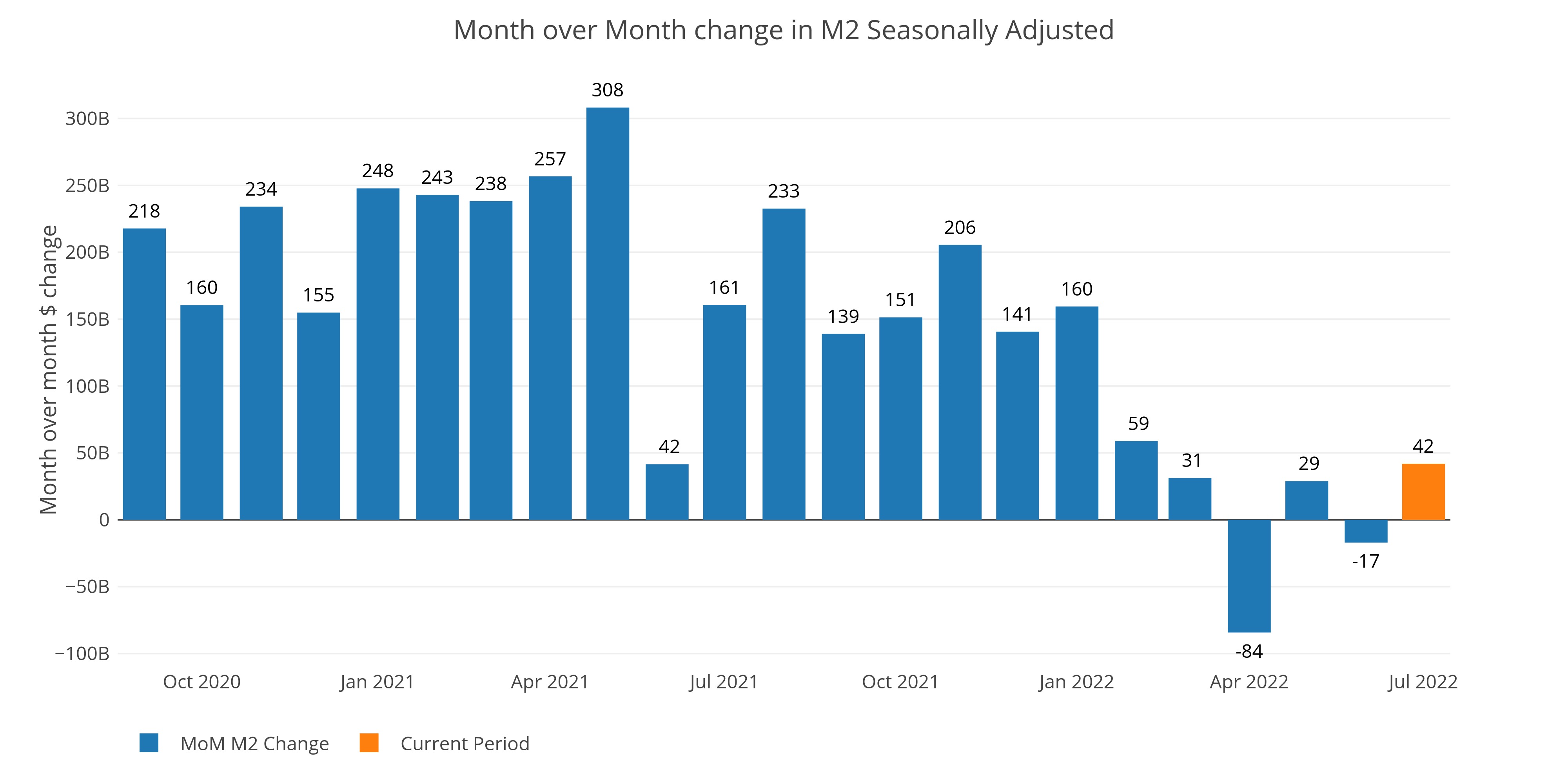

Money Supply Contracts in 2022 for the First Time on Record

This is an epic reversal that could spell serious trouble for the market and economy

Comex Inventory Withdrawals Have Slowed but not Stopped

Is the metal gone?

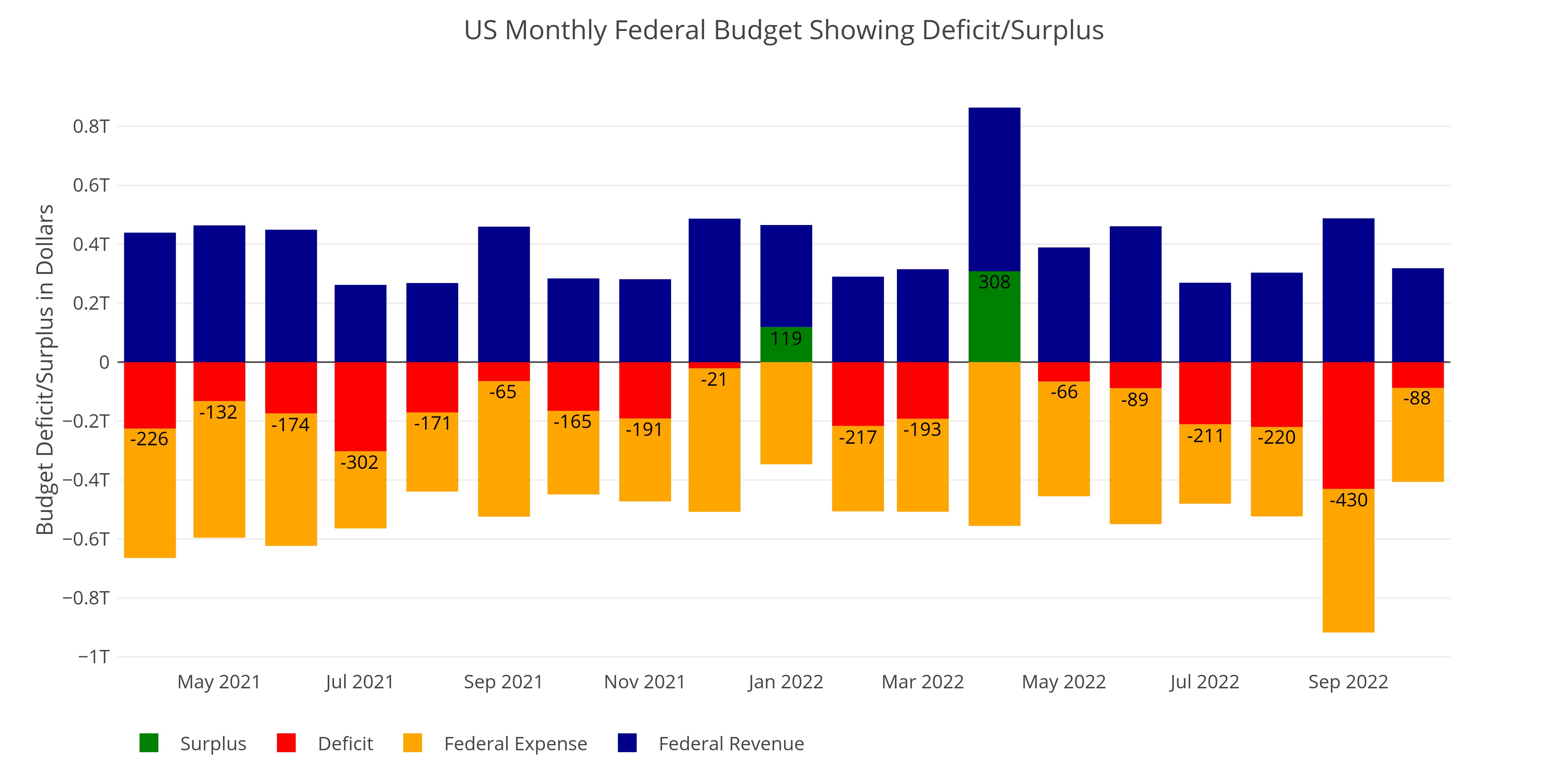

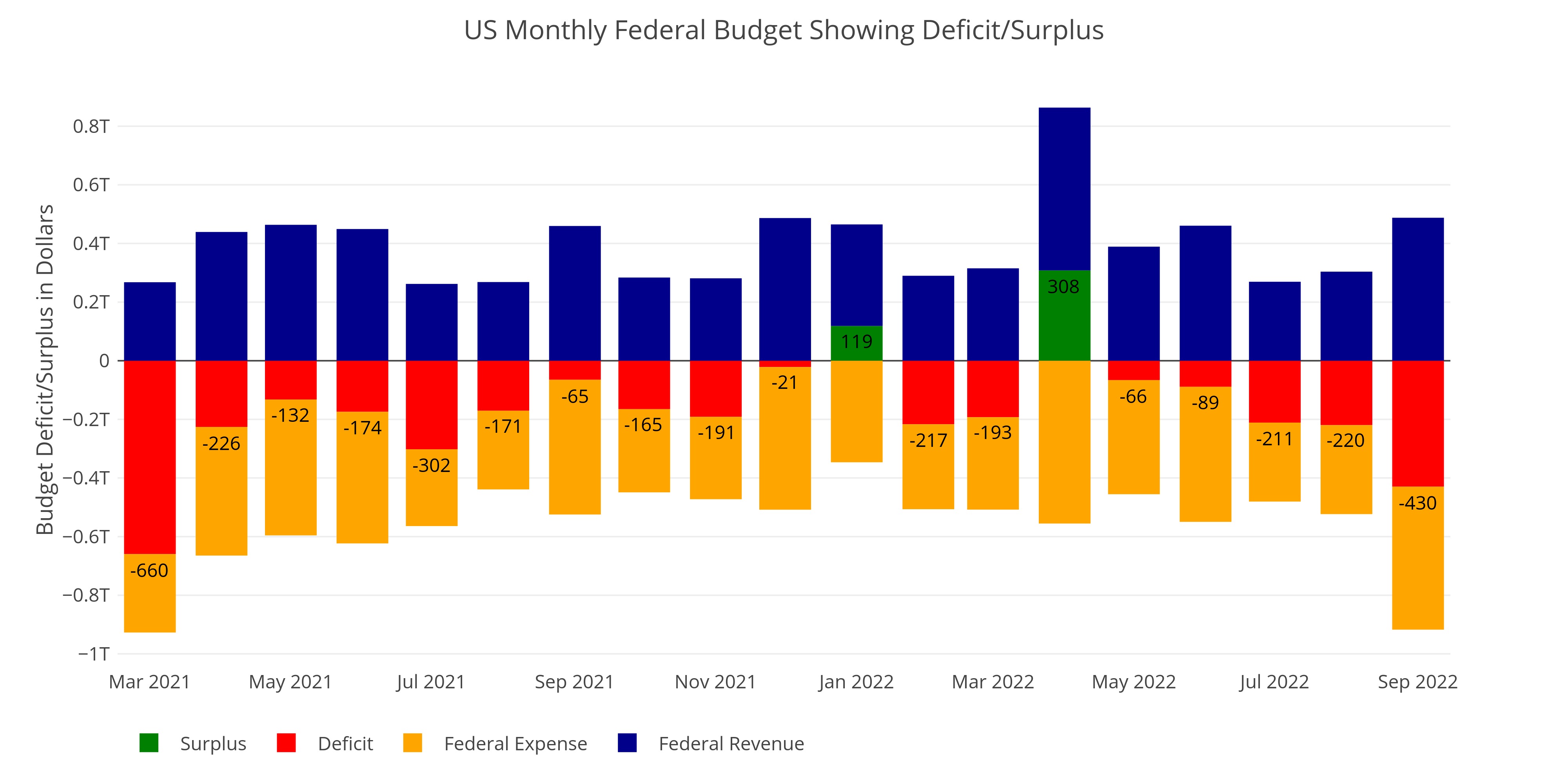

Budget Deficit Exceeds $1.4T in 2022

Surging revenues are not enough

CPI: Saved by Falling Energy Prices

Inflation never goes straight up

US Debt Hits the Ceiling - Interest Payments Keep Growing

Interest costs are exploding upwards

The Real Jobs Report is Way Worse Than the Headline Suggests

Looking at the other data sheds light on the situation

Trade Deficit Falls Due to Weak Consumer

Weak consumer cannot import as many goods

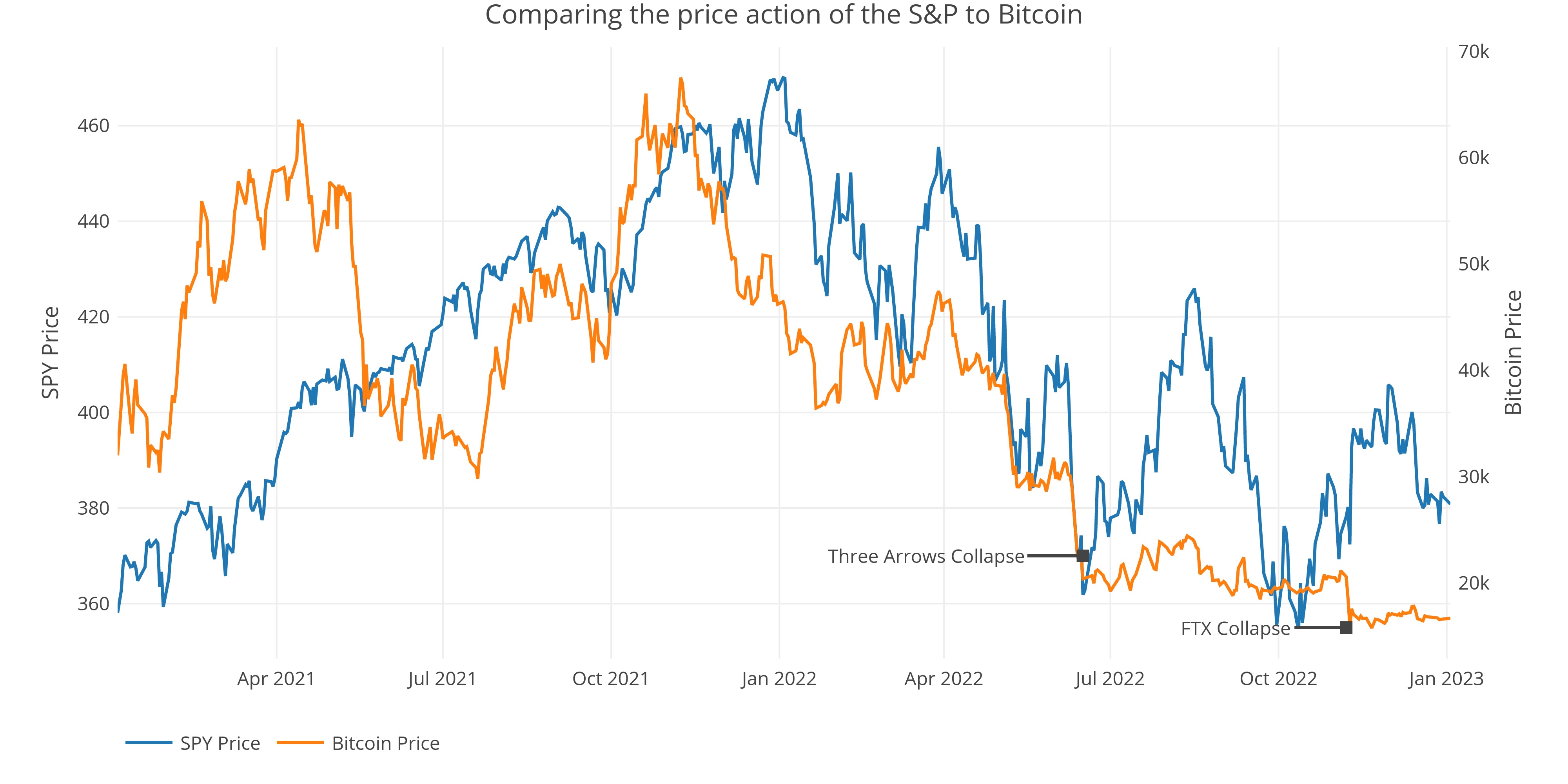

A Bet on Bitcoin is Gambling on the Whales

The market is being artificially propped up

Managed Money Ends 2023 on Bullish Note

Hedge Funds are bying back into the gold market

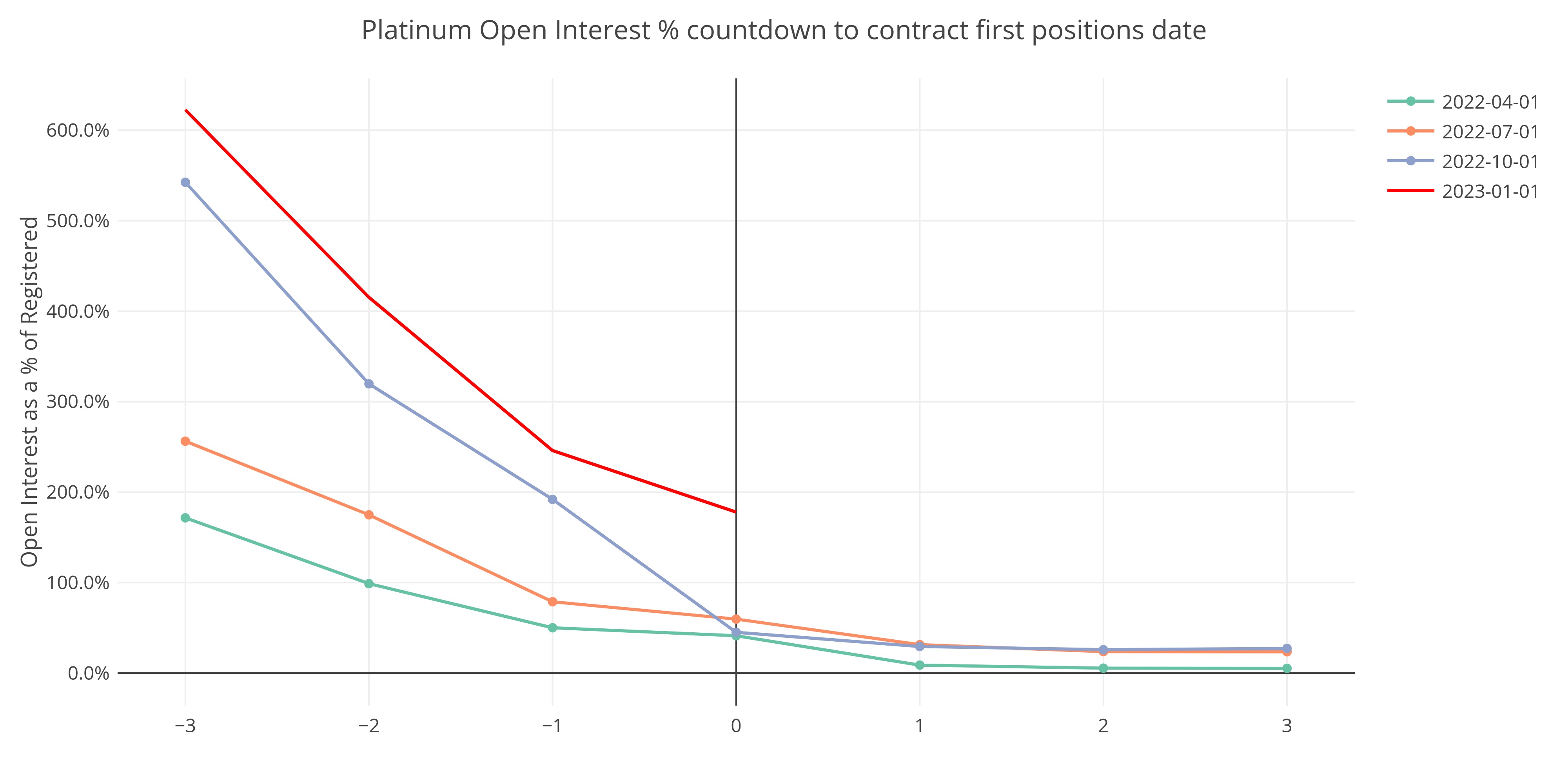

Did Platinum Just Break the Comex?

There is not enough supply to satisfy demand

The Fed has missed the MBS Target Reduction Every Month

The math is not on the Feds side

Money Supply Growth Continues Massive Divergence from History

This is an epic collapse that could spell serious trouble for the market and economy

Comex Update: Platinum Shorts On Edge While Silver Longs Still Wait

Gold is middle of the pack

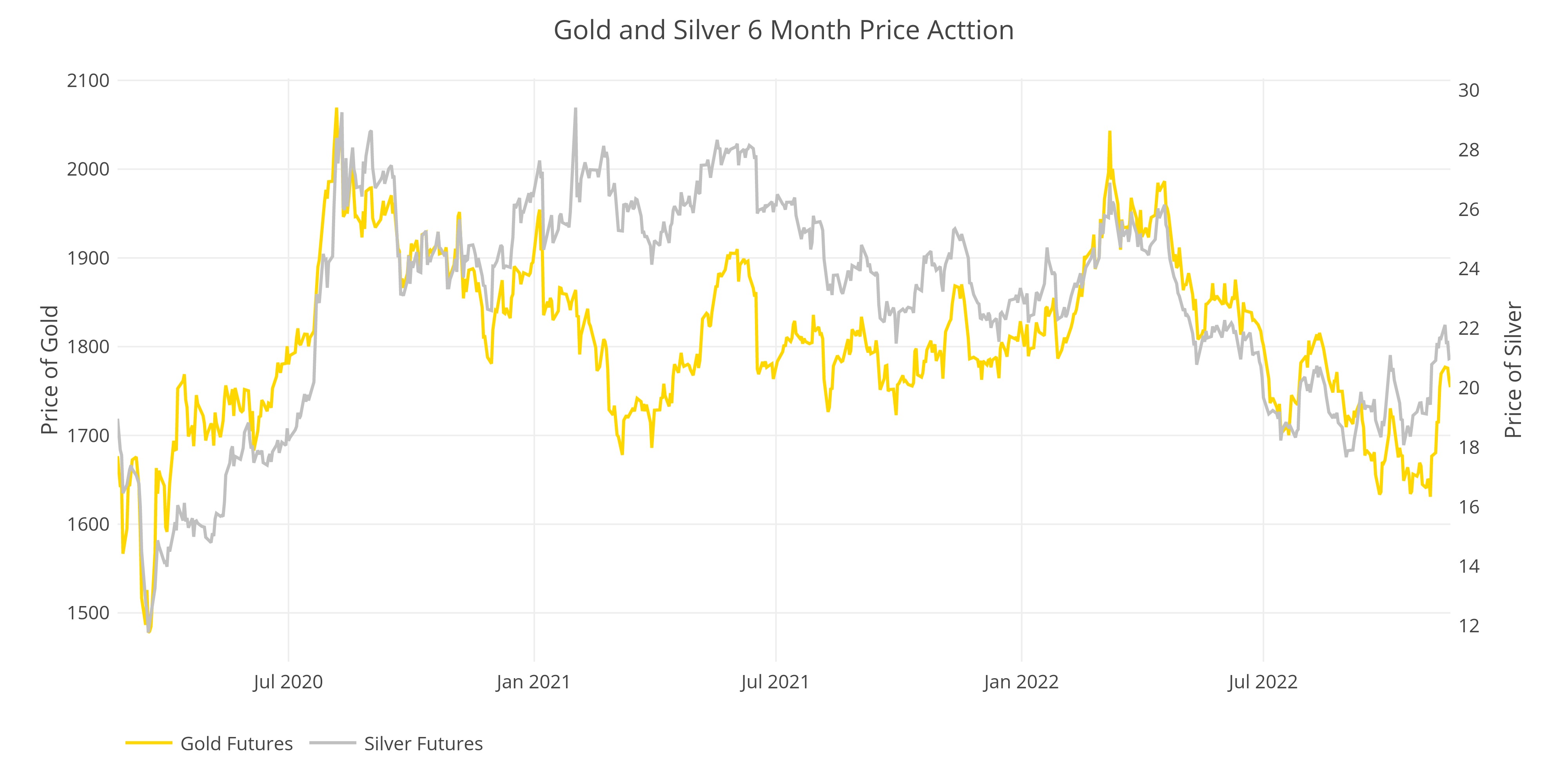

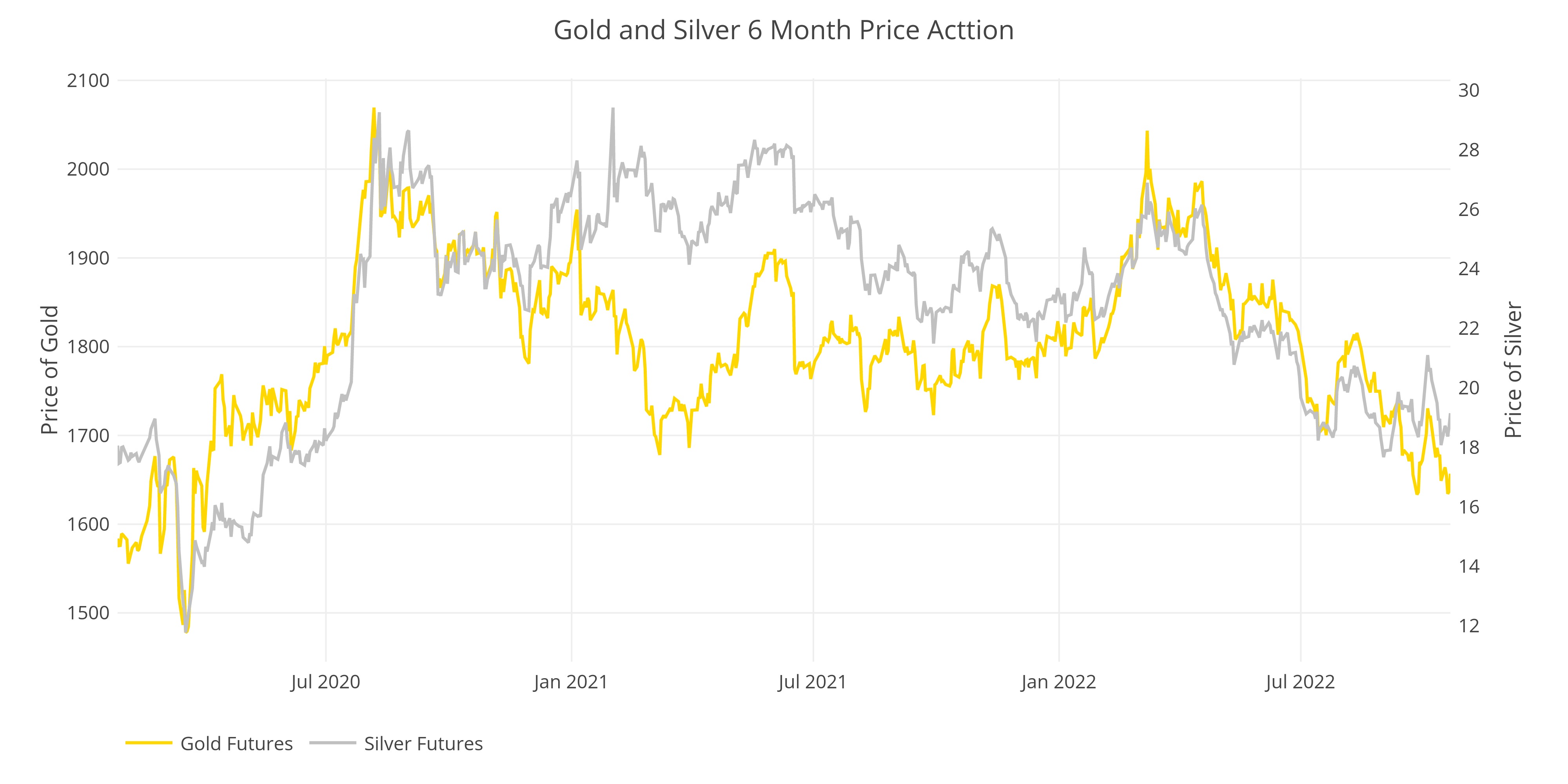

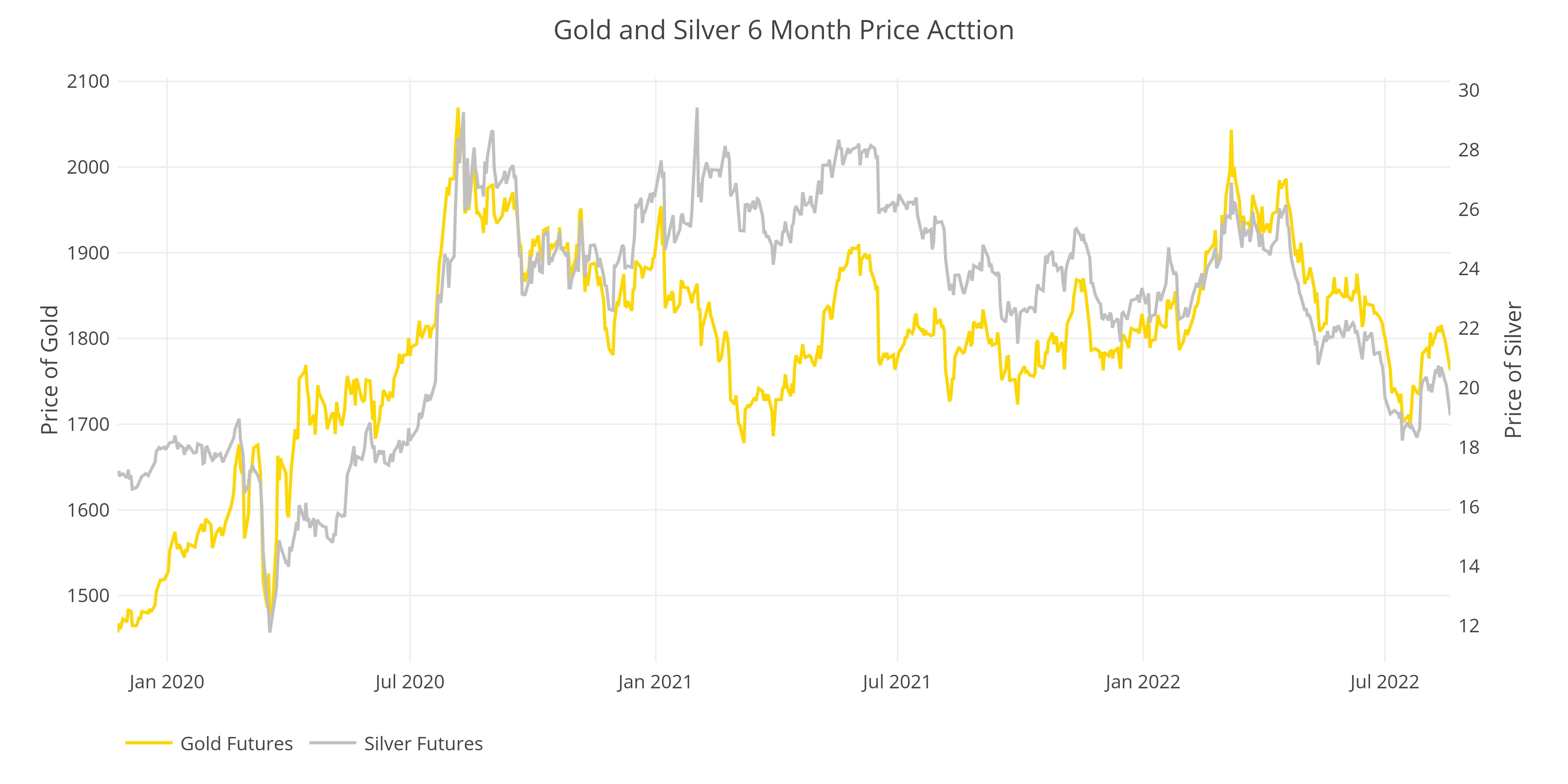

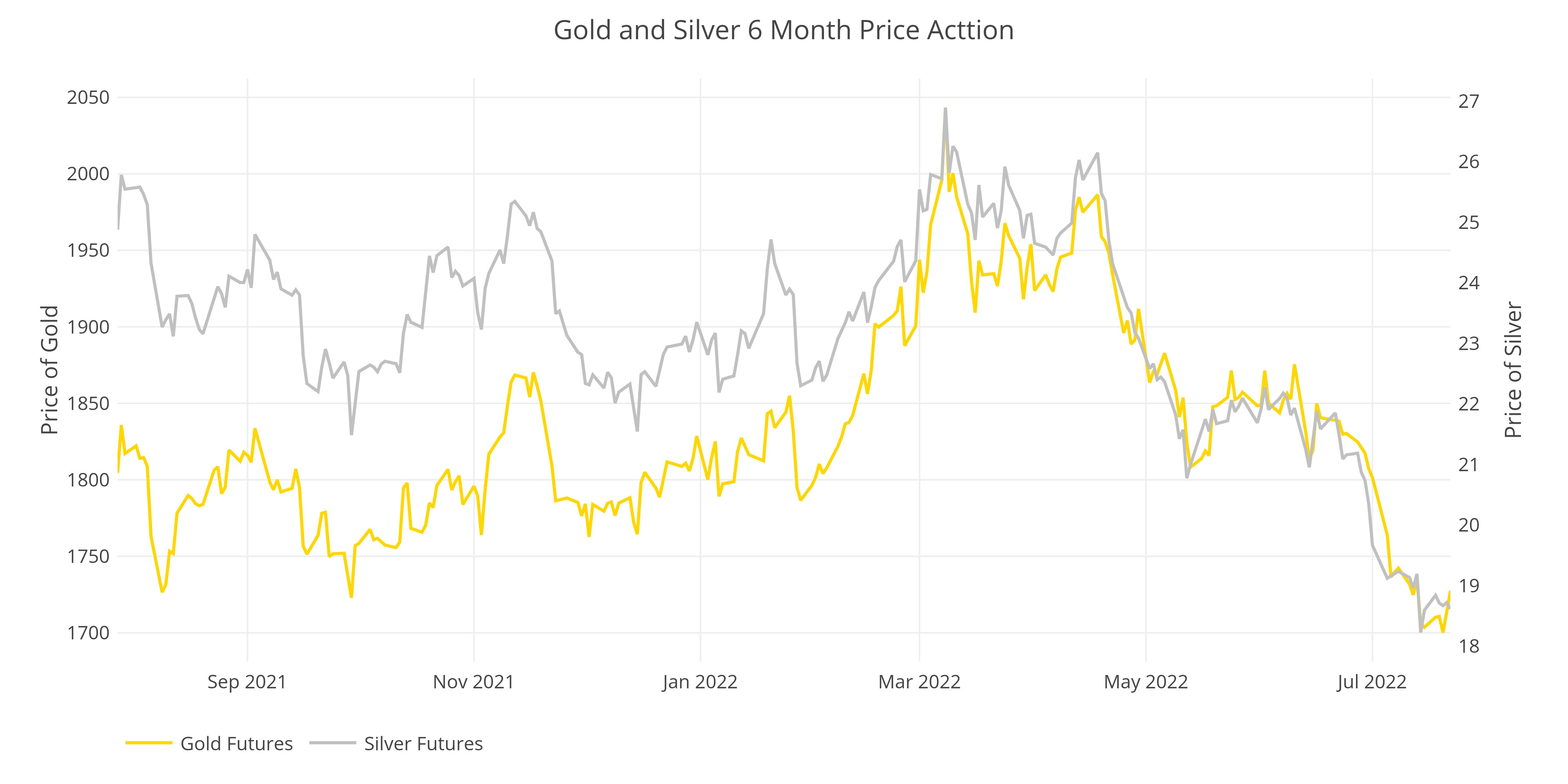

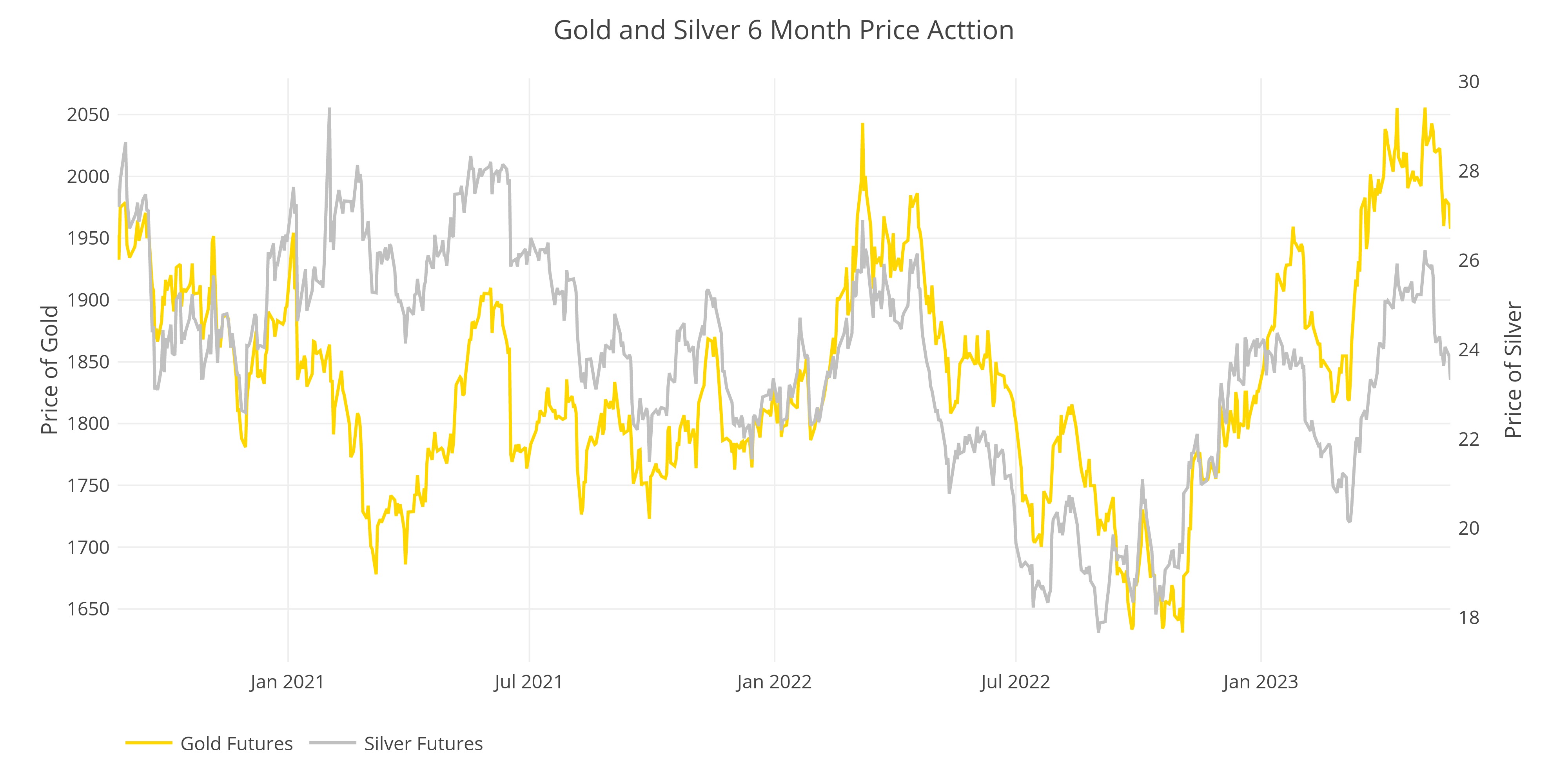

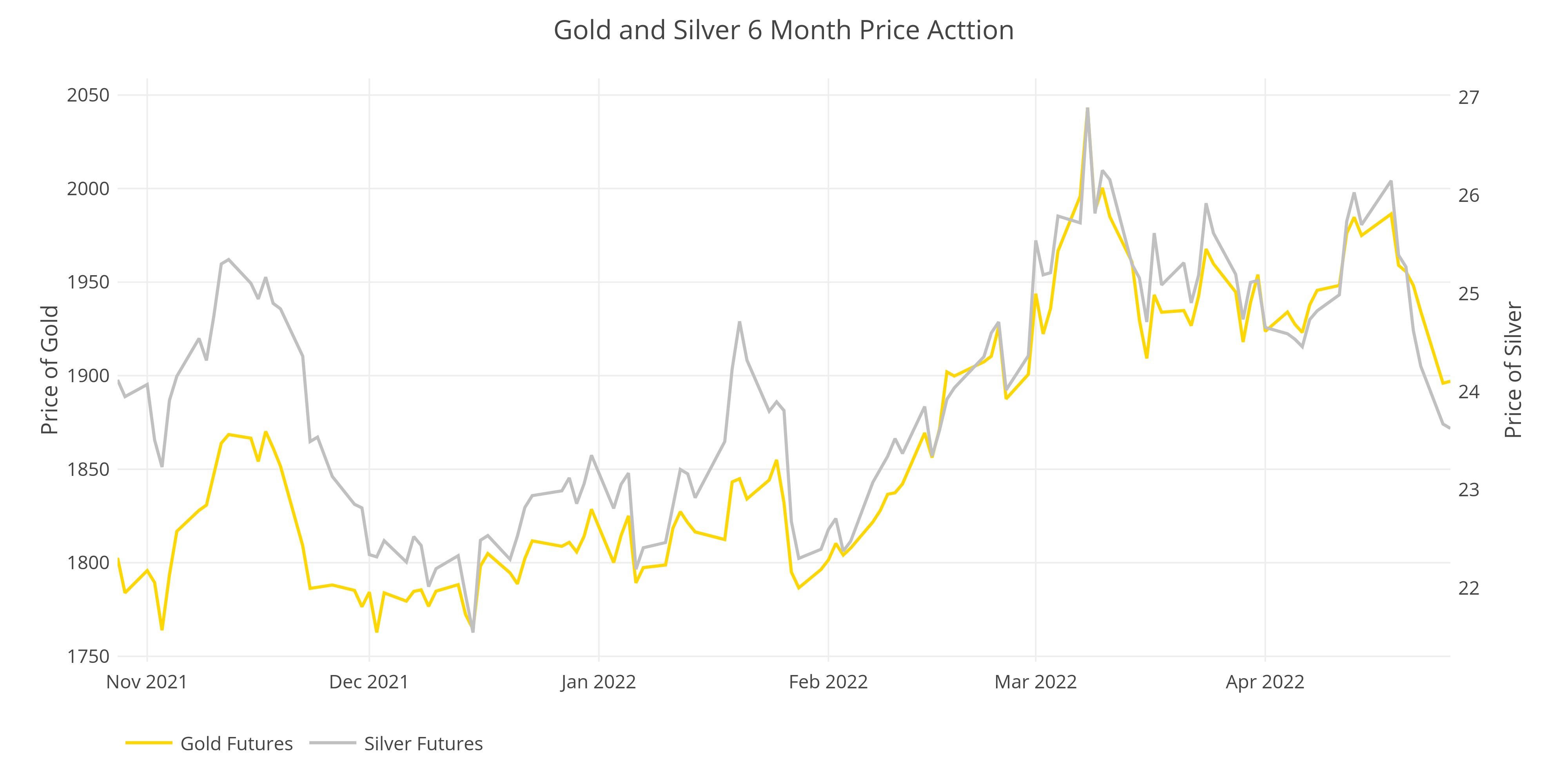

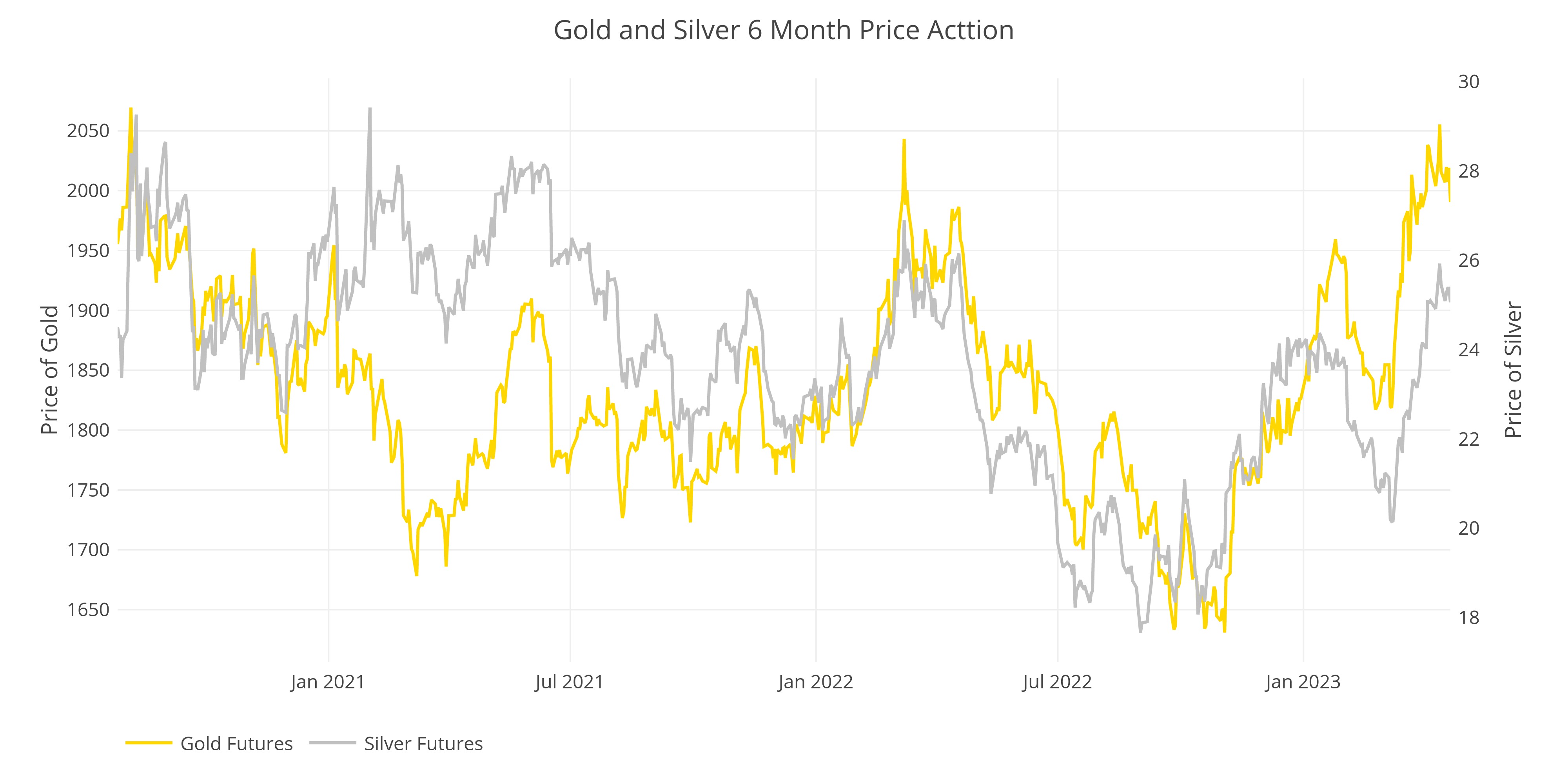

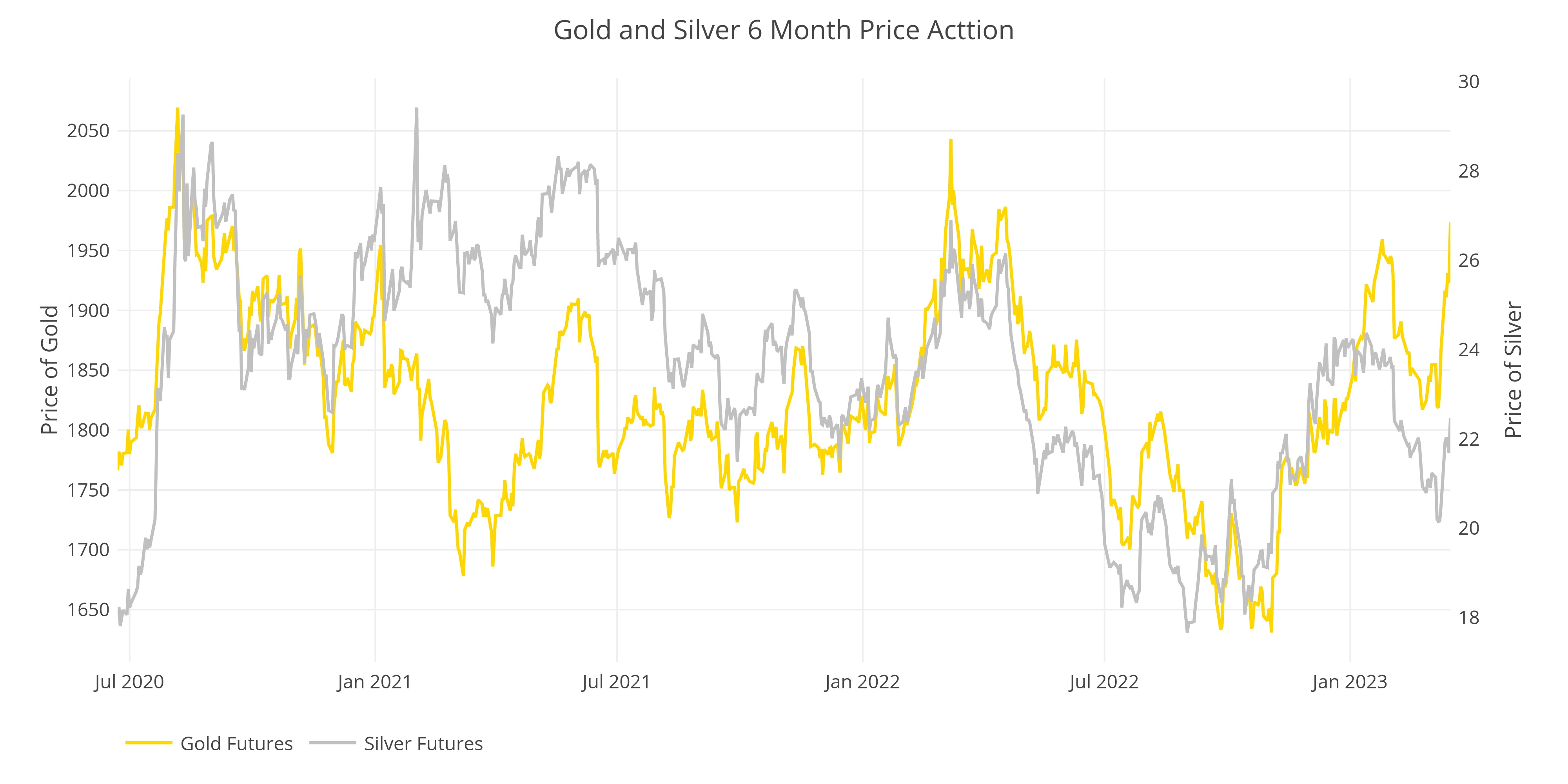

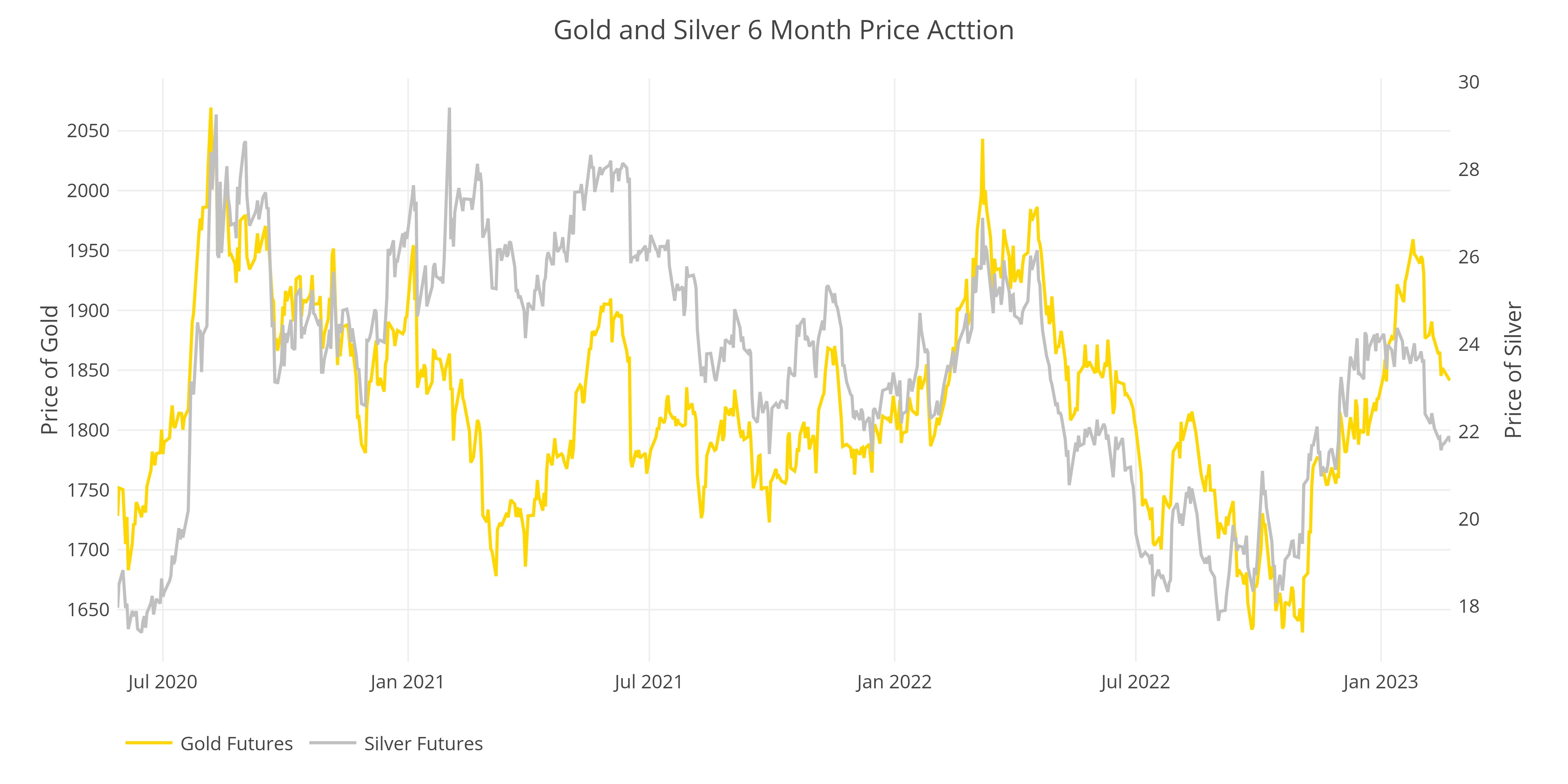

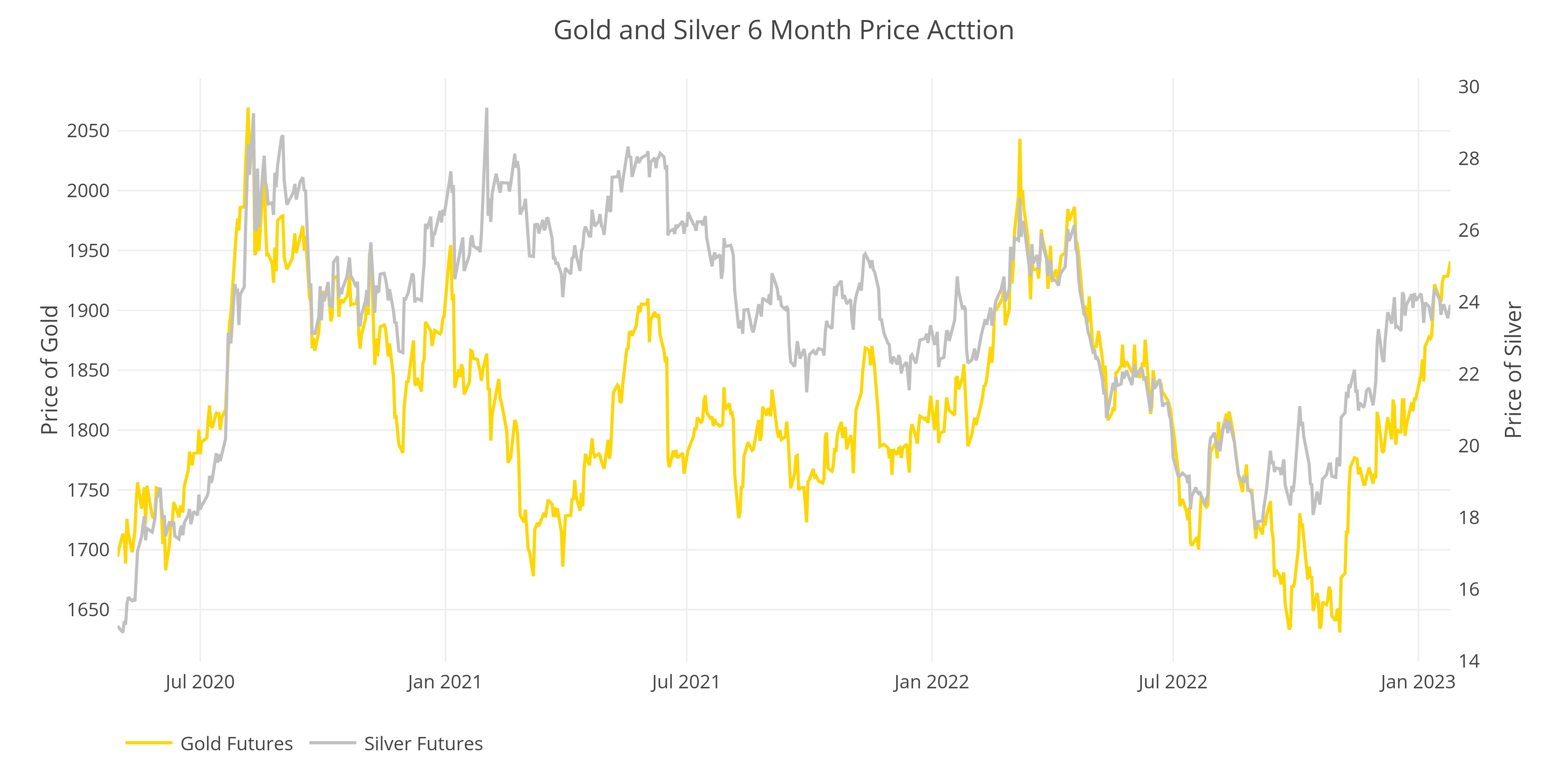

Gold and Silver are Setting up for a Strong Advance in 2023

The coiled spring gets tighter

Silver Registered Ratio Falls to 11.1% - the Lowest in at Least 22 Years

Are the vaults out of metal?

Budget Deficit: Is the Surge In Tax Revenues Over?

Fiscal year 2022 closes with another record in revenue

CPI: History Suggests the Inflation Fight Might Just be Starting

Inflation never goes straight up

TTM Trade Deficit Reaches New Record $982B

Trade Deficit is Surging Again

Annualized Interest Set to Exceed $700B by July, up $400B in Two years

This is a runaway freight train

Is Managed Money Buying this Bull Market?

Physical Demand combined with Paper Demand could send prices soaring

Fed Has $48B Loss in November and Sees Massive Balance Sheet Reduction

Is the Fed making up for missed months

Comex Results: Why is December so Quiet?

Gold is starting to look like silver did

Money Supply Growth Rate sees an Epic Divergence from Previous Years

This is an epic collapse that could spell serious trouble for the market and economy

The Technical Picture: Can the metals hold support?

A sizeable rally now needs time to consolidate

Comex Vaults See Seventh Straight Month of Outflows

Ratio of contracts to registered has reached 20

Bitcoin Hodlers: Time is Running Out to Convert Nothing into Something

This market is being propped up by the whales. How much longer can they hold it?

Budget Deficit: Annual Interest Expense Increases 40% Compared to Last October

Fiscal year 2022 closes with another record in revenue

CPI: Annualized Pace of Increase is Still over 5%

The window for the Fed is closing

Treasury Prepares for Another Debt Ceiling Saga

Interest costs are exploding upwards

Trade Deficit: The First Deficit Increase in Six Months

Trade Deficit increases on falling Exports and Rising Imports

Comex Results: This Game Has Changed

Open Interest relative to Registered is exploding

Will Managed Money Get Stuck Holding the Short Straw?

Managed Money is dominating the price for now, but that could change quickly

The Fed is Still Coming up Short on QT

October QT Falls short of $95B target

Money Supply Growth Rate is Still Negative

This poses major risks for stocks and the market at large

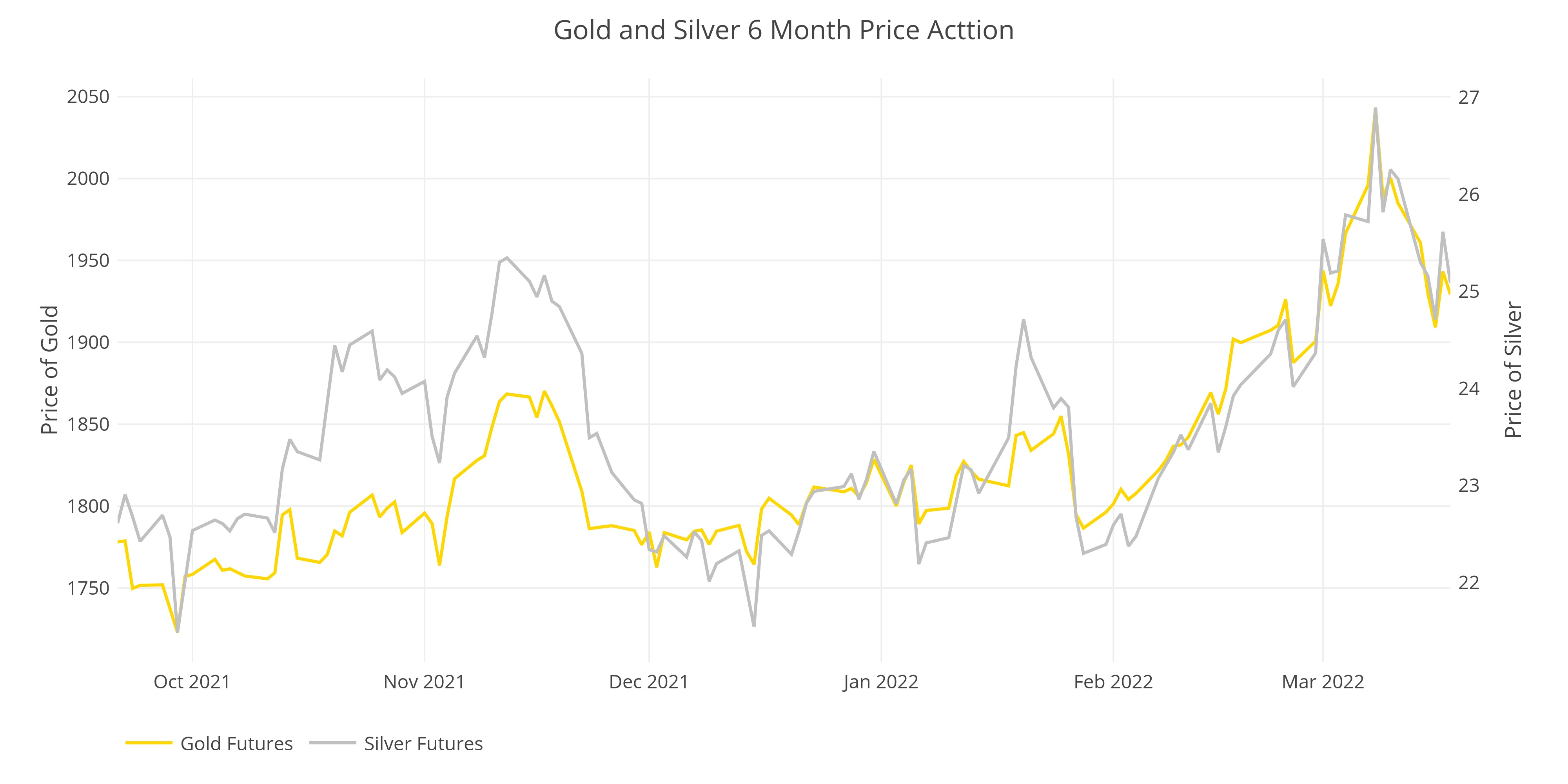

The Technical Picture: More Time is Needed Before a Sustainable Rally Begins

The CFTC Increased Margin to Cap the Advance in Silver

Student Loan Forgiveness Creates Largest September Deficit Ever

Fiscal year 2022 closes with another record in revenue

Comex Update: The Metal Will be Gone in Months

This has been a strategic and deliberate extraction

Comex Inventory: 17.4 Paper Ounces of Silver for Each Registered Ounce

This game of musical chairs will end soon

CPI: This Game of Chicken is Almost Over

The Fed has no excuse to stop hiking until something breaks

Jobs Report: 7 of 8 Categories are Below Trend While Revisions are Negative Again

Current month shows all 8 categories below 12-month trend

Treasury Locks in Higher Rates for Longer Despite Exploding Interest Costs

Interest costs are exploding upwards

Trade Deficit: Are Falling Imports Further Sign of Recession?

Trade Deficit almost 40% below recent records

CoTs Report: Managed Money Hammers Gold for 7th Straight Week

This the longest such streak since August 2018

Comex: Platinum Shorts Live to See Another Day

This could be early signs for what's happening in gold and silver

Surprise! Another Month = Another Failed Attempt at QT

September did not prove to be the first month of major run-off

Calling the Fed’s Bluff: They are Holding a Losing Hand

The math shows the Fed cannot stick to their plan

Collapse in Money Supply is Still a Major Risk for the Market

Money supply still deep in negative territory

Price Analysis: Support Becomes Resistance

The market is due for a bounce but it might be short lived

Comex Update: September Gold Delivery Volume Blasts Higher

Strength in gold continues

Comex Stock Report: The Vaults are Still Bleeding

Gold and silver continue to leave the vault at an alarming rate

August CPI Shows Inflation Getting Stickier

The Fed's runway continues to get shorter

Treasury Runs Largest August Deficit Ever as Interest Costs Soar

Record Revenues are not keeping pace with spending

Trade Deficit Still Historically High Despite Fall Since March

Trend should be easier to identify in the months ahead

US Debt: Annualized Interest Surges More Than $22B in a Single Month

Interest costs are exploding upwards

CFTC Report: Silver Net Short Position Reaches New High for the Move

Sentiment is extremely negative

Jobs Report: Multiple Full-time Job Holders Reaches All-Time High

Current month shows all 8 categories below 12-month trend

Is the Fed Worried About the Mortgage Market?

Fed has been unable to reduce holdings of MBS over the last 3 months

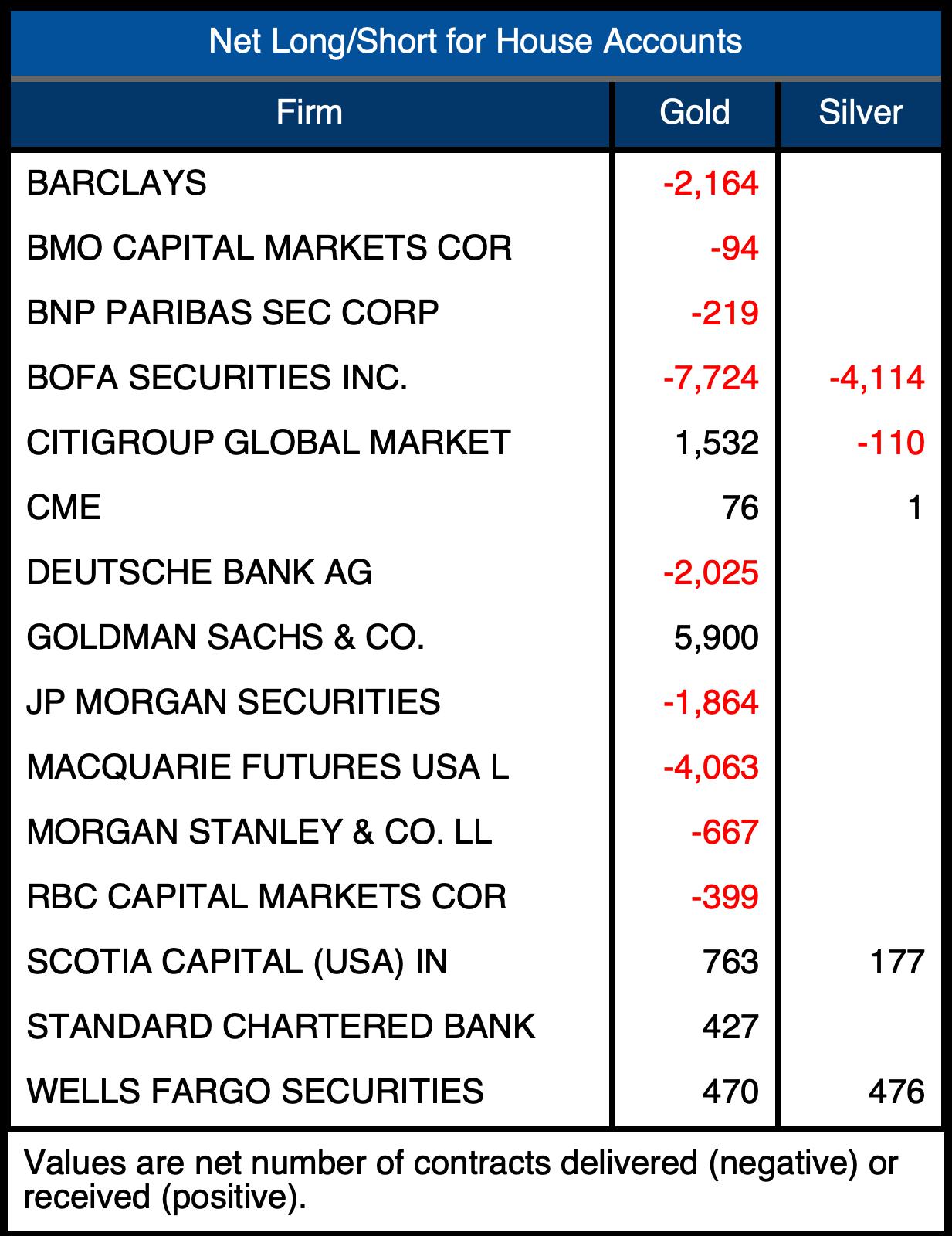

BofA Backstops Strong Delivery Volume in Silver

Silver and Gold Both Strong but for Different Reasons

Comex Update: House Accounts See Largest Net Delivery Volume on Record

Strength in gold continues

13 Week Money Supply Growth Hits Multi-Decade Low

Money supply falls deeper into negative territory

Gold and Silver Price Analysis: Caution is Warranted in the Short-Term

The Fed will pivot but the market doesn't see it yet

Comex Inventories Plummet - Is a "Vault-Run" Underway?

Gold inventories are down 18% since May with Silver Registered down 41% since March

July CPI Pauses - Is Peak Inflation Over?

Once the Fed returns to easing, inflation will surge again

Treasury Runs Second Largest July Deficit of All Time

A fall in Individual Taxes is very concerning

US Debt: The Sting of Higher Interest Rates is Just Getting Started

Interest costs have increased by $65B or 22% in 7 months

Is a Falling Deficit Further Proof of Recession?

The Government cannot ignore this recession forever

CFTC Report: Are the Shorts About to Get Squeezed?

Market is extreely oversold

Comex Deliveries: August Gold Starts Strong

Metal is leaving Comex at an accerlerated pace

Fed Balance Sheet: Too Little Too Late

Fed is closer to the end then the beginning of their tightening cycle

Money Supply Growth Rate Drops Below 2008

13-week annualized growth has turned negative

Comex Update: Gold Sees Massive Delivery Volume Mid-Month

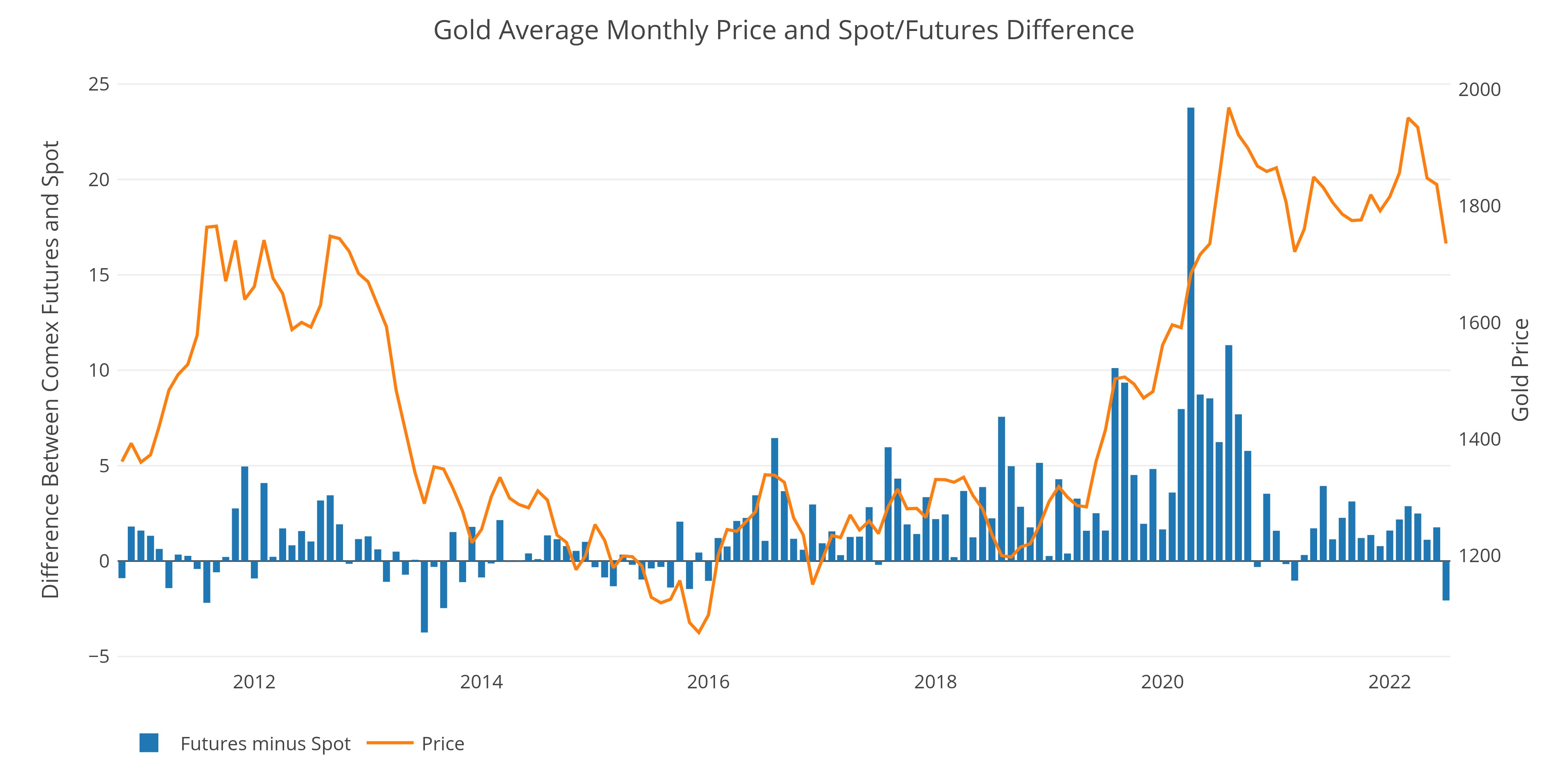

Backwardation shows huge demand for physical

Technical Analysis: Is This Capitulation?

Will FOMC and GDP be the spark?

Comex Stock Report: Why is Backwardation Causing a Collapse in Registered?

Backwardation should have the opposite effect

June YoY CPI was Horrific - The Next Three Months Could be Worse

Energy may cool, but low numbers from last year are coming off the board

Treasury Fails to Capitalize on Record Tax Revenues

Annual spending is still near \$6T

Treasury Interest Cost Will Soar Past $500B in the Months Ahead

Treasury is still converting short-term to long-term

Jobs Report: Revisions Have Turned Negative

Job growth continues to slow versus 12-month trend

Jobs Report: Revisions Have Turned Negative

Job growth continues to slow versus 12-month trend

Yearly Trade Deficit Approaches $1T

July could be break the $1T ceiling

CFTC Report Shows the Most Neutral Precious Metals Market in Years

Increase in Short Positioning pushes market to a neutral stance

Did the Fed Forget to Start QT?

Fed Balance Sheet Reduces by $1B versus $45B promised

Comex Results: Gold and Silver Fail to Deliver

Silver has weakest delivery volume in several years

Money Supply Growth Slows Enough to Pop the Everything Bubble but not Enough to Cure Inflation

13-week annualized growth is crashing

The Technicals: Gold Correction is at or Near Completion

Downside looks limited

The Technicals: Gold Correction is at or Near Completion

Downside looks limited

Technical Analysis: Gold is Building Solid Support

Silver is stuck between industrial and monetary metal

Comex Countdown: What's Really Going on With Silver?

Don't be fooled by tight trading ranges

Comex Inventory: Gold Outflows Accelerate While Silver Sees Significant Shuffling

Pledged gold is approaching a new record

CBO Does Not Expect Revenue Surge to Last

CBO can also not explain a third of the surge

Peak inflation Still Ahead as 97.5% of the CPI is Above the 12-Month Average

Rebound in Energy sparks highest inflation in 40 years

Yearly Trade Deficit Sets New Record Despite MoM Decrease

Could a fall in Imports be due to less discretionary income?

Treasury Scrambles to Lock in Rates as Borrowing Costs Soar

Treasury converts $370B of short-term to long-term over three months

CFTC: Hedge Funds Cover Brief Net Short Position in Silver

Gold has also seen a major reduction in long interest

Hiring slows in 5 of 8 sectors

Job growth is decelerating

Comex Delivery Update: Shorts are Dragging Their Feet Again

Demand for delivery remains healthy

Foreign Holders Join the Fed in Reducing Holdings

Fed Balance Sheet Reduction Commences

Monthly M2 Contracts for the First Time in Over 12 Years

13-week annualized growth is crashing

The Technicals: How Much Further is the Gold and Silver Correction?

Momentum has been lost

Technical Analysis: Has Thie Pullback Run Its Course?

The Fed can only keep talking for so long

Comex Countdown: Gold Shows Strength while Silver Sees Cash Settlement

Gold is clearly catching a bid behind the scenes

Comex: Total Inventory Grows but Supply to Meet Delivery Shrinks

More metal is being put into Eligible

CPI: Nearly 70% of the CPI is Above the 12-Month Average

MoM increase of 0.34% is higher than expectations

Federal Surplus: Did the Treasury Just See Peak Revenue?

April shatters previous surplus record

Was March a Strong Jobs Report? Maybe...

The BLS Modesl are anticipating stronger than average job growth later this year

A New Paradigm: Interest Grows Even When Total Debt Shrinks

What happens when the debt starts growing again?

Trade Deficit Explodes 22.3% MoM and 53.8% YoY

TTM Imported Goods Rises Above $3T

Comex Results: May is Quiet, but June Looks Strong in Both Metals

Underlying data shows strength in gold and silver

CFTC: Swaps Have Increased Gold Short Position by More than 1,300% since Nov 2015

Gold price has held up well in the face of massive selling from Hedge Funds

Can the Fed Pull Off a Magic Trick?

New Record is Reached Intra-month

Money Supply Growth Rate Continues to Decelerate

How much longer can markets stay levitated as Fed pulls liquidity?

Technical Analysis: Will $1900 Hold?

Will the Fed's bluff push precious metals lower

Comex Countdown: Are Banks Forgetting Silver to Focus on Gold?

May should be another strong month for gold

The Technicals: Is $2000 Support or Resistance?

Another headfake or is this the real deal?

The Surge in Gold Inventory Continues at Comex

Inventory is highest since August 2021

Treasury Runs Smallest Q1 Deficit Since 2016

Surging revenues have been a major windfall - will it continue?

CPI 1.2% MoM and 8.6% YoY - Is this Peak Inflation?

Will a recession slow price increases?

Comex Update: Spreads, House Accounts, and a US Debt Chart

Market Contango is growing

Annualized Interest on US Debt Increased $16.4B in 6 Months

...and the Fed is just getting started

Trailing Twelve Month Trade Deficit Exceeds $900B

Deficit relative to GDP is surging

Hedge Funds Have Room to Push Gold Higher

Down 40k Net Longs from the March Peak, Hedge Funds have dry powder to work with

Quantitative Easing Has Seemingly Ended (for now)

The Fed will be back sooner than they want

Was March a Strong Jobs Report? Maybe...

The BLS Modesl are anticipating stronger than average job growth later this year

Gold Enters April Delivery on a Strong Note

May and June continue to see abnormaly high demand

Comex April Countdown: Silver Pops Higher with Gold Trending Strong

April, May, and June are showing strength in gold

Money Supply Growth is Rapidly Decelerating

Could this put downward pressure on the stock market?

The Technicals: Next Week could be the Most Important Week for Gold in Years

Another headfake or is this the real deal?

Technical Analysis: Resting Between Fragile Support and Weak Resistance

Gold and silver enter a consolidation pattern

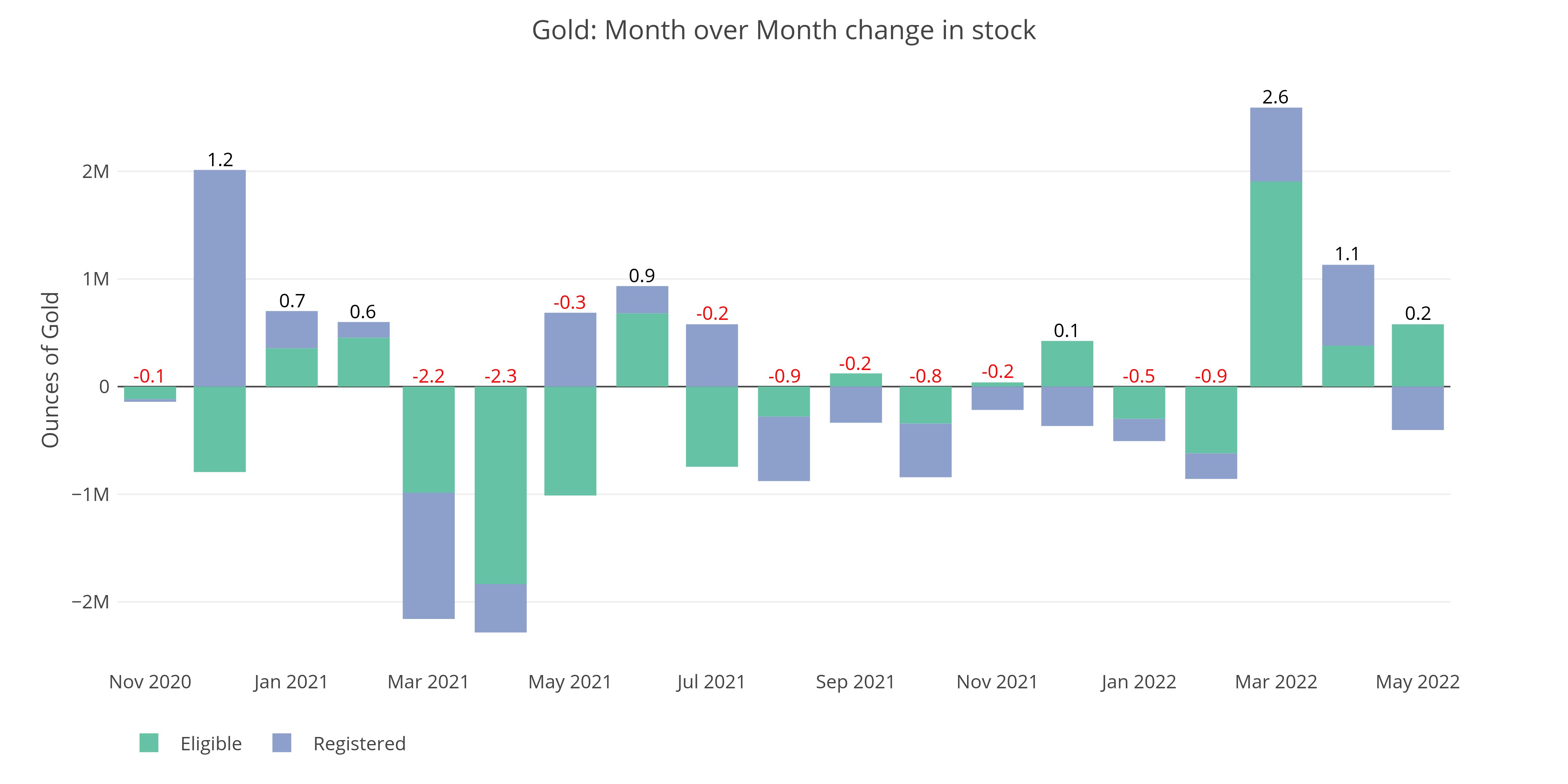

Banks Are Restocking Gold at Fastest Pace in Years

Are the banks preparing for massive delivery volume?

Bulls Beware the Margin Lever

Are the big players letting prices run?

Treasury Runs Largest Deficit in 8 Months After First Surplus in 2.5 Years

Revenues surged 16.7% compared to last February

Unrounded MoM CPI: 0.65% - Price Increases are Widespread

Inflation is infecting every part of the economy

Comex Update: First Gold and Now Silver

Silver is flashing a warning sign similar to gold

Trade Deficit: Another Record Shattered

Trade Deficit Surges 9.4% to $89.7B

Treasury Adds Another $94B in Short-Term Debt

Total debt increased $278B

February was a Strong Jobs Report Across All Measures

Seasonal adjustments are anticipating robust job growth in the spring and summer

Comex Results: February Becomes the Month of Adjustments

In the last day for contracts to roll, silver open interest was adjusted down 30%

CFTC: Managed Money Did Not Drive Year-End Price Surge

Hedge Funds have weak hands

The Fed Pulls Back on Treasuries but Dives in on MBS

Fed Still Manages to Add $68B in February

Seasonal Adjustments - Did Money Supply Expand or Contract?

Non-Seasonally Adjusted M2 Collapsed

Comex Countdown: 1 Day to Go - March Delivery Could Set Records

Activity is showing people want physical

Teh Technicals: A Healthy Correction

All markets consolidate

The Technicals: Is the Rally Sustainable?

Is gold simply getting a bid from the pending Russia invasion?

Comex Vaults See Inventory Fall 3% in the Last Month

The outflows have accelerated in recent weeks

Comex Countdown: Feb, March, and April All Flashing Yellow

Convergence of outlier trends have emerged

Comex Countdown: 2 Days to Go as War Begins

Convergence of outlier trends have emerged

Treasury Realizes First Surplus in Nearly 2.5 Years

Will it last?

Unrounded MoM CPI: 0.65% - Price Increases are Widespread

Inflation is infecting every part of the economy

2021 Trade Deficit Shatters Historical Record Set Back in 2006

The trend is likely to continue

Are There Tremors in the Gold Market?

Multiple indicators are flashing yellow

Treasury Increases Short-Term Debt by $200B as Total Debt Crosses $30T

Short-term debt poses greatest risk to Treasury

Don't get too excited, most of these revised job gains were already counted

Major revisions have pulled job growth from last summer into the last few months

What is the Comex Gold Market Signaling?

Jan, Feb, and March are all acting strange

Fed Struggles to Taper - Adds Over $100B in January

Will the Fed find it just as hard to raise interest rates?

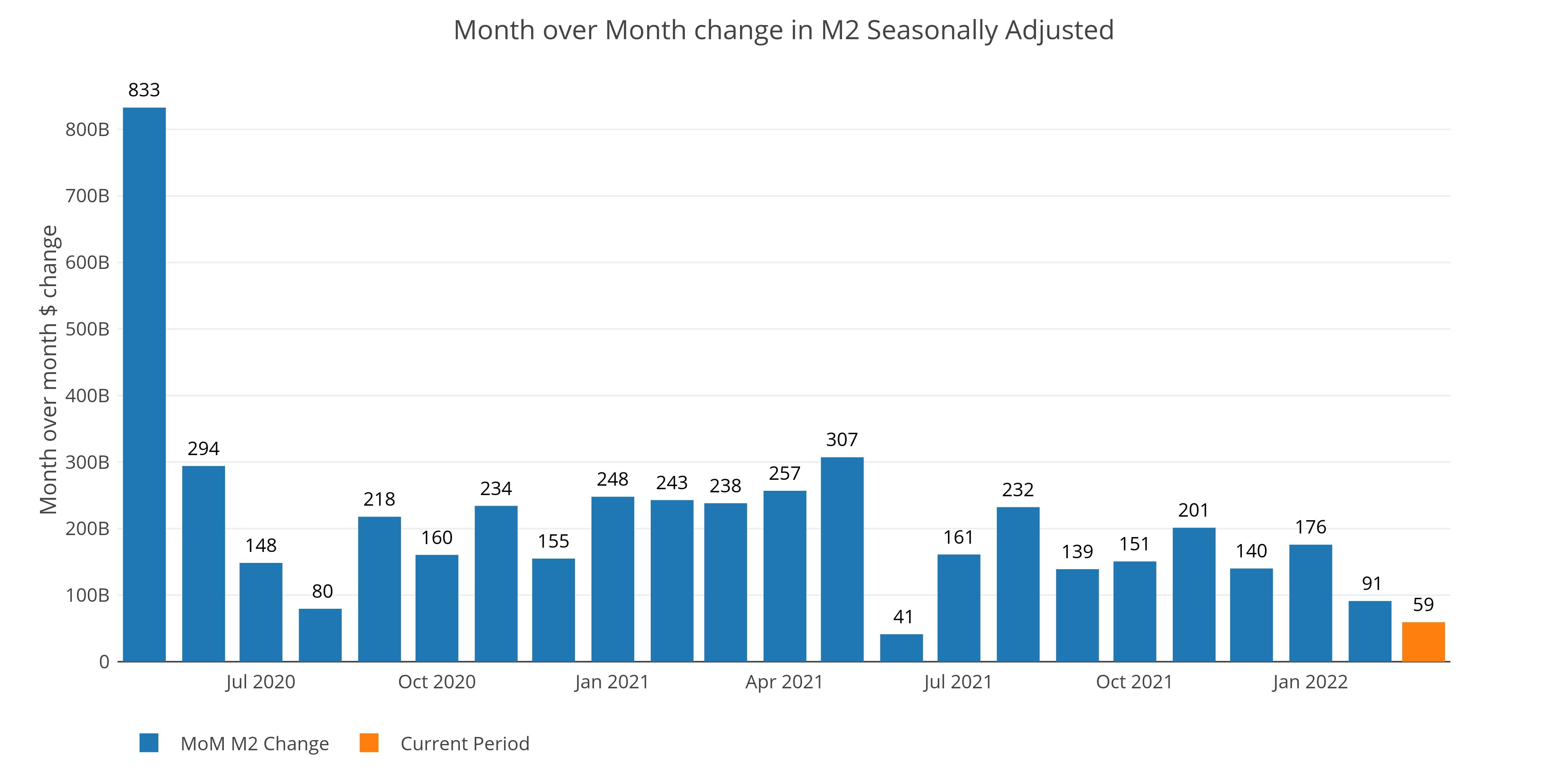

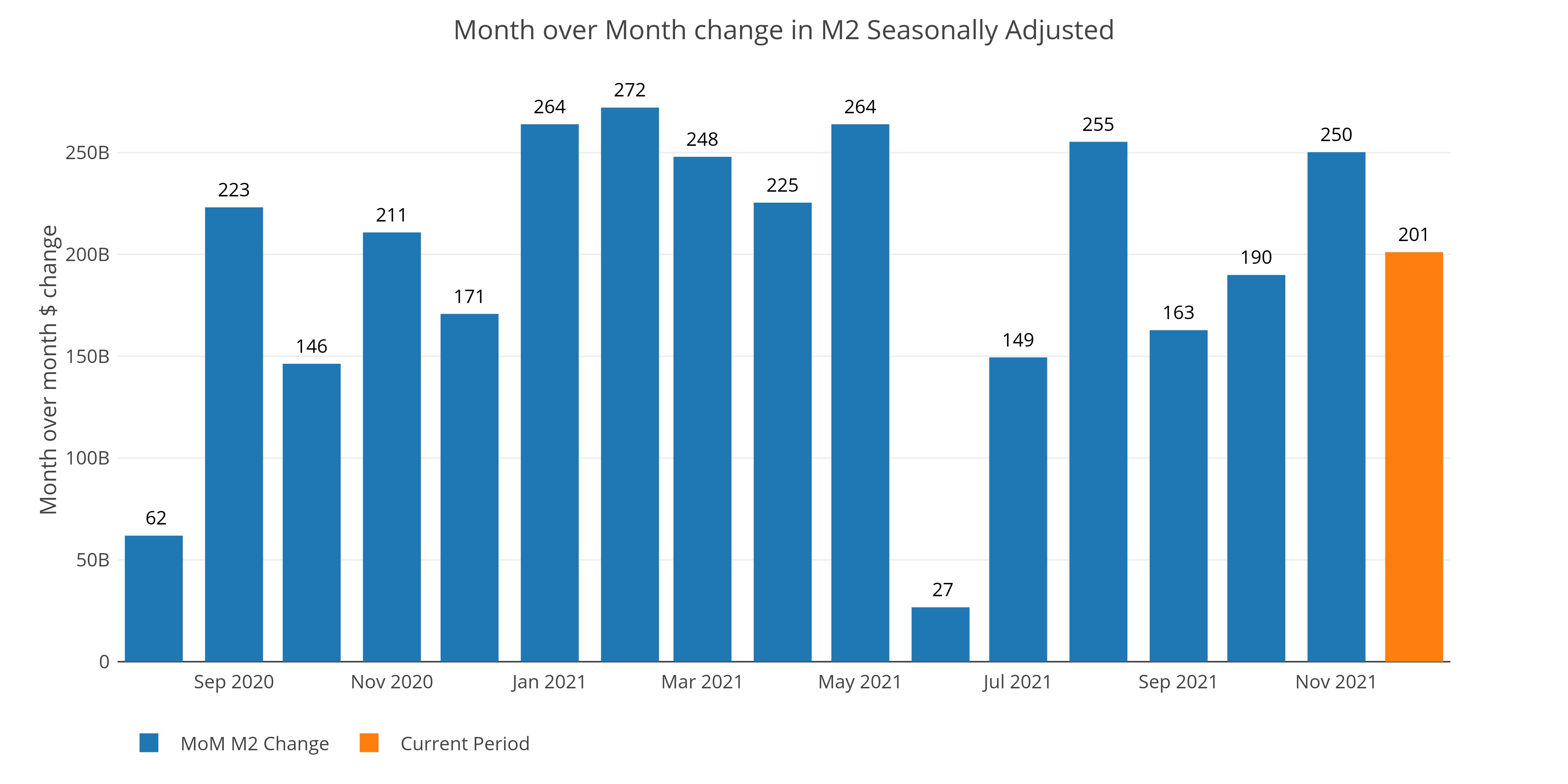

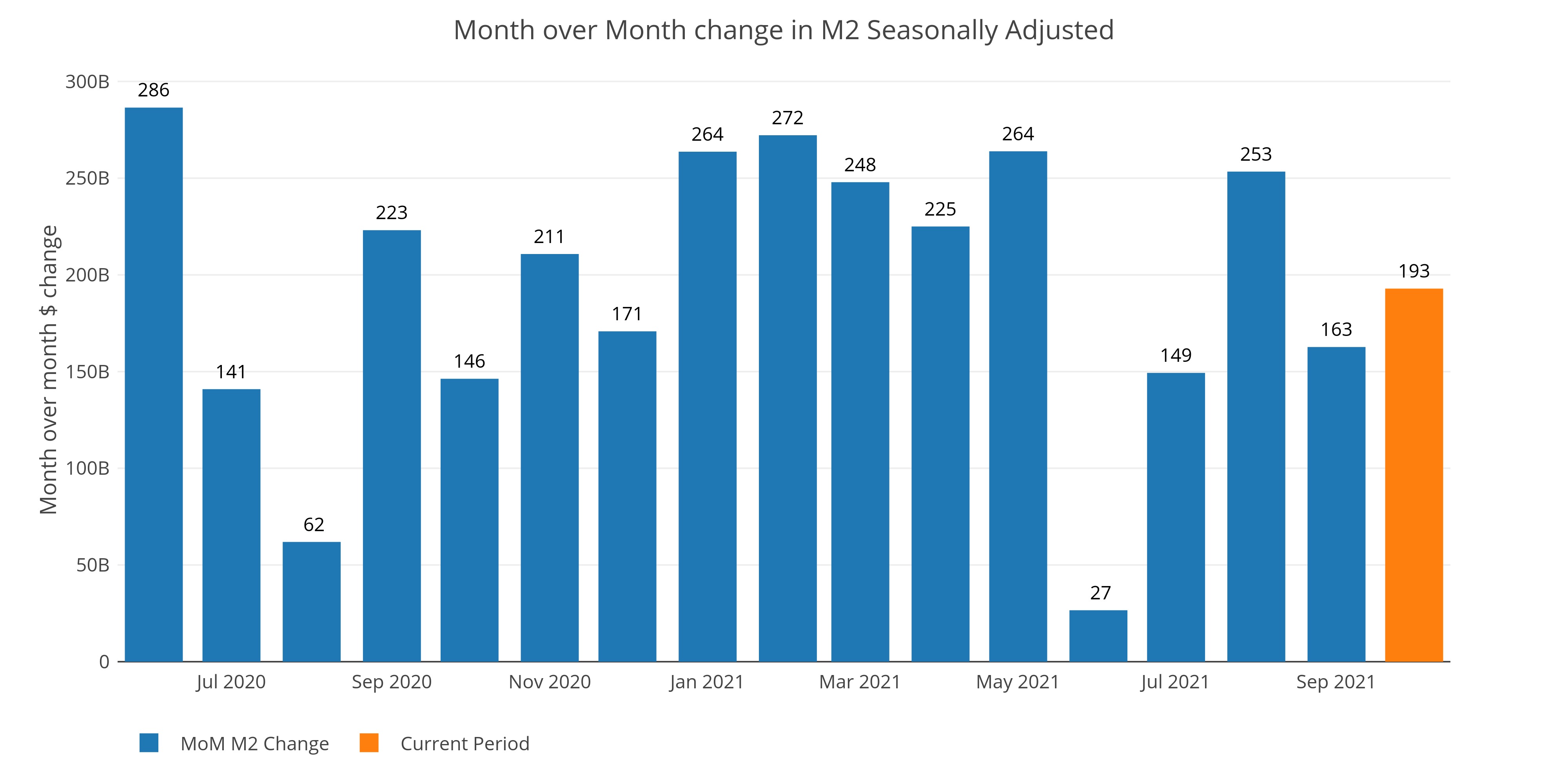

Money Supply Grows at 13.1% in 2021 - Is it enough to keep the bubble going?

Seasonally adjusted M2 is rapidly closing in on $22T

Gold and Silver May Need a Breather Before Moving Higher

All markets consolidate

The Technicals: Will $1800 Hold

Gold and silver both show promise but need to follow through

Comex Countdown: BofA House Strikes Back

January sees extremely strong demand in both gold and silver

Last Month Proves to be an Outlier - Metal is Leaving Comex Vaults Again

How will increased delivery volume affect Comex inventory in the months ahead?

Can the Deficit Fall Below $1 Trillion in 2022?

Will Tax Revenues Continue to Surge?

Is Omicron Hiding Much Higher Inflation?

A slow down in energy prices disguises a high inflation number

December Jobs: All but One Category are Way Behind 12-Month Trend

On average, the job market slows after the holiday season

Treasury adds $709B to the Debt in a Single Month

Who is going to absorb all the new debt as the Fed Tapers?

Comex House Accounts get Crushed in December: The Canary?

House Accounts see Largest Outflow on Record

Goods Deficit Approaches $100B

A data anomaly will not rescue the trade deficit next month

CFTC: Managed Money Did Not Drive Year-End Price Surge

Hedge Funds have weak hands

Comex Delivery Results: Will Momentum Continue in January?

Mid-Month contracts opening could drive both to Jan Records

Has the Taper Really Started? Who Will Fill the Massive Gap?

The Fed has Quadrupled International Treasury Purchases Since August 2019

November Money Supply: Similar and Different to Nov 1972

Seasonally adjusted M2 grows at $250B or 15.1% Annualized increase

Comex Countdown: December Delivery Surges and January Looks Strong

Gold sees lots of new contracts after First Notice

The Technicals: Yet Another Battle at $1800

Gold lost momentum last month but is trying to recover

Comex Stock Report: JP Morgan Refill the Coffers

How deep is the real supply at the Comex?

Tax Revenues Surge 20% Compared to 2020 and 2019, Will it Last?

$2.7T Trailing Twelve Month Deficit up 164% compared to Nov 2019

Expectations are Finally High Enough for Sky High Inflation

Shelter is finally starting to creep up

Data Anomaly causes October Trade Deficit to Shrink

$8B in Exported Goods were pulled forward from September to October

US Debt: The Landscape has Changed and the Fed can do Nothing About it

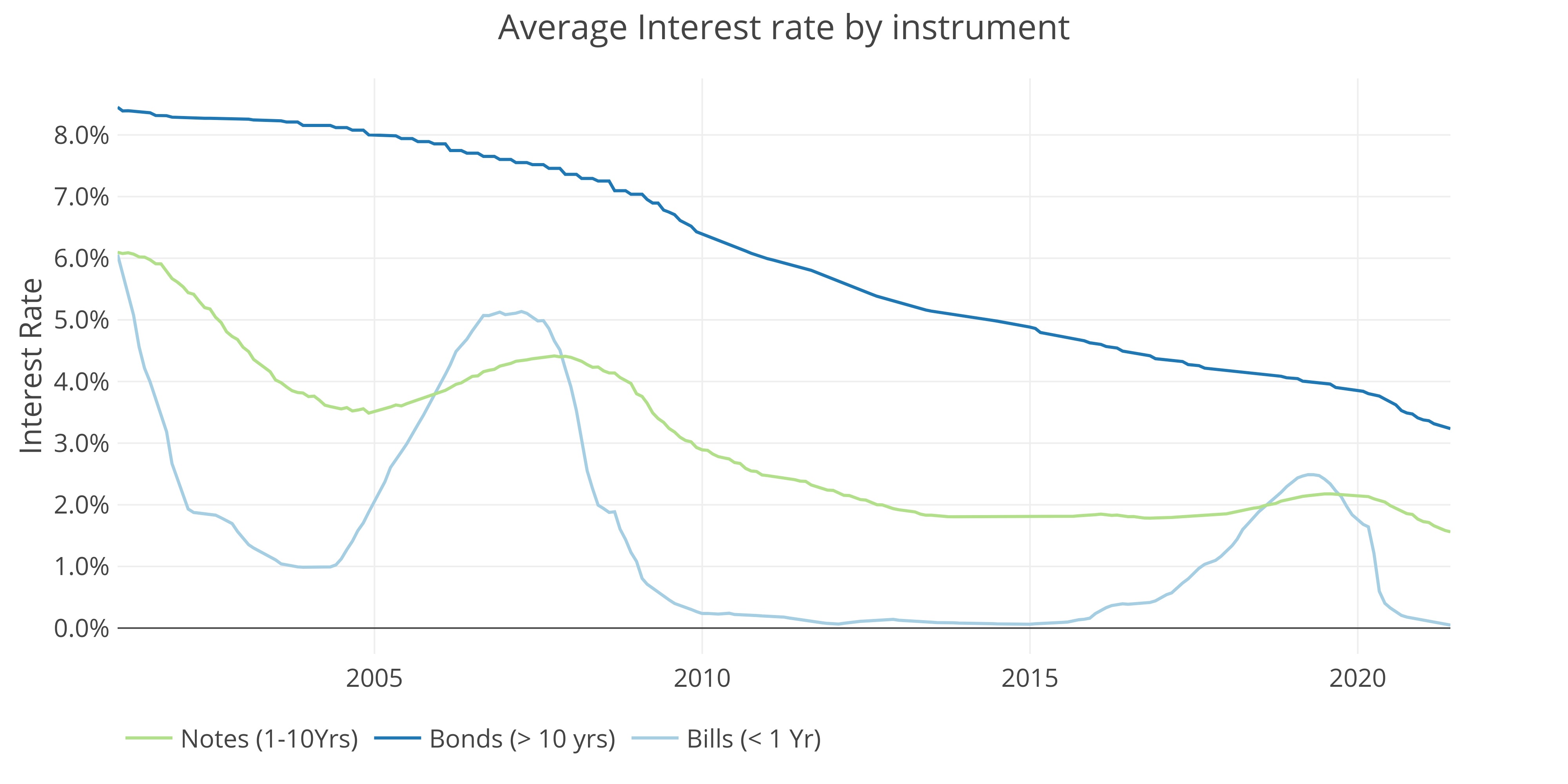

A 1% increase in rates is nearly 50% more costly in Notes and Bills than even 3 years ago

Hedge Fund are Driving Price Action in the Gold Market

Hedge Funds have weak hands

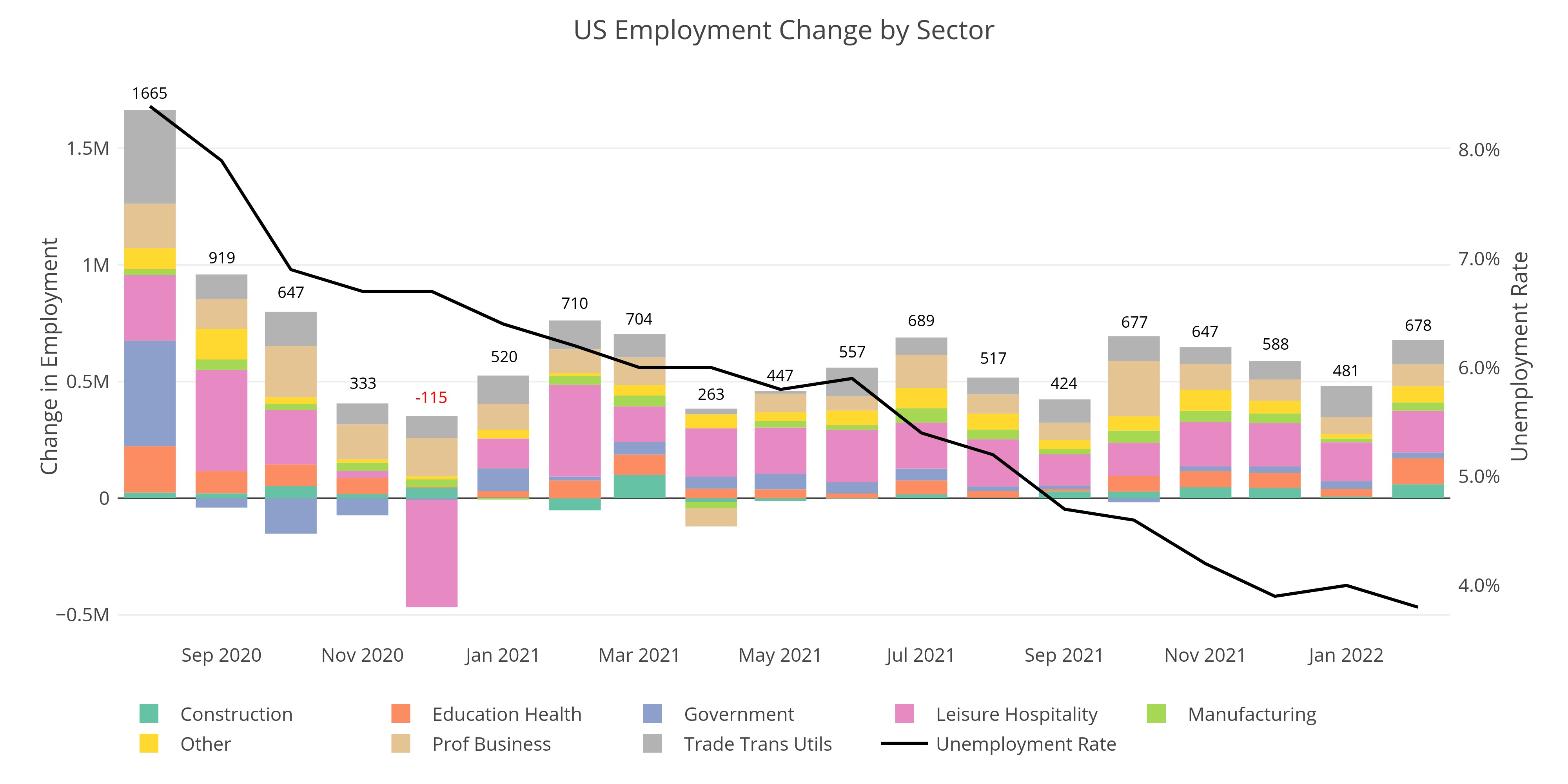

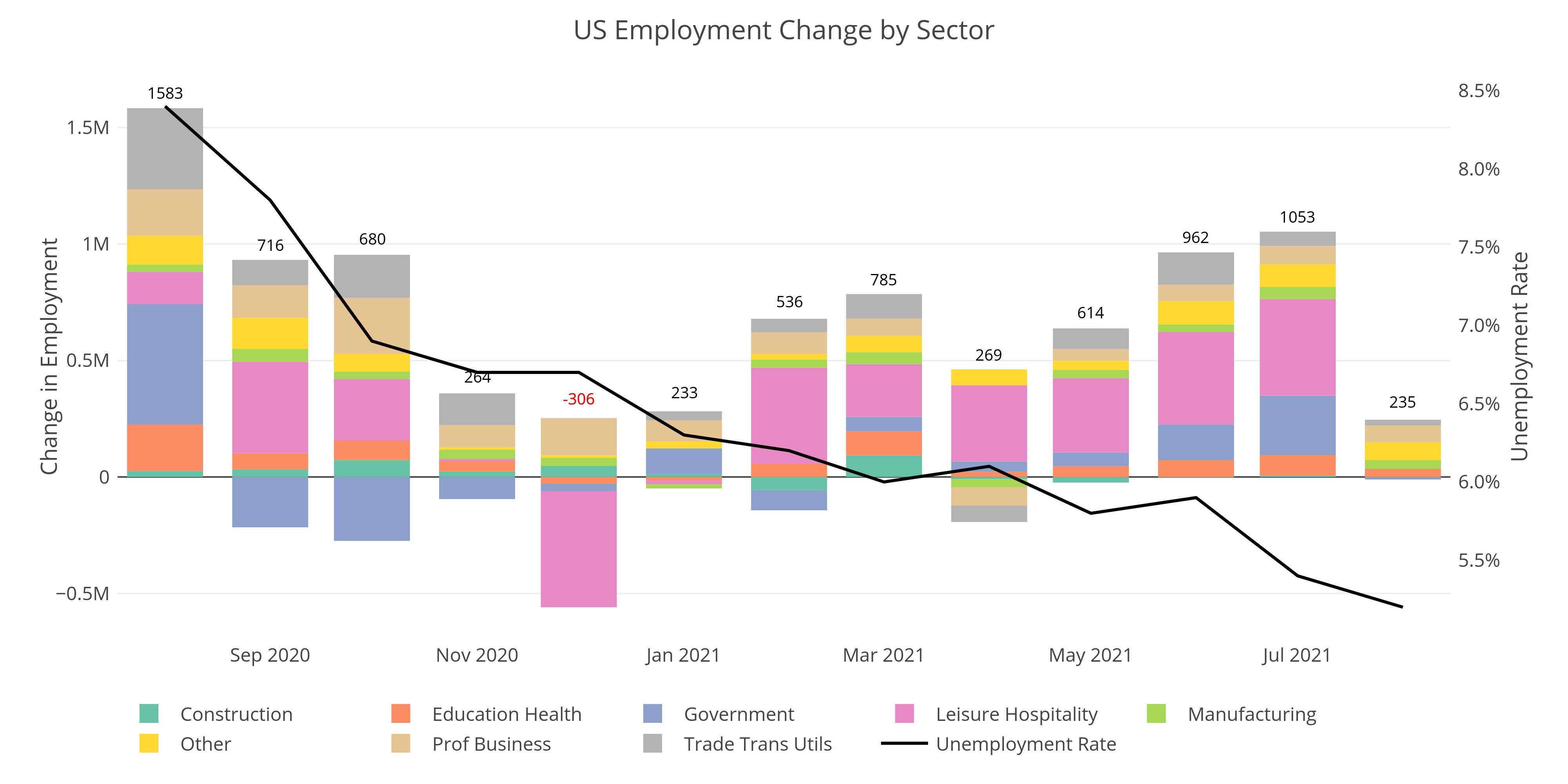

Jobs Analysis: What if Leisure and Hospitality has Fully Recovered?

Does little movement in gold mean the buyers are exhausted?

Gold and Silver Delivery Requests Near 1 Year Highs, Prompting Cash Settlements

Why are contracts cash settling?

What Taper? Fed adds $126B in November

Fed Increases MBS by $80B

Someone Took Immediate Delivery of 741 Comex Silver Contracts in November (so far)

Contracts opened after the close is nearing a record

Money Supply Growth Accelerates Into Year End

Growth Rate is nearing a record for this time of year

Will Gold Blast Through $1900 on a Brainard Nomination This Weekend?

Gold's head must hurt from hitting it's head so many times on $1870

Comex Vaults See Another Big Fall in Invetory

Recent trends of declining inventory continues

CPI Blasts past expectations, up .95% MoM with Widespread Increases

Will the opening economy spark even more inflation?

Budget Deficit Represents Greater than 35% of Total Expenditures

MoM Deficit increased 170%

Strong Jobs Creates Buying in Gold? Is all the bad news priced in?

Strong Jobs numbers across the board

Treasury Binges in October, Adding Almost Half a Trillion in Debt

And the debt spiral continues...

Sept Trade Deficit Smashes June Record by 10.5%

Exported Goods Collapse

Hedge Funds Increase Net Longs 180% in Gold and 726% in Silver During October

Gold and Silver Bulls Finally Show Up

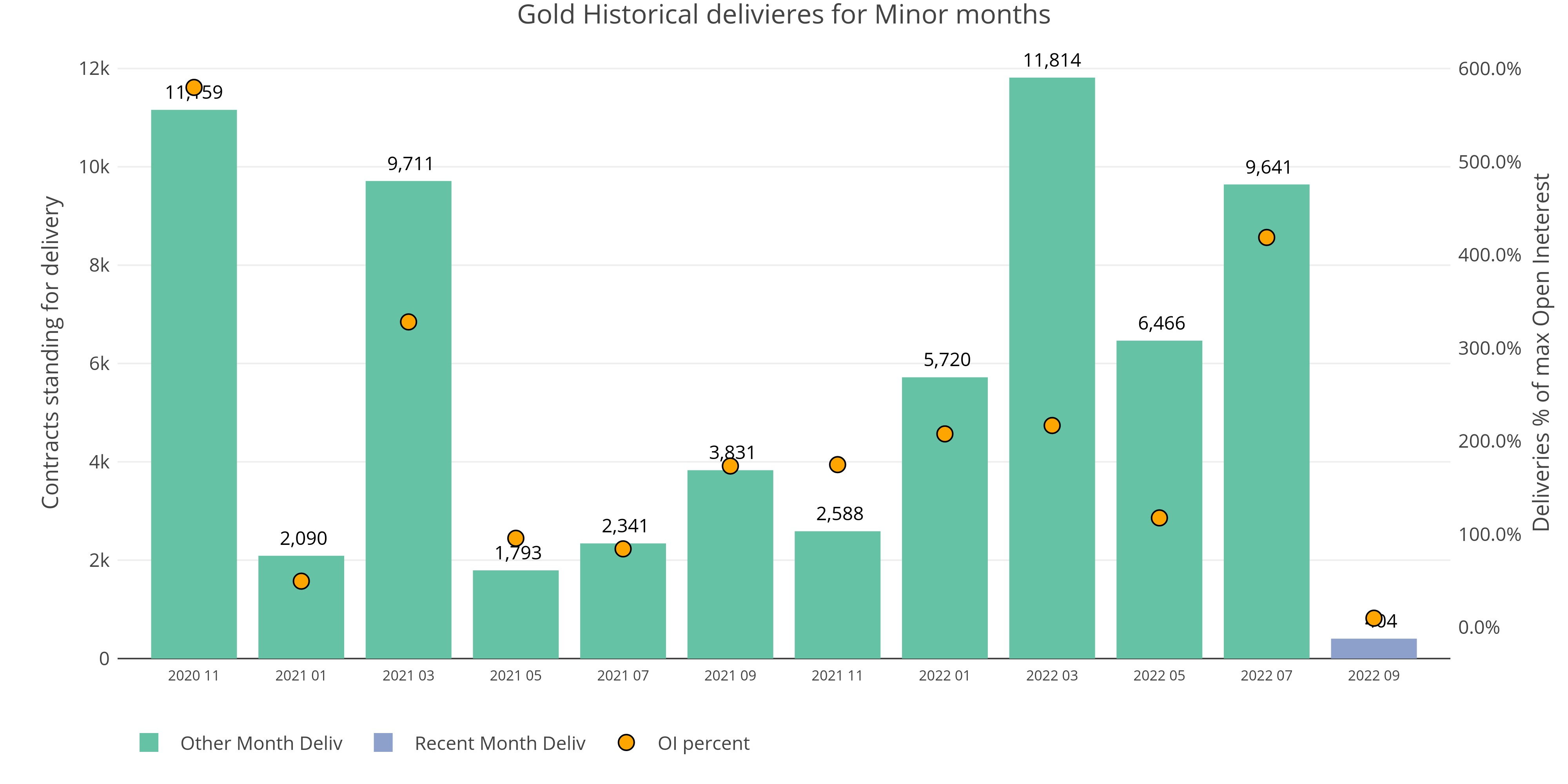

November Comex Delivery Analysis

Silver continues downward trend while Gold October is hard to categorize

Did the Fed Experiment with a Mini-Taper and Fail?

Fed Balance Sheet Now Exceeds $8.5T

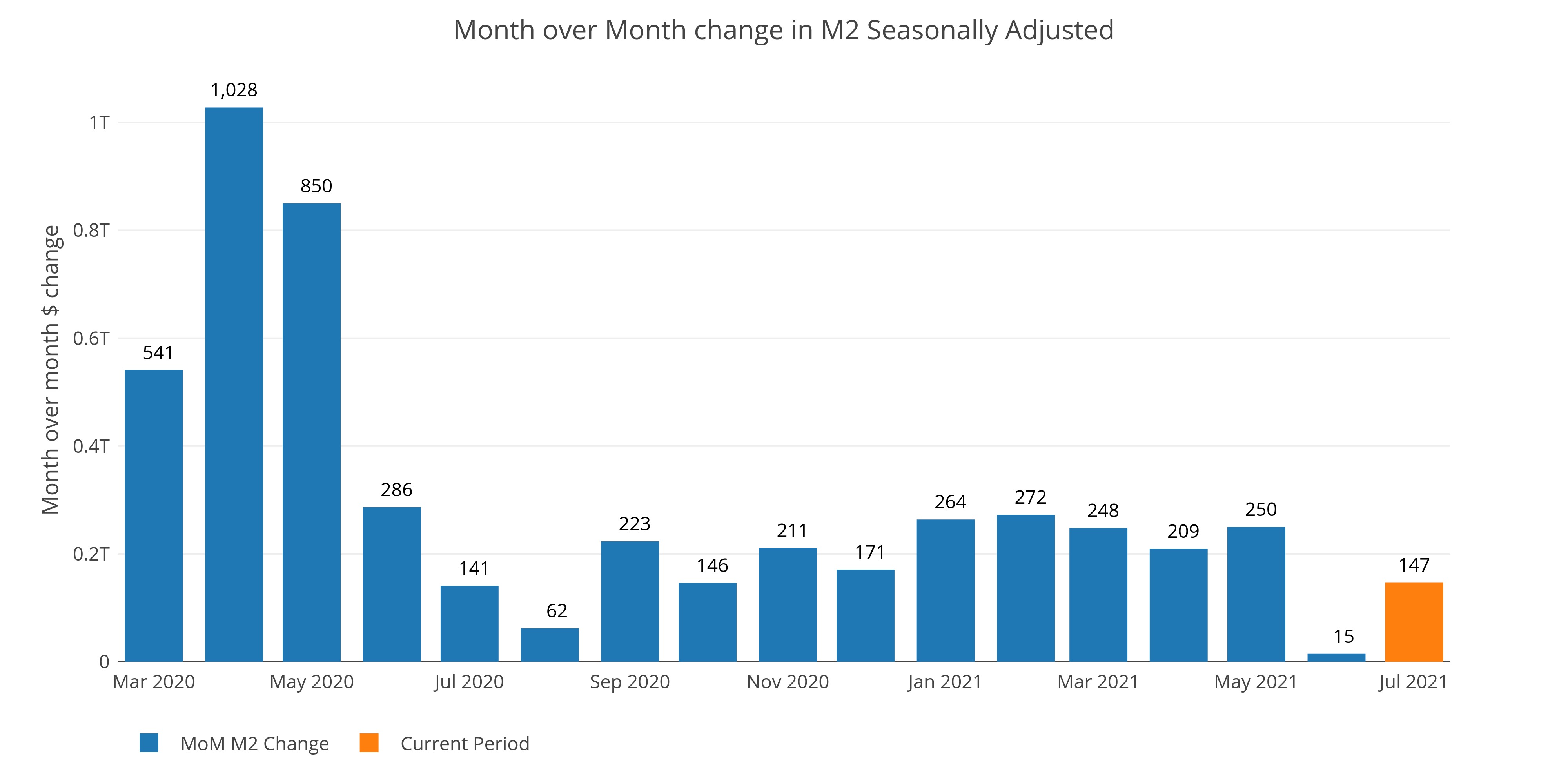

M2 Grows Almost 10% Annualized and Nears $21T

13 Week Money supply has begun accelerating again

Fiscal Spending up 18.7% MoM and 4.1% YoY

Increased tax revenues created a temporary windfall for the Treasury

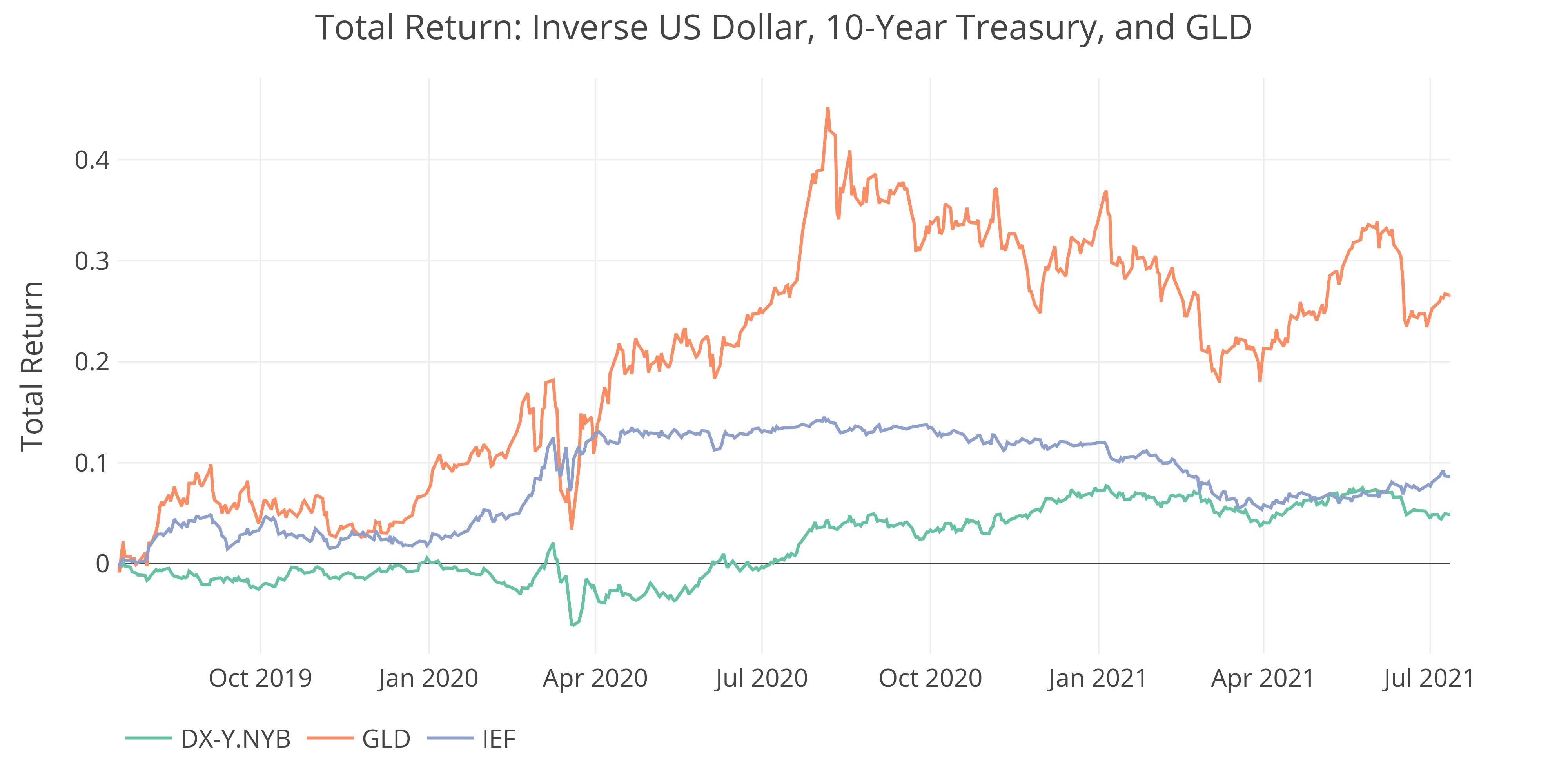

Price Analysis: Gold Diverges from Bonds as Critical Test Looms at $1800

Rising gold in the face of rising yields is a very bullish

Comex Countdown: Quiet Before the Storm?

October and November are quietly showing strength

Gold and Silver Comex Vaults Both See 1% Fall in Total Inventory

Recent trends of declining inventory continues

A More Accurate CPI is up .97 MoM and 7.1 YoY

The Fallacy of Owners Equivalent Rent

Another Big Jobs Miss: All but two categories are below the 12 month trend

Economy adds a meager 194k vs 500k expected

Surge in Services Imported Sends Trade Deficit to New Record

Imported Goods was close to record while Imported Services jumps

Hedge Fund Pile into Short Positions During September

Both gold and silver see massive draw downs in Managed Money Net Longs

Delivery Results: Silver Down and Gold Mixed

Silver continues downward trend while Gold October is hard to categorize

Fed absorbs 60B of 1-5 Year US Treasuries in September

Fed adds another 115B to the balance sheet in Total

M2 Grows at Fastest Pace Since February

M2 increased at an annual rate of 16.5% in September

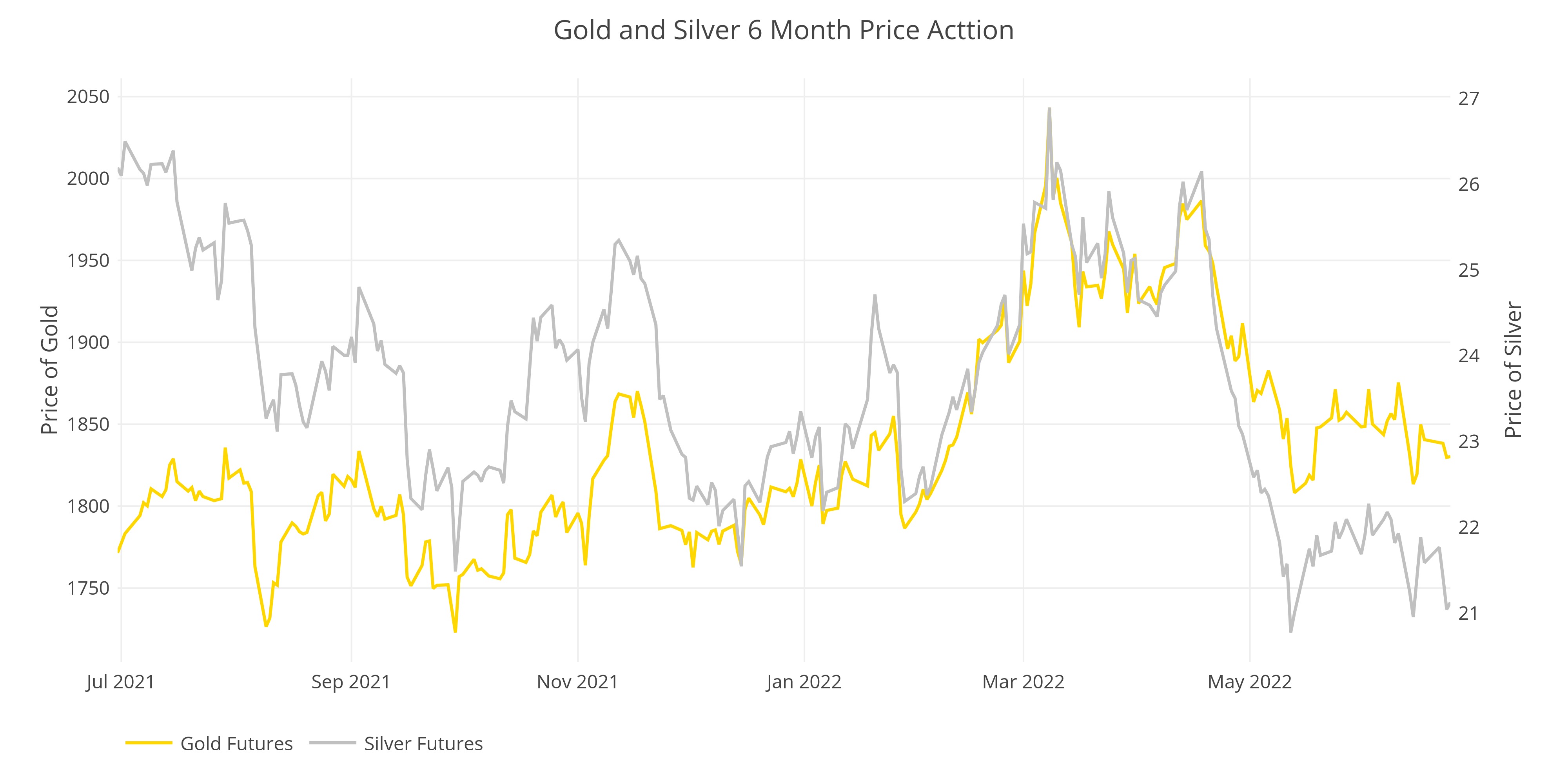

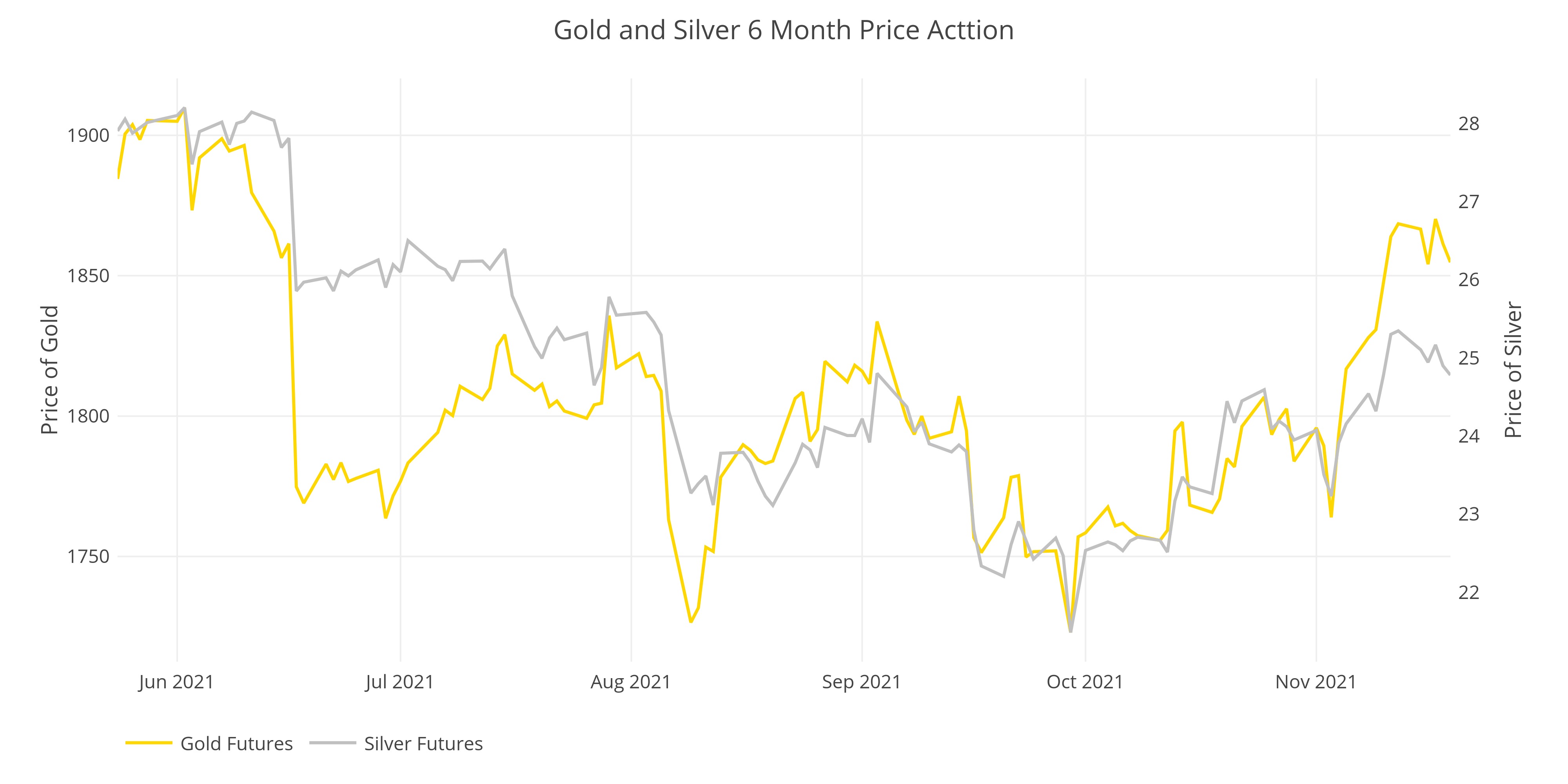

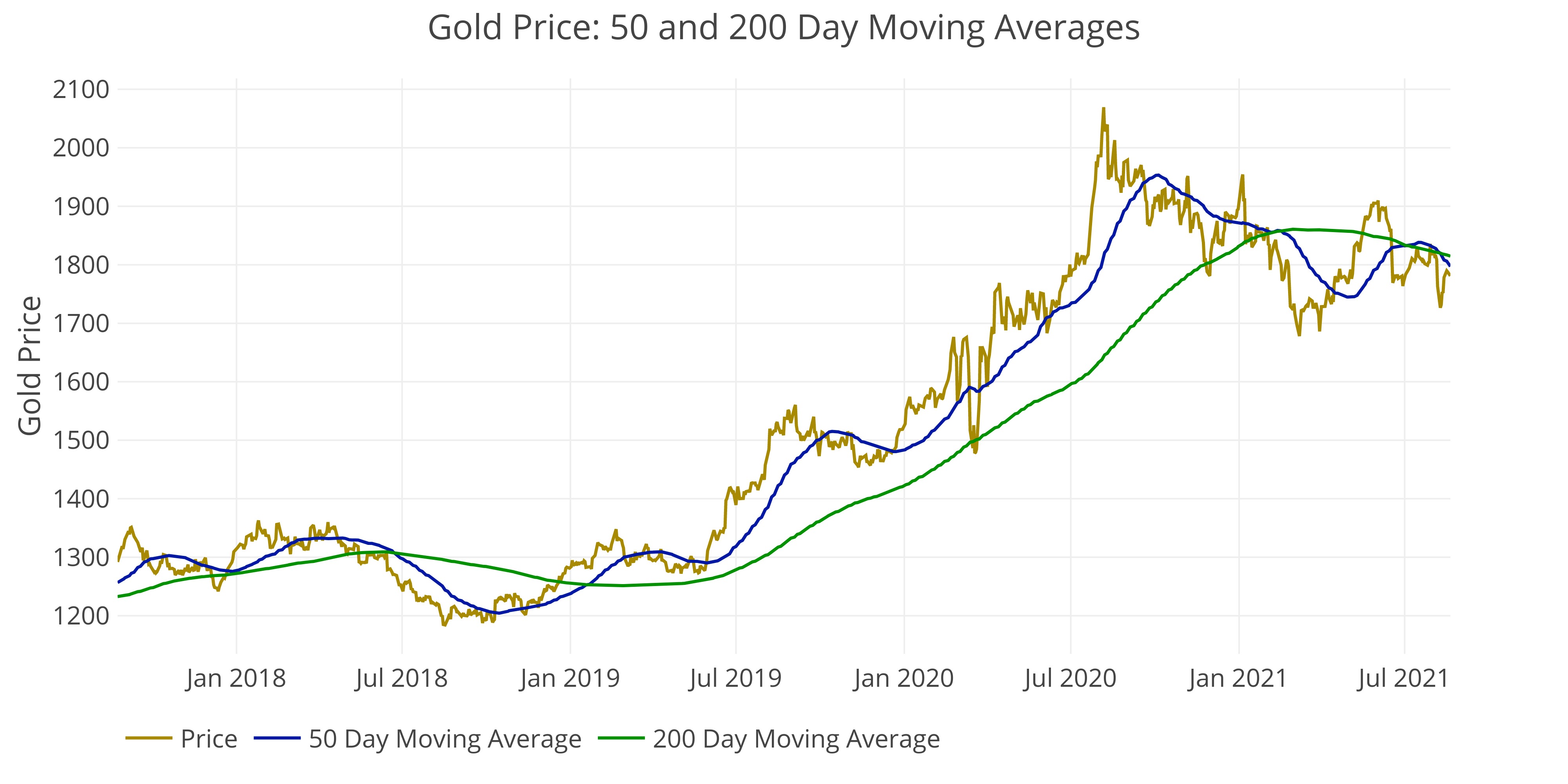

Aug 2021: Gold & Silver Bullish or Bearish?

Is the HUI signaling a down move?

Comex Countdown: Will Gold Lead Silver Higher

Gold has seen physical demand increase while silver is still drifting lower

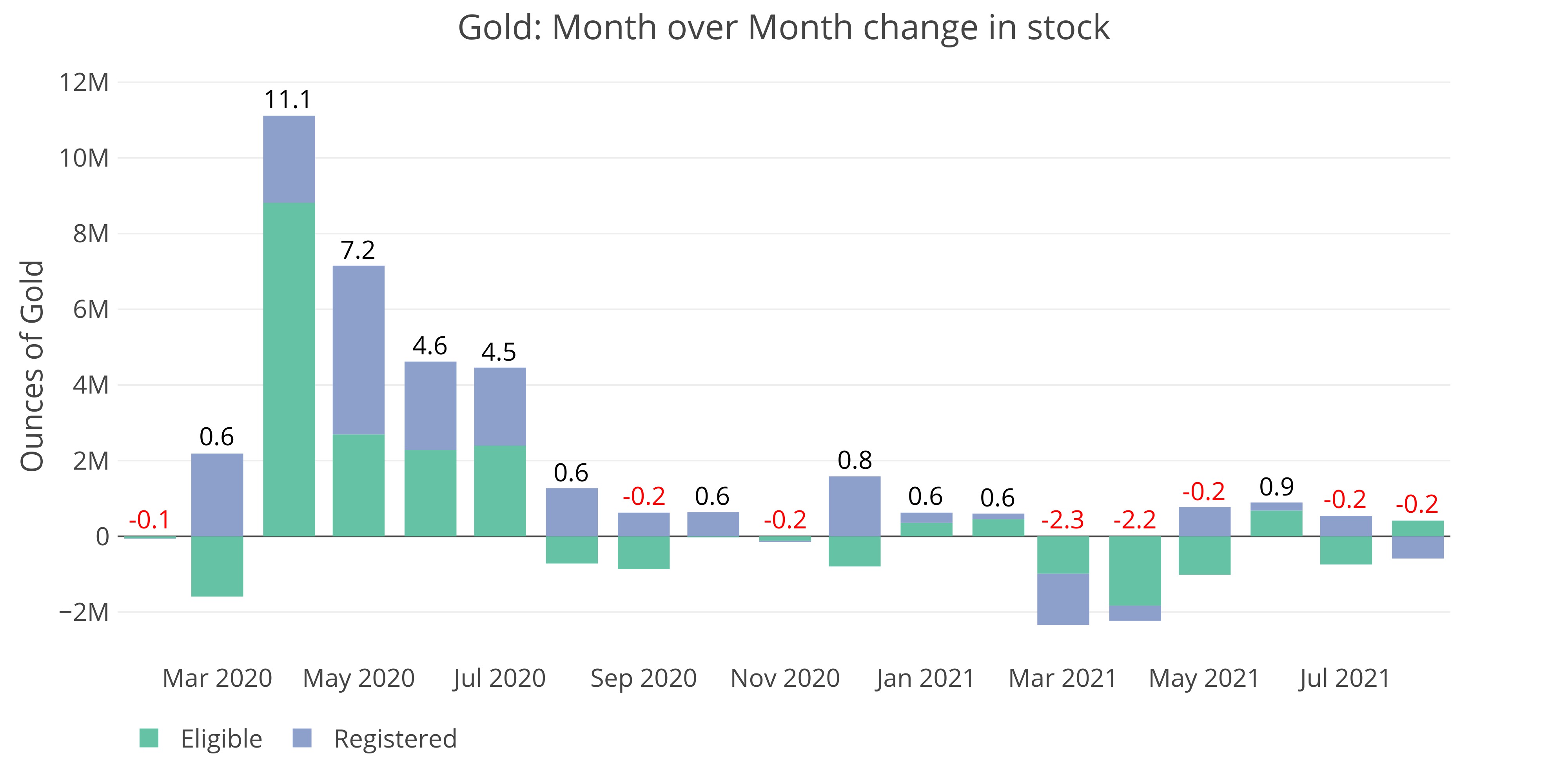

Gold and Silver both drain from Comex Inventory

Recent trends of declining inventory continues

Based on the data, the dip in CPI may prove "transitory"

The shuttering of the economy appears to be the main driver for a lower than expected CPI

US Budget Deficit is 171B in August

Tax revenues are down, but spending has fallen more rapidly in HHS and SBA

US Budget Deficit is 171B in August

Tax revenues are down, but spending has fallen more rapidly in HHS and SBA

Did the Treasury raid 250B from Government Retirement Accounts (again)?

With the debt ceiling in place, the Treasury is using "extrodinary" measures to keep the Government funded

Commitment of Traders shows a potentially very bullish setup in Gold and Silver

The most recent washout was larger in relative size than the Covid washout

Big Jobs Miss: Leisure and Hospitality add zero jobs

Economy adds a meager 235k vs 720k expected

Jul MoM Trade Deficit Shrinks but TTM hits New Record

-807B Trailing Twelve Month Trade Deficit is largest ever

Delivery Results: Gold and Silver both Underwhelm

After a decent showing for August futures, both metals have fallen to 12 month lows

While Fed Talks about Taper, Balance Sheet Grows 111B in Aug

Fed adds almost 85b in Treasuries and 53B in MBS

MoM Money Supply rebounds but trend is down

13 week annualized growth is collapsing

Sep 21 Delivery Countdown

Gold shows life, Silver is mixed

Aug 2021: Gold & Silver Bullish or Bearish?

Is the HUI signaling a down move?

Comex Inventory Aug

Gold slowly drains but Silver surges

US Deficit increases 73% MoM in July as tax season ends

Some spending categories are starting to normalize, but the US has reached a new normal in spending

CPI 2021-07: Many price categories are still increasing

The Fed is hoping inflation is transitory because it cannot implement tools to fight it

Jobs 2021-07: Government Jobs Account for almost a quarter of gains

The labor market continues to recover, probably due to expiring unemployment benefits

Trade Deficit Jun 21 sets New record of 75.7B

June 2021 Trade Deficit sets a new record, eclipsing previous record in March

US Debt 2021-07: Total Debt Shrinks by 101B into Debt Ceiling Saga

Why did they treasury allow debt to mature rather than using the limitless debt ceiling to increases cash positions?

CFTC COTS Analysis July 2021

Gold longs increase while silver longs decrease.

Comex Results: August 2021 Deliveries

Silver stays strong, Gold deliveries continue to fall

Fed Balance Sheet: July 2021

The latest month of 143B added was above average

Money Supply July 2021

Money Supply Growth Rate Collapses

Comex Countdown: Mid July 2021

Silver off-month rises

Gold and Silver Pricing Update: Mid July 2021

Gold 50 DMA attempts to breakthrough 200 DMA

US Budget Deficit Analysis: June 2021

Spending continues to outstrip taxes by a wide margin

US Debt Analysis: June 2021

Treasury converting short term debt to medium term

Comex Stock Update: July 2021

Silver continues to drain, Gold sees more supply come in

Trade Deficit Analysis: May 2021

Trade Deficit falls just short of record $75B in March 2021

Comex June/July 2021 Update

Silver nears records, Gold losing momentum

The Fed in a Box, Part 2: They cannot end Quantitative Easing

The recent fall in long-term rates may have been by design and is probably transitory

The Fed in a Box, Part 1: They cannot raise interest rates

Higher interest rates would create a massive burden on the Treasury as the cost to service debt would increase dramatically

Setting up an AWS analytics server and API in minutes

The steps to stand up an AWS server that can be used to host an analytics dashboard and/or a data feed API

Why Silver is different than GameStop

The Silver market started changing a year ago with increased physical delivery

What is the Comex

Informational post to provide context for Comex Updates

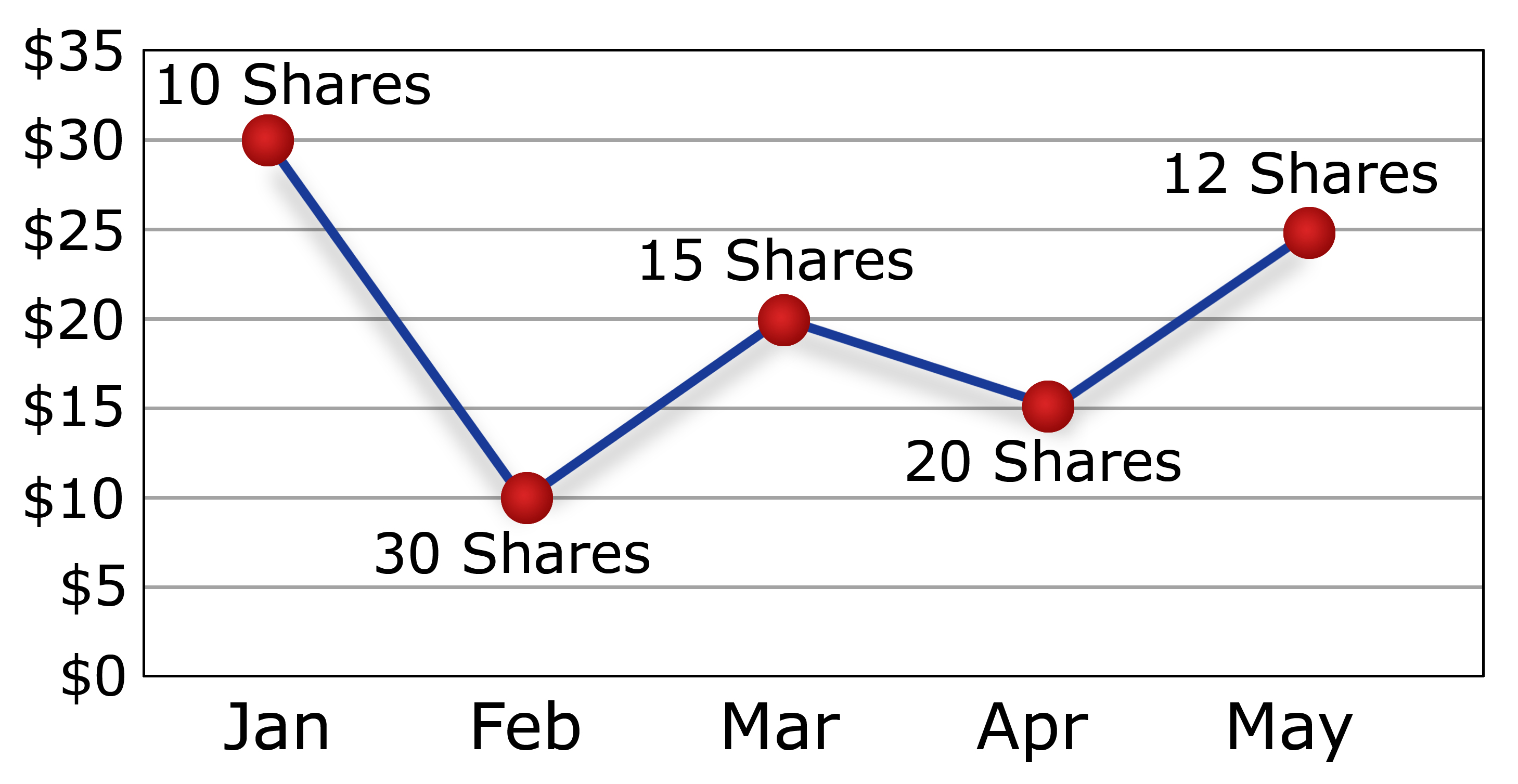

The Ultimate Dollar Cost Averaging Strategy

Dollar cost averaging is designed to invest by reducing the risk of market timing. Use etrader and AWS to automatically invest a set amount on each trading day.

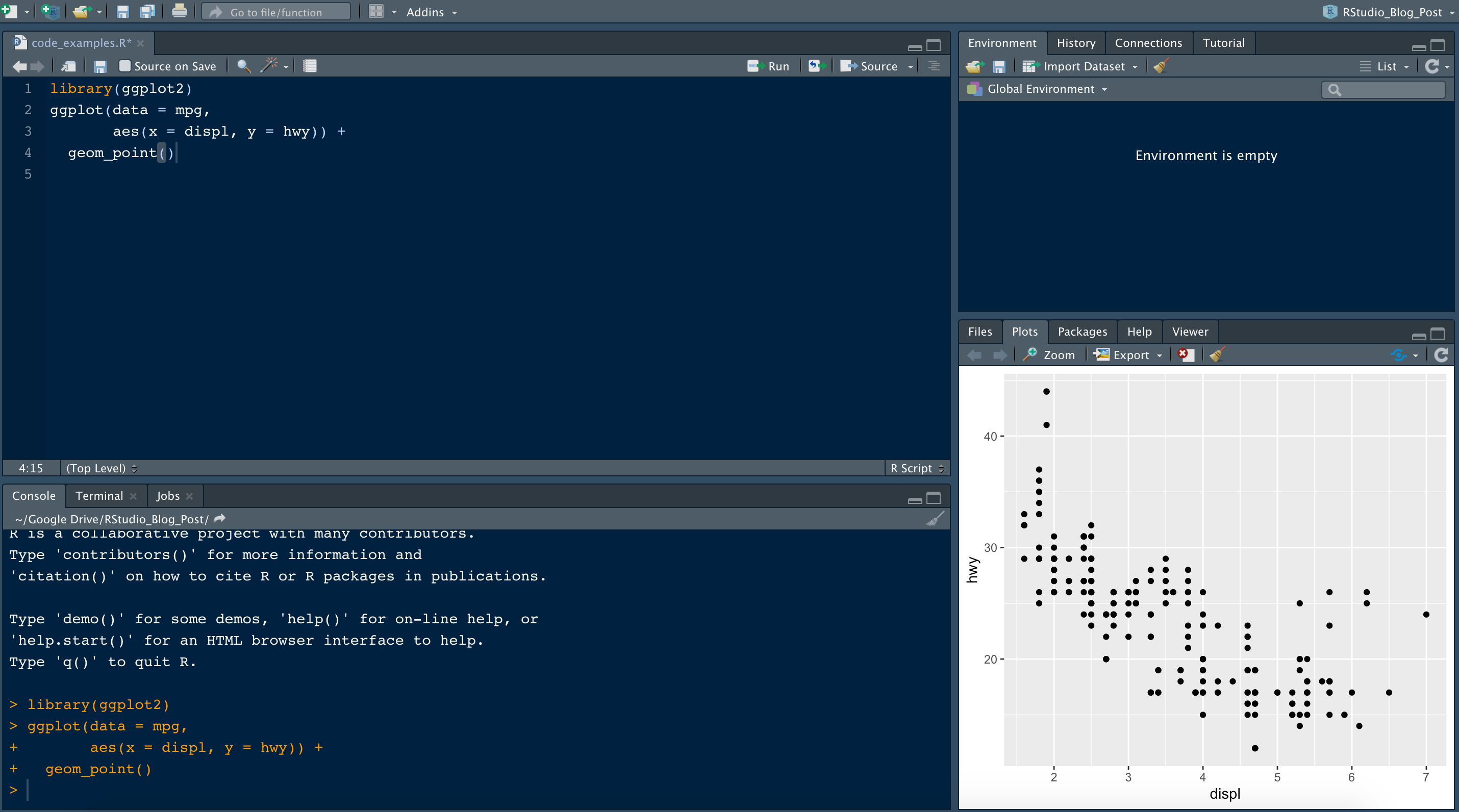

Automated trading and investing using RStudio on AWS

Set up a trading server in minutes. R offers multiple packages that connect to trading APIs. Trading scripts can be deployed and fully automated, for 12 months free and $3 a month thereafter.

Analyzing the S&P 500 with FMP

Financial Modeling Prep (FMP) is a new service that offers a range of financial metrics through an API. Use fmpcloudr to access the data and analyze it in R.

Trade on TD Ameritrade with R

Execute trades through TD Ameritrade using the `rameritrade` package in R. Zero previous programming experience required!

Target Asset Allocation

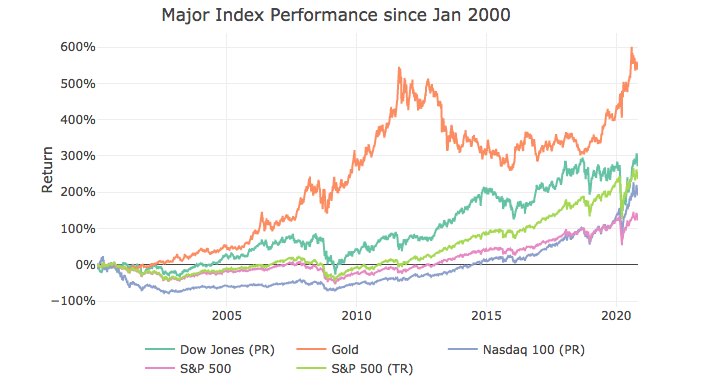

Stocks have the best track record, especially in the US. Bonds have limited upside with lots of downside. Gold is the best insurance policy.

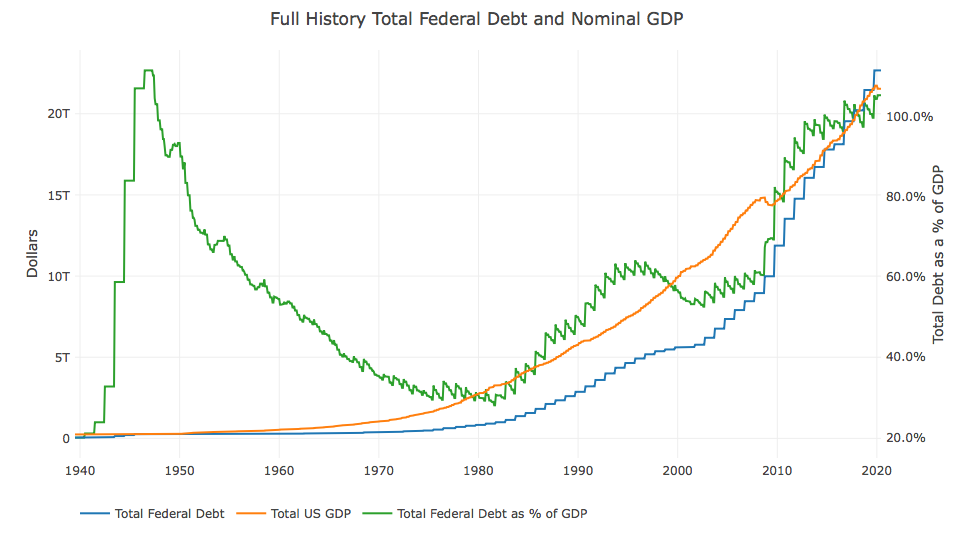

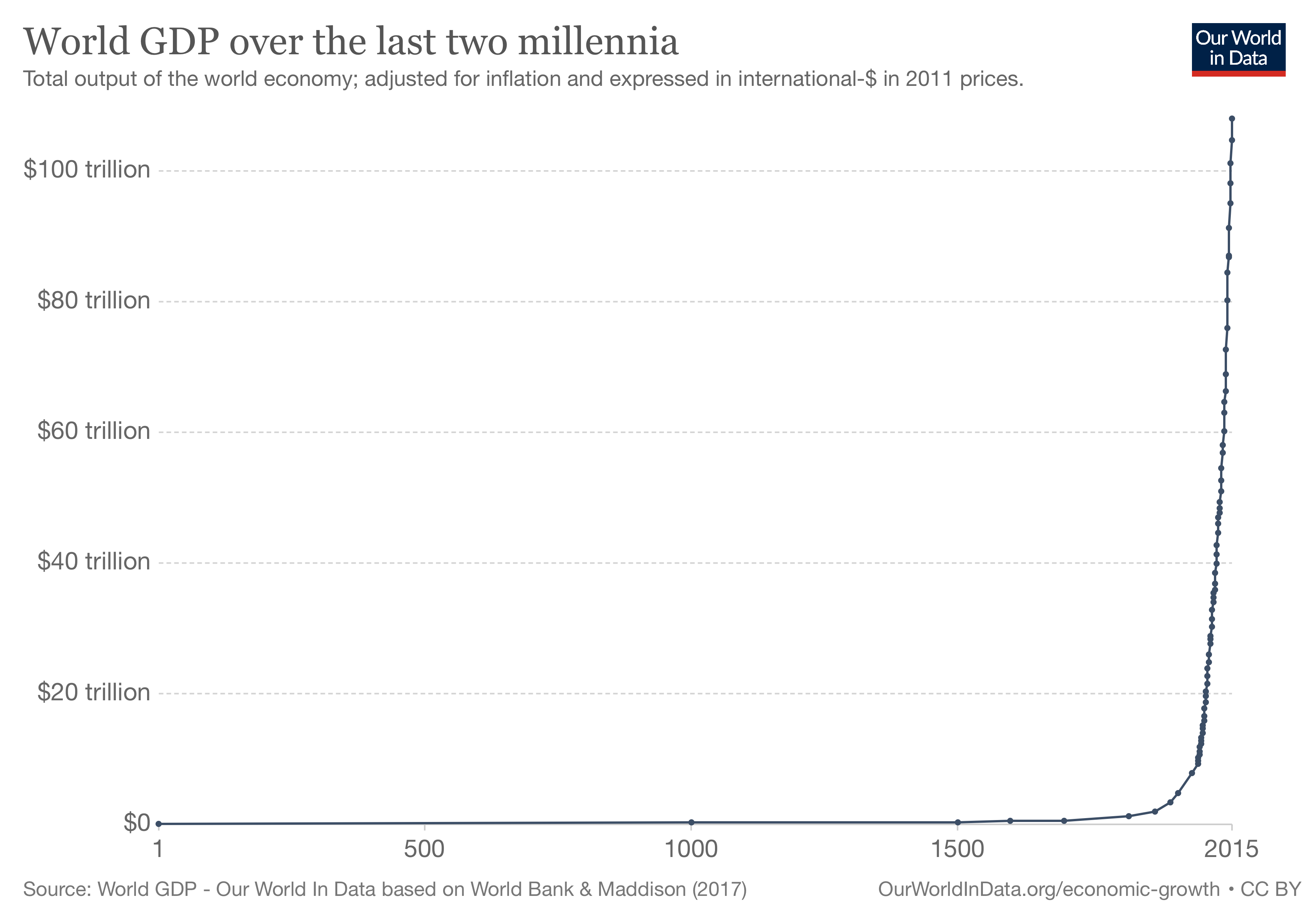

Analyzing the US Debt

The US Federal Government has an unsustainable growth in debt. Can it continue longer than most think? When will the US Debt bubble pop?

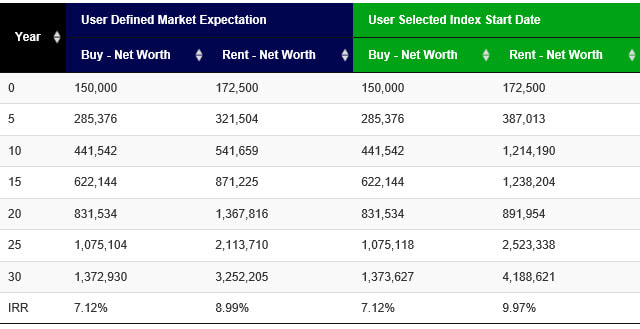

Homeownership Opportunity Cost

Part 3 of 3: Is buying a home the great investment everyone believes it is?

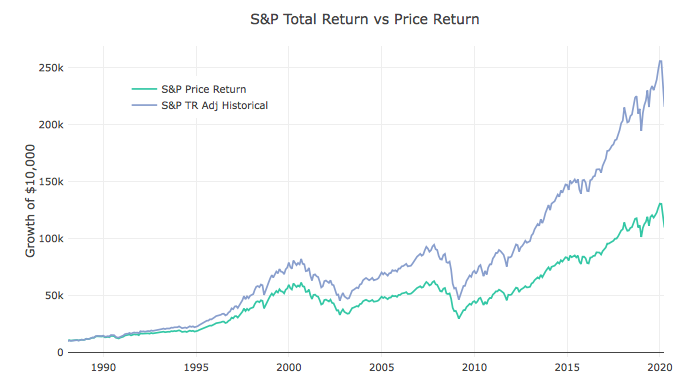

Average Stock Market Returns

Part 2 of 3: The market looks expensive and due for a correction, is it worth waiting? What does history show about investing at different times.

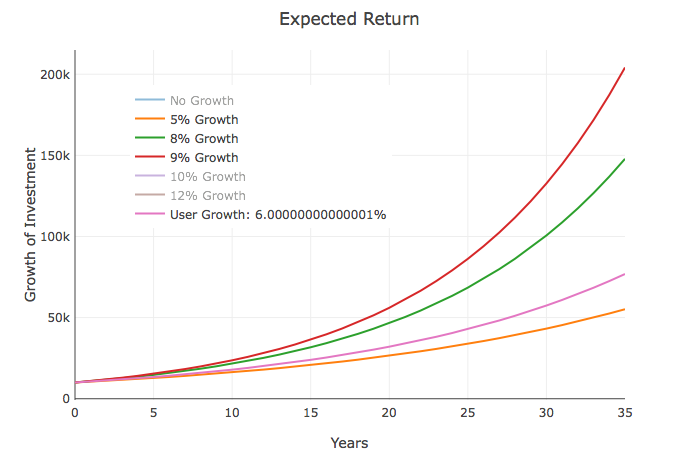

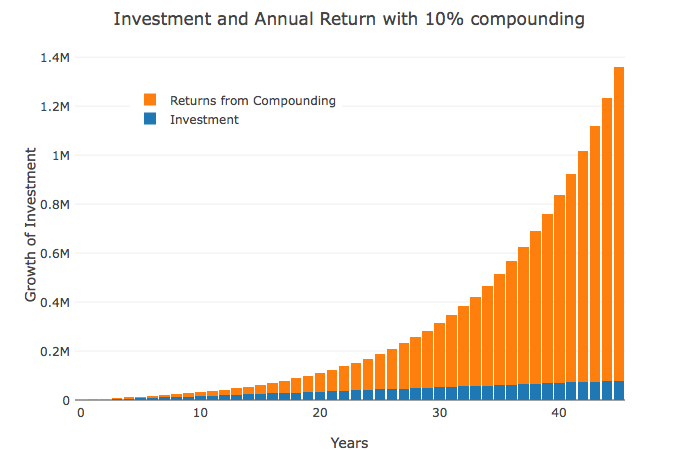

The Power of Compound Interest

Part 1 of 3: Is your daily coffee costing you $1,000,000?

Libertarian Part 4: Moving Forward

Living in a world that feels backwards

Libertarian Part 4: Moving Forward (TL;DR)

Living in a world that feels backwards

Libertarian Part 3: The Greatest Failed Experiment

Limited government proved too successful for its own good

Libertarian Part 3: The Greatest Failed Experiment (TL;DR)

Limited government proved too successful for its own good

Libertarian Part 2: Fiscally Conservative

Governments are expensive, inefficient, and distort markets

Libertarian Part 2: Fiscally Conservative (TL;DR)

Governments are expensive, inefficient, and distort markets

Libertarian Part 1: Socially Liberal

Government is immoral because it violates self-ownership

Libertarian Part 1: Socially Liberal (TL;DR)

Government is immoral because it violates self-ownership

Exploring Finance

Why I started a blog in 2020